Market Overview

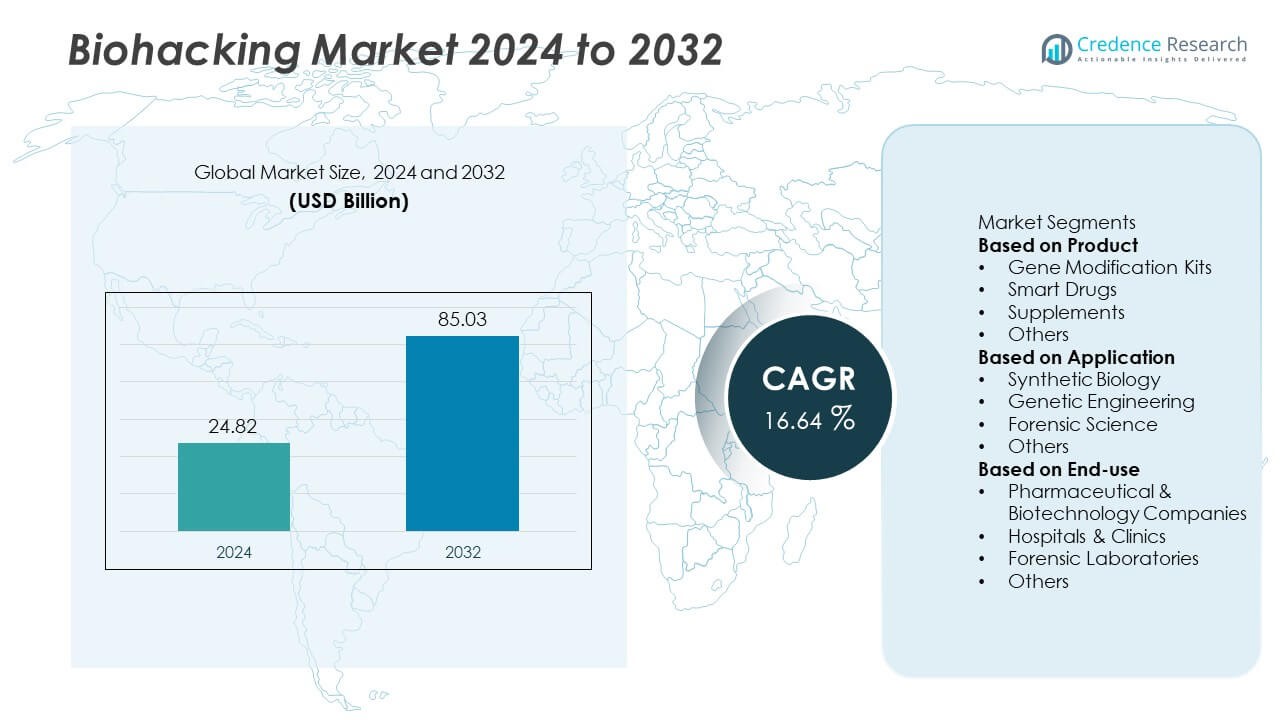

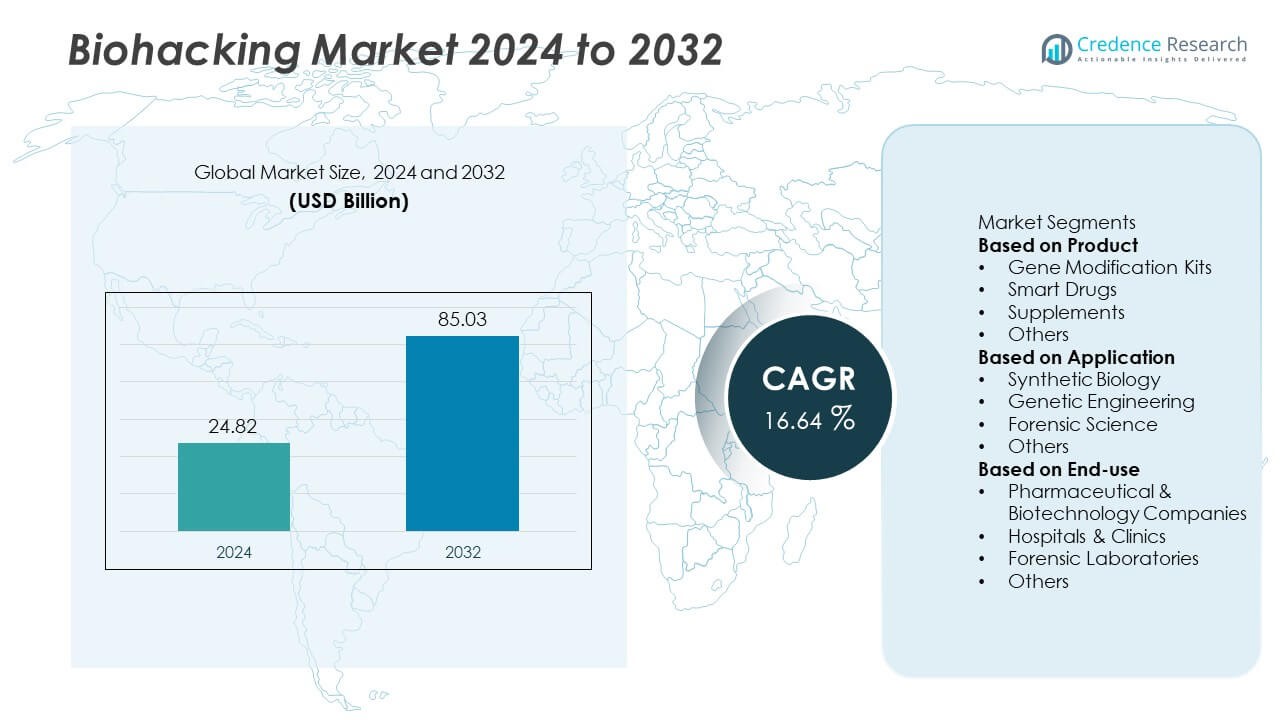

The Biohacking market reached USD 24.82 billion in 2024 and is projected to hit USD 85.03 billion by 2032, registering a CAGR of 16.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Biohacking Market Size 2024 |

USD 24.82 Billion |

| Biohacking Market, CAGR |

16.64% |

| Biohacking Market Size 2032 |

USD 85.03 Billion |

Top players in the Biohacking market include Thriveport, LLC, Fitbit, Inc., Muse (Interaxon Inc.), HVMN Inc., TrackMyStack, Moodmetric, The ODIN, OsteoStrong, Thync Global Inc., and Apple Inc. These companies drive market growth through advanced wearables, neurotechnology devices, personalized wellness platforms, and cognitive enhancement tools. North America leads the market with a 42% share, supported by strong consumer adoption and a mature biotech ecosystem. Europe follows with a 28% share, driven by rising interest in precision health and strict regulatory oversight. Asia-Pacific holds a 22% share, benefiting from expanding fitness culture, rising disposable income, and strong digital adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Biohacking market reached USD 24.82 billion in 2024 and will grow to USD 85.03 billion by 2032 at a 16.64% CAGR, supported by rising interest in human enhancement technologies.

- Strong demand for personalized wellness, nootropics, and wearables drives market expansion, with smart drugs holding a 41% segment share due to widespread use among students, professionals, and fitness users.

- Key trends include the rise of AI-powered biomarker tracking, implantable chips, genetic editing kits, and personalized supplement stacks designed for cognitive and metabolic optimization.

- Competition strengthens as major players enhance neurofeedback tools, metabolic sensors, and mobile health platforms while investing in product accuracy, user experience, and data security.

- Regionally, North America leads with a 42% share, followed by Europe at 28%, Asia-Pacific at 22%, Latin America at 5%, and the Middle East & Africa at 3%, reflecting varied adoption of wellness tech and genetic engineering tools.

Market Segmentation Analysis:

By Product

Smart drugs lead this segment with a 41% market share, driven by rising adoption among students, professionals, and fitness users. These products support focus, memory, and energy, which increases demand in high-pressure environments. Users prefer nootropic blends that offer clear mental benefits with simple daily use. Supplements also grow fast as more people follow wellness routines and personalized nutrition. Gene modification kits gain attention in DIY biology groups but remain niche due to safety limits. Other biohacking tools gain steady traction as consumers explore new ways to improve performance and track health changes.

- For instance, HVMN introduced its proprietary ketone formula based on DARPA-backed research, delivering a measured 10-gram dose of ΔG ketone ester per serving.

By Application

Genetic engineering dominates this segment with a 39% market share, supported by strong research activity in labs and biotech centers. The field benefits from growing use of CRISPR tools and genome-editing kits. These technologies help scientists study diseases, develop therapies, and design engineered organisms. Synthetic biology also expands as users build biological systems for learning and innovation. Forensic science applications grow as labs adopt faster DNA tools for testing and identity checks. Other applications rise as healthcare and academic sectors explore new biohacking uses for education and advanced research.

- For instance, The ODIN’s CRISPR bacterial engineering kit provides a plasmid carrying necessary components to induce a point mutation in the E. coli rpsL gene, enabling selection for successful gene insertion by growth on streptomycin-containing agar plates.

By End-use

Pharmaceutical and biotechnology companies hold a 46% market share, making them the leading end-users due to high investment in genetic tools, drug testing, and advanced research. These companies use biohacking solutions to speed discovery, study cell behavior, and improve treatment models. Hospitals and clinics expand adoption as they integrate wearables and personalized health tools for patient care. Forensic laboratories grow with increased use of rapid DNA kits and advanced testing devices. Other users, including academic centers and DIY communities, show steady growth as interest in human enhancement and biology education rises.

Key Growth Drivers

Rising Demand for Personalized Health and Performance Enhancement

Growing interest in optimized physical and cognitive performance drives strong demand for biohacking products. Consumers adopt smart drugs, supplements, and wearable devices to track health metrics and improve daily productivity. Personalized nutrition, sleep optimization, and mental-focus tools gain popularity among students, athletes, and professionals. Increasing awareness of biological self-improvement practices supports market expansion. Expanding digital platforms that guide users in monitoring biomarkers also strengthen adoption across global wellness communities.

- For instance, Fitbit devices use multi-sensor arrays to collect data at various frequencies (e.g., accelerometers at around 100 Hz and heart rate data available at 1-second intervals for researchers), and track sleep stages by comparing their data with 30-second epoch granularities from polysomnography (PSG).

Advancements in Genetic Engineering and DIY Biology Tools

Rapid progress in CRISPR, genome-editing kits, and synthetic biology tools supports the rise of experimental biohacking. Research labs, biotech startups, and independent biology groups use accessible kits to run small-scale experiments and study genetic functions. Growing affordability of gene modification tools encourages wider experimentation. These advancements support faster innovation cycles in drug development and biotechnology. High interest from education centers and research communities boosts long-term demand for genetic biohacking solutions.

- For instance, The ODIN’s CRISPR bacterial engineering kit includes Cas9 nuclease and a guide RNA designed to edit the rpsL gene in E. coli, producing measurable streptomycin resistance after successful modification.

Growing Integration of Wearables and Real-Time Monitoring Devices

Wearables play a crucial role in the expansion of biohacking by offering continuous tracking of heart rate, sleep patterns, glucose levels, and stress markers. Users rely on these devices to make real-time lifestyle adjustments and build personalized health routines. Advanced sensors and AI-backed analytics improve the accuracy of insights. Athletes and fitness users adopt these tools to optimize training and recovery. Increasing adoption across wellness programs and healthcare systems strengthens market growth.

Key Trends & Opportunities

Expansion of Nootropics, Supplements, and Cognitive Enhancement Tools

Demand for mental-performance enhancers continues to rise as consumers seek improved focus, memory, and stress management. Companies introduce new natural and synthetic blends tailored to specific cognitive needs. Personalized supplement stacks driven by genetic testing create new commercial opportunities. Digital wellness platforms recommend customized regimens, improving user outcomes. Rising workplace pressure and growing awareness of neuro-enhancement support ongoing product innovation.

- For instance, HVMN’s ketone formulation delivers 10 grams of 1,3-butanediol per serving, validated through metabolic studies showing increased blood ketone levels within 30 minutes.

Rising Adoption of Implantable Devices and Human Augmentation Technologies

Implantable chips, biosensors, and micro-devices gain attention as users explore advanced human-augmentation applications. These tools enable identity access, health monitoring, and environmental interaction enhancements. Technological progress makes implants safer and more reliable, attracting early tech adopters. Startups and research institutes expand trials focused on sensory upgrades, metabolic control, and bio-interfaces. This trend creates opportunities for cross-industry innovation across healthcare, security, and consumer electronics.

- For instance, Dangerous Things offers NFC and RFID implant chips with memory capacities of 888 bytes, enabling users to store encrypted access credentials.

Key Challenges

Regulatory Restrictions and Ethical Concerns

Biohacking faces regulatory hurdles due to safety concerns, genetic manipulation risks, and unclear legal frameworks. Authorities impose strict rules on gene-editing kits, nootropics, and implantable devices. Ethical debates around human enhancement slow mainstream adoption. Concerns grow regarding unregulated DIY experiments and potential misuse of biological tools. Companies must navigate evolving compliance standards while maintaining innovation pace.

Data Privacy Risks and Limited Awareness in Developing Regions

Wearables and implantable devices generate sensitive biometric data, increasing cybersecurity risks. Breaches or misuse of personal health information can reduce consumer trust. Limited awareness and low affordability in developing regions also restrict adoption. Lack of trained professionals and insufficient access to advanced tools slow market penetration. Vendors must improve data protection, offer affordable solutions, and educate consumers to overcome these barriers.

Regional Analysis

North America

North America leads the Biohacking market with a 42% market share, supported by strong adoption of wearables, nootropics, and personalized health technologies. Consumers show high interest in optimizing physical and cognitive performance, driving rapid uptake of supplements and smart devices. Research institutions and biotech companies invest heavily in genetic engineering and synthetic biology, boosting innovation. The region benefits from advanced healthcare systems and strong venture funding for biohacking startups. Growing participation in DIY biology communities further expands market growth across both professional and consumer applications.

Europe

Europe holds a 28% market share, driven by rising interest in wellness optimization and precision health technologies. Adoption of biohacking tools increases as consumers focus on mental performance, sleep enhancement, and metabolic health. Strong regulatory frameworks shape the use of gene-editing tools and nootropics, encouraging safe and standardized practices. Research organizations and universities contribute to growth through active genetic engineering and synthetic biology programs. Expanding demand for advanced diagnostics, wearables, and personalized supplements strengthens market momentum across key economies like Germany, the U.K., and France.

Asia-Pacific

Asia-Pacific accounts for a 22% market share, supported by growing awareness of performance enhancement, personalized nutrition, and biometric tracking tools. Rapid urbanization and rising fitness culture fuel demand for nootropics, supplements, and smart health devices. The region’s expanding biotech sector drives interest in genetic engineering and synthetic biology applications. Governments invest in biotech research infrastructure, boosting innovation and commercialization. Increasing digital adoption and rising disposable income encourage widespread use of mobile health platforms, strengthening market expansion across China, Japan, India, and South Korea.

Latin America

Latin America holds a 5% market share, influenced by rising interest in health monitoring devices and personalized wellness solutions. Consumers adopt supplements, smart wearables, and basic nootropics as awareness of performance optimization grows. Research activity in genetic engineering and synthetic biology remains limited but gradually expands in academic institutions. Economic constraints slow rapid adoption, yet growing fitness culture and social media influence support steady market penetration. Brazil and Mexico lead regional growth as startups introduce accessible biohacking products to new user groups.

Middle East & Africa

The Middle East & Africa account for a 3% market share, with growth driven by rising demand for wellness products and advanced health-monitoring devices. Urban populations show increasing interest in supplements, metabolic tracking, and cognitive enhancement solutions. Healthcare modernization efforts support adoption of wearable sensors and personalized treatment tools. However, limited awareness, high product costs, and restricted access to advanced genetic engineering tools slow expansion. Growth remains strongest in the UAE, Saudi Arabia, and South Africa as wellness-focused consumers explore emerging biohacking technologies.

Market Segmentations:

By Product

- Gene Modification Kits

- Smart Drugs

- Supplements

- Others

By Application

- Synthetic Biology

- Genetic Engineering

- Forensic Science

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinics

- Forensic Laboratories

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape in the Biohacking market features key players such as Thriveport, LLC, Fitbit, Inc., Muse (Interaxon Inc.), HVMN Inc., TrackMyStack, Moodmetric, The ODIN, OsteoStrong, Thync Global Inc., and Apple Inc. These companies compete by offering advanced wearable sensors, cognitive enhancement tools, personalized wellness platforms, and gene-modification kits. Vendors focus on integrating AI analytics, real-time biomarker tracking, and mobile-enabled insights to support performance optimization. Product innovation centers on expanding capabilities in sleep monitoring, stress management, metabolic tracking, and neurofeedback training. Partnerships with fitness brands, research institutions, and health-tech ecosystems strengthen product reach and user adoption. Strong investment in R&D and digital platforms helps companies improve accuracy, usability, and data interpretation. Competitive intensity continues to rise as firms enhance security features, expand global distribution, and target both consumer and professional segments in the evolving biohacking landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thriveport, LLC

- Fitbit, Inc.

- Muse (Interaxon Inc.)

- HVMN Inc.

- TrackMyStack

- Moodmetric

- The ODIN

- OsteoStrong

- Thync Global Inc.

- Apple Inc.

Recent Developments

- In October 2025, Fitbit (now under Google) previewed a redesigned app with a Gemini-powered AI health coach for Premium users on Android in the U.S.

- In January 2025, Apple launched enhanced programming on Apple Fitness+ including breath-meditation, strength training, yoga and a new collaboration with Strava.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for personalized wellness and performance enhancement tools will continue to rise.

- Wearables with advanced biometric sensors will support real-time health optimization.

- Nootropics and cognitive enhancers will see wider global adoption across user groups.

- Genetic editing kits and DIY biology tools will expand usage in research communities.

- AI-driven biomarker analysis will improve accuracy in personalized health recommendations.

- Implantable chips and biosensors will gain traction among early tech adopters.

- Neurofeedback and brain-training devices will grow as mental performance gains importance.

- Personalized supplement stacks based on genetic data will become more common.

- Regulatory frameworks will evolve to address gene editing, data safety, and human enhancement.

- Investment in biohacking startups will increase as wellness and biotech sectors converge.