Market Overview

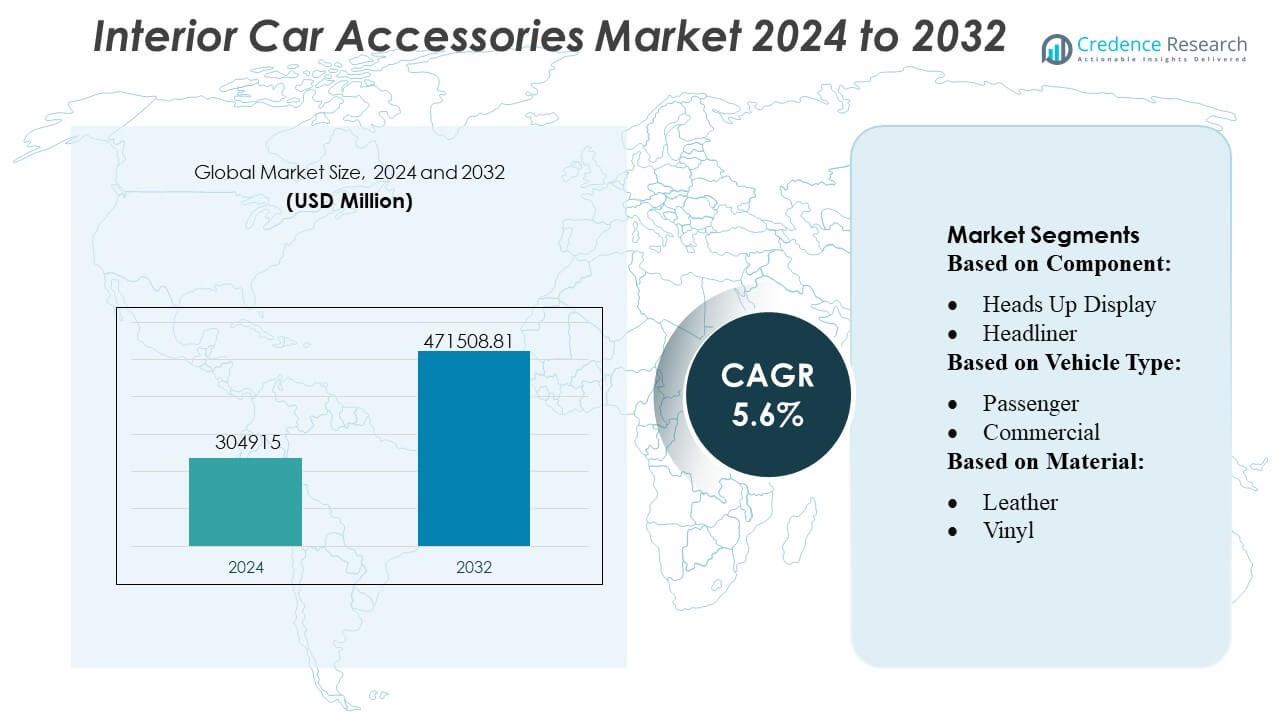

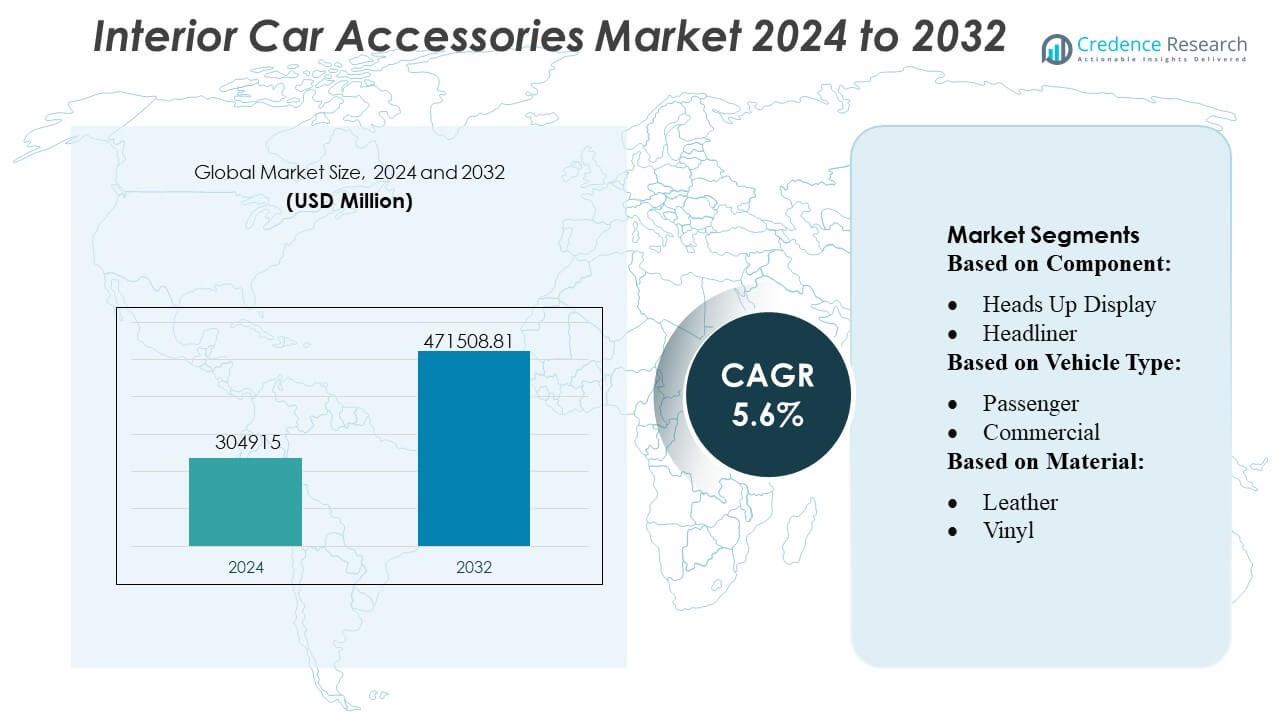

Interior Car Accessories Market size was valued USD 304915 million in 2024 and is anticipated to reach USD 471508.81 million by 2032, at a CAGR of 5.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Interior Car Accessories Market Size 2024 |

USD 304915 Million |

| Interior Car Accessories Market, CAGR |

5.6% |

| Interior Car Accessories Market Size 2032 |

USD 471508.81 Million |

The Interior Car Accessories Market is characterized by strong competition among global OEM suppliers, aftermarket manufacturers, technology integrators, and premium material providers that focus on digital cockpit systems, advanced seating solutions, customizable trims, and sustainable interior components. Companies strengthen their portfolios through modular designs, smart infotainment upgrades, and high-performance composite materials that enhance comfort, safety, and personalization. Asia-Pacific emerges as the leading region with an exact 34–36% market share, driven by its large automotive production base, rising passenger vehicle ownership, and increasing consumer preference for premium, technology-enhanced cabin features across mid-range and compact vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Interior Car Accessories Market reached USD 304,915 million in 2024 and is projected to hit USD 471,508.81 million by 2032, advancing at a CAGR of 5.6%, reflecting steady demand for comfort, safety, and premium in-cabin enhancements.

- Rising adoption of smart infotainment systems, digital cockpits, ergonomic seating, and ambient lighting drives sustained market expansion, supported by increasing vehicle personalization and growing consumer preference for tech-enabled interiors.

- Trends indicate rapid integration of sustainable materials, modular dashboard architectures, and lightweight composites, while advanced connectivity features strengthen differentiation across both OEM and aftermarket channels.

- Competitive intensity deepens as manufacturers prioritize design innovation, sensor-embedded interiors, and AI-enabled cabin functions, while restraints include high integration costs and supply chain complexities related to electronic components.

- Asia-Pacific leads with a 34–36% regional share, supported by strong automotive production, while the seat component segment maintains the largest share due to its central role in comfort and safety integration.

Market Segmentation Analysis:

Market Segmentation Analysis:

- By Component

The Interior Car Accessories Market is dominated by the Seat segment, accounting for over 22–24% of total component demand due to its central role in comfort, ergonomics, and safety integration. Automakers increasingly deploy multi-contour seats, ventilation modules, memory functions, and lightweight frames to enhance premium cabin experiences. Strong consumer inclination toward improved posture support and personalized comfort systems drives sustained adoption. Growth accelerates further as advanced driver-assistance systems integrate occupancy sensors and smart airbag modules within seat assemblies, making them a critical platform for safety, convenience, and vehicle differentiation.

- For instance, Tesla offers a Supercharger V3 system capable of delivering up to 250 kW output — enabling a Tesla vehicle to gain roughly 200 miles of range in 15 minutes under optimal conditions.

- By Vehicle Type

The Passenger Vehicle segment leads the Interior Car Accessories Market with a dominant above 70% share, supported by rising global car ownership, rapid model refresh cycles, and strong demand for tech-enabled cabin features. Consumers prioritize infotainment upgrades, enhanced seating materials, and ambient lighting systems, fueling widespread accessory adoption. OEMs and aftermarket suppliers respond by introducing modular interiors, customizable trim packages, and intuitive digital interfaces. Growth is reinforced by expanding mid-segment SUVs and hatchbacks, which increasingly integrate premium interior elements traditionally reserved for luxury categories, driving mass-market penetration.

- For instance, Siemens recently introduced the system is named SICHARGE FLEX. The central power unit delivers between 480 kW and 1.68 MW DC power. It provides up to 1,500 A charging current via its MCS dispensers. The system supports both CCS and MCS charging standards.

- By Material

Leather remains the leading material in the Interior Car Accessories Market with a market share exceeding 28–30%, driven by its durability, premium tactile feel, and ability to enhance perceived vehicle value. Automakers utilize high-grade leather for seats, steering wheels, and door trims to strengthen brand positioning and meet rising consumer preference for upscale cabin aesthetics. Growth is also propelled by breathable, stain-resistant, and lightweight leather alternatives that support improved interior ergonomics. Hybrid leather composites and advanced tanning technologies further extend adoption across mid-range models, strengthening the material’s sustained leadership.

Key Growth Drivers

1. Rising Demand for Connected and Digitized Cabin Experiences

Growing consumer expectations for connected, intuitive, and technology-rich cabin environments significantly boost demand for advanced interior car accessories. Automakers integrate features such as infotainment systems, digital instrument clusters, ambient lighting, and wireless charging modules to differentiate models and enhance user experience. The shift toward smart cockpits encourages adoption of AI-driven voice assistants, gesture control interfaces, and app-based personalization settings. This surge in digitization positions interior accessories as strategic components that increase comfort, convenience, and driver engagement across all major vehicle categories.

- For instance, Blink Charging officially announced in late September/early October 2024 that it had surpassed a significant milestone of 100,000 chargers sold, deployed, or contracted globally.

2. Strong Growth in Passenger Vehicle Sales and Customization Culture

Rising global passenger vehicle ownership, particularly across emerging markets, strengthens demand for interior accessories that enhance comfort, aesthetics, and utility. Consumers increasingly personalize vehicles with premium seat covers, dashboard trims, organizers, and entertainment modules to reflect lifestyle preferences. Growing SUV and crossover sales further stimulate adoption as these models offer larger cabin spaces suitable for customization. Automakers and aftermarket providers capitalize on this trend by offering modular, customizable interior packages, creating sustained demand for both factory-fitted and aftermarket accessories.

- For instance, Eaton in partnership with ChargePoint recently unveiled a modular ultrafast DC charging architecture under system delivers up to 600 kW for passenger electric vehicles and scales to megawatt-level output for heavy-duty commercial vehicles.

3. Increasing Focus on Safety, Comfort, and Ergonomics

Regulations promoting safer driving environments and rising consumer awareness around comfort fuels rapid expansion of ergonomic interior accessories. Features such as advanced seating systems, head-up displays, adaptive interior lighting, and padded headliners support driver focus and reduce fatigue during long-distance travel. Integrating sensors into seats, belts, and dashboards enhances occupant protection while supporting driver-assistance technologies. As comfort and safety become high-priority purchase drivers, manufacturers accelerate innovation in materials, cushioning technologies, and human-machine interfaces to deliver enhanced in-cabin wellbeing.

Key Trends & Opportunities

1. Expansion of Sustainable Materials and Eco-Friendly Cabin Components

A notable trend shaping the market is the shift toward sustainable interior materials, including plant-based leather, recycled plastics, fabric made from PET bottles, and low-VOC adhesives. OEMs increasingly prioritize carbon-neutral manufacturing and recyclable cabin components to align with environmental regulations and consumer sustainability expectations. This transition opens opportunities for suppliers specializing in bio-based composites, lightweight recycled trims, and green upholstery solutions. The preference for eco-friendly interiors accelerates collaborative R&D between automakers and material technology companies, expanding the market for low-impact cabin innovations.

- For instance, Schneider Electric’s EVlink Pro AC charging stations feature IP55-rated enclosures and operate efficiently in temperatures from –30 °C to 50 °C, with a charging capacity of up to 22 kW per unit, enabling reliable deployment in commercial outdoor environments.

2. Growth of Advanced Personalization and Premium Interior Upgrades

Consumers increasingly seek highly personalized interior environments, encouraging automakers and aftermarket players to offer expanded customization options. Premium upgrades such as customizable ambient lighting, multi-contour seats, high-end audio systems, and bespoke dashboard finishes gain strong traction. Digital retailing platforms enable customers to configure trims, textures, and in-cabin features before purchase, strengthening preference for tailored interiors. Luxury and mid-segment brands leverage this trend by offering curated trim packages, elevating accessory demand and establishing personalization as a key competitive differentiator.

- For instance, ABB’s Terra HP Generation III charger supports output voltages from 150 V to 920 V DC and a maximum current of 500 A via a CCS connector. A fully configured system can deliver up to 350 kW to a single vehicle.

3. Integration of AR/VR and AI for Next-Generation Cabin Experiences

The market experiences new opportunities as automakers deploy AI-driven cabin monitoring systems, AR-based heads-up displays, virtual assistants, and predictive comfort features. These technologies enable personalized seating adjustments, fatigue detection, immersive navigation overlays, and adaptive lighting based on user behavior. AR/VR tools in vehicle design and retail also streamline customization workflows. As digital cabins evolve toward immersive, intelligent ecosystems, suppliers of sensors, processors, and human-machine interface components gain opportunities to support next-generation interior architecture.

Key Challenges

1. High Cost of Premium Interior Technologies and Materials

The integration of premium materials, digital cockpit systems, and advanced comfort features significantly increases vehicle cost, limiting adoption in price-sensitive markets. High-end components such as carbon fiber composites, advanced infotainment modules, and luxury upholstery escalate production expenses and restrict scalability. Balancing affordability with premium cabin expectations remains difficult for OEMs, especially in compact and entry-segment models. Cost pressures force manufacturers to optimize supply chains, explore hybrid materials, and redesign interior layouts to deliver value without compromising quality.

2. Increasing Complexity in Supply Chains and Component Integration

The shift toward connected, digitalized, and multifunctional cabin systems introduces integration challenges for automakers. Coordinating electronics, software, upholstery, structural components, and lighting systems from diverse suppliers complicates assembly and increases failure risks. Semiconductor shortages, material availability constraints, and global logistics disruptions further delay production cycles. Ensuring flawless compatibility across sensors, displays, and control units becomes critical to avoid safety concerns and warranty issues. OEMs must strengthen supplier collaboration, standardize modules, and adopt modular interior architectures to mitigate risks.

Regional Analysis

North America

North America leads the Interior Car Accessories Market with a market share of 31–33%, supported by strong demand for technologically advanced interiors, high adoption of premium comfort features, and a robust aftermarket ecosystem. Consumers prioritize connected displays, upgraded seat materials, ambient lighting systems, and driver-focused digital interfaces. The presence of major automakers and accessory manufacturers accelerates the introduction of innovative cabin technologies. Rising sales of SUVs and pickup trucks further expand opportunities for customized interiors. Increasing electric vehicle adoption also drives investment in redesigned cabin layouts equipped with advanced infotainment, ergonomic seating, and smart storage solutions.

Europe

Europe accounts for 27–29% of global market share, driven by strong regulatory emphasis on safety, ergonomics, and sustainable interior materials. Automakers integrate high-quality textiles, eco-leather, and low-VOC components to comply with stringent environmental standards, strengthening demand for premium cabin accessories. Luxury vehicle production in Germany, Italy, and the U.K. supports adoption of high-end displays, customizable trims, and advanced comfort systems. Growing popularity of compact EVs accelerates need for lightweight and modular interior designs. E-commerce expansion further fuels aftermarket sales, particularly for infotainment upgrades, storage organizers, and aesthetic enhancements across passenger car segments.

Asia-Pacific

Asia-Pacific holds a dominant 34–36% market share, making it the fastest-growing region due to rapid expansion in passenger vehicle ownership, rising disposable income, and strong automotive production hubs in China, Japan, India, and South Korea. Consumers increasingly demand premium seat materials, infotainment upgrades, and comfort-focused accessories across mid-range and compact segments. Local OEMs and suppliers invest heavily in cost-effective yet high-quality interior technologies to meet mass-market expectations. The region’s aggressive shift toward electric vehicles accelerates adoption of digital cockpits, lightweight composites, and modular dashboards, solidifying Asia-Pacific as the central driver of global market expansion.

Latin America

Latin America captures a 6–7% share of the global market, supported by growing urbanization, rising mid-income vehicle ownership, and expanding aftermarket networks. Consumers show strong interest in affordable accessories such as seat covers, infotainment add-ons, mobile charging modules, and interior lighting kits. Brazil and Mexico lead regional demand due to strong assembly operations and the presence of global automotive brands. Economic fluctuations moderately affect premium accessory adoption, but the shift toward compact cars and small SUVs supports steady growth. Increasing penetration of e-commerce platforms further enhances access to customized and budget-friendly interior upgrades.

Middle East & Africa

The Middle East & Africa region holds a 4–5% market share, driven by demand for luxury and comfort-oriented accessories in Gulf countries and rising vehicle ownership in African markets. Premium SUVs dominate accessory purchases in the UAE, Saudi Arabia, and Qatar, where consumers prefer leather interiors, digital infotainment, and ambient lighting systems. Meanwhile, Africa’s aftermarket segment grows steadily due to high demand for cost-effective seat covers, dashboard trims, and utility-focused cabin organizers. Expanding dealership networks and the introduction of global automotive brands support market development, though economic constraints limit penetration of high-end interior technologies.

Market Segmentations:

By Component:

- Heads Up Display

- Headliner

By Vehicle Type:

By Material:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Interior Car Accessories Market reflects a diverse ecosystem of global consumer luxury brands such as Tiffany & Co., Michael Kors Holdings Limited, Richemont International SA, Coach, Inc., Prada S.p.A., Burberry Group plc, LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Chanel S.A., and Hermès International S.A. The Interior Car Accessories Market features a highly fragmented yet innovation-driven competitive landscape, shaped by intense rivalry between OEM suppliers, aftermarket manufacturers, technology integrators, and material specialists. Companies compete through advancements in smart infotainment systems, ergonomic seating solutions, customizable trims, ambient lighting modules, and high-performance composite materials. Digital cockpit upgrades, wireless connectivity features, and modular dashboard architectures have become central areas of differentiation, pushing firms to accelerate R&D investments. Sustainability also emerges as a competitive priority, with suppliers developing eco-leather, recycled fabrics, and low-VOC adhesives to meet regulatory expectations and changing consumer preferences. As personalization becomes a standard expectation, market participants increasingly offer configuration-friendly designs, subscription-based upgrades, and digitally enabled interior enhancement platforms. The ability to balance aesthetics, comfort, safety integration, and technology compatibility ultimately determines competitive advantage across both OEM and aftermarket channels.

Key Player Analysis

- Tiffany & Co.

- Michael Kors Holdings Limited

- Richemont International SA

- Coach, Inc.

- Prada S.p.A.

- Burberry Group plc

- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Chanel S.A.

- Hermès International S.A.

Recent Developments

- In September 2024, Toyoda Gosei Co., Ltd. announced the development of a new system that enables automotive developers to experience and compare vehicle interior sounds resulting from various combinations of sealing components (weatherstrips).

- In July 2024, HIE launched a customizable vegan handbag collection that allows customers to personalize their bags according to their preferences. The collection features a variety of styles and colors made from sustainable materials, emphasizing the brand’s commitment to eco-friendly fashion. Customers can choose different components, such as straps and embellishments, to create unique combinations that reflect their style.

- In July 2024, Antolin and MIT ADT University collaborate on automotive interior design projects. 2024-07-18. Antolin has signed a partnership with MIT Art. In this partnership, they would share the knowledge of both organizations to create fresh solutions for vehicle interiors.

- In May 2024, Yanfeng and Trinseo announced a partnership to accelerate their efforts to develop circular materials for automotive interiors. The partnership entails to creation of materials for End-of-life vehicle compliance and the development of circular materials.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Component, Vehicle Type, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will shift strongly toward intelligent, AI-enabled cabin environments with advanced personalization features.

- Demand for sustainable and recycled interior materials will accelerate as OEMs prioritize eco-friendly manufacturing.

- Digital cockpit expansion will drive greater adoption of smart displays, integrated infotainment, and connected control panels.

- Growth in electric vehicles will influence redesigned cabin layouts focused on space optimization and modular components.

- Premium comfort features such as advanced seating systems and adaptive lighting will become standard in mid-range vehicles.

- Aftermarket channels will expand through online retailing and customizable accessory bundles.

- Enhanced safety standards will push wider integration of sensor-embedded interiors and driver monitoring systems.

- Lightweight composite materials will gain traction to support vehicle efficiency and cabin durability.

- AR- and VR-enabled cabin enhancement technologies will strengthen the personalization and navigation experience.

- Collaboration between automakers and luxury lifestyle brands will increase demand for premium interior finishes and exclusive cabin aesthetics.

Market Segmentation Analysis:

Market Segmentation Analysis: