Market Overview:

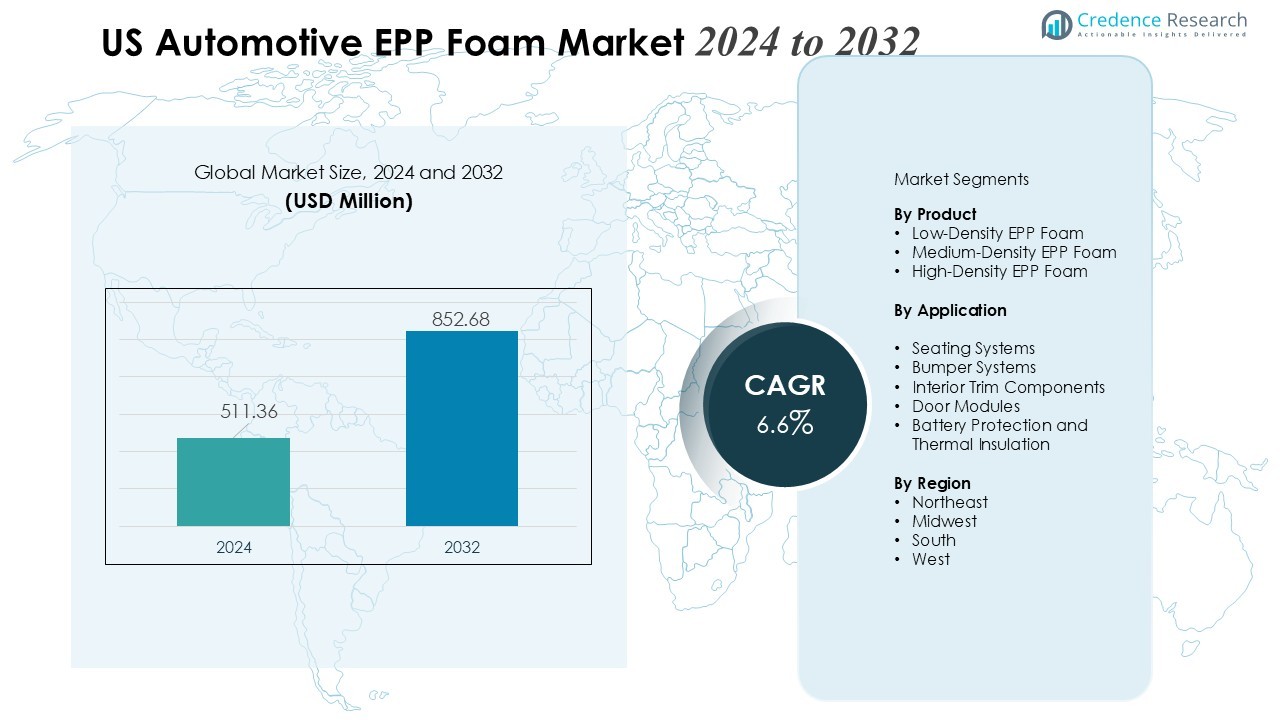

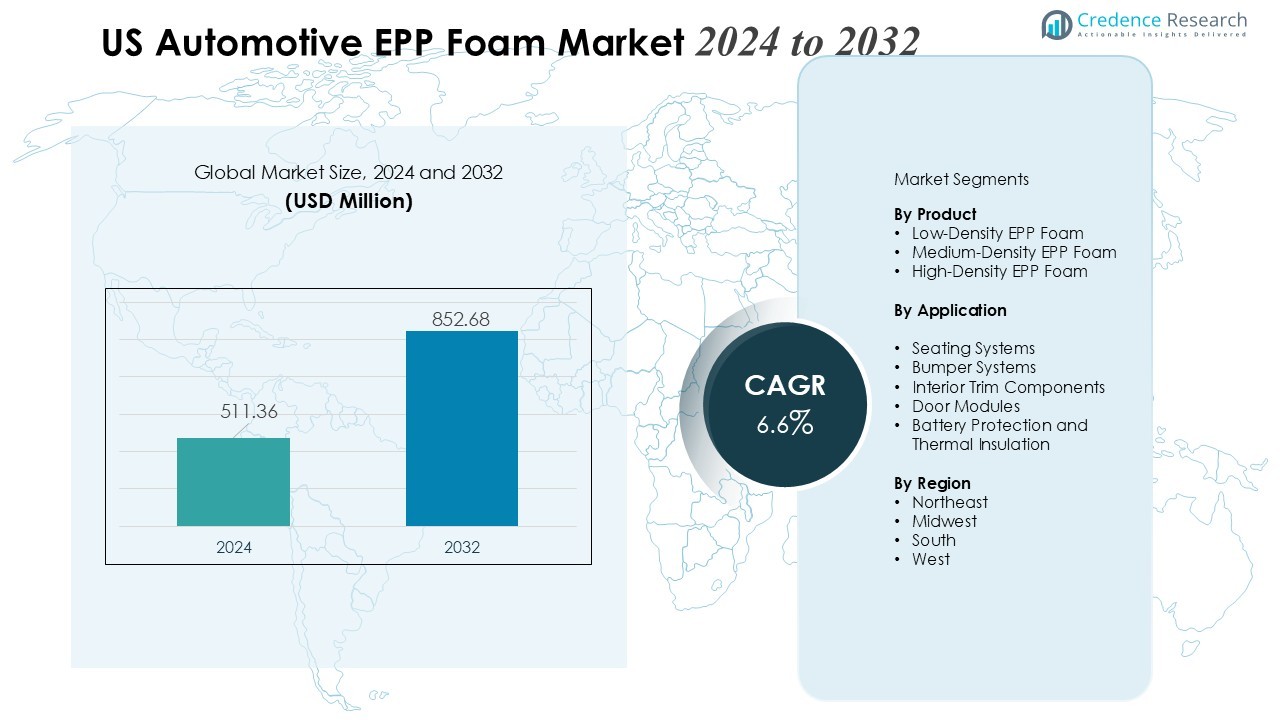

The US Automotive EPP Foam Market size was valued at USD 511.36 million in 2024 and is anticipated to reach USD 852.68 million by 2032, at a CAGR of 6.6 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| US Automotive EPP Foam Market Size 2024 |

USD 511.36 Million |

| US Automotive EPP Foam Market, CAGR |

6.6% |

| US Automotive EPP Foam Market Size 2032 |

USD 852.68 Million |

Strong demand for high-performance materials drives adoption across bumper systems, seating structures, door panels, and interior safety inserts. Automakers leverage EPP foam for its superior durability, recyclability, thermal resistance, and energy absorption properties. Rising emphasis on vehicle lightweighting, coupled with stringent fuel-efficiency and emission-reduction standards, accelerates material substitution from conventional plastics and metals toward EPP foam. Growth in EV production further strengthens market momentum as OEMs and Tier-1 suppliers prioritize lightweight materials to improve vehicle range and optimize battery efficiency.

Regionally, the Midwest and Southern United States hold dominant shares due to the concentration of automotive manufacturing hubs, component suppliers, and advanced material processing facilities. Increasing investments in EV production plants across states such as Michigan, Tennessee, and Georgia support market growth. The West Coast records notable expansion driven by strong EV adoption rates, while Northeastern states contribute through steady demand for high-performance, safety-enhancing automotive materials.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The US Automotive EPP Foam Market grows from USD 511.36 million (2024) to USD 852.68 million (2032), driven by strong demand for lightweight, impact-resistant materials.

- Automakers increase use of EPP foam across bumpers, seating, and interior safety zones to meet fuel-efficiency and emission-reduction standards.

- Rising safety requirements accelerate adoption of high-performance, energy-absorbing EPP components for collision protection and occupant safety.

- Expanding EV and hybrid vehicle manufacturing strengthens demand for thermally stable EPP foam used in battery insulation and vibration-control structures.

- Sustainability priorities and circular-material goals support wider deployment of recyclable EPP foam across critical automotive components.

- High material costs, molding complexity, and competition from lower-cost polymers such as EPS and EPE remain notable industry restraints.

- Midwest, Southern, and West Coast regions drive market momentum through strong OEM presence, EV investments, and preference for premium lightweight materials.

Market Drivers:

Market Drivers:

Rising Focus on Lightweight Vehicle Construction to Meet Fuel-Efficiency and Emission Standards

The US Automotive EPP Foam Market gains strong momentum from the industry-wide shift toward lightweight vehicles that meet federal fuel-efficiency mandates and emission-reduction targets. Automakers integrate EPP foam into bumpers, seating structures, headliners, and interior supports to reduce vehicle weight without compromising strength. It supports improved fuel economy and enhances overall structural safety. The material’s ability to retain shape after impact strengthens its relevance in next-generation vehicle platforms.

- For instance, Ford Motor Company developed a Multi-Material Lightweight Concept (MMLV) sedan that utilized a wide range of advanced materials (including aluminum, carbon fiber composites, magnesium, and high-strength steel, with some use of chemically foamed plastics for interior trim components). This comprehensive multi-material design achieved a total vehicle mass reduction to 1195 kg from the original 1559 kg steel baseline vehicle, representing a 364 kg reduction in mass.

Growing Safety Requirements and Demand for High-Performance Energy-Absorbing Materials

Strict safety regulations encourage OEMs to adopt EPP foam for energy-absorbing zones that protect occupants during collision events. The US Automotive EPP Foam Market benefits from the material’s high impact-resistance and its ability to disperse crash energy effectively. It meets OEM expectations for durability, deformation recovery, and thermal stability. Increasing installation in door panels, knee bolsters, headrests, and bumper cores expands its strategic importance.

- For instance, Knauf Automotive integrates EPP in door panels for side impact protection, achieving energy absorption with densities adjustable from 20 to 180 g/l. Increasing installation in door panels, knee bolsters, headrests, and bumper cores expands its strategic importance.

Expansion of Electric and Hybrid Vehicle Manufacturing Across the United States

The rapid rise in EV and hybrid production reinforces demand for lightweight, thermally stable materials. The US Automotive EPP Foam Market responds to OEM requirements for improved vehicle range, optimized battery performance, and reduced overall mass. It supports effective thermal insulation around battery packs and helps manage vibration within EV platforms. Growing EV investments across Michigan, Tennessee, Texas, and Georgia elevate consumption of advanced polymer foams.

Increased Emphasis on Recyclability, Sustainability, and Circular Material Use in Automotive Design

Automakers shift toward recyclable and eco-efficient materials to meet sustainability commitments and corporate ESG goals. The US Automotive EPP Foam Market aligns with these initiatives because EPP foam supports multiple recycling cycles without performance loss. It enables manufacturers to lower environmental footprints while maintaining design flexibility. Rising consumer and regulatory pressure for sustainable vehicle components strengthens industry adoption.

Market Trends:

Advancements in Lightweighting Strategies and Integration of EPP Foam in Next-Generation Vehicle Architectures

The US Automotive EPP Foam Market reflects a clear trend toward advanced lightweighting strategies across OEM platforms. Automakers increase the use of high-resilience EPP foam in bumper beams, seat cores, battery housings, and head-impact protection areas. It offers improved compression strength, impact absorption, and thermal resistance, which increases its suitability for structural and semi-structural components. Expanded use in EV battery insulation and vibration control solutions highlights its growing importance in electric mobility. Manufacturers invest in engineered foam grades that support higher temperature thresholds and improved durability. Rising adoption in autonomous and connected vehicle interiors strengthens its long-term relevance.

- For instance, Knauf Industries developed EPP foam components with a high strength-to-weight ratio that returns to shape after compression, enabling up to 30% weight reduction in bumper cores compared to metal alternatives.

Shift Toward Sustainable Materials, Circular Manufacturing Models, and Recyclable Polymer Foam Solutions

Automakers move toward sustainable material choices that support circular design frameworks across production lines. The US Automotive EPP Foam Market benefits from the strong preference for fully recyclable polymer foams that reduce waste and support eco-efficient manufacturing. It allows OEMs to reuse production scrap and repurpose end-of-life components without degradation in quality. Rising consumer demand for greener vehicles accelerates the use of low-density, energy-efficient foams in interior and safety applications. Manufacturers introduce bio-based and low-emission EPP formulations to meet tightening corporate sustainability targets. Growing alignment with ESG-focused supplier standards enhances the market’s overall direction.

- For instance, BASF developed a new generation of flexible PU foams that achieve 100% recyclability into thermoplastic raw materials for new foams at end-of-life.

Market Challenges Analysis:

High Material Costs, Complex Manufacturing Needs, and Competitive Pressure from Alternative Lightweight Polymers

The US Automotive EPP Foam Market faces challenges arising from fluctuating raw material prices and the technical expertise required for precision molding. Manufacturers incur higher production costs when they adopt advanced EPP grades for safety and EV applications. It creates cost pressures for OEMs that operate in a price-sensitive environment. Competitive materials such as EPS, EPE, and lightweight engineered plastics sometimes offer lower-cost options for non-critical components. Limited awareness among smaller suppliers restricts broader adoption. Variability in resin availability also affects production stability.

Regulatory Compliance Demands, Recycling Complexity, and Integration Constraints in EV Platforms

Strict regulatory expectations for recyclability and end-of-life material recovery create operational barriers for some suppliers. The US Automotive EPP Foam Market must adapt to evolving environmental rules that require traceability and improved waste-handling processes. It becomes difficult for manufacturers that lack advanced recycling systems or circular supply chains. EV platforms pose integration constraints when battery layouts and thermal requirements differ across models. Space limitations in compact EV designs reduce the volume of foam components in certain assemblies. Slow modernization among low-tier suppliers widens performance gaps across the value chain.

Market Opportunities:

Expansion of Electric Vehicle Production, Advanced Safety Modules, and High-Performance Thermal Insulation Needs

The US Automotive EPP Foam Market gains significant opportunity from the rapid expansion of EV manufacturing across major automotive hubs. OEMs seek lightweight, energy-absorbing, and thermally stable materials that support longer battery range and improved passenger safety. It creates strong demand for EPP foam in battery cushioning, impact-resistant modules, and temperature-control structures. Growth in autonomous and semi-autonomous vehicles opens opportunities for sensor housings and interior comfort systems. Rising investment in smart cabin designs increases adoption in headliners, seating structures, and door panels. EPP foam’s versatility strengthens its position in next-generation automotive programs.

Rising Sustainability Goals, Circular Production Models, and Demand for Fully Recyclable Polymer Solutions

Automakers advance sustainability initiatives that favor recyclable and low-emission materials. The US Automotive EPP Foam Market benefits from growing acceptance of circular production models that reuse foam scrap and reduce waste footprints. It aligns with corporate ESG targets that push suppliers to deliver cleaner, high-performance materials. Interest in bio-based EPP grades expands procurement opportunities across green vehicle platforms. Lightweight components that improve fuel efficiency and lower lifecycle emissions enhance market potential. Increasing consumer preference for eco-conscious automotive materials reinforces long-term growth prospects.

Market Segmentation Analysis:

By Product

The US Automotive EPP Foam Market shows strong demand across low-density, medium-density, and high-density EPP foam grades used in structural and safety applications. Automakers prefer low-density grades for seating cores, energy absorbers, and interior comfort components where flexibility and lightweight performance matter. Medium-density grades support bumper inserts, load floors, and door panels that require balanced impact resistance and structural integrity. High-density grades gain traction in EV battery protection, underbody modules, and advanced safety structures. It enables OEMs to meet durability and thermal stability requirements across diverse vehicle platforms. Rising integration of advanced foam grades supports long-term product innovation.

- For instance, BASF’s low-density EPP foam at 20-30 kg/m³ density delivers superior impact absorption in automotive seating, enabling 30% weight reduction over traditional materials while maintaining cushioning.

By Application

The US Automotive EPP Foam Market records high usage across seating systems, bumper assemblies, interior trims, door modules, and battery protection solutions. Seating structures remain a leading application due to strong demand for lightweight, compression-resistant, and comfort-enhancing materials. Bumper systems use EPP foam to achieve reliable crash energy absorption and deformation recovery. Interior trims integrate EPP for acoustic control, thermal insulation, and improved occupant protection. EV battery systems create new opportunities for high-temperature foam solutions that support cushioning, vibration control, and thermal management. It strengthens adoption across next-generation electric and hybrid vehicles.

- For instance, car manufacturers integrating Expanded Polypropylene (EPP) based bumper components improved crash safety performance and enhanced energy absorption in vehicle designs, particularly in managing impact forces during low-speed collisions.

Segmentations:

By Product

- Low-Density EPP Foam

- Medium-Density EPP Foam

- High-Density EPP Foam

By Application

- Seating Systems

- Bumper Systems

- Interior Trim Components

- Door Modules

- Battery Protection and Thermal Insulation

By Region

- Northeast

- Midwest

- South

- West

Regional Analysis:

Strong Automotive Manufacturing Base in the Midwest Driving High Consumption of EPP Foam Components

The US Automotive EPP Foam Market maintains a strong presence in the Midwest due to the concentration of major OEMs, Tier-1 suppliers, and advanced materials processors. States such as Michigan, Ohio, and Indiana support high-volume production of seating systems, bumper assemblies, and structural interior components. It benefits from established automotive clusters that rely on lightweight, high-resilience materials to meet evolving fuel-efficiency and safety requirements. Investment in EV and hybrid vehicle manufacturing expands demand for thermally stable EPP foam in battery housings and energy-absorbing modules. Collaboration between automotive research institutions and material innovators strengthens product development. Steady expansion of local supply chains reinforces long-term growth.

Rising EV Investments in the South Strengthening Adoption Across Battery Modules and Interior Structures

Southern states record strong growth driven by rapid expansion of EV production facilities across Tennessee, Texas, Georgia, and Alabama. The US Automotive EPP Foam Market leverages increasing adoption of lightweight materials required for range optimization and improved vehicle efficiency. It supports high-volume deployment in seat cores, bumper systems, door modules, and thermal insulation components. Growth in new manufacturing plants accelerates procurement of high-density foam grades for advanced safety and battery protection systems. Competitive labor markets and favorable state policies attract continued investment in automotive manufacturing. Increasing supplier presence enhances regional resilience and production capacity.

High EV Penetration on the West Coast Supporting Demand for Premium Lightweight and Sustainable Foam Solutions

Western states, led by California and Washington, show rising demand for advanced polymer foam solutions driven by high EV adoption rates and sustainability-focused regulations. The US Automotive EPP Foam Market benefits from increased integration of recyclable, low-emission foam materials in next-generation vehicle platforms. It aligns with consumer preference for eco-conscious automotive interiors and energy-efficient designs. Strong presence of EV manufacturers and technology-driven automotive firms accelerates demand for temperature-resistant foam used in battery packs and cabin systems. Growth in autonomous and connected vehicle development boosts utilization in interior safety and comfort modules. Regional emphasis on environmental performance strengthens the long-term outlook.

Key Player Analysis:

- BASF SE

- Sonoco Products Company

- Magna International, Inc.

- Woodbridge

- Clark Foam Products Corporation

- PDM Foam (Signode Industrial Group LLC)

- Knauf Industries

- Bradford Company

Competitive Analysis:

Competitive landscape in the US Automotive EPP Foam Market features major players such as BASF SE, Sonoco Products Company, Magna International, Inc., Woodbridge, and Clark Foam Products Corporation that influence product development and supply capabilities. These companies invest in advanced foam technologies that improve impact resistance, thermal stability, and recyclability to support OEM requirements. It strengthens competitive positioning by enabling suppliers to deliver tailored solutions for EV platforms, safety modules, and structural interior components. Leading firms expand regional manufacturing footprints to ensure consistent supply and faster delivery to automotive hubs in the Midwest and South. Partnerships with OEMs and Tier-1 suppliers drive innovation in high-density foam grades and modular components. Continuous focus on material optimization, sustainability, and cost efficiency shapes long-term competition.

Recent Developments:

- In November 2025, BASF inaugurated the expansion of its Alkyl Polyglucosides (APGs) production capacity in Chonburi, Thailand, enhancing its footprint in Asia for sustainable surfactants used in personal care and cleaning products.

- In October 2025, BASF started construction of a new electronic grade ammonium hydroxide plant in Ludwigshafen, Germany, to meet semiconductor industry demands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Product, Application and Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The US Automotive EPP Foam Market will experience stronger adoption of high-density foam grades that support EV battery protection and interior structural modules.

- It will record wider integration of recyclable and low-emission EPP formulations that align with OEM sustainability commitments.

- It will gain momentum from rising EV production across the Midwest, South, and West, which increases demand for lightweight thermal-resistant materials.

- It will benefit from expansion of autonomous and connected vehicle programs that require advanced energy-absorbing interior components.

- It will see greater investment in engineered foams designed for higher temperature performance and improved deformation recovery.

- It will attract new suppliers that introduce cost-efficient production technologies to meet OEM price targets.

- It will observe steady replacement of traditional plastics in seating systems, bumper cores, and interior comfort applications.

- It will expand through deeper collaboration between material innovators and Tier-1 suppliers focused on next-generation vehicle platforms.

- It will reflect increased procurement of foam solutions optimized for acoustic control and vibration management in EV cabins.

- It will maintain long-term growth as automakers prioritize lightweight designs, modular architecture, and circular material use across all major vehicle segments.

Market Drivers:

Market Drivers: