Market Overview

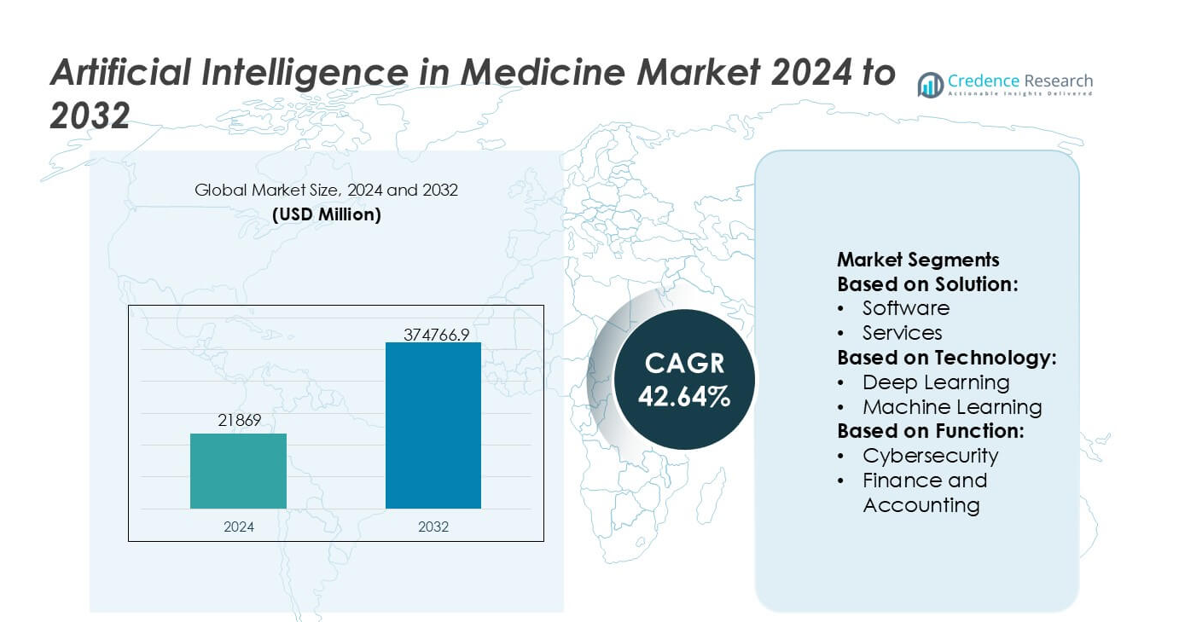

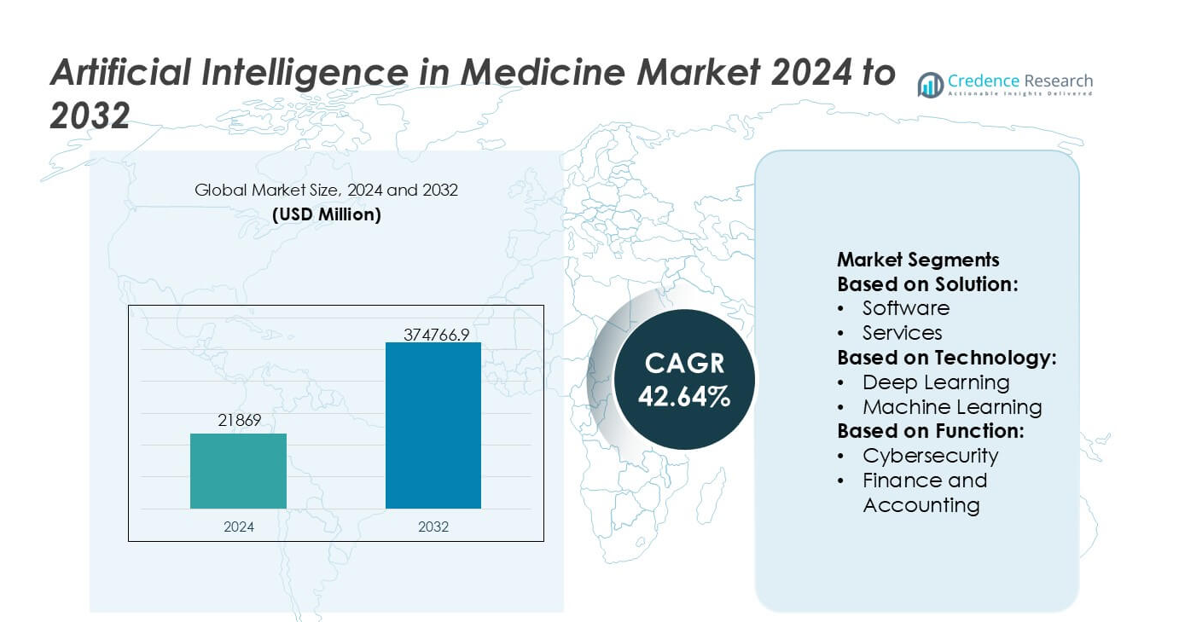

Artificial Intelligence in Medicine Market size was valued USD 21869 million in 2024 and is anticipated to reach USD 374766.9 million by 2032, at a CAGR of 42.64% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Artificial Intelligence in Medicine Market Size 2024 |

USD 21869 million |

| Artificial Intelligence in Medicine Market, CAGR |

42.64% |

| Artificial Intelligence in Medicine Market Size 2032 |

USD 374766.9 million |

The Artificial Intelligence in Medicine Market is shaped by a concentrated group of technology leaders and healthcare innovators that continue to accelerate algorithmic adoption across diagnostics, treatment planning, and operational workflows. These companies strengthen their competitive position through advanced model training, clinical validation partnerships, and scalable cloud-AI infrastructures that support real-time decision augmentation in hospitals. Their strategic focus on precision analytics, automation, and predictive insights enhances provider efficiency and patient outcomes. North America emerges as the leading region, holding an exact 41% market share, supported by robust digital-health investments, strong regulatory clarity for AI-enabled tools, and high integration of clinical informatics across care settings.

Market Insights

- The Artificial Intelligence in Medicine Market reached USD 21,869 million in 2024 and is projected to hit USD 374,766.9 million by 2032 at a 42.64% CAGR, reflecting unprecedented adoption across clinical and operational domains.

- Strong market drivers include rising demand for AI-enabled diagnostics, rapid integration of predictive analytics in treatment planning, and expanding hospital investments in workflow automation, boosting adoption across major solution and technology segments.

- Key trends highlight accelerated deployment of cloud-based AI platforms, expanding generative-AI applications, and broader use of machine learning in imaging, cybersecurity, and patient-monitoring workflows, strengthening segment-level growth.

- Competitive intensity increases as technology leaders enhance clinical-grade algorithms, pursue validation partnerships, and scale interoperable architectures, while restraints emerge from data privacy concerns, integration complexity, and workforce skill gaps.

- North America leads with 41% regional share, followed by Europe and Asia-Pacific, while software solutions maintain the dominant segment position with the highest adoption rate across healthcare systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Solution

The Artificial Intelligence in Medicine Market, by solution, is segmented into hardware, software, and services. Software is the dominant sub-segment, accounting for an estimated 48–52% market share, driven by widespread adoption of AI-powered clinical decision support, imaging analytics, and predictive modeling platforms. Within hardware, accelerators and processors support high-performance medical AI workloads, while services such as professional and managed offerings enable deployment and optimization. The dominance of software is reinforced by scalable cloud-based architectures, recurring licensing models, rapid algorithm updates, and strong demand from hospitals seeking cost-efficient, interoperable AI solutions.

- For instance, NVIDIA recently advanced medical AI performance with its Clara Holoscan platform powered by the Jetson AGX Orin module, delivering up to 275 trillion operations per second (TOPS) to support real-time surgical imaging and AI inference, as documented in the company’s technical release.

By Technology

By technology, the market includes deep learning, machine learning, natural language processing (NLP), machine vision, and generative AI. Deep learning holds the largest share, approximately 40–45%, due to its superior performance in medical imaging, pathology analysis, and genomics. Its dominance is driven by the growing volume of labeled healthcare data, advances in neural network architectures, and increased computational power. NLP is expanding rapidly in clinical documentation and electronic health record analysis, while generative AI is emerging in drug discovery and personalized treatment planning, further strengthening the technology-driven evolution of medical AI.

- For instance, Google demonstrated a major technical milestone with its Med-PaLM 2 medical large language model, which achieved a validated score of 85.4 on the U.S. Medical Licensing Examination-style benchmark according to Google Health’s published results, and is engineered to handle input sequences exceeding 20,000 tokens to support complex, multi-modal clinical reasoning showcasing deep learning and NLP integration at scale.

By Function

Based on function, the market spans cybersecurity, finance and accounting, human resource management, legal and compliance, operations, sales and marketing, and supply chain management. Operations is the dominant functional sub-segment, representing nearly 35–38% of demand, as healthcare providers prioritize AI to optimize clinical workflows, patient scheduling, diagnostics, and resource utilization. Growth is driven by the need to reduce operational costs, address workforce shortages, and improve care delivery efficiency. AI adoption in cybersecurity and compliance is also rising, supporting data protection and regulatory adherence in increasingly digitized healthcare environments.

Key Growth Drivers

Rising Integration of AI in Clinical Decision Support

The market advances as healthcare providers increasingly deploy AI-enabled clinical decision support tools that enhance diagnostic accuracy, streamline workflows, and reduce human error. Systems leveraging deep learning and natural language processing interpret medical images, pathology slides, and electronic health records with greater speed and precision. Hospitals adopt these platforms to personalize treatment pathways, accelerate disease detection, and improve patient outcomes. Growing validation studies, expanding datasets, and regulatory acceptance of AI-based diagnostics reinforce demand for intelligent decision support in medical environments.

- For instance, GE Healthcare’s recent SIGNA Hero MRI platform integrates the AI-based AIR Recon DL reconstruction engine, which reduces image noise and improves spatial resolution while enabling scan-time reductions of up to 50 seconds per sequence, as documented in GE’s technical specifications demonstrating measurable gains in diagnostic efficiency enabled by clinical AI.

Rapid Expansion of Digital Health Infrastructure

Accelerated digital transformation in hospitals, clinics, and outpatient centers drives AI adoption across administrative, diagnostic, and therapeutic functions. Wider availability of cloud-based health information systems, interoperable data platforms, and remote monitoring tools creates a supportive environment for algorithmic deployment. Telemedicine networks incorporate AI for triage, symptom checking, and chronic disease management, enabling scalable care delivery. Increasing investments in connected medical devices and data analytics platforms further strengthen AI readiness, allowing providers to manage large-scale clinical datasets with enhanced efficiency and lower operational costs.

- For instance, Oracle’s Healthcare Data Repository, part of Oracle Health’s unified platform, was engineered to process more than 16 billion clinical data transactions per year according to Oracle’s technical disclosures.

Growing Demand for Precision Medicine and Predictive Analytics

Demand rises as precision medicine initiatives increasingly rely on AI to analyze genomic, phenotypic, and behavioral data for individualized treatment strategies. Predictive analytics models help clinicians forecast disease progression, drug response, and hospitalization risks with higher reliability. Pharmaceutical companies use AI to accelerate biomarker discovery, optimize trial design, and reduce development costs. Healthcare systems integrate predictive engines to allocate resources, identify high-risk patients, and improve preventive care outcomes. This shift toward targeted, data-driven therapy enhances clinical effectiveness and fuels robust market expansion.

Key Trends & Opportunities

Increasing Use of Generative AI for Drug Discovery and Medical Imaging

Generative AI emerges as a transformative trend, offering opportunities to accelerate molecule design, optimize imaging workflows, and automate complex analytical tasks. Drug developers use generative models to simulate molecular interactions and propose novel therapeutic candidates at significantly reduced timelines. In imaging, these models enhance resolution, repair incomplete scans, and generate synthetic datasets to strengthen algorithm training. The ability of generative AI to reduce costs, expand research possibilities, and improve clinical accuracy positions it as a central innovation driver within the market.

- For instance, Intel’s technical benchmark reports. Using OpenVINO, benchmarks on 5th Gen Intel Xeon processors demonstrated up to a 12x faster inference for Stable Diffusion XL-1.0 compared to native libraries, enabling high-fidelity image generation and reconstruction workflows essential for medical AI.

Expansion of AI-Enabled Remote Monitoring and Virtual Care

The rise of remote care ecosystems presents significant opportunities for AI in continuous health monitoring, early risk detection, and automated patient engagement. Wearables and IoT-enabled medical devices provide real-time physiological data that AI systems analyze to flag abnormalities and suggest timely interventions. Virtual care platforms incorporate conversational AI for triage, behavioral coaching, and follow-up management. As home-based care models gain traction, healthcare providers and insurers invest in AI tools that enhance chronic disease management, reduce hospital admissions, and optimize long-term care outcomes.

- For instance, IBM validated a major advancement with its Watson Health Imaging AI now part of Merative where its algorithmic workload ran on IBM’s Power10 processors capable of executing 3-times higher AI inferencing throughput compared with prior Power9 systems, supported by a memory bandwidth of 1 terabyte per second as confirmed in IBM’s technical specifications.

Advancements in Multimodal AI and Unified Clinical Data Systems

A major trend involves the shift toward multimodal AI capable of analyzing text, images, genomic data, and sensor feeds simultaneously. This development improves diagnostic precision and produces more holistic patient insights. Unified data systems integrating EHRs, lab results, imaging archives, and patient-generated data create a strong foundation for such models. Vendors explore opportunities to commercialize integrated platforms that support real-time decision making and cross-disciplinary care coordination. As data interoperability improves, multimodal AI becomes more scalable, unlocking extensive clinical and operational benefits.

Key Challenges

Data Privacy, Security, and Interoperability Concerns

Despite rapid adoption, significant challenges arise from limited data interoperability, inconsistent data quality, and heightened privacy concerns. Healthcare providers struggle to unify fragmented systems and ensure secure transmission of sensitive information across platforms. Compliance with regulations such as HIPAA, GDPR, and regional health-data frameworks increases operational complexity. Breaches, algorithmic bias risks, and lack of standardized data-sharing protocols hinder large-scale deployment. These constraints slow AI integration, particularly in environments where legacy systems dominate or cybersecurity maturity remains low.

Regulatory Barriers and Slow Clinical Validation

Achieving regulatory approval for AI solutions remains difficult due to stringent requirements for transparency, reproducibility, and real-world evidence. Many algorithms require continuous training and updates, challenging existing regulatory pathways that expect fixed, validated models. Clinical validation demands extensive trials, long timelines, and significant investment, which can delay commercialization. Healthcare providers also express concerns about reliability, explainability, and medico-legal accountability when using AI for high-stakes decisions. These regulatory and validation barriers restrict market penetration, especially for emerging deep learning-based applications.

Regional Analysis

North America

North America leads the Artificial Intelligence in Medicine Market with a dominant 41% share, supported by advanced healthcare digitalization, widespread EHR adoption, and strong integration of AI-enabled diagnostics. The region benefits from robust R&D investments, favorable reimbursement pathways, and an active AI start-up ecosystem collaborating with hospitals and life-science companies. High deployment of machine learning in radiology, oncology, and population health management reinforces market expansion. Government initiatives promoting AI governance and interoperability accelerate clinical adoption. Large patient datasets, strong cloud infrastructure, and rapid regulatory clearances further solidify North America’s leadership in AI-driven medical innovation.

Europe

Europe secures 27% of the global market, driven by rising adoption of AI-enhanced imaging, predictive analytics, and telemedicine platforms across public and private healthcare systems. The region’s strong compliance culture, supported by the EU AI Act and GDPR frameworks, encourages ethical algorithm deployment and transparent clinical workflows. Countries such as Germany, the UK, and France invest heavily in hospital digitalization and AI-supported clinical trials. Growth accelerates as national health services integrate AI tools for workflow automation, early diagnosis, and chronic disease management. Collaborative research networks and cross-border data initiatives further improve scalability and adoption.

Asia-Pacific

Asia-Pacific represents 23% of the market, expanding rapidly due to increasing healthcare digitalization, large patient volumes, and government-backed AI programs in China, Japan, South Korea, and India. Hospitals adopt AI-based imaging, triage systems, and remote monitoring solutions to handle rising chronic disease burdens and clinician shortages. China’s aggressive investment in medical AI platforms and Japan’s focus on robotics-assisted care provide strong momentum. Growing telehealth usage, rising private-sector participation, and expanding clinical data infrastructures accelerate the region’s adoption curve. As affordability improves and regulatory frameworks mature, Asia-Pacific emerges as the fastest-growing AI-in-medicine ecosystem.

Latin America

Latin America holds a 6% market share, with adoption increasing as health systems modernize and prioritize cost-efficient digital tools. Countries such as Brazil, Mexico, and Colombia invest in AI-driven telemedicine, imaging analytics, and operational automation to expand access and reduce clinical bottlenecks. Rising chronic disease prevalence drives interest in predictive models and AI-supported screening tools. However, budget constraints, fragmented data ecosystems, and uneven digital infrastructure limit widespread deployment. Despite these challenges, growing partnerships with global technology vendors and expanding private healthcare networks create opportunities for AI integration across diagnostic and administrative workflows.

Middle East & Africa

The Middle East & Africa region accounts for 3% of the market, with growth primarily concentrated in GCC countries that invest in smart hospitals, AI-enabled diagnostics, and national digital-health strategies. The UAE and Saudi Arabia lead adoption through large-scale AI frameworks targeting precision medicine, tele-radiology, and population health analytics. Emerging African markets explore AI for infectious disease surveillance and remote clinical support, though infrastructure gaps persist. Increasing investment in cloud healthcare platforms, rising medical tourism, and partnerships with global AI vendors support long-term growth potential despite slower adoption in low-resource settings.

Market Segmentations:

By Solution:

By Technology:

- Deep Learning

- Machine Learning

By Function:

- Cybersecurity

- Finance and Accounting

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Artificial Intelligence in Medicine Market is shaped by a diverse group of technology leaders and healthcare innovators, including Medtronic, NVIDIA Corporation, Google, GE Healthcare, Oracle, Intel Corporation, Medidata, IBM, Itrex Group, and Microsoft. the Artificial Intelligence in Medicine Market continues to evolve as technology vendors, healthcare solution providers, and data-driven analytics companies expand their portfolios with advanced clinical AI capabilities. Competition intensifies as firms focus on developing scalable platforms that support imaging analysis, predictive diagnostics, workflow automation, and precision-medicine applications. Vendors increasingly differentiate through algorithm transparency, real-world validation, and integration with electronic health records and cloud-based infrastructures. Strategic partnerships with hospitals, pharmaceutical companies, and research institutions enhance innovation pipelines and accelerate clinical deployment. Continuous investment in multimodal AI, federated learning, and regulatory-compliant data ecosystems strengthens market positioning, while the rise of generative AI and autonomous clinical decision systems reshapes competitive strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Google LLC integrated its Gemini AI into the Chrome browser, adding features for searching, researching, and answering questions with AI, along with upcoming agentic cursor-controlling tools.

- In April 2025, HelloCareAI raised to expand its AI-driven virtual care platform for smart hospitals. The initiative focuses on enhancing patient care through AI-assisted nursing, remote monitoring, and efficient workflow management.

- In February 2025, Innovaccer launched “Agents of Care,” AI-powered assistants to fight healthcare burnout by automating tasks like prior authorizations and claims, using unified patient data for better coordination, freeing clinicians for patient care.

Report Coverage

The research report offers an in-depth analysis based on Solution, Technology, Function and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- AI will increasingly enhance diagnostic accuracy through advanced imaging analytics, real-time triage, and automated anomaly detection.

- Hospitals will adopt multimodal AI systems that integrate text, imaging, genomic, and sensor data for more holistic clinical decision-making.

- Generative AI will accelerate drug discovery, clinical documentation, and virtual clinical assistance across care settings.

- Predictive analytics will expand preventive care programs by identifying high-risk patients earlier and enabling proactive interventions.

- AI-enabled robotics and navigation systems will broaden the adoption of minimally invasive and precision-guided surgical procedures.

- Remote monitoring and virtual-care platforms will rely more heavily on AI-driven risk scoring and personalized treatment recommendations.

- Cloud-based AI ecosystems will strengthen interoperability, enabling seamless integration with hospital information and medical device networks.

- Regulatory frameworks will evolve to support adaptive AI models, improving trust, accountability, and clinical reliability.

- Collaboration between tech companies, pharmaceutical firms, and healthcare providers will accelerate commercial deployment of validated AI solutions.

- Workforce augmentation through AI-driven automation will optimize clinical workloads, reduce burnout, and improve operational efficiency.