Market Overview

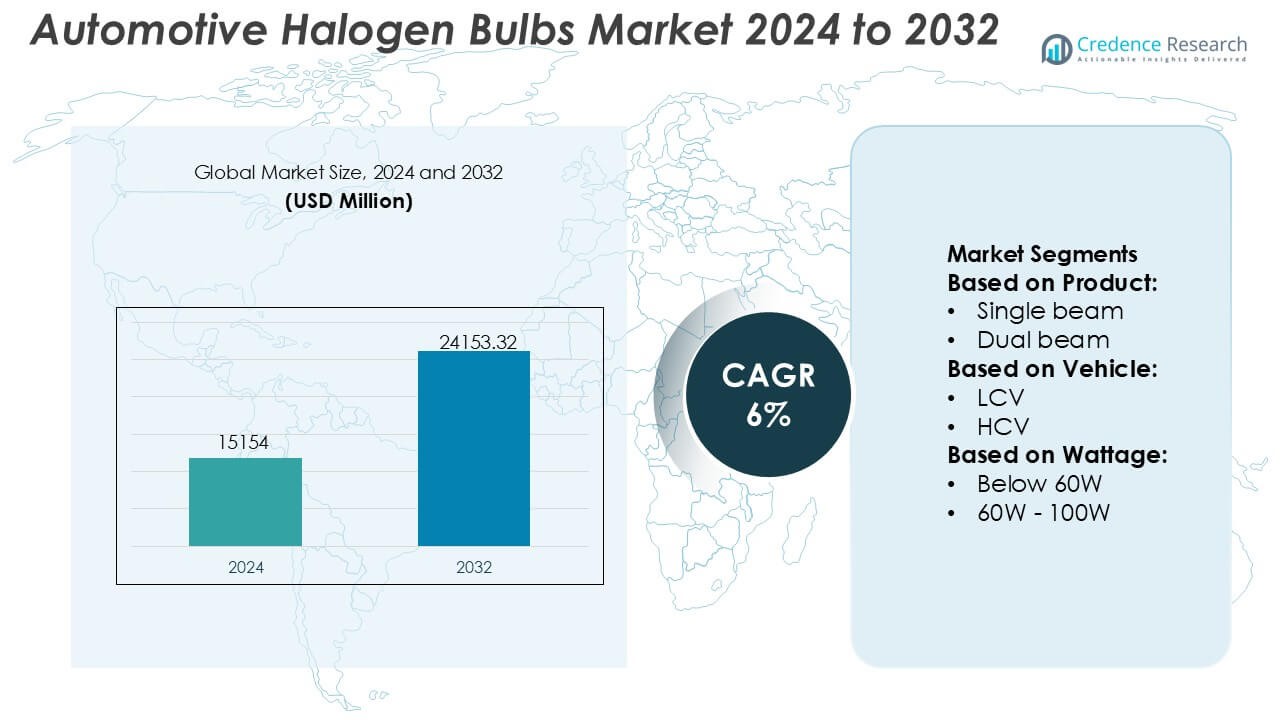

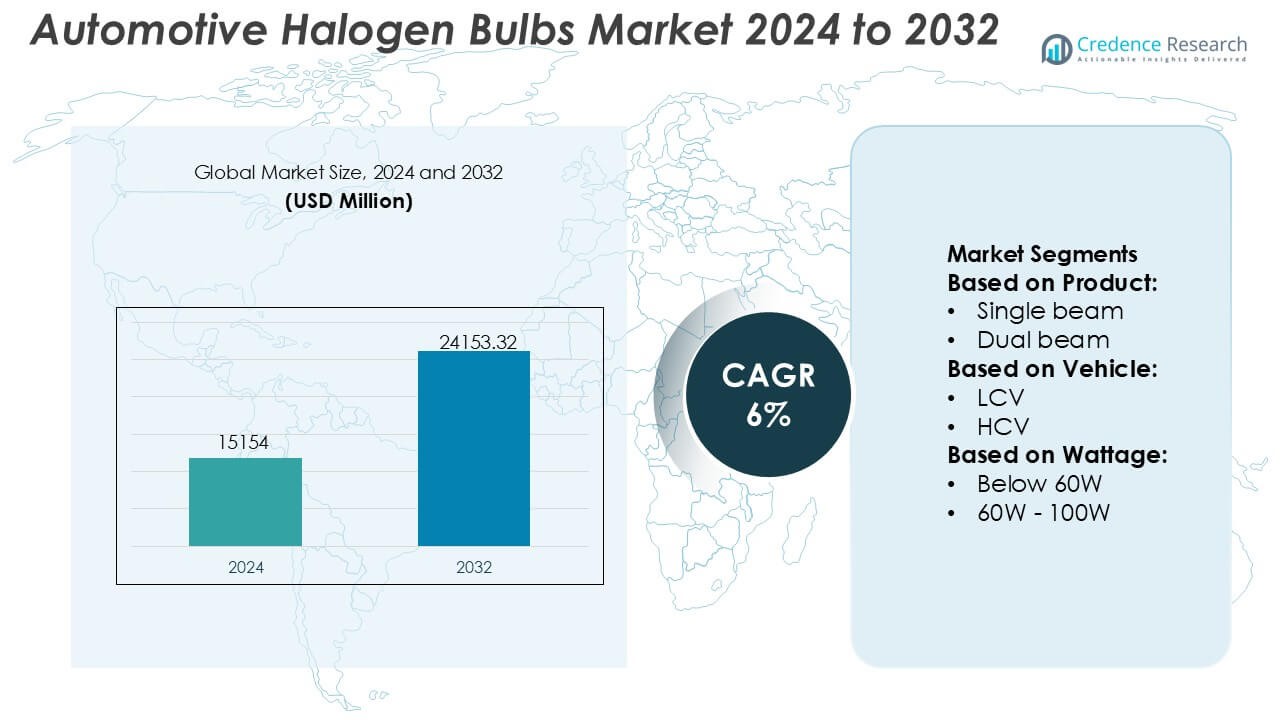

Automotive Halogen Bulbs Market size was valued USD 15154 million in 2024 and is anticipated to reach USD 24153.32 million by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Halogen Bulbs Market Size 2024 |

USD 15154 Million |

| Automotive Halogen Bulbs Market, CAGR |

6% |

| Automotive Halogen Bulbs Market Size 2032 |

USD 24153.32 Million |

The Automotive Halogen Bulbs Market is shaped by a mix of established lighting manufacturers and global aftermarket suppliers that continue to support high-volume demand for cost-efficient illumination solutions. These players strengthen their competitiveness through optimized filament engineering, improved thermal stability, and advanced coating technologies that enhance bulb longevity and beam clarity. Their distribution networks span OEM supply chains and extensive aftermarket channels, enabling broad product accessibility across diverse vehicle categories. Asia-Pacific leads the market with an exact 34% share, driven by its large vehicle parc, strong replacement demand, and widespread reliance on halogen lighting in budget and mid-range models.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Automotive Halogen Bulbs Market was valued at USD 15154 million in 2024 and is projected to reach USD 24153.32 million by 2032, registering a 6% CAGR during the forecast period.

- Growing reliance on affordable lighting solutions and strong aftermarket replacement cycles drives market expansion, supported by the large installed base of halogen-equipped vehicles across global markets.

- Advancements in filament engineering, thermal resistance, and coating technologies create opportunities for enhanced-performance halogen bulbs within both OEM and aftermarket channels.

- Market growth faces restraints from accelerating LED adoption in new vehicle models and regulatory pressure for energy-efficient lighting technologies, gradually reducing halogen installations.

- Asia-Pacific leads with a 34% share, followed by Europe and North America, while the 60W–100W wattage category and single-beam products dominate segment performance due to wide compatibility and high replacement frequency.

Market Segmentation Analysis:

By Product

Single beam halogen bulbs hold the dominant share in the product segment, supported by their widespread use across passenger cars and light commercial vehicles. Their prevalence stems from lower replacement costs, simple installation, and wide compatibility with legacy headlamp housings. Demand continues as fleet operators and budget-oriented consumers prefer standardized bulb formats that ensure reliable illumination without system upgrades. Dual beam variants grow gradually due to convenience in integrated high–low beam functions, but single beam bulbs remain the primary revenue driver because of high replacement frequency and extensive OEM–aftermarket availability.

- For instance, OmniVision Technologies produces various automotive imaging sensors, such as the OV04689, which is a 4-megapixel (MP) CMOS sensor capable of capturing 2688 × 1520 resolution.

By Vehicle

Passenger cars represent the leading vehicle segment, accounting for the highest consumption of halogen bulbs due to large global vehicle volumes and consistent aftermarket replacement cycles. Their dominance is reinforced by the continued presence of halogen technology in entry-level and mid-range models, particularly in emerging markets where affordability guides lighting choices. Light commercial vehicles contribute notable demand as operators prioritize cost-effective and easily serviceable lighting solutions. Heavy commercial vehicles adopt halogen bulbs mainly for auxiliary and fog-lamp applications, but the passenger car segment drives overall market momentum due to high installation rates and recurring maintenance needs.

- For instance, Bosch Sensortec produces the BMP390 barometric pressure sensor, which achieves a typical relative accuracy of ±0.03 hPa (equivalent to roughly ±25 cm in altitude change) and a typical absolute accuracy of ±0.50 hPa. This sensor is primarily designed for high-precision altitude tracking and indoor navigation.

By Wattage

The 60W–100W category leads the wattage segmentation, driven by its balance of brightness, beam reach, and energy efficiency across mainstream automotive platforms. This wattage range aligns with regulatory norms and OEM specifications, making it the preferred choice for both headlamp and fog-lamp configurations. Below-60W bulbs maintain demand in compact vehicles and two-lamp systems focused on efficiency, while above-100W bulbs find limited use in off-road or high-intensity applications. The 60W–100W segment remains dominant due to broad compatibility, stable performance, and strong aftermarket replacement volume across global markets.

Key Growth Drivers

- Large Installed Base of Halogen-Compatible Vehicles

A substantial global fleet of vehicles equipped with halogen headlamp housings drives consistent demand for replacement bulbs. Consumers in cost-sensitive regions continue to rely on halogen technology due to its affordability, easy installation, and wide aftermarket availability. This installed base generates recurring sales as bulbs require periodic replacement due to filament degradation. The strong presence of halogen systems in entry-level and mid-range passenger cars ensures stable replacement cycles, supporting manufacturers and distributors with predictable volumes across both organized and independent aftermarket channels.

- For instance, Sony Corporation’s automotive-grade IMX490 CMOS image sensor delivers a 5.4-megapixel resolution (2880 x 1860 effective pixels) and achieves a high dynamic range of 120 dB (up to 140 dB when prioritizing dynamic range) through its stacked pixel architecture.

- Cost Advantage Over LED and HID Technologies

Halogen bulbs maintain a competitive edge in markets where vehicle owners prioritize low upfront costs for maintenance and spare parts. Their simple construction and mature manufacturing processes enable lower price points compared to LED and HID alternatives. This cost advantage is particularly influential in regions with high used-vehicle penetration, where consumers opt for inexpensive yet reliable lighting solutions. Automakers also continue offering halogen headlamps in budget models to maintain competitive pricing, reinforcing ongoing demand across emerging economies and the global aftermarket ecosystem.

- For instance, Texas Instruments’ TPS92662-Q1 is an automotive-grade LED matrix manager that incorporates 12 integrated bypass switches (arranged in four sub-strings of three series switches).

- Strong Aftermarket Replacement Demand

Frequent replacement intervals caused by shorter halogen lifespan create a steady aftermarket revenue stream. Bulbs typically require replacement due to filament burnout, lumen reduction, or environmental wear, prompting vehicle owners to purchase new units during routine servicing. Retailers benefit from strong turnover of standardized SKUs, while distributors capitalize on continuous replenishment needs from repair shops and fleet operators. The aftermarket’s dependence on halogen technology remains strong because of compatibility with millions of vehicles and the ease with which consumers access a wide range of bulb types and wattage options.

Key Trends & Opportunities

- Rising Demand for Upgraded Performance Halogen Bulbs

A growing consumer shift toward enhanced visibility solutions creates opportunities for premium halogen variants offering higher luminosity, whiter color temperatures, and longer beam projection. These enhanced-performance bulbs provide an affordable upgrade alternative to LEDs, appealing to markets where regulatory restrictions or cost barriers limit LED adoption. Manufacturers innovate with improved filament materials, optimized gas mixtures, and advanced UV-blocking glass designs to differentiate their offerings. This trend strengthens value-added segments within the halogen category, supporting growth in both OEM-certified and aftermarket product lines.

- For instance, halogen bulbs leverage quartz glass technology for their products, including the H16 type. This material is essential because the filament of a standard halogen bulb operates at extremely high physical temperatures, typically around 2,500 degrees Celsius (approximately 2,773 Kelvin).

- Expansion of Halogen Products in Price-Sensitive Emerging Markets

Emerging economies continue to present strong opportunities as automotive ownership increases and halogen systems remain the dominant lighting technology due to low installation and replacement costs. Rural and semi-urban markets, where budget vehicles prevail, maintain high reliance on halogen bulbs for both visibility and auxiliary lighting applications. Distributors expand last-mile networks to cater to replacement needs, while local retailers stock a wide range of halogen SKUs. These dynamics position halogen bulbs as a stable revenue contributor despite the broader industry transition toward advanced lighting solutions.

- For instance, InvenSense’s ICM-42688-P six-axis MEMS sensor achieves a gyroscope noise density of 2.8 mdps/√Hz (millidegrees per second per root Hertz) and an accelerometer noise density of approximately 70 µg/√Hz (micro-G per root Hertz).

- Aftermarket Digitalization and E-Commerce Growth

The rapid expansion of online automotive parts marketplaces creates new opportunities for halogen bulb suppliers targeting retail consumers and small workshop buyers. E-commerce platforms enable transparent price comparison, greater SKU visibility, and fast replenishment cycles, boosting sales for standardized halogen categories. Digital catalogs help customers select compatible wattages, beam types, and fitments, reducing purchase errors. Online channels also support brand visibility for premium-performance halogen variants, encouraging manufacturers to adopt consumer-centric packaging, improved product information, and targeted digital marketing strategies.

Key Challenges

- Rapid Shift Toward LED Lighting Technologies

Accelerated adoption of LED headlamps by automakers reduces halogen installation rates in new vehicles, gradually shrinking the technology’s OEM footprint. LEDs offer higher energy efficiency, longer operational life, and superior luminance, prompting premium and mid-range vehicle segments to phase out halogen systems. As OEM transition intensifies, halogen manufacturers face long-term volume pressure and must rely heavily on the aftermarket to sustain demand. Regulatory shifts favoring energy-efficient lighting further constrain halogen usage, forcing suppliers to reassess their product strategies and geographic focus areas.

- Performance Limitations Compared to Advanced Lighting Systems

Halogen bulbs struggle to match the output, durability, and thermal efficiency of LED and HID technologies, restricting their adoption in performance-oriented vehicles. Frequent replacements, lower brightness levels, and susceptibility to heat-induced degradation affect consumer perception of value. These limitations reduce competitiveness in markets where drivers seek enhanced night-time visibility or longer service life. As automotive electrification grows, halogen bulbs face added challenges due to higher power requirements compared to efficient LED solutions, further narrowing their relevance in next-generation vehicle architectures.

Regional Analysis

North America

North America holds an exact 32% share, supported by a large operational vehicle fleet and strong aftermarket replacement activity. Older passenger cars and light commercial vehicles continue relying on halogen systems, maintaining steady product turnover. Consumer preference for cost-effective maintenance solutions reinforces halogen demand, especially in used-car markets. Retail chains and e-commerce platforms strengthen distribution efficiency, enabling rapid access to standardized bulb types. Although LED penetration rises in new vehicle models, halogen bulbs remain widely used across legacy vehicles, preserving stable aftermarket-driven revenue across the region.

Europe

Europe accounts for an exact 28% share, driven by widespread ownership of compact and mid-size vehicles that historically utilize halogen lighting systems. Regulatory emphasis on safety and consistent vehicle inspections sustains recurring replacement cycles in the aftermarket. Demand persists across Central and Eastern Europe, where affordability and accessibility guide purchase behavior. While Western European automakers transition toward LED headlamps in new models, the large installed base of older vehicles ensures ongoing reliance on halogen solutions. Strong repair networks and automotive service centers further support halogen bulb consumption across both urban and rural markets.

Asia-Pacific

Asia-Pacific leads the market with an exact 34% share, supported by high vehicle parc levels, strong aftermarket density, and widespread adoption of halogen systems in budget and mid-range vehicles. Emerging economies such as India, Indonesia, and Vietnam depend heavily on cost-efficient lighting products, reinforcing halogen’s dominance. Frequent usage patterns and challenging road conditions increase bulb replacement frequency, strengthening demand from service workshops and roadside retailers. Although LED adoption grows in premium segments, the affordability and compatibility of halogen bulbs continue to drive large-scale consumption across both passenger vehicles and commercial fleets.

Latin America

Latin America holds a 4% market share, driven primarily by a robust used-vehicle population and strong demand for low-cost maintenance parts. Halogen bulbs remain prevalent in passenger cars and light commercial vehicles due to affordability and easy installation. Economic variability encourages consumers to prioritize cost-effective lighting solutions, reinforcing reliance on halogen systems. Widespread aftermarket networks across Brazil, Mexico, and Argentina ensure steady availability of replacement bulbs. While LED adoption gains traction in newer models, the region’s large legacy vehicle base maintains stable halogen demand.

Middle East & Africa

The Middle East & Africa region captures 2% of the market, supported by demand from aging vehicle fleets and expanding aftermarket channels in countries such as South Africa, Saudi Arabia, and the UAE. Harsh climatic conditions accelerate bulb wear, driving frequent replacements and sustained aftermarket turnover. Budget-friendly halogen solutions dominate in both passenger and commercial segments due to their low cost and compatibility. Despite rising interest in LED upgrades in affluent urban centers, halogen bulbs retain strong relevance across rural markets where cost sensitivity and easy servicing requirements shape automotive lighting choices.

Market Segmentations:

By Product:

By Vehicle:

By Wattage:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive Halogen Bulbs Market is shaped by a mix of global electronics and sensor manufacturers, including Omnivision Technologies, Bosch Sensortec, Sony Corporation, Texas Instruments Incorporated, Panasonic Corporation, InvenSense, Samsung Electronics, Analog Devices, Knowles Electronics, and STMicroelectronics. the Automotive Halogen Bulbs Market is defined by a diverse group of lighting manufacturers, semiconductor specialists, and aftermarket suppliers that focus on delivering cost-efficient and durable illumination solutions for global vehicle fleets. Companies strengthen their market positions by optimizing filament design, enhancing thermal resistance, and improving gas-fill compositions to extend bulb life and maintain stable brightness. Many manufacturers invest in automated production lines to ensure consistent quality across high-volume SKUs while expanding distribution networks to support strong aftermarket replacement cycles. As automakers gradually transition to LED technologies, leading suppliers differentiate through upgraded halogen variants offering higher luminosity, whiter light output, and improved performance under demanding driving conditions, ensuring continued relevance across budget and mid-range vehicle categories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Omnivision Technologies

- Bosch Sensortec

- Sony Corporation

- Texas Instruments Incorporated

- Panasonic Corporation

- InvenSense

- Samsung Electronics

- Analog Devices

- Knowles Electronics

- STMicroelectronics

Recent Developments

- In November 2025, Zentek Ltd. announced the launch of a new Graphite Gel-Based Fire-Retardant (GBFR) for the U.S. market, partnering with Altek Advanced Materials for commercialization as GraphGel™, designed to protect structures from wildfires with an eco-friendly, easily removable gel that forms a thermal barrier.

- In October 2025, Ahlstrom launched a new range of flame-retardant paper. This flame retardant paper is based on Flame-Gard technology designed to enhance safety in the industrial sector.

- In June 2024, Melexis launched the MLX81123 IC, a smaller LIN RGB LED driver (SOIC8 & DFN-8 3x3mm) to expand its family, enabling more compact, versatile automotive ambient lighting by overcoming space limitations in vehicle interiors, building on its predecessor, the MLX81113. This chip integrates LIN transceiver, protocol control, and drivers, supporting various applications and enhancing user experience with cost-effective, reliable performance.

- In January 2024, OLEDWorks launched Atala as a dedicated brand for automotive lighting applications, offering cutting-edge OLED solutions characterized by high performance, unique design flexibility, and features that meet the auto industry’s stringent requirements. Atala is an acronym for Advanced Technology for Automotive Lighting Applications.

Report Coverage

The research report offers an in-depth analysis based on Product, Vehicle, Wattage and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will maintain steady aftermarket demand due to the large global base of vehicles equipped with halogen headlamp systems.

- Replacement cycles will continue driving revenue as halogen bulbs experience shorter operational lifespans than LED alternatives.

- Emerging markets will sustain halogen adoption, supported by budget-friendly vehicle ownership and low-cost maintenance needs.

- Manufacturers will develop enhanced-performance halogen variants offering improved brightness and beam projection.

- Upgraded filament materials and optimized gas mixtures will extend durability and reduce lumen degradation.

- Online aftermarket channels will expand product visibility and increase consumer access to standardized halogen SKUs.

- OEM usage of halogen systems will gradually decline as LED technologies gain dominance in new vehicle models.

- Regulatory emphasis on efficient lighting will pressure suppliers to optimize halogen energy consumption.

- Value-driven consumers will continue prioritizing halogen bulbs for affordability and compatibility.

- Hybrid distribution models combining retail, workshop supply, and e-commerce channels will strengthen market accessibility.