| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Filters Market Size 2024 |

USD 15,081.4 million |

| Automotive Filters Market , CAGR |

3.02% |

| Automotive Filters Market Size 2032 |

USD 19,126.9 million |

Market Overview

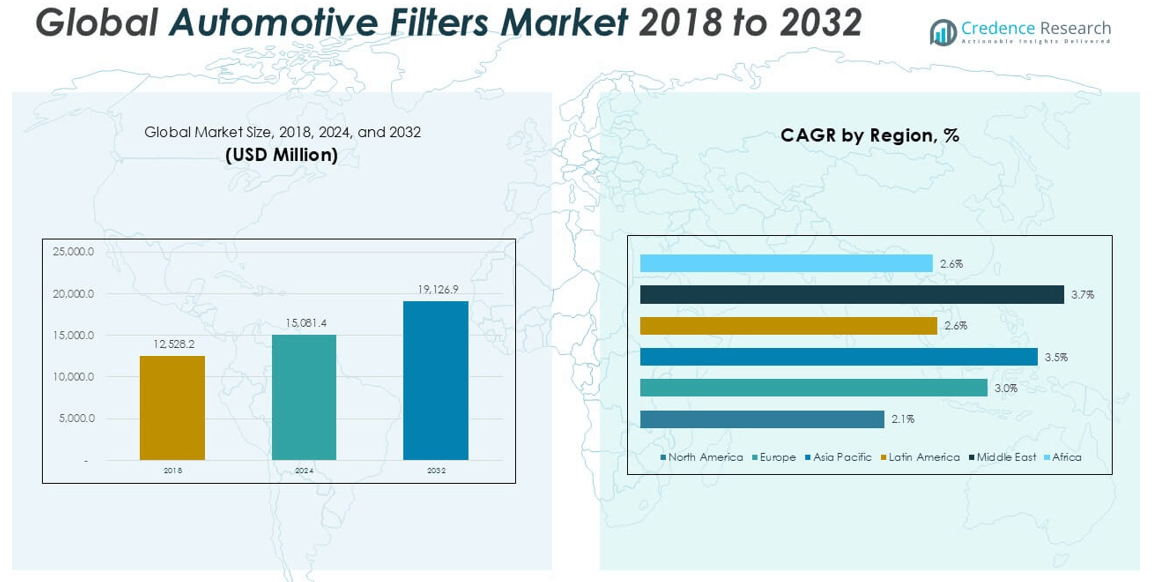

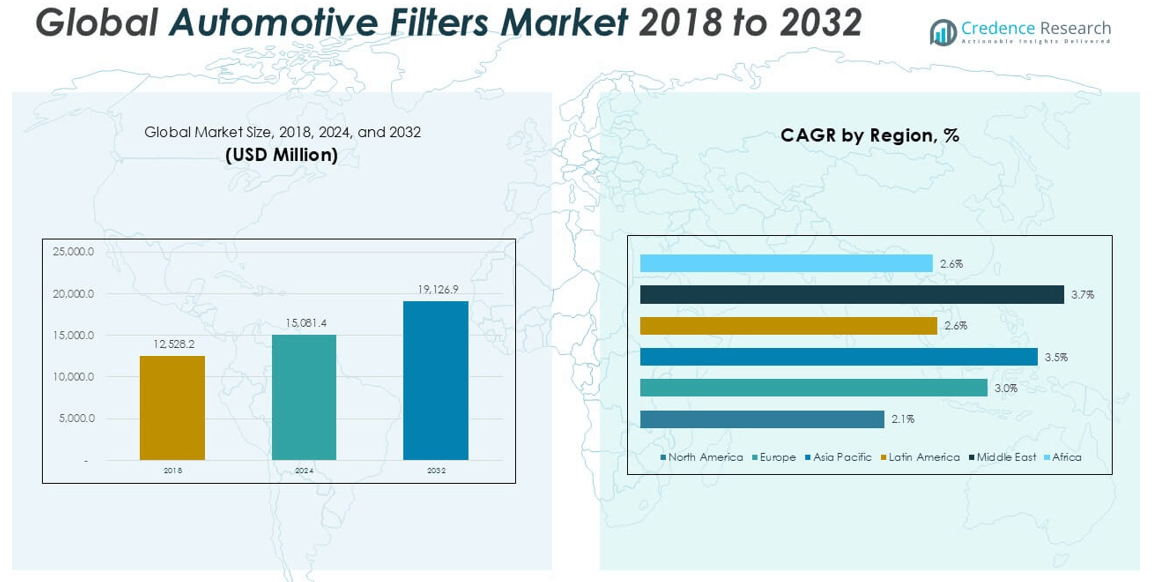

The Global Automotive Filters Market is projected to grow from USD 15,081.4 million in 2024 to an estimated USD 19,126.9 million by 2032, with a compound annual growth rate (CAGR) of 3.02% from 2025 to 2032.

Rising awareness regarding fuel efficiency and vehicle performance is driving the demand for advanced filtration solutions. Trends such as the electrification of vehicles are also influencing filter innovations, particularly in cabin air and battery cooling systems. Additionally, consumers are increasingly opting for regular filter replacements as part of preventive maintenance, boosting aftermarket sales. The shift toward environment-friendly filter materials and the integration of nanotechnology and multi-layered filtration systems are further shaping the market landscape.

Geographically, Asia Pacific dominates the automotive filters market due to the large automotive manufacturing base in countries like China, India, and Japan. North America and Europe follow closely, driven by strong aftermarket demand and stringent environmental regulations. Emerging markets in Latin America and the Middle East are expected to contribute significantly as vehicle ownership and industrialization rise. Key players in the global market include Mann+Hummel, Robert Bosch GmbH, Donaldson Company, Inc., Sogefi S.p.A., Denso Corporation, Mahle GmbH, and Cummins Inc., who are actively investing in R&D and expanding their global footprint.

Market Insights

- The Global Automotive Filters Market is projected to grow from USD 15,081.4 million in 2024 to USD 19,126.9 million by 2032, at a CAGR of 3.02% from 2025 to 2032.

- Stringent emission norms across North America, Europe, and Asia are boosting demand for advanced air, oil, and fuel filters in passenger and commercial vehicles.

- Rising consumer awareness about vehicle longevity and performance is increasing the frequency of filter replacements, especially in the aftermarket segment.

- Growth in electric vehicle sales is shifting focus toward new filter types such as cabin air and battery cooling systems, creating innovation opportunities.

- The gradual transition away from internal combustion engine vehicles may reduce long-term demand for traditional oil and fuel filters.

- Asia Pacific leads the global market with the highest share, driven by strong automotive production in China, India, and Japan.

- North America and Europe maintain steady growth supported by mature vehicle fleets, a strong aftermarket, and strict environmental standards.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Strict Emission Regulations and Environmental Standards Drive Filter Demand

Government mandates for reduced vehicular emissions have intensified the need for efficient filtration systems. Regulatory bodies in major automotive markets such as the U.S., Europe, and China are enforcing Euro 6 and BS-VI norms, which require advanced engine air, oil, and fuel filters. These standards promote the adoption of high-performance filters that enhance combustion and lower particulate emissions. The Global Automotive Filters Market benefits significantly from such regulatory pressure. Automakers and suppliers must align with evolving norms to maintain compliance and avoid penalties. This creates consistent demand for technologically upgraded filter solutions.

- For instance, the U.S. Environmental Protection Agency reported that over 15 million vehicles complied with Euro 6 and BS-VI emission standards in 2024, driving demand for advanced automotive filters.

Increased Vehicle Production and Fleet Expansion Support Market Growth

Rising automotive production, especially in emerging economies, contributes directly to higher filter consumption. Expanding vehicle fleets in countries like India, Brazil, and Indonesia fuel the need for both OEM and aftermarket filters. Heavy commercial vehicles, light trucks, and passenger cars all require multiple filtration systems for efficient operation. The Global Automotive Filters Market gains traction with the surge in personal and public transport vehicles. Demand for filters grows with every unit manufactured and sold. This upward trend in automotive output sustains the filter market throughout the forecast period.

- For instance, India produced approximately 4.5 million passenger vehicles in 2024, contributing to increased demand for OEM and aftermarket automotive filters.

Consumer Preference for Preventive Maintenance Boosts Aftermarket Sales

Vehicle owners increasingly adopt regular maintenance routines to ensure performance and longevity. Frequent replacement of engine, cabin, and oil filters prevents engine wear and protects occupants from air pollutants. This consumer behavior strengthens the aftermarket segment, which holds a large share in the Global Automotive Filters Market. The market responds to this demand with improved filter availability and product variety. Aftermarket suppliers introduce cost-effective and easily accessible filter solutions. Consumers continue to support filter replacement services at dealerships and independent garages alike.

Technological Advancements Enhance Filtration Efficiency and Lifecycle

Filter manufacturers invest in advanced materials and structural innovations to improve efficiency and durability. Multi-layered synthetic media, nanofiber technology, and electrostatic charge applications enable better contaminant capture. These advancements enhance performance and extend service intervals, reducing maintenance costs for end users. The Global Automotive Filters Market adopts such innovations to meet evolving industry standards. It gains momentum from R\&D activities aimed at producing low-restriction, high-capacity filters. The integration of smart filter monitoring systems also supports predictive maintenance strategies.

Market Trends

Shift Toward Electrification is Redefining Filter Applications

The global transition toward electric vehicles (EVs) is reshaping the automotive filtration landscape. EVs require specialized filters for cabin air quality, battery cooling, and thermal management systems. While traditional oil and fuel filters are less relevant in EVs, new filtration demands are emerging with increased focus on passenger comfort and battery efficiency. The Global Automotive Filters Market is adapting to these changes by developing EV-compatible products. It emphasizes innovation in particulate air filters and coolant filtration solutions. Manufacturers are realigning their product portfolios to address the unique needs of electric drivetrains.

- For instance, in 2024, over 150 new EV-specific filter models were launched globally by leading automotive suppliers to meet the evolving requirements of electric vehicle platforms.

Focus on Cabin Air Quality and Health-Driven Innovation is Growing

Consumers are more aware of in-cabin air pollution and its impact on health, particularly in urban environments. This awareness is pushing demand for advanced cabin air filters capable of capturing allergens, fine dust, and harmful gases. OEMs now prioritize premium filtration solutions in both entry-level and luxury vehicles. The Global Automotive Filters Market reflects this trend through the introduction of HEPA and activated carbon filters. It continues to support developments that improve air purification and passenger safety. These trends align with consumer expectations for health-centric vehicle features.

- For instance, a 2023 industry survey reported that more than 40 major automakers had adopted HEPA-grade cabin air filters in at least one of their vehicle models, reflecting a rapid shift toward advanced in-cabin air purification solutions.

Digital Integration and Smart Monitoring Systems Gain Traction

The integration of digital technologies into vehicle systems is influencing filter design and performance tracking. Smart filters equipped with sensors can alert drivers when replacements are due, enhancing convenience and maintenance accuracy. This technology supports predictive maintenance models and fleet management systems. The Global Automotive Filters Market is beginning to see adoption of such intelligent solutions, especially in commercial and high-end vehicles. It helps fleet operators reduce downtime and extend vehicle life. Manufacturers are partnering with tech firms to embed smart capabilities into their filtration products.

Sustainable Materials and Eco-Friendly Manufacturing See Greater Emphasis

Environmental concerns are prompting a shift toward recyclable and biodegradable filter materials. Manufacturers focus on reducing plastic content, lowering carbon footprints, and using renewable resources in filter production. This aligns with global sustainability goals and corporate environmental commitments. The Global Automotive Filters Market is seeing wider use of eco-conscious packaging and filter media. It supports OEM sustainability targets and enhances brand positioning in eco-sensitive markets. Innovation in green manufacturing practices is becoming a core component of competitive strategy

Market Challenges

Rising Popularity of Electric Vehicles Reduces Demand for Traditional Filters

The growing adoption of electric vehicles (EVs) presents a direct challenge to the demand for conventional automotive filters such as fuel, oil, and engine air filters. EVs operate without internal combustion engines, eliminating the need for several traditional filter types. The Global Automotive Filters Market must adjust to this structural shift in powertrain technology. It faces the task of developing new filtration solutions suitable for electric mobility. The transition places pressure on legacy filter manufacturers to innovate quickly or risk obsolescence. The decline in ICE vehicle production could slow the growth of core filter segments over time.

- For instance, in 2023, Mann+Hummel, a leading automotive filter manufacturer, reported a reduction of approximately 2 million units in global fuel filter sales compared to the previous year, attributing the decline to the accelerating shift from internal combustion engine vehicles to electric vehicles.

Price Sensitivity and Counterfeit Products Undermine Market Stability

Price-sensitive markets often experience a high influx of low-cost and counterfeit filter products, which hampers the adoption of high-quality, branded alternatives. These substandard filters compromise vehicle performance and customer trust. The Global Automotive Filters Market struggles to maintain brand integrity and profitability in such conditions. It must contend with the widespread availability of unauthorized aftermarket parts that offer no warranty or compliance with regulations. Companies incur higher costs to educate consumers and enforce product authenticity. The presence of unreliable substitutes disrupts competitive pricing strategies and weakens overall market value

Market Opportunities

Aftermarket Expansion in Emerging Economies Creates Long-Term Growth Avenues

Rising vehicle ownership and aging fleets in emerging economies are generating strong demand for replacement filters. Consumers in regions such as Asia Pacific, Latin America, and Africa are becoming more aware of preventive maintenance. This trend supports the expansion of the aftermarket segment, offering manufacturers opportunities to strengthen distribution networks and build local partnerships. The Global Automotive Filters Market can benefit from introducing affordable and durable products tailored to regional conditions. It also gains from increasing investments in localized manufacturing to reduce lead times and logistics costs. Companies that provide value-driven solutions can secure long-term customer loyalty in these high-growth regions.

Innovation in Filtration Technologies Opens New Product Segments

Advancements in filtration media and materials are unlocking new applications in thermal management, battery systems, and interior air purification. High-efficiency particulate air (HEPA) filters, nanofiber membranes, and electrostatic filtration technologies are gaining traction across both traditional and electric vehicle platforms. The Global Automotive Filters Market has the opportunity to lead in next-generation solutions that improve energy efficiency and passenger well-being. It can support OEMs by offering customized products that align with evolving vehicle architectures. Strategic investments in R\&D and collaboration with technology firms will allow manufacturers to capture value in premium and performance-focused vehicle segments.

Market Segmentation Analysis

By Product

The Global Automotive Filters Market is segmented into air filters, oil filters, fuel filters, cabin air filters, and others. Air filters hold a major share due to their critical role in protecting engines from airborne contaminants and ensuring efficient combustion. Oil filters also contribute significantly by maintaining engine lubrication and preventing damage from debris. Fuel filters ensure clean fuel delivery, essential for engine performance and fuel economy. Cabin air filters are gaining popularity as consumers prioritize in-vehicle air quality and health. The “others” category includes transmission filters and coolant filters, which serve specific functions in advanced vehicle systems. Each product type addresses unique performance and regulatory requirements, reinforcing its relevance across varying vehicle platforms.

- For instance, global production of automotive oil filters reached approximately 3.2 billion units in 2023, with passenger vehicles accounting for about 2.0 billion units, commercial vehicles 700 million units, and two-wheelers 200 million units. Full-flow oil filters dominated at nearly 1.8 billion units, while spin-on filters saw around 800 million replacements annually.

By Vehicle

The market is classified into two-wheelers, passenger cars, and commercial vehicles. Passenger cars dominate the Global Automotive Filters Market due to their large production volume and frequent filter replacements. Commercial vehicles follow closely, supported by fleet maintenance practices and the need for operational efficiency. Two-wheelers, while smaller in volume, contribute steadily in densely populated regions with high two-wheeler usage. The performance demands and regulatory standards differ by vehicle category, driving tailored filter design. It reflects the market’s ability to support a diverse and expanding automotive base across segments.

- For instance, the global two-wheeler automotive filter market reflecting robust demand in markets with high two-wheeler usage, especially in Asia-Pacific and other densely populated regions

By Sales Channel

Sales channels include original equipment manufacturers (OEMs) and the aftermarket. OEMs ensure factory-installed filter systems that meet exact vehicle specifications. However, the aftermarket segment holds a larger share in the Global Automotive Filters Market due to recurring replacement needs. It caters to individual vehicle owners and fleet operators through a vast distribution network. Market players focus on expanding aftermarket reach to capitalize on rising maintenance awareness and the growing number of aging vehicles.

Segments

Based on Product

- Air Filter

- Oil Filter

- Fuel Filter

- Cabin Air Filter

- Others

Based on Vehicle

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

Based on Sales Channel

- Original Equipment Manufacturer

- Aftermarket

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Automotive Filters Market

The North America Automotive Filters Market was valued at USD 2,425.09 million in 2024 and is projected to reach USD 2,869.03 million by 2032, growing at a CAGR of 2.1%. It accounted for approximately 16.1% of the global market share in 2024. The region benefits from a mature automotive industry and a well-established aftermarket sector. Demand is driven by the high volume of light-duty vehicles and a strong culture of preventive maintenance. The United States remains the largest contributor, supported by frequent filter replacements and technological upgrades in commercial fleets. The market continues to evolve with growing emphasis on premium filtration systems and electric vehicle integration.

Europe Automotive Filters Market

Europe held a 18.8% share in the global market with a value of USD 2,831.43 million in 2024, expected to reach USD 3,592.03 million by 2032 at a CAGR of 3.0%. The region benefits from strict emission regulations under Euro standards, which mandate the use of high-performance air and fuel filters. Countries such as Germany, France, and the UK lead in automotive production and innovation. The Automotive Filters Market in Europe aligns with the rising adoption of clean mobility technologies and sustainability goals. It sees growing use of eco-friendly materials and high-efficiency particulate filters. OEMs and aftermarket players are both expanding offerings to meet the regulatory and consumer demands.

Asia Pacific Automotive Filters Market

Asia Pacific dominates the global market with a 35.7% share, valued at USD 5,393.11 million in 2024 and projected to reach USD 7,076.94 million by 2032, growing at a CAGR of 3.5%. China, India, and Japan are the primary contributors, supported by robust automotive manufacturing, rising vehicle ownership, and urbanization. The Automotive Filters Market in this region benefits from increasing demand for fuel-efficient vehicles and government focus on emission reduction. It sees strong aftermarket sales driven by a large aging vehicle population. Local manufacturers play a key role in offering cost-effective filter solutions at scale. Technological partnerships are helping regional players upgrade their filtration technologies.

Latin America Automotive Filters Market

Latin America accounted for 13.6% of the global market share in 2024 with a value of USD 2,044.39 million, expected to grow to USD 2,507.53 million by 2032 at a CAGR of 2.6%. Countries such as Brazil and Mexico dominate the market due to their significant automotive assembly operations. The Automotive Filters Market in the region relies heavily on aftermarket demand as consumers focus on affordable maintenance practices. Fuel filter and cabin air filter segments are gaining attention as urban air quality deteriorates. Distribution channels are expanding to reach remote and rural areas. Market players are targeting growth through localized product lines and better service networks.

Middle East Automotive Filters Market

The Middle East market was valued at USD 1,431.44 million in 2024 and is forecasted to reach USD 1,912.69 million by 2032, growing at the highest regional CAGR of 3.7%. It held a 9.5% share of the global market in 2024. The Automotive Filters Market in this region is supported by rising demand for passenger cars and heavy vehicles in Gulf countries. Harsh environmental conditions increase the need for durable and high-efficiency air filters. The aftermarket is expanding quickly as vehicle imports rise and fleet operators seek cost-effective maintenance. Investments in local manufacturing are expected to boost availability and affordability. Key players are focusing on heat- and dust-resistant filter materials suited for regional use.

Africa Automotive Filters Market

Africa represented 6.3% of the global market in 2024 with a value of USD 955.95 million, projected to reach USD 1,168.65 million by 2032 at a CAGR of 2.6%. The Automotive Filters Market in Africa is still developing, with opportunities emerging through urban growth, expanding logistics, and increasing personal vehicle usage. South Africa leads in regional automotive activity, followed by Nigeria and Egypt. Market growth is driven by the need for reliable aftermarket filters and affordable maintenance solutions. International brands are gradually entering the market, supported by distribution partnerships. Awareness campaigns on vehicle upkeep are helping create consistent demand across rural and urban regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key players

- Denso Corporation

- ALCO Filters Ltd.

- Mann+Hummel Group

- Sogefi SpA

- L. Filter Ltd.

- MAHLE GmbH

- Robert Bosch GmbH

- Donaldson Company, Inc.

- K\&N Engineering, Inc.

- Fildex Filters Canada Corporation

- Filtrak BrandT GmbH

- Luman Automotive Systems Pvt. Ltd.

Competitive Analysis

The Global Automotive Filters Market is highly competitive and fragmented, with leading players focusing on innovation, expansion, and aftermarket penetration. Key companies such as Denso Corporation, Mann+Hummel Group, MAHLE GmbH, and Robert Bosch GmbH hold significant market shares due to their strong OEM relationships and extensive product portfolios. These firms invest in R\&D to enhance filter performance, durability, and sustainability. Regional players like ALCO Filters Ltd. and Luman Automotive Systems Pvt. Ltd. compete by offering cost-effective solutions tailored to local market needs. It remains dynamic, with continuous advancements in filtration technologies and strategic partnerships influencing market positioning. Companies aim to balance OEM supply with aftermarket growth to secure long-term profitability.

Recent Developments

- In early 2025, Denso enhanced its aftermarket presence by introducing DENSO First Time Fit® replacement filters, which provide OEM-level performance. This expansion broadens their reach in the global automotive aftermarket, offering consumers a reliable option for maintaining their vehicles with parts designed to meet or exceed original equipment manufacturer (OEM) standards. DENSO’s First Time Fit® line includes various filters, such as cabin air, oil, and air filters, all engineered for optimal performance and easy installation.

- In March 2025, MANN+HUMMEL launched new CO2-reduced filters made with lignin-based media and renewable energy, and they received an EcoVadis Gold rating for sustainability. These filters, part of the MANN-FILTER brand, utilize lignin, a natural compound found in wood, instead of fossil-based materials. The company also uses renewable energy for production and packaging in recycled materials. The EcoVadis Gold rating recognizes their commitment to sustainability.

Market Concentration and Characteristics

The Global Automotive Filters Market exhibits moderate to high market concentration, with a mix of multinational corporations and regional manufacturers competing across OEM and aftermarket segments. It features strong brand loyalty, especially among OEM suppliers, and high entry barriers due to stringent regulatory compliance and technological requirements. The market is characterized by consistent demand driven by routine maintenance, evolving emission standards, and the shift toward high-efficiency filtration systems. It supports a balanced presence of established players and emerging firms that focus on localized, cost-effective offerings. Innovation, supply chain integration, and product differentiation remain critical for maintaining a competitive edge.

Report Coverage

The research report offers an in-depth analysis based on Product, Vehicle, Sales Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Global Automotive Filters Market is expected to maintain steady growth through 2032, driven by rising vehicle ownership and maintenance awareness across emerging and developed regions.

- Electric vehicles will reduce demand for traditional oil and fuel filters but create new opportunities in battery cooling and cabin air filtration systems.

- The aftermarket segment will continue to lead in revenue share due to frequent filter replacement needs and growing awareness of vehicle upkeep.

- Asia Pacific will remain the largest regional market, supported by expanding automotive production, a large vehicle fleet, and rapid urbanization in countries like China and India.

- Smart filters with sensors and nanotechnology-enabled filtration media will gain traction, improving efficiency and supporting predictive maintenance strategies.

- Tightening emission standards globally will sustain the need for advanced engine air and fuel filters, particularly in commercial and passenger vehicles.

- Increasing focus on in-vehicle air quality will drive strong demand for high-performance cabin air filters, including HEPA and carbon-based solutions.

- Manufacturers will invest in recyclable materials and eco-friendly production processes to align with environmental goals and meet consumer expectations.

- Strategic alliances with automotive OEMs will help key players secure long-term supply contracts and accelerate integration of advanced filtration solutions.

- Online distribution channels and filter tracking technologies will enhance aftermarket sales by offering greater convenience and real-time service alerts.