Market Overview

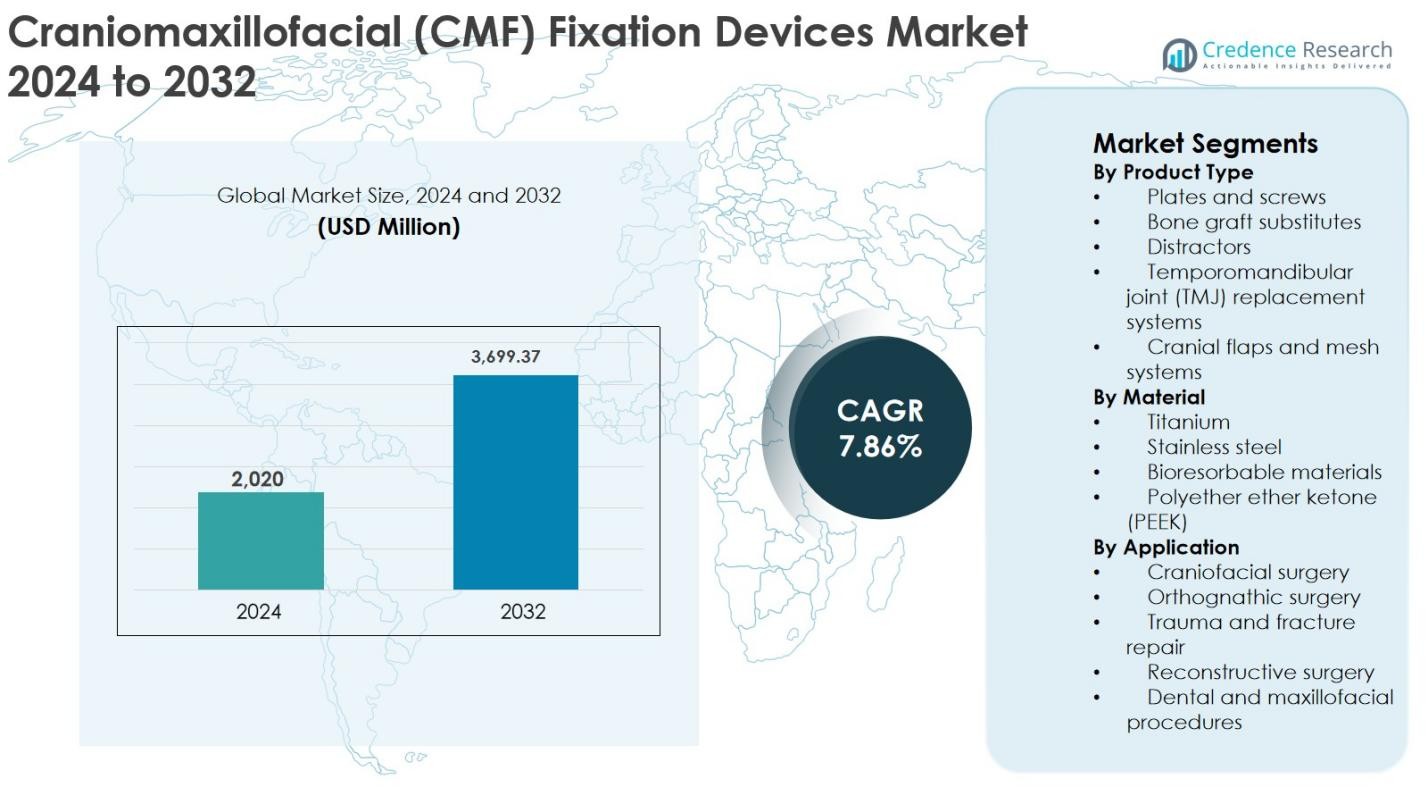

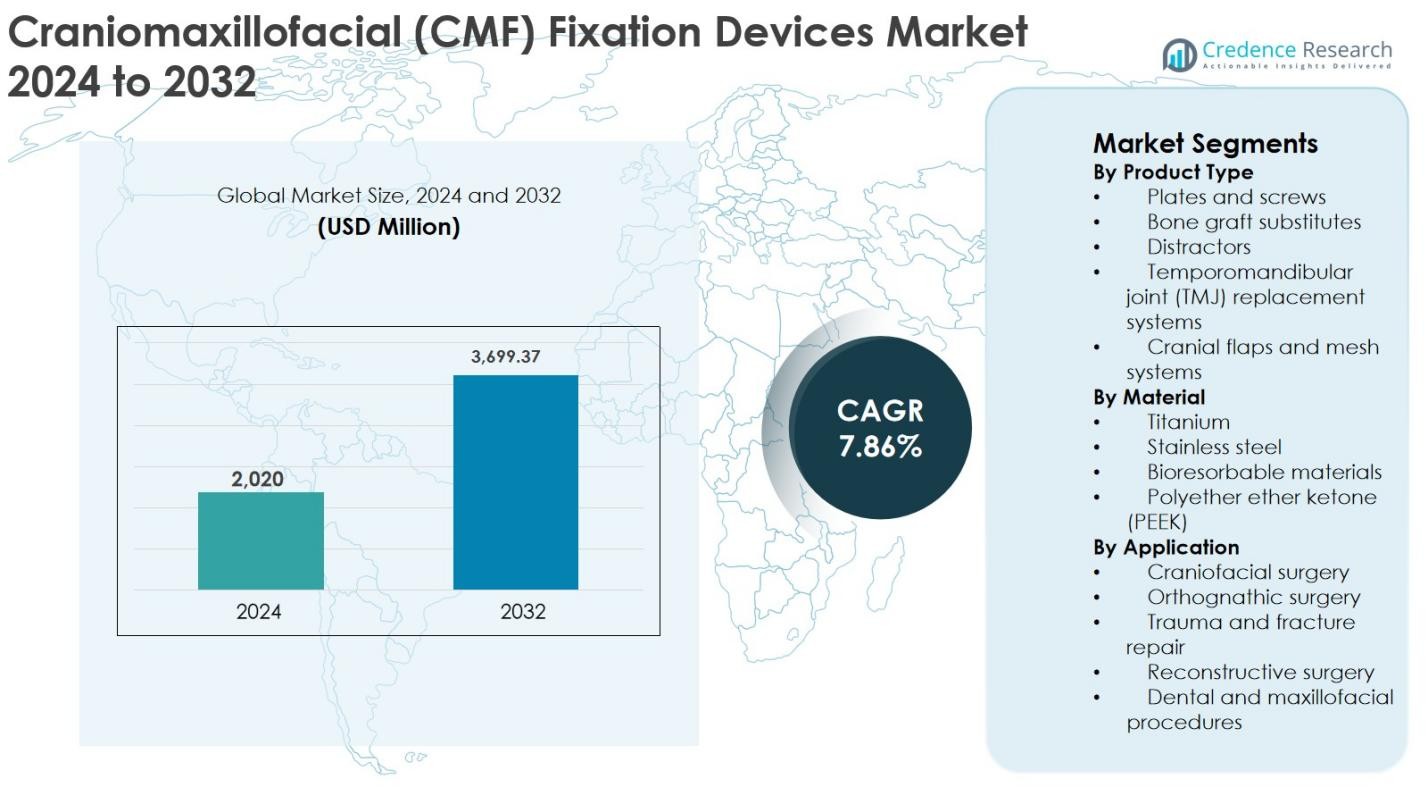

The Craniomaxillofacial (CMF) Fixation Devices Market size was valued at USD 2,020 million in 2024 and is anticipated to reach USD 3,699.37 million by 2032, growing at a CAGR of 7.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Craniomaxillofacial (CMF) Fixation Devices Market Size 2024 |

USD 2,020 Million |

| Craniomaxillofacial (CMF) Fixation Devices Market, CAGR |

7.86% |

| Craniomaxillofacial (CMF) Fixation Devices Market Size 2032 |

USD 3,699.37 Million |

The Craniomaxillofacial (CMF) Fixation Devices market is led by established medical device manufacturers such as Stryker Corporation, Medtronic, Zimmer-Biomet Inc, Integra LifeSciences, KLS Martin, L.P., Medartis AG, OsteoMed, B. Braun, NovaBone, and Gesco India, which compete through broad product portfolios, innovation, and strong surgeon engagement. These companies focus on anatomically contoured plates, advanced titanium systems, and patient-specific implants to strengthen market presence. Regionally, North America dominated the market with a 38% share in 2024, supported by high trauma surgery volumes and advanced healthcare infrastructure, followed by Europe with 29%, driven by strong reconstructive surgery adoption, and Asia Pacific with 22%, reflecting rapid healthcare expansion and rising surgical demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Craniomaxillofacial (CMF) Fixation Devices market was valued at USD 2,020 million in 2024 and is projected to reach USD 3,699.37 million by 2032, growing at a CAGR of 7.86% during the forecast period.

- Market growth is driven by the rising incidence of facial trauma, road accidents, congenital craniofacial disorders, and increasing volumes of reconstructive and orthognathic surgeries across developed and emerging economies.

- Key trends include growing adoption of anatomically contoured and patient-specific implants, increased use of titanium and bioresorbable materials, and integration of 3D planning technologies; plates and screws dominate the product segment with over 46% share, while titanium leads material usage with around 58% share.

- Competitive intensity remains high, with leading players focusing on product innovation, portfolio expansion, and surgeon-focused training to strengthen adoption across trauma and reconstructive applications.

- Regionally, North America led with 38% share, followed by Europe at 29%, Asia Pacific at 22%, Latin America at 7%, and Middle East & Africa at 4%, reflecting varying healthcare access and surgical volumes.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Product Type

The Craniomaxillofacial (CMF) Fixation Devices market by product type is led by plates and screws, which accounted for 46% market share in 2024 due to their widespread use in trauma, orthognathic, and reconstructive surgeries. Surgeons prefer plates and screws for their mechanical stability, precision fixation, and compatibility with advanced imaging-guided procedures. Rising incidences of facial trauma, road accidents, and sports injuries continue to drive demand. Additionally, growing adoption of low-profile and anatomically contoured plating systems further supports segment growth across hospitals and specialty clinics.

- For instance, Johnson & Johnson’s DePuy Synthes offers MatrixMIDFACE and MatrixMANDIBLE plating systems designed for rigid fixation in midface and mandibular trauma and reconstruction, featuring low‑profile plates and multidirectional locking screws.

By Material

Based on material, titanium dominated the Craniomaxillofacial (CMF) Fixation Devices market 58% market share in 2024, supported by its superior strength-to-weight ratio, corrosion resistance, and high biocompatibility. Titanium fixation devices enable long-term stability and reduced post-surgical complications, making them the preferred choice for complex craniofacial and trauma cases. Increasing surgical volumes, advancements in titanium alloy processing, and rising preference for MRI-compatible implants continue to strengthen this segment. The shift toward patient-specific implants also reinforces titanium’s dominance in advanced CMF procedures.

- For instance, DePuy Synthes offers titanium-based MatrixMANDIBLE and MatrixMIDFACE systems designed for rigid fixation and long-term stability in mandibular and midface trauma.

By Application

By application, trauma and fracture repair held the largest share of the Craniomaxillofacial (CMF) Fixation Devices market at 42% in 2024, driven by the high prevalence of maxillofacial injuries from road accidents, falls, and interpersonal violence. Emergency surgical interventions frequently require fixation devices for rapid stabilization and functional restoration. Expanding trauma care infrastructure, rising access to specialized maxillofacial surgeons, and increasing awareness of early surgical correction support segment growth. Technological improvements in fixation systems further enhance surgical outcomes in trauma-focused CMF applications.

Key Growth Drivers

Rising Incidence of Maxillofacial Trauma and Congenital Deformities

The Craniomaxillofacial (CMF) Fixation Devices market is strongly driven by the increasing incidence of facial trauma and congenital craniofacial deformities worldwide. Road traffic accidents, sports-related injuries, occupational hazards, and interpersonal violence continue to elevate the demand for CMF fixation procedures, particularly in urban and developing regions. Additionally, congenital conditions such as cleft lip and palate require early and often multiple surgical interventions, supporting consistent device utilization. Growing access to trauma care centers, improvements in emergency response systems, and increased availability of skilled maxillofacial surgeons further accelerate procedural volumes. These factors collectively sustain long-term demand for plates, screws, and advanced fixation systems across hospital and specialty surgical settings.

- For instance, national trauma system upgrades and expanded emergency maxillofacial coverage in several countries have been associated with higher detection and surgical management rates of facial fractures in critical care settings.

Advancements in Surgical Techniques and Implant Technologies

Technological innovation remains a major growth driver for the Craniomaxillofacial (CMF) Fixation Devices market. Continuous advancements in low-profile plating systems, anatomically contoured implants, and patient-specific solutions enhance surgical precision and reduce operative time. The integration of 3D imaging, computer-assisted design, and intraoperative navigation enables customized fixation strategies, improving functional and aesthetic outcomes. Furthermore, the development of bioresorbable and MRI-compatible materials minimizes long-term complications and post-operative imaging limitations. These innovations increase surgeon confidence, expand clinical indications, and encourage the adoption of next-generation fixation devices across complex craniofacial and reconstructive procedures.

- For instance, Stryker’s CMF portfolio incorporates preoperative virtual surgical planning and 3D-printed patient-specific guides and implants to streamline osteotomies and reconstruction in craniofacial surgery workflows.

Expanding Healthcare Infrastructure and Elective Surgical Volumes

Growth in healthcare infrastructure, particularly in emerging economies, significantly supports the Craniomaxillofacial (CMF) Fixation Devices market. Investments in tertiary hospitals, trauma centers, and specialty maxillofacial clinics improve access to advanced surgical care. Rising disposable income, expanding insurance coverage, and increasing awareness of reconstructive and corrective procedures also drive elective surgeries such as orthognathic and cosmetic craniofacial interventions. Medical tourism in regions offering cost-effective yet high-quality surgical services further boosts procedural demand. Together, these structural and socioeconomic factors create sustained growth opportunities for CMF fixation device manufacturers globally.

Key Trends & Opportunities

Growing Adoption of Patient-Specific and 3D-Printed Implants

A prominent trend shaping the Craniomaxillofacial (CMF) Fixation Devices market is the increasing adoption of patient-specific and 3D-printed implants. Customized fixation devices designed using preoperative imaging data allow precise anatomical matching, improved load distribution, and reduced intraoperative adjustments. This approach enhances surgical efficiency, shortens procedure time, and improves patient outcomes. Surgeons increasingly favor customized implants for complex reconstructions and trauma cases involving asymmetry or bone loss. As regulatory pathways for personalized medical devices become clearer, manufacturers have significant opportunities to expand portfolios and differentiate offerings through advanced customization capabilities.

- For instance, KLS Martin Group provides patient-specific mandibular reconstruction plates and distraction devices manufactured using 3D printing and virtual surgical planning, enabling precise contour restoration in complex jaw defects.

Rising Demand for Bioresorbable and Advanced Material Solutions

The market is witnessing growing interest in bioresorbable and advanced polymer-based fixation devices as alternatives to traditional metallic implants. These materials eliminate the need for secondary removal surgeries, reduce long-term foreign-body complications, and are particularly advantageous in pediatric cases. Innovations in polyether ether ketone (PEEK) and next-generation bioresorbable composites provide improved mechanical strength and controlled degradation profiles. Increasing clinical evidence supporting safety and efficacy creates opportunities for broader adoption across trauma and reconstructive applications. Manufacturers focusing on material innovation are well-positioned to capture emerging demand.

- For instance, Invibio Biomaterial Solutions supplies PEEK-OPTIMA polymers for cranial and maxillofacial implants, offering radiolucency and favorable strength-to-weight performance that support intraoperative visualization and imaging follow-up.

Key Challenges

High Cost of Advanced CMF Fixation Systems

The high cost associated with advanced Craniomaxillofacial (CMF) Fixation Devices presents a key challenge to market growth. Premium implants, patient-specific solutions, and technologically advanced materials significantly increase procedural expenses, limiting adoption in cost-sensitive healthcare systems. Hospitals in developing regions often face budget constraints, while reimbursement coverage for CMF procedures varies widely across countries. These financial barriers restrict access to advanced fixation technologies and slow penetration in emerging markets. Manufacturers must balance innovation with affordability to ensure wider clinical adoption without compromising product quality or performance.

Stringent Regulatory and Clinical Approval Requirements

Stringent regulatory frameworks and complex approval processes pose ongoing challenges for the Craniomaxillofacial (CMF) Fixation Devices market. CMF implants require extensive clinical validation to demonstrate safety, durability, and biocompatibility, leading to prolonged development timelines and high compliance costs. Variations in regulatory standards across regions further complicate global product launches. Additionally, post-market surveillance and reporting requirements increase operational complexity for manufacturers. These regulatory hurdles can delay innovation, limit rapid commercialization, and create barriers for smaller companies seeking market entry.

Regional Analysis

North America

North America dominated the Craniomaxillofacial (CMF) Fixation Devices market with 38% market share in 2024, driven by high procedural volumes, advanced healthcare infrastructure, and early adoption of innovative fixation technologies. The region benefits from a strong presence of leading medical device manufacturers, widespread availability of skilled maxillofacial surgeons, and favorable reimbursement frameworks for trauma and reconstructive surgeries. High incidence of facial trauma, sports injuries, and corrective orthognathic procedures further supports demand. Continuous investments in R&D and rapid adoption of patient-specific and titanium-based implants reinforce North America’s leadership position.

Europe

Europe accounted for 29% of the Craniomaxillofacial (CMF) Fixation Devices market share in 2024, supported by a well-established healthcare system and growing demand for reconstructive and corrective facial surgeries. Countries such as Germany, France, and the UK contribute significantly due to advanced trauma care networks and high surgical expertise. Increasing prevalence of road accidents, aging populations requiring reconstructive interventions, and strong regulatory emphasis on high-quality implants drive market growth. Additionally, rising adoption of bioresorbable materials and customized implants enhances procedural outcomes, sustaining steady demand across the region.

Asia Pacific

Asia Pacific held 22% market share in the Craniomaxillofacial (CMF) Fixation Devices market in 2024 and represents the fastest-growing regional segment. Rapid expansion of healthcare infrastructure, increasing trauma cases due to urbanization, and rising awareness of corrective facial surgeries fuel growth. Countries such as China, India, Japan, and South Korea are witnessing higher adoption of CMF fixation devices due to improving access to specialized surgical care. Growth in medical tourism, expanding middle-class population, and increasing investments in tertiary hospitals further strengthen the region’s market outlook.

Latin America

Latin America captured 7% of the Craniomaxillofacial (CMF) Fixation Devices market share in 2024, driven by gradual improvements in healthcare access and rising trauma-related surgical volumes. Brazil and Mexico are key contributors, supported by expanding hospital networks and growing adoption of advanced surgical techniques. Increasing incidence of road accidents and interpersonal violence sustains demand for CMF fixation systems. While cost sensitivity remains a challenge, growing public and private healthcare investments and increasing availability of trained specialists are improving access to modern fixation devices.

Middle East & Africa

The Middle East & Africa region accounted for 4% market share of the Craniomaxillofacial (CMF) Fixation Devices market in 2024, reflecting its emerging market status. Growth is supported by rising investments in healthcare infrastructure, particularly in Gulf Cooperation Council countries, and increasing adoption of advanced trauma care services. Expanding medical tourism, improving access to specialized surgeons, and growing awareness of reconstructive facial procedures contribute to demand. However, limited reimbursement coverage and uneven healthcare access across Africa moderate growth, creating a gradual but steady expansion trajectory for the region.

Market Segmentations:

By Product Type

- Plates and screws

- Bone graft substitutes

- Distractors

- Temporomandibular joint (TMJ) replacement systems

- Cranial flaps and mesh systems

By Material

- Titanium

- Stainless steel

- Bioresorbable materials

- Polyether ether ketone (PEEK)

By Application

- Craniofacial surgery

- Orthognathic surgery

- Trauma and fracture repair

- Reconstructive surgery

- Dental and maxillofacial procedures

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Craniomaxillofacial (CMF) Fixation Devices market features a well-established group of global and regional manufacturers focused on innovation, portfolio expansion, and strategic collaborations. Leading players such as Stryker Corporation, Medtronic, Zimmer-Biomet Inc, Integra LifeSciences, and KLS Martin, L.P. hold strong positions due to broad product offerings covering plates, screws, TMJ systems, and patient-specific implants. Companies including Medartis AG, OsteoMed, B. Braun, and NovaBone strengthen competition through specialization in trauma and reconstructive solutions. Regional manufacturers such as Gesco India expand access in cost-sensitive markets through localized production and pricing strategies. Competitive intensity is driven by continuous product innovation, increasing adoption of anatomically contoured and titanium-based systems, and investments in 3D-printed and bioresorbable technologies. Strategic partnerships with hospitals and surgeons further enhance market presence and long-term growth.

Key Player Analysis

- Medtronic

- KLS Martin, L.P.

- Integra LifeSciences

- Gesco India

- Zimmer-Biomet Inc

- OsteoMed

- B. Braun India

- Stryker Corporation

- NovaBone

- Medartis AG

Recent Developments

- In August 2024, Stryker announced the launch of its Pangea Plating System, an advanced plating solution designed for internal fixation and stabilization of fractures and osteotomies, including applications relevant to CMF procedures

- In January 2024, Enovis Corporation completed the acquisition of LimaCorporate S.p.A., expanding its reconstructive surgery and orthopedic implant portfolio which includes fixation technologies that support craniomaxillofacial applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Product Type, Material,Application, and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Craniomaxillofacial (CMF) Fixation Devices market will continue to expand due to rising global volumes of trauma, reconstructive, and orthognathic surgeries.

- Increasing adoption of patient-specific and anatomically contoured implants will improve surgical precision and clinical outcomes.

- Advancements in 3D imaging, virtual surgical planning, and additive manufacturing will support customization and workflow efficiency.

- Demand for titanium-based fixation systems will remain strong, supported by durability, biocompatibility, and long-term stability advantages.

- Bioresorbable materials will gain traction, particularly in pediatric and non-load-bearing applications.

- Emerging economies will witness faster growth as healthcare infrastructure and access to specialized surgeons improve.

- Medical tourism will contribute to higher procedural volumes in cost-competitive regions.

- Manufacturers will focus on surgeon training and digital integration to strengthen adoption of advanced systems.

- Strategic partnerships and localized manufacturing will support market penetration in price-sensitive markets.

- Ongoing regulatory alignment and clinical evidence generation will facilitate broader acceptance of next-generation CMF fixation technologies.

Market Segmentation Analysis:

Market Segmentation Analysis: