Market Overview

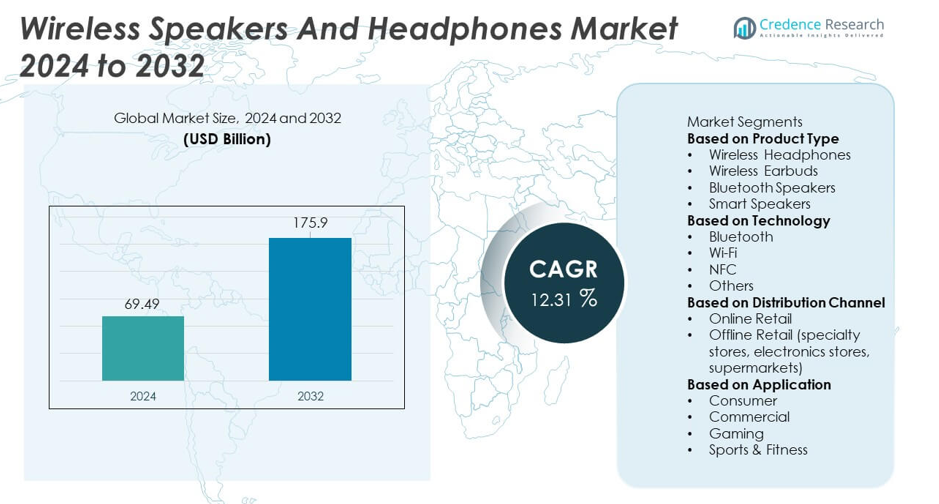

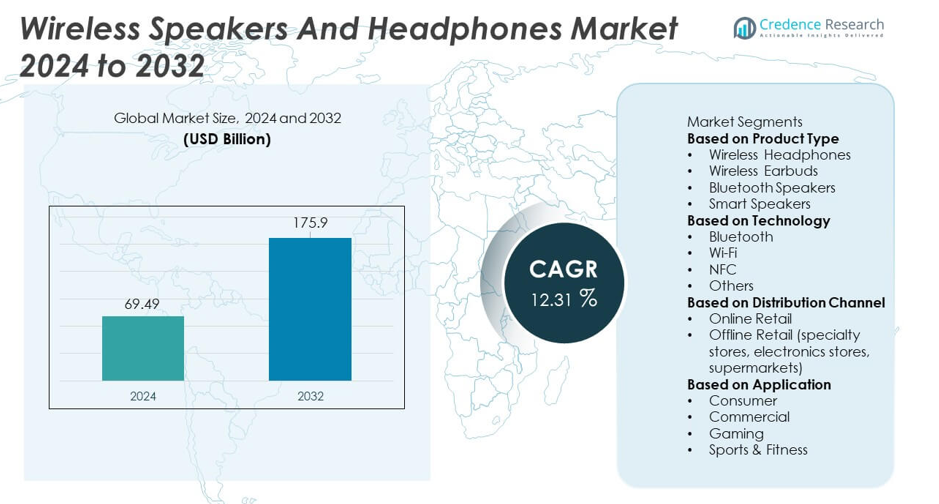

The Wireless Speakers and Headphones market size reached USD 69.49 billion in 2024 and is projected to reach USD 175.9 billion by 2032, supported by a strong 12.31% CAGR during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wireless Speakers and Headphones market Size 2024 |

USD 69.49 billion |

| Wireless Speakers and Headphones market, CAGR |

12.31% |

| Wireless Speakers and Headphones market Size 2032 |

USD 175.9 billion |

Top players in the Wireless Speakers and Headphones market include Sony Corporation, Apple Inc., Samsung Electronics, Bose Corporation, JBL, Sennheiser, Beats Electronics, Xiaomi, Skullcandy, and Bang & Olufsen. These companies strengthen their market positions through advanced audio engineering, active noise cancellation, spatial sound, and seamless Bluetooth connectivity across devices. They focus on improved battery performance, smart assistant integration, and ergonomic designs to meet rising consumer expectations in entertainment, fitness, and mobility. North America leads the market with a 36% share, supported by strong demand for premium audio and smart home devices, while Europe and Asia Pacific continue to grow rapidly due to increasing smartphone usage, e-commerce expansion, and rising interest in wireless personal audio solutions.

Market Insights

- The Wireless Speakers and Headphones market reached USD 69.49 billion in 2024 and is set to grow at a 12.31% CAGR, supported by rising demand for portable and smart audio devices.

- Strong growth is driven by increasing adoption of Bluetooth earbuds, noise-cancelling headphones, and smart speakers as consumers seek seamless connectivity, mobility, and enhanced entertainment experiences.

- Key trends include voice-assistant integration, spatial audio, low-latency codecs, and premiumization, with major players expanding portfolios through advanced features and strong omni-channel distribution strategies.

- Market restraints include high competition, price sensitivity, and ongoing challenges in battery durability, connectivity stability, and product differentiation across mass-market offerings.

- North America leads with a 36% share, followed by Europe at 28% and Asia Pacific at 29%, while wireless earbuds dominate the product segment with a 44% share, and online retail leads the distribution segment with a 58% share, supported by strong e-commerce penetration worldwide.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Wireless earbuds lead the segment with a 44% share, driven by strong consumer demand for compact designs, improved battery life, and seamless Bluetooth connectivity. Their popularity rises due to widespread use in fitness activities, commuting, and work-from-home setups. Wireless headphones maintain steady demand among audiophiles and professionals seeking superior sound quality and noise cancellation. Bluetooth speakers hold a significant share in outdoor and home entertainment use cases, while smart speakers grow rapidly with rising adoption of voice assistants. Continuous innovation in comfort, audio performance, and device integration supports strong growth across all product categories.

- For instance, Apple enhanced its AirPods Pro by introducing an H2 chip that processes 48,000 signals per second, improving adaptive audio performance.

By Technology

Bluetooth dominates the technology segment with a 71% share, supported by universal device compatibility, improved range, and energy-efficient chipsets. Advancements in Bluetooth 5.0 and 5.3 enhance sound quality and reduce latency, strengthening adoption in earbuds and wireless headphones. Wi-Fi–enabled audio devices gain traction in smart homes due to multi-room streaming and integration with virtual assistants. NFC supports niche applications requiring fast pairing but holds a smaller share. Continuous innovation in wireless connectivity, enhanced codecs, and low-latency streaming drives market expansion across diverse audio applications.

- For instance, Qualcomm upgraded its S5 Gen 2 Sound Platform to support aptX Lossless audio delivering 1,200 kbps transmission.

By Distribution Channel

Online retail leads the segment with a 58% share, driven by wide product availability, competitive pricing, and ease of comparison across brands. E-commerce platforms benefit from high demand for personal audio devices, frequent promotional discounts, and rapid delivery options. Offline retail remains important through specialty stores and electronics outlets where consumers prefer hands-on product trials, especially for mid- to high-end headphones. Supermarkets and hypermarkets contribute additional sales volume for budget and mainstream models. Growth in digital shopping behavior and strong online brand presence continue to reinforce online retail’s leadership.

Key Growth Drivers

Rising Adoption of Bluetooth and Smart Audio Devices

The growing use of Bluetooth-enabled headphones, earbuds, and speakers drives strong market expansion. Consumers prefer wireless audio solutions for their convenience, mobility, and compatibility with smartphones, tablets, and wearables. Advancements in Bluetooth technology improve range, latency, and sound quality, enhancing user experience across entertainment, fitness, and work applications. Smart audio devices integrated with voice assistants further boost demand by supporting hands-free control and seamless connectivity. This technological progress strengthens the shift from wired to wireless audio across global markets.

- For instance, Sony’s WF-1000XM5 earbuds use dual processors that manage more than 5,000 real-time sound adjustments each second.

Increasing Demand for Immersive Entertainment Experiences

Rising consumption of music, podcasts, gaming content, and video streaming fuels demand for high-quality wireless audio devices. Consumers seek immersive sound experiences supported by noise cancellation, spatial audio, and high-resolution codecs. Gaming and virtual reality platforms also contribute to higher adoption of low-latency wireless headphones. Home entertainment systems increasingly incorporate wireless speakers for flexible placement and multi-room audio. These evolving entertainment habits continue to support robust demand for advanced wireless audio solutions.

- For instance, Dolby Atmos for Apple Music delivers spatial audio using a rendering engine capable of handling more than 120 discrete sound objects.

Growth of Fitness, Wellness, and On-the-Go Usage

Fitness and active lifestyle trends significantly boost the adoption of wireless earbuds and sport-focused headphones. Lightweight designs, sweat resistance, and long battery life make these devices ideal for workouts and outdoor activities. Wearable integration allows users to track activity and access voice assistants hands-free. Commuters and remote workers also rely on wireless audio devices for calls, meetings, and travel, increasing daily usage. This shift toward portable and versatile audio drives consistent market growth across age groups.

Key Trends & Opportunities

Expansion of Smart Speakers and Voice-Assistant Integration

Growing adoption of smart home ecosystems supports strong demand for smart speakers equipped with AI-driven voice assistants. Consumers use these devices for music streaming, home automation, reminders, and connected-device control. Manufacturers invest in improved sound quality, multi-room capabilities, and seamless integration with smart appliances. This trend creates opportunities for brands to develop smarter, more interactive audio solutions. The rise of IoT-enabled homes continues to expand the smart speaker market globally.

- For instance, Amazon’s Echo Studio uses a 330-watt amplifier and five speakers to deliver detailed 3D audio.

Advancements in Audio Technology and Premiumization

Innovation in active noise cancellation, spatial sound, low-latency codecs, and enhanced battery efficiency drives significant product upgrades. Premium wireless headphones and earbuds gain popularity as consumers prioritize sound quality and comfort. High-fidelity wireless speakers equipped with enhanced acoustics attract audiophiles and home entertainment users. Brands offering premium materials, ergonomic designs, and customizable sound profiles gain competitive advantage. This premiumization trend opens new opportunities across mid- and high-end market segments.

- For instance, the Bose QuietComfort Ultra headphones use a sophisticated proprietary electronic system with ten microphones for noise cancellation and voice pickup, enhanced by CustomTune technology that calibrates sound and ANC to the user’s specific ear shape.

Key Challenges

High Competition and Price Sensitivity

The market faces intense competition due to the presence of global brands and numerous low-cost manufacturers. Consumers often compare prices heavily, pushing companies to maintain competitive pricing while sustaining quality. This price pressure affects profit margins and increases the challenge of differentiating products in a crowded market. Smaller players struggle to compete with established brands that offer advanced features and strong marketing reach.

Battery Performance Limitations and Technical Issues

Despite technological improvements, wireless audio devices often face challenges related to battery degradation, connectivity disruptions, and latency issues. Consumers expect long-lasting performance, fast charging, and stable wireless connections across devices. Inadequate battery life or inconsistent connectivity can reduce user satisfaction and lead to returns. Manufacturers must invest in advanced chipsets, efficient batteries, and improved firmware to overcome these technical limitations.

Regional Analysis

North America

North America leads the Wireless Speakers and Headphones market with a 36% share, supported by strong adoption of premium audio devices, widespread use of smartphones, and high consumer spending on smart electronics. The United States drives demand through growing interest in noise-cancelling headphones, smart speakers, and advanced Bluetooth earbuds. Fitness-focused users and remote workers also contribute to increased device usage across daily activities. Expanding smart home ecosystems accelerate the adoption of Wi-Fi and voice-enabled speakers. Canada adds steady growth through rising e-commerce sales and strong penetration of wearable-connected audio devices.

Europe

Europe holds a 28% share, driven by rising demand for high-quality wireless audio solutions and growing adoption of smart home technologies. Countries such as Germany, France, and the UK account for significant consumption due to strong preference for premium headphones, smart speakers, and multi-room audio systems. The region benefits from expanding music streaming platforms and increased interest in fitness and outdoor activities. Regulatory emphasis on environmental sustainability encourages manufacturers to develop energy-efficient and recyclable audio products. Steady growth in wireless connectivity and rising disposable income support ongoing market expansion.

Asia Pacific

Asia Pacific accounts for a 29% share, fueled by rapid urbanization, rising disposable incomes, and strong adoption of mobile-first audio devices. China and India lead regional demand with high smartphone penetration and growing sales of affordable earbuds and Bluetooth headphones. Southeast Asian countries contribute through expanding e-commerce channels and increasing interest in gaming and multimedia consumption. Consumers show strong preference for compact, budget-friendly wireless earbuds, supporting strong volume growth. The rollout of 5G networks and expanding youth population reinforce the region’s position as a major growth engine for wireless audio devices.

Latin America

Latin America holds a 4% share, supported by growing smartphone usage, rising music streaming adoption, and expanding online retail penetration. Brazil and Mexico drive the majority of demand as consumers adopt wireless earbuds for entertainment, fitness, and daily commuting. Economic improvements and declining device prices make wireless audio more accessible to mid-income users. Increasing influence of global audio brands and local e-commerce platforms further boosts market expansion. Despite price sensitivity, the region shows steady growth potential for affordable wireless speakers and headphones.

Middle East & Africa

The Middle East & Africa region accounts for a 3% share, driven by rising adoption of smart devices, increasing youth population, and expanding digital entertainment consumption. Gulf countries such as the UAE and Saudi Arabia show strong demand for premium headphones and smart speakers linked to smart home ecosystems. African markets experience growing interest in budget wireless earbuds due to improving internet access and rising mobile penetration. Urban lifestyle changes and expanding retail networks support gradual market growth. Continued investment in connectivity infrastructure enhances long-term adoption of wireless audio devices across the region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Product Type

- Wireless Headphones

- Wireless Earbuds

- Bluetooth Speakers

- Smart Speakers

By Technology

- Bluetooth

- Wi-Fi

- NFC

- Others

By Distribution Channel

- Online Retail

- Offline Retail (specialty stores, electronics stores, supermarkets)

By Application

- Consumer

- Commercial

- Gaming

- Sports & Fitness

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Major players in the Wireless Speakers and Headphones market include Sony Corporation, Apple Inc., Samsung Electronics, Bose Corporation, JBL (Harman International), Sennheiser, Xiaomi, Beats Electronics, Skullcandy, and Bang & Olufsen. These companies compete by offering advanced audio technologies, improved battery performance, and seamless integration with smartphones and smart home ecosystems. Leading brands invest heavily in noise-cancellation, spatial audio, and Bluetooth advancements to enhance user experience. Product differentiation through design, comfort, and sound quality strengthens their competitive edge. Many players expand their reach through online retail channels, influencer partnerships, and rapid product launches across price segments. Smart speakers integrated with voice assistants and AI-driven features further intensify competition. As consumer demand shifts toward portable, premium, and fitness-focused audio devices, companies continue to innovate in materials, ergonomics, and chipset efficiency to maintain strong market positioning.

Key Player Analysis

Recent Developments

- In September 2025, Apple Inc. released the AirPods Pro 3 — improving active noise cancellation, battery life, and spatial audio for iPhone users.

- In May 2025, Sony Corporation updated its flagship over-ear headphones with the launch of the WH-1000XM6.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Technology, Distribution Channel, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for wireless earbuds and premium headphones will continue to grow across all regions.

- Smart speakers will expand as smart home adoption strengthens and voice assistants evolve.

- Advancements in Bluetooth and low-latency audio will enhance gaming and streaming experiences.

- Noise cancellation and spatial audio will become standard features in mid-range devices.

- Battery efficiency and fast-charging innovations will improve long-term device performance.

- Fitness and outdoor usage will boost demand for durable, sweat-resistant wireless audio products.

- Premium and luxury audio brands will see rising interest from audiophiles seeking high-fidelity sound.

- AI-enabled audio personalization will improve user engagement and product differentiation.

- E-commerce growth will accelerate online sales of wireless speakers and headphones globally.

- Integration with AR, VR, and wearable ecosystems will create new opportunities for immersive audio solutions.