| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Spray Foam Insulation Market Size 2024 |

USD 506.85 million |

| U.S. Spray Foam Insulation Market, CAGR |

6.71% |

| U.S. Spray Foam Insulation Market Size 2032 |

USD 909.22 million |

Market Overview:

The U.S. Spray Foam Insulation Market is projected to grow from USD 506.85 million in 2023 to an estimated USD 909.22 million by 2032, with a compound annual growth rate (CAGR) of 6.71% from 2023 to 2032.

Several factors are propelling the growth of the U.S. spray foam insulation market. Stringent energy efficiency regulations and building codes are encouraging the adoption of high-performance insulation materials. The demand for green building practices and sustainable construction materials is also on the rise, further boosting the market. Technological advancements have led to the development of eco-friendly and high-performance foam technologies, enhancing the appeal of spray foam insulation. Additionally, the integration of insulation materials with smart building technologies is gaining traction, offering improved energy management and performance. The focus on energy-efficient retrofits and building renovations is another significant trend, as older homes and commercial buildings are increasingly being upgraded to meet modern energy efficiency standards.

The U.S. spray foam insulation market exhibits notable regional variations in demand, driven by factors such as climate conditions, construction activity, and regulatory standards. The South region holds the largest market share, accounting for approximately 35% of the overall U.S. spray foam insulation market. The high demand in this region is primarily driven by the need for energy-efficient cooling systems in warmer climates. The West region follows with a market share of around 30%, with states like California implementing stringent building codes and energy efficiency standards that promote the use of spray foam insulation. The Northeast and Midwest regions together account for approximately 25% of the market, with a strong presence in the retrofit and renovation segments, as many older buildings require energy-efficient insulation upgrades

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The U.S. Spray Foam Insulation Market is projected to grow from USD 506.85 million in 2023 to an estimated USD 909.22 million by 2032, with a CAGR of 6.71%, driven by stringent energy efficiency mandates and updated building codes.

- Closed-cell spray foam continues to gain traction due to its high thermal performance and structural benefits, especially in residential retrofits.

- Sustainability trends are accelerating demand for low-GWP and eco-friendly foam formulations that support LEED and net-zero building goals.

- Retrofit and renovation activities in aging buildings present strong growth opportunities, supported by utility rebates and energy upgrade programs.

- Technological innovation, including mobile spray rigs and safer chemical compositions, enhances application efficiency and industry adoption.

- High initial installation costs and a shortage of skilled labor remain key challenges, especially in rural and underdeveloped regions.

- The South leads regional demand with a 35% share, followed by the West at 30%, while the Northeast and Midwest contribute 25% through retrofit-focused activity.

Report Scope

This report segments the US Spray Foam Insulation Market as follows:

Market Drivers:

Strict Building Energy Codes and Efficiency Mandates Drive Insulation Adoption

Federal and state-level mandates focusing on energy efficiency continue to play a pivotal role in expanding the U.S. Spray Foam Insulation Market. Updated building codes such as the International Energy Conservation Code (IECC) are prompting developers and contractors to shift toward high-performance insulation solutions. Spray foam insulation delivers superior thermal resistance and air sealing, making it an ideal material to comply with increasingly strict efficiency requirements. Municipalities across the country are enforcing energy benchmarking and performance standards, which compel both residential and commercial buildings to upgrade insulation systems. These evolving regulations promote long-term reductions in energy consumption and carbon emissions. The trend aligns with national goals around sustainability and climate resilience, further boosting market growth.

Growing Preference for Sustainable and High-Performance Building Materials

Demand for eco-conscious construction materials has accelerated, favoring the growth of spray foam insulation across new construction and retrofit segments. Consumers and developers now prioritize materials that offer lifecycle energy savings, durability, and reduced environmental impact. Spray foam insulation meets these demands with its closed-cell structure that enhances both thermal performance and structural integrity. Manufacturers are also introducing formulations with low global warming potential (GWP) blowing agents, helping to meet green building certification requirements. Interest in LEED, ENERGY STAR, and net-zero building certifications continues to rise, positioning spray foam as a favorable choice in sustainable design. The U.S. Spray Foam Insulation Market benefits from this shift in consumer and regulatory preferences toward greener solutions.

- Huntsman Building Solutions, for example, offers spray foam products with low global warming potential (GWP) blowing agents, which are certified by GREENGUARD Gold for low chemical emissions.

Retrofit and Renovation Projects Provide Strong Market Momentum

Aging building stock across the U.S. offers strong growth prospects for spray foam insulation manufacturers. Many commercial and residential structures built before the implementation of energy codes lack adequate thermal insulation, creating opportunities for retrofit applications. Government-funded energy efficiency programs and utility rebates incentivize homeowners and property managers to upgrade insulation systems. Spray foam insulation’s ease of application and effectiveness in sealing gaps and cracks make it an attractive solution for older buildings. The ongoing push to improve building energy performance has led contractors to adopt spray foam for attics, basements, crawl spaces, and wall cavities. It provides a reliable and long-lasting method to reduce heating and cooling loads, strengthening its demand in the retrofit market.

Technological Innovations Enhance Product Efficiency and Installer Adoption

Continuous innovation in spray foam chemistry and application equipment supports greater market acceptance and efficiency. New product formulations reduce off-gassing, improve fire resistance, and enhance adhesion across multiple surfaces. These innovations make spray foam insulation safer, easier to apply, and more suitable for a wide range of building types. Equipment improvements, such as mobile spray rigs and real-time monitoring systems, have also improved the consistency and quality of application. Manufacturers are investing in training programs to certify applicators and maintain high industry standards. The U.S. Spray Foam Insulation Market gains from these advancements, which reduce application errors, shorten installation times, and increase contractor confidence in using spray foam products.

- For instance, BASF’s ENERTITE spray foam features a water-blown formula that reduces off-gassing and achieves GREENGUARD Gold certification for indoor air quality. Graco Inc. has introduced the Reactor 3 spray foam system, which provides real-time data monitoring and automated proportioning to ensure consistent application and reduce waste.

Market Trends:

Integration of Smart Technologies with Insulation Systems Gains Traction

The construction industry’s digital transformation is influencing the adoption of smart technologies alongside traditional building materials. Contractors and facility managers increasingly integrate spray foam insulation with sensors and smart energy systems to monitor indoor environmental conditions. These smart integrations allow real-time tracking of thermal performance, humidity levels, and energy consumption. Building owners value the operational insights that such data provides, which helps in optimizing HVAC performance and reducing utility costs. The integration trend supports predictive maintenance and energy audits, strengthening long-term efficiency goals. The U.S. Spray Foam Insulation Market benefits from this alignment between traditional materials and emerging digital tools.

- For example, Foam Comfort Inc. integrates spray foam insulation with smart thermostats such as Nest or Ecobee, allowing for precise temperature regulation and real-time monitoring of indoor conditions.

Demand for Low-GWP and Bio-Based Formulations Continues to Rise

Environmental concerns and evolving chemical regulations are pushing manufacturers to develop more sustainable spray foam formulations. The industry is witnessing a clear trend toward low-global-warming-potential (GWP) blowing agents and plant-based polyols. These alternatives meet regulatory requirements without compromising performance, helping builders comply with state and federal environmental laws. Some producers have introduced spray foams derived partially from soy or castor oil, reducing dependency on petroleum-based inputs. Contractors and developers focused on sustainability increasingly favor these innovations. The U.S. Spray Foam Insulation Market responds to this trend by expanding green product portfolios and gaining interest from environmentally conscious stakeholders.

Hybrid Insulation Systems Promote Design Flexibility and Cost Optimization

Construction professionals are exploring hybrid insulation systems that combine spray foam with other insulation types such as fiberglass or mineral wool. These systems allow builders to achieve desired R-values while managing material costs and meeting project-specific design needs. Open-cell spray foam is frequently used in interior spaces for soundproofing and thermal regulation, while closed-cell foam strengthens exterior insulation performance. Blended approaches are particularly popular in large commercial and institutional buildings where insulation needs vary by zone. This flexibility enables customized solutions that enhance performance and cost-efficiency. The U.S. Spray Foam Insulation Market adapts to this trend by offering a wider range of compatible products.

- For instance, hybrid solutions using 1 inch of Johns Manville Corbond III closed-cell spray foam with R-13 fiberglass batts achieve a cavity R-value of R-17.2, exceeding the 2015 IECC prescriptive requirement of R-13 for 2×4 framing.

Growth in DIY Home Improvement Market Fuels Demand for Consumer-Grade Products

The rise in DIY culture, driven by digital content and e-commerce accessibility, is impacting insulation purchasing patterns. Homeowners are now more inclined to take on insulation upgrades, especially for garages, attics, and crawl spaces. Manufacturers are responding by offering simplified spray foam kits and aerosol-based products that are easy to use and safe for residential applications. Instructional videos and online tutorials support safe application without professional assistance. Retailers and online platforms continue to expand product offerings to cater to this growing segment. The U.S. Spray Foam Insulation Market captures value from this shift by making insulation solutions more accessible to non-professional users.

Market Challenges Analysis:

Health and Environmental Concerns Create Regulatory and Perception Barriers

The U.S. Spray Foam Insulation Market faces challenges related to health and environmental safety. Certain chemical components used in spray foam, such as isocyanates and flame retardants, have raised concerns about indoor air quality and long-term exposure risks. Regulatory agencies, including the EPA and OSHA, continue to impose stricter guidelines on the use and handling of these materials. These regulations increase compliance costs for manufacturers and contractors, slowing adoption in certain regions. Public perception around chemical emissions and potential health hazards also affects consumer confidence, particularly in residential settings. It must address these concerns through transparent labeling, product innovation, and improved safety protocols to maintain trust and meet regulatory standards.

High Installation Costs and Skilled Labor Shortage Hinder Market Penetration

High initial installation costs remain a major barrier to wider use of spray foam insulation, especially when compared to traditional alternatives like fiberglass and cellulose. Spray foam requires specialized equipment and trained professionals, which drives up labor expenses and limits DIY applications. The shortage of certified applicators further complicates project timelines and increases dependence on a limited skilled workforce. This challenge is particularly acute in rural and underdeveloped areas, where contractor availability is low. The U.S. Spray Foam Insulation Market must invest in training programs, expand access to mobile application units, and support cost-effective product innovations to improve competitiveness. It can only sustain growth by closing the affordability and accessibility gap.

- For instance, according to Icynene-Lapolla, the average cost to install spray foam insulation in a standard U.S. home ranges from $2.50 to $4.00 per square foot, compared to $0.90 to $1.50 for fiberglass batt insulation.

Market Opportunities:

Growing investments in green buildings and energy-efficient retrofits present strong opportunities for the U.S. Spray Foam Insulation Market. Federal incentives, state-level rebates, and utility programs continue to promote upgrades in insulation systems to reduce carbon footprints. Builders and property owners increasingly prioritize materials that enhance thermal performance and support sustainability goals. Spray foam’s air sealing capabilities make it well-suited for LEED and ENERGY STAR-certified projects. Commercial spaces, schools, and public infrastructure are undergoing insulation improvements to meet new energy codes. The U.S. Spray Foam Insulation Market can expand its footprint by aligning with energy transition goals and strengthening collaboration with green construction stakeholders.

Advancements in spray foam formulations and equipment are opening new application areas across residential, commercial, and industrial segments. Low-GWP products, bio-based alternatives, and improved fire resistance are gaining traction with environmentally conscious customers. Customizable foam densities and installation methods allow adaptation across climates and building types. Contractors and architects seek materials that deliver both performance and design flexibility. The U.S. Spray Foam Insulation Market has the potential to lead through innovation, offering tailored solutions for evolving construction needs. It can capture new demand by leveraging R&D investments and responding to market feedback.

Market Segmentation Analysis:

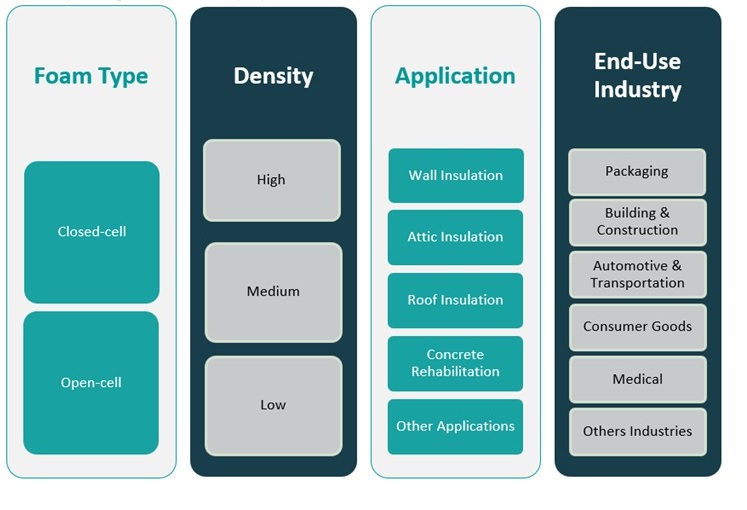

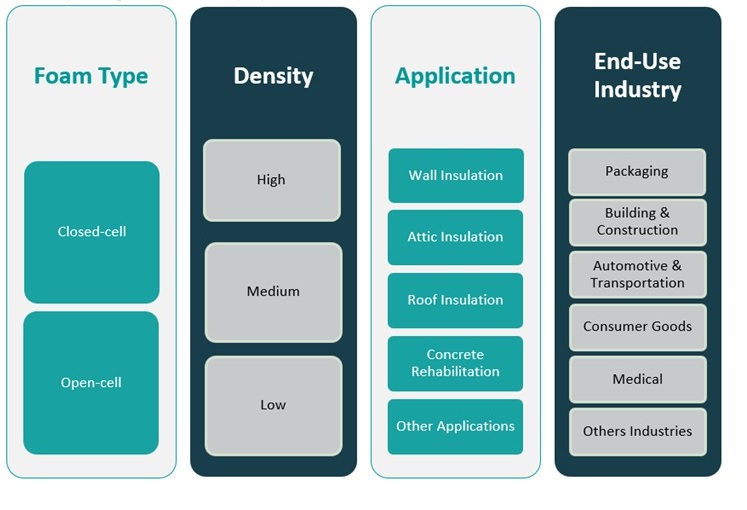

The U.S. Spray Foam Insulation Market is segmented by foam type, density, application, and end-use industry.

By foam type, closed-cell foam dominates due to its superior thermal resistance and moisture barrier capabilities, making it ideal for high-performance insulation. Open-cell foam is favored in interior applications for its cost-effectiveness and soundproofing properties.

By density, the market includes high, medium, and low-density foams. High-density spray foam is used in exterior applications and roofing due to its strength and rigidity. Medium-density foam balances performance and flexibility, while low-density variants serve interior wall cavities and attic spaces.

By application, wall insulation holds the largest share, followed by attic and roof insulation. Concrete rehabilitation and other niche applications are gaining traction in commercial and infrastructure projects. The U.S. Spray Foam Insulation Market benefits from versatility across these use cases.

By end-use industry, building and construction remain the dominant segment, driven by new residential developments and energy retrofits. Packaging, automotive and transportation, consumer goods, and medical sectors represent emerging segments, where thermal and structural benefits of spray foam support diverse applications.

Segmentation:

By Foam Type

By Density

By Application

- Wall Insulation

- Attic Insulation

- Roof Insulation

- Concrete Rehabilitation

- Other Applications

By End-Use Industry

- Packaging

- Building & Construction

- Automotive & Transportation

- Consumer Goods

- Medical

- Others

Regional Analysis:

The South region dominates the U.S. Spray Foam Insulation Market with a market share of 35%. High temperatures across states like Texas and Florida drive demand for energy-efficient cooling solutions, making spray foam a preferred insulation material. The region sees steady growth in both residential and commercial construction, supported by population expansion and economic development. Builders prioritize insulation systems that reduce HVAC loads and improve building envelopes, positioning spray foam as a strategic choice. State energy codes increasingly mandate performance-based standards, encouraging broader adoption of high-performance materials. The market in the South benefits from favorable weather conditions for year-round application and a strong base of trained installers.

The West region holds a 30% share of the U.S. Spray Foam Insulation Market, led by environmentally progressive states such as California and Washington. Local governments in this region enforce strict building efficiency standards, driving the use of advanced insulation technologies. Spray foam aligns well with sustainability goals and is often specified in green construction and net-zero energy projects. High real estate activity in urban centers and growing interest in smart buildings also support the market’s expansion. Frequent wildfires and changing climate patterns have increased awareness of building resilience, prompting greater investment in sealing and insulating materials. The market continues to grow as developers integrate spray foam into both new builds and energy retrofits.

The Northeast and Midwest regions together account for 25% of the U.S. Spray Foam Insulation Market. These regions have a large stock of older buildings that require thermal upgrades, creating opportunities in the retrofit segment. Harsh winters and fluctuating temperatures in cities like Chicago, Boston, and Detroit make thermal insulation a top priority for homeowners and facility managers. Energy efficiency programs, tax incentives, and home improvement grants further encourage insulation upgrades. Contractors in these regions value spray foam’s ability to seal leaks and improve building envelopes in aging structures. The market here remains strong due to renovation cycles and regulatory pressure to reduce building energy use. It is supported by a growing network of regional suppliers and certified applicators.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- BASF SE

- Dow

- Huntsman International LLC

- Lapolla Industries, Inc

- 3M

Competitive Analysis:

The U.S. Spray Foam Insulation Market features a concentrated landscape with several major players driving product innovation, distribution efficiency, and market reach. Key companies include Huntsman Corporation, Carlisle Companies Inc., BASF SE, Icynene-Lapolla, and Owens Corning. These firms invest in R&D to develop environmentally friendly formulations and improve application systems. Market leaders focus on expanding contractor training programs and strengthening partnerships with builders and architects. Smaller regional players compete by offering customized solutions and responsive service models. The U.S. Spray Foam Insulation Market remains competitive as firms seek to differentiate through sustainability, performance, and installation support. It continues to evolve through mergers, acquisitions, and strategic collaborations aimed at expanding geographic presence and product portfolios.

Recent Developments:

- In March 2025, BASF SE introduced a new line of biomass balance flexible polyurethane foam systems for the North American market, targeting the furniture industry. These products, certified under REDcert², are designed to replace fossil feedstocks with renewable alternatives, potentially reducing product carbon footprint emissions by up to 75% compared to conventional flexible polyurethane foam systems. This launch underscores BASF’s commitment to sustainability and innovation in polyurethane technology, which also supports the broader insulation and materials sectors in the U.S.

Market Concentration & Characteristics:

The U.S. Spray Foam Insulation Market exhibits moderate to high market concentration, with a few large players accounting for a significant share of overall revenue. It is characterized by strong brand loyalty, high entry barriers, and a growing emphasis on sustainability and performance standards. The market favors manufacturers with robust distribution networks, certified installer programs, and advanced product formulations. Product differentiation is based on thermal efficiency, environmental compliance, and ease of application. It also reflects a demand-driven structure, where construction trends and regulatory shifts influence purchasing patterns. The U.S. Spray Foam Insulation Market maintains a competitive edge through continuous innovation and regional service responsiveness.

Report Coverage:

The research report offers an in-depth analysis based on Foam Type, Density, Application and End-Use Industry. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The market is expected to witness steady growth driven by rising demand for energy-efficient and durable insulation solutions across various sectors.

- Closed-cell spray foam will likely continue to dominate colder regions due to its superior thermal resistance and moisture control capabilities.

- The residential sector is anticipated to remain the largest contributor, supported by growing awareness of home energy efficiency and indoor comfort.

- Advancements in product formulations and application technologies will improve sustainability and broaden usage in green construction.

- Incentives and regulatory support for energy conservation will encourage wider adoption in both new buildings and renovation projects.

- Smart building technologies, including insulation performance monitoring systems, will play a growing role in enhancing building efficiency.

- DIY spray foam kits are gaining traction among homeowners seeking affordable, easy-to-apply insulation for smaller-scale improvements.

- Commercial and industrial segments are set to increase usage to meet performance standards and reduce operational energy costs.

- Urban expansion and residential development across high-growth regions will continue to support long-term market demand.

- Ongoing R&D will focus on enhancing fire safety, environmental compliance, and product versatility to strengthen market competitiveness.