Market Overview

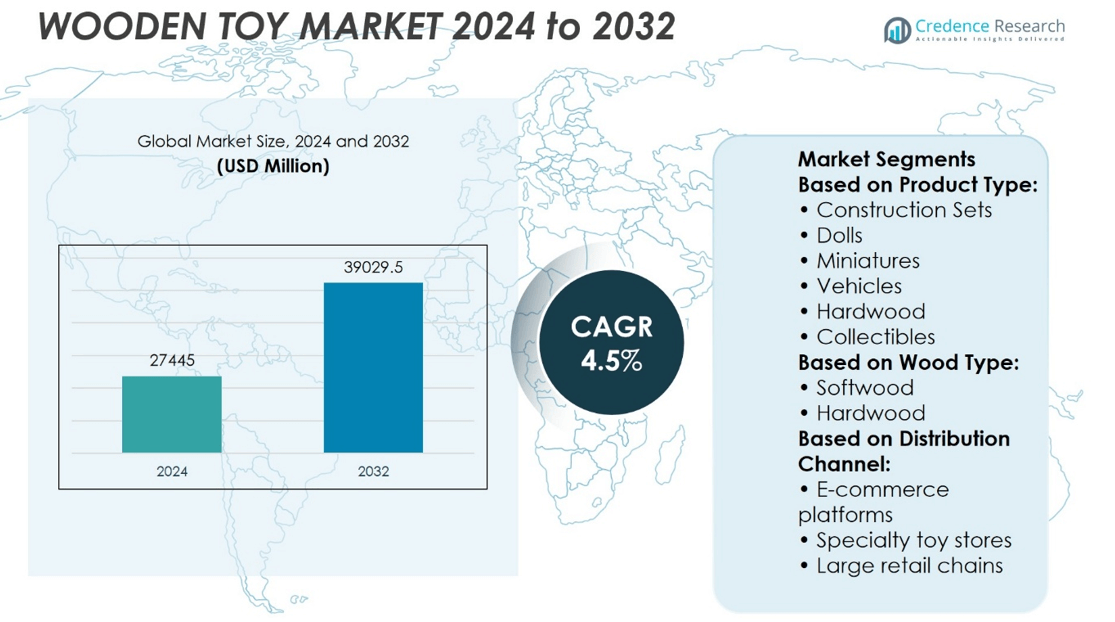

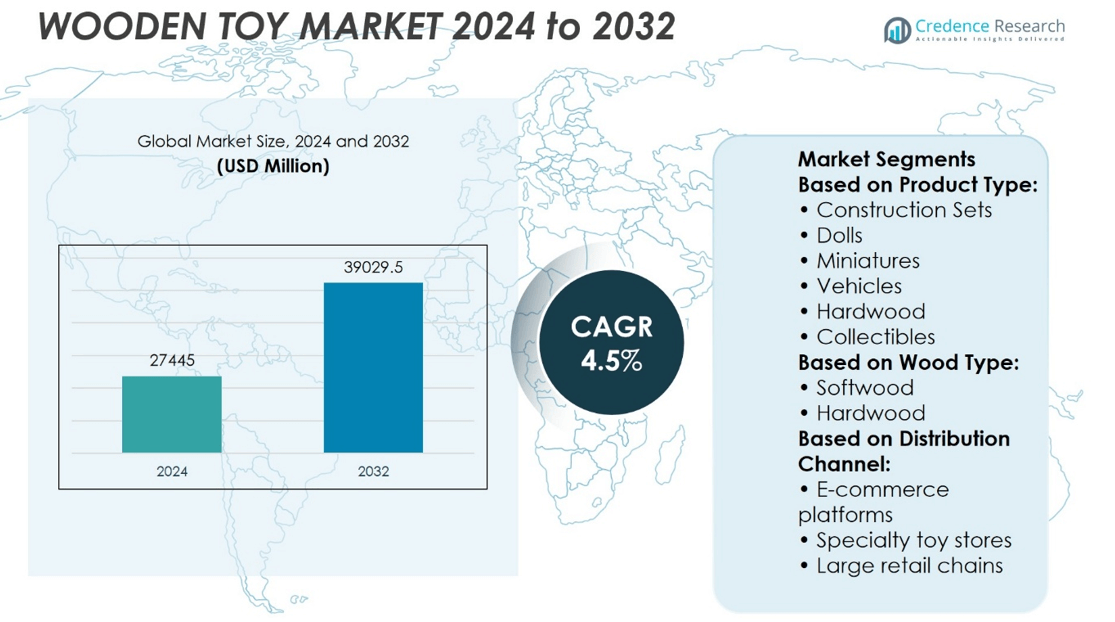

Wooden Toy Market size was valued at USD 27445 million in 2024 and is anticipated to reach USD 39029.5 million by 2032, at a CAGR of 4.5 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wooden Toy Market Size 2024 |

USD 27445 million |

| Wooden Toy Market, CAGR |

4.5% |

| Wooden Toy Market Size 2032 |

USD 39029.5 million |

The wooden toy market is driven by increasing parental preference for sustainable, non-toxic, and educational play options. Rising awareness of environmental impact and child safety fuels demand for toys made from certified wood and natural materials. Consumers value developmental benefits, aligning with Montessori and Waldorf education models. Trends such as minimalism, handcrafted aesthetics, and personalized products are gaining momentum, especially through e-commerce and social media platforms. Brands are responding with innovative, eco-friendly designs and storytelling that connect with conscious buyers. The market continues to evolve around ethical sourcing, premium craftsmanship, and screen-free, imagination-based play experiences.

Europe holds the largest share in the wooden toy market, followed by North America and Asia Pacific, driven by strong demand for sustainable and educational toys. Emerging markets in Asia and Latin America are showing steady growth due to rising awareness and income levels. Key players in the market include Hasbro Inc., Melissa & Doug, Hape Toys, Bella Luna Toys, The Wooden Wagon Inc., Bajo, Westwork Designs, wood-expressions, Roy Toy Manufacturing, and ABA factory, each competing through quality, innovation, and eco-friendly practices.

Market Insights

- The wooden toy market is projected to reach over USD 39029.5 million by 2032, growing at a CAGR of approximately 4.5% during the forecast period, driven by rising demand for sustainable and educational toys.

- Increasing parental awareness of non-toxic, eco-friendly, and skill-building toys continues to drive strong demand across both developed and developing regions.

- Handcrafted designs, minimalist aesthetics, and personalized wooden toys are becoming mainstream trends, especially through social media and e-commerce platforms.

- Leading players such as Hasbro Inc., Melissa & Doug, Hape Toys, Bella Luna Toys, The Wooden Wagon Inc., and Bajo are investing in premium design, FSC-certified sourcing, and regulatory compliance to maintain competitive advantage.

- High production costs, limited scalability of artisanal methods, and stringent safety regulations remain key restraints, especially for smaller brands.

- Europe dominates with over 35% market share, supported by strong consumer preferences for sustainable products and long-standing demand for educational wooden toys.

- Asia Pacific is growing at the fastest pace, driven by rising income levels, increasing awareness of safe toys, and rapid urbanization in countries like China, India, and Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Parental Awareness of Safe and Sustainable Materials Fuels Product Demand

The growing awareness among parents about the health hazards posed by plastic and synthetic materials has led to a shift toward wooden alternatives. Many consumers now prioritize non-toxic, eco-friendly, and durable materials in children’s products. The wooden toy market benefits directly from this preference, positioning itself as a safer and more responsible choice. It appeals strongly to eco-conscious households, especially in developed economies. Parents are actively seeking products that align with their values around child safety and environmental sustainability. This shift is influencing manufacturers to adopt FSC-certified wood and non-toxic finishes.

- For instance, a survey-based lifecycle study conducted in Japan evaluated the average usable lifespan of toys: wooden toys remained in use for 7.29 years, compared to 6.17 years for plastic toys

Educational and Developmental Benefits Drive Consumer Preference

Consumers increasingly associate wooden toys with enhanced educational and developmental outcomes. These toys are often designed to encourage creativity, fine motor skills, problem-solving, and imagination. The wooden toy market gains traction through its alignment with Montessori and Waldorf education models, which emphasize hands-on and sensory-based learning. Parents view these toys as tools that foster cognitive growth without overstimulation. It leads to a preference for tactile, open-ended play rather than battery-operated, screen-based options. This trend is particularly strong among early childhood educators and homeschoolers.

- For instance, a lifecycle survey conducted in Japan calculated that the average usable lifespan of wooden toys was 7.29 years, compared to 6.17 years for plastic toys

Influence of Social-Media and Premium Branding Boosts Market Growth

A surge in lifestyle and parenting content on digital platforms has brought aesthetic, handcrafted wooden toys into mainstream visibility. Influencers and niche brands showcase these products as aspirational and aligned with minimalist parenting trends. The wooden toy market sees rising demand due to strong visual appeal and perceived quality. It positions these toys as gifts and décor items, beyond basic playthings. This perception elevates their value proposition, encouraging higher spending per unit. Many consumers discover and purchase these toys through curated online boutiques and artisan marketplaces.

Retail Expansion and E-commerce Channels Strengthen Distribution Reach

Retailers and brands are scaling up their presence across physical and online channels to meet the growing demand. Specialty toy stores, department chains, and direct-to-consumer websites offer curated collections of wooden toys. The wooden toy market benefits from seamless availability and faster delivery across regions. It enables even small brands to access global consumers through digital platforms. Retail collaborations with sustainability-focused initiatives are expanding visibility. Efficient supply chains and packaging solutions support the momentum, driving volume sales in domestic and international markets.

Market Trends

Surging Popularity of Handcrafted and Artisanal Wooden Toys Influences Consumer Choices

Handcrafted wooden toys are gaining strong appeal among consumers seeking uniqueness and authenticity. Parents prefer products that reflect craftsmanship and individual character rather than mass-produced alternatives. The wooden toy market benefits from rising interest in heirloom-quality items that offer emotional and aesthetic value. It caters to a niche segment that values traditional methods, sustainable sourcing, and story-driven branding. Many consumers are willing to pay a premium for toys made by small-scale artisans using ethically sourced materials. This trend aligns with the broader consumer shift toward slow fashion and conscious consumption.

- For instance, the wooden toy cluster in Varanasi employs approximately 3,000 artisans, producing over 12,000 units of handcrafted toys monthly, according to the Ministry of Micro

Customization and Personalization Drive Product Differentiation

rands are responding to consumer demand by offering personalized wooden toys with names, dates, and unique designs. Customization strengthens emotional attachment and positions products as thoughtful gifts. The wooden toy market is seeing expanded options in customized educational blocks, puzzles, and keepsake toys. It encourages repeat purchases and strengthens brand loyalty. Parents view personalized toys as more meaningful and suitable for milestones such as birthdays or holidays. This trend has gained momentum through e-commerce platforms that simplify customization at checkout.

- For instance, Maple Landmark Woodcraft—creator of the NameTrains™ system—operates a facility with over 40 employees in Middlebury, Vermont.

Integration of STEM and Educational Concepts Enhances Toy Functionality

Manufacturers are introducing STEM-based features in wooden toys to appeal to modern educational priorities. These toys now incorporate math, science, and spatial reasoning elements without relying on electronic components. The wooden toy market benefits from this innovation by aligning with both learning and sustainability goals. It supports cognitive development while maintaining the tactile and visual appeal of natural materials. Brands are launching modular toys and interactive sets that blend design with educational value. This shift responds to parents looking for purposeful and screen-free playtime solutions.

Eco-friendly Packaging and Circular Design Gain Traction Across Brands

Sustainable packaging and circular design principles are becoming standard practices in the toy industry. Companies are moving toward recyclable, biodegradable, or reusable packaging that complements the product’s environmental ethos. The wooden toy market is adapting to these trends by minimizing plastic use and reducing overall packaging volume. It creates a consistent brand message and strengthens consumer trust. Retailers are also promoting zero-waste gift-wrapping options for eco-conscious buyers. This change supports long-term brand positioning in an increasingly sustainability-driven marketplace.

Market Challenges Analysis

High Production Costs and Limited Scalability Restrict Market Penetration

Wooden toys often require high-quality raw materials and skilled craftsmanship, which significantly increase production costs. Manufacturers face challenges in maintaining competitive pricing against mass-produced plastic alternatives. The wooden toy market struggles with scalability, especially for small and mid-sized businesses that rely on artisanal methods. It limits their ability to meet large-scale retail demand or expand rapidly into new regions. Many brands must balance sustainability with affordability, which proves difficult without compromising quality. This challenge affects pricing strategies and profit margins across various distribution channels.

Stringent Safety Regulations and Sourcing Constraints Hinder Product Development

Toys made from natural wood must meet rigorous safety and quality standards across different markets. Regulatory compliance involves frequent testing, certification, and material traceability, which adds cost and delays. The wooden toy market faces sourcing challenges due to limited availability of certified, sustainable timber. It makes supply chains vulnerable to disruption, especially during periods of high demand or material shortages. Ensuring consistent product quality while adhering to environmental guidelines requires investment in specialized equipment and skilled labor. These hurdles can deter new entrants and slow innovation among existing players.

Market Opportunities

Expansion into Emerging Markets and Niche Consumer Segments Unlocks Growth Potential

Rising disposable incomes and growing awareness of child safety are creating fertile ground for wooden toy brands in emerging markets. Parents in urban areas are beginning to prioritize quality, sustainability, and educational value over low-cost alternatives. The wooden toy market can capitalize on this shift by targeting middle-income households through localized product designs and pricing strategies. It allows brands to address new demographics while differentiating from conventional toys. Opportunities exist in tier-2 and tier-3 cities where modern retail and e-commerce are gaining traction. Strategic partnerships with local distributors can support wider market penetration and brand visibility.

Product Innovation and Eco-label Certification Strengthen Competitive Advantage

Brands that integrate innovation in design, modularity, and learning value can capture attention from tech-savvy and environmentally conscious consumers. The wooden toy market benefits when companies develop multifunctional toys that combine aesthetics, education, and interactivity. It creates space for premium positioning and customer loyalty. Certifications such as FSC, PEFC, or organic labeling reinforce consumer trust and enable entry into strict regulatory environments. Collaborations with educators and child development experts can further validate product value. These approaches open doors for long-term brand development and international expansion.

Market Segmentation Analysis:

By Product Type:

The wooden toy market includes a wide range of product categories such as construction sets, dolls, miniatures, vehicles, hardwood toys, and collectibles. Construction sets and vehicles hold strong appeal due to their educational and motor skill development benefits. These toys are widely adopted by parents and schools focused on interactive learning. Dolls and miniatures remain popular among younger children, supporting imaginative play and role-playing activities. Collectibles attract adult consumers and gift buyers looking for aesthetically pleasing and timeless pieces. Hardwood toy items also serve decorative or keepsake purposes, strengthening their presence in premium product lines. The market benefits from a balanced mix of play, learning, and collectible value.

- For instance, BRIO introduced its peg-and-hole wooden railway system in 1958 and by the early 2000s had produced billions of interlocking wooden track pieces.

By Wood Type:

The market is segmented into softwood and hardwood categories. Hardwood toys, typically made from beech, maple, or oak, dominate higher-end segments due to their strength, refined finish, and longevity. These are preferred for educational and collectible items where durability and appearance are essential. It helps brands position their products as premium and long-lasting. Softwood toys, made from pine or fir, are lighter and more economical, making them ideal for younger children and budget-conscious consumers. Both wood types support diverse product strategies, allowing manufacturers to cater to a wide range of consumer expectations.

- For instance, Grimm’s Spiel und Holz Design processes over 250,000 kilograms of alder, beech, maple, and lime wood annually.

By Distribution Channel:

The distribution channels for wooden toys include specialty toy stores, large retail chains, online platforms, and boutique outlets. E-commerce continues to gain market share due to its convenience, customization features, and global accessibility. It allows small-scale and artisanal brands to expand their reach without major investment in physical infrastructure. Specialty stores offer curated, experience-driven selections that appeal to customers seeking quality and uniqueness. Large retail chains focus on volume sales, targeting family segments through promotions and seasonal campaigns. A multichannel distribution model enhances product visibility and aligns with varied consumer buying behaviors.

Segments:

Based on Product Type:

- Construction Sets

- Dolls

- Miniatures

- Vehicles

- Hardwood

- Collectibles

Based on Wood Type:

Based on Distribution Channel:

- E-commerce platforms

- Specialty toy stores

- Large retail chains

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds a significant share in the wooden toy market, accounting for approximately 30% of the global revenue. The region benefits from high consumer awareness regarding eco-friendly and non-toxic products, driving strong demand for sustainable toy alternatives. Parents in the U.S. and Canada show a clear preference for educational toys that align with child development goals and minimal environmental impact. Brands operating in North America often highlight FSC-certified wood and compliance with ASTM toy safety standards to appeal to health-conscious consumers. The region’s mature retail infrastructure, including specialty stores and e-commerce platforms, supports a wide distribution network. Manufacturers benefit from strong digital marketing channels, increasing visibility and customer reach. Demand remains strong for premium, handcrafted toys that support imaginative and skill-based play.

Europe

Europe represents the largest market share, contributing around 35% globally, due to the region’s strict environmental regulations and strong consumer preference for sustainable, high-quality toys. Countries like Germany, France, and the Nordic nations show consistent demand for traditional wooden toys that promote creativity and motor skills. Educational institutions in many parts of Europe integrate wooden learning tools in early childhood development programs. European consumers value craftsmanship, and many prefer locally sourced or ethically manufactured wooden toys. The presence of long-standing heritage brands and strong artisan networks further reinforces market dominance. E-commerce is growing rapidly, though brick-and-mortar specialty stores still play a key role in driving consumer purchases in this region.

Asia Pacific

Asia Pacific is emerging as a high-growth region, accounting for about 20% of the global wooden toy market. Rising disposable incomes, expanding middle-class populations, and increasing awareness of child safety standards are contributing to rising demand. Countries such as China, Japan, India, and South Korea are seeing a shift in consumer preferences from plastic toys to wooden alternatives. While price sensitivity remains a challenge in some parts of the region, urban consumers increasingly value quality and sustainability. Domestic brands are scaling up production, and global players are entering the market through online platforms and local retail partnerships. Governments in countries like India and China are also promoting eco-friendly manufacturing practices, which may further support market growth.

Latin America and Middle East & Africa (MEA)

Latin America and MEA together contribute a smaller yet growing portion of the wooden toy market, collectively holding around 10% market share. In Latin America, Brazil and Mexico lead demand, driven by rising awareness of safe toys and expanding retail access. Local artisans and small-scale manufacturers are playing a growing role, especially in rural and semi-urban markets. In MEA, demand is largely concentrated in urban centers such as Dubai, Riyadh, and Johannesburg, where premium toy segments are gaining visibility. These regions face challenges such as import dependency and limited awareness, but growing online retail penetration and parent education initiatives are opening new avenues. Market share may expand further as affordability and accessibility improve.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The wooden toy market includes HABA, Melissa & Doug, PlanToys, Grimm’s Spiel und Holz Design, Janod, Bajo, Brio, Maple Landmark, Le Toy Van, and Tender Leaf Toys.The wooden toy market is highly competitive, with players focusing on craftsmanship, sustainability, safety standards, and design innovation to differentiate their offerings. Manufacturers prioritize eco-conscious production, often using FSC-certified wood and non-toxic finishes to appeal to environmentally aware consumers. Companies invest in in-house production capabilities to ensure quality control and compliance with global safety standard. Customization and personalization also play a major role, with firms integrating laser engraving and modular design systems to cater to individual consumer preferences. Export-oriented production models and strong distribution networks further strengthen competitiveness, allowing brands to penetrate global markets. Additionally, emphasis on educational value and developmental benefits enhances consumer engagement, particularly among parents and educators. Overall, the market rewards innovation, ethical sourcing, and adaptability to shifting consumer expectations around sustainability and product safety.

Recent Developments

- In February 2025, Ace Turtle launched its fifth Toys“R”Us store in India, as part of its strategic expansion plan aiming for 12 stores by the end of 2024. The store spans 6,000 sq. ft. and offers international brands like LEGO, Hasbro, and Mattel, alongside Indian brands such as Funskool and Winmagic.

- In September 2024, Melissa & Doug introduced Blockables, a new line of wooden snap-and-play building blocks designed to promote creativity and open-ended play. The collection features interlocking wooden pieces that allow kids to build structures in new ways, encouraging problem-solving skills.

- In January 2024, Melissa & Doug, renowned among parents as the leading brand for wooden and sustainable toys in preschool, introduced its latest innovation, Sticker WOW! This new product line launched nationally just in time for National Sticker Day, offers a fresh approach to sticker play. Sticker WOW! introduces collectible and refillable sticker stampers designed to ignite creativity through open-ended and mess-free fun. Specifically crafted for little hands, these stampers feature a variety of collectible characters and come pre-loaded with 300 stickers across 100 unique designs, ensuring enjoyable and surprising stamping experiences.

Market Concentration & Characteristics

The wooden toy market remains moderately fragmented, with a balanced mix of global brands and regional manufacturers competing across various price and quality segments. It features a strong presence of artisanal and small-scale producers that focus on handcrafted, eco-friendly, and educational toys, appealing to niche consumer bases. Large players such as Melissa & Doug, Hape Toys, and Hasbro Inc. dominate mass-market segments through extensive distribution networks and wide product portfolios. The market exhibits high product differentiation driven by sustainability, design aesthetics, and developmental value, which limits direct price competition. It is characterized by growing demand for FSC-certified wood, non-toxic finishes, and minimalist designs aligned with modern parenting trends. E-commerce plays a key role in expanding access to premium and custom toys, while specialty toy stores continue to serve as important retail touchpoints. Brand trust, safety certifications, and product innovation act as core competitive levers across all segments. The wooden toy market responds well to consumer preferences for ethical sourcing and screen-free play, reinforcing its resilience against broader industry shifts toward digital entertainment.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Wood Type, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and sustainable toys will continue to drive growth across global markets.

- Manufacturers will expand product lines with educational and developmental features to meet parent expectations.

- E-commerce will strengthen its position as the leading distribution channel for both mass-market and niche wooden toys.

- Brands will increase investments in FSC-certified materials and non-toxic coatings to meet safety and environmental standards.

- Customization and personalization options will become more popular, especially for gifting and milestone purchases.

- Emerging markets in Asia and Latin America will offer new growth opportunities driven by rising awareness and disposable income.

- Collaborations with educators and child development experts will influence product innovation and design.

- Small and artisanal brands will gain visibility through social media marketing and influencer partnerships.

- Digital tools like AR and QR codes may be used to enhance storytelling and engagement around physical wooden toys.

- Regulatory compliance and global safety standards will remain critical to building consumer trust and brand credibility.