Market Overview

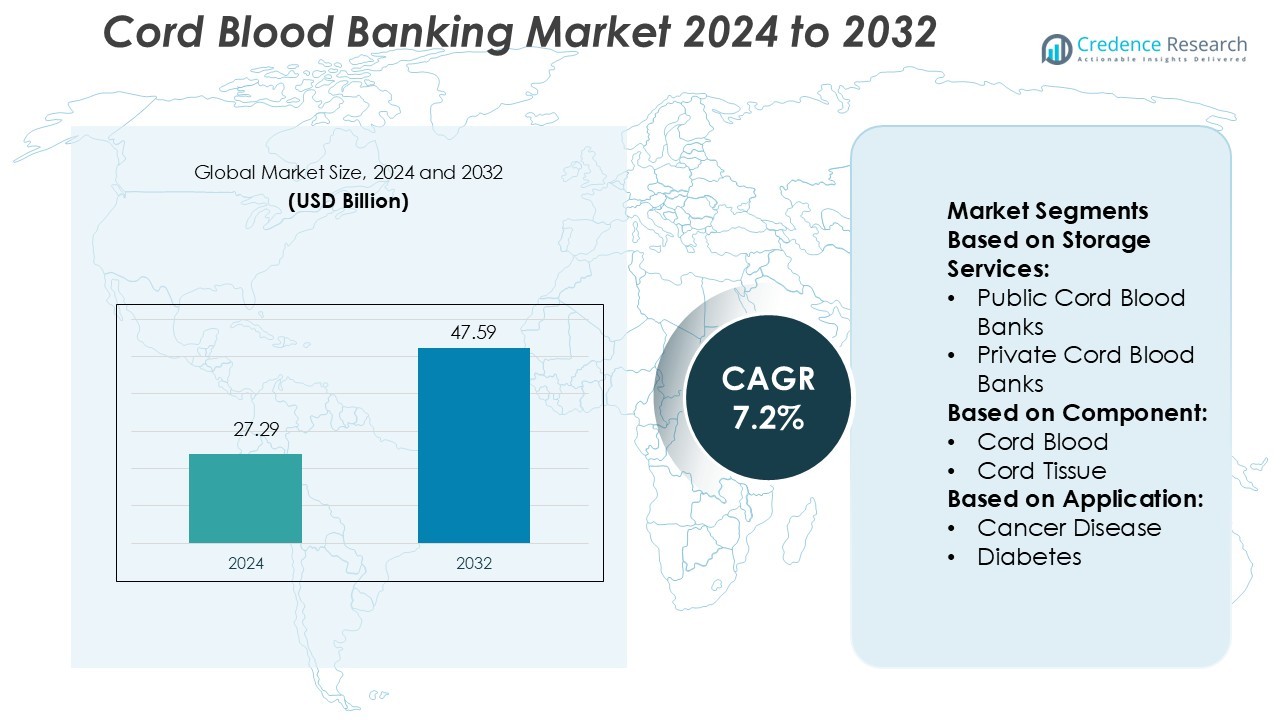

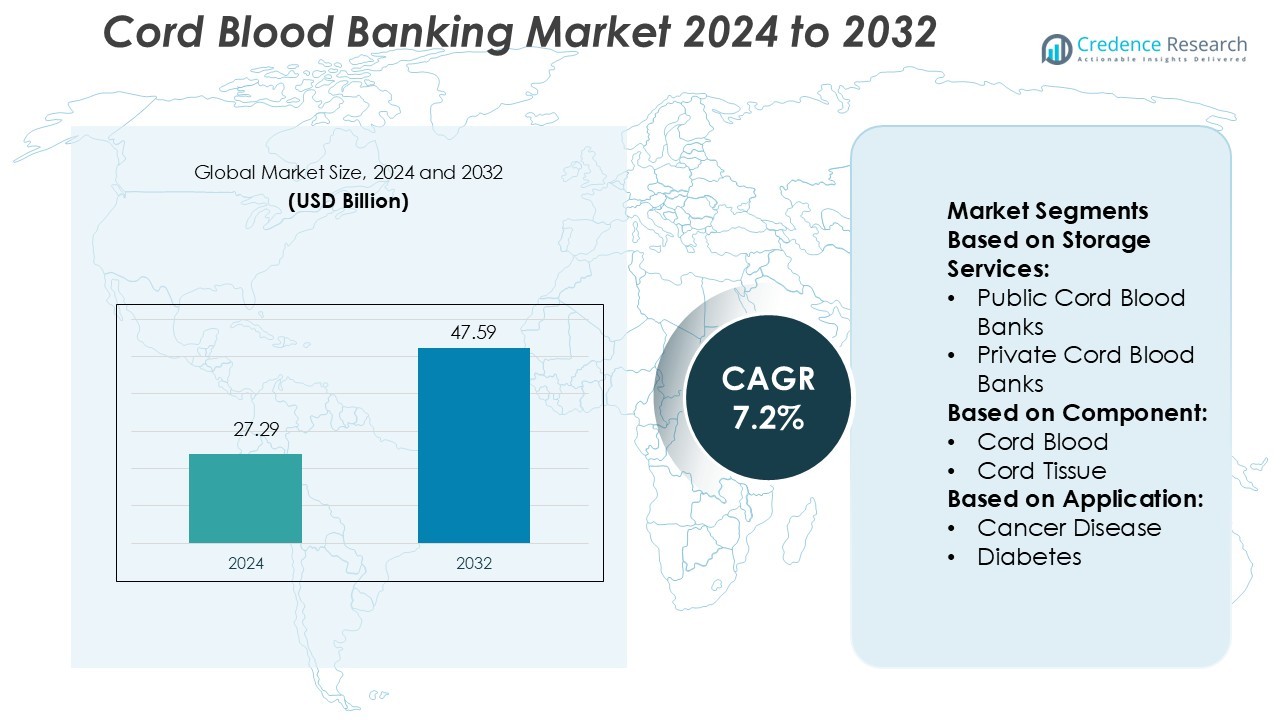

Cord Blood Banking Market size was valued USD 27.29 billion in 2024 and is anticipated to reach USD 47.59 billion by 2032, at a CAGR of 7.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Cord Blood Banking Market Size 2024 |

USD 27.29 Billion |

| Cord Blood Banking Market, CAGR |

7.2% |

| Cord Blood Banking Market Size 2032 |

USD 47.59 Billion |

The cord blood banking market is driven by top players including Cryo-Cell International, AlphaCord LLC, Cord Blood Foundation (Smart Cells International), CBR Systems Inc., Singapore Cord Blood Bank, California Cryobank Stem Cell Services LLC, Cordlife Group Limited, FamiCord, Global Cord Blood Corporation, and CSG-BIO. These companies focus on technological advancements, strategic partnerships, and expanding their global service networks to strengthen market positions. They invest heavily in automated processing systems and cryopreservation innovations to enhance stem cell viability. North America leads the global market with a 38% share, supported by advanced healthcare infrastructure, strong research investments, and high parental awareness. This leadership is reinforced by extensive clinical trials and favorable reimbursement frameworks that encourage higher participation in both public and private banking programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Cord Blood Banking Market was valued at USD 27.29 billion in 2024 and is expected to reach USD 47.59 billion by 2032, growing at a CAGR of 7.2%.

- Rising demand for regenerative therapies, growing clinical research, and increasing parental awareness are driving strong market expansion globally.

- Technological innovations in automated processing and cryopreservation are creating new opportunities, supported by strategic collaborations between public and private banking institutions.

- Intense competition among key players is shaping the market, with companies focusing on infrastructure expansion, service diversification, and international partnerships to strengthen their positions.

- North America dominates with a 38% share, followed by Europe at 27% and Asia Pacific at 23%, while public banks hold a larger segment share due to government support and higher donor participation.

Market Segmentation Analysis:

By Storage Services

Private cord blood banks hold the dominant market share. Rising awareness of personalized medicine and increasing preference for family stem cell storage drive this segment. Families choose private banks for exclusive access to stored stem cells, enabling future therapeutic use for genetic or acquired conditions. The availability of flexible storage plans, advanced cryopreservation technology, and improved collection logistics further strengthen adoption. Public banks continue to play a vital role in donor availability and research support, but private services lead due to rising consumer demand for individualized healthcare solutions.

- For instance, Cryo-Cell reports independent sources confirm that stem cells can lose viability and function if exposed to temperatures outside the 4–30 °C range (39–86 °F) during transportation.

By Component

Cord blood remains the dominant component segment, holding the highest market share. This dominance is driven by the established clinical applications of cord blood stem cells in treating hematologic and immune disorders. Cord blood offers easier collection, higher stem cell concentration, and lower rejection risk in transplants. Ongoing R&D expands its therapeutic applications, further boosting demand. Cord tissue is gaining traction for its regenerative potential, especially in orthopedics and neurological conditions. Its growing use in regenerative therapies positions it as a key future growth segment.

- For instance, AlphaCord, part of the CSG. BIO Group, is a provider of cord blood and tissue banking services. The CSG. BIO Group, as a whole, has processed and stored over 750,000 samples in its database.

By Application

Cancer disease applications lead the market, holding the dominant share. Cord blood stem cells are widely used in treating leukemia, lymphoma, and other blood cancers due to their high efficacy and lower graft-versus-host risks. Advancements in transplant success rates and supportive clinical guidelines drive adoption in oncology. Immune and blood disorders also represent significant segments, supported by rising transplant procedures worldwide. Diabetes and metabolic disorders are emerging applications, benefiting from ongoing clinical trials exploring the potential of cord tissue-derived stem cells in regenerative medicine.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The growing incidence of cancer, immune disorders, and blood diseases is driving demand for cord blood banking. Cord blood stem cells offer effective treatment options for conditions like leukemia and lymphoma. Medical research continues to expand clinical applications, increasing patient awareness and adoption. Public and private banks are investing in infrastructure to meet rising collection volumes. The higher success rate of stem cell transplants from cord blood compared to bone marrow strengthens market growth. This expanding therapeutic potential remains a strong growth catalyst.

- For instance, CBR has reported the release of more than 750 cord-blood units for clinical or investigational use by end of 2024, with 84% of those intended for regenerative-medicine applications.

Expanding Clinical Research and Trials

Ongoing clinical trials exploring regenerative therapies are creating new opportunities for cord blood banking. Researchers are studying stem cells for treating diabetes, metabolic disorders, and neurological diseases. Collaborations between biotech firms and medical institutions are improving cryopreservation and stem cell expansion technologies. These developments increase the clinical utility of stored cord blood. Regulatory approvals for advanced therapies further support adoption. The rising number of government-backed research programs also accelerates market expansion across developed and emerging economies.

- For instance, Cordlife Group Limited — The company records having processed and stored more than 400,000 cord blood, cord lining, cord tissue and placenta stem-cell units across its network.

Growing Awareness and Parental Enrollment

Increasing awareness among expectant parents about the medical benefits of cord blood banking boosts market demand. Educational campaigns and partnerships with maternity hospitals make collection more accessible. Many private cord blood banks offer flexible payment and storage options, encouraging higher enrollment rates. The growth of personalized medicine further highlights the importance of biological resource preservation. This growing awareness leads to higher participation in both public and private banking programs, strengthening the overall market outlook.

Key Trends & Opportunities

Technological Advancements in Cryopreservation

Innovations in cryopreservation techniques are improving the quality and viability of stored cord blood units. Automated processing systems enhance cell recovery rates, reducing contamination risks. Integration of AI-driven quality control helps banks maintain standardized storage protocols. Improved storage efficiency lowers operational costs for banks, boosting profitability. These advancements make long-term storage more reliable, encouraging wider participation in banking programs. The continued focus on quality assurance opens opportunities for technology providers and service expansion.

- For instance, FamiCord reports that its facilities currently store more than 1,000,000 biological samples, encompassing umbilical cord blood, cord tissue and placenta units.

Increasing Public-Private Collaborations

Governments and private institutions are forming strategic collaborations to strengthen cord blood infrastructure. Public banking initiatives expand access for patients needing transplants, while private players contribute funding and innovation. Joint programs enhance donor diversity, increasing the chances of successful matches. Such partnerships also support broader awareness campaigns and standardization of collection protocols. These efforts improve healthcare access and promote sustained market growth. This trend creates new investment and innovation opportunities in the sector.

- For instance, Global Cord Blood Corporation reported that by March 2022 its inventory across family bank subscribers and public bank donors reached 1,060,516 cord blood units.

Emergence of Regenerative Medicine Applications

Regenerative medicine is expanding the therapeutic potential of cord blood. Stem cells are increasingly used in clinical trials for cardiovascular and neurological disorders. This widening application range drives demand for high-quality storage solutions. Pharmaceutical and biotech companies are investing in new research programs to commercialize advanced therapies. The convergence of cord blood banking with regenerative medicine strengthens long-term market opportunities and positions the sector for sustained expansion.

Key Challenges

High Cost of Private Banking

The high cost of collection, processing, and long-term storage limits the adoption of private banking. Many families in low- and middle-income countries cannot afford the fees, restricting market penetration. Even in developed regions, cost remains a factor influencing parental decisions. Public banks often offer free storage but face capacity constraints. Addressing pricing models and expanding insurance coverage are essential to overcome this challenge. Cost reduction strategies will be critical for wider market accessibility.

Limited Awareness in Emerging Economies

In many developing countries, awareness of cord blood banking remains low. Limited education about its medical applications reduces parental participation rates. Inadequate infrastructure and lack of trained healthcare professionals further constrain collection efforts. Cultural factors also influence donation decisions in some regions. Expanding educational campaigns and healthcare partnerships can help bridge this gap. Overcoming this awareness challenge is crucial for unlocking growth potential in high-population markets.

Regional Analysis

North America

North America leads the cord blood banking market with a 38% share, driven by advanced healthcare infrastructure and high parental awareness. The U.S. dominates the region due to strong public and private banking programs and favorable reimbursement policies. Extensive research activities and clinical trials for regenerative therapies support sustained market expansion. Major players invest heavily in advanced processing and cryopreservation technologies. Strong government support and established regulatory frameworks enhance patient trust and participation. The region also benefits from widespread insurance coverage, enabling more families to access cord blood storage services.

Europe

Europe holds a 27% share of the cord blood banking market, supported by well-structured public banking systems and increasing clinical applications. Countries like Germany, the U.K., and France lead adoption through strong research investments and collaborative healthcare networks. EU-funded programs encourage donations and improve cross-border stem cell matching capabilities. Favorable regulations and ethical standards strengthen parental confidence in banking services. Expanding regenerative medicine trials across the region further drive market growth. Public-private partnerships and growing awareness campaigns continue to boost enrollment rates in both public and private banks.

Asia Pacific

Asia Pacific accounts for a 23% share of the cord blood banking market, propelled by growing healthcare investments and rapid urbanization. Countries such as China, India, Japan, and South Korea are witnessing rising parental enrollment due to increasing awareness of stem cell therapies. Governments are expanding infrastructure through public banking initiatives, while private companies offer affordable storage plans. Advancements in biotechnology and rising demand for regenerative treatments fuel market expansion. The region’s large birth rate base further strengthens its growth potential. Ongoing regulatory harmonization supports cross-border collaborations and enhances access to services.

Latin America

Latin America captures a 7% share of the cord blood banking market, with Brazil and Mexico leading adoption. The region is witnessing gradual infrastructure development, supported by government programs and private investments. Public awareness remains lower compared to developed markets but is steadily improving through targeted campaigns. Expanding partnerships with international stem cell organizations enhance service quality. Economic constraints remain a challenge, but affordable storage plans are increasing parental participation. The rising incidence of chronic diseases such as leukemia and immune disorders is boosting demand for cord blood storage services.

Middle East & Africa

The Middle East & Africa hold a 5% share of the global cord blood banking market. Growth is primarily driven by improving healthcare infrastructure in the Gulf countries and South Africa. Government initiatives and medical tourism support increased adoption of advanced treatments. Private banks are expanding their presence through partnerships with hospitals and fertility clinics. However, limited awareness and high costs remain key barriers in several African countries. Increasing investments in research and the growing prevalence of genetic and blood-related disorders are expected to create future growth opportunities in the region.

Market Segmentations:

By Storage Services:

- Public Cord Blood Banks

- Private Cord Blood Banks

By Component:

By Application:

By Geography

- North America

- Europe

- Germany

- France

- Italy

- U.K.

- Russia

- Rest of Europe

- Asia-Pacific

- India

- China

- Japan

- Rest of Asia-Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of Middle East and Africa

Competitive Landscape

The competitive landscape of the cord blood banking market is shaped by Cryo-Cell International, AlphaCord LLC, Cord Blood Foundation (Smart Cells International), CBR Systems Inc., Singapore Cord Blood Bank, California Cryobank Stem Cell Services LLC, Cordlife Group Limited, FamiCord, Global Cord Blood Corporation, and CSG-BIO. The cord blood banking market is characterized by rapid technological innovation, strategic partnerships, and expanding service portfolios. Companies focus on enhancing cryopreservation methods, automated processing systems, and stem cell expansion technologies to strengthen their positions. Many market participants are investing in clinical research to support broader therapeutic applications in regenerative medicine. Geographic expansion and collaborations with maternity hospitals help increase collection volumes and customer enrollment. Flexible payment models, digital platforms, and strong brand positioning further support growth. Intense competition drives continuous improvement in quality standards, operational efficiency, and accessibility of cord blood banking services worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Cryo-Cell International

- AlphaCord LLC

- Cord Blood Foundation (Smart Cells International)

- CBR Systems Inc.

- Singapore Cord Blood Bank

- California Cryobank Stem Cell Services LLC

- Cordlife Group Limited

- FamiCord

- Global Cord Blood Corporation

- CSG-BIO

Recent Developments

- In May 2025, Terumo Blood and Cell Technologies confirmed that Parachute Health adopted Rika Plasma Donation System, enabling 1,000 mL plasma collections in under 35 minutes with live donor-comfort analytics.

- In February 2024, CooperSurgical®, a global leader in fertility and women’s health, and Fulgent Genetics, Inc., a technology-based company with a well-established clinical diagnostic business and a therapeutic development business, announced that they have partnered to offer families of Cord Blood Registry® (CBR®) exclusive newborn genetic screening panels.

- In July 2023, Cell Genesis announced the launch of CEXCI Cord Protein Banking, a groundbreaking initiative that marks a new era in the field of stem cell research and personalized medicine.

- In May 2023, Terumo BCT introduced a next-generation platform, the Spectra Optia Apheresis System. This system is designed to improve patient care and streamline workflow in blood processing. This innovative system offers advanced features that improve the efficiency of apheresis procedures, allowing for better separation of blood components.

Report Coverage

The research report offers an in-depth analysis based on Storage Services, Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for regenerative therapies will significantly boost cord blood banking adoption.

- Advancements in cryopreservation will enhance stem cell quality and storage efficiency.

- Public and private banking collaborations will increase global accessibility.

- Rising parental awareness will drive higher enrollment rates across regions.

- Clinical research expansion will unlock new therapeutic applications.

- Digital platforms will streamline donor registration and storage management.

- Emerging markets will contribute strongly to overall industry growth.

- Regulatory harmonization will improve international stem cell exchange.

- Strategic investments will strengthen infrastructure and processing capabilities.

- Personalized medicine trends will increase long-term storage demand.