Market Overview

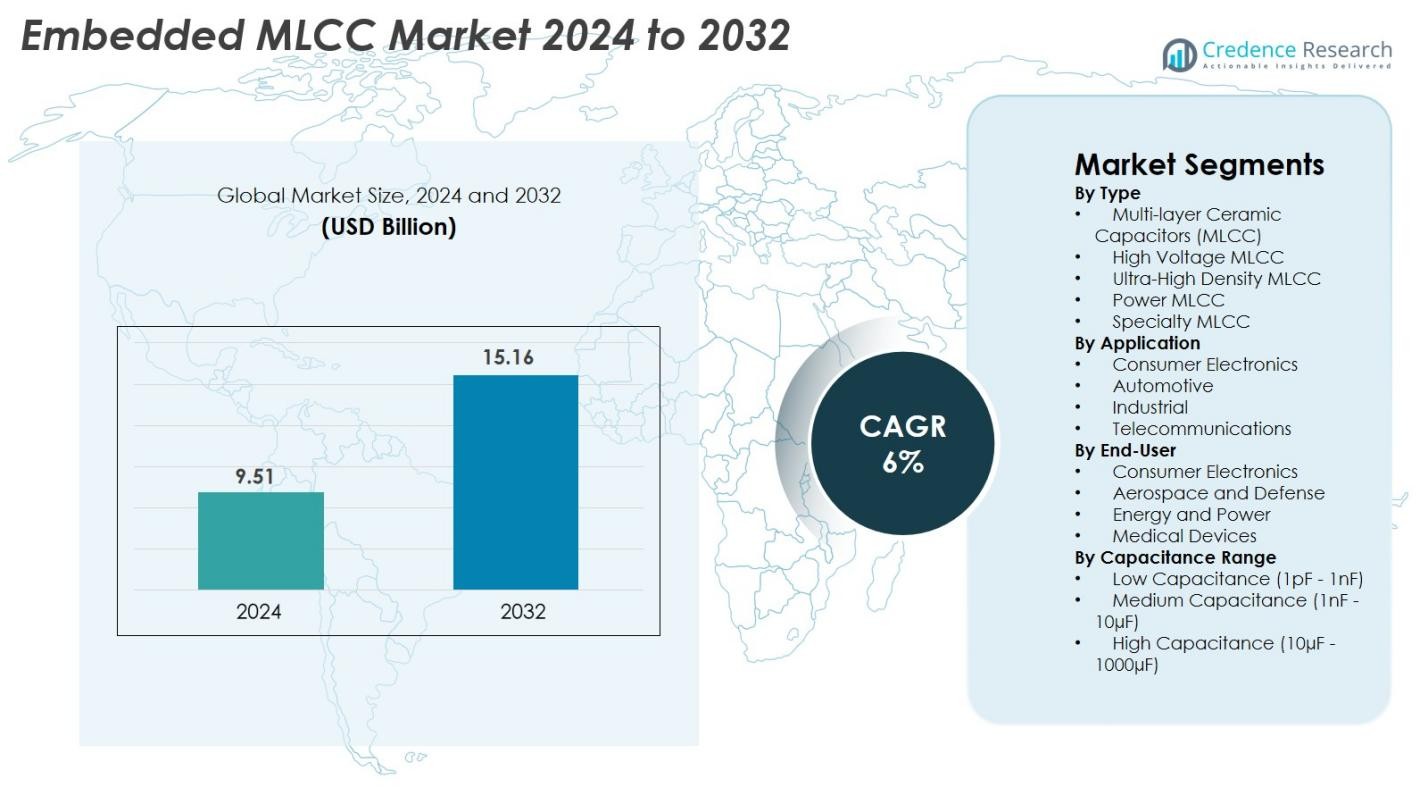

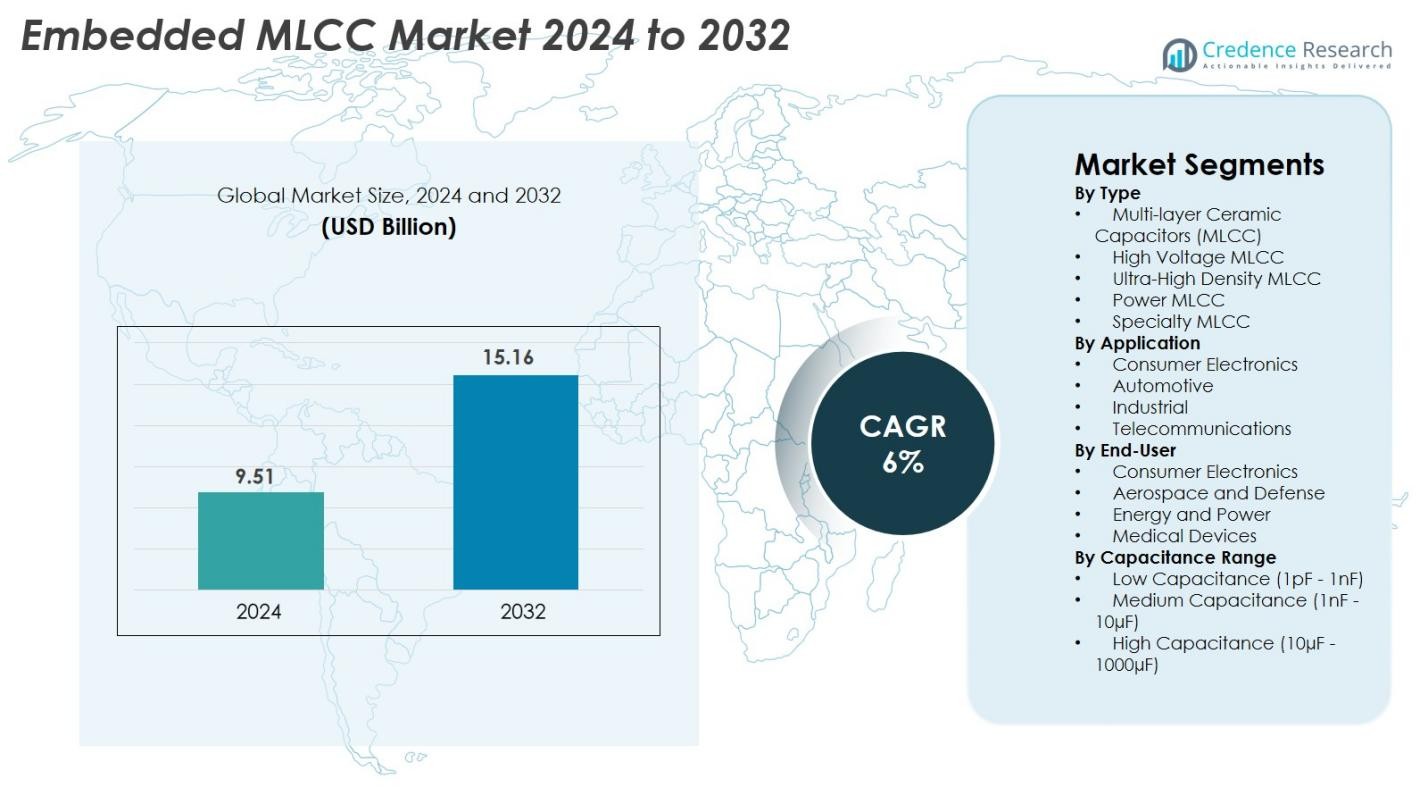

Embedded MLCC market size was valued at USD 9.51 Billion in 2024 and is anticipated to reach USD 15.16 Billion by 2032, at a CAGR of 6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Embedded MLCC Market Size 2024 |

USD 9.51 Billion |

| Embedded MLCC Market, CAGR |

6% |

| Embedded MLCC Market Size 2032 |

USD 15.16 Billion |

Embedded MLCC market is driven by strong participation from leading component manufacturers, including Samsung Electronics, Murata Manufacturing, TDK Corporation, Kyocera, Taiyo Yuden, Eyang, Vishay Intertechnology, Walsin Technology, and Yageo Corporation, all of which focus on miniaturized, high-density capacitor technologies for consumer electronics, automotive systems, and advanced semiconductor applications. Asia-Pacific leads the global market with over 40% share, supported by large-scale electronics production, strong semiconductor ecosystems, and expansive EV manufacturing bases across China, Japan, South Korea, and Taiwan. North America and Europe follow, driven by demand for high-reliability MLCCs in aerospace, automotive, 5G infrastructure, and industrial automation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Embedded MLCC market size was valued at USD 9.51 Billion in 2024 and is anticipated to reach USD 15.16 Billion by 2032, growing at a CAGR of 6% during the forecast period.

- Strong demand from consumer electronics and automotive applications drives market growth, with multi-layer ceramic capacitors leading the type segment with around 42% share due to high capacitance density and miniaturization benefits.

- Key trends include rising adoption of embedded MLCCs in advanced semiconductor packaging, expansion of EV electronics, and increased use in 5G, AI servers, and industrial automation systems.

- Market competition intensifies among major players such as Samsung Electronics, Murata, TDK, Kyocera, Taiyo Yuden, Yageo, and Walsin as they expand production capacity and develop high-performance, ultra-miniature MLCCs.

- Asia-Pacific dominates with over 40% regional share, followed by North America at roughly 28% and Europe at 22%, driven by strong electronics manufacturing, semiconductor activity, and growing adoption across automotive, telecom, and industrial sectors.

Market Segmentation Analysis

By Type

The Embedded MLCC market by type is led by Multi-layer Ceramic Capacitors (MLCC), holding 42% share in 2024 due to their compact size, high capacitance density, and suitability for miniaturized electronics. High Voltage MLCC and Ultra-High Density MLCC follow, driven by demand in EV powertrains and advanced computing systems. Power MLCC and Specialty MLCC continue gaining traction for industrial automation and IoT ecosystems. Growth is propelled by rising adoption of high-performance capacitors in 5G infrastructure, increased semiconductor integration, and the shift toward smaller, energy-efficient electronic components across consumer and industrial devices.

- For instance, Murata developed MLCCs with a capacitance of 100 µF in a standard 0603 (1.6 × 0.8 mm) package (GRM Series), enabling high capacitance in a small form factor for power modules and IT applications.

By Application

In the Embedded MLCC market, Consumer Electronics dominates with 45% share, supported by widespread use in smartphones, wearables, AR/VR devices, and smart home products. Automotive applications are expanding rapidly due to the rise of EVs, ADAS modules, and infotainment systems. Industrial uses grow steadily with automation, robotics, and power management innovations, while Telecommunications benefits from 5G rollouts and high-frequency circuit needs. Key drivers include rising component consumption per device, shrinking form factors, and increased reliance on high-stability capacitors for complex electronic architectures.

- For instance, Apple integrated a significant number of MLCCs in the iPhone 14 unit, likely totaling around 1,000 components, which is standard for a 5G smartphone. The device relies heavily on ultra-miniature 0201-size capacitors (0.6mm x 0.3mm) for essential functions like RF signal processing and power management, reflecting a continuous trend in the mobile industry to save space and enable advanced features.

By End-User

The Consumer Electronics end-user segment leads with 40% share, driven by mass-market production of compact, high-performance gadgets requiring dense capacitor integration. Aerospace & Defense shows strong demand for specialty MLCCs offering high reliability and thermal stability, while the Energy & Power sector increasingly uses MLCCs in power conversion, grid systems, and renewable installations. Medical Devices rely on ultra-reliable components for imaging systems, portable monitors, and implantable equipment. Growth is fueled by rising digitalization, electrification trends, and the push for miniaturized, durable, multilayer components across mission-critical applications.

Key Growth Drivers

Rising Demand for Miniaturization in Consumer and Industrial Electronics

The Embedded MLCC market continues to expand as miniaturization becomes a defining priority across smartphones, wearables, AR/VR systems, IoT devices, and industrial automation equipment. Modern electronics require compact, multilayer components that deliver high capacitance in minimal footprint, making embedded MLCCs essential for dense circuit designs. This integration enhances signal integrity, supports higher processing speeds, and reduces electromagnetic interference—key requirements for next-generation consumer and industrial electronics. The increasing component count per device, particularly in premium phones and medical devices, further accelerates demand. As manufacturers prioritize smaller, lighter, and more energy-efficient hardware, embedded MLCCs remain central to enabling advanced product architectures.

- For instance, Murata’s 008004-size MLCC measures just 0.25 × 0.125 mm and is used in ultra-compact modules requiring high-density placement, including smartphone RF sections.

Rapid Electrification of Automobiles and Expansion of EV Ecosystems

Electrification within the automotive sector significantly boosts embedded MLCC adoption. Electric vehicles, hybrid platforms, and advanced driver-assistance systems require large volumes of capacitors for powertrains, battery management, inverters, radar modules, infotainment, and charging systems. Embedded MLCCs provide the necessary reliability, temperature tolerance, and electrical stability demanded by automotive-grade applications. Global momentum toward low-emission mobility, coupled with investments in EV infrastructure and autonomous driving technologies, amplifies the need for robust, high-performance MLCCs. As automakers and Tier-1 suppliers focus on compact, efficient, and durable electronic systems, embedded MLCCs gain strong traction within the overall automotive electronics ecosystem.

- For instance, Toyota’s hybrid power control unit integrates MLCCs qualified to operate up to 150°C, supplied by Murata for high-voltage smoothing circuits.

Expansion of 5G, Data Centers, and High-Performance Computing

The rise of 5G deployment, cloud infrastructure, and artificial intelligence significantly strengthens embedded MLCC demand. Network equipment, RF modules, base stations, and edge computing devices require capacitors capable of supporting high-frequency performance, thermal stability, and low inductance. Embedded MLCCs enable superior power integrity and faster data transmission, making them essential for ultra-reliable, low-latency communication systems. Simultaneously, hyperscale data centers, GPU clusters, and AI servers rely on MLCCs for voltage regulation and stable power delivery. As industries accelerate digital transformation and embrace high-performance computing, embedded MLCC technology becomes vital for supporting advanced processing, connectivity, and energy efficiency requirements.

Key Trends & Opportunities

Increasing Integration of Embedded MLCCs in Advanced Semiconductor Packaging

A major trend shaping the market is the integration of MLCCs into advanced semiconductor packaging formats such as system-in-package architectures, chiplets, fan-out wafer-level packaging, and 2.5D/3D integrated circuits. Embedding capacitors within substrates or packages minimizes parasitic effects, strengthens power delivery, and enhances thermal management—attributes crucial for high-frequency and high-performance applications. As semiconductor manufacturers push for denser, more powerful chips, opportunities emerge for ultra-thin MLCCs, high-density stacking, and custom embedded capacitor designs. This trend aligns with growing demand in AI accelerators, IoT modules, EV control units, and cutting-edge wireless communication systems, strengthening long-term growth prospects.

- For instance, Intel’s EMIB-based chiplets integrate embedded capacitors at micro-bump pitch levels below 55 µm, reducing power-delivery noise in high-performance CPUs and GPUs.

Rising Focus on High-Reliability MLCCs for Defense, Aerospace, and Medical Devices

The market sees increasing opportunities in sectors requiring extremely high reliability, including aerospace, defense, implantable medical devices, diagnostic equipment, and mission-critical industrial systems. These applications demand MLCCs capable of operating under high radiation, wide thermal ranges, and mechanical stress. Manufacturers are developing radiation-hardened, thermally stable, and long-life MLCCs tailored for satellites, UAVs, radar systems, and advanced medical equipment. Government investments in defense modernization and the growing sophistication of medical technology further expand demand. This creates a profitable niche for vendors offering premium-grade embedded MLCCs with stringent certification and performance standards.

- For instance, AVX’s MIL-PRF-55681-qualified MLCCs operate reliably from –55°C to +125°C and are deployed in NASA satellite platforms requiring long-duration component stability.

Key Challenges

Supply Chain Constraints and Limited Availability of Critical Raw Materials

The Embedded MLCC industry faces persistent supply chain challenges due to limited access to high-purity ceramic materials and dependence on specific global suppliers. Fluctuations in raw material availability, geopolitical tensions, and logistical disruptions directly affect production stability. High-capacitance and ultra-miniature MLCCs require precise fabrication processes, and sudden spikes in demand from automotive or consumer electronics can strain manufacturing capacity. These constraints lead to longer lead times, cost fluctuations, and procurement difficulties. Ensuring steady raw material supply remains essential for maintaining output consistency, especially as embedded MLCC applications grow more diverse and technically demanding.

Technical Limitations in Miniaturization and Thermal Stability

Despite strong market demand for smaller MLCCs, manufacturers face notable engineering constraints when miniaturizing components without compromising reliability. As MLCCs shrink, risks such as cracking, thermal stress, and mechanical failure increase. High-frequency and high-voltage applications, including EV systems, 5G equipment, and AI processors, place additional strain on capacitor performance. Achieving the required thermal stability, capacitance density, and long-term durability is technically challenging and demands continuous innovation in dielectric materials, electrode structures, and manufacturing processes. Balancing extreme miniaturization with robust operational reliability remains a core hurdle for the industry.

Regional Analysis

North America

North America holds a substantial position in the Embedded MLCC market with 28% share in 2024, driven by strong adoption of advanced electronics across consumer devices, automotive systems, aerospace, and defense applications. The region benefits from robust semiconductor manufacturing capabilities, rising EV production, and growing demand for high-performance computing infrastructure. Expansion of 5G networks and investments in AI accelerators and data centers further strengthen embedded MLCC consumption. Additionally, the presence of leading OEMs, technology innovators, and defense contractors supports ongoing demand for high-reliability, miniaturized passive components across critical applications.

Europe

Europe accounts for 22% share of the Embedded MLCC market, supported by strong automotive manufacturing, industrial automation, and aerospace activities. Growth is fueled by rapid EV adoption across Germany, France, and the Nordic countries, accelerating demand for high-voltage and power MLCCs. The region’s emphasis on engineering excellence, stringent safety standards, and energy-efficient electronic systems encourages adoption of reliable, compact embedded components. Advancements in 5G deployment, renewable energy systems, and medical technologies further strengthen market expansion. Europe’s established supply chain for automotive electronics and precision manufacturing continues to create strong opportunities for embedded MLCC integration.

Asia-Pacific

Asia-Pacific dominates the Embedded MLCC market with 40% share, driven by large-scale electronics manufacturing, strong semiconductor production, and expanding automotive industries across China, South Korea, Japan, and Taiwan. The region benefits from the presence of key MLCC manufacturers, advanced PCB suppliers, and high-volume smartphone and consumer electronics producers. Growing EV adoption, increasing industrial automation, and rapid 5G deployment accelerate demand for high-density embedded capacitors. Additionally, expansion of data centers, AI hardware development, and IoT ecosystems boosts consumption. Asia-Pacific remains the fastest-growing region, supported by cost-efficient manufacturing, innovation hubs, and strong government support for electronics infrastructure.

Latin America

Latin America represents 6% share of the Embedded MLCC market, with growth primarily driven by rising adoption of consumer electronics, increasing digital transformation, and gradual expansion of automotive and industrial sectors. Brazil and Mexico lead the region due to strengthening electronics assembly capabilities and growing demand for connected devices. Investments in telecom upgrades, cloud infrastructure, and renewable energy technologies further support MLCC usage. Although manufacturing capabilities remain limited, increasing imports of advanced electronic components and rising demand for EVs and industrial automation systems create new opportunities for embedded MLCC integration across emerging industries.

Middle East & Africa

The Middle East & Africa segment holds 4% share of the Embedded MLCC market, supported by expanding telecommunications networks, increasing penetration of consumer electronics, and growing adoption of industrial automation solutions. Countries like the UAE, Saudi Arabia, and South Africa drive regional demand through investments in 5G infrastructure, smart city projects, and advanced power systems. The region’s transition toward digital manufacturing and renewable energy technologies contributes to steady growth in embedded component usage. Although local production remains limited, rising imports, infrastructure modernization, and increasing focus on defense electronics support long-term market expansion.

Market Segmentations

By Type

- Multi-layer Ceramic Capacitors (MLCC)

- High Voltage MLCC

- Ultra-High Density MLCC

- Power MLCC

- Specialty MLCC

By Application

- Consumer Electronics

- Automotive

- Industrial

- Telecommunications

By End-User

- Consumer Electronics

- Aerospace and Defense

- Energy and Power

- Medical Devices

By Capacitance Range

- Low Capacitance (1pF – 1nF)

- Medium Capacitance (1nF – 10µF)

- High Capacitance (10µF – 1000µF)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Embedded MLCC market features a dynamic competitive landscape defined by continuous innovation, expanding production capacities, and rising specialization across high-performance capacitor technologies. Leading players such as Samsung Electronics, Murata Manufacturing, TDK Corporation, Kyocera, Taiyo Yuden, Eyang, Vishay Intertechnology, Walsin Technology, and Yageo Corporation dominate the market through strong R&D investments and extensive product portfolios tailored for consumer electronics, automotive, industrial, and 5G applications. These companies focus on developing ultra-miniature MLCCs, high-voltage variants, and embedded solutions optimized for advanced semiconductor packaging. Strategic collaborations with semiconductor manufacturers, EV suppliers, and telecom equipment providers further strengthen their market position. Additionally, increased automation, material innovation, and capacity expansions enable top players to address rising demand for high-density, reliable capacitors across global supply chains. Emerging competitors continue to target niche applications by offering specialized MLCC designs with superior thermal stability and long operational life.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Kyocera

- Eyang

- Samsung Electronics

- Elohim

- Murata

- TDK

- Taiyo Yuden

- Walsin Technology Corporation

- Yageo Corporation

- Vishay Intertechnology

Recent Developments

- In October 2025, KYOCERA AVX released its new KGP Series stacked MLCCs for high-frequency industrial and downhole applications.

- In June 2025, Murata began mass production of 10 µF/50 V MLCC in 0805 format (GCM21BE71H106KE02).

- In February 2024, Murata Manufacturing Co., Ltd. introduced the world’s smallest high-Q 100 V MLCC (GJM022 series) for consumer electronics and industrial equipment.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User, Capacitance Range and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness strong growth as demand rises for miniaturized components in next-generation consumer electronics.

- Embedded MLCC adoption will increase with expanding 5G infrastructure and advanced communication systems.

- EV growth and electrification trends will drive higher usage of high-voltage and power MLCCs.

- Advanced semiconductor packaging will create new opportunities for ultra-thin embedded capacitor designs.

- Data centers and AI computing systems will boost demand for high-density, thermally stable MLCCs.

- Aerospace, defense, and medical devices will expand reliance on high-reliability embedded components.

- Manufacturers will focus on innovation in dielectric materials and electrode structures to improve performance.

- Supply chain diversification will become a priority to reduce dependency on limited raw material sources.

- Regional manufacturing expansion in Asia-Pacific will continue to strengthen global production capabilities.

- Market players will increase strategic partnerships with OEMs to develop customized embedded MLCC solutions.