Market Overview

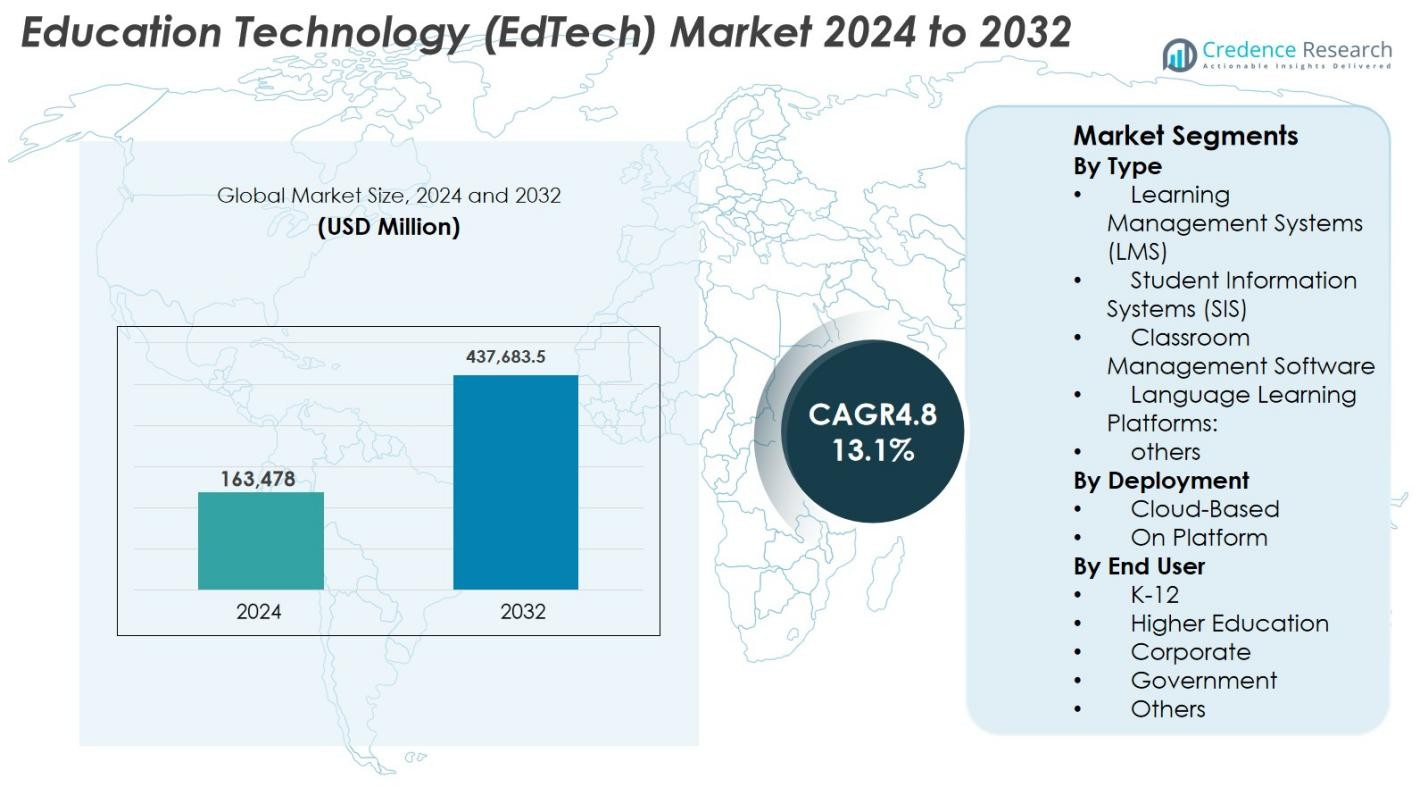

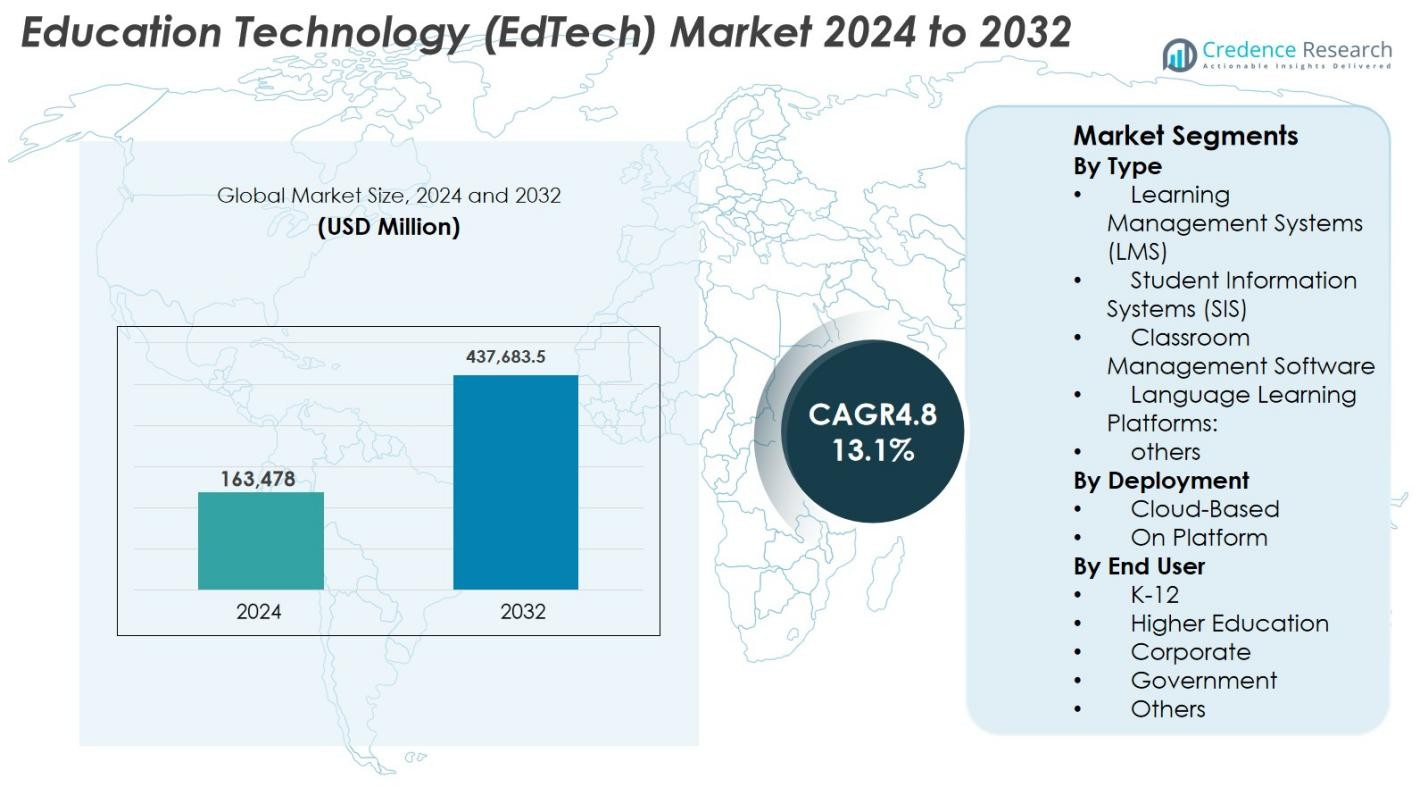

Education Technology (EdTech) Market size was valued at USD 163,478 Million in 2024 and is anticipated to reach USD 437,683.5 Million by 2032, at a CAGR of 13.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Education Technology (EdTech) Market Size 2024 |

USD 163,478 Million |

| Education Technology (EdTech) Market, CAGR |

13.1% |

| Education Technology (EdTech) Market Size 2032 |

USD 437,683.5 Million |

The Education Technology (EdTech) Market is shaped by major players such as Coursera, Udemy, Khan Academy, Duolingo, Blackboard, Skillshare, Teachable, Moodle, Canvas by Instructure, and Edmodo, each contributing to advancements in digital learning through AI-driven platforms, interactive content, and scalable cloud-based systems. These companies expand reach through partnerships with universities, corporates, and government bodies, strengthening their global footprint. North America leads the market with a 38.2% share in 2024, supported by strong digital infrastructure and high institutional adoption, followed by Europe at 27.6% and Asia-Pacific at 24.1%, reflecting rapid digitalization and growing demand for accessible online education.

Market Insights

- The Education Technology (EdTech) Market reached USD 163,478 Million in 2024 and will grow at a CAGR of 13.1% to reach USD 437,683.5 Million by 2032.

- Market expansion is fueled by rising digital learning adoption across K–12, higher education, and corporate training, along with increasing investment in AI-enabled and cloud-based learning ecosystems.

- Key trends include adoption of AR/VR learning tools, adaptive learning systems, AI-driven tutoring, and mobile-first platforms, delivering more personalized and immersive education experiences.

- Major players such as Coursera, Udemy, Khan Academy, Duolingo, Blackboard, Skillshare, Teachable, Moodle, and Canvas by Instructure strengthen global presence through tech innovation and strategic partnerships.

- North America leads with 38.2% share, followed by Europe at 27.6% and Asia-Pacific at 24.1%; Learning Management Systems (LMS) dominate the type segment with 38.4% share, driven by strong institutional deployment.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Type

The Education Technology (EdTech) Market by type is led by Learning Management Systems (LMS), accounting for 38.4% share in 2024, driven by their widespread adoption for course delivery, assessment integration, and centralized learning administration. LMS platforms support adaptive learning, analytics, and large-scale digital curriculum management, fueling institutional demand. Student Information Systems (SIS) and language learning platforms are also expanding as institutions prioritize workflow automation and multilingual learning. Classroom management software grows steadily with rising digital classrooms, while other niche tools gain traction through personalized learning models and AI-based tutoring ecosystems.

- For instance, Canvas has become the leading LMS in North American higher education, holding a market share of approximately 43%. The next three largest platforms Moodle, Brightspace (D2L), and Blackboard (Anthology) each control between 12% and 16%, reflecting strong faculty adoption for consistent course design and analytics-driven teaching

By Deployment

Cloud-Based deployment dominated the Education Technology (EdTech) Market with 64.7% share in 2024, supported by scalable infrastructure, lower upfront costs, and rapid onboarding across educational institutions and enterprises. Cloud models enable seamless updates, remote accessibility, and integration with AI-driven analytics, boosting operational efficiency. On-platform (on-premise) deployment retains relevance for institutions needing heightened data control, internal hosting, or customized compliance frameworks. However, cloud adoption continues accelerating due to rising hybrid learning formats, mobile-friendly learning delivery, and increased investment in digital transformation across the education ecosystem.

- For instance, Instructure expanded its cloud-native Canvas LMS with enhanced AI-powered course analytics and automated feedback tools in 2024, enabling institutions to scale remote learning with minimal IT overhead.

By End User

K-12 emerged as the dominant segment with 42.6% share in 2024, supported by accelerating adoption of digital classrooms, interactive learning content, gamification tools, and government-funded digital literacy programs. The higher education segment follows as universities expand remote learning platforms, virtual labs, and AI-enabled assessment systems. Corporate users show strong growth driven by continuous upskilling, micro-learning modules, and workforce development technologies. Government agencies increasingly deploy EdTech solutions for large-scale training, digital governance programs, and public sector skill platforms. Others, including vocational institutes, contribute steadily through flexible digital certification demand.

Key Growth Drivers

Increasing Digital Learning Adoption Across K–12 and Higher Education

The accelerating transition toward digital learning environments significantly drives the EdTech market, especially across K–12 and higher education ecosystems. Schools and universities increasingly integrate e-learning platforms, virtual classrooms, adaptive learning software, and digital content libraries to enhance engagement and learning outcomes. Government initiatives promoting digital literacy, national education digitalization programs, and large-scale funding for ICT infrastructure further support adoption. Hybrid and blended learning models have gained permanence post-pandemic, encouraging institutions to continue investing in scalable, cloud-based EdTech tools. The shift toward competency-based education, increased use of gamification, and demand for personalized learning also fuel growth. Rising enrollment in online degree programs, micro-credentials, and virtual tutoring platforms strengthens market expansion, establishing digital learning as a core long-term growth driver.

- For instance, India’s PM eVidya initiative unifies digital platforms like DIKSHA, which has delivered over 501 crore learning sessions and 5,879 crore learning minutes through QR-coded textbooks and e-content.

Expanding Demand for Skill Development, Corporate Training, and Lifelong Learning

The global workforce’s rapid skill evolution and widening digital skills gap are major drivers accelerating EdTech adoption in the corporate sector. Companies increasingly invest in digital training platforms, learning management systems, AI-based assessments, and micro-learning modules to upskill employees in areas such as data science, cybersecurity, AI literacy, communication, and leadership. The rise of remote work has amplified the need for flexible, accessible, and mobile-friendly training tools. Corporate e-learning delivers measurable cost savings, standardized content delivery, and personalized learning pathways that enhance productivity and retention. The expansion of digital bootcamps, professional certification programs, and industry-aligned training platforms strengthens EdTech’s role in workforce transformation. The lifelong learning culture driven by career shifts and continuous reskilling ensures sustained demand for corporate-focused EdTech solutions.

- For instance, Pluralsight Focused on technology and creative skill training, Pluralsight offers a catalog of technical courses suited for IT, software development, cloud, and cybersecurity; historically, it has served a large number of enterprise and corporate clients, including many in the Fortune 500.

Integration of AI, Analytics, and Personalization Technologies

The integration of artificial intelligence, machine learning, and analytics into modern education ecosystems is accelerating EdTech market expansion. AI-driven tools enhance learning outcomes through adaptive content delivery, predictive insights, automated grading, and intelligent tutoring systems that personalize instruction for each learner. Educators use real-time dashboards to track student engagement, identify learning gaps, and implement differentiated teaching strategies. Analytics support institutions in improving retention, optimizing curriculum structures, and enhancing program effectiveness. Natural language processing fuels conversational learning assistants and language platforms, while automation streamlines student information systems and administrative tasks. As AI capabilities advance, EdTech becomes increasingly dynamic, responsive, and data-driven, strengthening its long-term adoption.

Key Trends & Opportunities

Rising Adoption of Immersive Technologies: AR, VR, and Metaverse Learning

Immersive technologies such as augmented reality (AR), virtual reality (VR), and metaverse-driven learning spaces present significant opportunities in the EdTech market. AR and VR enable experiential learning by simulating complex environments, improving STEM education, and offering virtual labs for practical skill development in fields such as medicine, engineering, and skilled trades. Metaverse-based platforms introduce collaborative digital classrooms, gamified learning environments, and avatar-led peer interactions that drive engagement. Institutions increasingly pilot XR tools for virtual internships, remote training, and interactive subject visualization. Falling hardware costs, expanding XR content libraries, and stronger industry–academia partnerships create robust commercial potential for immersive learning innovations.

- For instance, Microsoft’s HoloLens 2 continues to be adopted by universities and medical schools for mixed-reality anatomy learning, allowing students to interact with 3D organ models and perform virtual procedures.

Growth of AI Tutoring, Automated Assessments, and Data-Driven Learning Models

AI-powered tutoring systems, automated evaluation tools, and data-centered learning frameworks are reshaping the EdTech landscape. Intelligent tutoring platforms mimic personalized coaching by providing real-time feedback, adaptive difficulty progression, and targeted remediation. Automated assessments reduce teacher workload through instant grading, analytics, and performance mapping. Predictive analytics help institutions identify at-risk students early and improve learning outcomes. Personalization powered by AI caters to diverse learning speeds and styles, increasing engagement and retention. These advancements create strong opportunities for EdTech providers to integrate generative AI engines, recommendation systems, and natural language processing into next-generation learning platforms.

- For instance, Khan Academy expanded its AI tutor Khanmigo, which offers step-by-step problem guidance, Socratic-style questioning, and personalized learning support across subjects including math, science, and writing.

Key Challenges

Digital Divide, Infrastructure Gaps, and Unequal Technology Access

Despite rapid technological progress, the EdTech market faces notable challenges due to persistent digital divides across regions and socioeconomic groups. Inadequate broadband connectivity, limited device availability, and insufficient ICT infrastructure restrict digital learning adoption, particularly in rural and underserved communities. Budget constraints within schools and institutions hinder large-scale implementation of advanced EdTech solutions. Students lacking consistent access to digital tools face learning disparities despite broader adoption of online education models. Teacher training limitations and outdated institutional systems further slow digital transformation. Addressing these gaps remains essential to achieving equitable learning outcomes and ensuring inclusive EdTech growth.

Data Privacy, Cybersecurity Risks, and Regulatory Compliance Issues

The widespread digitalization of education introduces heightened risks related to data privacy, cybersecurity, and compliance. EdTech platforms handle sensitive student and institutional data, making them potential targets for cyber threats and privacy breaches. Ensuring adherence to regulations such as GDPR, FERPA, and regional data protection laws adds complexity for providers and institutions. Weak security controls can lead to unauthorized access, data loss, or legal consequences, undermining trust in digital learning ecosystems. Concerns around AI transparency, algorithmic fairness, and responsible data usage further complicate adoption. Strengthening cybersecurity frameworks, monitoring systems, and ethical governance remains crucial for sustaining market confidence.

Regional Analysis

North America

North America dominated the Education Technology (EdTech) Market with a 38.2% share in 2024, supported by strong digital infrastructure, high adoption of learning management systems, and continued investments in AI-driven learning solutions. The U.S. leads demand due to extensive use of digital learning models across K–12, higher education, and corporate sectors. The region benefits from government-funded digital initiatives, widespread acceptance of hybrid learning, and rapid expansion of online degree and certification programs. Growing integration of AR, VR, and personalized AI tutoring tools further enhances North America’s position as the leading EdTech market.

Europe

Europe accounted for 27.6% share in 2024, driven by strong adoption of hybrid education, expanding digital classrooms, and supportive regulatory initiatives promoting secure data-driven learning ecosystems. Countries such as the U.K., Germany, and France lead in EdTech implementation, emphasizing cloud-based learning platforms, virtual classrooms, and teacher training programs. The region benefits from rising demand for language learning technologies, adult digital education, and corporate reskilling tools. Strict compliance norms encourage secure EdTech offerings, increasing user trust. Continuous investments in AI-enabled learning tools and cross-border digital education frameworks support Europe’s steady market expansion.

Asia-Pacific

Asia-Pacific held a 24.1% share in 2024 and remains the fastest-growing region, driven by rising internet penetration, expanding student populations, and government-backed digital learning initiatives. China, India, Japan, and South Korea lead demand for online tutoring platforms, test-preparation apps, and mobile-first learning solutions. Affordable devices and strong venture capital funding accelerate platform innovation and adoption. The region also experiences rising demand for corporate e-learning as companies focus on large-scale workforce upskilling. Growing mobile usage and expanding cloud infrastructure position Asia-Pacific as a major engine of global EdTech market growth.

Latin America

Latin America captured a 6.5% share in 2024, supported by increasing digital learning adoption across Brazil, Mexico, and Colombia. Government programs promoting remote learning and digital literacy drive demand for LMS platforms, hybrid classroom technologies, and affordable mobile-based learning solutions. The region also sees rising uptake of language learning and vocational training platforms due to workforce development needs. However, challenges remain, including uneven internet connectivity and limited funding in some education systems. Despite constraints, private-sector investments and expanding K–12 digital transformation initiatives continue to position Latin America as a developing yet promising EdTech market.

Middle East & Africa

The Middle East & Africa held a 3.6% share in 2024, supported by national digital education strategies, increasing smart classroom investments, and rising adoption of e-learning across Saudi Arabia, the UAE, and South Africa. Governments are modernizing education infrastructure, expanding STEM-focused programs, and promoting digital literacy, driving platform demand. The region also benefits from increasing mobile learning usage and growing corporate training needs. However, several African markets still face connectivity gaps and affordability challenges. Continued broadband expansion, ICT investment, and education reforms are expected to support steady long-term growth in the EdTech market.

Market Segmentations

By Type

- Learning Management Systems (LMS)

- Student Information Systems (SIS)

- Classroom Management Software

- Language Learning Platforms:

- others

By Deployment

By End User

- K-12

- Higher Education

- Corporate

- Government

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Education Technology (EdTech) Market features a diverse and expanding competitive landscape driven by continuous innovation, strategic partnerships, and rapid digital adoption across learning ecosystems. Leading players such as Coursera, Udemy, Khan Academy, Duolingo, Blackboard, Skillshare, Teachable, Canvas by Instructure, Moodle, and Edmodo strengthen their presence through advanced learning platforms, AI-driven personalization, and mobile-first learning experiences. Companies focus on expanding course libraries, enhancing interactive content, and improving learner analytics to attract both academic institutions and corporate clients. Strategic collaborations with universities, government bodies, and industry partners support platform scalability and market penetration. Many players invest in AR/VR tools, generative AI tutors, and adaptive learning technologies to differentiate offerings and address rising demand for hybrid and personalized learning models. As global competition intensifies, EdTech companies prioritize user engagement, localized content, and certification pathways to maintain competitive advantage in a rapidly evolving digital education environment.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skillshare

- Canvas by Instructure

- Udemy

- Teachable

- Blackboard

- Coursera

- Duolingo

- Moodle

- Khan Academy

- Edmodo

Recent Developments

- In December 2025, Impelsys acquired Delta Think to expand its data, publishing, and technology-services capabilities for education, healthcare and beyond.

- In November 2025, SMART Technologies unveiled its first “Make-in-India” interactive flat panels designed for education at DIDAC 2025

- In October 2025, Uprio a new AI-based edtech startup launched by former India head of BYJU’S, focused on personalized online tuition aligned with school curricula.

Report Coverage

The research report offers an in-depth analysis based on Type, Deployment, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The EdTech market will advance through deeper integration of AI-driven personalization across global learning systems.

- Hybrid and blended learning models will increasingly become the standard in K–12, higher education, and corporate environments.

- AR, VR, and immersive simulations will expand hands-on, skills-based, and experiential learning adoption.

- Data analytics will gain importance in tracking learner performance and improving instructional strategies.

- Corporate demand for digital upskilling and reskilling platforms will accelerate across industries.

- Mobile-first learning solutions will see wider penetration, especially in emerging regions.

- Collaboration among EdTech companies, universities, and government bodies will strengthen digital education ecosystems.

- Cybersecurity and data privacy enhancements will become critical to maintaining trust and regulatory compliance.

- Micro-learning, credentialing, and digital certification programs will reshape professional development pathways.

- Cloud-based infrastructure will continue enabling scalable, flexible, and globally accessible learning solutions.