Market Overview:

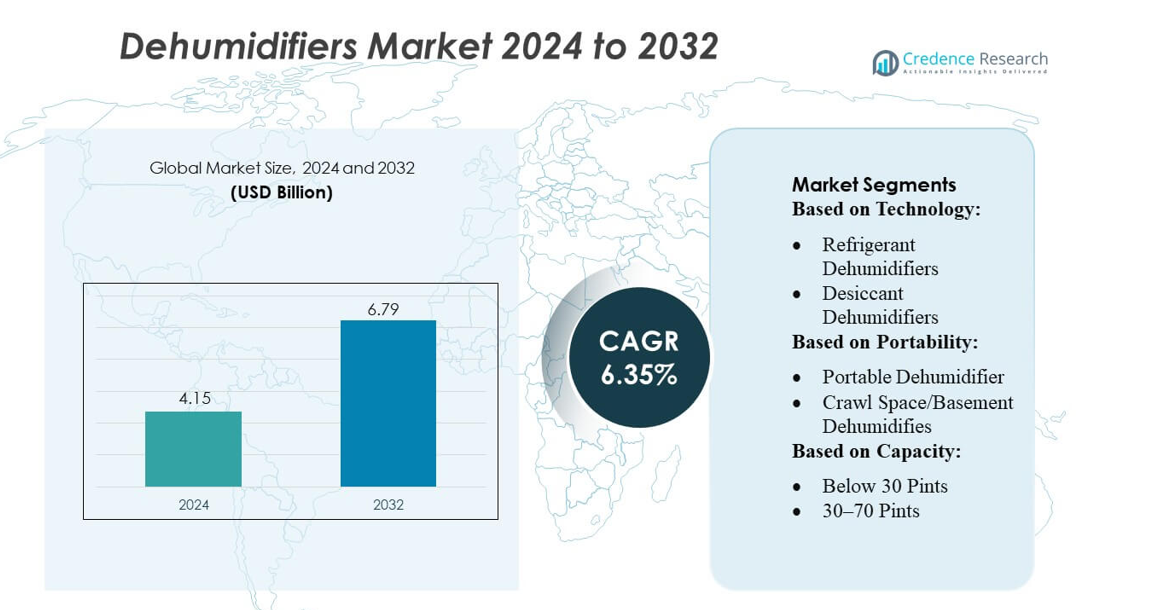

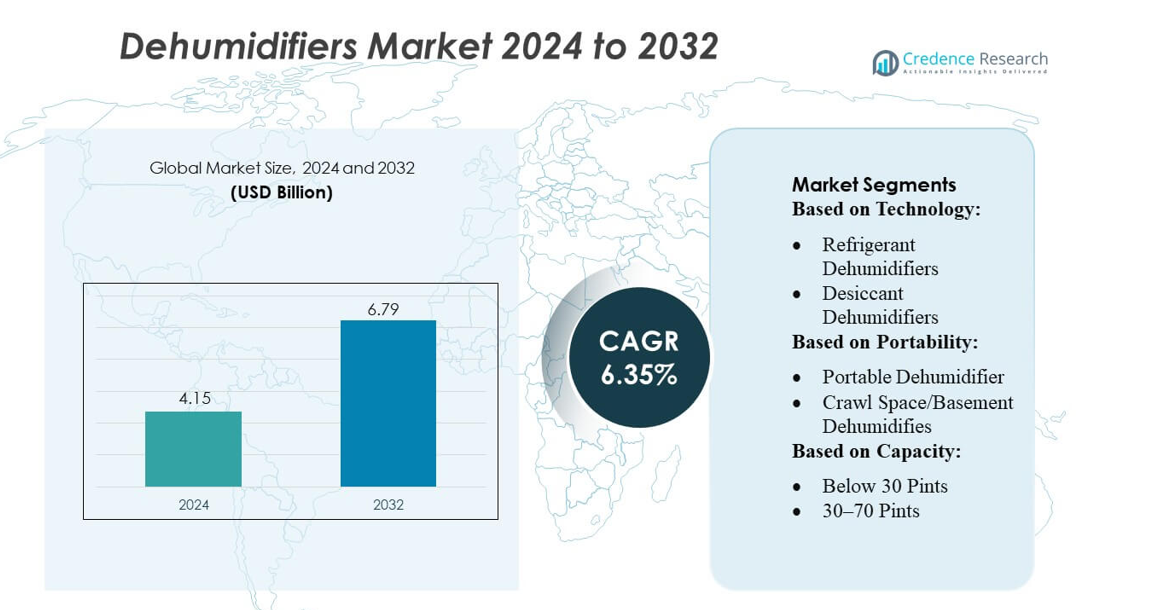

Dehumidifiers Market size was valued USD 4.15 billion in 2024 and is anticipated to reach USD 6.79 billion by 2032, at a CAGR of 6.35% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dehumidifiers Market Size 2024 |

USD 4.15 billion |

| Dehumidifiers Market, CAGR |

6.35% |

| Dehumidifiers Market Size 2032 |

USD 6.79 billion |

The Dehumidifiers Market features strong competition among global appliance manufacturers and specialized climate-control companies, each expanding their portfolios with energy-efficient, smart-enabled, and application-specific solutions. The competitive environment is shaped by continuous innovation in refrigerant systems, desiccant technologies, and automated humidity-management capabilities for residential, commercial, and industrial use. Asia-Pacific emerges as the leading region, accounting for 38% of the global market share, driven by high humidity levels, rapid urbanization, and strong manufacturing capacity. Companies operating in this region benefit from robust distribution networks, growing consumer awareness, and expanding industrial applications, which collectively reinforce Asia-Pacific’s dominant position in the market.

Market Insights

- The Dehumidifiers Market was valued at USD 4.15 billion in 2024 and is projected to reach USD 6.79 billion by 2032, growing at a CAGR of 6.35%, supported by rising residential, commercial, and industrial demand.

- Increasing awareness of indoor air quality, moisture control, and mold prevention drives adoption across households, with the refrigerant dehumidifier segment holding the largest share of around 55% due to its high efficiency in warm and humid climates.

- Smart and energy-efficient models equipped with IoT connectivity, automated humidity management, and eco-friendly refrigerants shape emerging market trends, enhancing convenience and compliance with green-building standards.

- Competitive intensity remains strong as companies expand product portfolios, strengthen distribution networks, and invest in desiccant-based technologies, although high upfront costs and energy consumption continue to restrain wider penetration.

- Asia-Pacific leads the market with 38% regional share, followed by North America and Europe, supported by rapid urbanization, industrial growth, and climate conditions that elevate long-term demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The refrigerant-based (compressor) dehumidifier segment remains dominant, capturing around 46–60 % of the global market in 2024–2025. This leadership stems from its cost-effectiveness, proven reliability, and strong performance across residential, commercial, and industrial settings — especially in moderate to high humidity conditions where rapid moisture removal is required. Meanwhile, the desiccant dehumidifier sub-segment is growing fastest (projected ~7–9 % CAGR), driven by demand in industrial, cold-climate, and low-humidity applications (e.g., pharmaceuticals, storage, cold-chain logistics) where precise humidity control is critical. Thermoelectric units maintain a small niche share — valued for compact size, quiet operation, and minimal maintenance — mostly in small spaces or specialized settings.

- For instance, Daikin provided 71 EWFH-TZ D air-cooled free cooling chillers, 330 high-efficiency fan array units (Pro-W units), and 8 intelligent control systems.The OSL-Hamar data center in Hamar, Norway.

By Portability

The portable dehumidifier segment is the leading installation type, holding a majority of revenue share (≈ 57–64 % in 2024–2025). Portables benefit from high demand among residential users and small offices due to their mobility, plug-and-play convenience, and flexible deployment across different rooms without permanent installation. These units are particularly attractive in urban environments, rented homes, or temporary setups. Fixed (whole-home or permanently installed) dehumidifiers remain important in large residences, commercial buildings, and industrial spaces, but their share is lower because of higher installation complexity and cost — though they retain a stable base where continuous, centralized humidity control is required.

- For instance, Orbia’s NovoLINC thermal interface materials (TIMs) address cooling bottlenecks for high-density AI racks by reducing GPU junction temperatures by 5–10 °C under heavy workloads compared to standard materials, and they achieve superior thermal resistance values below 1 mm²K/W, significantly enhancing the overall thermal management and energy efficiency of liquid-cooled server systems.

By Capacity

Mid-range units (30–70 pints) constitute the dominant capacity category, accounting for roughly 48 % of market volume in 2024. These units hit the sweet spot for typical residential and small commercial environments — offering a balance between moisture removal capacity and energy consumption — making them popular for living rooms, basements, laundry areas, and similar spaces. Compact units (≤ 30 pints) have a lower share currently but are gaining traction as consumers adopt dehumidifiers for smaller rooms, apartments, or targeted humidity zones; growth here is supported by rising awareness of indoor air quality and increasing demand for energy-efficient, space-conserving appliances. High-capacity units (> 70 pints) serve large houses, commercial buildings, warehouses, and industrial facilities; although their overall share is smaller, demand is rising as businesses prioritize structural protection, mold prevention, and scalable moisture control — especially in high-humidity or large-volume spaces.

Key Growth Drivers

Rising Focus on Indoor Air Quality and Health Protection

Growing consumer awareness regarding indoor air quality is a primary driver accelerating dehumidifier demand. Rising incidences of allergies, mold formation, and humidity-related respiratory issues have prompted households and commercial facilities to invest in humidity-control appliances. Urbanization-driven increases in compact living spaces intensify moisture accumulation, further strengthening adoption. Additionally, post-pandemic health consciousness has motivated facilities such as hospitals, offices, and schools to maintain optimal humidity to reduce microbial growth and safeguard occupant well-being, thereby boosting market penetration across both developed and emerging regions.

- For instance, Asetek reported shipping 171,000 sealed-loop liquid cooling units in the first quarter of 2025. 11 new liquid cooling product models began shipping that quarter. These products support compact, high-performance cooling in dense server racks and other environments, including edge computing applications.

Expanding Applications Across Industrial and Commercial Facilities

Industrial sectors increasingly deploy dehumidifiers to protect equipment, maintain product integrity, and ensure compliance with environmental and safety standards. Manufacturing plants, pharmaceuticals, warehouses, cold-chain logistics, and data centers rely on precise humidity management to prevent corrosion, condensation, and operational disruptions. Growing investments in industrial modernization, automation, and energy-efficient climate-control systems further stimulate demand. Commercial environments such as hotels, retail spaces, and fitness centers also require continuous moisture control to enhance customer comfort and infrastructure durability, reinforcing the market’s structural growth across diverse application areas.

- For instance, Chemours is developing Opteon™ 2P50, a two-phase immersion cooling dielectric fluid with a GWP of 10 and a design PUE approaching 1. This developmental fluid is currently undergoing full-scale field trials and has demonstrated highly positive results, with initial data showing up to a 90% cooling energy reduction and up to a 40% total energy savings compared to traditional cooling methods, while cutting water use nearly to zero.

Technological Advancements Enhancing Efficiency and User Convenience

Rapid advancements in compressor technology, desiccant materials, and smart connectivity features support market expansion. Energy-efficient designs, variable-speed compressors, and low-GWP refrigerants help manufacturers meet stricter environmental regulations while reducing operating costs. Integrated IoT capabilities, app-based monitoring, automatic humidity sensing, and predictive maintenance functions enhance user experience and operational convenience. Manufacturers are also developing compact, low-noise, and multi-functional units tailored to modern residential preferences. These innovations improve product appeal and encourage faster replacement cycles, thereby strengthening long-term market momentum.

Key Trends & Opportunities

Growing Demand for Smart and Connected Dehumidifiers

Smart home adoption is accelerating the shift toward connected dehumidifiers equipped with Wi-Fi, mobile applications, voice control, and real-time humidity monitoring. Consumers increasingly prefer automated solutions that optimize performance based on room conditions, energy usage, and occupancy patterns. This trend presents opportunities for manufacturers to integrate advanced sensors, remote diagnostics, and compatibility with platforms like Google Home and Alexa. The move toward intelligent humidity-control ecosystems also encourages cross-selling with air purifiers and HVAC systems, expanding revenue streams and reinforcing the market’s transition toward digital, automated indoor-air management.

- For instance, Arkema’s Foranext® 1233zd fluid supports direct-to-chip two-phase cooling to handle the extreme heat from modern microprocessors in data centers, improving overall thermal performance, efficiency, and sustainability.

Increasing Adoption of Energy-Efficient and Eco-Friendly Designs

Rising regulatory pressure to reduce energy consumption and eliminate high-GWP refrigerants is creating strong opportunities for next-generation, eco-efficient dehumidifiers. Manufacturers are investing in R&D to adopt low-GWP refrigerants, enhance heat-exchange mechanisms, and optimize power usage through inverter technology. Renewable-powered and hybrid dehumidification systems are emerging as niche opportunities in sustainability-focused markets. Additionally, the shift toward desiccant-based systems in cold climates and commercial applications supports innovation in moisture-absorbent materials. These developments open new avenues for premium offerings targeting environmentally responsible customers and businesses.

- For instance, Huawei Technologies Co., Ltd. launched its FusionModule2000 smart modular data center, which supports an IT load of up to 310 kilowatts per module (depending on the specific configuration).

Expansion in Construction, Renovation, and Flood-Prone Regions

The surge in residential and commercial construction, coupled with increasing renovation activities, is creating opportunities for dehumidifier deployment during site drying and moisture-control phases. Growing climate volatility and rising frequency of floods and storms in several regions have boosted adoption for structural drying and restoration services. Contractors and disaster-recovery agencies increasingly depend on high-capacity, portable, and industrial-grade dehumidifiers to prevent mold, protect materials, and accelerate project timelines. These widening application areas create long-term, recurring opportunities for manufacturers across both developed and emerging markets.

Key Challenges

High Energy Consumption and Operating Costs

Despite technological improvements, many dehumidifier models still face criticism for high power usage, particularly in large spaces or continuous-operation environments. Consumers in cost-sensitive regions often hesitate to adopt due to concerns over rising electricity bills. Industrial and commercial facilities must also balance energy-efficiency targets with operational requirements, creating constraints for older or less efficient designs. The challenge intensifies in markets with unstable power supply or high energy tariffs. Manufacturers must continue innovating to deliver high-capacity performance without escalating energy consumption to sustain adoption.

Growing Competition and Price Pressure in the Low-End Segment

The market faces significant price pressure due to the influx of low-cost regional manufacturers, particularly in Asia. These products often compete aggressively through lower pricing, making it challenging for global brands to maintain margins while sustaining quality. Consumers increasingly evaluate cost over long-term performance, intensifying competition in the mid- and entry-level categories. Additionally, supply-chain disruptions and fluctuations in raw-material costs strain profitability. Differentiation through innovation, reliability, and after-sales support becomes essential for manufacturers aiming to remain competitive in a rapidly commoditizing segment.

Regional Analysis

North America

North America holds a significant share of the global dehumidifiers market, accounting for an estimated 30–32% due to strong residential adoption and high awareness of indoor air quality. Demand remains robust across the U.S. and Canada as consumers prioritize moisture control in basements, crawl spaces, and energy-efficient homes. The region benefits from advanced manufacturing capabilities, wide product availability, and active replacement cycles. Commercial and industrial sectors further strengthen growth as humidity control becomes essential in warehouses, data centers, and healthcare facilities. Stringent building standards and rising mold-mitigation practices continue to reinforce the region’s dominant market position.

Europe

Europe captures roughly 25–27% of the global dehumidifiers market, supported by mature demand in Northern and Western European countries where colder climates increase indoor moisture accumulation. The region’s strong emphasis on energy-efficient appliances and stringent environmental regulations drives the adoption of advanced refrigerant and desiccant dehumidifiers. Industrial applications—especially in manufacturing, food processing, and storage facilities—further contribute to stable demand. Growing retrofitting activities and improvements in building insulation have expanded the need for reliable humidity control solutions. The presence of established brands and supportive government policies on indoor air quality sustain Europe’s solid market position.

Asia-Pacific

Asia-Pacific represents the largest and fastest-growing market, accounting for 35–38% of global share, driven by rapid urbanization, rising disposable incomes, and heightened awareness of health and comfort. High humidity levels in countries such as China, India, Japan, and Southeast Asia fuel strong residential and commercial adoption. Expanding industrial activity—especially in electronics, pharmaceuticals, and automotive manufacturing—also boosts demand for precision humidity control. Government investments in infrastructure and energy-efficient appliances strengthen the region’s long-term outlook. Local manufacturing advantages and competitive pricing further enhance the region’s leadership in both consumption and production of dehumidifiers.

Latin America

Latin America contributes approximately 6–8% to the global dehumidifiers market, with growth primarily concentrated in Brazil, Mexico, and coastal nations facing persistent humidity. Rising consumer awareness of mold prevention and indoor air quality is gradually expanding residential adoption. Commercial segments—particularly hospitality, food storage, and retail—are adopting dehumidification solutions to protect goods and enhance occupant comfort. Although price sensitivity remains a barrier, increasing availability of energy-efficient models and expanding distribution networks are improving penetration rates. Infrastructure development and climate-related challenges, such as flooding and dampness, further support moderate but steady market growth across the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds roughly 5–7% of the global dehumidifiers market, driven by growth in commercial and industrial sectors rather than residential usage. Hot climates combined with air-conditioning environments in the Gulf countries create persistent indoor humidity challenges, boosting demand for refrigerant dehumidifiers in offices, hotels, and retail spaces. Industrial applications—especially in oil & gas, logistics, and pharmaceuticals—adopt high-capacity units to maintain controlled environments. In Africa, increasing construction activity and awareness of moisture-related deterioration support gradual market expansion. Despite infrastructure constraints, improving economic conditions and urban development sustain MEA’s positive outlook.

Market Segmentations:

By Technology:

- Refrigerant Dehumidifiers

- Desiccant Dehumidifiers

By Portability:

- Portable Dehumidifier

- Crawl Space/Basement Dehumidifies

By Capacity:

- Below 30 Pints

- 30–70 Pints

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dehumidifiers Market features a diverse mix of global consumer appliance brands and specialized climate-control companies, including Danby Products Ltd, STULZ Air Technology Systems, Inc., Honeywell International Inc., Bry-Air Inc., GE Appliances (a Haier Company), CondAir Group, Whirlpool Corporation, De’Longhi Appliances S.r.l., LG Electronics Inc., and Munters Group. the Dehumidifiers Market remains highly dynamic, shaped by continuous innovation, technological advancement, and expanding application needs across residential, commercial, and industrial environments. Companies focus on enhancing product energy efficiency, noise reduction, and smart connectivity to align with evolving consumer expectations and regulatory standards. Industrial segments see rising investment in high-capacity, desiccant-based, and precision humidity-control systems, driven by growth in manufacturing, logistics, and data center infrastructure. Market participants increasingly adopt sustainability strategies, including eco-friendly refrigerants and recyclable components, to strengthen regulatory compliance. Competitive intensity is further reinforced by pricing strategies, distribution-channel expansion, and accelerated product launches aimed at capturing share in both mature and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In August 2024, ASHRAE launched a new Data Center Resources page, not in April as the user prompt stated, to centralize resources for professionals managing data center environments. This hub provides access to the latest standards, guidelines, and best practices for maintaining optimal temperature and humidity, addressing critical needs due to server heat generation and supporting professionals in design and operations.

- In May 2024, Nature’s Miracle Holdings Inc. launched its efinity brand dehumidifier, initially releasing two models: the SJD-07EG (345-pint-per-day) and the SJD-10EG (506-pint-per-day). The company is also developing a more powerful 876-pint-per-day model.

- In February 2024, AkzoNobel N.V. completed a major expansion of its powder coatings manufacturing facility in Como, Italy investment added four new manufacturing lines—two for automotive primers and two for architectural coatings—which would produce coatings and increase the company’s capacity to serve customers across the entire Europe, Middle East, and Africa (EMEA) region (not just Eastern Europe)

Report Coverage

The research report offers an in-depth analysis based on Technology, Portability, Capacity and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth as consumers prioritize healthier indoor environments and moisture control.

- Manufacturers will increase the adoption of eco-friendly refrigerants to meet tightening sustainability regulations.

- Smart and connected dehumidifiers will gain traction as IoT integration becomes standard across residential products.

- Industrial demand will rise as sectors such as pharmaceuticals, electronics, and food processing require precise humidity control.

- Energy-efficient technologies will continue to shape product development to reduce power consumption and operational costs.

- Compact and portable models will see higher adoption in urban households with limited space.

- Commercial applications will expand as humidity management becomes essential in offices, retail spaces, and hospitality facilities.

- Climate variability and extreme weather patterns will increase dehumidifier usage in flood-prone and high-humidity regions.

- Companies will invest more in automated and remote-monitoring features to enhance user convenience and system reliability.

- Emerging markets will contribute significantly to future demand as awareness and affordability improve.