Market Overview

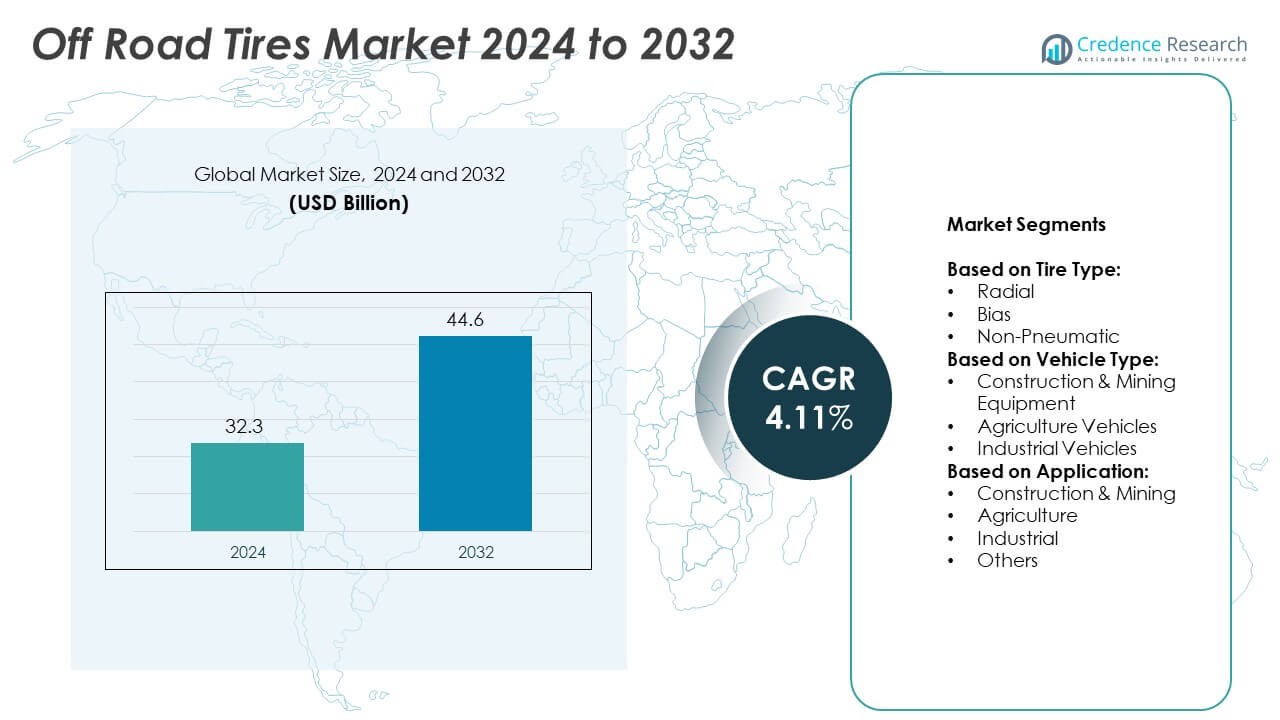

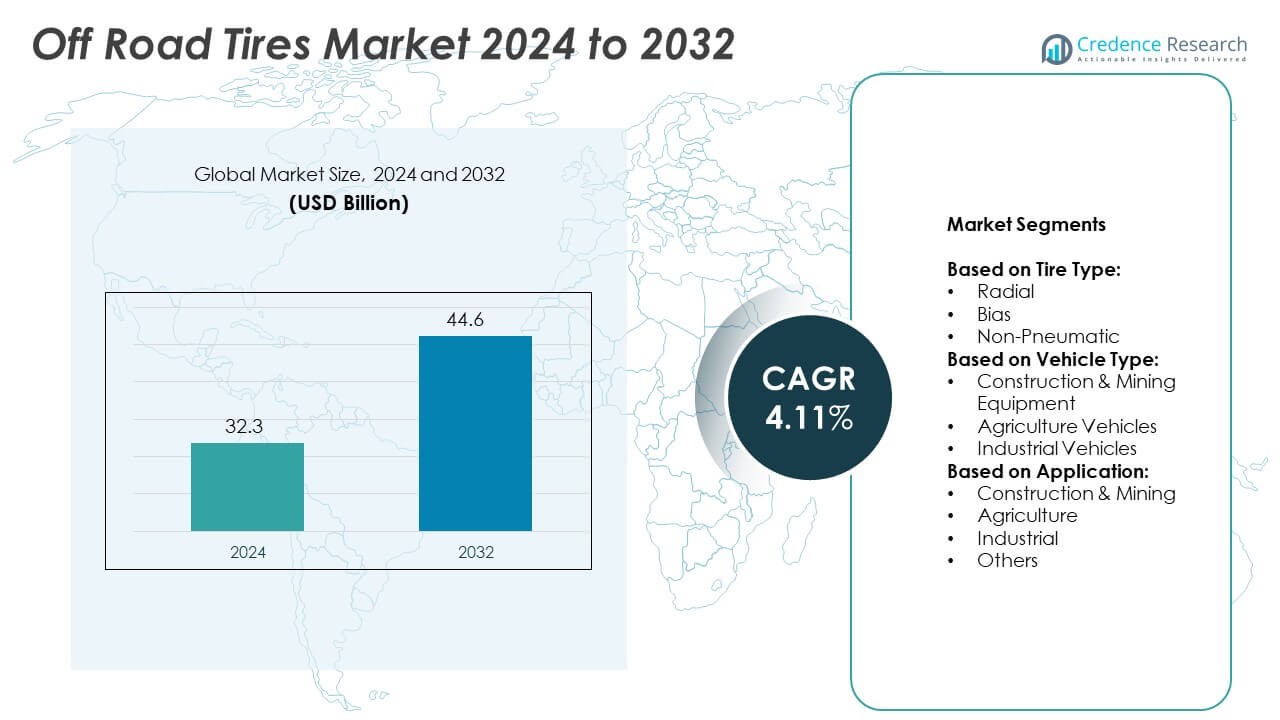

The Global Off-the-Road Tires Market size was valued at USD 32.3 billion in 2024 and is anticipated to reach USD 44.6 billion by 2032, at a CAGR of 4.11% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Off-the-Road Tires Market Size 2024 |

USD 32.3 Billion |

| Off-the-Road Tires Market, CAGR |

4.11% |

| Off-the-Road Tires Market Size 2032 |

USD 44.6 Billion |

The Off-Road Tires market grows steadily due to rising demand from construction, mining, and agricultural sectors. Increasing infrastructure development and mechanization drive the need for durable, high-performance tires. Technological advancements, including smart tire systems and improved tread designs, enhance efficiency and safety. Sustainability trends push manufacturers to adopt eco-friendly materials and energy-efficient production methods. Growing preference for radial tires further supports market expansion, while customization for specific applications strengthens competitiveness across diverse industrial and commercial segments globally.

The Off-Road Tires market shows strong growth across key regions, including North America, Asia-Pacific, Europe, Latin America, and the Middle East & Africa. Asia-Pacific leads in demand due to rapid industrialization, infrastructure projects, and agricultural mechanization. North America focuses on advanced technologies and high-performance tire solutions, while Europe emphasizes sustainability and innovation. Prominent players driving the market include Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, and Continental AG, who invest in product innovation and global expansion strategies.

Market Insights

- The Off-Road Tires market was valued at USD 32.3 billion in 2024 and is projected to reach USD 44.6 billion by 2032, growing at a CAGR of 11% during the forecast period.

- Rising demand from construction, mining, and agricultural sectors drives market growth, supported by increasing infrastructure development and mechanization across global economies.

- The market shows a clear trend toward radial tire adoption due to superior durability, fuel efficiency, and enhanced performance on rough terrains compared to traditional bias tires.

- Intense competition exists among key players focusing on innovation, sustainability, and product customization, with companies investing in smart tire technologies and digital monitoring systems.

- High raw material costs and price fluctuations act as major restraints, affecting profit margins and creating challenges for manufacturers to maintain cost-effective pricing strategies.

- Asia-Pacific leads the global market due to rapid industrialization, infrastructure expansion, and agricultural modernization, while North America and Europe focus on technological advancements and eco-friendly tire solutions.

- Growing demand for sustainable, high-performance tires and customized solutions tailored for construction, agriculture, and mining equipment creates significant opportunities for manufacturers worldwide.

Market Drivers

Rising Demand from Construction and Mining Activities

The Off-Road Tires market experiences strong growth due to increasing construction and mining projects worldwide. Heavy-duty equipment such as loaders, dump trucks, and excavators require durable tires to operate on uneven terrains. Infrastructure expansion in developing economies drives the need for robust and high-performance tires. Manufacturers focus on producing tires with enhanced load-bearing capacity and superior grip to meet these demands. It benefits from growing investments in highways, railways, and urban development projects. Governments also support industrialization, creating continuous demand for off-road equipment tires.

- For instance, Goodyear’s OTR lineup includes specialized tires used across 6 equipment types, such as surface mining, underground mining, construction, ports, industrial handling, and quarrying

Technological Advancements Enhancing Tire Performance

Innovation in tire technology strengthens the growth of the Off-Road Tires market. Companies develop products with advanced tread patterns, self-cleaning properties, and puncture resistance to handle extreme conditions. Integration of smart sensors enables real-time monitoring of pressure and temperature, improving operational efficiency. It creates opportunities for manufacturers to offer customized solutions for different terrains and applications. Increased focus on eco-friendly materials supports sustainability initiatives in the industry. Tire makers invest in research and development to enhance durability and improve energy efficiency.

- For instance, Trelleborg offers custom off-highway tires up to 80 inches in height with traction treads up to 7 inches deep

Rising Agricultural Mechanization Driving Market Growth

The Off-Road Tires market gains momentum from the rising adoption of modern farming machinery. Tractors, harvesters, and sprayers require high-traction tires to function effectively in challenging agricultural environments. Farmers increasingly adopt advanced equipment to boost productivity and efficiency. It benefits from government incentives promoting agricultural modernization in several regions. Manufacturers focus on developing tires with better soil protection and higher fuel efficiency. Growing demand for food security worldwide drives the expansion of agricultural machinery and related tire sales.

Growing Industrialization and Urban Development Worldwide

Rapid industrialization boosts the Off-Road Tires market by expanding demand for material-handling and construction vehicles. Urban development projects such as smart cities, warehouses, and logistics hubs create consistent tire requirements. It supports operations in ports, airports, and large-scale infrastructure projects where heavy-duty vehicles dominate. Manufacturers cater to diverse needs by offering versatile tire solutions for industrial equipment. Rising investments in renewable energy projects also fuel demand for specialized off-road tires. Continuous economic growth strengthens adoption across multiple industrial sectors.

Market Trends

Increasing Adoption of Radial Tire Technology

The Off-Road Tires market witnesses a significant shift toward radial tire designs due to their superior performance. Radial tires offer better traction, enhanced durability, and improved heat dissipation compared to bias-ply alternatives. Manufacturers invest heavily in expanding radial production to meet rising demand from construction, agriculture, and mining sectors. It benefits from the growing preference for tires that provide better stability and reduced rolling resistance. The adoption of advanced rubber compounds further improves wear resistance and lifespan. End-users choose radial tires for lower maintenance costs and enhanced operational efficiency.

- For instance, BelAZ produces an ultra-class haul truck—the BelAZ 75710—with a payload capacity of 496 short tons, underscoring the need for ultra-durable OTR tires.

Integration of Smart Tire Technologies

Technological integration drives a major trend in the Off-Road Tires market, with manufacturers introducing smart solutions. Tire Pressure Monitoring Systems (TPMS) and sensor-enabled tires allow real-time tracking of performance parameters. It supports better safety, fuel efficiency, and reduced downtime for off-road vehicles. Companies partner with technology providers to create connected tire solutions suitable for demanding environments. Predictive maintenance features help fleet operators minimize unexpected failures and enhance productivity. Increasing digitalization in the industrial and agricultural sectors accelerates the adoption of sensor-equipped off-road tires.

- For instance, Trelleborg’s E3/L3 pneumatic grader tire size 23.5‑25 features a tread depth of 45/32nds, offering a robust footprint with strong chip and chunk resistance.

Focus on Sustainability and Eco-Friendly Materials

The Off-Road Tires market responds to rising environmental concerns by adopting sustainable manufacturing practices. Companies develop tires using bio-based materials and recyclable components to reduce ecological impact. It promotes energy-efficient production techniques that lower carbon emissions and resource consumption. Growing regulatory pressure encourages the industry to invest in green innovations. Manufacturers focus on extending tire life to minimize waste generation and disposal challenges. Sustainable tire solutions gain popularity among industries prioritizing environmental responsibility and long-term cost savings.

Rising Demand for Customized and Application-Specific Tires

Demand for tailored tire solutions drives a key trend in the Off-Road Tires market. Manufacturers develop specialized products for construction, agriculture, mining, and industrial applications. It enables improved performance by optimizing tread patterns and sidewall designs for specific terrains. Companies expand product portfolios to cater to diverse requirements, from high-load capacities to extreme-weather adaptability. Customization helps meet unique operational challenges faced by heavy-duty equipment users. Growing end-user expectations push tire makers to deliver innovative, purpose-built solutions with superior reliability.

Market Challenges Analysis

High Raw Material Costs and Price Volatility

The Off-Road Tires market faces significant challenges due to fluctuations in raw material prices. Natural rubber, synthetic rubber, and petroleum-based compounds form a large part of production costs. It becomes difficult for manufacturers to maintain stable pricing when input costs remain unpredictable. Rising energy and transportation expenses further increase production pressures. Companies struggle to balance profitability while offering competitive pricing to customers. Dependence on global supply chains exposes the industry to disruptions caused by economic uncertainty and trade restrictions.

Operational and Performance Limitations in Extreme Conditions

The Off-Road Tires market encounters performance-related challenges, particularly in harsh terrains and extreme climates. High wear and tear reduce tire lifespan, increasing replacement costs for end-users. It creates pressure on manufacturers to develop products with stronger durability and advanced resistance features. Achieving a balance between high traction, fuel efficiency, and extended longevity remains difficult. Limited availability of advanced testing facilities affects innovation in performance optimization. Meeting diverse application requirements across agriculture, construction, mining, and industrial sectors demands significant research and development investment.

Market Opportunities

Expanding Infrastructure Development and Industrial Growth

The Off-Road Tires market presents significant opportunities driven by large-scale infrastructure and industrial projects worldwide. Rapid urbanization increases demand for heavy-duty vehicles used in construction, mining, and logistics. It benefits from government investments in roads, railways, energy facilities, and smart city developments. Growing need for advanced material-handling equipment further supports market expansion. Manufacturers have opportunities to introduce high-performance tires designed for diverse terrains and operational requirements. Emerging economies in Asia-Pacific, Africa, and Latin America create strong prospects for long-term growth.

Advancements in Tire Technology and Product Customization

Technological innovation creates new opportunities for the Off-Road Tires market, enabling manufacturers to deliver better performance and efficiency. Development of smart tires with integrated sensors supports predictive maintenance and improved vehicle safety. It allows operators to reduce downtime and enhance productivity in challenging environments. Rising demand for customized tires tailored to specific applications encourages companies to expand product portfolios. Use of eco-friendly materials and energy-efficient designs aligns with global sustainability goals. Collaborations between tire makers and equipment manufacturers strengthen innovation and open doors to niche market segments.

Market Segmentation Analysis:

By Tire Type:

The Off-Road Tires market is segmented into radial, bias, and non-pneumatic tires. Radial tires dominate due to their enhanced durability, better traction, and fuel efficiency, making them highly preferred across construction, mining, and agricultural sectors. It benefits from increasing demand for tires capable of handling extreme terrains with reduced maintenance costs. Bias tires continue to serve in specific applications requiring strong sidewall support and lower initial costs. Non-pneumatic tires gain popularity in industrial environments where puncture resistance and reliability are critical. Manufacturers focus on developing innovative designs to meet evolving performance requirements across multiple terrains.

- For instance, Yokohama’s 11R22.5 114R tire offers a tread depth of 16/32‑inch, enhancing wear resistance for high‑scrub applications.

By Vehicle Type:

The Off-Road Tires market caters to construction and mining equipment, agriculture vehicles, and industrial vehicles. Construction and mining equipment generate the largest revenue share due to heavy usage in infrastructure and extraction projects. It sees rising demand for specialized tires that deliver stability and endurance in challenging conditions. Agriculture vehicles contribute significantly with growing adoption of advanced tractors, harvesters, and sprayers to enhance farming productivity. Industrial vehicles, including forklifts and loaders, demand tires that support high load capacities and operational safety. Manufacturers develop tailored solutions for each vehicle category to ensure optimal efficiency and durability.

- For instance, NIRA Dynamics AB has its Tire Pressure Indicator (TPI) software deployed in vehicles, enabling indirect monitoring of tire pressure without physical sensors. By leveraging data from existing sensors, such as those used by the anti-lock braking system (ABS), the software detects a drop in tire pressure. As of mid-2025, the TPI system has been deployed in over 110 million vehicles.

By Application:

The Off-Road Tires market is divided into construction and mining, agriculture, industrial, and others. Construction and mining remain the leading application segment, driven by global investments in infrastructure and resource extraction. It benefits from projects requiring heavy-duty equipment capable of navigating rough terrains. The agriculture segment experiences steady growth, supported by increased mechanization and demand for efficient farming solutions. Industrial applications witness consistent adoption of off-road tires for material handling, warehousing, and logistics operations. The “others” category includes defense, forestry, and recreational sectors, which contribute niche opportunities for specialized tire designs and technological innovations.

Segments:

Based on Tire Type:

- Radial

- Bias

- Non-Pneumatic

Based on Vehicle Type:

- Construction & Mining Equipment

- Agriculture Vehicles

- Industrial Vehicles

Based on Application:

- Construction & Mining

- Agriculture

- Industrial

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 22%, supported by strong demand for construction, mining, and agricultural equipment. The United States leads the region due to large-scale infrastructure projects and advanced manufacturing capabilities. It records increasing adoption of radial tires because of better durability and improved operational efficiency. Manufacturers focus on integrating technologies like tire pressure monitoring systems to enhance safety and performance. The rising use of heavy machinery in industrial and logistics sectors continues to fuel market expansion.

Asia Pacific

Asia Pacific dominates the Off-Road Tires market with a share of 38%, driven by rapid industrialization and urban development. China and India remain the largest contributors, supported by high investments in infrastructure and mining activities. It experiences significant growth in agricultural mechanization, leading to higher demand for durable and high-traction tires. Manufacturers establish local production facilities to serve cost-sensitive markets efficiently. Ongoing economic expansion and government-backed development projects strengthen the region’s leadership position globally.

Europe

Europe contributes nearly 26% to the global Off-Road Tires market, supported by advanced industrial and agricultural sectors. Countries such as Germany, France, and the U.K. lead in adopting innovative tire technologies for heavy-duty vehicles. It witnesses growing demand for eco-friendly and sustainable tire solutions to meet strict environmental regulations. Manufacturers focus on developing high-performance products designed to enhance efficiency and durability. Infrastructure modernization projects across the region support consistent growth in tire adoption.

Latin America

Latin America holds a market share of about 8%, with Brazil, Argentina, and Chile driving demand through construction, agriculture, and mining sectors. It benefits from government initiatives supporting infrastructure development and industrial growth. Manufacturers focus on creating cost-effective tire solutions tailored to local terrain conditions. Agricultural modernization significantly contributes to rising sales of advanced off-road tires. The replacement tire market also gains traction due to high wear in challenging operating environments.

Middle East & Africa

The Middle East & Africa account for approximately 6% of the Off-Road Tires market, fueled by large-scale mining, oil exploration, and infrastructure projects. Gulf countries drive demand for premium off-road tires designed for extreme conditions and heavy equipment. It faces challenges such as high temperatures and rough terrains, encouraging manufacturers to develop heat-resistant and durable solutions. Expansion of transportation and energy networks across African nations supports the adoption of advanced tire technologies. Ongoing regional development projects create steady growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Apollo Tyres Ltd.

- Continental AG

- Bridgestone Corporation

- Trelleborg AB

- Sumitomo Rubber Industries, Ltd.

- Michelin Group

- Titan International, Inc.

- Goodyear Tire & Rubber Company

- Balkrishna Industries Limited (BKT)

- Yokohama Rubber Co., Ltd.

Competitive Analysis

The Off-Road Tires market features strong competition among leading players, including Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Continental AG, Apollo Tyres Ltd., Yokohama Rubber Co., Ltd., Balkrishna Industries Limited (BKT), Trelleborg AB, Titan International, Inc., and Sumitomo Rubber Industries, Ltd. These companies focus on expanding their product portfolios with advanced tire technologies designed for durability, superior traction, and improved performance across challenging terrains. It shows growing investments in research and development to deliver tires with enhanced fuel efficiency, longer lifespan, and better load-bearing capabilities. Manufacturers emphasize strategic partnerships, mergers, and acquisitions to strengthen global presence and reach emerging markets effectively. Many companies adopt sustainability-driven initiatives, introducing eco-friendly materials and energy-efficient production techniques. Increasing demand for specialized solutions tailored to agriculture, construction, mining, and industrial applications pushes tire makers to enhance customization. Technological advancements, such as smart tire systems with embedded sensors, support predictive maintenance and operational efficiency. The competitive landscape remains dynamic, with companies striving to balance performance, cost-effectiveness, and innovation while addressing the rising needs of diverse end-user industries.

Recent Developments

- In 2025 Bridgestone’s lunar rover tires earned the “Tire Concept of the Year” award at the Tire Technology International Awards for Innovation and Excellence.

- In September 2024, Michelin introduced two new tire sizes for the CEREXBIB 2 line, developed exclusively for New Holland’s CR11 combine harvester, featuring ULTRAFLEX Technology.

- In 2024, Goodyear agreed to sell its Off‑the‑Road tire business to Yokohama Rubber, with the transition expected by early 2025.

Report Coverage

The research report offers an in-depth analysis based on Tire Type, Vehicle Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience steady growth driven by rising construction, mining, and agricultural activities.

- Asia-Pacific will continue to dominate due to rapid industrialization and infrastructure development.

- Smart tire technologies with sensors and predictive maintenance systems will gain wider adoption.

- Real-time tire performance monitoring will enhance operational efficiency for fleet operators.

- Sustainability initiatives will accelerate the use of eco-friendly materials and energy-efficient designs.

- Tire retreading and recycling practices will become more popular to reduce operational costs.

- Growth of electric and autonomous heavy equipment will create demand for advanced tire solutions.

- Mining applications will drive significant market value due to high tire replacement cycles.

- Localized manufacturing and stronger supply chain strategies will improve regional market responsiveness.

- Subscription-based tire management and service models will gain traction among fleet operators.