| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicle On-board Charger (OBC) Market Size 2024 |

USD 5,450.7 million |

| Electric Vehicle On-board Charger (OBC) Market, CAGR |

15.90% |

| Electric Vehicle On-board Charger (OBC) Market Size 2032 |

USD 17,746.8 million |

Market Overview

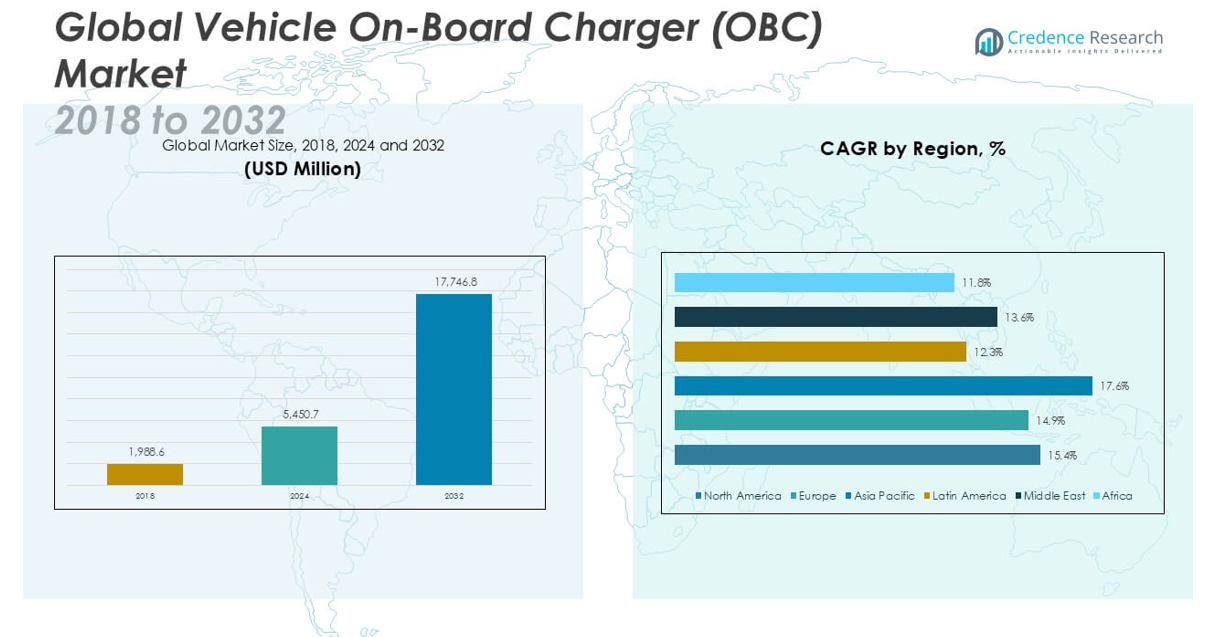

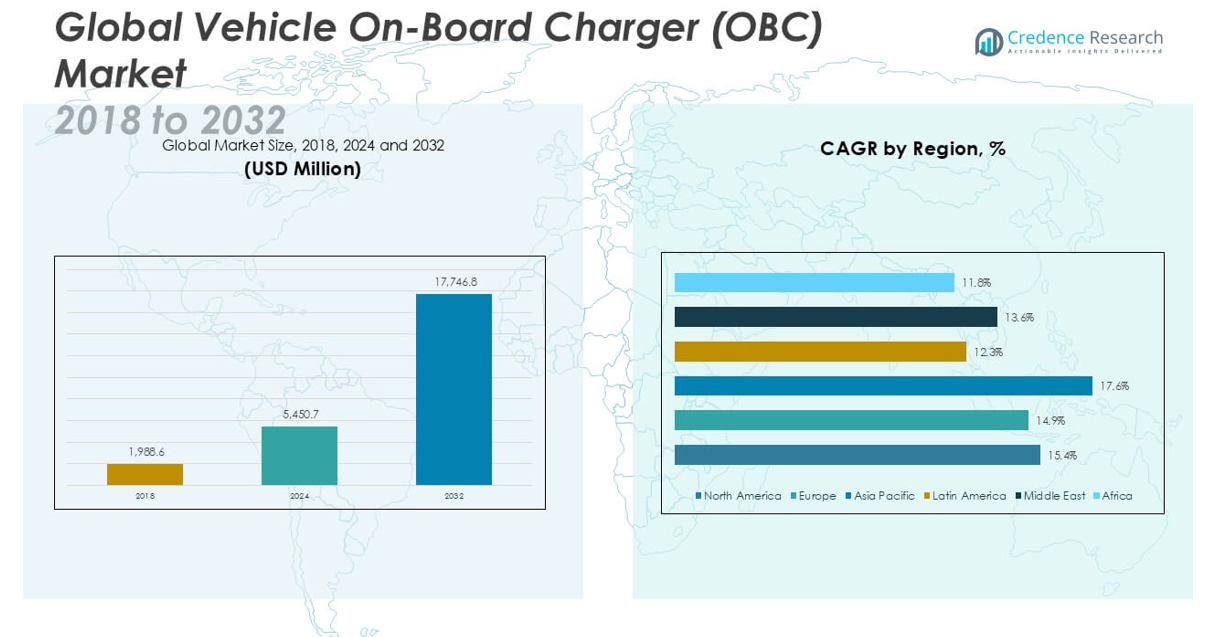

The Electric Vehicle On-board Charger (OBC) market size was valued at USD 1,988.6 million in 2018, increased to USD 5,450.7 million in 2024, and is anticipated to reach USD 17,746.8 million by 2032, at a CAGR of 15.90% during the forecast period.

The Electric Vehicle On-board Charger (OBC) market is led by prominent players such as BYD, Delta Electronics, Infineon Technologies, STMicroelectronics, Bel Power Solutions, Eaton, TDK Corporation, Tesla, Inc., Toyota Industries Corporation, LG Electronics, BorgWarner Inc., Siemens AG, Vitesco Technologies, and Innolectric GmbH. These companies focus on technological innovation, product diversification, and strategic collaborations to strengthen their market position. Asia Pacific dominates the global OBC market, holding a significant 42.0% market share in 2024, driven by rapid electric vehicle adoption, large-scale manufacturing, and strong government support in countries like China, Japan, and South Korea. Europe and North America follow as key markets, supported by stringent emission regulations and expanding charging infrastructure.

Market Insights

- The Electric Vehicle On-board Charger (OBC) market was valued at USD 1,988.6 million in 2018, reached USD 5,450.7 million in 2024, and is expected to grow to USD 17,746.8 million by 2032 at a CAGR of 15.90%.

- The market is driven by the increasing global adoption of electric vehicles, strong government support, rising environmental concerns, and growing investments in charging infrastructure.

- A key trend shaping the market is the development of high-power and bidirectional on-board chargers that support faster charging and vehicle-to-grid applications, enhancing energy management capabilities.

- Asia Pacific leads the market with a 42.0% share in 2024, followed by Europe at 28.0% and North America at 20.4%, while Battery Electric Vehicles (BEVs) dominate the propulsion type segment due to their high adoption rate.

- High costs of advanced OBC systems, design complexities, and the lack of standardized global charging protocols restrain market growth, particularly in emerging regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vehicle Type:

In the Electric Vehicle On-board Charger (OBC) market, Passenger Cars dominate the vehicle type segment, holding the largest market share in 2024. The rising consumer preference for electric passenger vehicles, coupled with supportive government incentives and expanding charging infrastructure, significantly drives this growth. Light Commercial Vehicles (LCV) and Heavy Commercial Vehicles (HCV) are also gaining momentum, supported by increasing electrification in logistics and public transportation sectors. However, the demand in passenger cars remains more pronounced due to higher production volumes and rapid advancements in vehicle design and charging efficiency.

- For instance, Tesla’s Model 3 alone recorded global deliveries exceeding 1,246,000 units by the end of 2023, significantly boosting the demand for on-board chargers specifically engineered for passenger vehicles.

By Current Type

AC chargers account for the largest market share, driven by their cost-effectiveness, widespread compatibility, and suitability for home and workplace charging. AC chargers continue to dominate as they meet most daily charging needs of urban users, particularly in the passenger car segment. On the other hand, DC chargers are witnessing faster growth due to increasing demand for rapid charging solutions in commercial applications and public charging stations.

- For instance, BYD’s integrated AC on-board charger system supports charging at up to 7 kW, which efficiently meets typical residential and workplace charging needs, while their commercial DC chargers can deliver up to 120 kW, reducing charging time significantly for fleet operations.

By Propulsion Type

Battery Electric Vehicles (BEVs) lead the market with the highest share, supported by zero-emission targets, continuous battery improvements, and increasing consumer acceptance. Hybrid Electric Vehicles (HEVs) and Plug-in Hybrid Electric Vehicles (PHEVs) also contribute to market expansion but are outpaced by the accelerating adoption of BEVs.

Market Overview

Rising Adoption of Electric Vehicles Globally

The increasing global shift towards electric vehicles (EVs) serves as a primary growth driver for the Electric Vehicle On-board Charger (OBC) market. Governments across major economies are aggressively promoting EV adoption through incentives, subsidies, and stricter emission regulations. This growing consumer demand for eco-friendly vehicles directly increases the requirement for OBCs, which are essential components for efficient charging. The expansion of EV manufacturing, coupled with advancements in battery technology, further fuels the market, positioning OBCs as a critical technology in the evolving automotive landscape.

- For instance, Hyundai Motor Company sold over 241,000 battery electric vehicles globally in 2023, directly contributing to the growing demand for integrated and efficient on-board chargers across multiple EV models.

Expansion of Charging Infrastructure

The rapid development of charging infrastructure significantly boosts the growth of the OBC market. As public and private sectors invest heavily in building accessible charging stations, the need for compatible and high-performance on-board chargers rises. OBCs enable flexible charging from both residential and public stations, making them a key enabler for seamless EV usage. The proliferation of AC and DC fast-charging networks across urban and rural areas supports the integration of OBCs in a wide range of electric vehicle types, enhancing the market’s expansion.

- For instance, as of December 2023, Delta Electronics has supplied more than 1,000 ultra-fast DC charging stations across Europe, which complements their advanced on-board charger solutions designed for high interoperability with public charging networks.

Technological Advancements in OBC Design

Continuous innovation in on-board charger technology, including improvements in charging efficiency, compact size, and lightweight design, drives the market forward. Manufacturers are focusing on developing multi-functional OBCs that support both AC and DC charging with higher power density and reduced energy loss. These advancements not only improve vehicle range and performance but also align with the automotive industry’s goal of reducing vehicle weight and maximizing space. The shift towards integrated power electronics further accelerates adoption, making advanced OBCs a preferred choice among EV manufacturers.

Key Trends and Opportunities

Growth in Bidirectional Charging Capabilities

Bidirectional charging, enabling vehicle-to-grid (V2G) and vehicle-to-home (V2H) applications, emerges as a prominent trend in the OBC market. This technology allows EVs to discharge stored energy back to the grid or power residential loads, creating opportunities for energy management and grid stability. Manufacturers are increasingly investing in OBCs that support bidirectional energy flow, offering additional value to end users and contributing to the broader adoption of smart energy solutions. This trend positions OBCs as essential components in the future energy ecosystem.

- For instance, Nissan’s LEAF, equipped with bidirectional charging capability since its second generation, has supported over 100 V2G pilot installations globally, allowing vehicles to send power back to the grid using OBC-integrated technology.

Increasing Demand for Higher Power Ratings

The rising need for faster charging is driving the demand for high-power OBCs capable of operating at increased voltage levels. Consumers are seeking reduced charging times, especially for long-distance travel and commercial fleets. OBC manufacturers are responding by developing chargers that can efficiently handle higher power without compromising safety or thermal performance. This trend opens up growth opportunities for advanced cooling technologies, power conversion systems, and next-generation materials that support high-power charging while maintaining compact designs.

- For instance, Vitesco Technologies has developed an 800V on-board charger system capable of delivering up to 22 kW AC charging, supporting significantly faster charging cycles compared to traditional 400V systems and enhancing the usability of high-performance EVs.

Key Challenges

High Cost of Advanced OBC Systems

The development and integration of high-performance OBCs often involve significant costs, posing a challenge to market growth, especially in price-sensitive regions. Complex power electronics, advanced safety features, and compact designs contribute to higher manufacturing expenses. These increased costs can limit adoption in entry-level and mid-range electric vehicles, potentially slowing market penetration. Balancing cost-efficiency while meeting performance and regulatory standards remains a persistent challenge for manufacturers aiming to scale production and reach broader consumer segments.

Design Complexity and Thermal Management

As OBCs evolve to support higher power ratings and bidirectional functionality, design complexity increases significantly. Managing thermal loads within compact spaces becomes a critical issue, requiring advanced thermal management systems and high-quality materials. Failure to effectively address heat dissipation can lead to reduced charger lifespan and safety concerns. This challenge compels manufacturers to invest in robust design solutions that ensure reliability, efficiency, and compliance with stringent automotive safety standards without increasing system size.

Compatibility with Diverse Charging Standards

The lack of global uniformity in charging standards presents another key challenge for the Electric Vehicle On-board Charger market. Different regions adopt varied grid voltages, connector types, and communication protocols, making it difficult for OBC manufacturers to design universally compatible systems. Ensuring interoperability across multiple markets while meeting regional certification requirements increases product development time and cost. Overcoming this challenge is crucial for manufacturers seeking to establish a competitive presence in both established and emerging EV markets.

Regional Analysis

North America

North America accounted for 20.4% of the global Electric Vehicle On-board Charger (OBC) market in 2024, with a market size of USD 1,117.4 million, growing from USD 457.4 million in 2018. The region is projected to reach USD 3,105.7 million by 2032, registering a CAGR of 15.4%. Strong government policies supporting EV adoption, substantial investments in charging infrastructure, and the presence of key automotive players drive market expansion. The increasing demand for passenger and commercial electric vehicles positions North America as a vital contributor to the global OBC market.

Europe

Europe held approximately 28.0% of the global OBC market share in 2024, reaching USD 1,526.2 million from USD 536.9 million in 2018. The region is expected to grow to USD 4,702.9 million by 2032, at a CAGR of 14.9%. Europe’s growth is propelled by stringent carbon emission regulations, generous EV subsidies, and the accelerated rollout of charging infrastructure. Countries like Germany, France, and the UK are at the forefront of EV penetration, significantly driving the demand for on-board chargers. The rapid transition to battery electric vehicles further reinforces Europe’s leading market position.

Asia Pacific

Asia Pacific dominates the Electric Vehicle On-board Charger (OBC) market with a 42.0% share in 2024, growing from USD 805.4 million in 2018 to USD 2,289.3 million in 2024. The region is projected to reach USD 8,128.0 million by 2032, advancing at the fastest CAGR of 17.6%. China leads regional growth, supported by strong domestic EV production, favorable policies, and rising consumer adoption. Other key markets like Japan and South Korea are also rapidly expanding their EV infrastructure. Asia Pacific remains the primary growth engine due to high manufacturing capabilities and large-scale EV deployment.

Latin America

Latin America represented 3.5% of the global OBC market share in 2024, increasing from USD 67.6 million in 2018 to USD 190.8 million in 2024. The market is anticipated to reach USD 709.9 million by 2032, growing at a CAGR of 12.3%. The region’s growth is driven by improving EV adoption, supportive policy frameworks, and gradual investments in charging networks. Brazil and Mexico are key contributors, with expanding EV sales and automotive partnerships. However, the market’s pace is comparatively moderate due to limited infrastructure and higher EV costs in some countries.

Middle East

The Middle East captured approximately 4.5% of the global Electric Vehicle On-board Charger (OBC) market share in 2024, rising from USD 79.5 million in 2018 to USD 245.3 million in 2024. The market is projected to reach USD 851.8 million by 2032, registering a CAGR of 13.6%. Increasing awareness of sustainable mobility, growing EV imports, and government-led green initiatives contribute to market expansion. Countries like the UAE and Saudi Arabia are investing in electric transportation and charging infrastructure, positioning the Middle East as an emerging growth area despite current infrastructural limitations.

Africa

Africa accounted for 1.5% of the global OBC market share in 2024, growing from USD 41.8 million in 2018 to USD 81.8 million in 2024. The market is expected to reach USD 248.5 million by 2032, advancing at a CAGR of 11.8%. Growth in Africa remains steady, supported by gradual EV penetration and government initiatives to promote clean energy transportation. South Africa leads regional adoption due to its relatively mature automotive market. However, limited charging infrastructure and affordability challenges continue to restrain rapid growth across most African countries.

Market Segmentations:

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCV)

- Heavy Commercial Vehicles (HCV)

By Current Type

By Propulsion Type

- Battery Electric Vehicles (BEV)

- Hybrid Electric Vehicles (HEV)

- Plug-in Hybrid Electric Vehicles (PHEV)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Electric Vehicle On-board Charger (OBC) market is highly competitive, with leading players focusing on technological advancements, strategic partnerships, and product portfolio expansion to strengthen their market position. Key companies such as BYD, Delta Electronics, Infineon Technologies, STMicroelectronics, and Tesla, Inc. actively invest in developing high-efficiency, compact, and bidirectional charging solutions to meet the growing demand for faster and smarter charging capabilities. Market participants are also exploring collaborations with automotive manufacturers to integrate advanced OBC systems into next-generation electric vehicles. The competitive landscape is further shaped by continuous innovation in power electronics and thermal management technologies, aimed at improving charging speed and energy efficiency. Regional players like Innolectric GmbH and global giants such as Siemens AG and LG Electronics contribute to the dynamic market through diverse product offerings and tailored solutions for varying vehicle segments. The focus on cost reduction, reliability, and regulatory compliance remains central to gaining a competitive edge.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BYD

- Delta Electronics

- Infineon Technologies

- STMicroelectronics

- Bel Power Solutions

- Eaton

- TDK Corporation

- Tesla, Inc.

- Toyota Industries Corporation

- LG Electronics

- BorgWarner Inc.

- Siemens AG

- Vitesco Technologies

- Innolectric GmbH

Recent Developments

- In October 2024, HYUNDAI MOBIS announced its plans to mass-produce a component that doubles electric vehicle charging speed by the end of 2025. The company unveiled an integrated charging control unit (ICCU) that boosts EV charging speed to 22 kilowatts (kW) from the current 11 kW. The unit would also allow users to power or charge electronic devices using the EV battery.

- In October 2024, KOSTAL Automobil Elektrik (KAE) announced its newest production facility in Querétaro, Mexico. The KOSTAL Electro Mobility Mexicana (KEMM) plant is the KOSTAL Group’s third facility in Querétaro. The new plant would create 750 new jobs and produce onboard chargers (OBC) for KOSTAL’s OEM customers in the U.S.

- In March 2024, VMAX announced that the company had selected Infineon Technologies AG’s new CoolSiC hybrid discrete with TRENCHSTOP 5 Fast-Switching IGBT and CoolSiC Schottky Diode for its next-generation 6.6 kW OBC/DCDC on-board chargers. Infineon’s components come in a D²PAK package and combine ultra-fast TRENCHSTOP 5 IGBTs with half-rated free-wheeling SiC Schottky barrier diodes to achieve a perfect cost-performance ratio for both hard and soft switching topologies. With their superior performance, optimized power density, and leading quality, the power devices are ideally suited for VMAX’s on-board chargers.

- In November 2023, Infineon Technologies AG launched the 650 V CoolMOS CFD7A in the QDPAK package designed for efficient rapid charging of electric vehicles. This package family aimed to deliver similar thermal capabilities with enhanced electrical performance compared to the established TO247 THD devices, facilitating efficient energy use in onboard chargers and DC-DC converters.

- In November 2023, BorgWarner signed an agreement with a major North American OEM to supply its bi-directional 800V Onboard Charger (OBC) for the automaker’s premium passenger vehicle battery electric vehicle (BEV) platforms. The technology leverages silicon carbide (SiC) power switches for improved efficiency and delivers amplified power density, power conversion, and safety compliance. Production is slated to begin in January 2027.

Market Concentration & Characteristics

The Electric Vehicle On-board Charger (OBC) Market is moderately concentrated, with a mix of global leaders and regional players competing on technology, efficiency, and pricing. It features a strong presence of established companies such as BYD, Delta Electronics, Tesla, Inc., and Infineon Technologies, which command significant market shares through continuous innovation and strategic partnerships. The market is characterized by rapid technological advancements, growing demand for high-power and compact chargers, and a shift towards bidirectional charging capabilities. It displays a strong focus on integrating lightweight, energy-efficient designs that align with evolving electric vehicle requirements. The pace of product development remains high, driven by the need for faster charging solutions and enhanced vehicle compatibility. Price sensitivity is prominent, particularly in emerging markets, pushing manufacturers to balance cost with performance. The market shows increasing vertical integration, with several automotive companies incorporating OBC production into their supply chains to ensure product reliability and customization. It is also marked by evolving regulatory standards that influence charger design, efficiency, and safety across key regions. The competitive landscape is dynamic, with continuous product differentiation shaping buyer preferences.

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Current Type, Propulsion Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for Electric Vehicle On-board Chargers (OBCs) will continue to grow with the rising global adoption of electric vehicles.

- Advancements in bidirectional charging technology will become a major focus for manufacturers.

- High-power OBCs that enable faster charging will gain significant traction across all vehicle segments.

- Compact and lightweight OBC designs will be prioritized to improve vehicle efficiency and space utilization.

- Battery Electric Vehicles (BEVs) will remain the dominant propulsion type driving OBC market growth.

- Manufacturers will increasingly integrate OBC systems with smart energy management solutions.

- Regional markets like Asia Pacific will maintain leadership due to high EV production and strong government support.

- Partnerships between automotive OEMs and power electronics companies will shape product innovation.

- Growing investments in charging infrastructure will directly support the expansion of the OBC market.

- The need for standardized global charging protocols will remain critical to ensure product compatibility and market scalability.