Market Overview:

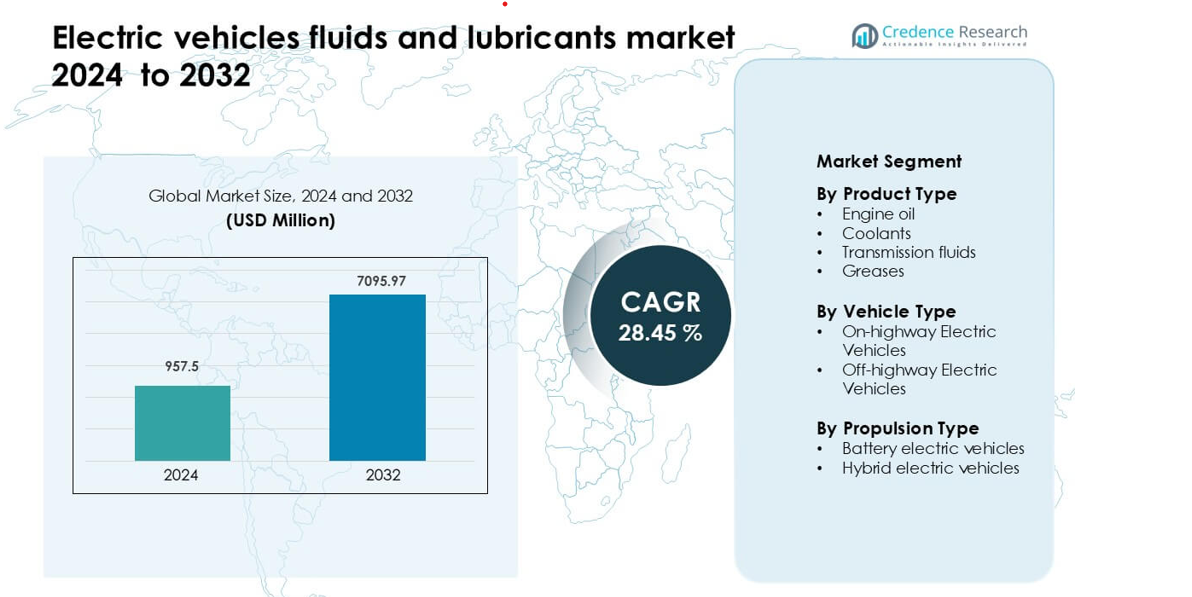

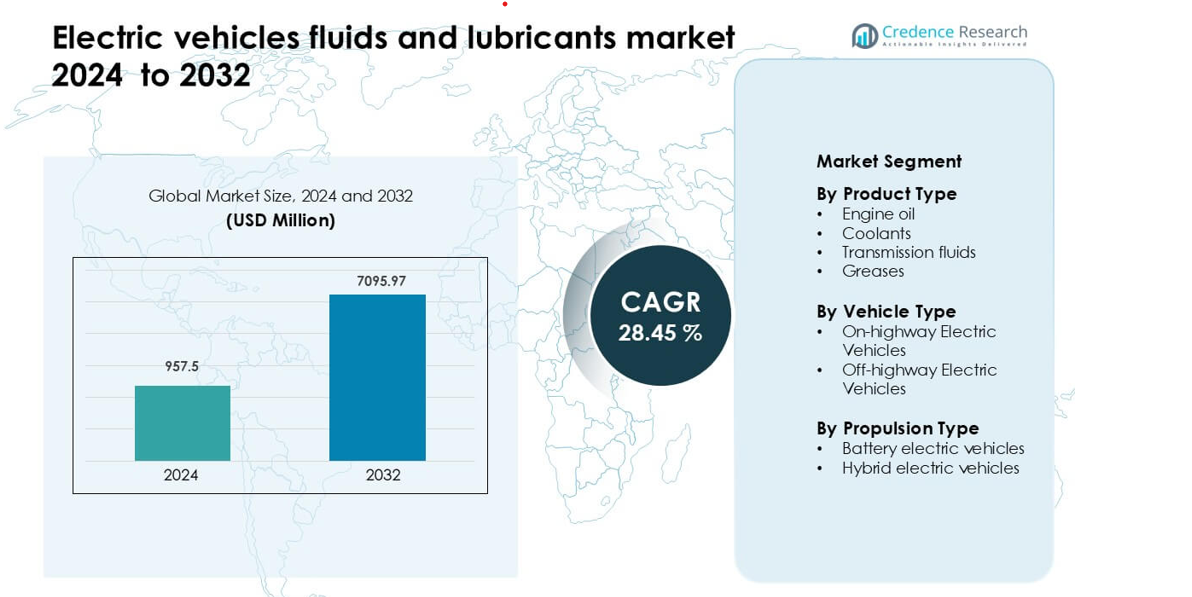

Electric vehicles fluids and lubricants market was valued at USD 957.5 million in 2024 and is anticipated to reach USD 7095.97 million by 2032, growing at a CAGR of 28.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Electric Vehicles Fluids and Lubricants Market Size 2024 |

USD 957.5 million |

| Electric Vehicles Fluids and Lubricants Market, CAGR |

28.45% |

| Electric Vehicles Fluids and Lubricants Market Size 2032 |

USD 7095.97 million |

The Electric Vehicles (EV) fluids and lubricants market is shaped by the presence of major global players, including Exxon Mobil, Shell, BP, TotalEnergies, FUCHS, PETRONAS, Saudi Arabian Oil Co., Repsol, ENEOS, and Gulf Oil International. These companies compete through advanced EV-specific coolants, dielectric fluids, and long-life synthetic lubricants developed in collaboration with leading automakers. Asia Pacific leads the global market with an exact share of 38%, driven by high EV manufacturing activity, large-scale battery production, and strong policy support in China, Japan, South Korea, and India. This regional dominance continues to attract aggressive expansion and product innovation from key industry participants.

Market Insights

- Electric vehicles fluids and lubricants market was valued at USD 957.5 million in 2024 and is anticipated to reach USD 7095.97 million by 2032, growing at a CAGR of 28.45% during the forecast period.

- Rapid EV adoption driven by emissions regulations, government incentives, and OEM electrification strategies fuels demand for specialized thermal-management fluids and low-viscosity lubricants.

- A shift toward synthetic, long-life, and eco-friendly formulations is emerging as automakers and lubricant firms collaborate to optimize performance for next-generation electric drivetrains.

- Market competition remains intense, with major players like ExxonMobil, Shell, BP, TotalEnergies, FUCHS, PETRONAS, Repsol, ENEOS, and others racing to co-develop EV-specific products and expand geographically.

- High R&D costs, lack of global standardization of EV fluid specs, and a structural decline in lubricant volumes per vehicle especially in full BEVs pose key challenges, while Asia

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the EV fluids and lubricants market, engine oil remains the dominant product sub-segment, holding an estimated 55–56% share, primarily due to the extensive use of hybrid electric vehicles that still depend on internal combustion components. Specialized EV-compatible engine oils support reduced friction, enhanced thermal stability, and protection under high motor torque, making them essential for hybrid powertrains. Rising OEM specifications for EV-tailored lubricants and growing hybrid vehicle production continue to accelerate demand in this category, reinforcing its leading position.

- For instance, Shell’s Helix Hybrid 0W-20 uses its PurePlus Technology to produce a base oil that is 99.5% pure, offering very strong antioxidation stability and flow down to –40 °C, which helps performance in cold starts.

By Vehicle Type

Among vehicle categories, on-highway electric vehicles command the largest share at approximately 68–72%, driven by the rapid global expansion of electric passenger cars, commercial vans, and buses. These vehicles operate across extended duty cycles and high-mileage applications, creating strong demand for advanced thermal-management fluids, coolants, and transmission lubricants. Increasing fleet electrification, urban mobility programs, and the growth of long-range EV platforms further support the dominance of this sub-segment in the market.

- For instance, Shell has co-engineered its E-Fluid portfolio with commercial bus OEMs: its E-Thermal Fluid (for batteries and power electronics) exhibits 8× lower electrical conductivity compared to a conventional heavy-duty ATF, enabling safer operation in sealed high-voltage systems.

By Propulsion Type

In propulsion systems, hybrid electric vehicles (HEVs) lead the market with a share of around 74–75%, primarily because they incorporate both electric motors and internal combustion engines, requiring a wider range of fluids such as engine oils, coolants, and transmission fluids. Their dual-system architecture increases overall lubricant consumption compared to battery-electric vehicles. Continued hybrid adoption by major automakers, supported by fuel-efficiency regulations and cost-effective electrification strategies, sustains the strong demand for HEV-specific fluid formulations.

Key Growth Drivers

Rising Global Electrification and Expanding EV Fleet

The continuous rise in electric vehicle adoption remains one of the strongest drivers of demand for specialized EV fluids and lubricants. Governments worldwide are enforcing stricter emissions norms, offering incentives, and investing heavily in charging infrastructure, which collectively accelerate EV penetration. As the global fleet expands, the requirement for advanced fluids such as battery coolants, dielectric fluids, and e-motor greases grows proportionally. Unlike conventional vehicles, EVs rely heavily on superior thermal management to enhance battery efficiency and prevent overheating, pushing manufacturers to innovate high-performance formulations. Increasing production of passenger EVs, electric two-wheelers, and commercial electric fleets further contributes to the rising consumption of specialized lubricants. OEMs are integrating tailored fluid systems to improve longevity, reduce energy loss, and support fast-charging environments, reinforcing this driver.

- For instance, Repsol has developed a battery-thermal fluid that delivers a dielectric breakdown voltage of 77 kV and a kinematic viscosity of 27.4 cSt at 40 °C, supporting direct immersion cooling in high-voltage EV battery modules.

Advancements in Thermal Management and Lubrication Technologies

Rapid technological innovation in EV thermal management systems significantly boosts market growth. Modern EVs operate under higher voltages and generate intense localized heat, particularly within battery packs, power electronics, and electric motors. This has led to an increased need for high-performance fluids capable of delivering superior cooling efficiency and electrical insulation. Manufacturers are developing dielectric coolants, long-life transmission fluids, and low-viscosity lubricants that minimize friction and improve drivetrain efficiency. These innovations help extend component life, enhance vehicle range, and support next-generation battery chemistries such as solid-state systems. With OEMs focusing on improving energy density and fast-charging capabilities, demand grows for fluids that can stabilize temperatures under extreme loads. The ongoing shift toward integrated e-axle systems and compact powertrains further strengthens the need for specialized lubrication technologies.

- For instance, 3M’s Novec™ 649 dielectric coolant supports immersion cooling with a boiling point of 49 °C, thermal conductivity of 0.069 W/m·K, and dielectric strength of 40 kV, enabling direct-contact cooling for high-power battery modules used in prototype solid-state systems.

Increasing Hybrid Vehicle Production and Diverse Fluid Requirements

The surge in hybrid electric vehicle (HEV) production acts as an important growth driver, as hybrids require a broader range of fluids compared to purely battery-electric vehicles. HEVs combine electric motors with internal combustion engines, which means they still rely on engine oils, transmission fluids, and cooling solutions traditionally used in ICE platforms—along with EV-specific fluids. This dual-system architecture increases overall fluid consumption per vehicle, creating strong market potential. Automakers are expanding their hybrid portfolios to meet fuel-efficiency regulations in markets where full EV adoption is slower, further boosting demand for specialized lubricants. HEV engines also operate under unique thermal and mechanical loads due to frequent start-stop cycles and regenerative braking, increasing the need for advanced formulations that enhance durability and system reliability. This structural demand ensures steady market growth even as BEV adoption accelerates.

Key Trends & Opportunities

Growth of EV-Specific Synthetic and Long-Life Fluids

A major trend shaping the market is the shift toward fully synthetic, long-life, and low-viscosity fluids optimized for EV architectures. As automakers aim to reduce maintenance intervals and enhance vehicle efficiency, synthetic formulations offer extended durability, improved oxidation stability, and superior heat dissipation. Opportunity emerges as OEMs increasingly collaborate with lubricant manufacturers to co-develop customized fluids for new-generation motors, integrated e-axles, and high-performance drivetrains. Fluids that support high-speed motor rotation, minimize electrical losses, and operate safely in wide temperature ranges are gaining prominence. Additionally, the market is witnessing increased focus on eco-friendly and biodegradable fluids aligned with sustainability goals. Suppliers that invest in research and partner with OEMs stand to capture substantial opportunities in premium-value product categories.

- For instance, Cargill’s Priolube™ EF 3446, a fully synthetic dielectric ester base oil, has a kinematic viscosity of 6.1 cSt at 40 °C and 2.0 cSt at 100 °C, which helps reduce churning losses in e-axles while maintaining load-carrying capability.

Rapid Expansion of EV Thermal Management Innovations

Thermal management remains one of the most dynamic areas of opportunity, as EV batteries, inverters, and motors demand precise temperature control for optimal performance. The trend is shifting toward immersion cooling, liquid-to-air systems, and advanced dielectric fluids capable of direct battery contact. These technologies offer major opportunities for fluid manufacturers to develop formulations that enhance safety, support fast charging, and improve battery lifespan. As automakers reduce battery spacing and push for compact pack designs, high-performance coolants become essential. Moreover, high-voltage charging systems used in commercial EVs create demand for fluids that manage extreme heat loads. The intersection of battery innovation and fluid development presents a substantial long-term opportunity for suppliers focusing on next-generation energy storage systems.

- For instance, BASF’s GLYSANTIN® G22® ELECTRIFIED® coolant maintains an electrical conductivity of ≤ 50 µS/cm at 20 °C, which ensures low and stable currents under a 4 V source, minimizing hydrogen generation and fluid decomposition.

Growth Potential in Commercial EV and Fleet Electrification

Fleet electrification particularly in logistics, ride-hailing, and public transportation—presents a growing market opportunity for EV fluids and lubricants. Commercial EVs operate longer daily distances, experience higher load cycles, and rely on fast charging, making effective thermal and lubrication systems critical. These conditions drive stronger demand for high-performance coolants, gear oils, and greases tailored for heavy-duty electric powertrains. Governments are increasingly mandating zero-emission public transport fleets, which further boosts product requirements. As fleet operators prioritize efficiency, uptime, and total cost of ownership, suppliers have opportunities to offer advanced, long-life, and maintenance-reducing fluid formulations. This segment is expected to attract significant investments in the coming years.

Key Challenges

Limited Standardization and High R&D Costs

One of the key challenges in the EV fluids market is the lack of industry-wide standardization for fluid requirements across different vehicle platforms. Each OEM develops its own EV architecture, battery chemistry, and thermal management system, requiring custom-formulated fluids. This raises development costs for lubricant manufacturers and complicates mass-scale production. High R&D investment is required to create formulations that meet stringent electrical insulation, material compatibility, and performance specifications. Manufacturers face long testing cycles and rigorous validation procedures before approval. Smaller companies struggle to compete due to the capital-intensive nature of EV fluid innovation. The absence of harmonized standards also limits cross-compatibility, slowing market scalability.

Reduced Fluid Consumption in Fully Electric Vehicles

Another major challenge is the declining consumption of traditional lubricants as the market shifts toward battery-electric vehicles (BEVs). Unlike hybrids or ICE vehicles, BEVs eliminate the need for engine oils and require significantly fewer mechanical lubricants. While specialized EV fluids such as coolants and dielectric lubricants are growing, their total volume per vehicle is comparatively lower. This structural reduction in fluid usage tightens market potential and intensifies competition among suppliers. Companies must continuously innovate higher-value products to offset declining volumes. As BEV technology improves with solid-state batteries and simplified powertrain designs, fluid requirements may decrease further, posing a long-term challenge for traditional lubricant manufacturers

Regional Analysis

North America

In North America, the EV fluids and lubricants market holds approximately 25–28% of global revenue, driven by strong EV adoption in the U.S. and Canada. The region benefits from tight emissions regulations, government incentives, and a mature automotive industry that rapidly integrates advanced thermal management and lubricant systems into EV powertrains. Major OEMs and lubricant suppliers collaborate closely to develop high-performance synthetic coolants and greases tailored for harsh driving conditions and cold climates, which supports both innovation and steady market growth.

Europe

Europe accounts for about 25–30% of the global EV fluids and lubricants market, reflecting its aggressive push toward decarbonization. The region’s regulatory environment—anchored in the European Green Deal—presses automakers to accelerate EV deployment, creating strong demand for specialized coolants, dielectric fluids, and EV-grade lubricants. High EV penetration in major markets like Germany, France, and the Nordic countries stimulates investments in next-generation thermal management solutions. Furthermore, Europe’s established automotive R&D ecosystem strengthens partnerships between OEMs and fluid-technology providers.

Asia Pacific

Asia Pacific dominates the EV fluids and lubricants space with a share of 35–40%, underpinned by massive EV production in China, Japan, South Korea, and India. Supportive government policies, large-scale investment in charging infrastructure, and local OEM manufacturing capacity drive demand for specialized fluids tailored to high-volume EV platforms. The intensity of thermal management needs in densely populated and hotter regions amplifies the consumption of coolants and dielectric fluids. Additionally, regional players are innovating aggressively in greases and long-life lubricants suited for fast-charging and high-power EV systems.

Latin America

Latin America contributes roughly 4–6% to the global market for EV fluids and lubricants, reflecting its emerging but growing EV ecosystem. Market growth hinges on rising EV adoption in countries such as Brazil, Mexico, and Chile, spurred by improving charging infrastructure and government incentives. While demand is still relatively modest compared to more mature markets, there is growing interest in thermal-management fluids and low-viscosity lubricants. Infrastructure investments and OEM expansion in the region present meaningful opportunities for fluid suppliers willing to localize and scale operations.

Middle East & Africa

The Middle East & Africa (MEA) region holds around 3–5% of the global EV fluids and lubricants market. EV adoption here is nascent but accelerating, especially in the UAE, Saudi Arabia, and South Africa, where sustainability and clean-energy mandates are gaining traction. High ambient temperatures create unique thermal management challenges, which elevate demand for robust coolants and advanced dielectric fluids. Meanwhile, limited local manufacturing encourages partnerships with global fluid suppliers to establish supply chains that can cater to the distinctive performance needs of EVs in this region.

Market Segmentations:

By Product Type

- Engine oil

- Coolants

- Transmission fluids

- Greases

By Vehicle Type

- On-highway Electric Vehicles

- Off-highway Electric Vehicles

By Propulsion Type

- Battery electric vehicles

- Hybrid electric vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the electric vehicle fluids and lubricants market is characterized by strong participation from global energy giants, specialized lubricant manufacturers, and automotive fluid technology innovators. Leading companies such as Exxon Mobil, Shell, BP, TotalEnergies, FUCHS, PETRONAS, and ENEOS focus on expanding their EV-specific portfolios, including dielectric coolants, long-life transmission fluids, and high-performance greases tailored for electric powertrains. These players invest heavily in research collaborations with OEMs to co-develop advanced thermal management solutions that meet evolving EV architecture requirements. Competitive strategies emphasize product innovation, sustainability, and geographic expansion, supported by partnerships and acquisitions to strengthen supply chains. Companies increasingly prioritize synthetic, eco-friendly, and high-efficiency formulations to differentiate themselves in a market where technical performance and compatibility with next-generation batteries remain critical competitive factors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Repsol

- BP Plc.

- Gulf Oil International Ltd.

- Saudi Arabian Oil Co.

- FUCHS

- TotalEnergies

- Exxon Mobil Corporation

- Shell Plc.

- ENEOS Corp.

- Petroliam Nasional Berhad (PETRONAS)

Recent Developments

- In September 2024, BP plc (Castrol) brand introduced Castrol ON EV Transmission Fluids W2 and W5 for EVs with wet e-motors, expanding its Castrol ON EV thermal, transmission, and grease portfolio; by 2023, three of the world’s four largest motor manufacturers were already using Castrol electric-vehicle fluids as factory fill.

- In June 2023, Gulf Oil International Ltd. launched Gulf eLEC Brake Fluid and related EV coolant solutions, formulated to handle high brake-system demands in EVs and to keep traction batteries within optimal temperature ranges, building on its earlier Gulf eLEC driveline and coolant EV-fluid range.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type, Propulsion Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand rapidly as global EV adoption accelerates and OEMs increase production of high-performance electric powertrains.

- Demand for advanced thermal-management fluids will rise with the growth of fast-charging infrastructure and high-voltage battery systems.

- Dielectric coolants will gain stronger penetration as immersion cooling technologies become more widely integrated into EV battery packs.

- Synthetic and long-life lubricants will see higher uptake as automakers target extended service intervals and reduced maintenance requirements.

- Hybrid vehicles will continue generating significant fluid demand due to their dual powertrain architecture.

- Collaboration between lubricant manufacturers and EV OEMs will intensify to co-develop customized formulations for next-generation platforms.

- Sustainability will influence product innovation, driving interest in biodegradable and energy-efficient EV fluids.

- Regional leaders in EV manufacturing, particularly Asia Pacific, will strengthen their dominance in production and consumption.

- Increased regulatory focus on battery safety will accelerate development of thermally stable and fire-resistant fluids.

- Competitive differentiation will rely on R&D capabilities, rapid product testing, and strong partnerships across automotive supply chains.