Market Overview

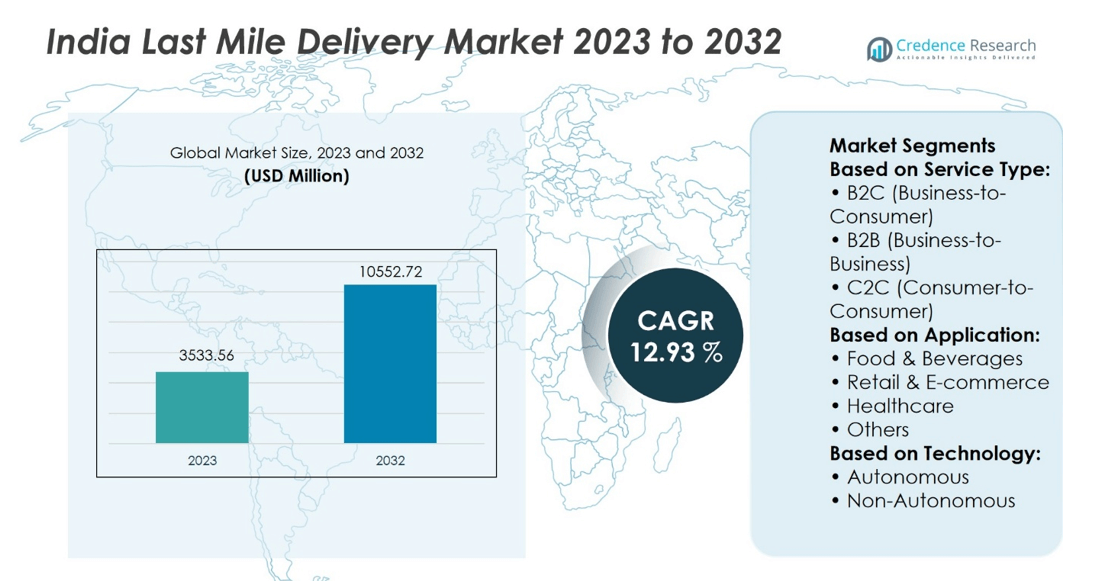

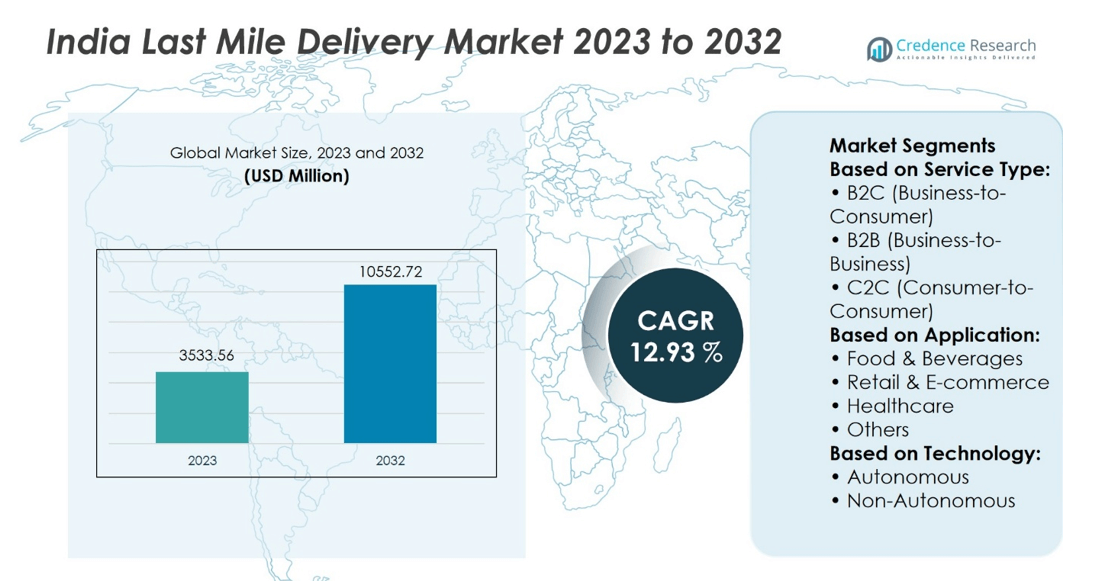

India Last Mile Delivery Market size was valued at USD 3533.56 million in 2023 and is anticipated to reach USD 10552.72 million by 2032, at a CAGR of 12.93% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| India Last Mile Delivery Market Size 2024 |

USD 3533.56 million |

| India Last Mile Delivery Market, CAGR |

12.93% |

| India Last Mile Delivery Market Size 2032 |

USD 10552.72 million |

The India Last Mile Delivery Market grows on strong drivers such as rapid e-commerce expansion, rising urbanization, and evolving consumer lifestyles that demand faster and more reliable fulfillment. It gains momentum from the adoption of advanced technologies like AI-driven route optimization, real-time tracking, and predictive analytics, which improve efficiency and transparency. Sustainability also shapes the market, with companies deploying electric vehicles and greener delivery models. Trends include the rise of hyperlocal networks, quick commerce, and expansion into tier-II and tier-III cities. It evolves as a critical enabler of digital commerce, blending innovation with nationwide accessibility.

The India Last Mile Delivery Market shows strong geographical variation, with southern and northern regions leading growth due to dense urban populations, advanced infrastructure, and high e-commerce penetration, while western and eastern regions expand steadily through rising digital adoption and localized logistics networks. Key players shaping the market include DHL Group, FedEx Corp, United Parcel Service Inc, com Inc, and Ekart. It reflects a competitive landscape where both global leaders and domestic specialists invest in technology, sustainability, and network expansion.

Market Insights

- India Last Mile Delivery Market size was valued at USD 3533.56 million in 2023 and is expected to reach USD 10552.72 million by 2032, at a CAGR of 12.93%.

- Rapid e-commerce growth, urbanization, and shifting consumer lifestyles drive strong demand for faster and reliable fulfillment.

- Adoption of AI-driven route optimization, predictive analytics, and real-time tracking improves delivery efficiency and customer transparency.

- Competition intensifies as global logistics leaders and domestic specialists invest in technology, sustainability, and network expansion.

- High operational costs, traffic congestion, and infrastructure gaps act as restraints that challenge profitability and service consistency.

- Southern and northern regions lead growth due to dense populations and advanced infrastructure, while western and eastern regions grow steadily with rising digital adoption.

- Key players such as DHL Group, FedEx Corp, United Parcel Service Inc, com Inc, and Ekart strengthen networks through innovation and strategic partnerships.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

E-Commerce Expansion Driving Delivery Volumes

The India Last Mile Delivery Market grows rapidly with the surge of e-commerce platforms serving urban and semi-urban regions. The rise of online marketplaces and direct-to-consumer brands fuels high-frequency order volumes. Consumers demand quick fulfillment, and this pushes companies to strengthen logistics infrastructure. Large players like Amazon and Flipkart scale delivery fleets to meet same-day and next-day expectations. Regional e-commerce startups expand networks to capture tier-II and tier-III demand. It supports growth in both parcel density and geographical coverage, making last mile delivery a critical enabler of online retail.

Rising Urbanization and Changing Consumer Lifestyles

Rapid urbanization shapes delivery models across metro and tier-I cities, where consumer lifestyles demand convenience. Increasing working populations depend on flexible delivery slots for groceries, apparel, and electronics. This trend creates opportunities for logistics companies to invest in micro-fulfillment centers. It also boosts reliance on technology-driven scheduling systems that optimize workforce efficiency. Food delivery platforms like Swiggy and Zomato influence consumer expectations for speed and reliability. The shift in lifestyle preferences accelerates last mile service adoption across urban clusters.

- For instance, Swiggy completed over 2,000 million orders in 2023, powered by AI-enabled demand prediction and optimized rider allocation, underscoring how changing lifestyles accelerate last mile service adoption across urban clusters.

Technological Integration Enhancing Delivery Efficiency

Advanced technology remains a key driver in improving efficiency and customer satisfaction. Artificial intelligence and route optimization tools reduce delivery times and fuel costs. Real-time tracking systems create transparency and trust for end-users. Companies invest in electric vehicles and drones to address sustainability concerns and reach congested or remote zones. It enhances operational resilience while supporting faster delivery turnaround. Logistics platforms integrate machine learning for demand prediction, aligning capacity with peak shopping seasons. The push for automation strengthens reliability in the India Last Mile Delivery Market.

- For instance, Delhivery does handle a very large volume of shipments. They process over 1.5 million packages daily, which translates to roughly 547.5 million shipments annually, not 1.5 billion.

Government Initiatives and Infrastructure Development

Supportive government initiatives act as a catalyst for market expansion. Investment in road networks, digital infrastructure, and smart city projects improves delivery accessibility. The introduction of policies favoring electric mobility encourages companies to deploy greener fleets. It helps logistics providers lower operational costs while aligning with sustainability goals. Regulatory frameworks for digital payments also promote cashless transactions, reducing delays in the delivery cycle. Public-private partnerships drive innovation in supply chain efficiency. Infrastructure reforms and digital adoption together create a favorable environment for scaling last mile delivery services.

Market Trends

Growth of Hyperlocal Delivery Models

The India Last Mile Delivery Market witnesses strong traction from hyperlocal models serving food, grocery, and essential retail categories. Consumers expect instant fulfillment, which drives companies to position dark stores and micro-warehouses closer to demand clusters. Food aggregators and quick commerce players dominate this trend with 10-to-30-minute delivery commitments. It pushes logistics partners to optimize delivery density and improve vehicle utilization. Retailers integrate hyperlocal services to compete with established marketplaces. The model supports demand in urban zones where convenience and immediacy influence purchasing choices.

Rising Adoption of Electric Vehicles and Green Logistics

Sustainability shapes operational strategies across last mile networks. Logistics companies invest in electric two-wheelers and small vans to reduce emissions and control fuel costs. It aligns with government policies that encourage greener fleets through incentives and infrastructure. Startups experiment with battery-swapping stations to increase vehicle availability. Large delivery firms form partnerships with EV manufacturers to scale adoption. The India Last Mile Delivery Market benefits from this trend by reducing environmental impact while achieving cost efficiency.

- For instance, Flipkart’s announcement of over 10,000 electric vehicles in its delivery fleet, with a focus on Tier-1 cities, showcases its commitment to sustainable logistics.

Integration of Technology and Advanced Analytics

Technology adoption transforms how companies manage last mile delivery operations. Artificial intelligence tools enable precise demand forecasting, while advanced analytics support route planning. It reduces delivery times and ensures better allocation of fleets during peak periods. Real-time tracking platforms enhance customer engagement and satisfaction. Digital twins and simulation software gain traction for supply chain optimization. Companies also expand API integrations with retailers to create seamless fulfillment experiences across industries.

- For instance, Delhivery reported handling 250 million shipments in fiscal supported by machine learning algorithms for demand prediction.

Expansion into Rural and Semi-Urban Markets

Demand increasingly shifts beyond metro cities into tier-II and tier-III locations. Logistics players expand networks and set up localized distribution centers to meet growing rural orders. It requires flexible vehicle models and innovative delivery formats like hub-and-spoke systems. E-commerce firms push deeper penetration into underserved markets to capture new customers. Partnerships with regional logistics startups strengthen rural accessibility. This expansion diversifies growth sources and positions last mile delivery as a nationwide enabler of digital commerce.

Market Challenges Analysis

High Operational Costs and Logistical Complexities

The India Last Mile Delivery Market faces constant pressure from rising operational costs and logistical hurdles. Fuel price fluctuations, vehicle maintenance, and labor expenses create challenges in sustaining profitability. It struggles with fragmented networks where delivery partners manage multiple locations without efficient route planning. Urban congestion further delays fulfillment and adds to fuel consumption. Companies attempt to balance affordability with service quality, but high costs continue to erode margins. Seasonal peaks amplify complexities as demand surges require extra capacity and workforce. These factors make cost optimization one of the toughest challenges for logistics providers.

Infrastructure Gaps and Workforce Constraints

Limited infrastructure and workforce availability hinder reliable last mile execution across diverse regions. Many rural and semi-urban areas lack proper road connectivity, which restricts access for delivery fleets. It becomes difficult for companies to maintain consistency in service levels when infrastructure fails to support demand. Delivery personnel shortages create high attrition rates, impacting reliability and increasing training costs. Safety risks for riders in congested cities further complicate workforce stability. Payment collection in cash-on-delivery transactions also adds delays and inefficiencies. These structural barriers slow down the ability of the India Last Mile Delivery Market to achieve seamless nationwide coverage.

Market Opportunities

Expansion through Tier-II and Tier-III Market Penetration

The India Last Mile Delivery Market holds strong opportunities in expanding services to tier-II and tier-III cities, where e-commerce adoption continues to accelerate. Rising internet penetration and smartphone usage drive consumer access to digital marketplaces in semi-urban and rural areas. Companies can strengthen presence by establishing localized distribution hubs and partnering with regional logistics firms. It opens access to untapped demand while building brand loyalty in underserved regions. Flexible vehicle fleets and hub-and-spoke delivery models create efficient networks across diverse geographies. This expansion enables logistics providers to diversify revenue streams while improving national coverage.

Leveraging Technology and Sustainable Delivery Models

Advanced technology integration presents significant opportunities to optimize last mile operations. Artificial intelligence, predictive analytics, and automation enhance route efficiency, reduce delivery timelines, and improve customer experience. It allows companies to streamline operations during peak demand while lowering costs. Electric vehicles and green logistics strategies offer opportunities to align with sustainability goals while reducing fuel dependency. Partnerships with EV manufacturers and investments in charging infrastructure strengthen long-term scalability. The growing emphasis on eco-friendly logistics creates a favorable environment for innovation, positioning the India Last Mile Delivery Market as a driver of sustainable growth.

Market Segmentation Analysis:

By Service Type

The India Last Mile Delivery Market operates across B2C, B2B, and C2C delivery models, with B2C maintaining dominance due to the strong growth of e-commerce platforms. Consumers demand faster and more reliable delivery for online purchases, and companies respond with same-day and next-day services. B2B deliveries also gain momentum as manufacturers and wholesalers seek efficient supply chain links to retailers. It drives partnerships between logistics providers and enterprise clients to handle bulk movements with speed and accuracy. The C2C segment rises with digital platforms enabling peer-to-peer shipments, particularly in urban areas where convenience and affordability influence choices.

- For instance, Ekart, Flipkart’s logistics arm, processes over 10 million shipments per month, backed by expansive fulfillment infrastructure and optimized delivery networks, illustrating how B2C demand drives scale and innovation in last mile operations.

By Application

Food and beverages represent a significant share within last mile delivery due to the popularity of online food aggregators and quick commerce platforms. It creates demand for rapid fulfillment supported by dense local distribution networks. Retail and e-commerce applications expand quickly as online shopping penetrates across metros and semi-urban centers. Healthcare delivery, including medicines and critical supplies, emerges as a high-value application where precision and reliability remain essential. Other segments, including consumer electronics and personal goods, strengthen demand diversity and require flexible service models. The broadening of applications reinforces last mile delivery as a vital enabler of India’s digital economy.

By Technology

The integration of technology reshapes service capabilities across autonomous and non-autonomous delivery models. Non-autonomous delivery remains the current backbone, supported by fleets of two-wheelers, vans, and local distribution vehicles. It accounts for most volumes while companies focus on optimizing routes through AI and advanced analytics. Autonomous delivery represents an emerging frontier, with trials of drones and robotic carriers in controlled environments. Logistics providers invest in automation to address labor shortages, cut costs, and expand into hard-to-reach areas. The gradual adoption of autonomous solutions signals the market’s long-term shift toward innovative and sustainable delivery models.

- For instance, Delhivery operates in over 18,000 pin codes across India and processes more than 1.5 million shipments daily, supported by automated sortation hubs and AI-powered route planning systems.

Segments:

Based on Service Type:

- B2C (Business-to-Consumer)

- B2B (Business-to-Business)

- C2C (Consumer-to-Consumer)

Based on Application:

- Food & Beverages

- Retail & E-commerce

- Healthcare

- Others

Based on Technology:

- Autonomous

- Non-Autonomous

Based on the Geography:

- Southern India

- Northern India

- Western and Eastern India

Regional Analysis

Southern India

Southern India accounts for the largest share of the India Last Mile Delivery Market, contributing around 35% of the overall market. The region benefits from strong e-commerce penetration in states such as Karnataka, Tamil Nadu, Telangana, and Kerala, where urban populations adopt digital platforms at scale. Bengaluru, Chennai, and Hyderabad lead demand due to their concentration of tech-savvy consumers, advanced logistics infrastructure, and high density of delivery startups. Food and grocery delivery platforms such as Swiggy, BigBasket, and Dunzo strengthen last mile activity by building dense hyperlocal networks. It also benefits from strong connectivity through highways and expanding warehousing clusters, which enable efficient supply chain flows. The presence of multinational e-commerce giants and local logistics players ensures consistent innovation in delivery models, including the early adoption of electric vehicles. Southern India sets the benchmark for speed, efficiency, and digital adoption within last mile logistics.

Northern India

Northern India represents about 30% of the India Last Mile Delivery Market, driven by the economic influence of Delhi NCR, Punjab, Uttar Pradesh, and Haryana. The region is marked by high consumer spending and growing online retail adoption across urban and semi-urban clusters. Delhi NCR serves as a critical hub where logistics providers experiment with express delivery models to meet demand for same-day and next-day services. Food delivery continues to expand rapidly, supported by a young population and rising preference for convenience. It faces challenges from traffic congestion and seasonal disruptions, which force companies to adopt advanced route optimization and micro-warehousing strategies. Demand for healthcare delivery is also increasing, particularly in cities like Lucknow and Chandigarh, where timely access to medicines and medical devices has become critical. Northern India continues to attract heavy investment in last mile logistics infrastructure due to its large consumer base.

Western and Eastern India

Western India accounts for about 20% of the India Last Mile Delivery Market, led by Maharashtra and Gujarat where cities such as Mumbai, Pune, and Ahmedabad drive demand. High population density, thriving retail ecosystems, and the presence of major ports like Mumbai and Kandla support robust delivery operations. Logistics providers invest in hyperlocal fulfillment centers and electric two-wheeler fleets to manage demand efficiently across urban and industrial corridors. Eastern India contributes nearly 15% of the market, covering West Bengal, Odisha, Bihar, and Jharkhand. Demand concentrates in cities like Kolkata, Bhubaneswar, and Patna, where e-commerce platforms partner with regional logistics startups to expand reach. The region faces infrastructure challenges such as poor road connectivity and workforce shortages, yet rising digital penetration and growing healthcare delivery needs sustain momentum. Together, Western and Eastern India represent 35% of the India Last Mile Delivery Market, offering a mix of mature urban demand and emerging opportunities in underserved regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The India Last Mile Delivery Market include DHL Group, United Parcel Service Inc, FedEx Corp, com Inc, and Ekart. The India Last Mile Delivery Market is highly competitive, with both global logistics providers and domestic companies expanding aggressively to capture growing e-commerce and retail demand. Competition intensifies around delivery speed, service reliability, and coverage across metro, semi-urban, and rural areas. Companies differentiate through investments in technology such as AI-driven route optimization, real-time tracking systems, and predictive analytics to enhance operational efficiency. Sustainability has become a defining factor, with firms deploying electric vehicles and exploring alternative delivery models to reduce costs and environmental impact. Hyperlocal delivery networks, quick commerce integration, and healthcare logistics also emerge as areas of strong rivalry. The ability to scale infrastructure rapidly, align with regional needs, and build customer-centric solutions shapes competitive positioning. Players that leverage innovation, invest in localized hubs, and create end-to-end digital ecosystems are better positioned to lead in this evolving market.

Recent Developments

- In March 2025, Ekart partnered with IKEA to manage last-mile deliveries of home furnishings in North India.

- In January 2025, FedEx launched FedEx Surround® in India, an advanced monitoring and intervention solution designed to provide near-real-time shipment visibility, AI-powered predictive analytics, and enhanced handling for sensitive shipments.

- In December 2024, Indian Railways is transforming its parcel business through improved logistics efficiency, streamlined operations, and the use of digital tracking systems. Such upgrades shorten transit times and facilitate quicker movement of goods nationwide.

- In August 2024, Amazon India entered into an MoU with Indian Railways to improve the logistics of e-commerce through the optimization of hub-and-spoke networks and utilization of railway infrastructure for quicker movement of packages.

Market Concentration & Characteristics

The India Last Mile Delivery Market displays moderate concentration, where a mix of global logistics providers, e-commerce giants, and domestic specialists compete for market share. It is defined by high-volume parcel movements driven by e-commerce growth, food delivery expansion, and increasing adoption of hyperlocal models. Large players dominate metro and tier-I cities with advanced technology, dense fleets, and established infrastructure, while regional operators play a crucial role in tier-II and tier-III locations by offering flexible and cost-effective services. The market emphasizes speed, transparency, and reliability, with consumers expecting real-time tracking, faster fulfillment, and convenient payment options. It continues to shift toward sustainability, with growing investments in electric vehicles and green logistics solutions. Intense competition fosters innovation, pushing companies to adopt AI-based route optimization, digital platforms for customer engagement, and partnerships that strengthen last mile networks. Market characteristics also include high operational costs, workforce dependency, and the need for scalable delivery infrastructure to meet fluctuating demand. The India Last Mile Delivery Market reflects a dynamic structure where scale, adaptability, and technology integration determine long-term leadership.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Application, Technology and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- E-commerce growth will continue to drive higher parcel volumes across metro and semi-urban regions.

- Quick commerce and hyperlocal delivery will expand further with demand for groceries and essentials.

- Companies will increase adoption of electric vehicles to lower fuel costs and support sustainability goals.

- Investment in micro-fulfillment centers will improve speed and delivery efficiency.

- Artificial intelligence and predictive analytics will enhance route planning and demand forecasting.

- Drone and autonomous delivery trials will gain momentum in controlled environments.

- Tier-II and tier-III cities will emerge as high-potential markets for logistics expansion.

- Healthcare and pharmaceutical delivery will gain strategic importance with rising online demand.

- Strategic partnerships between logistics providers and e-commerce platforms will strengthen service networks.

- Customer expectations for real-time tracking and flexible delivery options will shape innovation in services.