Market Overview

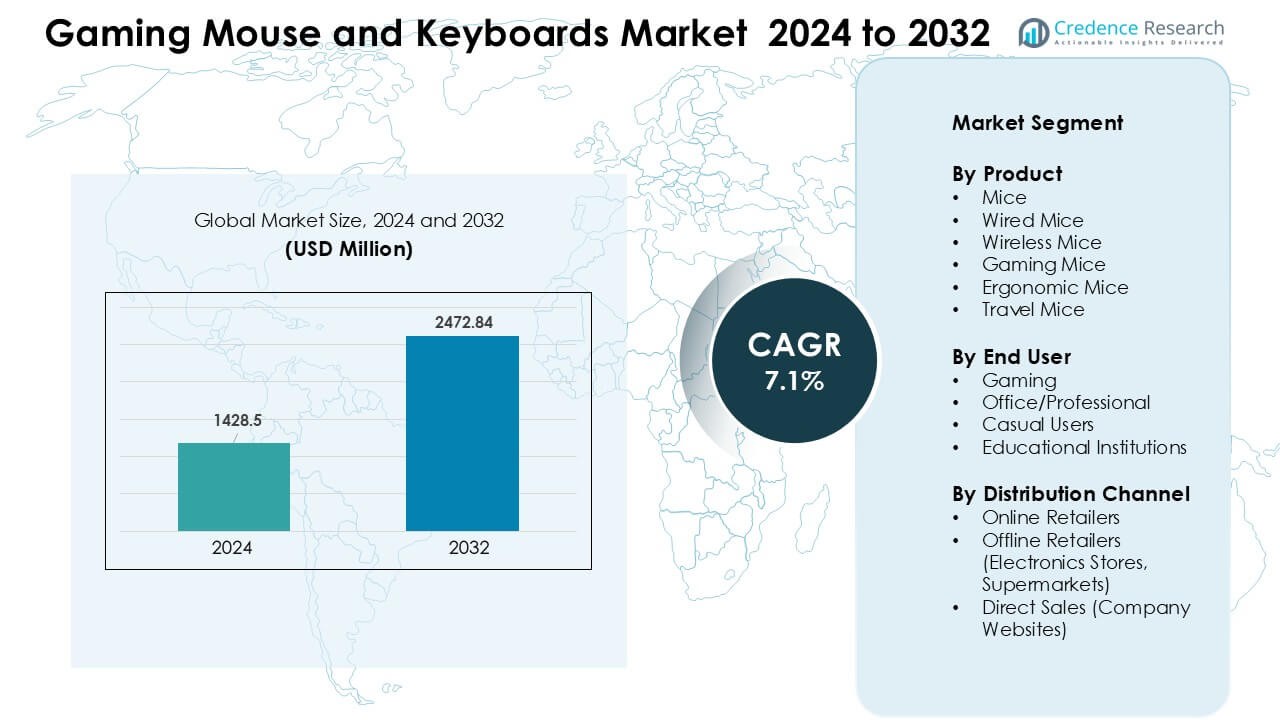

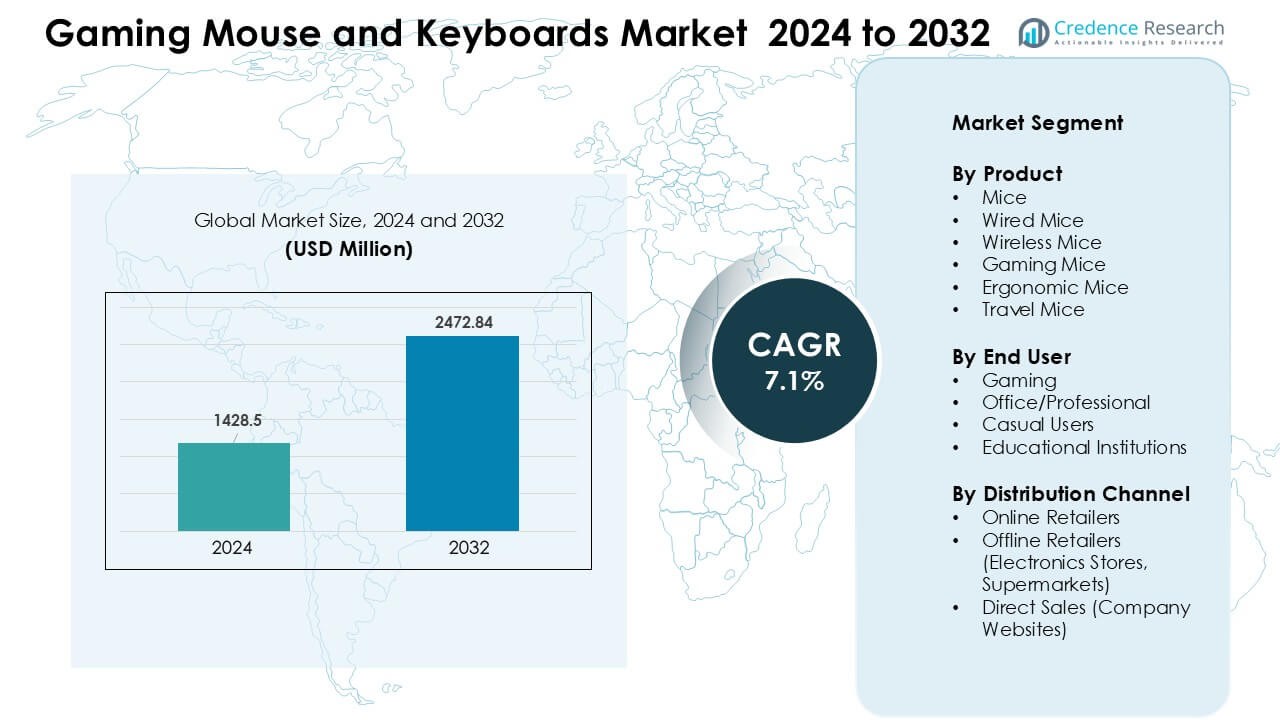

Gaming Mouse and Keyboards Market was valued at USD 1428.5 million in 2024 and is anticipated to reach USD 2472.84 million by 2032, growing at a CAGR of 7.1 % during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gaming Mouse and Keyboards Market Size 2024 |

USD 1428.5 Million |

| Gaming Mouse and Keyboards Market, CAGR |

7.1 % |

| Gaming Mouse and Keyboards Market Size 2032 |

USD 2472.84 Million |

The Gaming Mouse and Keyboards Market is shaped by major companies such as Dell (Alienware), HyperX, ASUS, Lenovo, Corsair, HP, Microsoft, SteelSeries, Razer, and Logitech. These brands compete through advanced sensors, mechanical switch technology, RGB ecosystems, and strong esports partnerships. Product portfolios continue to expand as firms offer wired and wireless models for both entry-level and professional players. North America leads the global market with a 34% share in 2024, driven by high gaming PC adoption, strong online retail presence, and rising demand for premium peripherals across competitive and casual gaming communities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Gaming Mouse and Keyboards Market was valued at USD 1428.5 million in 2024 and is projected to reach USD 2472.84 million by 2032, growing at a CAGR of 7.1%.

- Rising gaming activity and esports growth drive strong demand, with gaming users holding the largest share due to higher adoption of precision mice and mechanical keyboards.

- Wireless technology, RGB customization, and ergonomic designs shape market trends as players seek better comfort, aesthetics, and performance across mid-range and premium segments.

- Competition intensifies among Dell (Alienware), HyperX, ASUS, Lenovo, Corsair, HP, Microsoft, SteelSeries, Razer, and Logitech as brands invest in innovation, esports partnerships, and integrated software ecosystems.

- North America leads with a 34% share, followed by Asia-Pacific at 31% and Europe at 28%, while gaming mice remain the top product category with the highest segment share.

Market Segmentation Analysis:

By Product

Gaming mice held the dominant share in 2024 due to strong adoption among esports players and hobby gamers. These devices offered high DPI settings, fast response rates, and customization that improved gameplay. Wired gaming mice also showed steady demand because many players preferred stable connections for competitive use. Wireless gaming mice grew as battery life improved and latency decreased, making them appealing to a wider audience. Ergonomic and travel mice kept niche demand from comfort-focused and mobile users.

- For instance, Logitech’s G Pro X Superlight 2 features a 32,000 DPI HERO 2 sensor and maintains latency under 1 ms with its wireless Lightspeed technology making it a top pick among esports professionals.

By End User

Gaming users accounted for the largest share in 2024, driven by rising esports events and steady interest in PC gaming. Many players sought high-precision mice and keyboards for better control during fast action titles. Office and professional users showed stable adoption as companies invested in ergonomic gear for long work hours. Casual users supported demand through mid-range products, while educational institutions increased purchases for computer labs and training centers.

- For instance, The Zowie EC2 gaming mouse is engineered for competitive FPS play with a 3360 optical sensor and is widely used in esports tournaments including CS:GO Majors.

By Distribution Channel

Online retailers held the leading share in 2024, supported by wide product variety, fast delivery, and strong discount options. Many buyers preferred online platforms because they compared features and checked reviews before purchasing gaming gear. Offline retailers such as electronics stores and supermarkets stayed important for buyers who wanted hands-on testing. Direct sales through company websites grew as brands offered exclusive models and customization tools that attracted loyal users.

Key Growth Drivers

High Gaming Adoption and Esports Expansion

Growing interest in multiplayer titles and esports events drives strong demand for advanced gaming mice and keyboards. Many players want fast response times, customizable controls, and smooth tracking to compete effectively. Esports teams also push brands to develop models with better sensors and durable switches. Rising gameplay hours across regions support steady upgrades as users replace older devices for better comfort and accuracy. Streamers and content creators further shape buying decisions because audiences follow their gear choices. These combined factors keep gaming peripherals among the fastest-growing PC accessory categories.

- For instance, Logitech’s G502 HERO gaming mouse uses its “HERO 25K” sensor that supports up to 25,600 DPI with more than 400 IPS max tracking speed and 1000 Hz polling rate delivering sub-millisecond responsiveness and >250 km of PTFE-feet glide durability, ideal for high-intensity esports titles.

Shift Toward Customization and Ergonomics

Users now prefer products that match their play style, hand shape, and comfort needs. Many brands offer adjustable DPI, programmable buttons, and hot-swappable switches that give players more control. This level of fine-tuning helps reduce strain and improves reaction speed during long sessions. Ergonomic designs also gain value as players seek wrist support and lighter bodies for smooth movement. Premium models often include adjustable weights and flexible key layouts, which appeal to both competitive and everyday gamers. The rising focus on comfort and personalization continues to boost upgrade cycles.

- For instance, Logitech’s G502 HERO allows repositionable weights (five 3.6 g weights) letting users fine-tune the mouse balance to their hand posture or play style for optimal control and reduced wrist strain.

Technological Improvements in Wireless Performance

Advances in wireless transmission and battery efficiency encourage more players to shift away from wired gear. Modern wireless systems now match wired performance by offering low latency and stable connections during fast action. Longer battery life and rapid-charge features reduce downtime, making wireless devices practical for daily use. Many brands also add RGB lighting, smart sensors, and onboard memory without reducing efficiency. These improvements expand the appeal of wireless peripherals among both beginners and serious players. As technology matures, the wireless segment records consistent growth and wider adoption.

Key Trends & Opportunities

Growing Demand for RGB and Aesthetic Customization

Custom lighting and unique design themes shape buying behavior, especially among young users. Many players want peripherals that match their gaming setups and support synchronized lighting effects. Brands now release models with advanced RGB software, themed editions, and modular parts that enhance desk aesthetics. This trend strengthens premium sales and encourages users to upgrade even when older devices work well. The rising influence of social media and gaming influencers makes visual appeal a notable market opportunity.

- For instance, Corsair’s K100 RGB mechanical keyboard features 44-zone dynamic per-key RGB lighting and supports Corsair iCUE software, allowing full customization of lighting patterns and integration with other RGB peripherals for synchronized effects across multiple devices.

Rising Preference for Multi-Device Ecosystems

Players want seamless integration across their mice, keyboards, and headsets to create a unified setup. Many brands promote ecosystems that share software platforms, lighting systems, and macro profiles. This approach simplifies control and helps users stay consistent across games. Bundled offers and cross-device compatibility also increase brand loyalty. As ecosystem features improve, companies gain stronger recurring sales from returning users.

- For instance, Razer’s Synapse ecosystem allows users to control settings and macros across Razer mice, keyboards, and headsets with a single software platform, offering unified lighting and performance profiles that transfer across games.

Key Challenges

High Competition and Price Sensitivity

The market faces pressure from many global and regional brands offering similar features. This wide supply lowers prices and reduces margins, especially in entry-level and mid-range categories. Buyers often compare products online and choose cheaper alternatives with comparable performance. Brands must invest in design, marketing, and partnerships to stand out, which adds further cost. Price-sensitive users slow premium segment growth in certain regions.

Limited Differentiation in Commodity Segments

Basic wired mice and keyboards show minimal feature differences, which leads to slow replacement cycles. Many casual users only upgrade when devices fail, reducing steady demand. Vendors struggle to justify new models because improvements are small and hard to communicate. This challenge forces brands to lean heavily on marketing rather than performance upgrades. It also shifts focus toward specialized and premium segments where innovation has clearer value.

Regional Analysis

North America

North America held the largest share of the Gaming Mouse and Keyboards Market in 2024 with about 34%. Strong esports activity, high gaming PC adoption, and steady spending on premium peripherals supported this lead. Many users upgraded to high-DPI mice and mechanical keyboards for better accuracy. The U.S. market grew faster due to rising streamer influence and strong online retail penetration. Brands also benefited from large gaming communities and strong promotional events. Continued investment in wireless technology and RGB customization keeps North America a key growth hub.

Europe

Europe accounted for nearly 28% of the market share in 2024, supported by strong PC gaming culture and growing esports leagues across Germany, the U.K., France, and Nordic countries. Demand rose for advanced mechanical keyboards, ergonomic designs, and customizable mice as players focused on comfort and long-term durability. Online platforms and electronics retailers improved product reach with wide model availability. Sustainability trends also shaped buying choices, pushing brands to offer recyclable materials and energy-efficient features. Europe continues to show stable growth driven by high-performance gaming demand and technology upgrades.

Asia-Pacific

Asia-Pacific captured the fastest-growing share, reaching about 31% of the global market in 2024. Large gaming populations in China, South Korea, Japan, and India drove heavy adoption of gaming mice and keyboards. Esports tournaments and gaming cafés boosted demand for fast-response devices and high-end mechanical switches. Local and global brands expanded aggressively through online marketplaces, making products more accessible. Rising income levels and widespread mobile-to-PC gaming migration further lifted sales. Asia-Pacific is expected to remain a dominant growth engine due to strong gaming culture and rapid digital expansion.

Latin America

Latin America held close to 5% market share in 2024, with growing interest in competitive gaming across Brazil, Mexico, and Argentina. Young users drove strong demand for affordable but high-performance peripherals. Expansion of esports teams and gaming events encouraged upgrades to better sensors and durable switches. Online retailers improved product variety and pricing, helping users access models previously limited to major cities. Despite economic fluctuations, the region shows steady growth as players shift from casual accessories to branded gaming-grade peripherals.

Middle East & Africa

The Middle East & Africa region accounted for nearly 2% of the global market in 2024, driven by rising gaming communities in the UAE, Saudi Arabia, and South Africa. Growth came from expanding internet access, gaming cafés, and regional esports competitions. Many buyers preferred mid-range gaming mice and keyboards that balanced performance and price. Retail expansion and online marketplaces improved product reach across urban areas. Although the market remains small, rising disposable income and increasing local gaming events support gradual adoption of premium peripherals.

Market Segmentations:

By Product

- Mice

- Wired Mice

- Wireless Mice

- Gaming Mice

- Ergonomic Mice

- Travel Mice

By End User

- Gaming

- Office/Professional

- Casual Users

- Educational Institutions

By Distribution Channel

- Online Retailers

- Offline Retailers (Electronics Stores, Supermarkets)

- Direct Sales (Company Websites)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Gaming Mouse and Keyboards Market features strong activity from leading brands such as Dell (Alienware), HyperX, ASUS, Lenovo, Corsair, HP, Microsoft, SteelSeries, Razer, and Logitech. These companies compete through advanced sensor technology, mechanical switch innovation, and wider customization features that appeal to both casual and professional gamers. Many brands invest in esports sponsorships, influencer collaborations, and themed product launches to strengthen market visibility. Wireless innovation, ergonomic designs, RGB software ecosystems, and cross-device integration remain key areas of differentiation. Firms also expand through online retail channels and direct-to-consumer platforms, offering exclusive editions and personalized configurations. Rising demand for high-performance gaming setups encourages brands to increase R&D spending and enhance user experience through improved latency, battery life, and durability. As competition intensifies, vendors focus on delivering balanced pricing, strong build quality, and reliable after-sales support to maintain user loyalty in a rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Dell (Alienware)

- HyperX

- ASUS

- Lenovo

- Corsair

- HP

- Microsoft

- SteelSeries

- Razer

- Logitech

Recent Developments

- In April 2025, ASUS ROG announced a new peripherals lineup including the ROG Azoth X keyboard and ROG Keris II Origin mouse. The keyboard features hot‑swappable ROG NX mechanical switches V2, customizable keycaps, RGB lighting, an OLED display for system info/status, and multiple connectivity modes (2.4 GHz wireless, Bluetooth, wired).

- In January 2025, At CES 2025 HyperX launched the new Pulsefire Saga and Pulsefire Saga Pro gaming mice. The key novelty: a modular chassis main clicks and rear domes can be magnetically swapped. This allows gamers to customize the grip type to their liking.

- In January 2024, Alienware unveiled its first-ever pro‑grade wireless peripherals: the Alienware Pro Wireless Mouse and Alienware Pro Wireless Keyboard.

Report Coverage

The research report offers an in-depth analysis based on Product, End-User, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will rise as esports expansion encourages more players to upgrade gear.

- Wireless gaming peripherals will grow faster due to better latency and battery efficiency.

- Ergonomic designs will gain traction as users focus on comfort during long sessions.

- RGB lighting ecosystems will stay popular among gamers building themed setups.

- AI-based customization features will improve precision and adapt controls to gameplay styles.

- Cross-device software integration will strengthen brand loyalty and unified gaming systems.

- Premium mechanical keyboards will grow as users prefer durable switches and faster response.

- Cloud-based gaming profiles will help players maintain settings across multiple devices.

- Online retail channels will expand further through exclusive models and bundled offers.

- Asia-Pacific will emerge as the strongest growth hub supported by rising gaming populations.