Market Overview:

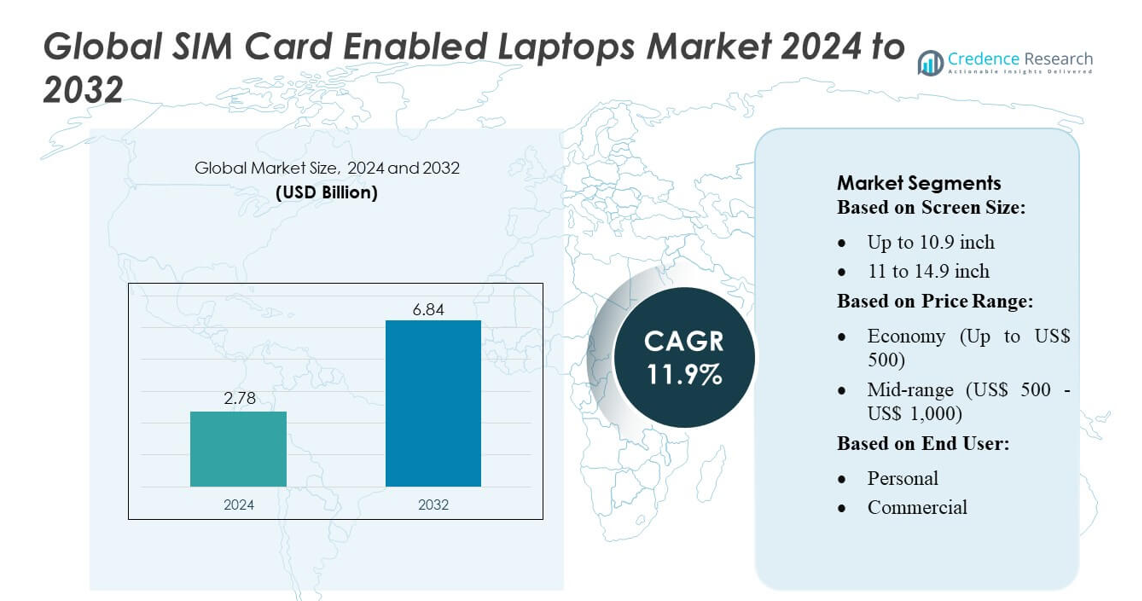

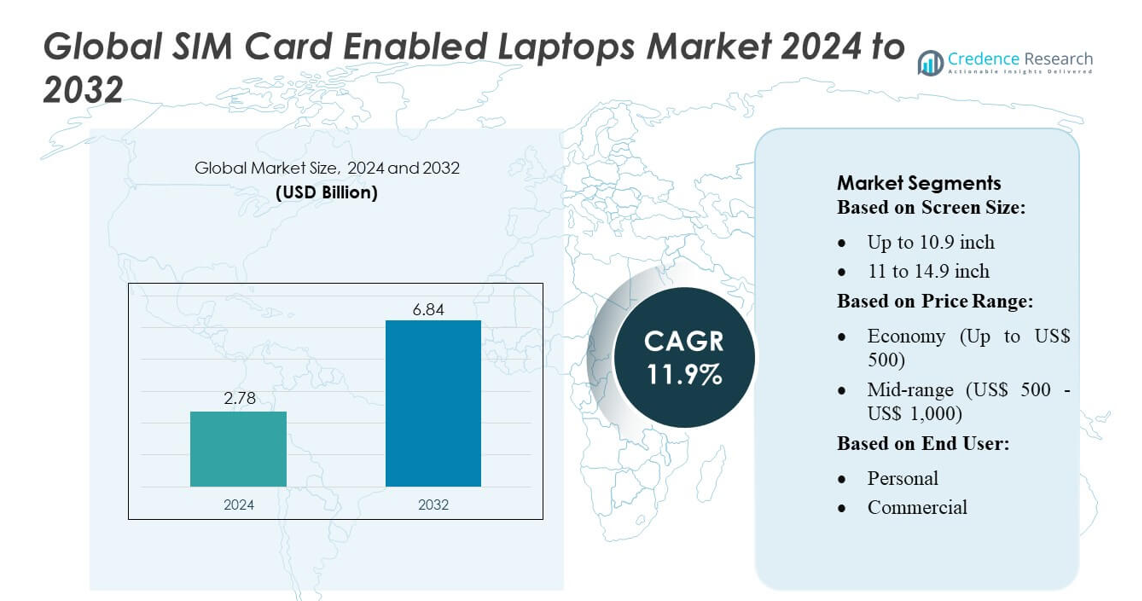

Global SIM Card Enabled Laptops Market size was valued USD 2.78 billion in 2024 and is anticipated to reach USD 6.84 billion by 2032, at a CAGR of 11.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| SIM Card Enabled Laptops Market Size 2024 |

USD 2.78 billion |

| SIM Card Enabled Laptops Market, CAGR |

11.9% |

| SIM Card Enabled Laptops Market Size 2032 |

USD 6.84 billion |

The Global SIM Card Enabled Laptops Market is highly competitive, with leading players including Microsoft Corporation, Acer Inc., Lenovo, Huawei Technologies Co., Ltd., Dell, HP Development Company, L.P., Apple Inc., Micro-Star International Co., Ltd. (MSI), LG, and ASUSTeK Computer Inc. These companies focus on product innovation, integration of 4G/5G connectivity, lightweight designs, and extended battery life to cater to mobile professionals, students, and hybrid workforces. Competitive strategies include regional expansion, bundled connectivity solutions, and R&D-driven enhancements. North America emerges as the leading region, accounting for approximately 35% of the global market, driven by high mobile broadband penetration, early adoption of hybrid work models, and strong consumer purchasing power. The combination of technological innovation, strategic partnerships, and robust infrastructure positions the region as a critical hub for market growth.

Market Insights

- The Global SIM Card Enabled Laptops Market was valued at USD 2.78 billion in 2024 and is projected to reach USD 6.84 billion by 2032, growing at a CAGR of 11.9% during the forecast period.

- Market growth is driven by rising demand for mobile connectivity, increasing adoption of hybrid work and remote learning, and technological advancements in lightweight designs and long-lasting batteries.

- Key trends include integration of 5G connectivity, expansion in emerging markets, and rising demand for mid-range and high-performance laptops for gaming, education, and corporate use.

- The market is highly competitive, with top players focusing on product innovation, bundled connectivity solutions, regional expansion, and strategic partnerships.

- North America leads the regional market with around 35% share, while the 11–14.9 inch screen segment dominates globally due to its balance of portability and productivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Screen Size

The 11 to 14.9-inch segment dominates the SIM card enabled laptops market, capturing approximately 45% share due to its optimal balance of portability and productivity. These laptops appeal to professionals and students who require lightweight devices without compromising on performance. Growth is driven by increasing mobile workforce adoption, rising demand for remote learning solutions, and advancements in battery efficiency that support longer connectivity. Smaller laptops (up to 10.9 inches) are gaining traction in ultra-portable niches, while larger screens (15 to 16.9 inches and above 17 inches) see moderate adoption among gaming and corporate users seeking immersive experiences.

- For instance, Acer Swift 14 AI, launched in 2024, integrate an AI‑ready NPU capable of 45 TOPS, a 75 Wh battery and offer up to 14.5″ 2.5K displays with 120 Hz refresh rate.

By Price Range

Mid-range laptops priced between US$ 500 and US$ 1,000 hold the largest share of approximately 50% in the SIM card enabled laptop market. This segment benefits from the affordability-performance balance, attracting a broad consumer base including students, remote workers, and small businesses. Drivers include increased adoption of mobile broadband solutions, competitive pricing strategies by manufacturers, and bundled connectivity services. Economy laptops (up to US$ 500) are growing in emerging markets, while high-end devices (above US$ 1,000) are favored for gaming, corporate, and specialized commercial applications demanding high processing power and premium features.

- For instance, Lenovo ThinkPad X13 Gen 6 provides optional 5G or 4G LTE WWAN via an integrated Nano‑SIM slot along with Wi‑Fi 6E support, enabling reliable mobile broadband access even when fixed internet is unavailable.

By End User

The personal segment leads with a market share of roughly 40%, driven by widespread adoption of mobile internet, remote work, and digital learning requirements. Consumers increasingly prefer laptops with integrated SIM cards for uninterrupted connectivity on-the-go. Corporate and commercial users also contribute significantly, leveraging these devices for field operations and mobile workforce management. Gaming, educational institutes, and BFSI segments are emerging rapidly due to demand for specialized applications, real-time data access, and secure network solutions, while industrial and creative studios adopt these laptops for mobile computing in remote or flexible operational environments.

Key Growth Drivers

Rising Demand for Mobile Connectivity

The surge in remote work, digital learning, and mobile computing is driving demand for SIM card enabled laptops. Consumers and enterprises increasingly prefer devices that provide seamless internet access without relying on Wi-Fi hotspots. This demand is particularly strong among professionals, students, and field-based workers who require uninterrupted connectivity. Advancements in 4G/5G integration, along with expanding mobile broadband networks globally, further enhance adoption. The ability to maintain productivity on-the-go is a critical factor, making mobile connectivity the primary growth driver in this market.

- For instance, MateBook 14 delivers a slim 1.31 kg design and a sharp 2880 × 1920 OLED panel — features that help maintain usability and portability even when users rely on mobile broadband networks over long periods.

Increasing Adoption Across Enterprises and SMBs

Corporate and commercial sectors are rapidly integrating SIM card enabled laptops to support field operations, sales teams, and mobile workforce management. Small and medium-sized businesses leverage these devices to reduce dependence on fixed internet infrastructure while enhancing real-time data access and collaboration. The adoption is also supported by enterprise-grade security solutions embedded in these laptops. This trend drives consistent demand across industries like BFSI, healthcare, and education, making organizational adoption a strong contributor to overall market growth.

- For instance, Dell WWAN module (DW5825e / DW5932e) uses an M.2 3042 Key‑B interface, supports LTE‑Advanced Cat12 or 5G NR (Sub‑6, 3GPP Release 16), and maintains compatibility across Latitude series systems.

Technological Advancements and Device Portability

Innovations in lightweight laptop designs, long-lasting batteries, and high-performance processors enhance the appeal of SIM card enabled laptops. Manufacturers are incorporating multi-band LTE/5G modules and advanced chipsets that enable faster connectivity and smoother user experiences. These technological improvements, combined with increasingly slim form factors, meet the growing consumer preference for portability without compromising functionality. As a result, enhanced device performance and convenience continue to fuel adoption across personal, corporate, and commercial segments globally.

Key Trends & Opportunities

Integration with 5G Networks

The transition from 4G to 5G connectivity is creating substantial opportunities for SIM card enabled laptops. 5G networks provide ultra-fast speeds, low latency, and reliable connections, supporting high-definition video streaming, cloud-based applications, and real-time collaboration. Laptop manufacturers are increasingly embedding 5G modules to cater to mobile professionals and gaming enthusiasts. This integration enables new business models, such as subscription-based connectivity services, and opens growth avenues in regions investing heavily in next-generation network infrastructure.

- For instance, HP EliteBook 840 14‑inch G11 Notebook PC offers a factory‑configurable 5G Sub‑6 Cat 19 eSIM WWAN option, enabling compatibility across multiple LTE and 5GNR (Sub‑6) bands — from Band 1 through Band 43 and n1/n3/n7/n20/n38 among others.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East offer significant growth potential due to rising internet penetration and mobile network coverage. Price-sensitive consumers are adopting mid-range SIM card enabled laptops for education and personal use, while enterprises leverage these devices for field operations. Government initiatives promoting digital literacy and remote working infrastructure further enhance demand. Manufacturers targeting these markets with cost-effective, portable, and connected devices can capture a larger market share and capitalize on the ongoing digital transformation.

- For instance, MacBook Air with M4 chip offers a 15.3‑inch Liquid Retina display, up to 32 GB unified memory, and a 66.5‑watt‑hour battery delivering up to 18 hours of video playback or 15 hours of wireless web browsing.

Growing Demand for Hybrid Work and Education Solutions

The post-pandemic shift toward hybrid work and online learning continues to drive demand for laptops with built-in SIM connectivity. Students, teachers, and professionals require uninterrupted internet access in remote or underserved locations. Educational institutions and corporates are investing in devices that support cloud-based applications, video conferencing, and collaborative tools. This trend not only expands the addressable market but also creates opportunities for laptop vendors to offer bundled connectivity plans, pre-installed productivity software, and tailored enterprise solutions to enhance user experience.

Key Challenges

High Device Costs and Connectivity Expenses

The higher price of SIM card enabled laptops, combined with recurring mobile data charges, poses a barrier to adoption, especially in price-sensitive markets. Many consumers and small businesses weigh the cost-benefit of built-in mobile connectivity versus relying on Wi-Fi or external hotspots. Manufacturers must balance advanced features with affordability to attract wider adoption. Additionally, fluctuating data plan pricing and network subscription complexities can deter potential users, impacting the growth rate in certain regions and market segments.

Limited Network Coverage in Rural and Remote Areas

Despite growing 4G and 5G deployment, network coverage remains inconsistent in rural and remote regions, limiting the practical utility of SIM card enabled laptops. Users in these areas may experience slow speeds or frequent connectivity interruptions, reducing the value proposition. This challenge is particularly critical for educational and industrial applications where reliable internet is essential. Market expansion depends on improving network infrastructure, partnerships with telecom operators, and offering hybrid connectivity solutions to ensure seamless user experiences across geographies.

Regional Analysis

North America

North America dominates the SIM card enabled laptops market, holding approximately 35% share, driven by high mobile broadband penetration and widespread adoption of remote work solutions. The U.S. and Canada lead in enterprise adoption, with corporations and educational institutions increasingly investing in connected laptops for field operations and online learning. Advanced 4G/5G networks, robust infrastructure, and strong consumer purchasing power support market growth. Manufacturers are introducing premium and mid-range laptops with integrated SIM connectivity to cater to professionals and students, while government initiatives promoting digitalization and remote services further reinforce adoption in both urban and semi-urban regions.

Europe

Europe accounts for roughly 25% of the global market, supported by strong corporate adoption and a growing mobile workforce. Countries such as Germany, the U.K., and France are witnessing increased demand for SIM card enabled laptops in professional, educational, and commercial sectors. Expansion of 5G networks, government-backed digital transformation programs, and rising preference for hybrid work models are key growth drivers. The market benefits from the presence of leading laptop manufacturers and competitive pricing strategies. Adoption in educational institutes and SMEs further boosts growth, while environmental regulations push vendors toward energy-efficient and sustainable connected devices.

Asia-Pacific

Asia-Pacific represents about 30% of the global SIM card enabled laptops market, with China, India, Japan, and South Korea as key contributors. Rapid urbanization, increased internet penetration, and rising mobile broadband coverage drive adoption in both personal and commercial segments. Growth is fueled by educational institutes, SMEs, and the expanding digital workforce. Affordable mid-range devices are gaining traction among price-sensitive consumers, while enterprise and gaming segments favor higher-end laptops. Government initiatives promoting digital literacy and hybrid work models, along with growing e-commerce and technology awareness, present significant opportunities for manufacturers to expand market presence in the region.

Latin America

Latin America holds an estimated 5% share in the global market, driven by growing mobile internet adoption and increasing reliance on digital devices for education and small business operations. Brazil, Mexico, and Argentina are leading contributors due to expanding 4G/5G coverage and rising awareness of mobile connectivity benefits. Demand for cost-effective mid-range laptops is high, particularly among students and remote professionals. Market growth is supported by regional government programs promoting digital inclusion, along with partnerships between laptop vendors and telecom operators offering bundled connectivity solutions. However, price sensitivity and infrastructure gaps remain key adoption constraints.

Middle East & Africa

The Middle East & Africa accounts for around 5% of the market, with adoption primarily in the UAE, Saudi Arabia, and South Africa. Increasing corporate digitization, educational initiatives, and mobile workforce requirements drive demand for SIM card enabled laptops. Growth is supported by expanding 4G/5G networks, government-backed smart city projects, and rising consumer awareness of mobile productivity solutions. High-end corporate and commercial adoption contrasts with moderate personal use due to affordability challenges. Market expansion opportunities exist in remote and underserved areas, supported by collaborations between manufacturers and telecom providers offering localized connectivity solutions to enhance accessibility and reliability.

Market Segmentations:

By Screen Size:

- Up to 10.9 inch

- 11 to 14.9 inch

By Price Range:

- Economy (Up to US$ 500)

- Mid-range (US$ 500 – US$ 1,000)

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Global SIM Card Enabled Laptops Market players such as Microsoft Corporation, Acer Inc., Lenovo, Huawei Technologies Co., Ltd., Dell, HP Development Company, L.P., Apple Inc., Micro-Star International Co., Ltd. (MSI), LG, and ASUSTeK Computer Inc. The Global SIM Card Enabled Laptops Market is highly competitive, driven by rapid technological advancements, product innovation, and strategic partnerships. Companies are focusing on integrating 4G/5G connectivity, lightweight designs, and long-lasting battery performance to meet the needs of mobile professionals, students, and hybrid workers. Competitive strategies include regional expansion, bundled connectivity solutions, and aggressive pricing to capture diverse consumer segments. Emphasis on R&D, sustainability, and enhanced user experience strengthens differentiation. Rising demand for mid-range and high-performance laptops, coupled with the entry of new players offering cost-effective solutions, intensifies competition and fosters continuous innovation across the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Microsoft Corporation

- Acer Inc.

- Lenovo

- Huawei Technologies Co., Ltd.

- Dell

- HP Development Company, L.P.

- Apple Inc.

- Micro-Star International Co., Ltd. (MSI)

- LG

- ASUSTeK Computer Inc.

Recent Developments

- In May 2025, GCT Semiconductor and Giesecke+Devrient (G+D) announced a partnership to launch an advanced eSIM solution for multi-network IoT devices that integrates the new GSMA SGP.32 standard with Integrated Profile Activation Device (IPAd) functionality.

- In May 2025, Tongxin Microelectronics showcased its latest high-performance security chips for payment IC cards and terminals at Seamless Middle East Fintech 2025 in Dubai. The company demonstrated chips that meet international standards like EMVCo and CC EAL6+ for payment cards and PCI 7.x and UPTS 3.0 for terminals.

- In May 2025, Advanced Card Systems Ltd. (ACS) participated in Identiverse 2025, held June 3-6, 2025, at the Mandalay Bay Resort & Casino in Las Vegas. The company showcased its WalletMate Series and readers for contact smart cards and NFC technology. Identiverse is an annual conference focused on the field of identity security.

- In February 2025, CardLab Aps launched “Access,” a next-generation biometric smart card designed to replace traditional passwords with the help of a T-Shape fingerprint sensor. This card stores fingerprint data securely on the card itself, eliminating the need for passwords and reducing the risks of cybercrime

Report Coverage

The research report offers an in-depth analysis based on Screen Size, Price Range, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of SIM card enabled laptops is expected to rise with increasing mobile workforce requirements.

- Integration of 5G connectivity will drive faster and more reliable internet access globally.

- Mid-range and affordable laptops will witness strong demand in emerging markets.

- Growth in remote learning and hybrid work models will sustain long-term market expansion.

- Technological advancements in battery life and lightweight designs will enhance portability and convenience.

- Enterprises and SMEs will increasingly adopt connected laptops for field operations and real-time collaboration.

- Rising consumer preference for seamless, on-the-go connectivity will fuel product innovation.

- Expansion of mobile broadband networks will open opportunities in rural and underserved regions.

- Increasing demand for gaming and high-performance laptops with built-in SIM connectivity will shape product development.

- Strategic partnerships between laptop manufacturers and telecom operators will enhance bundled service offerings and market penetration.