Market Overview

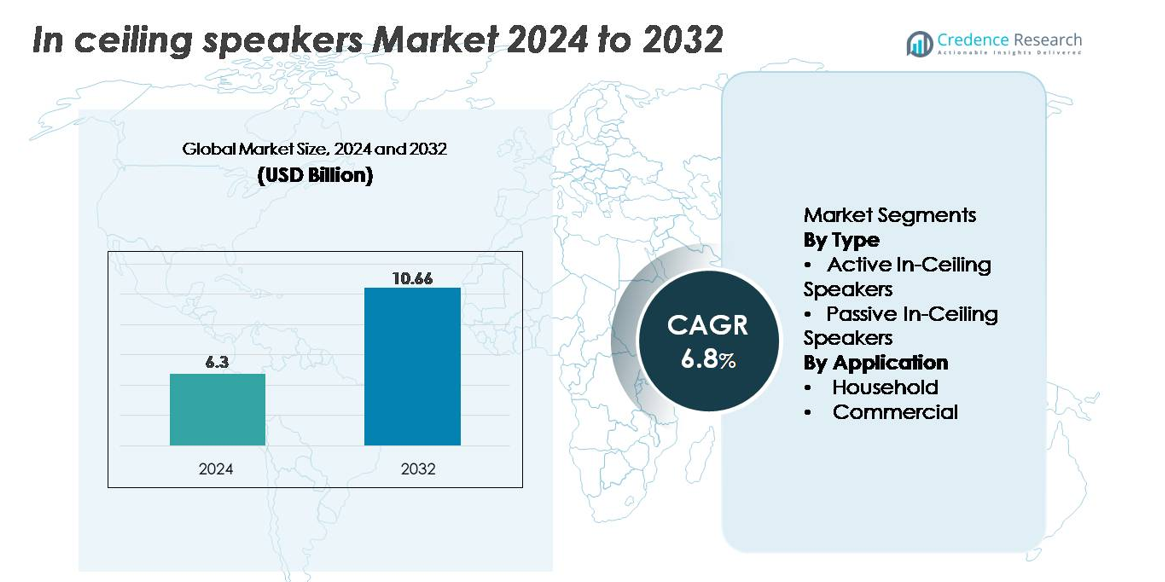

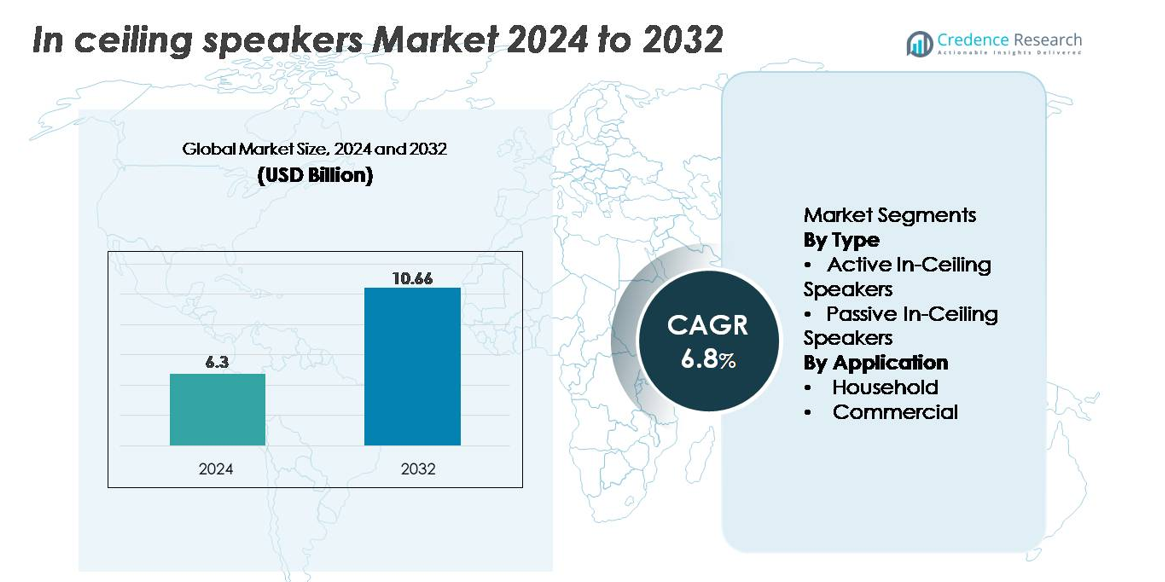

The global in ceiling speakers market was valued at USD 6.3 billion in 2024 and is projected to reach USD 10.66 billion by 2032, registering a CAGR of 6.8% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| In Ceiling Speakers Market Size 2024 |

USD 6.3 billion |

| In Ceiling Speakers Market, CAGR |

6.8% |

| In Ceiling Speakers Market Size 2032 |

USD 10.66 billion |

The in ceiling speakers market is shaped by strong participation from leading audio manufacturers such as Yamaha, Bose, Klipsch Audio Technologies, Q Acoustics, Bowers & Wilkins, Polk Audio, and Highland Technologies, each competing through advancements in acoustic engineering, amplifier integration, and smart home compatibility. These companies focus on multi room audio performance, discreet architectural design, and premium sound quality to strengthen their market footprint across residential and commercial installations. North America leads the global market with a 34% share, supported by high smart home adoption and strong home entertainment spending, followed by Europe and Asia Pacific, where demand continues to accelerate across modern housing and commercial infrastructure projects.

Market Insights

- The global in ceiling speakers market was valued at USD 6.3 billion in 2024 and is projected to reach USD 10.66 billion by 2032, registering a 6.8% CAGR during the forecast period.

- Market growth is driven by rising smart home adoption, demand for discreet multi room audio solutions, and increasing investments in home renovation and architectural audio integration across both residential and commercial spaces.

- Key trends include the shift toward wireless and networked audio, integration with voice assistants, and growing preference for active in ceiling speakers, which hold the dominant share within the type segment due to built in amplification and seamless connectivity.

- Competitive activity intensifies as brands such as Yamaha, Bose, Klipsch, Q Acoustics, and Bowers & Wilkins enhance product performance through advanced acoustic engineering and smart home compatibility, while cost and installation complexity act as notable restraints.

- Regionally, North America leads with 34%, followed by Europe at 28% and Asia Pacific at 24%, reflecting strong demand across premium households, hospitality, and modern commercial infrastructure.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Active in ceiling speakers dominate the type segment, driven by increasing demand for integrated amplification, wireless connectivity, and compatibility with smart home ecosystems. Their plug and play design, reduced wiring requirements, and ability to support multi room audio make them the preferred choice among homeowners and commercial installers. Passive speakers continue to serve projects needing customized amplification and fine-tuned acoustic control, but they hold a smaller market share due to higher installation complexity. Growing adoption of whole home audio systems and smart entertainment platforms further accelerates demand for active in ceiling solutions.

- For instance, the Bose Virtually Invisible 791 Series II features a 7 inch woofer and dual 1 inch tweeters arranged in a Stereo Everywhere configuration, delivering a frequency range extending up to 20,000 Hz with wide dispersion engineered to maintain uniform coverage across large rooms.

By Application

The household segment accounts for the dominant share of the in ceiling speakers market, supported by rising smart home adoption, aesthetic preferences for invisible audio, and growing investment in home entertainment upgrades. Consumers favor in ceiling speakers for multi room streaming, home theaters, and clean interior layouts. The commercial segment grows steadily across hospitality, retail, workplaces, and educational spaces, where uniform audio coverage and architectural integration are essential. While it holds a smaller share than residential use, commercial demand strengthens through renovation cycles, ambience focused customer experiences, and increased deployment of networked AV systems.

- For instance, the Polk Audio RC80i widely used in premium residential installations features an 8 inch dynamic balance woofer and a 1 inch swivel mounted soft dome tweeter, delivering a frequency response from 35 Hz to 20,000 Hz, enabling full range coverage for living rooms and home cinemas.

Key Growth Driver

Rising Smart Home Adoption and Integration with Connected Audio Ecosystems

The rapid expansion of smart homes significantly drives demand for in ceiling speakers, supported by seamless integration with platforms such as Amazon Alexa, Google Home, and Apple HomeKit. Consumers increasingly favor invisible audio solutions that blend aesthetics with high performance sound, particularly in living rooms, kitchens, and home theaters. The shift toward multi room streaming, supported by technologies like Wi Fi 6, Bluetooth 5.3, and whole home audio controllers, makes in ceiling speakers a preferred choice over traditional wired systems. Builders and developers of premium residences now pre install audio wiring, further accelerating adoption. In addition, rising sales of smart TVs, AV receivers, and immersive content contribute to the need for distributed audio built directly into architectural spaces. As smart home penetration deepens globally, demand for aesthetically integrated, easy to control speakers continues to rise, establishing in ceiling systems as a core component of modern residential entertainment ecosystems.

- For instance, Sonos’ integrated architectural speakers developed with Sonance feature a 6.5 inch polypropylene woofer and a 1 inch soft dome tweeter, delivering a frequency range from 44 Hz to 20,000 Hz and auto tuning through Trueplay calibration, which optimizes sound based on room acoustics.

Expansion of Commercial Infrastructure and Demand for Ambient Audio Solutions

Commercial infrastructure development including retail establishments, hotels, restaurants, co working spaces, corporate offices, and wellness centers continues to boost demand for in ceiling speakers designed for uniform sound distribution. These speakers are increasingly used for background music, public announcements, ambience enhancement, and customer experience optimization. Businesses favor in ceiling systems because they deliver discrete audio coverage while maintaining architectural aesthetics and ensuring wide dispersion for large spaces. Growth in hospitality renovation projects, the revival of travel activity, and the rise of experience driven retail environments further strengthen market demand. Additionally, commercial buyers value energy efficient amplifiers, modular speaker arrays, and centralized AV management platforms that simplify control across multiple zones. As companies prioritize brand ambience, customer engagement, and employee comfort, in ceiling audio becomes an essential component of modern commercial AV deployments.

- For instance, the Yamaha VXC8 ceiling speaker widely deployed in commercial venues uses an 8 inch cone woofer with a 1 inch soft dome tweeter, delivering a maximum sound pressure level of 116 dB (Peak, calculated) and a frequency response ranging from 55 Hz to 20,000 Hz ( 10 dB), enabling consistent coverage in large open spaces.

Increasing Consumer Preference for Aesthetics and Space Optimization

The shift toward minimalist interior design fuels a strong preference for audio systems that integrate seamlessly into ceilings without occupying visible space. In ceiling speakers have become a popular alternative to floor standing or bookshelf speakers, particularly in premium homes, luxury apartments, and modern offices where clean layouts are prioritized. Advancements in slim profile drivers, bezel less grills, and paintable surfaces allow these speakers to blend effortlessly into ceilings. Renovation trends also support adoption, as homeowners seek to upgrade entertainment systems without altering room layouts. Moreover, improvements in acoustic engineering such as wide dispersion tweeters, pivoting drivers, and damped back box designs help compensate for installation constraints, enabling high fidelity audio without compromising aesthetics. The combination of design driven demand and improved acoustic performance reinforces the role of in ceiling speakers as a preferred solution for both functional and aesthetic upgrades.

Key Trends & Opportunities:

Growth of Wireless, Multi Room, and Networked Audio Technologies

A major trend shaping the market is the rise of wireless and networked audio ecosystems that allow seamless multi room streaming and easier system configuration. Technologies such as Wi Fi mesh audio, AirPlay 2, Chromecast built in, and proprietary whole home platforms enable users to control in ceiling speakers through mobile apps or voice assistants. This shift presents opportunities for manufacturers to develop active, amplifier integrated ceiling speakers with advanced connectivity. The trend is accelerating demand for retrofit friendly solutions in older buildings where wiring is limited. Moreover, the integration of smart amplification, DSP tuning, and automatic room calibration positions in ceiling speakers as a future oriented segment within the connected home and smart commercial audio market.

- For instance, the Sonos Amp a key driver of wireless architectural audio delivers 125 watts per channel at 8 ohms and supports up to four in ceiling speakers per unit, while enabling wireless multi room playback across more than 32 zones within a single network.

Advancements in High Fidelity Audio Engineering and Immersive Sound Formats

Growing interest in high fidelity audio and immersive entertainment experiences encourages manufacturers to design in ceiling speakers compatible with Dolby Atmos, DTS:X, and 3D audio environments. Consumers increasingly seek cinematic sound in home theaters, gaming rooms, and luxury residential spaces. This trend drives innovations such as angled drivers for height channels, pivoting tweeters for soundstage customization, and improved crossover networks that deliver enhanced frequency response. In commercial settings, demand for immersive sound is rising across boutique cinemas, themed attractions, and experiential venues. The shift toward 3D and spatial audio opens opportunities for premium in ceiling speaker manufacturers to offer specialized architectural audio solutions that elevate both home and commercial entertainment.

- For instance, the Bowers & Wilkins CCM7.5 S2 often deployed in home theater ceilings features a 25 mm carbon dome tweeter and a 180 mm Continuum cone driver, achieving a frequency range from 32 Hz to 28,000 Hz and supporting precise spatial imaging for immersive audio installations.

Growing Opportunity for Custom Installation and Professional AV Integration Services

The market presents strong opportunities for professional integrators, driven by increasing demand for custom designed audio layouts tailored to individual spaces. Builders, architects, and AV consultants are incorporating in ceiling speaker systems into residential and commercial blueprints at an early stage. This trend enhances installation efficiency while creating recurring opportunities for integrators offering system design, calibration, and maintenance. Premium consumers, in particular, rely on professional installation to ensure optimal acoustics in multi room audio, home theaters, and open plan layouts. As the market moves toward more complex, networked AV systems, integrators have a growing opportunity to deliver bundled solutions combining in ceiling speakers with routers, amplifiers, and automation controls.

Key Challenges:

Installation Complexity and Requirement for Professional Expertise

Despite rising demand, installation complexity remains a significant challenge, particularly in retrofit scenarios. In ceiling speakers require precise placement, ceiling modification, electrical routing, and acoustic calibration to achieve desired sound quality. Incorrect installation can lead to issues such as vibration, sound leakage, or suboptimal dispersion. Many homeowners hesitate due to the need for professional labor, which increases overall system cost. Additionally, installation is often limited by ceiling structure, insulation type, and space constraints, making it difficult to implement in older buildings. This barrier can slow adoption among cost sensitive consumers who prefer plug and play alternatives.

Rising Competition from Soundbars and Portable Wireless Speakers

The market faces growing competitive pressure from soundbars, smart speakers, and portable wireless audio devices that offer convenience, affordability, and strong brand presence. Products from leading consumer electronics companies provide high quality sound without requiring installation, making them attractive to mainstream buyers. These alternatives often feature advanced capabilities such as voice assistants, built in subwoofers, and room calibration, reducing the need for fixed architectural audio. For many consumers, the simplicity and lower cost of soundbars and smart speakers create a compelling substitute, particularly in small dwellings where in ceiling installations may not be feasible. This competition continues to challenge long term adoption in entry level residential markets.

Regional Analysis:

North America

North America holds the largest market share at around 34%, driven by strong smart home adoption, widespread use of multi room audio systems, and high consumer spending on home entertainment upgrades. The U.S. leads regional demand due to robust residential construction, premium home remodeling, and increasing integration of architectural audio in luxury homes. Commercial deployments in offices, retail chains, and hospitality properties further strengthen growth. The presence of leading AV integrators, established home automation brands, and high penetration of Wi Fi and voice controlled ecosystems continues to position North America as the primary revenue contributing region.

Europe

Europe accounts for approximately 28% of the global market, supported by strong adoption of premium residential audio, rising smart home penetration, and growing interest in minimalist interior design trends. Countries such as Germany, the U.K., and France lead installations across modern apartments, heritage home renovations, and boutique commercial spaces. The demand is reinforced by energy efficient building standards that favor integrated AV wiring and discreet audio solutions. Commercial projects across hospitality, cafés, retail boutiques, and coworking spaces further expand usage. Europe’s established audio manufacturing ecosystem and focus on design driven acoustics continue to drive steady regional growth.

Asia Pacific

Asia Pacific captures about 24% market share, emerging as the fastest growing regional market due to rapid urbanization, rising disposable incomes, and expanding residential real estate development. China, Japan, South Korea, and India show strong uptake of in ceiling speakers across premium homes and smart apartments. Demand in commercial spaces such as malls, hospitality chains, and corporate offices continues to rise with ongoing infrastructure investments. The region also benefits from a growing base of local audio manufacturers and expanding adoption of smart home platforms. Increasing consumer preference for space saving, aesthetically integrated audio solutions further boosts market penetration.

Latin America

Latin America represents around 8% market share, with demand driven by growing adoption of modern home entertainment systems and increased renovation activities in urban areas. Brazil, Mexico, and Chile lead consumption as homeowners and businesses invest in hidden, high quality audio solutions. Hospitality, retail, and corporate environments increasingly deploy in ceiling speakers to improve ambience and customer engagement. However, growth remains moderate due to economic fluctuations and varying access to high end AV products. Expanding availability of affordable smart home devices and improving construction standards are expected to gradually strengthen long term adoption across the region.

Middle East & Africa (MEA)

The Middle East & Africa region holds approximately 6% of the global market, supported by rising investments in luxury residential developments, hospitality expansions, and high end commercial infrastructure. The UAE, Saudi Arabia, and South Africa drive regional demand, particularly in premium villas, hotels, shopping complexes, and entertainment venues. Consumers in wealthier GCC markets show strong preference for architectural audio integrated into smart home ecosystems. While adoption in Africa remains limited by affordability factors, rapid urban development and expanding retail and leisure sectors create emerging opportunities for in ceiling speaker installations.

Market Segmentations:

By Type

- Active In Ceiling Speakers

- Passive In Ceiling Speakers

By Application

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the in ceiling speakers market is characterized by a mix of established audio brands, specialized AV manufacturers, and emerging smart home technology providers. Leading companies compete through advancements in acoustic engineering, wireless connectivity, and smart home integration, focusing on features such as multi room compatibility, DSP tuning, and low profile architectural designs. Premium players emphasize high fidelity sound, broader frequency response, and seamless integration with automation platforms like Control4, Crestron, and Savant. Mid-tier manufacturers strengthen market presence by offering cost effective models tailored for residential and commercial projects. Distribution partnerships with builders, AV integrators, and home automation installers play a critical role in brand visibility and sales expansion. Intensifying competition encourages continuous innovation in materials, driver technology, and amplifier design, while the shift toward active and networked solutions accelerates differentiation across product lines.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Yamaha

- Bose

- Klipsch Audio Technologies

- Q Acoustics

- Bowers & Wilkins

- Highland Technologies

- Polk Audio

Recent Developments:

- In July 2025, Klipsch also revealed updates to its heritage loudspeaker line at a major audio event while primarily referencing floorstanding models, the move underscores the company’s broader strategy of combining traditional audio craftsmanship with modern design sensibilities, which typically influences its architectural speaker R&D roadmap.

- In August 2024, Klipsch Audio Technologies introduced a new “Professional In Ceiling Series” featuring weather resistant (IPX5) architectural speakers in multiple sizes (4.5″, 6.5″, 8″), designed for custom residential and commercial integration with improved bass via its patented folded port design

Report Coverage:

The research report offers an in depth analysis based on Type, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for in ceiling speakers will continue rising as smart home adoption accelerates across residential markets.

- Active, wireless, and networked ceiling speakers will gain prominence due to easier installation and better system integration.

- Multi room audio ecosystems will expand, driving deeper compatibility with voice assistants and home automation platforms.

- Premium households will increasingly prioritize invisible audio solutions that enhance aesthetics without compromising sound quality.

- Commercial installations in hospitality, retail, and workplaces will grow with rising demand for ambience enhancing architectural audio.

- Advancements in acoustic engineering will improve dispersion, clarity, and low profile driver design.

- Manufacturers will focus on energy efficient amplifiers, DSP based tuning, and auto calibration technologies.

- AV integrators will see rising opportunities as custom designed audio layouts become standard in new construction.

- Competition will intensify as global brands enhance product differentiation through smart connectivity and high fidelity options.

- Emerging markets will adopt in ceiling speakers more rapidly with urban development and expanding middle class purchasing power.