Market Overview

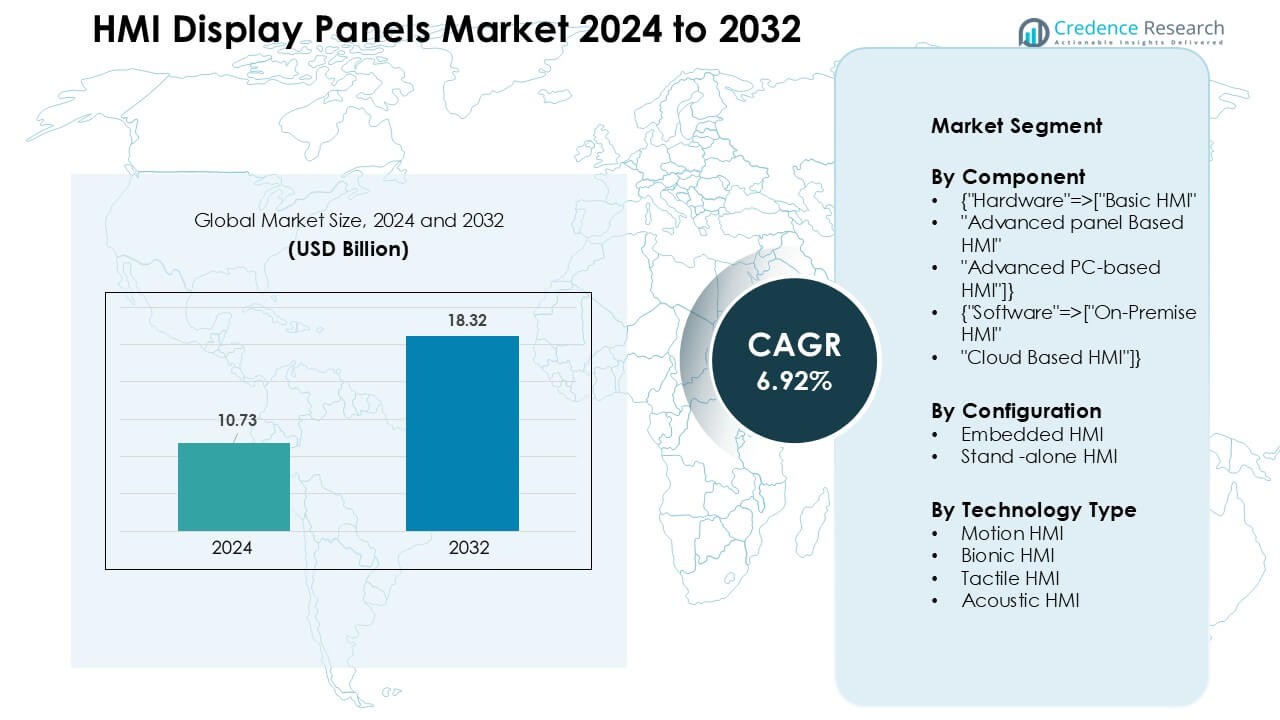

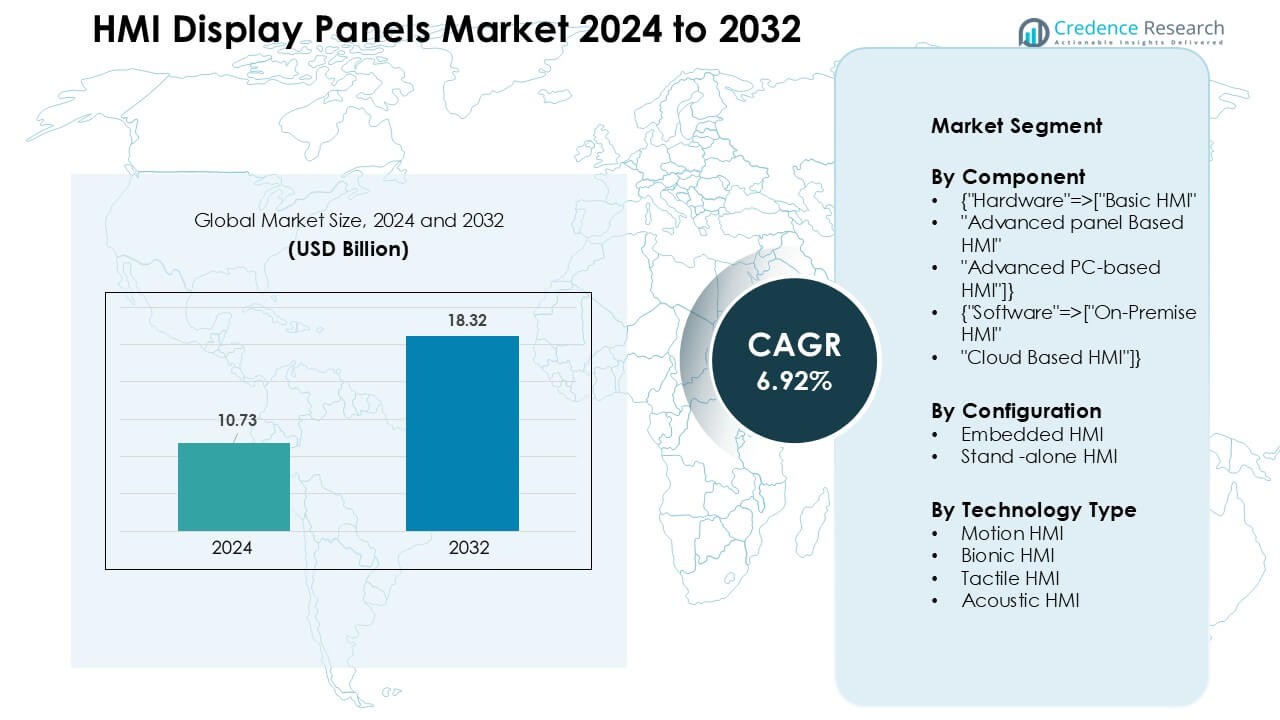

HMI Display Panels Market was valued at USD 10.73 billion in 2024 and is anticipated to reach USD 18.32 billion by 2032, growing at a CAGR of 6.92% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| HMI Display Panels Market Size 2024 |

USD 10.73 Billion |

| HMI Display Panels Market, CAGR |

6.92% |

| HMI Display Panels Market Size 2032 |

USD 18.32 Billion |

The HMI display panels market is led by major companies such as Siemens AG, Rockwell Automation, Schneider Electric SE, Mitsubishi Electric Corporation, Omron Corporation, General Electric Company, ABB Ltd., Advantech Co., Eaton Corporation PLC, and Honeywell International Inc. These players dominate through strong portfolios in advanced touchscreen interfaces, rugged industrial panels, and integrated automation systems. Their focus on real-time monitoring, cloud-enabled platforms, and high-performance visualization tools strengthens global competitiveness. North America emerged as the leading region in 2024 with about 34% share, supported by rapid industrial automation, strong investments in smart manufacturing, and early adoption of digital control technologies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The HMI Display Panels Market was valued at USD 10.73 billion in 2024 and is projected to reach USD18.32 billion by 2032, growing at a CAGR of 6.92%.

- Demand grows as industries adopt automation and real-time monitoring, with hardware leading the component segment with about 68% share due to high use in advanced panel-based systems.

- Touchscreen and multi-modal interfaces shape market trends, supported by rising investment in smart factories and cloud-connected HMI platforms across manufacturing and energy sectors.

- Competition remains strong as Siemens AG, Rockwell Automation, Schneider Electric SE, Mitsubishi Electric, and ABB focus on advanced visualization, rugged design, and integrated control systems.

- North America held the largest regional share with 34%, followed by Asia-Pacific at 41%, supported by rapid industrialization and strong demand for embedded and standalone HMI solutions across key industries.

Market Segmentation Analysis:

By Component

Hardware led the component segment in 2024 with about 68% share, driven by strong adoption of advanced panel-based HMI systems across manufacturing, automotive, and energy sectors. Demand rose as industries shifted toward high-resolution touch displays, rugged enclosures, and real-time control interfaces that support complex automation tasks. Advanced panel-based HMI held the largest share within hardware because these systems offer faster processing, flexible integration, and improved visual clarity for operators. Software demand continued to climb as cloud-based HMI gained traction, but hardware remained dominant due to essential use in production-floor operations.

- For instance, Siemens AG’s SIMATIC HMI Unified Panels are widely installed in automotive and heavy-industry plants; for example, large-scale industrial projects frequently utilize numerous SIMATIC panels deployed for machine-level control in assembly lines, enabling operators to monitor dozens of process variables in real time.

By Configuration

Standalone HMI dominated the configuration segment in 2024 with nearly 61% share due to wide use in industrial machinery, packaging systems, and energy equipment. Companies preferred standalone units because they support independent processing, simple installation, and stable performance without external controllers. Adoption grew in factories upgrading legacy systems to modern operator panels that offer improved diagnostics and intuitive interfaces. Embedded HMI expanded steadily as OEMs integrated display modules into equipment, but higher customization needs kept growth moderate compared to standalone systems.

- For instance, Rockwell Automation offers its “FactoryTalk View ME” as part of its machine‑level HMI package these standalone HMIs are used by discrete manufacturing plants to provide local operator interfaces without dependency on centralized SCADA.

By Technology Type

Tactile HMI led the technology segment in 2024 with around 54% share, supported by widespread use of touch-based interfaces across automation, automotive, medical devices, and retail systems. Touch controls remained preferred because they offer simple interaction, high accuracy, and fast response for operators handling real-time tasks. Demand increased as industries adopted multi-touch screens, gesture support, and durable capacitive panels. Motion, bionic, and acoustic HMI gained interest in specialized applications such as AR-enhanced control and hands-free operation, but their market presence stayed smaller than tactile systems.

Key Growth Drivers

Rising Industrial Automation Across Manufacturing

Growing automation in manufacturing remains a core driver for the HMI display panels market. Companies upgrade factories with advanced control systems to improve productivity, reduce downtime, and support real-time decision-making. Modern HMI panels offer high-resolution displays, faster processors, and intuitive interfaces that enhance operator efficiency on production floors. Demand rises as industries adopt smart machinery, robotic systems, and automated production lines that require continuous monitoring and precise human–machine interaction. The shift toward Industry 4.0 accelerates this trend, pushing manufacturers to replace older push-button controls with digital touchscreens and panel-based HMI units. As plants expand their automation footprint, the need for rugged, reliable, and network-enabled HMI systems continues to grow. Integration with PLCs, SCADA, and IoT platforms further strengthens adoption across automotive, electronics, chemicals, and food processing industries.

- For instance, according to the International Federation of Robotics (IFR), the number of operational industrial robots worldwide reached 4,281,585 units by end‑2023, reflecting a growing baseline of automation and each of these automated operations typically requires reliable HMI panels for monitoring and control.

Growing Demand for Real-Time Monitoring and Control

Industries increasingly rely on real-time monitoring to enhance operational safety, quality, and efficiency. HMI display panels enable operators to visualize equipment status, process variables, and performance indicators in a clear and actionable format. Companies in power generation, oil and gas, and logistics depend on HMI systems to oversee critical processes where quick decisions prevent faults and reduce operational risks. The shift toward predictive maintenance also boosts demand as HMI interfaces help track machine health and trigger alerts. Modern HMI panels support advanced visualization tools, high-speed communication, and remote monitoring, helping firms manage assets across distributed facilities. With rising complexity in industrial operations, organizations prioritize systems that deliver accurate and continuous data. Adoption grows as firms replace legacy panels with next-generation HMI solutions that support faster updates, multi-screen layouts, and high interoperability.

- For instance, in energy‑sector applications, HMI panels are used to monitor and control power plants and substations operators track live data on generator output, voltage, current, and temperature via HMI dashboards, enabling immediate corrective action if any parameter deviates from safe limits.

Expansion of Smart Infrastructure and Connected Systems

Smart infrastructure development increases the use of HMI display panels across transportation, utilities, building automation, and public safety systems. Cities deploy connected networks that require digital dashboards, control interfaces, and interactive screens for monitoring traffic flows, grid performance, and emergency systems. Building automation systems also use HMI panels to manage HVAC, lighting, and energy consumption with real-time data. The expansion of renewable energy plants boosts adoption as operators rely on HMI tools to track output, temperature, and system health. The wider penetration of IoT devices drives higher need for human–machine interfaces that interpret sensor data and enable control through touch, gesture, or voice. As governments and private firms invest in modernization, the demand for robust, scalable, and network-integrated HMI solutions grows across industrial, commercial, and public sectors.

Key Trend & Opportunity

Adoption of Cloud-Based and Web-Enabled HMI Platforms

Cloud HMI solutions create new opportunities by allowing remote access, centralized data storage, and real-time system updates. Companies benefit from lower maintenance costs and simplified deployment across multiple sites. Web-enabled HMI interfaces allow operators to monitor production lines or equipment from any connected device, improving operational flexibility. The growing use of mobile devices in industries supports this shift as organizations deploy tablets and laptops for on-the-go monitoring. Cloud-native HMI platforms also integrate easily with analytics systems, enabling stronger insights and process optimization. As industries expand digital transformation efforts, cloud and web-based HMI solutions emerge as a major growth area.

- For instance, the web-based HMI tool WebIQ built using HTML5, CSS and JavaScript enable operators to access machine control interfaces directly from browsers on desktops, tablets or smartphones, without installing specialized software.

Advancements in Touch and Gesture Interface Technologies

HMI display panels increasingly adopt advanced tactile, multi-touch, and gesture-based technologies to improve operator interaction. Modern capacitive touchscreens deliver higher accuracy, durability, and faster response times, making them suitable for harsh industrial environments. Gesture control and hands-free interaction grow in sectors that require sterile or safety-sensitive conditions, such as medical equipment and hazardous plant operations. Integration of haptic feedback enhances user experience by providing physical cues during critical actions. These advancements open opportunities for next-generation HMI systems across robotics, automotive dashboards, medical devices, and precision manufacturing. As industries demand more intuitive and adaptive interfaces, innovation in touch and gesture technology accelerates adoption.

- For instance, industrial HMI manufacturers such as Winmate Inc. produce panel‑PC HMIs with projected‑capacitive (P‑CAP) multi‑touch screens and rugged housings designed for dusty, wet, or vibration‑prone factory floors these panels sustain reliable touch operations even in harsh environments, demonstrating how capacitive touch becomes industrially viable.

Rising Use of AI-Driven and Predictive Interfaces

AI-based HMI systems gain traction as industries focus on predictive and adaptive control. Machine-learning algorithms allow interfaces to analyze data patterns, suggest corrective actions, and personalize dashboards for operators. Smart HMI panels help reduce errors by detecting anomalies early and offering decision support. AI integration also strengthens predictive maintenance by projecting equipment failures and optimizing schedules. Companies explore voice-enabled and context-aware interfaces that adjust based on user behavior and environmental conditions. These intelligent features create strong opportunities for vendors to develop next-generation HMI displays that support autonomous workflows and higher operational accuracy.

Key Challenge

High Integration and Upgrade Costs

HMI display panels often require significant investment in hardware, software, and integration with existing control systems. Many industries still operate legacy PLCs and automation setups, making compatibility a challenge. Upgrading to advanced panel-based or PC-based HMI units demands reconfiguration of communication protocols, operator training, and alignment with safety standards. Small and medium enterprises frequently delay adoption due to limited budgets and fear of operational disruption during transition. High upfront costs also impact replacement cycles, slowing the shift from traditional panels to modern touchscreen systems. Vendors must address these barriers with cost-efficient, modular, and easily deployable solutions.

Cybersecurity Risks in Connected HMI Systems

As HMI panels become more connected through Ethernet, cloud platforms, and IoT devices, cybersecurity risks increase. Unauthorized access, malware, and data breaches can compromise equipment controls and disrupt operations. Industries dependent on remote monitoring face higher vulnerability due to multiple access points and networked assets. Older systems lack robust encryption and authentication features, creating loopholes for attacks. Companies require ongoing security updates, firewalls, and intrusion detection systems, raising operational complexity. Ensuring secure communication between HMI devices and industrial networks remains a key challenge, especially as digitalization expands across manufacturing and critical infrastructure.

Regional Analysis

North America

North America led the HMI display panels market in 2024 with about 34% share, driven by strong industrial automation, high adoption of advanced control systems, and rapid modernization of manufacturing plants. The U.S. remained the primary contributor due to strong investments in automotive, aerospace, food processing, and energy sectors. Companies upgraded production lines with touchscreen interfaces, rugged panels, and cloud-connected HMI platforms to enhance efficiency and predictive maintenance. Growing demand for smart infrastructure, digitalized utilities, and intelligent transportation systems further supported adoption. Canada showed steady growth as industries increased spending on robotics, process control, and connected equipment.

Europe

Europe accounted for nearly 29% share in 2024, supported by established automotive manufacturing, advanced machinery production, and strong emphasis on Industry 4.0 standards. Germany, France, and Italy drove the market with high deployment of panel-based HMI systems that enhance equipment reliability and operator visibility. The region’s focus on energy efficiency, industrial safety, and smart factory initiatives strengthened demand for modern HMI technologies. Companies adopted high-resolution displays, capacitive touchscreens, and PC-based HMI to streamline production workflows. Expansion in renewable energy projects also increased the use of network-enabled HMI panels for real-time monitoring and system control.

Asia-Pacific

Asia-Pacific held the largest share after North America in 2024, reaching about 41% due to rapid industrialization and strong growth in manufacturing hubs such as China, India, Japan, and South Korea. The region experienced high adoption of automation systems in electronics, automotive, chemicals, and semiconductor production. Demand grew as factories replaced legacy interfaces with advanced touch panels, embedded HMI units, and IoT-enabled systems. China led with major investments in smart factories, while India expanded adoption in packaging, food processing, and utilities. Rising development of smart cities and digital infrastructure further accelerated HMI deployment across industrial and commercial sectors.

Latin America

Latin America captured around 7% share in 2024, with growth driven by expanding industrial activities in Brazil, Mexico, and Argentina. The region adopted HMI systems to modernize production lines in food processing, mining, automotive parts, and oil and gas. Companies increasingly used touchscreen panels and standalone HMI units to improve monitoring accuracy and reduce downtime in harsh operating environments. Digital transformation programs also encouraged adoption of cloud-based HMI solutions. Although economic fluctuations slowed large-scale investments, steady demand for process automation supported market expansion, especially in sectors focused on efficiency improvement and operational safety.

Middle East & Africa

The Middle East & Africa region held nearly 6% share in 2024, supported by strong adoption in oil and gas, utilities, and construction sectors. Countries such as Saudi Arabia, the UAE, and South Africa invested in advanced control technologies to strengthen plant reliability and expand digital operations. HMI display panels gained traction in power generation, desalination plants, and industrial machinery upgrades. Growing development of smart cities and infrastructure projects also boosted demand for modern operator interfaces. While adoption remained slower than in developed regions, rising automation and long-term industrial diversification supported steady market growth.

Market Segmentations:

By Component

- “Hardware”=>[“Basic HMI”

- “Advanced panel Based HMI”

- “Advanced PC-based HMI”]}

- {“Software”=>[“On-Premise HMI”

- “Cloud Based HMI”]

By Configuration

- Embedded HMI

- Stand -alone HMI

By Technology Type

- Motion HMI

- Bionic HMI

- Tactile HMI

- Acoustic HMI

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the HMI display panels market features major players such as Siemens AG, Rockwell Automation, Schneider Electric SE, Mitsubishi Electric Corporation, Omron Corporation, General Electric Company, ABB Ltd., Advantech Co., Eaton Corporation PLC, and Honeywell International Inc. These companies compete by expanding product portfolios, integrating advanced touch technologies, and enhancing connectivity features across industrial applications. Vendors focus on developing rugged, high-resolution panels that support real-time monitoring, cloud integration, and multi-protocol communication. Strategic initiatives include partnerships with automation firms, investments in smart manufacturing solutions, and the launch of scalable HMI platforms suited for diverse industrial environments. Leading companies strengthen their market presence through innovations in capacitive touchscreens, AI-enabled interfaces, and edge-connected systems. Regional expansion remains a key strategy, with strong growth momentum visible across Asia-Pacific and North America. The competitive environment continues to intensify as firms prioritize digitalization, cybersecurity features, and user-centric interface design.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Siemens AG

- Rockwell Automation

- Schneider Electric SE

- Mitsubishi Electric Corporation

- Omron Corporation

- General Electric Company

- ABB Ltd.

- Advantech Co.

- Eaton Corporation PLC

- Honeywell International Inc.

Recent Developments

- In October 2025, Rockwell announced a lineup of new technologies (including updated visualization/industrial-PC hardware and software tools for HMI/monitoring workflows) to debut at Automation Fair® 2025 (event: Nov 17–20, 2025).

- In January 2025, Schneider Electric released a document titled “HMI Product Line-up Guide – English 2025” (catalog reference DIA5ED1161001EN, Version 8.0), dated January 1, 2025. This catalog summarized the available Magelis and Harmony operator terminals and their associated software, including EcoStruxure Operator Terminal Expert tooling.

- In November 2024, Siemens’ product pages show continued rollouts and refreshed generations across the SIMATIC HMI portfolio (Unified Panels for modern visualization, 2nd-gen Basic Panels, mobile HMI units and a new Option+ application bridging runtime and OS features). Siemens documents and product pages describe these updates though Siemens has most detail on its product pages rather than a single dated press release.

Report Coverage

The research report offers an in-depth analysis based on Component, Configuration, Technology Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for advanced touchscreen panels will rise as factories accelerate digital transformation.

- Cloud-connected HMI systems will gain adoption for remote monitoring and centralized control.

- AI-driven interfaces will improve decision support and predictive maintenance accuracy.

- Rugged and high-resolution industrial displays will see stronger use in harsh environments.

- Embedded HMI units will expand as OEMs integrate smarter control modules into machinery.

- Industrial cybersecurity features will become essential for all connected HMI platforms.

- Gesture, voice, and multi-modal interfaces will grow in sectors requiring hands-free control.

- Smart city and infrastructure projects will drive wider deployment of HMI systems.

- Adoption in renewable energy plants will increase due to rising demand for real-time analytics.

- Vendors will invest more in open-architecture platforms to improve interoperability across automation ecosystems.