| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antioxidants Market Size 2024 |

USD 5,052.13 Million |

| Antioxidants Market , CAGR |

5.68% |

| Antioxidants Market Size 2032 |

USD 8,111.80 Million |

Market Overview:

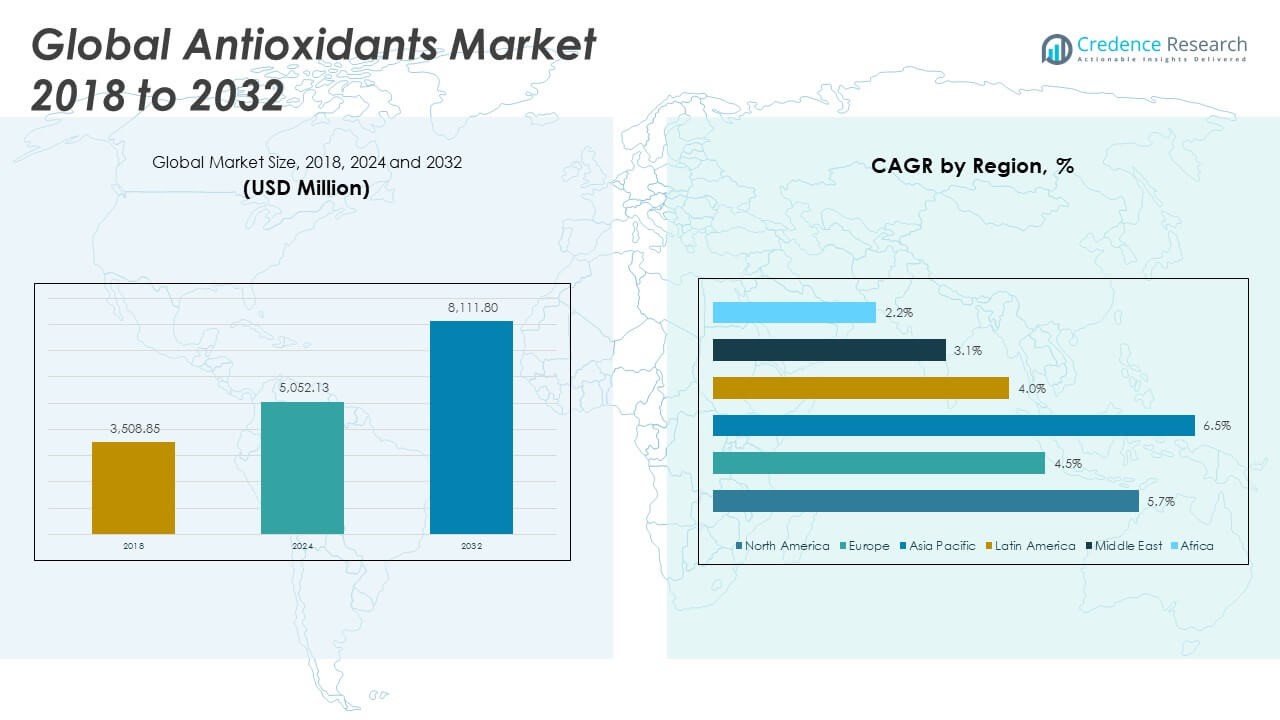

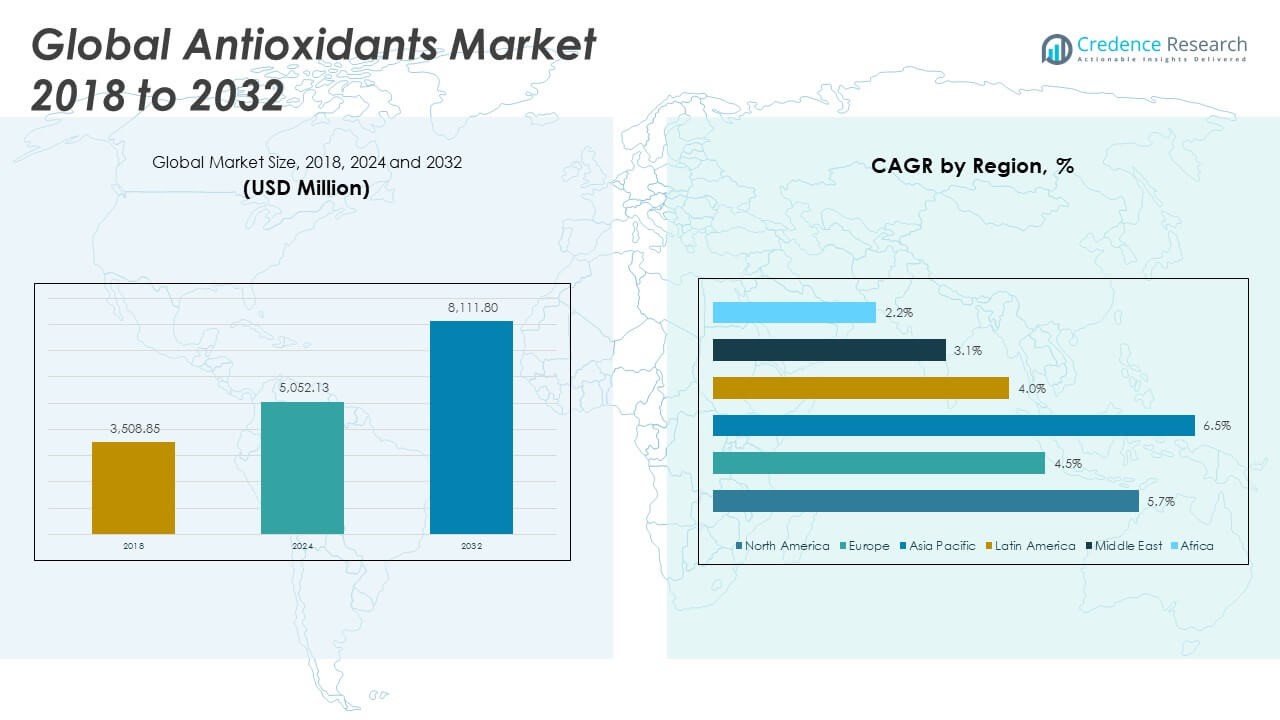

The Global Antioxidants Market size was valued at USD 3,508.85 million in 2018 to USD 5,052.13 million in 2024 and is anticipated to reach USD 8,111.80 million by 2032, at a CAGR of 5.68% during the forecast period.

The global antioxidants market is primarily driven by increasing health awareness and the rising demand for functional and preventive healthcare solutions. Consumers are increasingly seeking products that offer immunity-boosting, anti-aging, and disease-prevention benefits, which has significantly fueled the demand for natural antioxidants in food, beverages, supplements, and personal care items. The clean-label movement, driven by a preference for natural and transparent ingredient lists, is pushing manufacturers to replace synthetic preservatives with plant-based alternatives such as tocopherols, carotenoids, and polyphenols. In the cosmetics industry, antioxidants are used in formulations to combat oxidative stress and environmental damage, boosting their adoption in anti-aging and skin-repair products. Additionally, the feed and pharmaceutical sectors are increasingly incorporating antioxidants to improve product stability and efficacy. Technological advancements in extraction processes and growing regulatory support for natural and sustainable additives are further catalyzing market expansion across sectors by enhancing availability and cost-efficiency of high-quality antioxidant compounds.

Regionally, North America commands a dominant position in the global antioxidants market, driven by advanced healthcare infrastructure, a well-established nutraceutical sector, and strong consumer preference for wellness-oriented products. The United States, in particular, contributes significantly to market revenue due to widespread adoption of antioxidant-enriched foods, supplements, and cosmetics. Europe follows closely, bolstered by stringent regulations favoring natural additives, rising demand for clean-label products, and growing investments in food innovation and pharmaceutical research. Countries such as Germany, France, and the UK are at the forefront of adopting plant-based and organic antioxidants. Asia-Pacific is the fastest-growing regional market, with expanding middle-class populations, rising disposable incomes, and increasing health awareness across countries like China, India, Japan, and South Korea. The region is also benefiting from the popularity of traditional medicine and herbal supplements. Meanwhile, Latin America and the Middle East & Africa are gradually gaining momentum, supported by urbanization, dietary shifts, and developing food and pharmaceutical industries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Antioxidants Market was valued at USD 5,052.13 million in 2024 and is expected to reach USD 8,111.80 million by 2032, growing at a CAGR of 5.68%.

- Increasing health awareness and rising demand for preventive healthcare are fueling the consumption of antioxidant-rich foods, supplements, and cosmetics.

- Natural antioxidants such as tocopherols, carotenoids, and polyphenols are replacing synthetic preservatives, driven by the clean-label and plant-based product movement.

- Technological advancements in extraction methods are enhancing antioxidant quality, yield, and stability across food, pharma, and personal care industries.

- Government regulations favoring natural additives and food safety are accelerating the shift toward sustainable and organic antioxidant ingredients.

- High production costs and limited availability of natural sources pose challenges for scalability, particularly for smaller manufacturers in resource-constrained regions.

- North America leads the market in revenue share, while Asia-Pacific is the fastest-growing region, supported by rising incomes, health consciousness, and traditional medicine integration.

Market Drivers:

Rising Health Consciousness and Preference for Preventive Healthcare Solutions

The increasing global focus on health and wellness is a primary driver of the Global Antioxidants Market. Consumers are becoming more aware of the harmful effects of oxidative stress and free radicals, which contribute to chronic conditions such as cardiovascular diseases, diabetes, and neurodegenerative disorders. This shift in health priorities is pushing demand for antioxidant-rich products that support immune health and slow aging. The market benefits from a growing interest in preventive healthcare, where individuals seek functional foods and dietary supplements as everyday health boosters. Brands are responding with new formulations featuring natural antioxidants like vitamins C and E, carotenoids, and flavonoids. It is gaining further traction through digital health platforms and social media campaigns emphasizing long-term wellness.

- For example, Galderma’s C-RADICAL Defense Antioxidant Serum(September 2023) features a proprietary encapsulated Vitamin C system with 14 additional antioxidants, designed for enhanced skin penetration and stability, and validated for significant improvements in skin texture and reduction of environmental oxidative stress in clinical studies.

Growing Demand for Natural Ingredients Across Food, Beverage, and Cosmetics Sectors

Consumers are increasingly favoring natural and plant-derived ingredients, prompting manufacturers to reformulate products using clean-label antioxidants. The Global Antioxidants Market is seeing high demand from food and beverage companies aiming to replace synthetic preservatives with natural counterparts that preserve shelf life without compromising product safety. In cosmetics, antioxidants are valued for their anti-aging and protective properties against environmental damage. The push toward sustainable and organic personal care products reinforces their integration into skincare and haircare formulations. It supports a broader trend toward transparency and traceability in sourcing, which aligns with consumer values. Natural antioxidants are also appealing due to their alignment with vegetarian, vegan, and allergen-free product claims.

Technological Advancements Enhancing Extraction and Stability of Natural Antioxidants

Innovation in extraction and processing technologies is improving the quality, yield, and cost-effectiveness of antioxidant production. Techniques such as supercritical fluid extraction, cold-pressing, and enzymatic hydrolysis are being deployed to isolate active compounds from natural sources with greater precision. The Global Antioxidants Market is benefitting from R&D investments that enhance the stability and bioavailability of antioxidants in various applications. Improved formulation techniques allow antioxidants to maintain efficacy under different processing conditions, including high heat and prolonged storage. It creates more opportunities for integration across packaged foods, pharmaceuticals, and nutraceuticals. These advancements support scalability for both large manufacturers and niche producers focused on specialty products.

Regulatory Push and Industry Shift Toward Clean-Label and Sustainable Products

Government regulations restricting synthetic additives and promoting food safety are accelerating the transition toward natural antioxidants. In many developed markets, authorities have placed tighter controls on artificial preservatives, creating strong incentives for industries to adopt cleaner alternatives. The Global Antioxidants Market is responding to this regulatory momentum by aligning product development with evolving compliance standards. Companies are reformulating legacy products and investing in new lines that meet organic, non-GMO, and eco-friendly certifications. It is further driven by retailer requirements for transparency and clean-label claims, which influence consumer purchasing decisions. These regulatory and commercial shifts create a favorable environment for sustained market growth.

- For example, Louis Dreyfus Company (LDC) launched plant-based Vitamin E products in March 2025, specifically formulated to meet food, beverage, and pharmaceutical regulations for antioxidant content and purity, with batch certificates confirming compliance with FDA and EFSA guidelines.

Market Trends:

Emergence of Algae-Derived and Marine-Based Antioxidants in Commercial Applications

Marine-based sources, particularly algae, are gaining attention as sustainable and potent sources of antioxidants. Algae contain high concentrations of astaxanthin, phycocyanin, and other carotenoids with strong antioxidant properties. These compounds are being explored for use in functional foods, nutraceuticals, cosmetics, and pharmaceuticals due to their superior efficacy and stability. The Global Antioxidants Market is experiencing a shift in ingredient sourcing as manufacturers invest in marine biotechnology to diversify product offerings. It is creating new opportunities for startups and R&D-driven companies to commercialize high-value extracts. Marine-derived antioxidants are also attractive to environmentally conscious consumers who seek sustainable and ocean-friendly ingredients.

Integration of Antioxidants into Active and Performance Nutrition Products

The increasing interest in fitness, endurance, and athletic recovery has expanded the scope of antioxidant application in performance nutrition. Manufacturers are now formulating sports beverages, protein bars, and supplements with antioxidants to reduce exercise-induced oxidative stress and support muscle recovery. The Global Antioxidants Market is adapting to this trend by collaborating with sports nutrition brands to introduce customized blends tailored for active consumers. It is helping to position antioxidants not only as wellness ingredients but also as performance enhancers. This development is particularly strong in North America and Europe, where fitness-focused lifestyles drive demand for scientifically backed functional ingredients. The trend also reflects a growing synergy between sports science and nutritional innovation.

Use of Microencapsulation and Delivery Systems for Enhanced Bioavailability

Microencapsulation and controlled-release technologies are transforming the delivery and functionality of antioxidants in end-use products. These techniques protect sensitive antioxidant compounds from degradation and enhance their absorption in the human body. The Global Antioxidants Market is leveraging this trend to improve the shelf life and efficacy of antioxidant-enriched foods, beverages, and supplements. It is enabling manufacturers to create more stable, convenient, and consumer-friendly formulations. These systems also allow antioxidants to be incorporated into applications with challenging processing conditions, such as baking, extrusion, or long-term storage. Demand for microencapsulated antioxidants is growing in fortified products aimed at children, seniors, and individuals with dietary restrictions.

- For example, the use of UV and oxygen barrier packagingis a technical measure employed to further safeguard antioxidant integrity throughout distribution and storage.

Growth of Antioxidants in Pet Nutrition and Veterinary Health Products

Pet owners are increasingly seeking health-enhancing formulations for their animals, creating demand for antioxidant-enriched pet foods and supplements. Products targeting joint health, immune function, skin support, and aging prevention are being fortified with natural antioxidants. The Global Antioxidants Market is witnessing steady growth from the pet care segment, where premiumization and humanization of animal nutrition are key trends. It is encouraging brands to introduce antioxidant blends derived from fruits, vegetables, and herbal extracts. Veterinary health companies are also incorporating antioxidants in therapeutic diets for managing inflammation and chronic diseases. This trend signals a broadening application scope and deeper market penetration beyond traditional human-focused sectors.

- For instance, recent research demonstrated that a COS-supplemented diet significantly increased the activities of key antioxidant enzymes—superoxide dismutase (SOD), glutathione peroxidase (GSH-Px), and catalase (CAT)—in dogs after 4 and 7 weeks of supplementation, with statistical significance (p<0.05p<05). Specifically, SOD and GSH-Px activities were higher in the COS group at week 4 (p=0.009p=0.009 and p=0.037p=0.037), and CAT activity was significantly elevated at both week 4 (p<0.05p<0.05) and week 7 (p<0.001p<0.001)

Market Challenges Analysis:

High Production Costs and Limited Availability of Natural Sources

Natural antioxidants often require complex extraction processes, stringent quality control, and consistent sourcing, which drive up production costs. Manufacturers face difficulties in securing reliable and scalable raw materials, particularly for high-demand compounds like polyphenols, carotenoids, and flavonoids. The Global Antioxidants Market is under pressure to maintain cost competitiveness while meeting consumer expectations for purity and sustainability. It becomes challenging for smaller producers to achieve economies of scale, especially in regions with limited access to suitable plant or marine resources. Seasonal variations, climate impact, and land-use limitations further constrain availability and increase price volatility. These supply-side limitations can restrict innovation and slow product development across industries.

Lack of Regulatory Harmonization and Consumer Misconceptions

Inconsistent global regulatory frameworks present a significant challenge for antioxidant manufacturers, especially when expanding into new international markets. Differing rules regarding allowable ingredients, health claims, and labeling standards complicate compliance and delay product launches. The Global Antioxidants Market also faces issues related to consumer confusion, particularly regarding the efficacy and safety of synthetic versus natural antioxidants. It becomes difficult to communicate product value when misinformation circulates, especially through unverified sources. Misinterpretations about antioxidants’ role in disease prevention or aging reversal may lead to unrealistic expectations or distrust. These factors create barriers to adoption and require brands to invest in targeted education and transparent marketing.

Market Opportunities:

Expansion into Emerging Economies with Growing Health Awareness

Rising health consciousness and improving disposable incomes across emerging economies present a strong opportunity for the Global Antioxidants Market. Countries such as India, China, Brazil, and Indonesia are witnessing increasing demand for functional foods, supplements, and personal care products. It can benefit from expanding distribution networks and localized product development tailored to regional preferences. Government-led public health initiatives and urbanization trends are accelerating awareness of preventive healthcare. This shift allows both multinational and regional players to introduce affordable, antioxidant-rich products to a broad consumer base. Early entry and strategic partnerships in these markets can help secure long-term growth.

Innovation in Application Areas Beyond Traditional Health Segments

Antioxidants are finding new applications in industries such as pet nutrition, biodegradable packaging, and natural food preservatives. These segments offer untapped potential for the Global Antioxidants Market to diversify revenue streams. It can leverage technological innovation to create high-performance antioxidant systems for specialized uses. Demand is rising for antioxidant-infused materials in active packaging to extend shelf life and reduce chemical preservatives. In pet health, premium formulations targeting immunity and longevity are growing rapidly. These expanding applications provide attractive opportunities for product innovation and portfolio diversification.

Market Segmentation Analysis:

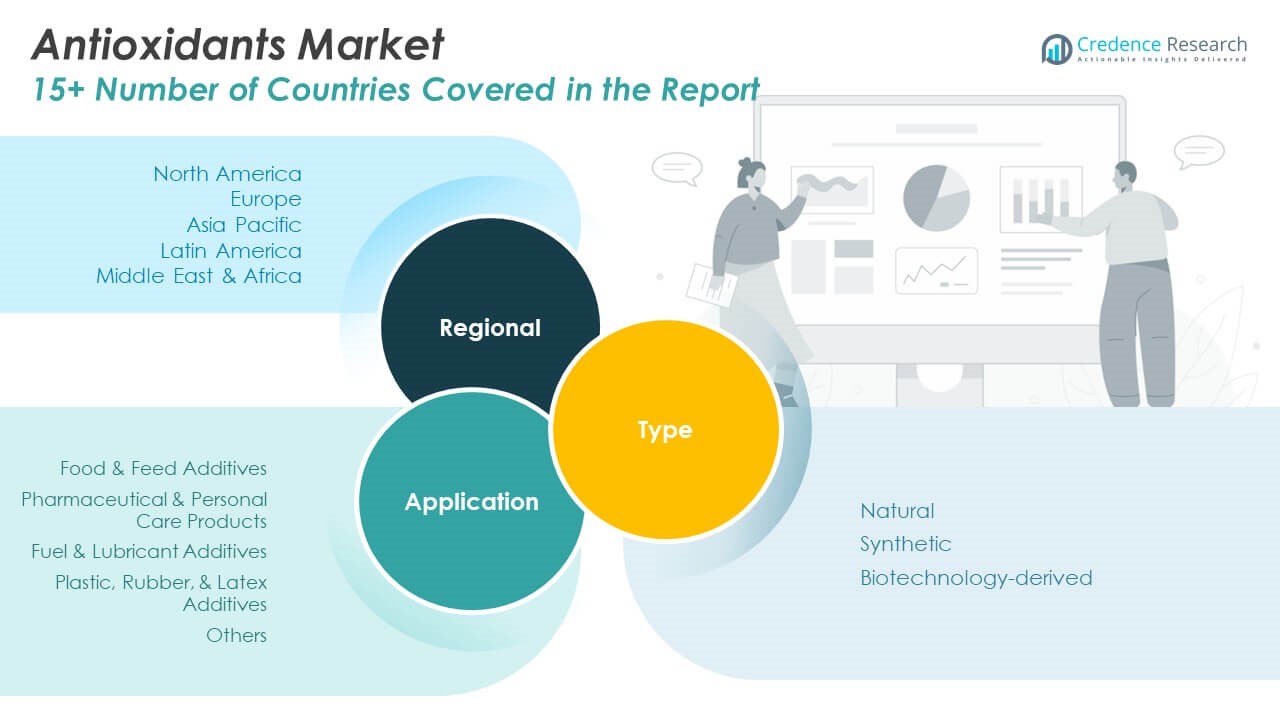

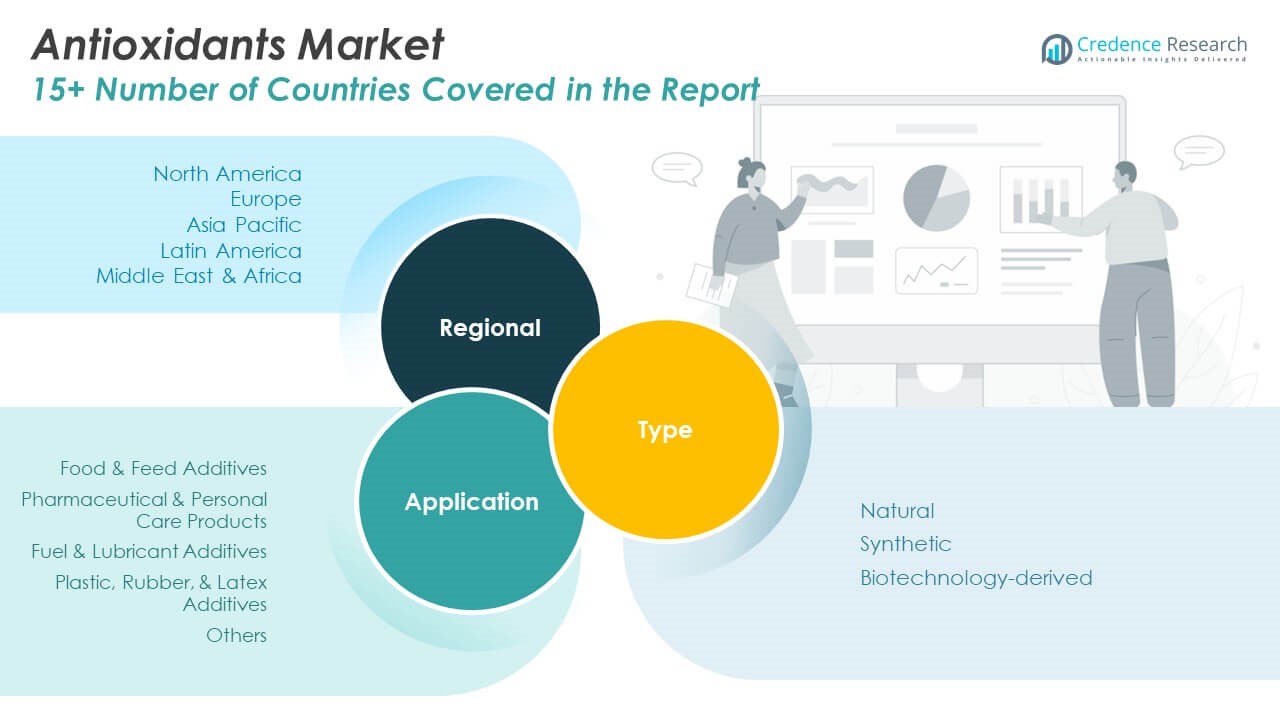

The Global Antioxidants Market is segmented

By type into natural, synthetic, and biotechnology-derived antioxidants. Natural antioxidants, including tocopherols, carotenoids, and polyphenols, are experiencing strong demand due to growing consumer preference for clean-label and plant-based ingredients. Synthetic antioxidants such as BHA and BHT continue to hold market share due to their cost-effectiveness and stability, particularly in industrial applications. Biotechnology-derived antioxidants are emerging as a niche segment, gaining attention through innovation and advanced extraction technologies.

- For example, Quali®-E is a plant-based, non-GMO tocopherol with a minimum assay of 67% d-alpha-tocopherol. DSM’s proprietary cold-extraction process preserves antioxidant activity and ensures stability, with shelf life validated for up to 24 months at ambient temperature.

By application, the market is divided into food & feed additives, pharmaceutical & personal care products, fuel & lubricant additives, plastic, rubber & latex additives, and others. Food & feed additives dominate the market, driven by demand for shelf-life extension and health-boosting formulations. The pharmaceutical and personal care segment is growing due to the integration of antioxidants in anti-aging and therapeutic products. It also finds significant use in industrial applications, where antioxidants enhance the durability and performance of fuels, lubricants, plastics, and rubbers. The market shows clear potential for expansion across both consumer and industrial domains.

- For instance, Covi‑ox® T‑70 C is a natural, mixed tocopherol oil (Vitamin E) with a minimum assay of 700 mg total tocopherols per gram (70%), derived from vegetable oils and containing various tocopherol isomers. It is intended for cosmetic and dietary supplement applications, such as skin care preparations, and meets USP-NF and FCC standards, as well as EU regulation for food-grade antioxidants.

Segmentation:

By Type

- Natural

- Synthetic

- Biotechnology-derived

By Application

- Food & Feed Additives

- Pharmaceutical & Personal Care Products

- Fuel & Lubricant Additives

- Plastic, Rubber, & Latex Additives

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

The North America Antioxidants Market size was valued at USD 1,047.24 million in 2018 to USD 1,484.93 million in 2024 and is anticipated to reach USD 2,393.96 million by 2032, at a CAGR of 5.7% during the forecast period. North America holds approximately 28% share of the Global Antioxidants Market, driven by a mature nutraceuticals industry and strong consumer demand for wellness products. The region benefits from high health awareness, advanced food and beverage processing capabilities, and a strong regulatory environment supporting clean-label formulations. The United States dominates regional consumption due to its proactive adoption of functional ingredients across food, supplements, and cosmetics. It continues to attract significant investment from manufacturers focusing on natural and plant-based antioxidants. Growth in sports nutrition, anti-aging skincare, and fortified foods supports steady market expansion. Retail innovation and online distribution also enhance accessibility to antioxidant-enriched products.

The Europe Antioxidants Market size was valued at USD 678.79 million in 2018 to USD 925.66 million in 2024 and is anticipated to reach USD 1,356.48 million by 2032, at a CAGR of 4.5% during the forecast period. Europe accounts for 18% of the Global Antioxidants Market and is characterized by its preference for clean-label, organic, and sustainable ingredients. Countries such as Germany, France, Italy, and the United Kingdom lead regional demand, driven by strict food safety regulations and growing consumer interest in plant-based diets. The region has a strong base of natural ingredient suppliers and food processors embracing antioxidant integration across bakery, dairy, and functional beverages. It also supports innovation in personal care, with antioxidant-rich skincare products gaining popularity. The European market is guided by regulatory initiatives that restrict synthetic additives, prompting a faster shift to natural alternatives. Sustainability and traceability continue to shape product development strategies.

The Asia Pacific Antioxidants Market size was valued at USD 1,488.57 million in 2018 to USD 2,224.80 million in 2024 and is anticipated to reach USD 3,796.40 million by 2032, at a CAGR of 6.5% during the forecast period. Asia Pacific holds the largest share of the Global Antioxidants Market at 42%, led by rapid economic development, rising health awareness, and growing urban populations. China, India, Japan, and South Korea are key markets showing increasing consumption of antioxidant-rich dietary supplements, fortified foods, and herbal products. It benefits from a robust supply of natural raw materials, such as green tea, turmeric, and seaweed, that support local production. Traditional medicine and herbal health practices create strong demand for natural antioxidants. Rising disposable incomes and government-backed health initiatives further promote market penetration. International players are expanding in the region through joint ventures and local manufacturing.

The Latin America Antioxidants Market size was valued at USD 158.72 million in 2018 to USD 225.56 million in 2024 and is anticipated to reach USD 318.69 million by 2032, at a CAGR of 4.0% during the forecast period. Latin America represents 4% of the Global Antioxidants Market and is gaining momentum due to dietary shifts, improved access to health products, and regional food processing growth. Brazil and Mexico lead the market with increased consumer interest in natural food preservatives and immune-boosting ingredients. The region also sees rising use of antioxidants in meat and beverage processing industries. It is supported by local agricultural richness, which offers an abundant supply of antioxidant-rich botanicals. Export-focused companies are also investing in antioxidant production for functional food and cosmetic markets abroad. Economic fluctuations and uneven regulatory structures remain challenges, but demand continues to grow steadily.

The Middle East Antioxidants Market size was valued at USD 88.54 million in 2018 to USD 115.33 million in 2024 and is anticipated to reach USD 152.72 million by 2032, at a CAGR of 3.1% during the forecast period. The Middle East holds approximately 2% of the Global Antioxidants Market and is witnessing modest growth driven by rising health awareness and urbanization. Gulf countries such as the UAE and Saudi Arabia are investing in food innovation and preventive health sectors. Demand for antioxidant-enriched beverages, snacks, and supplements is gradually increasing. It is influenced by shifting consumer preferences toward natural and halal-certified products. The region is also exploring antioxidant applications in cosmetics and wellness tourism sectors. Although local production is limited, import dependence creates opportunities for global players to expand.

The Africa Antioxidants Market size was valued at USD 46.99 million in 2018 to USD 75.85 million in 2024 and is anticipated to reach USD 93.55 million by 2032, at a CAGR of 2.2% during the forecast period. Africa accounts for 1% of the Global Antioxidants Market and remains in an early growth phase. Demand is driven by nutritional deficiencies, urbanization, and an expanding middle class with access to processed and fortified foods. South Africa leads regional activity, followed by Nigeria and Kenya. It has yet to establish large-scale production, making most antioxidant products reliant on imports. Government health programs and international aid for nutritional improvement contribute to market development. With growing exposure to global wellness trends, Africa is expected to experience steady but gradual demand for antioxidant applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Koninklijke DSM N.V.

- Givaudan

- BASF SE

- ICC Industries Inc.

- Kemin Industries Inc.

- Eastman Chemical Company

- Camlin Fine Sciences Ltd.

- Archer Daniels Midland Company (ADM)

- Barentz International BV

- Kalsec, Inc.

Competitive Analysis:

The Global Antioxidants Market is moderately fragmented, with several key players competing across food, pharmaceutical, cosmetic, and animal nutrition sectors. Leading companies such as BASF SE, Archer Daniels Midland Company, Koninklijke DSM N.V., and Kemin Industries maintain strong market positions through diversified portfolios, global presence, and ongoing investments in research and development. It fosters competition through product innovation, strategic partnerships, and regional expansions to meet evolving consumer demands for natural and clean-label ingredients. Smaller firms and regional manufacturers focus on niche markets by offering plant-based or specialty antioxidants. Mergers and acquisitions remain common as players seek to strengthen supply chains and expand technological capabilities. Competitive intensity is further shaped by regulatory compliance, price sensitivity, and innovation in extraction methods. Companies that can ensure consistent quality, scalability, and regulatory alignment are more likely to gain market share in this evolving and demand-driven landscape.

Recent Developments:

- In April 2025, Givaudan Active Beauty launched PrimalHyal™ UltraReverse, a next-generation hyaluronic acid with strong antioxidant and anti-aging properties. This ingredient is notable for its ability to penetrate skin cells and act at the DNA level, targeting several primary hallmarks of aging and protecting skin from environmental stressors.

- In March 2025, BASF announced an investment to expand production capacity for aminic antioxidantsat its Puebla, Mexico site, addressing the rising global demand for long-life lubricant additives. Additionally, on January 8, 2025, BASF agreed to sell its Food and Health Performance Ingredients business—which includes plant sterol esters and omega-3 oils—to Louis Dreyfus Company, marking a strategic shift to focus on core areas such as vitamins and carotenoids.

Market Concentration & Characteristics:

The Global Antioxidants Market exhibits moderate market concentration, with a mix of multinational corporations and regional players competing across diverse application segments. It features a balanced presence of synthetic and natural antioxidant suppliers, though demand is increasingly shifting toward plant-based and clean-label formulations. Companies focus on innovation, quality assurance, and regulatory compliance to differentiate their offerings and secure long-term contracts with food, pharmaceutical, and cosmetic manufacturers. The market shows strong growth potential due to its versatility in multiple industries and adaptability to changing consumer preferences. It is characterized by high R&D intensity, evolving extraction technologies, and increasing emphasis on sustainable sourcing. Market dynamics are shaped by raw material availability, pricing pressure, and regional regulatory frameworks that impact product approval and labeling.

Report Coverage:

The research report offers an in-depth analysis based on type and application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising demand for natural antioxidants will drive product innovation across food, cosmetic, and supplement industries.

- Technological advancements in extraction and formulation will enhance antioxidant stability and bioavailability.

- Clean-label and organic product trends will expand opportunities for plant-based antioxidant sources.

- Growth in preventive healthcare and immunity-focused products will strengthen supplement market integration.

- Asia Pacific will continue to lead global growth, supported by urbanization and health awareness.

- Expansion into pet nutrition and veterinary health will create new application segments.

- Regulatory support for natural additives will accelerate the replacement of synthetic antioxidants.

- E-commerce and digital marketing will improve consumer access to antioxidant-enriched products.

- Strategic collaborations and M&A activities will reshape competitive dynamics and supply chains.

- Investment in sustainable sourcing and traceability will become key differentiators for market players.