Market Overview

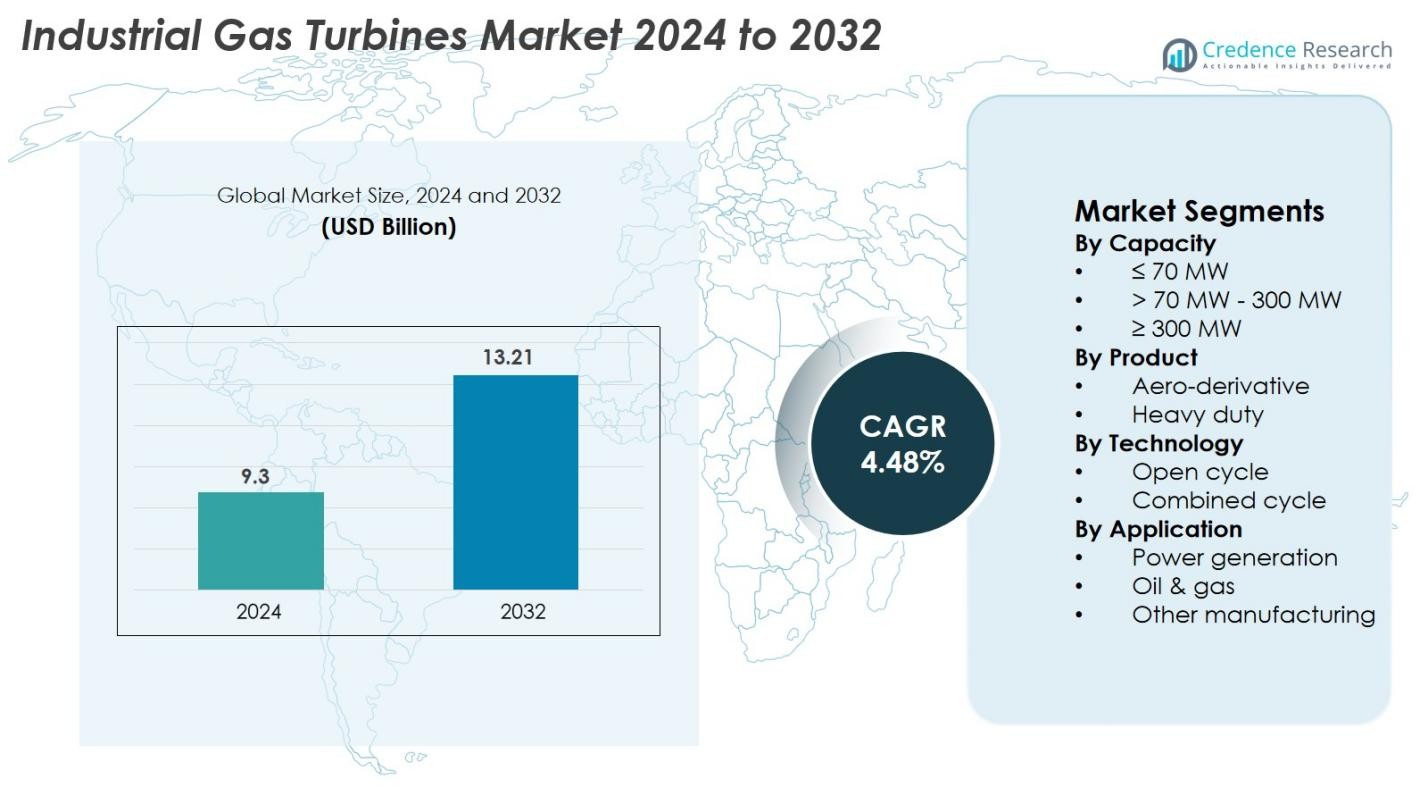

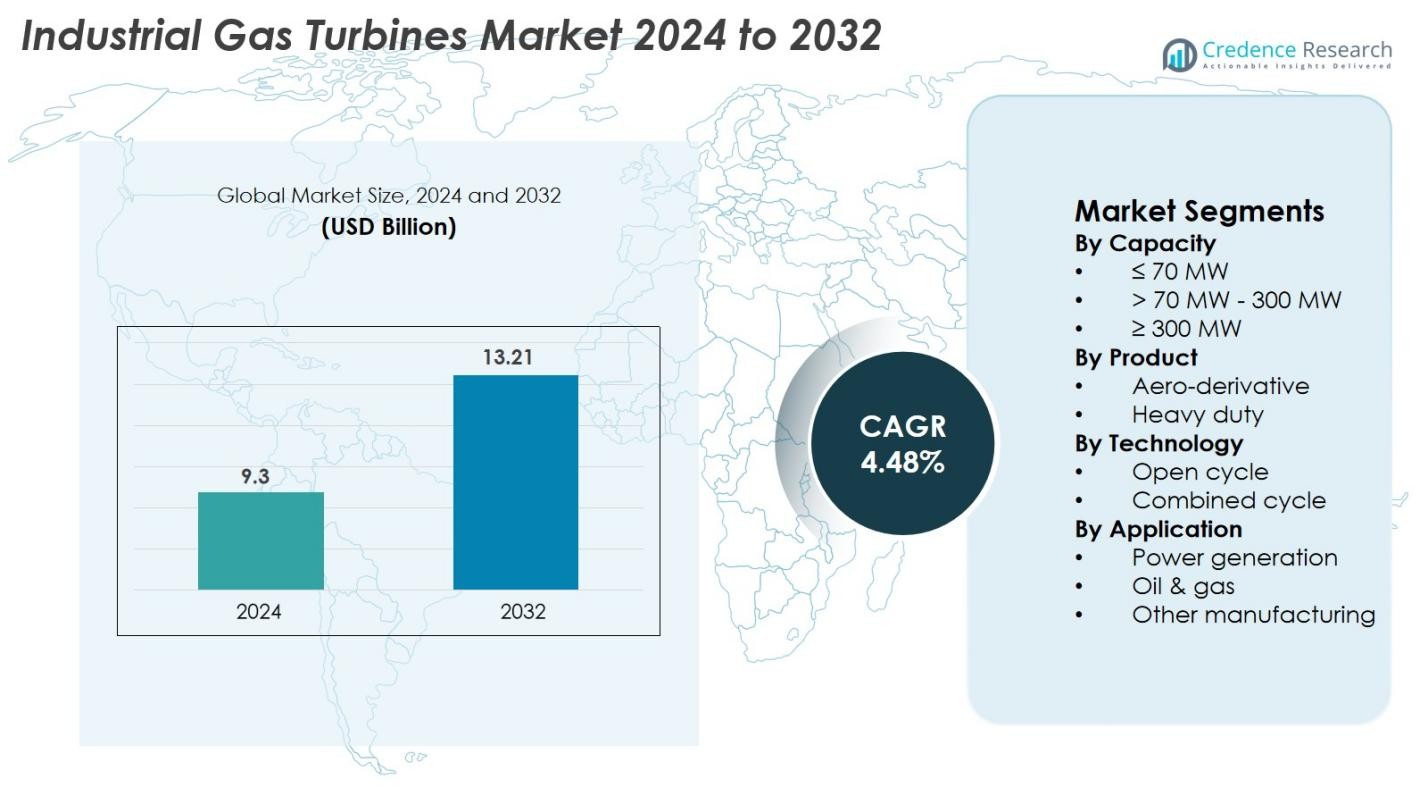

Industrial Gas Turbines Market size was valued at USD 9.3 Billion in 2024 and is anticipated to reach USD 13.21 Billion by 2032, at a CAGR of 4.48% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Gas Turbines Market Size 2024 |

USD 9.3 Billion |

| Industrial Gas Turbines Market, CAGR |

4.48% |

| Industrial Gas Turbines Market Size 2032 |

USD 13.21 Billion |

Industrial Gas Turbines Market is driven by strong participation from leading manufacturers, including GE Vernova, Siemens Energy, Mitsubishi Power, Baker Hughes, Harbin Electric, Doosan, Capstone Green Energy, IHI Corporation, Bharat Heavy Electricals, Ansaldo Energia, Destinus Energy, and Flex Energy Solutions. These companies focus on high-efficiency turbines, hydrogen-ready models, digital monitoring systems, and long-term service agreements to strengthen their global presence. Regionally, Asia-Pacific leads the market with around 36% share, supported by rapid industrialization and rising power demand, followed by North America at 32% due to strong natural gas infrastructure and modernization initiatives, while Europe holds 27%, driven by its accelerated decarbonization efforts.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Industrial Gas Turbines Market was valued at USD 9.3 Billion in 2024 and is projected to reach USD 13.21 Billion by 2032, growing at a CAGR of 4.48% during the forecast period.

- The market grows due to rising electricity demand, modernization of thermal power infrastructure, and increasing adoption of high-efficiency combined-cycle systems, with the >70 MW–300 MW segment holding over 51% share.

- Key trends include rapid adoption of hydrogen-ready turbines, digital monitoring technologies, and expansion of hybrid renewable-gas power solutions across industrial applications.

- Leading companies such as GE Vernova, Siemens Energy, Mitsubishi Power, Baker Hughes, Harbin Electric, and Doosan focus on efficiency improvements, hydrogen compatibility, long-term service agreements, and fleet modernization strategies.

- Regionally, Asia-Pacific dominates with around 36% share due to rapid industrialization, followed by North America at 32% supported by strong natural gas infrastructure, while Europe accounts for 27% driven by decarbonization initiatives and replacement of coal-based plants.

Market Segmentation Analysis

By Capacity

The Industrial Gas Turbines Market by capacity is primarily dominated by the >70 MW – 300 MW segment, accounting for 51% of the market share in 2024. This segment leads due to its widespread deployment in large industrial plants, combined heat and power (CHP) facilities, and utility-scale power generation. Its high efficiency, stable output, and suitability for continuous baseload operations make it the preferred choice for industries seeking reliable energy solutions. Increasing investments in grid modernization and rising electricity demand across emerging economies further strengthen the growth of this capacity range.

- For instance, the Siemens Energy SGT5-9000HL gas turbine, at the Keadby 2 power station in the UK, has achieved a world-record net efficiency of 64.18% in combined-cycle mode and has a total plant output of nearly 850 MW, as verified by Guinness World Records in May 2024

By Product

In the product category, heavy-duty gas turbines hold the dominant position with a market share of 62% in 2024. These turbines are favored for their robust design, long lifecycle, and ability to operate under harsh industrial conditions with high thermal efficiency. Heavy-duty models are extensively used in large-scale power plants, petrochemical facilities, and district heating systems. Growth in industrialization, expansion of large utility projects, and increasing adoption of combined-cycle configurations continue to drive demand for this segment, positioning it as the backbone of heavy industrial power applications.

- For instance, MAN Energy Solutions’ MGT8000 gas turbine generates up to 18 MW of electrical power and is designed for combined heat and power installations.

By Technology

Based on technology, the combined-cycle segment leads the Industrial Gas Turbines Market with 58% share in 2024, owing to its significantly higher efficiency and lower emissions compared to open-cycle systems. Combined-cycle plants integrate gas and steam turbines to maximize energy extraction, making them popular in regions focusing on decarbonization and energy efficiency. The ability to deliver higher output with reduced fuel consumption drives adoption across utilities and large industries. Growing regulatory pressure to reduce carbon footprints and the need for cost-effective power generation continue to accelerate demand for combined-cycle technology.

Key Growth Drivers

Rising Global Electricity Demand and Industrial Expansion

The Industrial Gas Turbines Market is significantly driven by the growing global demand for electricity, fueled by rapid urbanization, rising population, and expanding industrial activities. Developing economies in Asia-Pacific, the Middle East, and Africa are investing heavily in new power plants to address widening demand-supply gaps, directly boosting turbine installations. Industries such as petrochemicals, metals, chemicals, and manufacturing increasingly rely on high-efficiency gas turbines to ensure uninterrupted power and operational reliability. The need for flexible, fast-start power solutions that can balance renewable energy variability further accelerates market growth. Gas turbines offer advantages such as lower emissions than coal, competitive fuel efficiency, and strong operational stability, making them a preferred choice for modern power systems. Additionally, government-led infrastructure development, electrification initiatives, and industrial modernization programs continue to propel the adoption of gas turbines across both utility and industrial settings.

- For instance, GE’s LM6000 turbine delivers 56 MW of output and supports start-up times under 5 minutes, enabling rapid grid-balancing during renewable fluctuations.

Shift Toward Low-Emission and Cleaner Energy Technologies

The global push for decarbonization is a major growth catalyst for industrial gas turbines, as companies and governments transition from coal-based energy to cleaner-burning natural gas. Gas turbines produce significantly lower CO₂, NOx, and SOx emissions, making them aligned with sustainability targets and stringent environmental regulations. Many countries are implementing emission standards and green energy mandates that encourage industries to adopt gas-based power solutions, thereby creating strong market momentum. In addition, gas turbines play a crucial role in supporting renewable energy integration by providing rapid ramp-up capabilities that stabilize grids during fluctuations in solar and wind output. Their ability to operate in combined-cycle configurations further enhances efficiency, making them a viable solution for energy-intensive industries aiming to reduce carbon footprints. The emergence of hydrogen-ready turbines also expands the long-term potential of this segment, supporting future decarbonization pathways.

- For instance, Siemens Energy’s SGT-800 turbine achieves NOx emissions as low as 15 ppm using Dry Low Emission (DLE) technology and can operate with up to 75% hydrogen in the fuel mix.

Technological Advancements and Efficiency Improvements

Continuous technological innovation is a key growth driver, as manufacturers develop advanced turbines offering higher power output, improved heat rates, and extended maintenance intervals. Modern turbines incorporate cutting-edge materials, digital monitoring systems, advanced cooling technologies, and predictive analytics to optimize performance and minimize downtime. The trend toward high-efficiency combined-cycle systems further strengthens the market, as these technologies can achieve efficiencies exceeding 60%, making them one of the most cost-effective thermal power options globally. OEMs are also investing in flexible fuel capabilities, enabling turbines to operate on natural gas, LNG, syngas, and hydrogen blends. These advancements enhance the market viability of gas turbines in diverse industrial applications, from oil & gas to power generation and process industries. Improved lifecycle economics and reduced operational costs are encouraging industries to replace aging steam and diesel systems with modern high-efficiency turbine solutions.

Key Trends & Opportunities

Hydrogen-Ready Turbines and Decarbonization Pathways

A major emerging trend in the Industrial Gas Turbines Market is the shift toward hydrogen-ready turbines, driven by the global pursuit of carbon-neutral energy systems. Manufacturers are actively developing turbines capable of operating on hydrogen blends ranging from 30% to 100%, enabling industries to transition gradually from natural gas to zero-carbon fuels. This trend opens substantial long-term opportunities, especially in regions investing heavily in green hydrogen production such as Europe, Japan, and the Middle East. Hydrogen-compatible turbines play a pivotal role in future hybrid power plants and industrial clusters where emissions reduction is a priority. Public and private sector initiatives to build hydrogen infrastructure, combined with multi-billion-dollar decarbonization funds, further accelerate adoption. As global climate commitments intensify, hydrogen-capable gas turbines are positioned as key enablers of clean industrial energy, offering a significant growth opportunity for manufacturers and utilities.

- For instance, GE’s H-Class turbines have demonstrated successful operation on fuel blends containing up to 50% hydrogen and are being engineered for 100% hydrogen capability.

Digitalization, Predictive Maintenance, and Smart Power Plants

Another key trend shaping the market is the rapid adoption of digital technologies, including IoT sensors, AI-driven diagnostics, and cloud-based performance monitoring systems. Digitalization enables real-time insights into turbine operations, predictive maintenance, and rapid fault detection, significantly reducing unscheduled downtime. Power producers and industrial operators are increasingly integrating digital twins to simulate turbine behavior, optimize performance, and enhance lifecycle management. These smart technologies improve fuel efficiency, reduce emissions, and lower maintenance costs, making digital turbines an attractive investment. OEMs are also offering remote asset management services, enabling continuous monitoring of turbine fleets across multiple sites. As industries move toward smart power plants and interconnected energy networks, digitalization provides strong opportunities for operational improvement and long-term cost optimization. This trend aligns with the broader global shift toward Industry 4.0 and energy intelligence platforms.

- For instance, Solar Turbines’ InSight Connect ecosystem provides continuous monitoring for more than 2,000 installed turbines and processes over 20 million data points daily.

Key Challenges

Volatility in Natural Gas Prices and Fuel Supply Uncertainty

One of the major challenges facing the Industrial Gas Turbines Market is the volatility in natural gas prices, which directly impacts the operating cost and feasibility of turbine-based power generation. Geopolitical conflicts, supply chain constraints, and LNG demand fluctuations cause unpredictable price movements, creating uncertainty for industries dependent on stable fuel costs. In regions with limited natural gas infrastructure, supply shortages further hinder widespread adoption. Sudden spikes in fuel prices can reduce the cost competitiveness of gas turbines compared to coal or renewable energy, influencing investment decisions. Additionally, the long-term fuel-transition landscape remains unclear as countries balance natural gas dependency with renewable targets. This instability complicates capacity planning, financial forecasting, and project execution for industrial users and utilities planning new turbine installations.

Growing Competition from Renewable Energy and Storage Technologies

The rapid expansion of solar, wind, and energy storage solutions presents a significant challenge, as these alternatives continue to achieve lower costs and greater scalability. Many countries prioritize renewables in their energy mix, supported by financial incentives and stringent emission regulations that restrict fossil-based technologies. As battery storage grows more efficient and cost-effective, renewable systems increasingly compete with gas turbines in peak power and grid-balancing applications. Utilities face pressure to reduce carbon emissions, leading to reduced investment in traditional gas-based projects. In addition, environmental groups and policymakers often push for accelerated phase-outs of fossil fuel infrastructure, increasing regulatory barriers. This competitive pressure requires gas turbine manufacturers to innovate faster, emphasizing hybrid systems, hydrogen compatibility, and ultra-low emission technologies to maintain relevance in an evolving energy landscape.

Regional Analysis

North America

North America holds a substantial position in the Industrial Gas Turbines Market, accounting for 32% of the global share in 2024, driven by strong investments in combined-cycle power plants and modernization of aging thermal infrastructure. The U.S. leads the region due to its extensive natural gas availability, large industrial base, and rapid adoption of digital and hydrogen-ready turbine technologies. Increasing emphasis on reducing coal dependence and enhancing grid resilience further strengthens demand. The region is also witnessing growth in distributed power solutions and gas-fired CHP systems across manufacturing and commercial sectors.

Europe

Europe represents 27% of the market share, supported by its accelerated decarbonization agenda and widespread replacement of coal-fired plants with cleaner gas-based systems. Countries such as the U.K., Germany, Italy, and the Netherlands are investing heavily in high-efficiency combined-cycle turbines and hydrogen-compatible models. The region’s strong policy support for low-emission technologies and expansion of renewable-gas hybrid plants also boosts installations. Additionally, the development of green hydrogen projects across Northern and Western Europe positions the region as a key adopter of next-generation industrial gas turbines aimed at enabling long-term carbon neutrality.

Asia-Pacific

Asia-Pacific dominates the Industrial Gas Turbines Market with the largest share of 36%, driven by rapid industrialization, expanding power demand, and strong infrastructure growth across China, India, Japan, and Southeast Asia. Investments in new power plants, industrial clusters, and gas-based generation capacity fuel market expansion. Many countries are shifting from coal to natural gas to meet emission targets, accelerating turbine deployment. The region also benefits from rising LNG imports and growing interest in combined-cycle plants. Government-led energy security initiatives and large-scale manufacturing growth continue to make Asia-Pacific the fastest-growing market globally.

Middle East & Africa

The Middle East & Africa region accounts for 12% of the global market, primarily driven by expanding power generation needs, industrial diversification, and large-scale oil and gas operations. Countries such as Saudi Arabia, the UAE, Qatar, and South Africa are adopting high-capacity heavy-duty turbines for utility and industrial use. The Middle East’s abundance of natural gas and ongoing development of hydrogen-ready facilities further support turbine uptake. Africa’s rising electrification projects and demand for efficient on-grid and off-grid solutions contribute to steady growth, although infrastructure limitations remain a challenge in some markets.

Latin America

Latin America holds 7% of the Industrial Gas Turbines Market, with Brazil, Mexico, and Argentina leading regional demand. The region is increasingly transitioning from oil and diesel-based generation to cleaner, more efficient natural gas turbines. Investments in LNG terminals, industrial power systems, and combined-cycle projects are accelerating adoption. Economic recovery, industrial expansion, and government initiatives to enhance grid reliability support future growth. While renewable energy is also expanding, gas turbines remain essential for backup and stabilization roles. The region’s growing focus on energy efficiency and flexible power solutions continues to drive steady market opportunities.

Market Segmentations

By Capacity

- ≤ 70 MW

- > 70 MW – 300 MW

- ≥ 300 MW

By Product

- Aero-derivative

- Heavy duty

By Technology

- Open cycle

- Combined cycle

By Application

- Power generation

- Oil & gas

- Other manufacturing

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial Gas Turbines Market features a strong and technologically mature competitive landscape shaped by global OEMs focusing on efficiency, flexibility, and low-emission performance. Leading players such as GE Vernova, Siemens Energy, Mitsubishi Power, Baker Hughes, Harbin Electric, Capstone Green Energy, Doosan, IHI Corporation, Bharat Heavy Electricals, Destinus Energy, Ansaldo Energia, and Flex Energy Solutions dominate through advanced turbine portfolios and long-term service agreements. These companies compete on parameters such as thermal efficiency, hydrogen-readiness, digital monitoring capabilities, lifecycle cost, and reliability. Continuous investment in R&D, hybrid energy systems, and decarbonization solutions including hydrogen-fueled turbines and combined-cycle upgrades—shapes market differentiation. Strategic collaborations, service expansion, and modernization of existing turbine fleets remain key strategies to strengthen global presence. As industries pursue lower emissions and higher efficiency, competition intensifies around solutions that integrate digitalization, predictive maintenance, and sustainable fuel compatibility, positioning technology leadership as the core differentiator in this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Harbin Electric

- Capstone Green Energy

- Doosan

- GE Vernova

- Baker Hughes

- IHI Corporation

- Bharat Heavy Electricals

- Destinus Energy

- Ansaldo Energia

- Flex Energy Solutions

Recent Developments

- In November 2025, GE Vernova announced the commercial start-up of its 7HA.01 gas turbine at the Jafurah Cogeneration ISPP in Saudi Arabia.

- In October 2025, GE Vernova also entered a partnership with YTL PowerSeraya in Singapore to conduct a carbon-capture feasibility study for a 600 MW hydrogen-ready combined-cycle gas turbine plant.

- In September 2025, Mitsubishi Power signed a contract to supply two M701JAC gas turbines to the O Mon 4 power plant in Vietnam.

Report Coverage

The research report offers an in-depth analysis based on Capacity,Product, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will witness steady growth as industries prioritize reliable and efficient power generation solutions.

- Adoption of hydrogen-ready gas turbines will expand as countries accelerate decarbonization goals.

- Combined-cycle systems will see increasing demand due to their higher efficiency and lower emission profiles.

- Digitalization and predictive maintenance technologies will enhance turbine performance and reduce operational downtime.

- Utilities and industries will modernize aging thermal power infrastructure to meet stricter environmental standards.

- LNG availability and gas infrastructure expansion will support turbine deployment in emerging economies.

- Hybrid renewable-gas power plants will gain traction to stabilize grids with high solar and wind penetration.

- Manufacturers will invest more in advanced materials and turbine cooling technologies to boost efficiency.

- Service-led revenue models, including long-term maintenance contracts, will become more prominent.

- Competition will intensify as OEMs focus on low-emission designs, flexible fuel turbines, and global service capabilities.