Market Overview

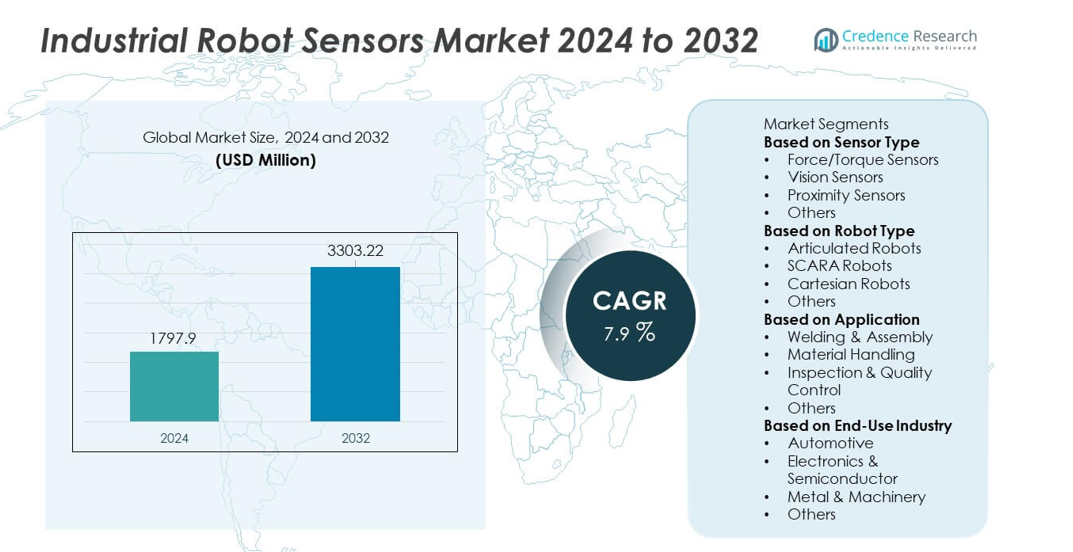

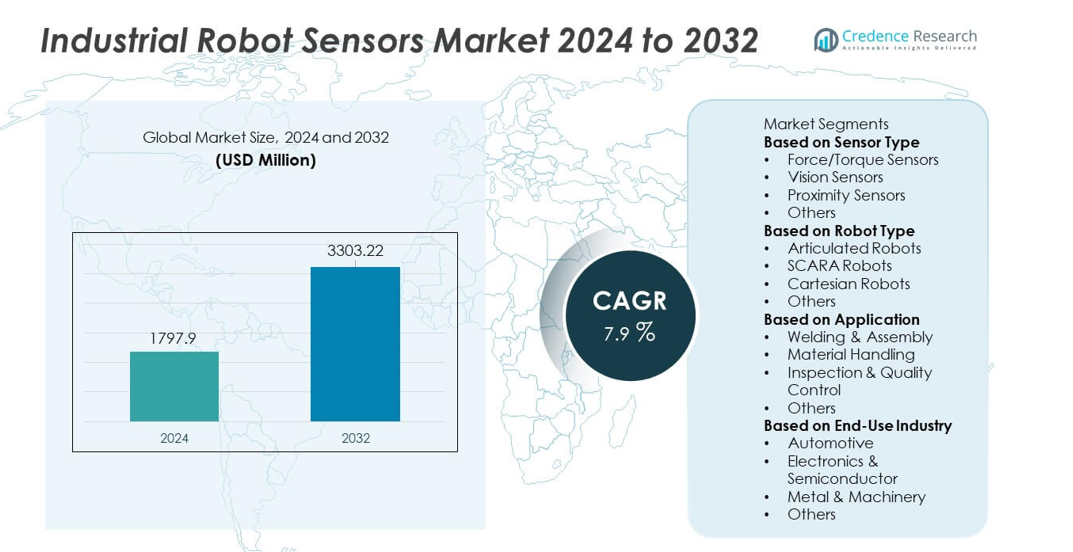

Industrial Robot Sensors market size reached USD 1,797.9 million in 2024 and is projected to grow to USD 3,303.22 million by 2032, registering a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Robot Sensors Market Size 2024 |

USD 1,797.9 million |

| Industrial Robot Sensors Market, CAGR |

7.9% |

| Industrial Robot Sensors Market Size 2032 |

USD 3,303.22 million |

The Industrial Robot Sensors market is driven by leading companies such as FANUC Corporation, ABB Ltd., Omron Corporation, Siemens AG, Rockwell Automation, SICK AG, Keyence Corporation, Cognex Corporation, Yaskawa Electric Corporation, and Honeywell International Inc., all of which focus on advancing force, vision, and proximity sensing technologies to support intelligent automation. These players invest in high-precision systems that enhance speed, accuracy, and safety across production lines. Asia Pacific leads the market with a 31% share, supported by strong robotics adoption in China, Japan, and South Korea, while North America follows with 34% due to rapid digitalization and smart-factory expansion.

Market Insights

- The Industrial Robot Sensors market reached USD 1,797.9 million in 2024 and will grow at a 7.9% CAGR through 2032, driven by rising automation across major industries.

- Key growth drivers include increasing adoption of advanced sensing technologies, with Force/Torque Sensors holding a 41% share, supported by demand for precise control in assembly and handling tasks.

- Market trends highlight strong uptake of AI-enabled vision sensors and rapid integration of sensor-rich collaborative robots, while Articulated Robots dominate the robot type segment with a 48% share.

- Competitive momentum grows as major players invest in high-performance sensing platforms, although the market faces restraints from high integration costs and calibration complexity.

- Regionally, Asia Pacific holds 31%, North America holds 34%, and Europe accounts for 29%, reflecting strong investment in smart factories and sensor-driven automation across global manufacturing hubs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Sensor Type

Force/Torque Sensors lead this segment with a 41% share, supported by rising adoption in precision tasks such as assembly, polishing, grinding, and delicate part handling. Manufacturers prefer these sensors because they improve robot accuracy, force control, and safety during complex operations. Vision Sensors follow as factories automate inspection and object-recognition activities. Proximity Sensors remain important for collision avoidance and position detection, especially in high-speed lines. Other sensors support temperature, pressure, and multi-axis feedback needs. Growth in advanced manufacturing and human-robot collaboration strengthens demand for high-performance sensor packages across industries.

- For instance, FANUC announced its one millionth robot shipment globally in September 2023 and continues to expand its product lines, integrating high-speed 2D and 3D sensors across multiple models for advanced automation tasks.

By Robot Type

Articulated Robots dominate the segment with a 48% share, driven by their flexibility, multi-axis movement, and ability to handle complex industrial tasks across automotive, electronics, and metal fabrication plants. These robots rely heavily on force, vision, and proximity sensors to improve accuracy and repeatability. SCARA Robots follow due to high demand for fast pick-and-place operations in electronics assembly. Cartesian Robots maintain steady use in packaging, palletizing, and machine loading. Other robot types expand in niche applications. Overall, demand rises as factories modernize production lines and integrate sensor-rich robotic systems.

- For instance, the KUKA LBR Med robot is equipped with redundant, integrated torque sensors in its joints, which provide haptic capabilities, safe collision detection, and allow the robot to react to external forces.

By Application

Welding & Assembly remains the leading application with a 45% share, supported by strong adoption in automotive and machinery manufacturing. These operations require precise force control, seam tracking, and vision-guided alignment, driving high demand for advanced robot sensors. Material Handling follows due to growing use in palletizing, machine tending, and logistics automation. Inspection & Quality Control expands rapidly as industries adopt vision-based defect detection and measurement solutions. Other applications continue to grow in specialized tasks. Increasing automation intensity and rising quality standards strengthen demand across all application categories.

Key Growth Drivers

Rising Automation in Manufacturing and Assembly Lines

Automation accelerates across automotive, electronics, and metal-processing industries, driving strong demand for precise and responsive robot sensors. Factories adopt force, vision, and proximity sensors to enhance accuracy, reduce defects, and support high-speed production cycles. Robots equipped with advanced sensing improve real-time decision-making and adaptive control, enabling smoother operations in dynamic environments. Companies also upgrade existing robotic systems with smarter sensors to boost productivity without major capital investments. This driver strengthens market expansion as industries pursue consistent output, lower operational errors, and higher manufacturing efficiency.

- For instance, ABB offers Integrated Force Control technology, which uses force/torque sensors capable of precisely measuring six components of force and torque (Fx, Fy, Fz, Mx, My, Mz).

Growing Adoption of Collaborative Robots (Cobots)

Collaborative robots continue to grow in importance as industries adopt flexible automation solutions that work safely alongside human operators. Cobots rely heavily on force, proximity, and vision sensors to detect contact, maintain safe speeds, and react to environmental changes. These sensing technologies support tasks such as assembly, packaging, and small-part handling, where precision and safety are essential. Companies favor cobots for their lower installation costs and easy programming. As cobots penetrate small and medium-sized factories, demand for advanced, multifunctional robot sensors increases, strengthening overall market growth.

- For instance, Omron introduced its TM cobots with cameras capturing either 1.2 or 5 megapixel resolution to support high-accuracy pick-and-place. The 5MP cameras have a frame rate of approximately 35 frames per second.

Expansion of Quality Control and Digital Inspection Systems

Industries increasingly depend on robot-enabled inspection to meet stricter quality standards and minimize human error. Vision sensors, 3D cameras, and laser measurement systems help detect defects, measure dimensions, and improve product consistency. Manufacturers adopt sensor-integrated robots for repetitive and high-accuracy inspection tasks in electronics, automotive, and medical device production. These solutions support real-time data collection, predictive maintenance, and reduced rework rates. Growth in smart factories and Industry 4.0 systems accelerates investment in inspection-focused robot sensors, strengthening the segment’s long-term expansion.

Key Trends & Opportunities

Growing Integration of AI-Enhanced Vision and Force Sensing

AI-driven sensing technology transforms industrial robotics by enabling advanced detection, pattern recognition, and autonomous decision-making. Vision systems combined with AI improve inspection accuracy, while adaptive force sensing enhances precision in assembly and polishing tasks. Manufacturers invest in intelligent sensors that support dynamic adjustments and self-learning capabilities. This trend creates opportunities for vendors offering integrated sensing platforms designed for complex, data-intensive operations. As factories pursue higher autonomy levels, AI-enhanced sensors play a central role in optimizing workflow efficiency and reducing manual oversight.

- For instance, Cognex advanced its ViDi Deep Learning tools to improve pattern detection by leveraging a system that requires hundreds of images for training, as opposed to the millions typically needed by other general-purpose deep learning software.

Rising Demand for Smart Sensors in Industry 4.0 Environments

Smart sensors gain traction as industries move toward connected and data-driven production systems. These sensors support predictive maintenance, remote condition monitoring, and seamless machine-to-machine communication. Manufacturers deploy sensor-rich robots to enhance transparency and real-time decision-making across production lines. Advancements in wireless connectivity, edge computing, and digital twins further accelerate adoption. This trend creates significant opportunities for vendors offering multifunctional and network-ready sensors that integrate easily with factory automation platforms.

- For instance, Siemens expanded its Industrial Edge portfolio, enabling the processing of large volumes of high-frequency data locally at the machine level to reduce latency and improve real-time analytics for applications like condition monitoring and predictive maintenance.

Key Challenges

High Sensor Integration Costs and Complex Calibration Requirements

Integrating advanced sensors into robotic systems requires significant investment in hardware, software, and calibration procedures. Industries face challenges related to compatibility with existing robotic platforms, which increases installation time and cost. Precision calibration is critical for tasks such as welding, inspection, and assembly, but it demands skilled technicians and frequent adjustments. Smaller manufacturers struggle to adopt high-end sensing technologies due to budget constraints. These factors limit widespread deployment and slow market penetration in cost-sensitive sectors.

Performance Limitations in Harsh Industrial Environments

Robot sensors often experience performance degradation when exposed to dust, vibration, high temperatures, or electromagnetic interference. Vision sensors may struggle with lighting variations, while proximity and force sensors face accuracy issues in unstable conditions. These limitations affect reliability and reduce efficiency in heavy industries such as metal processing, foundries, and automotive welding. Companies must invest in protective housings and ruggedized sensor designs, increasing operational costs. Addressing these challenges requires stronger durability standards and enhanced sensor resilience for demanding industrial settings.

Regional Analysis

North America

North America holds a 34% share in the Industrial Robot Sensors market, driven by strong adoption of automation across automotive, aerospace, and electronics sectors. The region benefits from advanced manufacturing ecosystems, high labor costs, and rapid deployment of smart factories. Companies invest heavily in force, vision, and proximity sensors to enhance precision and efficiency in production lines. The United States leads with major investments in robotics R&D and sensor innovation. Growing demand for quality inspection and collaborative robot integration further supports market growth. These factors position North America as a key region for high-performance sensor adoption.

Europe

Europe accounts for a 29% share, supported by strong industrial automation in Germany, France, and Italy. The region’s focus on high-precision manufacturing, stringent quality standards, and advanced automotive production drives demand for robot sensors. European factories adopt vision and force sensors for welding, assembly, and inspection applications, improving productivity and reducing error rates. Increasing integration of smart manufacturing and Industry 4.0 technologies accelerates uptake of sensor-enabled robots. Collaborative robot deployment rises across small and mid-sized industries, strengthening regional momentum. Sustainability policies and digital transformation initiatives further support long-term adoption of advanced robotic sensing solutions.

Asia Pacific

Asia Pacific leads the global growth momentum with a 31% share, fueled by rapid industrialization and expansion of electronics, automotive, and semiconductor manufacturing. China, Japan, and South Korea dominate robot deployment, creating strong demand for high-performance sensors. Manufacturers invest in vision, force, and proximity sensors to enhance speed, accuracy, and operational reliability in high-volume production environments. Government incentives for robotics adoption and smart factory development further boost regional growth. Rising labor costs drive industries to automate, while large-scale production facilities increase demand for sensor-integrated robots. The region remains a key manufacturing hub with strong long-term expansion potential.

Latin America

Latin America holds a 4% share, with growth supported by expanding automation in automotive, food processing, and consumer goods manufacturing. Countries such as Brazil and Mexico invest in robot-based solutions to improve productivity and reduce operational inefficiencies. Demand for vision and proximity sensors increases as factories modernize inspection and material-handling operations. Although adoption remains slower than other regions, rising interest in Industry 4.0 and competitive manufacturing pressures support gradual growth. Limited infrastructure and high integration costs present challenges, yet strategic investments and government modernization programs continue to strengthen regional adoption of advanced robot sensors.

Middle East & Africa

The Middle East & Africa region holds a 2% share, driven by emerging adoption of automation in oil & gas, logistics, and industrial manufacturing. Countries such as the United Arab Emirates and Saudi Arabia lead investments in smart factory technologies, supporting demand for vision and proximity sensors. Industrial modernization programs and diversification initiatives encourage companies to adopt robot-driven operations. However, limited technical expertise and high installation costs restrain rapid expansion. Growth remains steady as industries upgrade equipment to improve safety, accuracy, and quality. Increased investment in manufacturing and logistics automation supports future demand for sensor-enabled robotic systems.

Market Segmentations:

By Sensor Type

- Force/Torque Sensors

- Vision Sensors

- Proximity Sensors

- Others

By Robot Type

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Others

By Application

- Welding & Assembly

- Material Handling

- Inspection & Quality Control

- Others

By End-Use Industry

- Automotive

- Electronics & Semiconductor

- Metal & Machinery

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape features major players such as FANUC Corporation, ABB Ltd., Omron Corporation, Siemens AG, Rockwell Automation, SICK AG, Keyence Corporation, Cognex Corporation, Yaskawa Electric Corporation, and Honeywell International Inc., all of which focus on advancing sensor precision, reliability, and integration capabilities. These companies invest heavily in R&D to enhance force, vision, and proximity sensing technologies that support high-speed automation and intelligent robotic operations. Partnerships with robotics manufacturers strengthen product compatibility and expand commercial reach. Vendors compete by offering compact, high-performance sensors that support Industry 4.0 connectivity, predictive maintenance, and smart production systems. Many firms also develop AI-enhanced sensing platforms to improve detection accuracy and real-time decision-making. Increasing demand for collaborative robots encourages companies to design safer, more responsive sensor systems. Overall, competition intensifies as players scale innovations, expand production capacity, and target growth across automotive, electronics, and semiconductor industries.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- FANUC Corporation

- ABB Ltd.

- Omron Corporation

- Siemens AG

- Rockwell Automation

- SICK AG

- Keyence Corporation

- Cognex Corporation

- Yaskawa Electric Corporation

- Honeywell International Inc.

Recent Developments

- In June 2025, Siemens AG announced new AI and robotics features for automated guided vehicles. Its Safe Velocity software uses data from onboard sensors and safety laser scanners to monitor speed and dynamically adjust protection fields.

- In May 2024, FANUC America (a subsidiary of FANUC Corporation) showcased its CRX and CR series collaborative robots at the Automate 2024 trade show held in Chicago.

- In May 2024, Omron Corporation partnered with Neura Robotics to demonstrate cognitive cobots at Automate 2024. The joint cells combined Omron safety and control with Neura’s 3D vision and torque sensing for adaptive assembly tasks.

Report Coverage

The research report offers an in-depth analysis based on Sensor Type, Robot Type, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high-precision force and vision sensors will rise as factories automate complex tasks.

- AI-driven sensing technologies will expand, improving detection accuracy and autonomous robot decision-making.

- Collaborative robot adoption will accelerate, increasing the need for safe and responsive sensor systems.

- Smart factories will integrate more sensor-enabled robots to support predictive maintenance and real-time monitoring.

- Advancements in 3D vision and depth-sensing will enhance inspection, welding, and assembly operations.

- Sensor miniaturization will improve robot flexibility and support compact, lightweight automation solutions.

- Wireless and edge-connected sensors will gain traction in Industry 4.0 environments.

- Ruggedized sensors will see stronger demand in harsh industrial settings such as metal and heavy machinery sectors.

- Integration of multimodal sensors will improve robot adaptability in dynamic production lines.

- Growing manufacturing expansion in Asia will increase regional demand for advanced robotic sensing platforms.