Market Overview

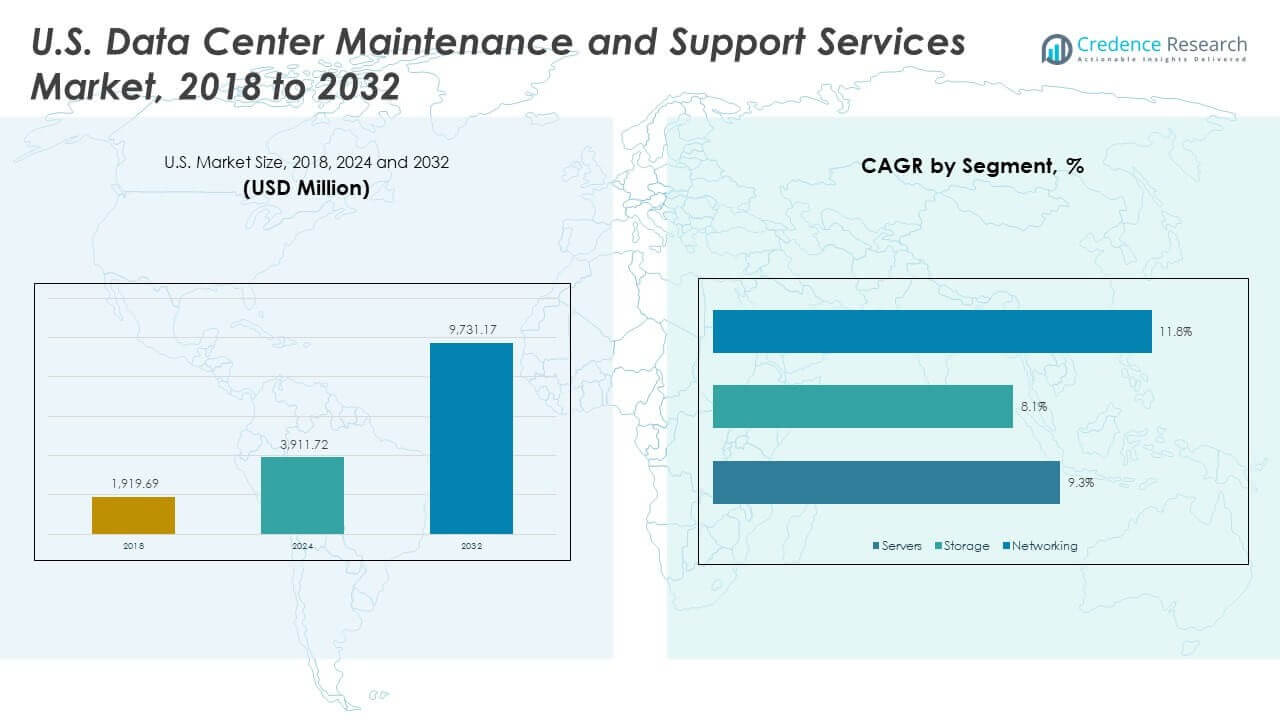

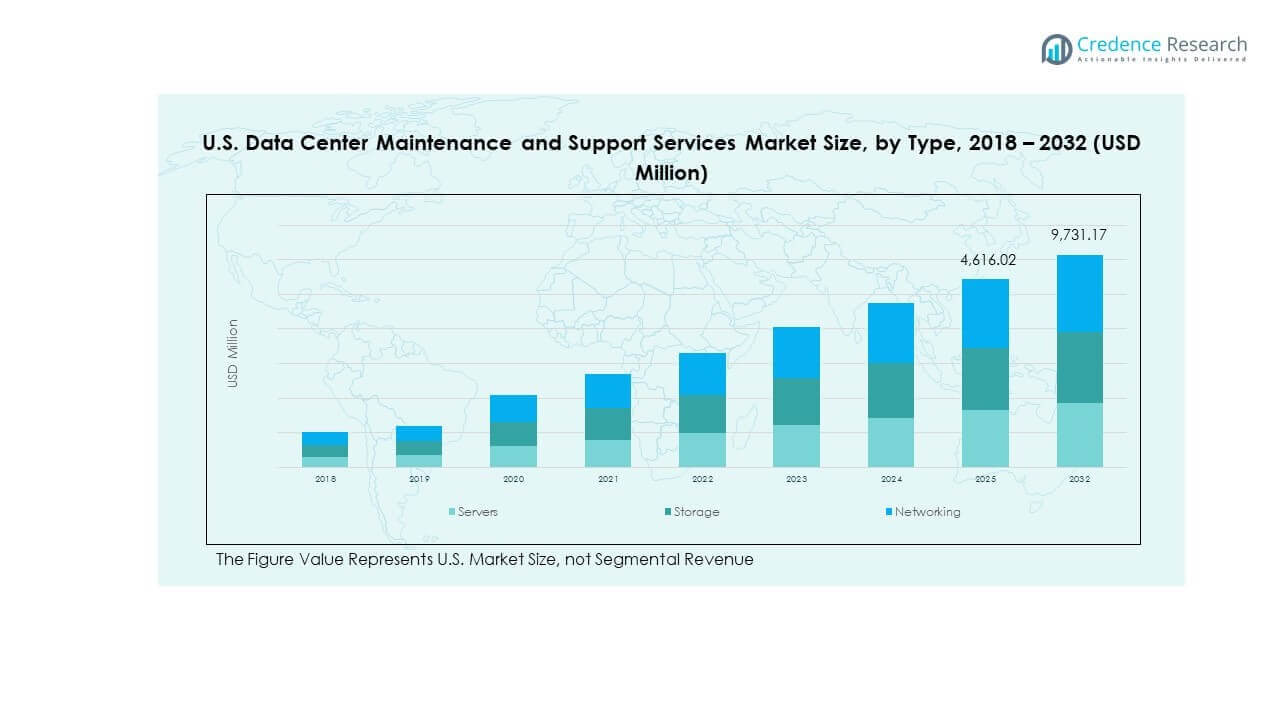

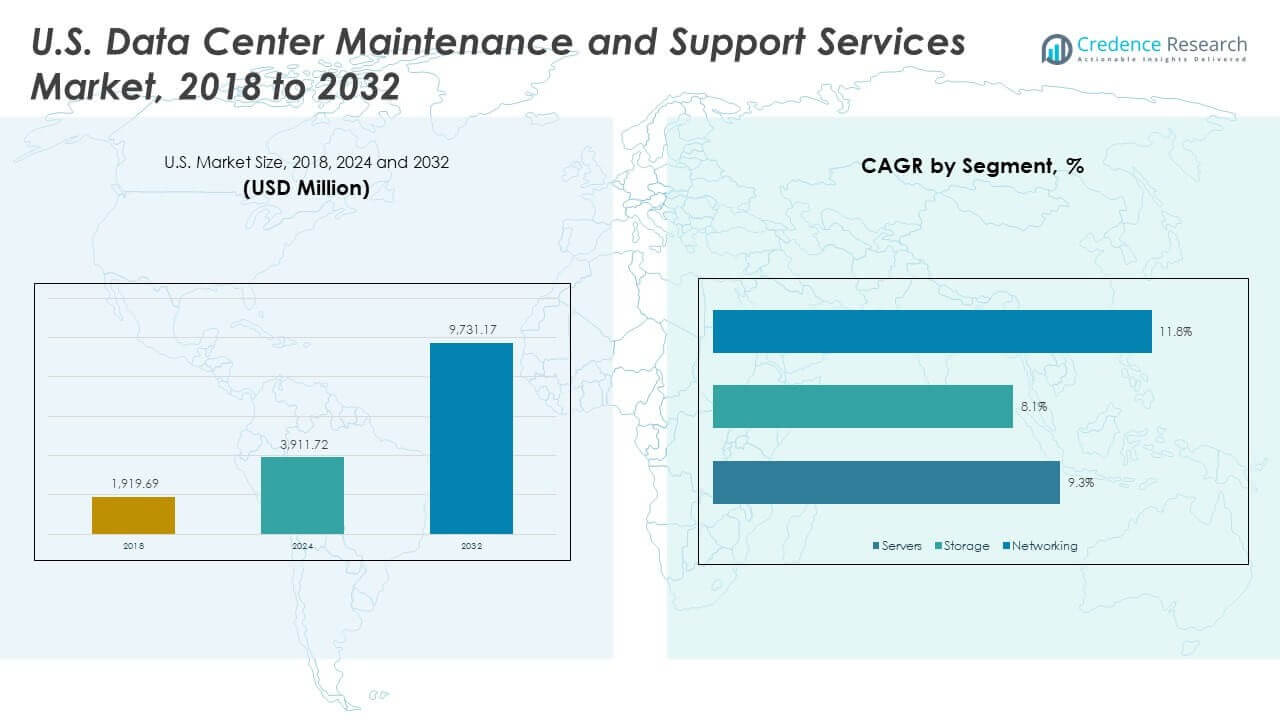

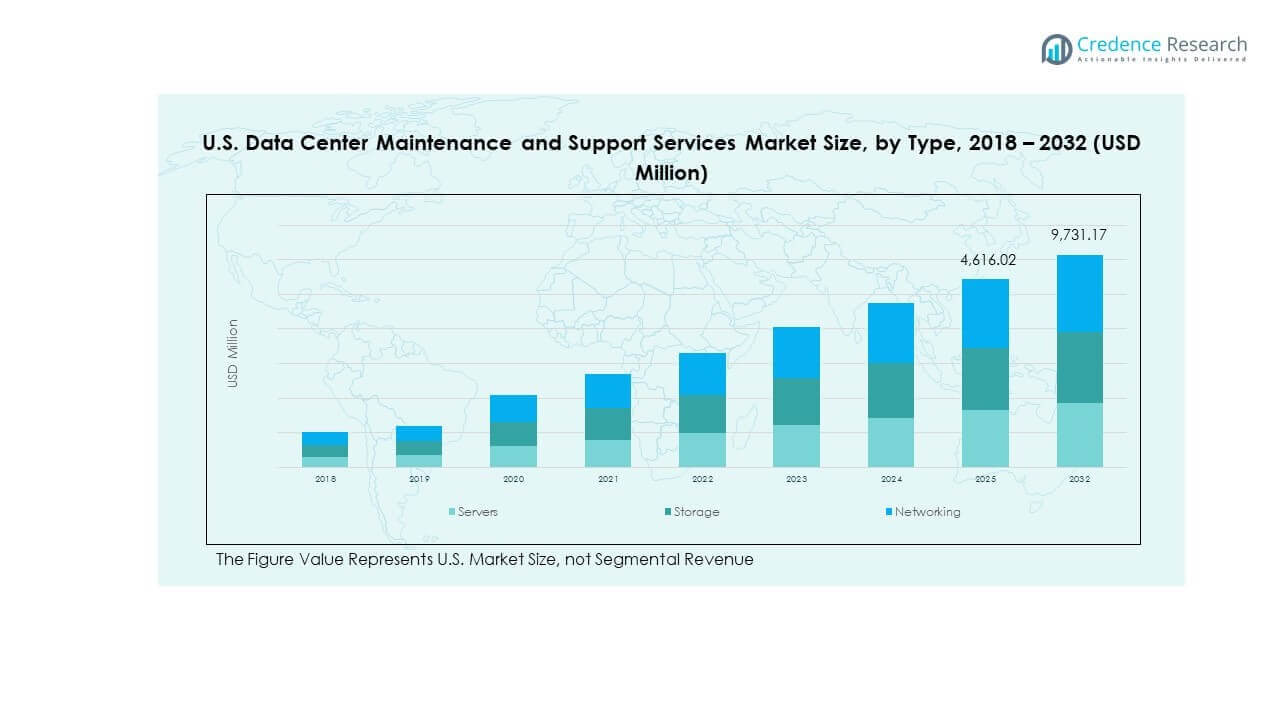

The U.S. Data Center Maintenance and Support Services Market size was valued at USD 1,919.69 million in 2018 to USD 3,911.72 million in 2024 and is anticipated to reach USD 9,731.17 million by 2032, at a CAGR of 11.24% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2019-2022 |

| Base Year |

2023 |

| Forecast Period |

2024-2032 |

| U.S. Data Center Maintenance And Support Services Market Size 2023 |

USD 3,911.72 Million |

| U.S. Data Center Maintenance And Support Services Market, CAGR |

11.24% |

| U.S. Data Center Maintenance And Support Services Market Size 2032 |

USD 9,731.17 Million |

Market growth is driven by the rapid adoption of cloud computing, virtualization, and edge technologies that require continuous infrastructure support. Enterprises are investing in automation, AI-based monitoring, and predictive maintenance to ensure high uptime and operational efficiency. Innovation in sustainable practices and resilient architectures is reshaping the industry. The market holds strategic importance for businesses and investors by enabling secure data management, improving service continuity, and supporting digital transformation goals across industries.

Regionally, the Northeast leads due to strong data center density, financial services demand, and government-backed digital infrastructure. The Midwest shows rising potential with cost-efficient hubs and investments in colocation and edge facilities. The West and South are fast-growing, supported by hyperscale deployments, favorable policies, and increasing demand for scalable solutions in technology-driven states. Emerging regions benefit from digital adoption and diversified enterprise requirements, making geographic expansion vital for future growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Dynamics:

Market Drivers

Growing Dependence on Advanced Cloud-Based and Hybrid Infrastructure for Long-Term Scalability

The U.S. Data Center Maintenance and Support Services Market is driven by enterprises adopting cloud-first strategies to manage workloads efficiently. Businesses depend on hybrid and multi-cloud environments, creating the need for advanced maintenance to ensure performance stability. Regular support allows companies to balance costs and achieve predictable service quality. Technology providers integrate proactive solutions to reduce downtime and maintain compliance with security frameworks. Demand rises as industries modernize IT systems to meet customer expectations. Investors recognize this dependency as a sign of sustainable demand growth. The market positions itself as a cornerstone for digital transformation. It delivers critical services that help organizations future-proof their operations.

Adoption of Predictive Analytics and AI-Based Monitoring Tools for Efficiency Gains

Organizations adopt predictive maintenance powered by AI to avoid costly outages. These tools analyze performance metrics and identify issues before they disrupt operations. It allows businesses to maintain high system availability and optimize resource use. AI-driven monitoring ensures data centers remain agile in a fast-changing digital environment. Providers are investing heavily in automation that reduces manual oversight. This accelerates resolution speed and enhances operational resilience. The U.S. Data Center Maintenance and Support Services Market gains importance by offering assurance of uninterrupted business continuity. Investors see strong value in funding innovations that minimize risks and ensure steady service delivery.

- For instance, in May 2025, a large North American retail chain using IBM Watson AIOpsreduced their mean time to resolution (MTTR) from hours to under 15 minutes, achieving an average MTTR reduction of 52%, as documented in industry case studies and user testimonials outlining real-world operational improvements with Watson AIOps.

Innovation in Sustainable Energy Practices and Green Data Center Operations

Sustainability becomes a core driver as companies invest in energy-efficient systems. Maintenance providers introduce solutions that reduce energy loss and optimize power distribution. It supports corporate commitments toward reducing carbon footprints while improving cost savings. Green cooling technologies and efficient resource allocation form part of long-term strategies. The U.S. Data Center Maintenance and Support Services Market aligns with regulatory requirements on energy management. Businesses view these investments as essential for reputation and compliance. Investors are drawn to providers that demonstrate measurable progress in reducing energy intensity. The push for sustainable operations cements maintenance services as critical to future infrastructure goals.

- For instance, in May 2025, a Microsoft study published in Nature confirmed that liquid cooling technologies, such as cold plates and immersion cooling, resulted in a 15–21% reduction in greenhouse gas emissionsand 15–20% less energy use compared to standard air cooling in Microsoft’s U.S. data centers.

Strategic Importance of Maintenance Services in Protecting Enterprise Data Assets

Data centers store sensitive business and consumer information, requiring round-the-clock support. It ensures security patches, hardware upgrades, and continuous monitoring against cyber threats. The U.S. Data Center Maintenance and Support Services Market delivers vital services that guard against disruptions. Organizations cannot risk data loss or extended downtime in competitive industries. Investors value the strategic role of providers in preserving trust and reliability. Regular support services improve lifecycle management of assets, reducing long-term costs. Stronger maintenance frameworks directly enhance customer confidence in digital platforms. It elevates the market into a central enabler of secure and efficient operations.

Market Trends

Integration of Remote Management Services for Faster Troubleshooting and Control

Remote management emerges as a prominent trend for data center operations. Companies seek real-time access to performance data without requiring physical presence. It reduces costs and speeds up issue resolution. The U.S. Data Center Maintenance and Support Services Market adapts by offering remote diagnostics and automated alerts. Advanced service providers extend visibility across distributed infrastructure and colocation sites. Businesses adopt these capabilities to minimize disruptions and maximize uptime. Remote services improve flexibility in a competitive digital ecosystem. Investors find long-term value in scalable models that combine accessibility with efficiency.

Expansion of Edge Data Centers Driving Localized Support Needs

Edge computing expands rapidly across the U.S., creating new maintenance demands. Distributed infrastructure requires localized monitoring and service capabilities. It ensures consistent performance for applications with low-latency requirements. The U.S. Data Center Maintenance and Support Services Market responds by deploying regional service hubs. Providers design flexible models that deliver quick support for edge environments. Businesses prefer providers capable of scaling with edge growth. This trend reshapes traditional maintenance strategies, emphasizing mobility and agility. Investors track opportunities where demand for edge services intersects with robust maintenance offerings.

Rising Demand for Cybersecurity-Focused Maintenance and Compliance Services

Enterprises place stronger emphasis on security within support contracts. Maintenance providers now integrate cybersecurity assessments into regular service schedules. It reflects growing threats targeting mission-critical infrastructure. The U.S. Data Center Maintenance and Support Services Market enhances value by embedding compliance-focused frameworks. Companies prioritize partners with expertise in regulatory adherence and threat detection. This trend underscores the merging of IT security and maintenance operations. Businesses demand transparency in how vulnerabilities are addressed. Investors recognize that providers with advanced security offerings stand to capture greater market share.

Customization of Service Models to Match Sector-Specific Business Needs

Industries such as healthcare, finance, and retail seek tailored maintenance strategies. Providers design offerings aligned with regulatory demands and workload intensity. It ensures higher satisfaction and compliance with strict industry requirements. The U.S. Data Center Maintenance and Support Services Market leverages this trend to differentiate services. Businesses want contracts that reflect industry-specific performance metrics. Service-level agreements evolve to incorporate unique sector goals. This flexibility builds deeper partnerships with enterprises. Investors value providers who innovate through customer-focused customization.

Market Challenges

Rising Operational Complexity in Managing Hybrid and Multi-Vendor Environments

The U.S. Data Center Maintenance and Support Services Market faces the challenge of maintaining hybrid systems built across multiple vendors. Each platform has unique configurations, creating integration difficulties. It requires specialized expertise to ensure smooth interoperability and high performance. Businesses often struggle to allocate resources for diverse infrastructure needs. The shortage of skilled professionals further intensifies this issue. Providers need to train staff constantly to keep up with evolving technologies. The risk of service gaps remains a key concern for enterprises. Investors recognize complexity as both a barrier and a driver for innovative solutions.

High Cost Pressures and Balancing Investments with Sustainable Business Models

Enterprises weigh the cost of maintenance against shrinking IT budgets. The U.S. Data Center Maintenance and Support Services Market must deliver cost-effective solutions without sacrificing reliability. Rising expenses related to energy, hardware, and compliance put pressure on providers. Businesses expect transparent pricing while maintaining service quality. It limits the flexibility of smaller service providers to scale operations. Vendors face competitive pricing pressure in regions with high density of providers. Achieving balance between innovation investment and cost reduction is an ongoing struggle. Investors evaluate sustainability of business models under these financial constraints.

Market Opportunities

Leveraging AI, Automation, and Advanced Analytics to Enhance Value Creation

AI-powered analytics and automation create growth opportunities for providers. Predictive insights allow proactive intervention and reduced downtime. The U.S. Data Center Maintenance and Support Services Market benefits from integrating machine learning into service delivery. Businesses increasingly demand tools that improve efficiency and reduce human error. Automated support systems strengthen client trust and boost scalability. It enables companies to meet dynamic needs across industries. Investors identify value in funding automation that guarantees measurable performance improvements.

Expanding Regional Coverage and Building Service Ecosystems for Edge Growth

Providers have the opportunity to expand into emerging U.S. regions supporting edge adoption. Enterprises demand localized services to match distributed workloads. The U.S. Data Center Maintenance and Support Services Market grows stronger when providers build regional hubs. It enhances speed, responsiveness, and reliability of maintenance. Partnerships with telecom operators and cloud providers extend market scope. Businesses benefit from ecosystem-driven service networks. Investors seek companies that capture growth at the intersection of edge expansion and support services.

Market Segmentation:

By type, the market is segmented into servers, storage, and networking. Servers hold the dominant share, accounting for more than 40% of revenue, driven by their central role in processing, data storage, and application management. Enterprises focus on preventive maintenance and optimization as cloud adoption and virtualization expand. Storage also captures a significant share due to rising volumes of structured and unstructured data. The need for backup efficiency, compliance, and software-defined storage systems continues to support demand. Networking contributes close to one-third of revenues, reflecting the importance of maintaining switches, routers, and connectivity solutions that power IoT, 5G, and cloud environments.

By end user, the market covers IT and telecom, BFSI, government and defense, healthcare, and others. IT and telecom dominate with over 35% share, fueled by 5G deployment, digital content growth, and enterprise cloud workloads. BFSI emerges as one of the fastest-growing segments, driven by the need for secure transactions, compliance, and fintech adoption. Government and defense show steady demand, prioritizing security and operational continuity for mission-critical applications. Healthcare records strong growth as digital health, EHR systems, and AI-driven diagnostics require uninterrupted access. Other industries, including retail, manufacturing, and education, are expanding adoption to support digital platforms, e-commerce, and Industry 4.0 initiatives.

Regional Insights:

The Northeast region holds 32% share of the U.S. Data Center Maintenance and Support Services Market, supported by high data center density in states such as Virginia, New Jersey, and New York. Strong connectivity, financial services demand, and government-backed digital initiatives create consistent growth. Enterprises in this region emphasize advanced monitoring and predictive maintenance to protect mission-critical infrastructure. It benefits from established colocation hubs and proximity to major enterprise headquarters. Demand for secure and resilient data management continues to expand, making the Northeast a leader in service adoption.

- For instance, in August 2025, Equinix was recognized as a Leader in the IDC MarketScape: Worldwide Datacenter Colocation Services Vendor Assessment for the fourth time, specifically for its offerings of AI-ready infrastructure and strong reliability (operating across more than 75 metropolitan areas), which have been adopted by numerous enterprises in the Northeast for mission-critical digital operations.

The Midwest accounts for 25% of the market, supported by rising investments in colocation and edge data centers. States like Illinois, Ohio, and Michigan are emerging as cost-efficient hubs due to affordable land and energy resources. Enterprises in manufacturing, healthcare, and retail sectors contribute to steady demand for maintenance services. It supports hybrid cloud environments and workload distribution across regional centers. Growth is reinforced by regional economic diversification and investments in digital infrastructure. The Midwest demonstrates strong potential for long-term expansion of support services.

- For instance, in March 2025, Stack Infrastructure announced the development of a new 36MW data center in Elk Grove Village, Illinois, featuring a closed-loop water cooling system and 263,000 sq. ft. of space specifically designed to support artificial intelligence, machine learning, and cloud workloads for enterprise clients.

The West and South collectively represent 43% share, with California, Texas, and Arizona driving most of the growth. The U.S. Data Center Maintenance and Support Services Market in these regions is fueled by hyperscale deployments, cloud providers, and growing technology enterprises. Texas attracts investment with favorable policies, while California remains central for innovation-driven demand. It benefits from large-scale data traffic, edge computing expansion, and renewable energy integration. Healthcare, BFSI, and IT enterprises in the South push demand for customized support solutions. Together, the West and South position themselves as dynamic growth engines in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Competitive Insights:

The U.S. Data Center Maintenance and Support Services Market is highly competitive, driven by global technology providers and specialized service firms. It is shaped by companies investing in predictive analytics, automation, and advanced monitoring to strengthen service delivery. Market leaders such as Cisco Systems Inc. and Dell Technologies Inc. emphasize integrated hardware and support portfolios, while Equinix Inc. leverages its strong colocation presence. Capgemini Service SAS and HCL Technologies Ltd. focus on managed services and digital transformation support. Carrier U.S. Corp. and Fujitsu Ltd. provide critical infrastructure maintenance aligned with energy efficiency and reliability. Competition intensifies with IBM and HPE expanding AI-based solutions, positioning themselves as strategic partners for enterprises. Providers gain an edge by combining scalability, compliance expertise, and cost-efficient service models.

Recent Developments:

- In September 2025, ePlus inc. expanded its Managed Services and Enhanced Maintenance Support portfolio for Juniper Networks, integrating proactive monitoring, 24×7 issue resolution with certified engineers, and a comprehensive executive dashboard for network wellness. This new offering enables single-call support for multi-vendor environments, expedient escalation to Tier 3 Juniper engineers, and dedicated customer success resources, allowing IT teams in U.S. data centers to elevate their maintenance experience, minimize downtime, and improve operational efficiency.

- In August 2025, Capgemini Service SAS announced the acquisition of Cloud4C, a prominent provider of automation-driven managed services for hybrid cloud platforms, aiming to boost its portfolio in U.S. data center maintenance and support services by enhancing automation, multicloud management, and next-gen resilience for enterprise clients.

- In August 2025, Equinix Inc. announced new partnerships with alternative energy leaders Oklo, Radiant, ULC-Energy, Stellaria, and Bloom Energy to drive reliable and sustainable power for its U.S. data centers, responding to the rising demand for electrification and AI-enabled workloads.

- In April 2025, Fujitsu Ltd. expanded its strategic collaboration with Supermicro to offer managed generative AI infrastructure services for enterprises. The company launched the PRIMERGY GX2570 M8s Supermicro OEM server with integrated support and management tools for secure, scalable AI workloads, effective July 2025, targeting the need for robust infrastructure and support services in the data center market.