Market Overview

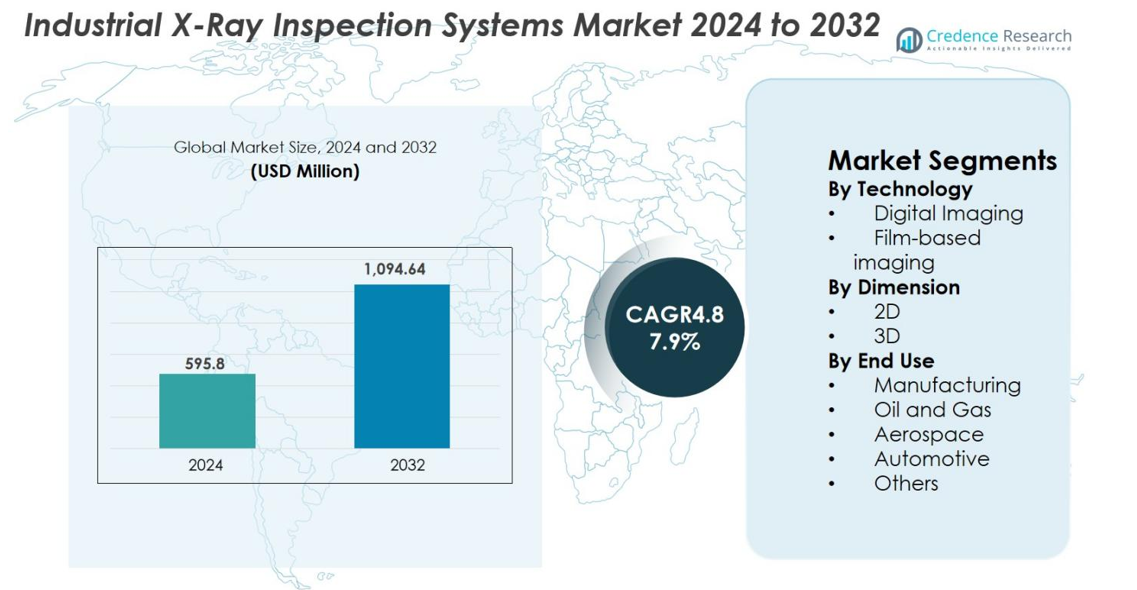

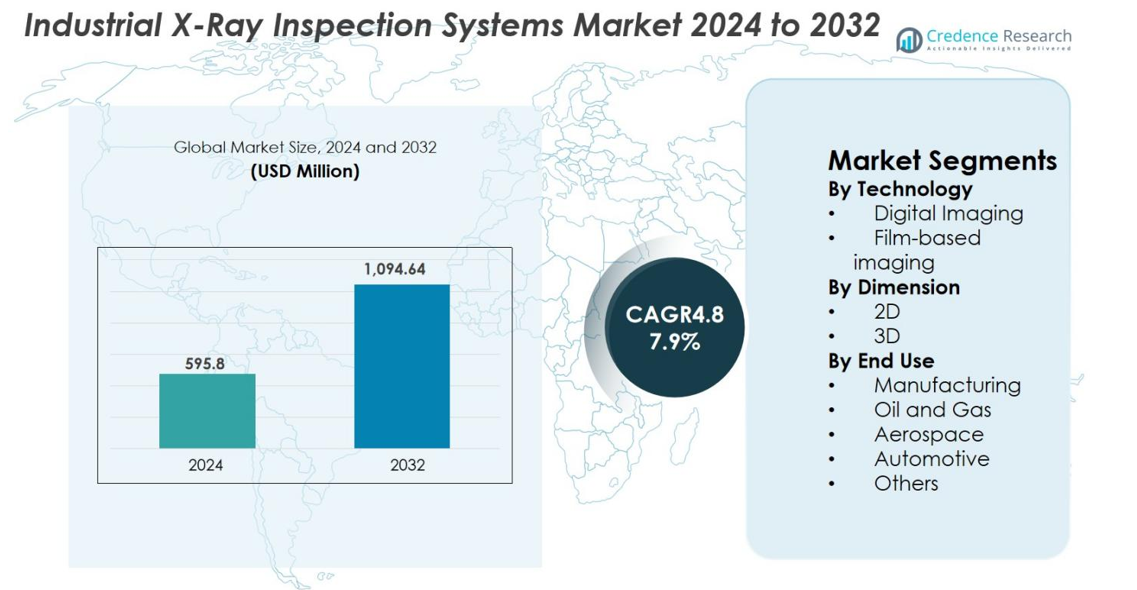

Industrial X-Ray Inspection Systems Market size was valued at USD 595.8 Million in 2024 and is anticipated to reach USD 1,094.64 Million by 2032, at a CAGR of 7.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial X-Ray Inspection Systems Market Size 2024 |

USD 595.8 Million |

| Industrial X-Ray Inspection Systems Market, CAGR |

7.9% |

| Industrial X-Ray Inspection Systems Market Size 2032 |

USD 1,094.64 Million |

Industrial X-Ray Inspection Systems Market features leading players such as Nikon Metrology NV, YXLON International GmbH, Nordson DAGE, VJ Technologies Inc., Shimadzu Corporation, Thermo Fisher Scientific Inc., Mettler-Toledo International Inc., Smiths Detection Inc., 3DX-RAY Ltd., and Bosello High Technology srl, all actively advancing digital and CT-based inspection technologies to meet rising quality assurance demands. These companies strengthen their portfolios through automation, AI-driven defect detection, and high-resolution imaging platforms. Regionally, North America led the market with a 32.6% share in 2024, driven by strong aerospace, electronics, and automotive manufacturing bases. Asia Pacific followed closely with 29.7%, supported by rapid industrialization and expansion in semiconductor and EV component production.

Market Insights

- Industrial X-Ray Inspection Systems Market was valued at USD 595.8 Million in 2024 and is expected to reach USD 1,094.64 Million by 2032, registering a CAGR of 7.9% during the forecast period.

- Growing demand for non-destructive testing across electronics, aerospace, automotive, and manufacturing drives adoption, with digital imaging holding a 72.4% segment share due to its speed, accuracy, and integration with automated systems.

- Key trends include rapid advancement of 3D and CT-based inspection technologies and increasing use of AI-driven defect detection, enhancing precision and real-time analysis capabilities.

- Major players such as Nikon Metrology NV, YXLON International GmbH, Nordson DAGE, Shimadzu Corporation, and Thermo Fisher Scientific focus on innovation, automation, and expansion into high-growth industries including semiconductors and EV components.

- Regionally, North America led with a 32.6% share in 2024, followed by Asia Pacific at 29.7% and Europe at 28.4%, reflecting strong industrial bases and rising quality assurance requirements across advanced manufacturing sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis

By Technology

Digital Imaging dominated the Industrial X-Ray Inspection Systems Market in 2024 with an 72.4% share, driven by its superior resolution, fast processing, and ability to integrate with automated inspection lines. Industries increasingly adopt digital radiography for real-time defect detection, reduced film-handling costs, and enhanced workflow efficiency. Film-based imaging retains niche use in legacy systems and low-volume inspections but continues to decline due to limited storage flexibility and slower turnaround times. The expansion of AI-driven defect analytics and high-speed digital detectors further accelerates the shift toward advanced digital imaging platforms.

- For instance, the Waygate Technologies “Phoenix V|tome|x M” industrial CT system uses next-generation 4 MP dynamic detectors and proprietary software to deliver up to 2–3× faster CT scans or doubled resolution enabling high-throughput 3D inspection for castings and electronics parts.

By Dimension

2D X-ray inspection held the leading position with an 63.1% share in 2024, supported by its widespread use in electronics, automotive components, and weld integrity assessments. Its cost-effectiveness and compatibility with high-throughput production environments sustain strong adoption. However, 3D X-ray systems are gaining momentum due to their ability to generate volumetric images, enabling precise measurement of internal geometries and complex assemblies. Growth in additive manufacturing, aerospace components, and EV battery inspection is propelling demand for 3D CT systems, which deliver enhanced depth analysis and defect characterization.

- For instance, Nikon launched the VOXLS 40 Series, featuring 225–450 kV microfocus sources designed for 3D CT inspection of additive-manufactured metal parts and EV battery modules, enabling high-resolution volumetric analysis for complex geometries.

By End Use

Manufacturing emerged as the dominant end-use segment with 41.6% share in 2024, fueled by rising adoption in electronics, semiconductors, and precision engineering industries requiring rigorous quality control. Aerospace and automotive sectors also exhibit strong uptake due to increasing reliance on lightweight materials and safety-critical components that demand stringent inspection standards. Oil & gas applications utilize X-ray systems for pipeline weld integrity and corrosion monitoring. Broader digital transformation across industrial workflows and the expansion of automated NDT processes continue to drive system upgrades and new installations across diverse end-use industries.

Key Growth Drivers

Rising Demand for High-Precision Quality Assurance

The Industrial X-Ray Inspection Systems Market is strongly driven by the growing need for highly accurate, non-destructive quality verification across advanced manufacturing sectors. As industries move toward miniaturized components, intricate assemblies, and lightweight materials, conventional inspection methods fail to detect internal defects effectively. X-ray systems overcome these limitations by delivering high-resolution imaging, real-time monitoring, and automated defect identification. Electronics and semiconductor industries rely on digital radiography for solder joint evaluation and void detection, while aerospace and automotive manufacturers adopt X-ray inspection to meet stringent safety regulations. The increasing global emphasis on zero-defect manufacturing and reduced product failure rates continues to accelerate investments in advanced X-ray inspection technologies.

- For instance, Waygate Technologies enhanced its Phoenix V|tome|x M CT platform with AI-aided defect recognition, enabling automated porosity, crack, and inclusion detection in aerospace castings and additive-manufactured parts.

Expansion of Automation and Industry 4.0 Adoption

Automation, robotics, and Industry 4.0 frameworks are transforming industrial workflows, boosting the adoption of intelligent X-ray inspection systems. High-speed digital detectors, automated scanning modules, and AI-enhanced defect classification significantly improve throughput and reduce inspection errors. Manufacturers increasingly seek systems capable of predictive maintenance, process optimization, and seamless integration with ERP/MES platforms. Smart factories across automotive, aerospace, electronics, and food processing industries demand connected X-ray solutions equipped with cloud analytics and remote diagnostics. As digital transformation accelerates globally, companies prioritize automated inspection technologies that enhance traceability, ensure regulatory compliance, and optimize cost efficiency, making X-ray inspection a critical component of modern industrial operations.

- For instance, Waygate Technologies expanded its Mentor Visual iQ ecosystem with cloud-connected analytics, enabling remote diagnostics and AI-assisted defect assessment integrated directly into automated inspection workflows.

Increasing Regulatory Standards and Safety Requirements

Stricter global regulations on product safety, structural integrity, and compliance requirements are driving increased adoption of industrial X-ray inspection systems. Industries such as aerospace, oil & gas, automotive, and medical devices must follow rigorous inspection protocols to detect internal defects, weld discontinuities, or material inconsistencies that could result in safety failures. Regulatory bodies mandate the use of non-destructive testing (NDT) methods for components exposed to extreme conditions. As supply chains expand and quality risks grow, companies rely more on X-ray inspection to maintain standardization and reliability. The need for certification compliance, safety validation, and risk mitigation continues to strengthen demand for high-resolution and automated X-ray systems worldwide.

Key Trends & Opportunities

Rapid Adoption of 3D and CT-Based X-Ray Inspection

A major trend transforming the market is the increasing adoption of 3D and computed tomography (CT) X-ray systems, which overcome the limitations of traditional 2D imaging. These systems offer volumetric visualization, enabling detailed analysis of internal geometries, hidden cavities, and multi-material components. Industries such as additive manufacturing, aerospace, and EV battery production rely on CT inspection for porosity analysis, structural validation, and precision measurement. This shift presents strong opportunities for manufacturers offering high-quality detectors and automated reconstruction software. As Industry 4.0 progresses, combining CT imaging with digital twins and AI analytics enhances predictive modeling and process optimization, expanding the technology’s application scope across industrial sectors.

- For instance, VJ Technologies integrated its VXCT platform into EV battery module production lines, where automated CT reconstruction and AI-based defect classification create digital models that support predictive maintenance and real-time quality control.

Growth of AI-Driven Defect Detection and Smart Inspection Systems

AI-enabled X-ray inspection systems are emerging as a transformative opportunity for manufacturers seeking accuracy, speed, and automation. Machine learning algorithms improve defect recognition, minimize manual interpretation, and enable automated classification of anomalies. Smart inspection platforms continually refine their detection capabilities using extensive imaging datasets. High-volume industries such as electronics, automotive, packaging, and medical devices are rapidly integrating AI-driven solutions to support zero-defect manufacturing goals. Cloud-based analytics, remote monitoring features, and edge computing capabilities further enhance decision-making and operational efficiency. As digitization accelerates, AI-powered X-ray inspection technologies offer significant opportunities for enhanced productivity and long-term cost savings.

- For instance, ZEISS their “ZADD Segmentation” software is explicitly designed for AI-based defect detection on CT X-ray data. It can identify small and fuzzy defects even when image quality is imperfect. It performs automated segmentation and evaluation of anomalies in 3D CT scans, making defect assessment faster and more reliable.

Key Challenges

High Cost of Advanced X-Ray Systems and Operational Complexity

A major challenge limiting wider adoption of industrial X-ray inspection systems is the high cost associated with advanced digital and CT-based technologies. Small and medium enterprises often find it difficult to justify investment in high-resolution detectors, automated scanning platforms, and AI-based software. The systems require strict radiation compliance, skilled operators, and frequent calibration, adding to operational difficulty. Retrofitting existing facilities to accommodate high-energy systems may also increase installation costs. These combined financial and operational barriers discourage adoption in cost-sensitive sectors and highlight the need for more affordable, modular, and user-friendly X-ray inspection solutions.

Technical Limitations in Inspecting Dense or Large Components

Despite significant technological progress, X-ray inspection maintains inherent limitations when used on very dense materials, thick welds, or large structural components that restrict penetration depth. High-energy sources and specialized detectors are necessary to achieve deeper penetration, resulting in higher system costs and infrastructure requirements. In industries such as aerospace, heavy engineering, and shipbuilding, imaging distortions or resolution loss can hinder accurate defect identification. Large components may also require multiple imaging cycles or repositioning, slowing workflow efficiency. These technical constraints limit the applicability of X-ray inspection in certain settings and drive continuous innovation toward more powerful and adaptable imaging technologies.

Regional Analysis

North America

North America held the largest share of the Industrial X-Ray Inspection Systems Market in 2024, accounting for 32.6% of global revenue. The region benefits from strong adoption across aerospace, defense, automotive, and electronics manufacturing, where stringent regulatory requirements demand advanced non-destructive testing technologies. The U.S. leads growth due to high investment in automation, digital quality control, and CT-based inspection capabilities. Expanding semiconductor production and rising demand for EV components further strengthen market penetration. Ongoing upgrades in industrial infrastructure and the presence of major technology providers continue to drive regional expansion.

Europe

Europe captured 28.4% of the Industrial X-Ray Inspection Systems Market in 2024, supported by robust manufacturing activity in Germany, France, the U.K., and Italy. The region’s well-established aerospace, automotive, and medical device industries rely heavily on X-ray inspection to meet stringent safety and compliance standards. Strong regulatory frameworks such as CE certification and EN standards fuel demand for high-precision imaging systems. Increasing investments in renewable energy infrastructure and advanced engineering also enhance market adoption. Europe’s growing shift toward automation and Industry 4.0 drives steady demand for digital and 3D inspection technologies.

Asia Pacific

Asia Pacific accounted for 29.7% of the market in 2024 and is projected to be the fastest-growing region, driven by rapid industrialization, expanding electronics manufacturing, and rising automotive production in China, Japan, South Korea, and India. The region’s strong semiconductor fabrication ecosystem significantly increases demand for high-resolution X-ray inspection systems. Government incentives promoting domestic manufacturing and quality assurance further support adoption. Growing EV battery production and advanced materials processing also accelerate market growth. As industries push for improved reliability and process automation, Asia Pacific continues to expand its use of digital, AI-enabled X-ray inspection solutions.

Latin America

Latin America contributed 5.1% to the global Industrial X-Ray Inspection Systems Market in 2024, with growth primarily driven by the automotive, oil and gas, and food processing sectors in Brazil, Mexico, and Argentina. Increasing focus on product safety, pipeline integrity, and quality certification is encouraging more companies to adopt digital radiography and automated X-ray inspection solutions. Industrial modernization and foreign investment in manufacturing expand opportunities, though adoption remains slower compared to developed markets due to budget constraints. As regulatory standards strengthen and technological awareness increases, the region shows steady but moderate market progression.

Middle East & Africa

The Middle East & Africa region accounted for 4.2% of the market in 2024, with demand concentrated in oil and gas, heavy engineering, and aerospace sectors in the UAE, Saudi Arabia, and South Africa. The region relies on X-ray inspection for weld integrity testing, pipeline monitoring, and structural assessment in energy and infrastructure projects. Ongoing industrial diversification initiatives and increased investments in manufacturing enhance adoption potential. However, higher equipment costs and limited technological penetration slow broader market expansion. As quality control standards rise and industrial automation advances, MEA continues to gradually integrate more advanced X-ray inspection systems.

Market Segmentations

By Technology

- Digital Imaging

- Film-based imaging

By Dimension

By End Use

- Manufacturing

- Oil and Gas

- Aerospace

- Automotive

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Industrial X-Ray Inspection Systems Market features a diverse and technologically advanced landscape, with leading players focusing on innovation, automation, and high-resolution imaging solutions to strengthen their global presence. Key companies such as Nikon Metrology NV, YXLON International GmbH, Nordson DAGE, VJ Technologies Inc., 3DX-RAY Ltd., Shimadzu Corporation, Thermo Fisher Scientific Inc., Mettler-Toledo International Inc., Smiths Detection Inc., and Bosello High Technology srl actively expand their portfolios through digital radiography, CT-based systems, and AI-driven defect detection software. These players invest heavily in R&D to enhance imaging precision, penetration capability, and system automation, aligning with the rising demand for real-time quality assurance. Strategic collaborations, acquisitions, and geographic expansion remain core growth strategies as companies compete to serve high-potential sectors such as aerospace, electronics, automotive, and oil and gas. With increasing regulatory standards and the shift toward Industry 4.0, market leaders continue to prioritize reliability, speed, and integration capabilities to differentiate their offerings.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Thermo Fisher Scientific Inc.

- 3DX-RAY Ltd.

- Bosello High Technology srl

- Nikon Metrology NV

- Smiths Detection Inc.

- VJ Technologies, Inc.

- Shimadzu Corporation

- YXLON International GmbH

- Mettler-Toledo International Inc.

- Nordson DAGE

Recent Developments

- In July 2025, LK Metrology acquired ProCon X‑Ray GmbH expanding LK’s offering to include industrial CT and X-ray inspection systems.

- In May 2025, Excillum and Waygate Technologies announced a technology collaboration Waygate unveiled its new high-resolution CT system (Phoenix Nanotom® HR) using Excillum’s NanoTube N3 X-ray source.

- In February 2025, Nordson Test & Inspection announced it would unveil next-generation inspection and metrology systems including new X-ray inspection and metrology technologies at the upcoming IPC APEX Expo.

Report Coverage

The research report offers an in-depth analysis based on Technology, Dimension, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will experience strong growth as industries accelerate adoption of automated, real-time quality inspection technologies.

- Digital and computed tomography systems will gain wider penetration due to increasing demand for high-resolution internal imaging.

- AI-driven defect detection and predictive analytics will become standard features, enhancing inspection accuracy and efficiency.

- Integration of X-ray systems with Industry 4.0 platforms will expand, supporting smart factories and data-driven decision-making.

- Semiconductor, electronics, and EV battery manufacturing will emerge as major growth engines due to rising precision requirements.

- Miniaturization of components in advanced industries will drive demand for more powerful and compact X-ray systems.

- Portable and inline inspection solutions will gain popularity for enabling faster, flexible, and continuous inspection workflows.

- Regulatory tightening across aerospace, medical devices, and automotive sectors will boost adoption of advanced NDT technologies.

- Adoption in emerging economies will rise as manufacturers modernize production and improve quality standards.

- Collaborative innovations among equipment manufacturers, software providers, and automation companies will shape next-generation inspection ecosystems