Market Overview

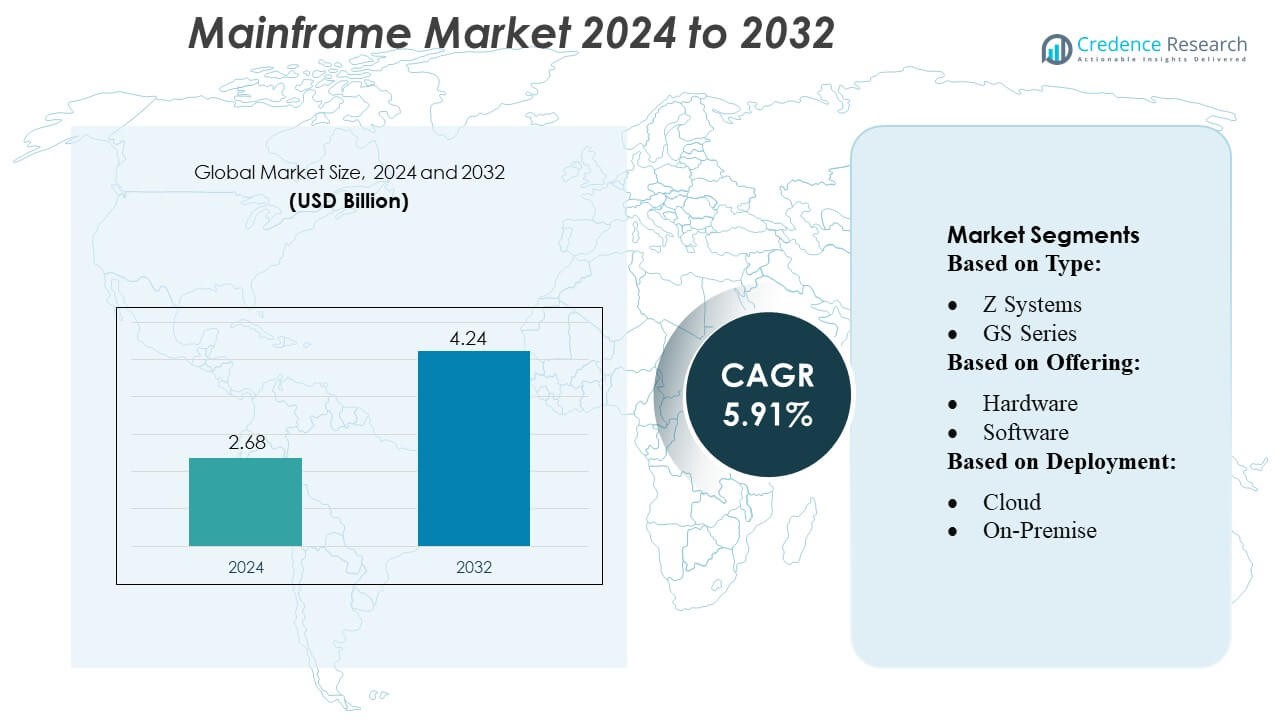

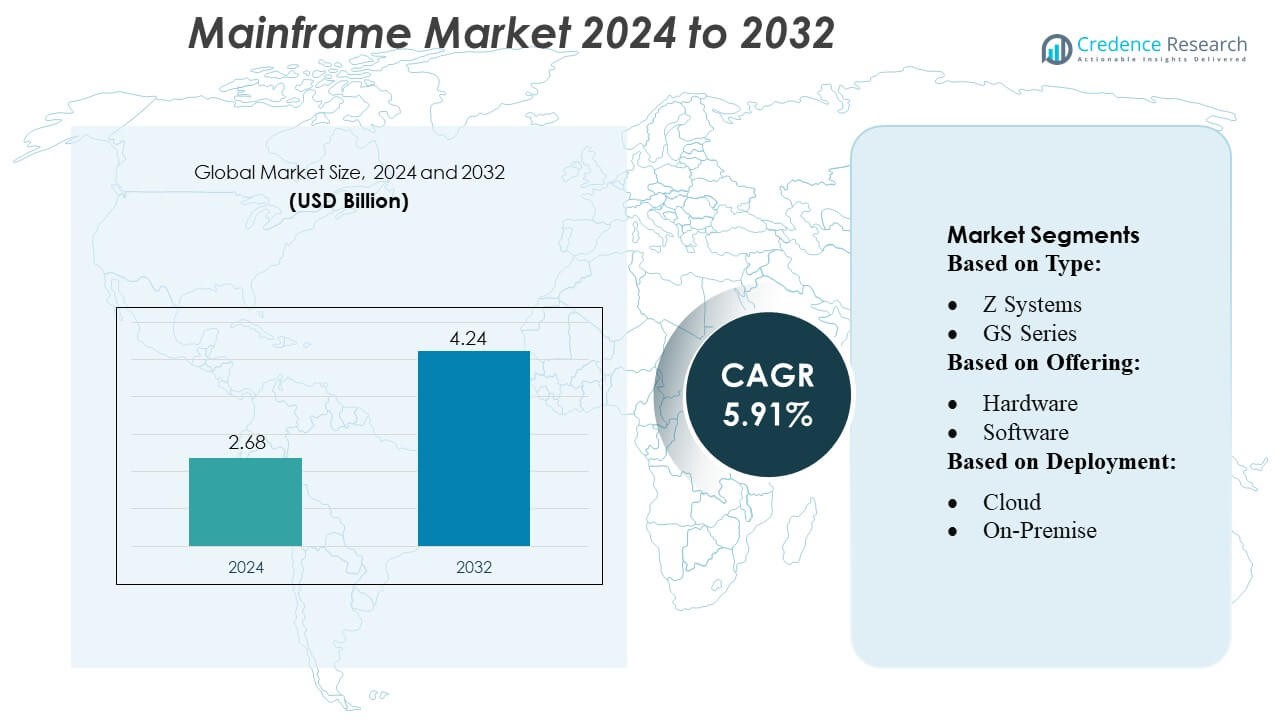

Mainframe Market size was valued USD 2.68 billion in 2024 and is anticipated to reach USD 4.24 billion by 2032, at a CAGR of 5.91% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Mainframe Market Size 2024 |

USD 2.68 Billion |

| Mainframe Market, CAGR |

5.91% |

| Mainframe Market Size 2032 |

USD 4.24 Billion |

The mainframe market is shaped by a diverse mix of established firms leveraging their technology portfolios, consulting expertise, and managed-services offerings to compete on modernization, integration, and performance. These companies strive to deliver hybrid mainframe-cloud environments, automated operations, and secure transaction platforms to meet enterprise demands. With increasing demand for scalable, reliable, and compliant infrastructure, vendors focus on innovations in workload automation, integration frameworks, and modernization services. Meanwhile, the region leading this market is North America, which held about 41% of the global mainframe market share in 2024, owing to extensive adoption in sectors such as finance, government, healthcare, and large enterprises that require mission-critical computing.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global mainframe market reached USD 2.68 billion in 2024 and is projected to grow to USD 4.24 billion by 2032, reflecting a CAGR of 5.91%, supported by sustained enterprise demand for high-performance, secure, and scalable computing infrastructure across mission-critical operations.

- Modernization initiatives remain the primary growth catalyst, with enterprises increasingly transitioning from legacy architectures to hybrid mainframe–cloud ecosystems. This shift is accelerating investment in workload automation, advanced integration frameworks, and managed services, enabling improved agility and operational efficiency.

- Key market trends include rising adoption of automated operations, implementation of reinforced cybersecurity frameworks to protect mission-critical workloads, and the expansion of modernization-as-a-service Large enterprises continue to drive demand as they maintain the dominant market share, supported by their complex, high-transaction environments.

- The competitive landscape is characterized by established vendors enhancing their consulting, performance optimization, and hybrid integration capabilities. However, growth is tempered by high modernization costs, complex migration processes, and a widening shortage of mainframe-skilled professionals, which challenges scalability.

- North America accounted for approximately 41% of the global market in 2024, driven by strong adoption across BFSI, government, and healthcare sectors. Large enterprises sustained their leadership in the end-user segment, influenced by stringent compliance needs, heavy transaction processing, and reliance on resilient high-availability systems.

Market Segmentation Analysis:

By Type

Z Systems leads the market with the largest share, holding around two-thirds of the segment due to its high performance, strong security, and ability to handle heavy transaction workloads in banking and government. GS Series follows as the next major sub-segment, supported by demand from industries seeking reliable but cost-efficient systems. Other Types account for a smaller portion of the market, mainly serving niche applications. The dominance of Z Systems is driven by continuous upgrades, workload optimization features, and enterprise preference for stable, mission-critical computing.

- For instance, IBM Z platform often adopted by Capgemini in modernization projects can support more than 12 billion encrypted transactions per day on a single system, enabling large banks to manage massive daily loads reliably.

By Offering

Hardware remains the dominant offering, contributing nearly half of the market as organizations continue refreshing and expanding their mainframe infrastructure. The need for advanced processing, storage, and security enhancements keeps hardware demand strong. Services form the next major sub-segment and are expanding rapidly, supported by modernization projects, system integration needs, and outsourcing of mainframe management. Software also plays a key role by enabling workload automation, security updates, and cloud integration, although it holds a smaller share compared to hardware.

- For instance, Infosys has launched the Infosys Modernization Suite (part of its Cobalt portfolio), comprising over 40 distinct modernization services across mainframe, cloud, database and application modernization workloads.

By Deployment

On-premise deployment holds the dominant share, accounting for over 70% of the segment as enterprises prioritize full control over data, compliance, and security. This model remains essential for financial services, public sector agencies, and telecom operators handling sensitive, high-volume transactions. Hybrid deployment is growing quickly as organizations integrate mainframes with cloud platforms to improve scalability and modernization. Cloud-only deployment represents the smallest sub-segment but continues to expand as enterprises adopt flexible consumption models and shift selected workloads off-site.

Key Growth Drivers

- Rising Demand for High-Volume Transaction Processing

The mainframe market continues to expand as enterprises increasingly rely on platforms that support high-volume, low-latency transaction processing. Banking, insurance, retail, and government agencies handle millions of daily transactions that require unmatched reliability, throughput, and uptime. Mainframes deliver consistent performance with sub-second response rates and near-zero downtime, enabling mission-critical operations. The growth of digital banking, online payments, and real-time fraud detection further fuels adoption, as organizations seek systems capable of processing massive workloads securely while maintaining strict regulatory and operational requirements.

- For instance, IBM z17, announced in 2025, runs on the new Telum II processor, which supports more than 450 billion AI inferencing operations per day with 1‑millisecond response time.

- Expansion of Hybrid IT and Modernization Initiatives

Hybrid IT adoption is accelerating mainframe demand as enterprises integrate legacy core systems with cloud-native environments. Organizations are modernizing application architectures through APIs, containerization, and DevOps pipelines to improve agility without disrupting existing workloads. Mainframe-as-a-Service offerings allow businesses to scale compute capacity on demand and reduce operational costs. These modernization strategies help enterprises unlock additional value from long-standing mainframe investments, enabling seamless interoperability with public cloud platforms while preserving the performance, auditability, and security benefits inherent to mainframe infrastructure.

- For instance, TCS, this AI‑powered solution can reduce modernization costs by over 70% and deliver application modernization results twice as fast as traditional manual conversion approaches.

- Increasing Focus on Advanced Security and Compliance

Growing cybersecurity risks and stricter compliance mandates are strengthening the role of mainframes in enterprise IT strategies. Mainframes provide built-in hardware encryption, secure multi-tenancy, centralized governance, and automated auditing capabilities that meet regulatory standards across sectors such as BFSI, healthcare, and government. Their architecture minimizes exposure to external threats and unauthorized access, offering a resilient environment for sensitive data and high-stakes operations. As threat landscapes expand and data protection regulations intensify globally, organizations view mainframes as essential platforms for safeguarding critical digital assets.

Key Trends & Opportunities

1. Integration of AI, Automation, and AIOps

AI-driven automation is reshaping mainframe operations as enterprises deploy AIOps for predictive maintenance, anomaly detection, workload optimization, and intelligent resource allocation. These capabilities reduce manual intervention, enhance availability, and improve operational efficiency. Vendors increasingly integrate on-chip AI accelerators and machine-learning-based tools to streamline performance tuning and boost real-time processing. The opportunity lies in leveraging mainframes as centralized analytics hubs that handle large-scale datasets, enabling enterprises to embed AI into mission-critical workflows without compromising speed, security, or reliability.

- For instance, DXC also claims to complete 47,000 workload migrations to the cloud annually, leveraging AI and automation to accelerate and de-risk transitions from legacy mainframe environments.

2. Growing Adoption of Mainframe-as-a-Service (MFaaS)

MFaaS is emerging as a strategic opportunity as organizations seek to reduce capital expenditure while maintaining mainframe capabilities. Cloud-based consumption models allow enterprises to access scalable compute power, automated updates, and managed services without investing in hardware ownership. This shift supports modernization, accelerates deployment, and simplifies maintenance for organizations with limited in-house expertise. MFaaS providers also offer advanced monitoring, security, and system integration services, making the model attractive for sectors with fluctuating workloads or regulatory-driven compute demands.

- For instance, HCL manages more than 710,000 MIPS (Million Instructions Per Second) across its global mainframe delivery footprint.

3. API-Driven Modernization and Open-Source Integration

API-driven modernization is enabling mainframes to integrate seamlessly with open-source tools, microservices, and cloud-native applications. Enterprises are increasingly adopting RESTful APIs, Linux distributions, and open frameworks to modernize legacy applications while retaining core processing capabilities. This trend opens opportunities for hybrid application development, faster innovation cycles, and improved data accessibility. Companies can extend traditional workloads into digital ecosystems without rewriting entire platforms, reducing modernization risks and costs while enhancing operational flexibility.

Key Challenges

1. Shortage of Mainframe Skills and Aging Workforce

A significant challenge facing the mainframe market is the shrinking pool of skilled professionals. Many experienced COBOL, z/OS, and mainframe systems engineers are nearing retirement, while younger IT professionals gravitate toward cloud-native and open-source technologies. This talent gap complicates maintenance, modernization, and innovation efforts. Organizations struggle to recruit and train new talent capable of managing both legacy applications and modern integration frameworks, increasing operational risks and slowing digital transformation initiatives reliant on mainframe infrastructure.

2. High Modernization Costs and Integration Complexity

Despite their advantages, mainframes often require substantial investment for upgrades, application modernization, and integration with cloud ecosystems. Migrating legacy code, rearchitecting systems, and aligning mainframe workloads with digital platforms can be time-consuming and costly. Complexity increases when enterprises manage heterogeneous environments or depend on decades-old custom applications. Additionally, modernization efforts may disrupt mission-critical operations if not managed carefully. These challenges create barriers for organizations with limited budgets or constrained technical resources, slowing the pace of transformation.

Regional Analysis

North America

North America holds the largest share of the mainframe market at around 40%. The region leads due to strong adoption in banking, government, insurance, and healthcare, where high-volume transaction processing and strict compliance are critical. Many enterprises continue to upgrade existing systems and integrate mainframes with cloud environments, supporting steady growth. Large technology vendors and advanced IT infrastructure also strengthen the region’s position. As digital payments and data-intensive applications expand, organizations increasingly rely on mainframes for efficiency, security, and reliability, keeping North America as the dominant regional market.

Asia-Pacific

Asia-Pacific accounts for roughly 30% of the global mainframe market and is the fastest-growing region. Rapid digitalization in countries such as China, India, and Japan drives higher adoption across banking, telecom, and government sectors. Enterprises rely on mainframes to manage rising transaction loads, digital services, and large-scale citizen-service platforms. Growing investments in IT modernization and cloud-mainframe integration further strengthen demand. As economies expand and digital transactions accelerate, APAC is expected to gain additional market share and continue outpacing other regions in growth rate.

Europe

Europe holds an estimated 20–25% share of the mainframe market, supported by strong adoption in financial services, public administration, and manufacturing. Strict data protection regulations and high security requirements encourage enterprises to maintain or upgrade mainframe environments. Many organizations continue modernizing legacy systems by adding APIs, automation tools, and hybrid-cloud capabilities. Although overall growth is steady rather than rapid, Europe remains a key region due to consistent investment in secure data processing and long-term reliance on mainframe infrastructure for mission-critical operations.

Latin America

Latin America represents around 5–6% of the global mainframe market. Adoption is mainly driven by large banks, telecom providers, and government institutions in countries such as Brazil and Mexico. These sectors rely on mainframes to handle expanding digital-services demand and rising transaction volumes. While the region’s digital transformation pace is slower than North America or APAC, steady IT investment and modernization initiatives continue to support market growth. Limited legacy infrastructure and budget constraints keep the regional share modest, but demand is gradually increasing.

Middle East & Africa (MEA)

Middle East & Africa account for about 4–5% of the global mainframe market. Growth is influenced by government digitalization programs, rising cybersecurity needs, and increased investment in banking and telecom systems. Gulf countries, in particular, are expanding secure data-center capacity and adopting mainframes for high-volume processing. Although overall adoption remains limited due to economic and infrastructure differences across the region, ongoing modernization and regulatory requirements support gradual market expansion. MEA remains a small but steadily developing segment in the global mainframe landscape.

Market Segmentations:

By Type:

By Offering:

By Deployment:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The mainframe market features a highly competitive landscape shaped by leading technology and service providers such as Capgemini, Infosys Limited, Wipro, IBM Corporation, TATA Consultancy Services Limited, DXC Technology Company, HCL Technologies Limited, Amazon Web Services, Inc., Accenture, and Open Text Corporation. The mainframe market is defined by a mix of hardware providers, software vendors, and IT service firms that focus on modernization, integration, and advanced workload optimization. Competition intensifies as enterprises adopt hybrid IT strategies, requiring vendors to deliver secure, scalable, and cloud-compatible mainframe solutions. Companies differentiate through AI-driven automation, enhanced cybersecurity features, and tools that streamline application modernization without disrupting mission-critical operations. Service providers also emphasize consulting expertise, migration frameworks, and managed services to support clients transitioning from legacy environments to more agile architectures. Overall, innovation, long-term support capabilities, and modernization efficiency remain key competitive drivers in the market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Capgemini

- Infosys Limited

- Wipro

- IBM Corporation

- TATA Consultancy Services Limited

- DXC Technology Company

- HCL Technologies Limited

- Amazon Web Services, Inc.

- Accenture

- Open Text Corporation

Recent Developments

- In April 2025, IBM’s z17 mainframe improves enterprise IT by embedding AI into critical operations with real-time analytics, high-speed inference and secure innovation. It integrates accelerated AI infrastructure, such as, the Telum II processor and various tools such as, watsonx Code Assistant for Z and Test Accelerator for Z to boost developer productivity, simplify modernization, and support generative AI in mainframe environments.

- In March 2025, Kyndryl and Google Cloud expanded their partnership. They used Google’s Gemini models for mainframe modernization. Kyndryl uses generative AI to help clients assess, modernize, and migrate their mainframe applications and data to the cloud.

- In March 2024, NTT DATA was named a Leader in two IDC MarketScape reports for its application modernization services on both AWS and Microsoft Azure platforms. The company was recognized for its ability to deliver value to clients modernizing applications for public and private cloud environments.

Report Coverage

The research report offers an in-depth analysis based on Type, Offering, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The mainframe market will continue growing as enterprises rely on high-volume, mission-critical transaction processing.

- Hybrid-cloud integration will accelerate, enabling seamless connectivity between legacy systems and modern applications.

- AI and automation will play a larger role in optimizing mainframe operations and reducing manual workloads.

- Modernization initiatives will intensify as organizations update legacy applications using APIs, containers, and DevOps practices.

- Security enhancements will remain a priority as cyber threats increase and regulatory requirements tighten.

- Mainframe-as-a-Service adoption will rise as companies seek scalable, flexible, and cost-efficient consumption models.

- Demand from banking, government, and telecom sectors will stay strong due to continued dependence on reliable core systems.

- Skills shortages will influence vendor strategies, prompting more training programs and low-code development tools.

- Energy-efficient and performance-optimized mainframe technologies will gain importance as sustainability goals expand.

- The competitive landscape will evolve as vendors strengthen partnerships, integration tools, and modernization services.