| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Netherlands Diabetes Drugs Market Size 2024 |

USD 738.19 Million |

| Netherlands Diabetes Drugs Market, CAGR |

1.95% |

| Netherlands Diabetes Drugs Market Size 2032 |

USD 909.62 Million |

Market Overview

Netherlands Diabetes Drugs Market size was valued at USD 738.19 million in 2023 and is anticipated to reach USD 909.62 million by 2032, at a CAGR of 1.95% during the forecast period (2023-2032).

The Netherlands diabetes drugs market is driven by the rising prevalence of diabetes, an aging population, and increasing awareness of diabetes management. Government initiatives promoting early diagnosis and advanced treatment options further support market growth. Technological advancements in insulin delivery systems, the growing adoption of GLP-1 receptor agonists, and the shift toward personalized medicine enhance treatment efficacy and patient adherence. Additionally, the expansion of digital health solutions, including mobile applications and continuous glucose monitoring (CGM) systems, improves patient outcomes. The pharmaceutical industry’s focus on innovation, coupled with favorable reimbursement policies, accelerates the adoption of novel therapies. However, stringent regulatory requirements and pricing pressures pose challenges to market expansion. The increasing emphasis on preventive healthcare and lifestyle modifications also influences drug demand. Overall, steady market growth is anticipated as healthcare providers and policymakers continue to prioritize effective diabetes management strategies in response to the rising disease burden.

The Netherlands diabetes drugs market is geographically diverse, with key demand centers in urban regions such as Amsterdam, Rotterdam, and The Hague, where advanced healthcare facilities drive the adoption of innovative diabetes treatments. Rural areas are witnessing gradual improvements in diabetes management, supported by government initiatives and increasing healthcare accessibility. The market is highly competitive, with major pharmaceutical companies such as Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, and AstraZeneca leading in drug innovation and distribution. These companies focus on developing next-generation insulin, GLP-1 receptor agonists, and SGLT2 inhibitors to improve treatment outcomes. Additionally, firms like Boehringer Ingelheim, Novartis, and Johnson & Johnson contribute to market growth by introducing novel therapies and combination treatments. The increasing role of digital health solutions and personalized medicine further enhances market dynamics, as key players integrate advanced technologies to optimize diabetes care and patient adherence in the Netherlands.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Netherlands diabetes drugs market was valued at USD 738.19 million in 2023 and is projected to reach USD 909.62 million by 2032, growing at a CAGR of 1.95% during the forecast period.

- Rising diabetes prevalence, an aging population, and increasing awareness drive the demand for advanced diabetes treatments.

- The market is shifting towards GLP-1 receptor agonists and SGLT2 inhibitors due to their cardiovascular and renal benefits.

- Major pharmaceutical players, including Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, and AstraZeneca, dominate the competitive landscape.

- Stringent regulatory policies and pricing pressures pose challenges for market expansion and drug affordability.

- Western Netherlands leads in diabetes drug adoption, while Southern, Northern, and Eastern regions show steady growth.

- The integration of digital health technologies, such as continuous glucose monitoring (CGM) and telemedicine, is reshaping diabetes management and improving patient adherence.

Report Scope

This report segments the Netherlands Diabetes Drugs Market as follows:

Market Drivers

Rising Prevalence of Diabetes and Aging Population

The increasing prevalence of diabetes in the Netherlands is a key driver of the diabetes drugs market. A growing number of individuals are being diagnosed with Type 1 and Type 2 diabetes, primarily due to sedentary lifestyles, unhealthy dietary habits, and genetic predisposition. For instance, the International Diabetes Federation (IDF) reported that approximately 5.9% of adults in the Netherlands were living with diabetes as of 2022. Additionally, the aging population significantly contributes to market growth, as older adults are more susceptible to diabetes and its related complications. According to health reports, the number of diabetes patients is expected to rise steadily in the coming years, increasing the demand for effective treatment options. This demographic shift necessitates the development of more advanced and accessible diabetes drugs to manage the disease efficiently.

Advancements in Diabetes Treatment and Drug Innovation

Ongoing research and development efforts in the pharmaceutical industry are leading to the introduction of innovative diabetes medications. The adoption of GLP-1 receptor agonists, SGLT-2 inhibitors, and insulin analogs is transforming diabetes management by improving efficacy and reducing side effects. For instance, Sublin B.V., a Dutch pharmaceutical company, is developing a first-in-class sublingual insulin delivery formulation to provide a non-invasive alternative to injectable therapies. Additionally, the integration of digital health technologies, such as continuous glucose monitoring (CGM) systems and smart insulin pens, enhances treatment adherence and patient outcomes. Biopharmaceutical companies are actively investing in the development of next-generation diabetes drugs that offer prolonged effectiveness and minimal risk of complications. These advancements not only improve patient quality of life but also drive market growth by increasing the adoption of novel therapies.

Government Initiatives and Favorable Reimbursement Policies

The Dutch government plays a crucial role in supporting diabetes management through various healthcare initiatives and policies. Government-backed programs promote early diagnosis, patient education, and access to advanced diabetes treatments. The implementation of national diabetes management strategies ensures that patients receive timely and affordable medical interventions. Moreover, favorable reimbursement policies under the universal healthcare system encourage the widespread adoption of innovative diabetes drugs. Insurance coverage for modern insulin therapies and oral antidiabetic medications further enhances patient accessibility, leading to increased market demand. As policymakers continue to prioritize diabetes care, the pharmaceutical industry benefits from a supportive regulatory environment that fosters market expansion.

Growing Focus on Preventive Healthcare and Lifestyle Management

The increasing emphasis on preventive healthcare is reshaping the Netherlands diabetes drugs market. Public health campaigns and educational initiatives encourage lifestyle modifications, such as improved diet and regular physical activity, to reduce the risk of diabetes. While lifestyle interventions are gaining prominence, the demand for pharmaceutical interventions remains strong, particularly for individuals with advanced or poorly managed diabetes. The shift toward holistic diabetes care, which combines medication with personalized lifestyle management programs, enhances long-term treatment outcomes. Pharmaceutical companies are collaborating with healthcare providers to integrate drug therapies with digital health solutions, such as mobile apps and telemedicine, to offer comprehensive diabetes care. This trend highlights the evolving nature of diabetes treatment and the continuous demand for innovative and effective pharmaceutical solutions.

Market Trends

Increasing Adoption of GLP-1 Receptor Agonists and SGLT-2 Inhibitors

The Netherlands diabetes drugs market is witnessing a significant shift toward the use of GLP-1 receptor agonists and SGLT-2 inhibitors. These drug classes have gained popularity due to their dual benefits in managing blood glucose levels and reducing cardiovascular risks. For instance, clinical studies conducted by the University of Groningen have demonstrated the cardiovascular and renal benefits of these therapies, leading to their widespread adoption among healthcare providers. Healthcare providers increasingly prefer these therapies over traditional insulin treatments, especially for Type 2 diabetes patients, as they offer superior efficacy, weight management benefits, and a lower risk of hypoglycemia. The growing adoption of these innovative drugs is driving pharmaceutical companies to expand their product portfolios and invest in further research to enhance their formulations.

Technological Integration in Diabetes Management

The integration of digital health solutions and advanced medical technologies is transforming diabetes treatment in the Netherlands. For instance, the ENGAGE consortium is developing wearable, non-invasive digital devices to monitor disease progression and improve patient-provider interactions. Continuous glucose monitoring (CGM) systems, smart insulin pens, and digital health platforms are becoming more prevalent, enabling patients to track and manage their blood sugar levels effectively. These technologies enhance patient adherence to prescribed treatments and improve overall health outcomes. Pharmaceutical companies are increasingly collaborating with tech firms to develop digital solutions that complement diabetes medications, ensuring a more personalized and data-driven approach to disease management. The expansion of telemedicine services further strengthens this trend by providing remote consultation and medication management options.

Rising Demand for Personalized and Combination Therapies

Personalized medicine is gaining traction in diabetes treatment, with a growing focus on tailored drug regimens based on individual patient profiles. Physicians are moving away from a one-size-fits-all approach, instead opting for combination therapies that address specific patient needs. The use of fixed-dose combination drugs, which combine multiple active ingredients into a single pill, is becoming more common to improve treatment adherence and convenience. This trend aligns with the broader shift in the healthcare industry toward precision medicine, where genetic, lifestyle, and metabolic factors guide drug selection for optimal outcomes. The demand for such customized treatments is expected to fuel research and innovation in diabetes drug development.

Expansion of Preventive and Holistic Diabetes Care

There is an increasing emphasis on preventive healthcare and holistic diabetes management in the Netherlands. Public health campaigns and educational initiatives promote early screening, lifestyle modifications, and proactive disease management to reduce the long-term burden of diabetes. Pharmaceutical companies are recognizing this trend and developing drugs that complement lifestyle interventions, such as weight loss and cardiovascular protection. Additionally, healthcare providers are incorporating dietary and exercise programs alongside pharmaceutical treatments to offer a more comprehensive approach to diabetes care. This shift reflects the growing awareness that effective diabetes management requires a combination of medical, behavioral, and technological interventions.

Market Challenges Analysis

Stringent Regulatory Framework and Pricing Pressures

The Netherlands diabetes drugs market faces significant challenges due to strict regulatory requirements and pricing controls. The Dutch healthcare system emphasizes cost-effectiveness, leading to rigorous approval processes for new pharmaceutical products. For instance, the Dutch Medicine Prices Act sets maximum allowable prices for medicines based on reference pricing from neighboring countries. Regulatory authorities impose stringent clinical trial standards and post-marketing surveillance to ensure drug safety and efficacy. While these measures enhance patient safety, they also prolong market entry timelines for innovative diabetes medications. Additionally, pricing regulations and government-imposed reimbursement policies exert downward pressure on drug prices, limiting profit margins for pharmaceutical companies. The emphasis on cost containment often results in negotiations between drug manufacturers and health insurers, sometimes restricting patient access to the latest therapies. These pricing pressures pose challenges for companies looking to introduce premium or next-generation diabetes drugs in the market.

Increasing Competition and Generic Drug Penetration

The growing presence of generic diabetes drugs intensifies competition in the Dutch pharmaceutical market. As patents for several branded diabetes medications expire, generic alternatives become widely available at lower prices, leading to market fragmentation. While generics enhance affordability and accessibility, they also reduce the market share of branded drugs, impacting revenue generation for leading pharmaceutical firms. Healthcare providers and insurance companies often prefer cost-effective generic options, further limiting the demand for high-cost innovative therapies. Additionally, the market’s competitive landscape is further shaped by biosimilar insulin products, which offer similar efficacy at reduced prices. To differentiate themselves, branded drug manufacturers must invest in continuous innovation, patient support programs, and value-added services, increasing overall operational costs. The rising competition from generics and biosimilars challenges the profitability and long-term growth of established diabetes drug manufacturers in the Netherlands.

Market Opportunities

The Netherlands diabetes drugs market presents significant growth opportunities driven by the increasing adoption of advanced therapies and digital health solutions. The demand for innovative drug classes, such as GLP-1 receptor agonists and SGLT-2 inhibitors, continues to rise due to their proven efficacy in managing blood glucose levels while providing additional cardiovascular and renal benefits. Pharmaceutical companies have the opportunity to expand their portfolios by developing next-generation diabetes treatments with improved safety profiles and patient convenience. Additionally, the integration of digital health technologies, such as continuous glucose monitoring (CGM) devices and AI-powered diabetes management platforms, enhances patient adherence and treatment outcomes. Collaborations between pharmaceutical firms and technology providers can further optimize personalized diabetes care, leading to improved disease management and long-term market expansion.

The increasing focus on preventive healthcare and early diabetes detection also presents lucrative opportunities for market players. Government initiatives promoting early screening programs and lifestyle interventions create demand for medications that complement holistic diabetes management. The shift toward personalized medicine, where treatment regimens are tailored based on genetic and metabolic profiles, allows pharmaceutical companies to introduce targeted therapies that enhance treatment efficacy. Additionally, the Netherlands’ strong healthcare infrastructure and supportive reimbursement policies encourage investment in research and development, enabling the launch of novel drug formulations. With a growing emphasis on value-based healthcare, pharmaceutical companies that offer cost-effective, high-impact solutions will gain a competitive edge. As diabetes prevalence continues to rise, the demand for innovative, patient-centric treatment options is expected to drive sustained growth in the Netherlands diabetes drugs market.

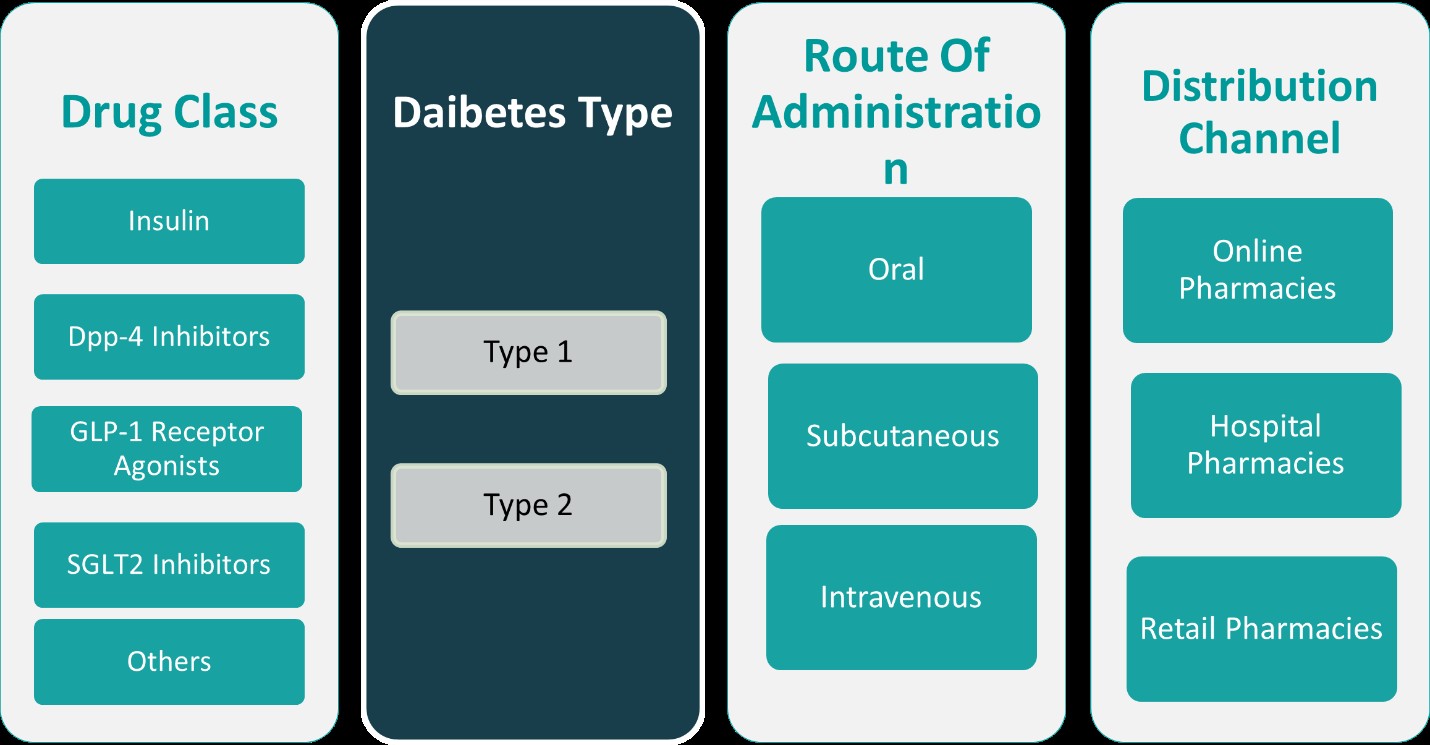

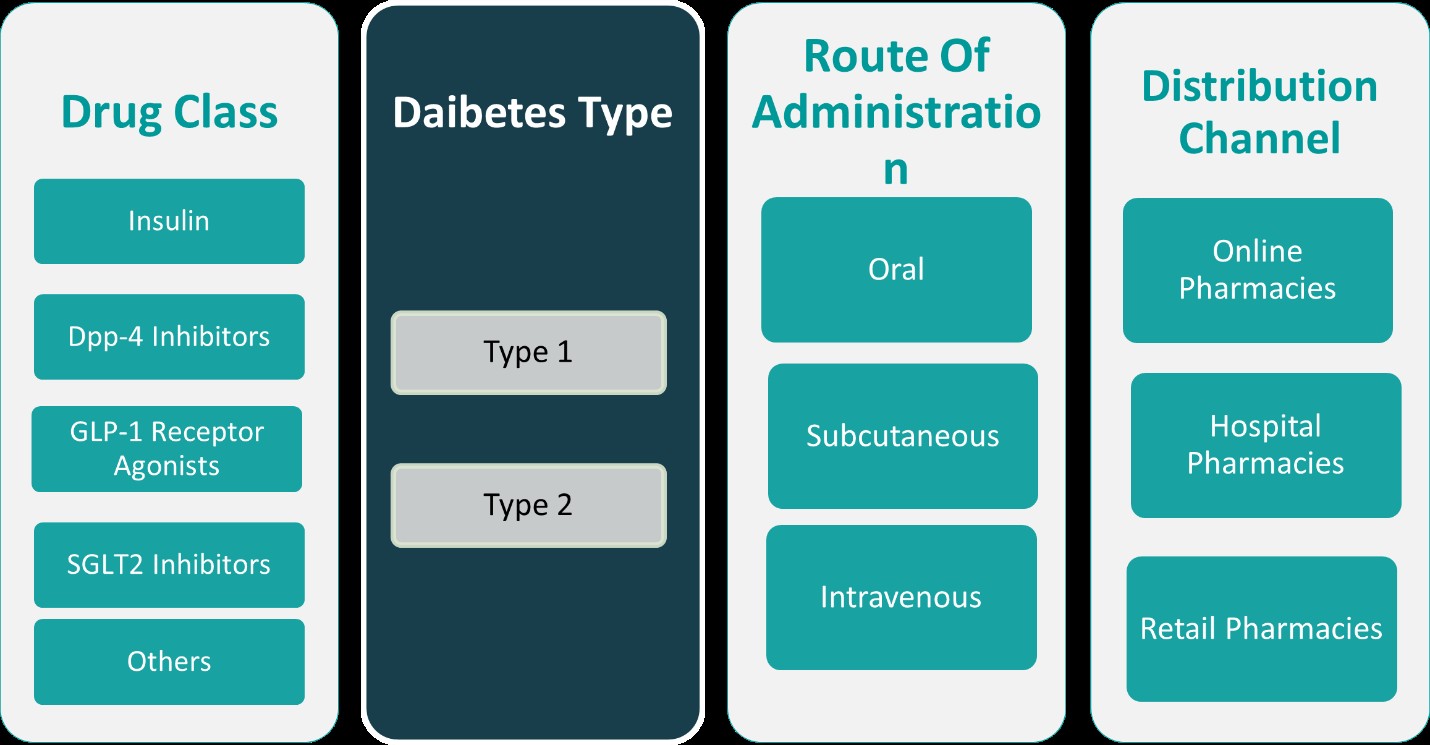

Market Segmentation Analysis:

By Drug Class:

The Netherlands diabetes drugs market is segmented by drug class into insulin, DPP-4 inhibitors, GLP-1 receptor agonists, SGLT2 inhibitors, and others. Insulin remains a dominant segment, particularly for Type 1 diabetes patients who require lifelong insulin therapy. The demand for rapid-acting, long-acting, and biosimilar insulin is growing as healthcare providers focus on improving glycemic control and minimizing complications. DPP-4 inhibitors continue to hold a significant market share due to their oral administration convenience and minimal risk of hypoglycemia. However, the market is shifting towards GLP-1 receptor agonists and SGLT2 inhibitors, which are gaining traction for their superior glucose-lowering efficacy and cardiovascular benefits. These drug classes are particularly favored for Type 2 diabetes management, as they promote weight loss and reduce the risk of heart disease. The “others” category, including combination therapies and emerging drug classes, offers potential growth opportunities as pharmaceutical companies invest in developing novel treatments that enhance patient outcomes and treatment adherence.

By Diabetes Types:

The market is also segmented based on diabetes type, including Type 1, Type 2, Type 3, Type 4, and Type 5 diabetes. Type 2 diabetes dominates the market, driven by its increasing prevalence due to sedentary lifestyles, obesity, and aging populations. The demand for oral antidiabetic medications, such as DPP-4 inhibitors and SGLT2 inhibitors, is particularly high in this segment. Type 1 diabetes accounts for a smaller but stable share, with insulin therapy remaining the primary treatment option. Emerging diabetes classifications, such as Type 3, Type 4, and Type 5, represent evolving areas of research. Type 3 diabetes is often linked to neurodegenerative diseases like Alzheimer’s, while Type 4 and Type 5 relate to age-related and genetic factors. As scientific understanding of these diabetes subtypes advances, new treatment approaches and drug development initiatives may emerge, offering further opportunities for pharmaceutical companies to expand their product portfolios in the Netherlands market.

Segments:

Based on Drug Class:

- Insulin

- DPP-4 Inhibitors

- GLP-1 Receptor Agonists

- SGLT2 Inhibitors

- Others

Based on Diabetes Types:

- Type 1

- Type 2

- Diabetes Type 3

- Diabetes Type 4

- Diabetes Type 5

Based on Route of Administration:

- Oral

- Subcutaneous

- Intravenous

- Route of Administration 4

- Route of Administration 5

Based on Technology:

- Technology 1

- Technology 2

- Technology 3

Based on Distribution Channel:

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

- Distribution Channel 4

- Distribution Channel 5

Based on the Geography:

- Western Netherlands

- Southern Netherlands

- Northern Netherlands

- Eastern Netherlands

Regional Analysis

Western Netherlands

Western Netherlands holds the largest share of the Netherlands diabetes drugs market, accounting for approximately 40% of the total market. This dominance is attributed to its high population density, advanced healthcare infrastructure, and the presence of leading medical institutions. Cities such as Amsterdam, Rotterdam, and The Hague have well-established hospitals and diabetes care centers that drive demand for innovative diabetes treatments. The region also has a higher prevalence of Type 2 diabetes due to urban lifestyles and dietary habits, further increasing the need for effective antidiabetic medications, including GLP-1 receptor agonists and SGLT2 inhibitors. Additionally, Western Netherlands benefits from strong governmental support for diabetes management programs, leading to greater adoption of novel therapies and digital health solutions such as continuous glucose monitoring (CGM) systems.

Southern Netherlands

Southern Netherlands accounts for approximately 25% of the Netherlands diabetes drugs market. The region, which includes cities like Eindhoven, Maastricht, and Tilburg, has a rising diabetic population, driven by aging demographics and lifestyle-related factors. The healthcare system in Southern Netherlands is well-developed, with strong collaborations between research institutions and pharmaceutical companies, fostering innovation in diabetes treatment. The increasing focus on personalized medicine and preventive healthcare in this region presents opportunities for pharmaceutical firms to expand their product offerings. Insulin and combination therapies remain widely used in this region, particularly among elderly patients. Additionally, the adoption of digital health technologies, such as mobile health applications and remote monitoring solutions, is gaining traction, improving patient adherence and diabetes management outcomes.

Northern Netherlands

Northern Netherlands holds around 15% of the diabetes drugs market, making it a smaller but steadily growing region. The region, encompassing cities such as Groningen and Leeuwarden, has a lower population density compared to the western and southern regions but still faces increasing diabetes prevalence. Due to a relatively aging population, there is a sustained demand for insulin therapies, particularly among Type 1 and elderly Type 2 diabetes patients. The region is also witnessing a gradual shift toward SGLT2 inhibitors and GLP-1 receptor agonists, as healthcare providers emphasize improved cardiovascular outcomes alongside glucose control. Northern Netherlands benefits from strong regional healthcare programs that promote early diagnosis and lifestyle interventions, increasing awareness of diabetes management options.

Eastern Netherlands

Eastern Netherlands accounts for roughly 20% of the Netherlands diabetes drugs market. The region, which includes cities such as Arnhem, Nijmegen, and Enschede, has a balanced mix of urban and rural populations, influencing healthcare access and treatment preferences. While urban areas have higher adoption rates of advanced diabetes drugs, rural regions still rely on traditional insulin therapies and generic medications. Government initiatives to enhance diabetes care in rural communities are creating new opportunities for market expansion. Additionally, research collaborations between universities and pharmaceutical companies in the region support the development of next-generation diabetes treatments. The growing emphasis on telemedicine and digital health platforms is improving patient engagement and medication adherence, positioning Eastern Netherlands as an emerging market for innovative diabetes management solutions.

Key Player Analysis

- Novo Nordisk A/S

- Sanofi

- Merck & Co., Inc.

- Eli Lilly and Company

- AstraZeneca

- Takeda Pharmaceutical Company Limited

- Boehringer Ingelheim International GmbH

- Novartis AG

- Johnson & Johnson Services, Inc.

- Bayer AG

- Abbott Laboratories

- AbbVie

- Company 13

- Company 14

Competitive Analysis

The Netherlands diabetes drugs market is highly competitive, with leading pharmaceutical companies driving innovation and market expansion. Novo Nordisk, Sanofi, Merck & Co., Eli Lilly, AstraZeneca, Boehringer Ingelheim, Novartis, Johnson & Johnson, Bayer, and Abbott Laboratories dominate the industry by offering a broad range of diabetes treatments, including insulin, oral antidiabetic drugs, and next-generation therapies like GLP-1 receptor agonists and SGLT2 inhibitors. The competition is driven by the development of next-generation diabetes treatments, including GLP-1 receptor agonists, SGLT2 inhibitors, and advanced insulin formulations. Companies are focusing on research and development to introduce more effective therapies with improved patient compliance and fewer side effects. Additionally, partnerships with digital health firms are becoming increasingly common, enabling the integration of continuous glucose monitoring (CGM) systems and smart insulin delivery solutions. Regulatory policies and pricing pressures create challenges for new entrants, as stringent approval processes and cost-containment measures limit profit margins. However, established players continue to invest in personalized medicine, combination therapies, and biosimilars to maintain their competitive edge. The growing emphasis on patient-centric diabetes care, alongside government healthcare initiatives, further influences market dynamics, fostering both innovation and competition within the industry.

Recent Developments

- In March 2025, Novo Nordisk signed a deal worth up to $2 billion for the rights to UBT251, a new obesity and diabetes drug developed by United BioTechnology. The drug combines GLP-1, GIP, and glucagon to manage blood sugar and reduce hunger.

- In February 2025, Sanofi received FDA approval for MERILOG, the first rapid-acting insulin aspart biosimilar, to improve glycemic control in adults and pediatric patients with diabetes.

- In December 2024, JD Health began offering Merck’s GLUCOPHAGE XR (Reduce Mass) online in China, enhancing access to metformin hydrochloride extended-release tablets for type 2 diabetes patients.

- In December 2024, Torrent Pharma acquired three diabetes brands from Boehringer Ingelheim, including those with Empagliflozin, to strengthen its anti-diabetes portfolio

- In November 2024, AstraZeneca presented promising early data for its obesity pipeline, including AZD5004, an oral GLP-1 receptor blocker, at ObesityWeek 2024.

Market Concentration & Characteristics

The Netherlands diabetes drugs market is characterized by a high level of concentration, with a few major pharmaceutical companies dominating sales and innovation. Established players lead the market due to their extensive research and development efforts, strong distribution networks, and comprehensive product portfolios covering insulin, GLP-1 receptor agonists, SGLT2 inhibitors, and combination therapies. Market concentration is further reinforced by strict regulatory requirements, which create entry barriers for smaller firms and new entrants. The industry is shaped by increasing demand for personalized medicine, digital health integration, and patient-centric treatment approaches. Additionally, pricing regulations and reimbursement policies influence competitive dynamics, driving companies to focus on cost-effective solutions while maintaining high-quality standards. The market’s competitive landscape continues to evolve as companies invest in biosimilars, combination drugs, and innovative therapies aimed at improving diabetes management outcomes, ensuring sustained market growth in the Netherlands.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Diabetes Types, Route of Administration, Technology, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Netherlands diabetes drugs market will continue to grow due to rising diabetes prevalence and an aging population.

- Advanced therapies like GLP-1 receptor agonists and SGLT2 inhibitors will gain more market share.

- Digital health solutions, including continuous glucose monitoring and smart insulin delivery, will enhance diabetes management.

- Regulatory policies and pricing pressures will influence drug affordability and market entry for new treatments.

- Personalized medicine and combination therapies will drive innovation in diabetes care.

- Biosimilars and generic alternatives will increase competition and expand patient access to cost-effective treatments.

- Pharmaceutical companies will invest more in research and development to introduce novel, patient-centric therapies.

- Government initiatives and early screening programs will promote preventive diabetes management.

- Telemedicine and digital healthcare adoption will improve accessibility and adherence to diabetes treatments.

- Collaboration between pharmaceutical and technology companies will shape the future of diabetes drug development and delivery.