| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Europe Electric Vehicle (EV) Hub Motor Market Size 2024 |

USD 8,494.11 Million |

| Europe Electric Vehicle (EV) Hub Motor Market, CAGR |

10.72% |

| Europe Electric Vehicle (EV) Hub Motor Market Size 2032 |

USD 19,183.14 Million |

Market Overview

Europe Electric Vehicle (EV) Hub Motor Market size was valued at USD 8,494.11 million in 2024 and is anticipated to reach USD 19,183.14 million by 2032, at a CAGR of 10.72% during the forecast period (2024-2032).

The Europe Electric Vehicle (EV) Hub Motor market is experiencing significant growth, driven by the rising adoption of EVs, stringent emission regulations, and advancements in hub motor technology. Governments across Europe are implementing policies and incentives to promote electric mobility, further accelerating market expansion. The increasing demand for energy-efficient and lightweight propulsion systems enhances the adoption of hub motors, which improve vehicle efficiency by eliminating the need for traditional drivetrain components. Additionally, the shift toward autonomous and connected vehicles is fostering innovations in hub motor integration with smart control systems. Key market trends include the growing preference for in-wheel motor technology, enhanced regenerative braking systems, and increasing investments in research and development for high-performance hub motors. The expansion of charging infrastructure and the rise of urban mobility solutions, such as electric two-wheelers and shared EV fleets, further support market growth, positioning hub motors as a crucial component in the future of electric transportation.

The Europe EV hub motor market is witnessing strong growth across key countries, including the UK, Germany, France, Italy, Spain, and the Netherlands, driven by increasing EV adoption, stringent emission regulations, and advancements in electric mobility infrastructure. Northern and Western Europe, in particular, are leading the market with a strong presence of automakers and technology firms investing in hub motor innovations. Countries like Sweden and Denmark are accelerating adoption through government incentives and sustainable transport initiatives. Key players driving the market include Protean Electric, Elaphe Propulsion Technologies, Bonfiglioli Riduttori S.p.A., ZF Friedrichshafen AG, YASA Limited, Siemens AG, e-Traction B.V., Hyundai Mobis, ECOmove GmbH, and Robert Bosch GmbH. These companies are focused on technological advancements, high-efficiency motor designs, and strategic partnerships to enhance the performance and scalability of hub motors in electric two-wheelers, passenger cars, and commercial EVs, supporting the transition toward sustainable transportation.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Europe EV hub motor market was valued at USD 8,494.11 million in 2024 and is expected to reach USD 19,183.14 million by 2032, growing at a CAGR of 10.72% during the forecast period.

- Rising government incentives, stringent emission regulations, and increasing adoption of electric two-wheelers and passenger EVs are driving market growth.

- The growing demand for light electric vehicles (LEVs) and last-mile mobility solutions is fueling the adoption of hub motors for their efficiency and space-saving advantages.

- Key players, including Protean Electric, ZF Friedrichshafen AG, Siemens AG, and Hyundai Mobis, are investing in advanced motor designs and strategic partnerships to strengthen their market position.

- High initial costs and complex integration challenges are restraining market expansion, particularly in high-performance and commercial EVs.

- Germany, the UK, and France are leading the market, while Scandinavian and Eastern European countries are emerging as potential growth hubs.

- Increasing investments in high-torque, rare-earth-free, and AI-driven hub motor technologies are expected to shape future market developments.

Report Scope

This report segments the Europe Electric Vehicle (EV) Hub Motor Market as follows:

Market Drivers

Growing Adoption of Electric Vehicles (EVs) and Government Incentives

The increasing adoption of electric vehicles (EVs) across Europe is a primary driver for the EV hub motor market. Governments are actively promoting the transition to electric mobility through stringent emission regulations, financial incentives, and infrastructure development. For instance, the European Union’s aggressive carbon neutrality goals and country-specific initiatives, such as subsidies, tax exemptions, and grants for EV buyers, have significantly boosted the demand for electric vehicles. Additionally, urban low-emission zones and bans on internal combustion engine (ICE) vehicles in various cities have further accelerated the shift toward EVs, driving the demand for advanced propulsion technologies like hub motors. These motors enhance vehicle efficiency by eliminating transmission and drivetrain losses, making them an attractive choice for automakers focusing on sustainable and high-performance EV solutions.

Technological Advancements in Hub Motors

Continuous advancements in hub motor technology have played a crucial role in market expansion. Manufacturers are investing in research and development to improve motor efficiency, reduce weight, and enhance overall performance. For example, the integration of advanced materials, such as high-performance magnets and lightweight alloys, has led to improved torque density and energy efficiency. Additionally, innovations in motor cooling systems and power electronics are enhancing the durability and reliability of hub motors. The development of smart and connected hub motors, which can integrate with vehicle control systems and optimize power distribution based on driving conditions, is also gaining traction. These technological improvements not only enhance vehicle performance but also make hub motors a more viable option for mainstream EV manufacturers, further driving market growth.

Rising Demand for Lightweight and Space-Efficient Propulsion Systems

The increasing need for lightweight and space-efficient propulsion systems in EVs is another key factor fueling the demand for hub motors. Unlike conventional electric drivetrains that require complex transmission systems, hub motors are directly integrated into the wheel assembly, eliminating the need for additional components. This compact and modular design offers several advantages, including reduced vehicle weight, enhanced energy efficiency, and improved interior space utilization. As automakers focus on extending battery range and improving vehicle aerodynamics, hub motors provide a competitive advantage by optimizing weight distribution and enabling better handling. Additionally, the ability to operate each wheel independently enhances traction control and stability, making hub motors an attractive solution for various EV applications, from passenger cars to electric two-wheelers and commercial vehicles.

Expansion of Urban Mobility Solutions and Shared EV Fleets

The growing popularity of urban mobility solutions, such as electric scooters, bikes, and shared EV fleets, is contributing to the rising demand for hub motors. Many European cities are investing in sustainable transportation initiatives to reduce congestion and carbon emissions, leading to increased adoption of compact and energy-efficient electric vehicles. Hub motors are particularly well-suited for light EVs used in ride-sharing, last-mile delivery, and urban commuting due to their high efficiency, low maintenance, and space-saving design. Additionally, major automakers and mobility service providers are integrating hub motors into their fleet solutions to improve operational efficiency and reduce total cost of ownership. The expansion of smart cities and connected mobility ecosystems is further driving innovation in hub motor technology, positioning it as a key enabler in the future of urban transportation.

Market Trends

Growing Integration of In-Wheel Motor Technology

The increasing adoption of in-wheel motor technology is a key trend shaping the Europe EV hub motor market. Automakers and technology developers are focusing on integrating hub motors directly into the wheels to eliminate the need for traditional drivetrain components, thereby improving overall vehicle efficiency. For instance, Lexus’s LF-30 concept vehicle showcases the potential of in-wheel motors in enhancing vehicle design and performance by allowing for a more compact and efficient layout. This design not only reduces vehicle weight but also enhances traction control and handling by enabling independent wheel torque distribution. Additionally, in-wheel motors improve energy efficiency and regenerative braking performance, making them ideal for various EV applications, including passenger cars, commercial fleets, and urban mobility solutions. As advancements in power electronics and thermal management continue, in-wheel motor technology is expected to gain further traction across the European market.

Advancements in Regenerative Braking and Energy Efficiency

With increasing emphasis on energy-efficient mobility, manufacturers are enhancing regenerative braking capabilities in hub motors. Regenerative braking helps recover kinetic energy during deceleration, feeding it back into the battery to extend driving range. As EV adoption rises, improving battery efficiency and optimizing energy consumption have become critical. Hub motors play a crucial role in maximizing energy recovery, particularly in urban environments where frequent braking occurs. Moreover, the integration of AI-based control systems and smart braking algorithms is further improving the efficiency and responsiveness of regenerative braking, contributing to better performance and lower energy consumption.

Rise in Adoption of Hub Motors in Light Electric Vehicles (LEVs)

The increasing demand for light electric vehicles (LEVs), such as e-bikes, e-scooters, and electric motorcycles, is driving the growth of the hub motor market in Europe. With the expansion of urban mobility initiatives and the growing preference for last-mile transportation solutions, LEVs equipped with hub motors are becoming more popular. Their compact design, cost-effectiveness, and lower maintenance requirements make them ideal for shared mobility and personal transport. Additionally, many European governments are promoting micro-mobility solutions through subsidies and infrastructure investments, further accelerating the adoption of hub motors in this segment. As cities focus on reducing congestion and emissions, hub motors in LEVs are expected to play a crucial role in sustainable urban transport.

Increasing R&D Investments for High-Performance Hub Motors

Automakers and component manufacturers are investing heavily in R&D to develop high-performance hub motors with enhanced durability, power output, and efficiency. Efforts are being directed toward lightweight materials, improved thermal management, and AI-driven smart control systems to optimize performance under various driving conditions. For example, companies like Hyundai are expanding their R&D facilities to focus on sustainable mobility solutions, which includes advancements in hub motor technology. Additionally, the focus on integrating hub motors with vehicle connectivity features, such as IoT-based diagnostics and remote monitoring, is gaining momentum. These advancements are not only enhancing the reliability of hub motors but also making them suitable for high-performance EVs, including luxury and sports electric cars. As innovation in power electronics and battery technologies progresses, hub motors are expected to become even more efficient, solidifying their role in the future of electric mobility in Europe.

Market Challenges Analysis

High Initial Costs and Complex Manufacturing Process

The Europe EV hub motor market faces challenges related to the high initial costs and complex manufacturing processes of hub motor systems. Unlike conventional drivetrains, hub motors require specialized materials, advanced power electronics, and precise engineering, leading to higher production costs. For instance, the use of rare-earth magnets in hub motors contributes significantly to their high cost, as these materials are essential for achieving high efficiency and performance. Additionally, integrating hub motors into vehicle designs demands significant modifications to suspension and braking systems, which can increase manufacturing complexity and limit adoption, particularly among mass-market automakers. The high cost of rare-earth magnets used in hub motors further adds to pricing pressures, making it difficult for manufacturers to achieve cost competitiveness with traditional propulsion technologies. Although ongoing advancements in material science and production techniques aim to reduce costs, the economic viability of hub motors remains a key challenge for widespread adoption.

Durability Concerns and Limited Aftermarket Support

Durability and maintenance concerns pose another challenge for the EV hub motor market. Since hub motors are directly integrated into the wheels, they are more exposed to road shocks, water, and debris, increasing the risk of wear and tear compared to centrally mounted motors. Ensuring long-term reliability and effective thermal management remains a significant technical hurdle. Additionally, the limited aftermarket support and repair infrastructure for hub motors further complicate their adoption, as traditional vehicle service centers often lack expertise in repairing or replacing them. The absence of standardized hub motor designs across different manufacturers also creates challenges in component availability and compatibility. To overcome these issues, industry players must focus on enhancing motor durability, improving sealing technologies, and expanding specialized service networks to support the growing adoption of hub motor-powered EVs in Europe.

Market Opportunities

The Europe EV hub motor market presents significant growth opportunities driven by the increasing demand for sustainable mobility solutions and the rapid expansion of electric vehicle infrastructure. Governments across Europe are actively supporting electric mobility initiatives, including investments in charging networks and urban mobility programs. This shift is creating a favorable environment for hub motor adoption, particularly in light electric vehicles (LEVs) such as e-bikes, e-scooters, and compact urban EVs. As cities enforce low-emission zones and congestion charges, the demand for efficient, space-saving, and lightweight propulsion systems is expected to rise. Hub motors, with their direct-drive efficiency and ability to enhance energy recovery through regenerative braking, are well-positioned to capitalize on these evolving transportation needs. Additionally, the rise of shared mobility and last-mile delivery services presents further opportunities for hub motor integration, as fleet operators seek cost-effective and low-maintenance electric drivetrain solutions.

Advancements in hub motor technology, material science, and power electronics are further opening doors for innovation and market expansion. The ongoing development of high-performance hub motors with improved torque density, thermal management, and AI-driven smart control systems is enhancing their viability for passenger cars and commercial EVs. Automakers and technology companies are increasingly investing in integrated hub motor solutions that offer superior handling, energy efficiency, and seamless connectivity with vehicle control systems. Additionally, the exploration of alternative materials and motor designs, such as rare-earth-free magnets and next-generation solid-state motor technologies, is expected to reduce production costs and address supply chain challenges. As European automakers shift toward electrification, the integration of hub motors into new vehicle platforms, particularly in premium and performance EV segments, presents a lucrative opportunity for manufacturers looking to gain a competitive edge in the evolving electric mobility landscape.

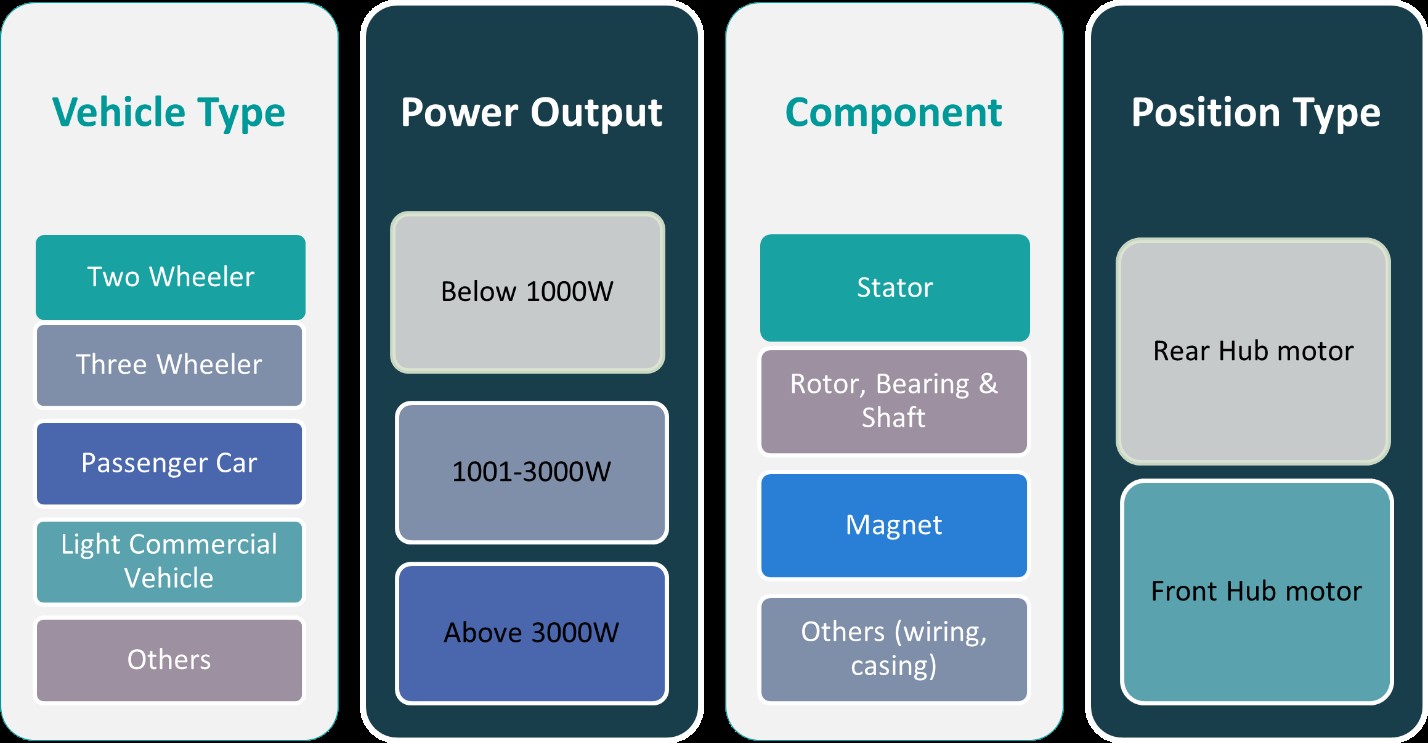

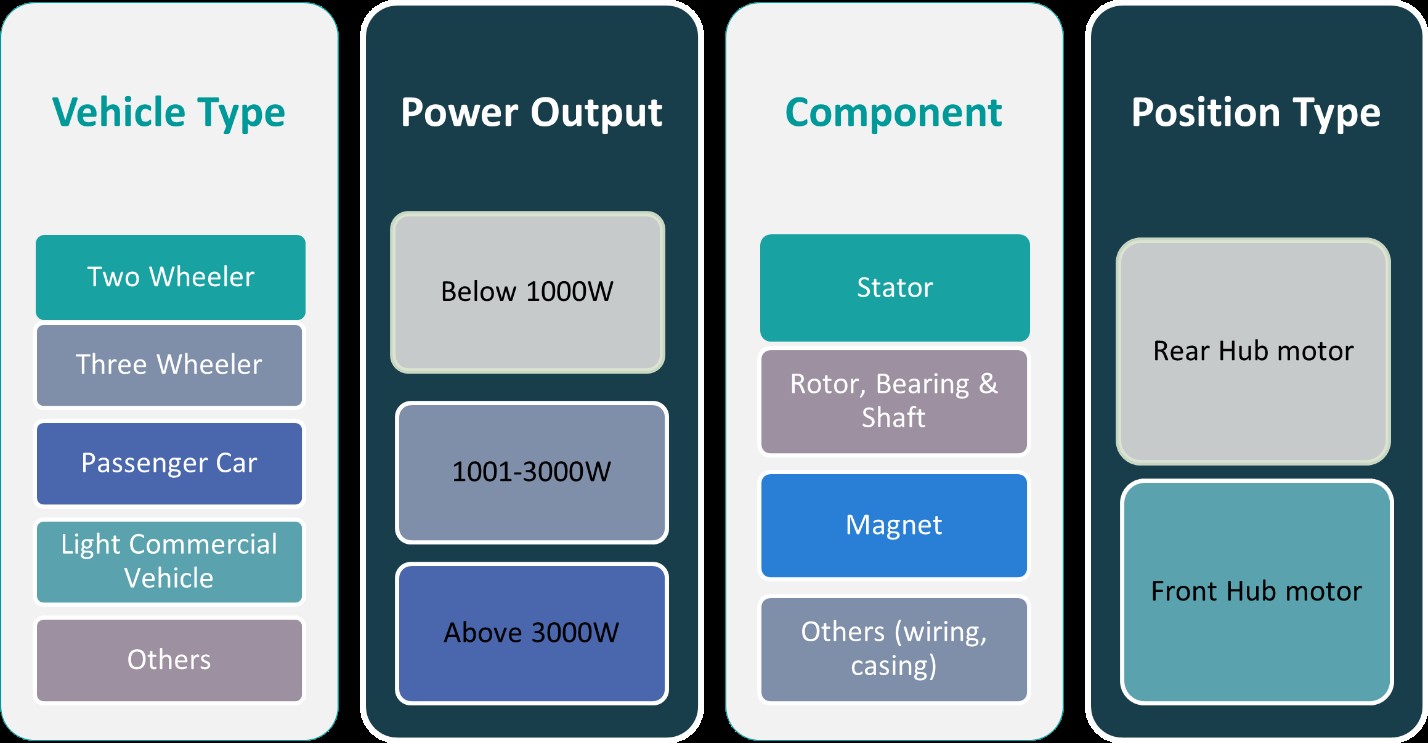

Market Segmentation Analysis:

By Vehicle Type:

The Europe EV hub motor market is segmented by vehicle type, including two-wheelers, three-wheelers, passenger cars, light commercial vehicles (LCVs), and others. The two-wheeler segment dominates due to the rising adoption of electric scooters and motorcycles, driven by increasing urbanization and government incentives for sustainable transportation. Hub motors are widely used in electric two-wheelers as they offer compact design, high efficiency, and cost-effectiveness. Similarly, the three-wheeler segment is witnessing growth, particularly in last-mile delivery and public transportation, where electric auto-rickshaws and cargo carriers benefit from hub motors’ low maintenance and enhanced maneuverability. The passenger car segment is expanding as automakers integrate hub motor technology into premium EVs for improved performance and space optimization. Additionally, light commercial vehicles such as delivery vans are adopting hub motors to maximize cargo space and enhance energy efficiency, aligning with the demand for emission-free urban logistics. The others segment, including specialty vehicles, is expected to grow as hub motor technology advances in diverse applications.

By Power Output:

Based on power output, the market is classified into below 1000W, 1001-3000W, and above 3000W segments. The below 1000W segment is primarily driven by the increasing use of hub motors in electric bicycles, e-scooters, and micro-mobility vehicles, which require lower power but high efficiency for urban commuting. The 1001-3000W segment caters to electric motorcycles, three-wheelers, and some compact passenger EVs, where balanced power and efficiency are crucial for performance and extended battery range. This segment is growing rapidly due to the rising demand for medium-power electric vehicles in ride-sharing and commercial fleet applications. The above 3000W segment is witnessing expansion as premium electric vehicles and high-performance EVs adopt hub motors for enhanced acceleration, independent torque control, and all-wheel drive capabilities. The increasing R&D in high-power hub motors is expected to drive further adoption in larger EVs, including light commercial fleets and next-generation electric performance vehicles.

Segments:

Based on Vehicle Type:

- Two-Wheeler

- Three-Wheeler

- Passenger Car

- Light Commercial Vehicle

- Others

Based on Power Output:

- Below 1000W

- 1001-3000W

- Above 3000W

Based on Component:

- Stator

- Rotor, Bearing & Shaft

- Magnet

- Others (wiring, casing)

Based on Position Type:

- Rear Hub Motor

- Front Hub Motor

Based on the Geography:

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

Regional Analysis

United Kingdom and Germany

The United Kingdom and Germany collectively account for a significant market share of approximately 35% in the Europe EV hub motor market. The UK is witnessing rapid growth due to strong government initiatives promoting electric mobility, including incentives for EV adoption and investments in charging infrastructure. The presence of leading automakers and technology firms focusing on hub motor development further supports market expansion. Similarly, Germany, as a key automotive hub, drives the adoption of hub motors with major manufacturers integrating advanced in-wheel motor technologies in their EV models. Germany’s commitment to sustainability goals and the push for high-performance electric powertrains contribute to the growing demand for hub motors, particularly in premium and commercial electric vehicles.

France and Italy

France and Italy together hold a market share of around 22%, supported by increasing urban mobility solutions and government-led initiatives for sustainable transport. France has been at the forefront of EV adoption policies, offering subsidies and incentives that encourage the use of electric two-wheelers and compact passenger EVs with hub motor configurations. The country’s focus on reducing urban emissions and enhancing micro-mobility solutions has accelerated the demand for efficient electric propulsion systems. Meanwhile, Italy’s expanding electric two-wheeler and three-wheeler market, along with government efforts to promote shared and last-mile mobility solutions, has created a strong market for hub motors. The increasing penetration of electric mopeds and delivery vehicles is expected to drive further adoption in the coming years.

Spain and the Netherlands

Spain and the Netherlands together contribute approximately 18% to the market, with Spain witnessing strong demand for electric scooters and motorcycles, particularly in urban centers where congestion charges and emission-free zones are driving EV adoption. The Spanish government’s support for electric public transport and shared mobility initiatives further boosts the need for hub motors in light electric vehicles (LEVs). Similarly, the Netherlands is a major player in the e-bike and e-scooter segment, where hub motors are widely integrated. The country’s well-established EV infrastructure, combined with one of the highest electric bicycle adoption rates in Europe, makes it a key market for low-power hub motor systems.

Rest of Europe

The Rest of Europe, including Sweden, Poland, Denmark, Austria, Belgium, Switzerland, and Russia, accounts for approximately 25% of the market. Sweden and Denmark are leading the Nordic region in electric vehicle adoption, with a strong focus on sustainable transport solutions and incentives for EVs. Poland is emerging as a growing market due to increasing investments in EV manufacturing and battery production. Meanwhile, Austria, Belgium, and Switzerland are witnessing increasing demand for electric mobility, particularly in urban mobility and logistics applications. Russia’s EV market is still in its early stages but is expected to expand as infrastructure improves and government policies shift towards electrification of public transport and commercial fleets.

Key Player Analysis

- Protean Electric

- Elaphe Propulsion Technologies

- Bonfiglioli Riduttori S.p.A.

- ZF Friedrichshafen AG

- YASA Limited

- Siemens AG

- e-Traction B.V.

- Hyundai Mobis

- ECOmove GmbH

- Printed Motor Works

- Magnetic Systems Technology

- Robert Bosch GmbH

- Tajima Motor Corporation

Competitive Analysis

The Europe EV hub motor market is highly competitive, with several key players focusing on innovation, strategic partnerships, and expanding their product portfolios to strengthen their market presence. Protean Electric, ZF Friedrichshafen AG, Siemens AG, Hyundai Mobis, Robert Bosch GmbH, Elaphe Propulsion Technologies, Bonfiglioli Riduttori S.p.A., YASA Limited, e-Traction B.V., ECOmove GmbH, and Printed Motor Works are among the leading companies driving market advancements. These firms are investing in high-efficiency motor designs, lightweight materials, and AI-driven control systems to enhance hub motor performance. Additionally, partnerships with automakers and EV manufacturers are helping them integrate hub motors into next-generation electric vehicles. The competition is further fueled by the demand for cost-effective, high-torque, and energy-efficient solutions in passenger EVs, two-wheelers, and commercial fleets. Companies are also focusing on reducing reliance on rare-earth materials to create sustainable and scalable hub motor technologies, ensuring long-term growth in the evolving electric mobility sector.

Recent Developments

- In May 2024, Bajaj Auto intended to introduce a mass-market electric scooter under the Chetak brand, increasing its retail presence three times over the next three to four months.

- In April 2024, VinFast, the electric vehicle arm of Vietnamese conglomerate Vingroup, will begin selling its VF DrgnFly electric bike in the U.S. The bike, a 750W rear hub motor, offers a smooth riding experience and a top speed of up to 45 km/h.

- In February 2024, Kabira Mobility, located in Verna, Goa, introduced two electric motorcycles in India, the KM3000 and KM4000, featuring an aluminium core hub motor powertrain, telescopic forks, monoshock, disc brakes, 17-inch wheels, and modular battery pack.

- In February 2024, BYD, auto manufacturing conglomerate based in Shenzhen, China, plans to establish an electric vehicle factory in Mexico, aiming to establish an export hub to the U.S., leveraging Mexico’s automaking sector’s close integration with the U.S.

- In October 2023, GEM Motor signed a strategic partnership agreement with Stilride to develop a specialized advanced electric drive. Stilride presented an electric scooter that will be available to Swedish customers in an exclusive limited series in spring 2024 and will be powered by an innovative GEM in-wheel drive G2.6.

Market Concentration & Characteristics

The Europe EV hub motor market exhibits a moderate to high market concentration, with a mix of established players and emerging innovators driving technological advancements. Leading companies, including Protean Electric, ZF Friedrichshafen AG, Siemens AG, and Hyundai Mobis, hold a significant share due to their expertise in high-efficiency motor technology and strategic collaborations with automakers. The market is characterized by continuous R&D investments, integration of AI-driven control systems, and the shift toward rare-earth-free materials to enhance sustainability. Additionally, the demand for compact, lightweight, and high-torque hub motors is shaping product innovation. The market also sees increasing participation from startups and niche players focusing on customized solutions for electric two-wheelers and light commercial vehicles. Strong government policies, EV subsidies, and emission regulations further support market expansion, ensuring steady growth. As competition intensifies, companies are emphasizing cost efficiency, performance optimization, and scalability to meet the evolving needs of electric mobility.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vehicle Type, Power Output, Component, Position Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Europe EV hub motor market is expected to witness steady growth, driven by increasing electric vehicle adoption and government incentives.

- Advancements in lightweight materials and high-efficiency motor technologies will enhance overall vehicle performance and range.

- Automakers will increasingly integrate AI-driven control systems to optimize energy efficiency and torque distribution.

- The demand for rare-earth-free and sustainable hub motor solutions will rise as manufacturers focus on reducing environmental impact.

- Expanding urban mobility and last-mile delivery services will boost the adoption of hub motors in electric two-wheelers and light commercial vehicles.

- Strategic partnerships between motor manufacturers and EV companies will accelerate innovation and large-scale production.

- Cost reductions and improvements in battery technology will make hub motor-driven EVs more affordable for consumers.

- The market will see a rise in modular and customizable hub motor solutions tailored for different vehicle types.

- Emerging players and startups will contribute to increasing competition with innovative and cost-effective motor designs.

- Regulations supporting zero-emission transportation will continue to drive investment in hub motor research and development.