Market Overview:

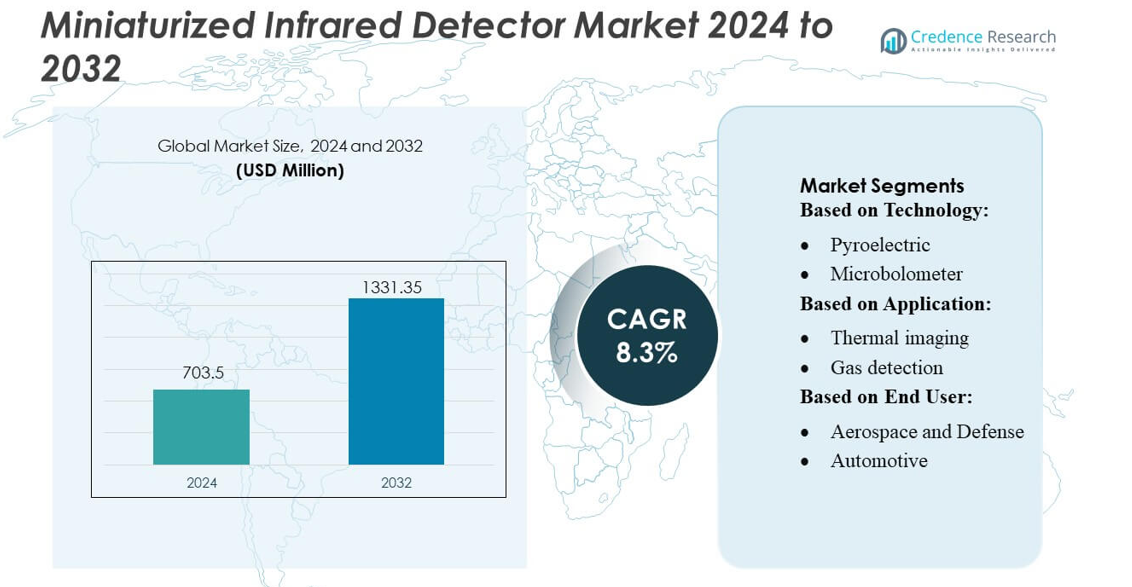

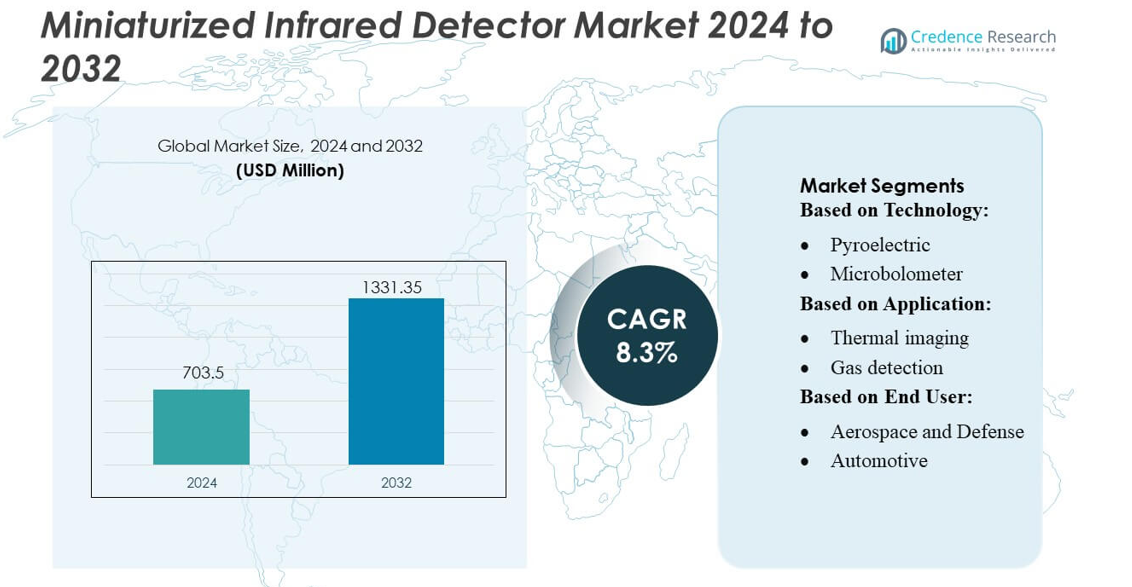

Miniaturized Infrared Detector Market size was valued USD 703.5 million in 2024 and is anticipated to reach USD 1331.35 million by 2032, at a CAGR of 8.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Miniaturized Infrared Detector Market Size 2024 |

USD 703.5 million |

| Miniaturized Infrared Detector Market, CAGR |

8.3% |

| Miniaturized Infrared Detector Market Size 2032 |

USD 1331.35 million |

The Miniaturized Infrared Detector Market is highly competitive, with leading companies including Raytheon Technologies Corporation, Hamamatsu Photonics K.K., FLIR Systems, Inc., Lynred, Excelitas Technologies Corp., Teledyne Technologies Incorporated, Texas Instruments Incorporated, NXP Semiconductors N.V., Honeywell International Inc., and Murata Manufacturing Co., Ltd. These players maintain their market leadership through continuous innovation, strategic partnerships, and expansion of global distribution networks. They focus on developing high-resolution, low-power, and cost-efficient infrared detectors for aerospace, defense, automotive, healthcare, and industrial applications. North America emerges as the dominant region, holding an estimated 32% market share, driven by strong adoption in defense surveillance, autonomous vehicles, industrial monitoring, and smart technology integration. The combination of advanced R&D capabilities, technological expertise, and regulatory support positions key players and the region to sustain growth and reinforce competitive advantage in the global market.

Market Insights

- The Miniaturized Infrared Detector Market size was valued at USD 703.5 million in 2024 and is projected to reach USD 1331.35 million by 2032, growing at a CAGR of 8.3% during the forecast period.

- Market growth is driven by increasing adoption in aerospace, defense, automotive, healthcare, and industrial applications, along with rising demand for compact, high-resolution, and low-power infrared detectors.

- Key trends include integration with IoT and AI-enabled systems, expansion in thermal imaging, gas detection, and motion sensing applications, and rising adoption in consumer electronics and smart infrastructure.

- The market is highly competitive, with leading players focusing on innovation, strategic partnerships, and global distribution expansion to strengthen technological capabilities and product portfolios.

- North America is the largest regional market with a 32% share, followed by Europe and Asia-Pacific, while microbolometers and thermal imaging applications remain the dominant technology and application segments globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

The miniaturized infrared detector market is segmented into Thermopile, Pyroelectric, Microbolometer, Photodetectors, and Others. Among these, the Microbolometer sub-segment dominates, capturing an estimated 42% market share in 2025, driven by its high sensitivity, low power consumption, and cost-effective manufacturing for uncooled thermal imaging applications. Growth in consumer electronics, automotive safety systems, and portable thermal cameras is further accelerating adoption. Thermopile and Pyroelectric detectors maintain moderate growth due to their reliability in temperature measurement and gas sensing, whereas photodetectors see niche adoption in specialized industrial applications.

- For instance, Raytheon Technologies Corporation developed uncooled microbolometer focal‑plane arrays (FPAs) with formats such as 640 × 512 and pixel pitches of around 20 µm, delivering thermal sensitivity (NETD) below 50 mK.

By Application

Thermal imaging, gas detection, motion sensing, and temperature measurement form the key application segments. Thermal imaging holds the largest share, approximately 48%, fueled by increasing demand in automotive night vision, surveillance, and industrial inspection systems. Gas detection and temperature measurement follow closely, supported by regulatory safety requirements in industrial and environmental monitoring. Motion sensing devices are witnessing gradual adoption in consumer electronics and smart home applications. Overall, innovation in high-resolution, low-power sensors and integration with AI analytics are primary drivers enhancing market growth across these applications.

- For instance, Hamamatsu Photonics offers InGaAs photodiode arrays covering infrared wavelengths from 0.9 µm to 1.7 µm with typical photosensitivity of 0.95 A/W — enabling high‑sensitivity detection without the need for cooling.

By End-User

End-user segments include Aerospace & Defense, Automotive, Healthcare & Life Sciences, Industrial Manufacturing, and Others. Aerospace & Defense is the dominant segment with nearly 35% market share, driven by strategic adoption of miniaturized infrared detectors for surveillance, target acquisition, and navigation. The Automotive sector is rapidly growing due to night vision, pedestrian detection, and driver-assistance systems. Healthcare and industrial manufacturing applications leverage thermal imaging and gas detection for diagnostics and process monitoring. The market’s expansion is further supported by increasing investments in IoT-enabled devices and safety-critical applications across industries.

Key Growth Drivers

Increasing Adoption in Automotive and Aerospace Applications

Rising integration of miniaturized infrared detectors in automotive safety systems, such as night vision and pedestrian detection, alongside aerospace applications like navigation, surveillance, and target acquisition, is fueling market growth. Demand for compact, high-sensitivity sensors that can operate under extreme conditions is driving R&D investments. Additionally, regulatory mandates for vehicle and defense safety technologies are accelerating adoption. The need for reliable, energy-efficient, and lightweight detectors ensures sustained growth across both automotive and aerospace sectors globally.

- For instance, FLIR’s “PathFindIR” automotive thermal camera uses a 324 × 256 pixel uncooled microbolometer focal‑plane array, operating in the 8–14 µm spectral range, and offers a spatial resolution of 2 mrad with a field‑of‑view of 36° (H) × 27° (V).

Advancements in Thermal Imaging and Sensing Technologies

Technological innovations in microbolometer, thermopile, and photodetector designs have enhanced resolution, sensitivity, and power efficiency, broadening the applications of miniaturized infrared detectors. Integration with AI-enabled imaging systems and portable devices allows real-time thermal analysis for industrial inspection, healthcare diagnostics, and security. The development of uncooled detectors reduces operational costs, increasing market penetration. Continuous improvements in manufacturing processes, such as MEMS-based fabrication, support high-volume production, further driving adoption across consumer, industrial, and defense sectors.

- For instance, Lynred’s “PICO640S BB 7‑14” uncooled infrared detector operates across a 7–14 µm spectral range and delivers a Noise Equivalent Temperature Difference (NETD) of 30 mK, making it highly sensitive for optical gas imaging and leak detection.

Growing Demand for IoT and Smart Device Integration

The rise of IoT-enabled smart homes, industrial automation, and wearable devices is propelling the demand for compact, low-power infrared detectors. These sensors enable motion detection, temperature monitoring, and environmental sensing in real-time applications. Increasing adoption of smart infrastructure, connected vehicles, and healthcare monitoring systems creates opportunities for miniaturized detectors. Their compatibility with wireless systems and integration with AI-driven analytics enhance predictive maintenance and operational efficiency, positioning the market for sustained expansion across multiple technology-driven industries.

Key Trends & Opportunities

Expansion in Healthcare and Life Sciences Applications

Miniaturized infrared detectors are increasingly deployed in non-invasive patient monitoring, fever detection, and medical imaging. Their ability to deliver precise thermal measurements enables early disease detection and improved diagnostic accuracy. Growing healthcare infrastructure, combined with rising awareness of preventive care and wearable health monitoring devices, offers significant growth opportunities. Integration with AI and machine learning further enhances predictive analytics, enabling real-time monitoring and efficient resource allocation, making healthcare a high-potential sector for market expansion.

- For instance, Excelitas’ “CoolEYE” IR array (4×4 pixel) delivers non‑contact facial skin‑temperature screening, operating over 0‑+120 °C object temperature range, with ≤ 5 mA supply current at 5 V, and offering a digital SMBus interface for easy integration.

Adoption in Industrial and Environmental Monitoring

Industrial manufacturing and environmental monitoring sectors are leveraging miniaturized infrared detectors for gas detection, process monitoring, and predictive maintenance. Increasing emphasis on workplace safety, emission monitoring, and regulatory compliance is driving the deployment of high-sensitivity thermal sensors. Industrial IoT adoption and smart factory initiatives create opportunities for integrating these detectors into automated systems. Enhanced durability, compact size, and energy efficiency make them ideal for continuous monitoring in harsh industrial environments, expanding market potential in industrial and environmental applications.

- For instance, Teledyne’s “MicroCalibir” long‑wave infrared (LWIR) camera core uses a 12 µm microbolometer pixel technology combined with a deep‑ADC ROIC circuit; this radiometric version delivers a noise‑equivalent temperature difference (NETD) below 50 mK and supports a dynamic temperature measurement range exceeding 650 °C, enabling precise temperature tracking in industrial process monitoring.

Increasing Penetration in Consumer Electronics

The miniaturized infrared detector market is witnessing growing adoption in consumer electronics such as smartphones, smart cameras, and wearables. Features like gesture recognition, proximity sensing, and thermal imaging for photography enhance user experience and device functionality. Rising consumer demand for advanced, compact sensors presents opportunities for manufacturers to innovate and differentiate products. Integration with augmented reality (AR), smart home devices, and gaming applications further drives adoption, enabling revenue growth in consumer-focused segments and creating new product development avenues.

Key Challenges

High Manufacturing Costs and Complex Fabrication

The production of miniaturized infrared detectors, especially microbolometers and high-sensitivity photodetectors, involves complex MEMS fabrication processes, specialized materials, and precision assembly. These factors contribute to high manufacturing costs, limiting adoption in cost-sensitive applications. Scaling production while maintaining sensor performance, uniformity, and reliability poses a significant challenge for manufacturers. The need for advanced fabrication facilities and quality control systems adds operational complexity, constraining rapid market expansion in price-sensitive industrial, consumer, and emerging markets.

Technical Limitations and Environmental Sensitivity

Infrared detectors often face performance degradation under extreme temperatures, high humidity, or harsh industrial environments. Challenges like limited spectral response, low signal-to-noise ratio, and drift in uncooled detectors restrict their use in specific applications. Achieving high sensitivity without increasing power consumption or size remains technically demanding. Additionally, integration with other electronic systems requires careful calibration and design, which can slow product development. Overcoming these technical limitations is critical for broader adoption across automotive, healthcare, and industrial sectors.

Regional Analysis

North America:

North America holds a leading position with approximately 32% market share, driven by strong adoption in aerospace, defense, automotive, and healthcare applications. The United States dominates due to extensive defense surveillance programs, autonomous vehicle initiatives, and advanced industrial monitoring systems. Canada contributes through industrial safety and environmental monitoring solutions. High investments in R&D, coupled with technological innovation and supportive regulatory frameworks, sustain market growth. Increasing deployment of IoT-enabled sensors, portable thermal imaging devices, and connected automotive solutions continues to strengthen North America’s dominance in the miniaturized infrared detector market.

Europe:

Europe captures around 28% of the market, led by Germany, France, and the UK. Growth is fueled by aerospace and defense modernization, automotive innovation, industrial automation, and environmental monitoring initiatives. The region emphasizes connected vehicles, smart infrastructure, and energy-efficient solutions, driving demand for high-resolution, compact infrared detectors. Healthcare applications, including diagnostic imaging and patient monitoring, are expanding. R&D investments for cost-effective uncooled sensors and government support for industrial IoT and safety technologies further bolster adoption. Europe’s strong industrial and technological base ensures steady growth and market competitiveness.

Asia-Pacific:

Asia-Pacific accounts for roughly 25% of the market, supported by rapid industrialization, urbanization, and expansion of electronics and automotive sectors. China, Japan, South Korea, and India are key contributors, with demand from smart city projects, thermal imaging, industrial monitoring, and consumer electronics. Defense modernization programs and increasing healthcare applications enhance adoption. Cost advantages, domestic manufacturing, and growing R&D capabilities accelerate growth. The integration of infrared detectors into IoT-enabled and AI-driven systems presents significant opportunities, positioning the region as a high-growth market for both established and emerging players.

Latin America:

Latin America holds about 8% of the market, driven by industrial automation, energy monitoring, and defense modernization in countries such as Brazil and Mexico. Adoption of thermal imaging, gas detection, and environmental monitoring is increasing in industrial and government sectors. However, high costs and limited local manufacturing restrict rapid market penetration. Strategic partnerships, import of advanced technologies, and government initiatives in smart infrastructure and security systems are expected to create growth opportunities. Rising awareness of industrial safety and environmental monitoring further supports market development in the region.

Middle East & Africa:

The Middle East and Africa represent approximately 7% of the market, with growth fueled by defense modernization, infrastructure development, and industrial applications. Countries such as UAE, Saudi Arabia, and South Africa are investing in surveillance, security, and industrial monitoring solutions. Adoption of compact, high-sensitivity infrared detectors is rising in energy, oil & gas, and smart infrastructure sectors. Challenges include high equipment costs and limited domestic manufacturing. Nevertheless, government initiatives, public-private partnerships, and expanding industrial IoT adoption are expected to create gradual but sustained growth opportunities in the region.

Market Segmentations:

By Technology:

- Pyroelectric

- Microbolometer

By Application:

- Thermal imaging

- Gas detection

By End User:

- Aerospace and Defense

- Automotive

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Miniaturized Infrared Detector Market include Raytheon Technologies Corporation, Hamamatsu Photonics K.K., FLIR Systems, Inc., Lynred, Excelitas Technologies Corp., Teledyne Technologies Incorporated, Texas Instruments Incorporated, NXP Semiconductors N.V., Honeywell International Inc., and Murata Manufacturing Co., Ltd. The Miniaturized Infrared Detector Market is highly competitive, driven by rapid technological innovation and increasing demand across aerospace, defense, automotive, healthcare, and industrial sectors. Companies are focusing on developing high-resolution, low-power, and cost-efficient detectors, including microbolometers, thermopiles, and photodetectors, to meet diverse application requirements. Strategic initiatives such as partnerships, mergers, acquisitions, and global distribution expansion are common to strengthen market presence and gain a technological edge. Continuous R&D investments aimed at enhancing sensitivity, accuracy, and integration with IoT and AI-enabled systems are shaping the competitive dynamics, while the emphasis on compact and portable solutions fosters differentiation and drives market growth globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In July 2025, Honeywell acquired Nexceris’s Li‑ion Tamer business, enhancing its Building Automation fire‑safety portfolio. The technology enabled early detection of lithium‑ion battery off‑gassing and smoke detection.

- In August 2024, KARAM Safety launched portable single gas detectors that feature replaceable sensors, real-time gas monitoring, IP67 compliance, and multi-device calibration. These detectors enhance workplace safety by detecting hazardous gases, are available in three variants, and help ensure worker safety and regulatory compliance.

- In April 2024, Teledyne DALSA launched the radiometric version of its MicroCalibir platform, a compact, long-wave infrared thermal camera for applications requiring precise temperature measurements. This new version provides absolute temperature data with high accuracy (e.g., +/-2°C or +/-2%) and is suitable for uses in industrial monitoring, security, and search and rescue. It maintains the compact size and low power consumption of the original platform.

- In January 2023, Hamamatsu Photonics introduced the P16702-011MN InAsSb photovoltaic detector, accompanied by a preamplifier that exhibits high sensitivity to mid-infrared light up to 11 micrometers (um) in wavelength. The detector’s attributes make it an ideal choice for portable gas analyzers, facilitating prompt analysis of exhaust gas components directly at measurement sites near industrial facilities.

Report Coverage

The research report offers an in-depth analysis based on Technology, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market is expected to expand steadily due to increasing demand in aerospace and defense applications.

- Growth in automotive safety systems, including night vision and pedestrian detection, will drive adoption.

- Technological advancements in microbolometers and photodetectors will enhance performance and reduce costs.

- Rising use of thermal imaging and gas detection in industrial sectors will create new opportunities.

- Integration with IoT and AI-enabled systems will support smart devices and predictive monitoring.

- Healthcare applications, including diagnostics and wearable monitoring, will increasingly adopt miniaturized infrared detectors.

- Expansion in consumer electronics and smart home devices will contribute to market growth.

- Increasing investments in R&D will result in more compact, energy-efficient, and high-resolution sensors.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will drive regional growth.

- Strategic collaborations, partnerships, and product innovations will intensify competition and innovation.