| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Australia Multimode Dark Fiber Market Size 2024 |

USD 37.92 Million |

| Australia Multimode Dark Fiber Market, CAGR |

7.49% |

| Australia Multimode Dark Fiber Market Size 2032 |

USD 67.57 Million |

Market Overview

The Australia Multimode Dark Fiber Market is projected to grow from USD 37.92 million in 2024 to an estimated USD 67.57 million by 2032, with a compound annual growth rate (CAGR) of 7.49% from 2025 to 2032. The market’s expansion is driven by increasing demand for high-speed internet connectivity and the rapid adoption of cloud-based services, which are pushing the need for more robust and efficient communication infrastructure.

Key drivers of this market include the expansion of telecommunications infrastructure, especially in urban and rural areas. The growing trend of digital transformation in industries such as education, healthcare, and finance is further boosting the demand for high-bandwidth networks. Additionally, the increasing adoption of 5G technology and Internet of Things (IoT) applications is creating opportunities for multimode dark fiber deployment. As businesses seek faster and more reliable data transmission, dark fiber solutions continue to gain traction.

Geographically, Australia represents a significant share in the Asia-Pacific region, with key players focusing on metropolitan areas such as Sydney, Melbourne, and Brisbane. These cities are experiencing rapid infrastructure development and digital innovation, driving the demand for multimode dark fiber. Major market players in Australia include Telstra, Optus, and TPG Telecom, who are actively expanding their fiber network offerings to cater to the growing data traffic and demand for high-speed connectivity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Australia Multimode Dark Fiber Market is projected to grow from USD 37.92 million in 2024 to an estimated USD 67.57 million by 2032, with a compound annual growth rate (CAGR) of 7.49% from 2025 to 2032.

- The global multimode dark fiber market is expected to grow from USD 3,652.64 million in 2024 to USD 6,242.00 million by 2032, with a CAGR of 6.93% from 2025 to 2032.

- Key drivers include the expansion of telecom infrastructure, adoption of 5G technology, and the growing trend of digital transformation in industries like education, healthcare, and finance.

- High initial infrastructure costs and regulatory challenges related to fiber-optic network installation in rural areas may hinder market growth, limiting access in some regions.

- Urban centers such as Sydney, Melbourne, and Brisbane are leading the demand for multimode dark fiber due to rapid infrastructure development and high-tech adoption.

- The telecom industry and increasing cloud service adoption are fueling the demand for dark fiber, with companies seeking faster and more reliable data transmission solutions.

- Government-backed projects like the National Broadband Network (NBN) aim to expand broadband access to underserved regions, boosting the market for dark fiber in rural Australia.

- The rollout of 5G and the expansion of IoT applications are creating new opportunities for multimode dark fiber deployment, particularly in industries requiring high bandwidth and low latency.

Market Drivers

Increasing Demand for High-Speed Internet and Data Connectivity

The rising demand for high-speed internet services is one of the primary drivers of the Australia Multimode Dark Fiber Market. As Australia continues to embrace digital transformation across various sectors such as education, healthcare, finance, and entertainment, the need for faster, more reliable data transmission networks becomes ever more critical. Dark fiber provides an efficient and scalable solution for meeting the growing data demands of businesses and consumers. It offers higher bandwidth capabilities compared to traditional fiber optic solutions, enabling businesses to handle massive data traffic efficiently. For instance, multimode dark fiber networks accounted for the largest revenue-generating segment in 2022. The surge in internet-connected devices, particularly with the rise of Internet of Things (IoT) applications, also drives the need for robust communication infrastructure. As companies increasingly rely on cloud-based applications, the demand for dark fiber to support seamless, high-speed connectivity is expected to continue growing, positioning it as a vital enabler of Australia’s digital economy.

Expansion of 5G Networks and Technological Advancements

The rollout of 5G technology across Australia is another key driver propelling the multimode dark fiber market. As telecommunications companies and service providers prepare for the next-generation wireless network, dark fiber is becoming a critical component in the infrastructure development of 5G. The higher data rates, lower latency, and increased reliability offered by 5G networks require robust backhaul infrastructure, which is best provided by dark fiber networks. Dark fiber offers the flexibility and scalability needed to support the vast amount of data generated by 5G-enabled devices, ensuring seamless connectivity for consumers and businesses. Additionally, advancements in fiber optics technology, such as the development of high-capacity multimode fiber, allow for more efficient data transmission over longer distances, making dark fiber a preferred choice for 5G network backhaul. Multimode fiber networks are recognized for their scalability and efficiency, which are essential for supporting 5G infrastructure. As the Australian government and private sector push for 5G adoption, the demand for dark fiber infrastructure will continue to rise.

Government Initiatives and Infrastructure Investment

Government initiatives and investments in digital infrastructure play a crucial role in driving the growth of the Australia Multimode Dark Fiber Market. The Australian government has been actively promoting the development of the National Broadband Network (NBN), a nationwide initiative aimed at improving high-speed internet access for both urban and rural areas. This initiative has led to significant investments in fiber optic networks, including dark fiber infrastructure, to provide faster and more reliable internet connectivity to underserved regions. Furthermore, the government’s push for smart city projects, which require high-bandwidth connectivity for the deployment of IoT devices, smart grids, and other technological solutions, is expected to fuel the demand for dark fiber. By investing in fiber-optic infrastructure and encouraging private sector participation, the government is laying the foundation for a future-ready digital ecosystem. As infrastructure development accelerates, the availability of dark fiber solutions will continue to expand, supporting both residential and business connectivity needs across Australia.

Growing Demand for Data Centers and Cloud-Based Solutions

As businesses across Australia increasingly rely on cloud-based services and data centers for storing, processing, and managing vast amounts of data, the demand for dark fiber networks continues to grow. Data centers require high-speed, low-latency connectivity to handle large volumes of data and ensure uninterrupted service for their clients. Dark fiber provides the ideal solution for data center interconnectivity, enabling organizations to build private, secure, and scalable networks that support their operational needs. With the rise in digital transformation and the increasing adoption of cloud computing across industries, the demand for dark fiber as a backbone for data centers will continue to increase. Furthermore, cloud service providers in Australia are expanding their infrastructure to meet the growing demand for cloud services, and dark fiber networks are integral to their success. As enterprises shift towards hybrid and multi-cloud environments, the need for private, high-performance connectivity provided by dark fiber networks will further strengthen, ensuring seamless cloud access and high-speed data transfers.

Market Trends

Emergence of Edge Computing

Edge computing is a growing trend in Australia’s multimode dark fiber market, as more businesses move data processing closer to end-users for improved speed and reliability. This technology reduces latency and enhances overall performance by processing data at the “edge” of the network, rather than relying on centralized cloud systems. Dark fiber networks are essential for supporting edge data centers, as they provide the low-latency, high-speed connectivity necessary to support real-time applications. With industries such as autonomous vehicles, smart cities, and healthcare relying increasingly on edge computing, the demand for dark fiber networks to interconnect edge data centers and provide high-bandwidth connections will continue to rise.

Sustainability and Energy-Efficient Fiber Solutions

Sustainability is becoming a significant focus in Australia’s multimode dark fiber market as companies and governments look for energy-efficient solutions to reduce their environmental impact. Fiber optic networks, including dark fiber, are being recognized for their low-energy consumption compared to traditional copper-based networks. Additionally, advances in fiber-optic technology are making multimode fiber even more efficient, allowing businesses to achieve greater speeds with lower energy costs. The push for greener data centers and telecom infrastructure is encouraging the adoption of energy-efficient fiber networks, as businesses increasingly look to meet sustainability goals while maintaining high-performance connectivity. This trend aligns with global efforts to reduce carbon footprints and integrate more sustainable practices across industries.

Increased Investment in 5G Infrastructure

The ongoing deployment of 5G networks across Australia is a prominent trend in the multimode dark fiber market. As the telecommunications industry prepares for 5G, dark fiber plays a pivotal role in enabling high-speed, low-latency communication required for next-generation mobile networks. For instance, Telstra has invested over AUD 1.5 billion in 5G infrastructure since 2020, leveraging dark fiber to connect 5G towers to central hubs. Additionally, private network setups for industries such as manufacturing, healthcare, and logistics are increasingly relying on 5G-enabled dark fiber networks to support mission-critical operations.

Rise of Data Centers and Cloud Computing

Another key trend shaping the Australian multimode dark fiber market is the expansion of data centers and the increasing adoption of cloud computing. For instance, Australia hosts approximately 314 data centers as of 2025, making it one of the leading countries in the Asia-Pacific region. Dark fiber is increasingly being used to connect these data centers, providing the necessary high-speed, reliable communication channels between them. The demand for cloud-based services is driving the need for dedicated, high-capacity fiber networks, ensuring seamless data transfer between servers, cloud platforms, and end-users. As Australia’s digital transformation accelerates, organizations are investing in dark fiber networks to enhance their cloud infrastructure, enabling scalable and efficient data handling for a wide array of industries.

Market Challenges

High Initial Infrastructure Costs

One of the primary challenges facing the Australia Multimode Dark Fiber Market is the high initial cost of building and maintaining dark fiber infrastructure. Deploying fiber-optic networks, particularly dark fiber, requires substantial upfront investments in construction, equipment, and ongoing maintenance. For instance, the installation of underground cables and construction of data centers can cost millions of dollars per kilometer, depending on the terrain and urban density. These costs can be prohibitive for smaller telecom operators or businesses seeking to build their own private networks. Additionally, the capital-intensive nature of dark fiber infrastructure means that many companies are hesitant to invest without a clear, long-term return on investment. For service providers, the expense of expanding their networks to underserved or remote regions adds another layer of financial strain. While dark fiber offers high capacity and low latency benefits, the financial barriers to entry can limit the market’s overall growth, especially in areas where demand may not immediately justify the cost.

Regulatory and Policy Uncertainties

Another significant challenge for the Australia Multimode Dark Fiber Market is the evolving regulatory landscape. The telecommunications and broadband sectors in Australia are subject to government policies and regulations that may change over time, impacting market dynamics. Issues such as infrastructure sharing, spectrum allocation, and network access are often influenced by regulatory decisions. Furthermore, the National Broadband Network (NBN) initiative, which aims to provide nationwide broadband coverage, has created some complexities within the dark fiber market. The NBN infrastructure, controlled by the government, competes with private sector efforts to deploy their own fiber networks, and regulatory uncertainties regarding NBN’s future expansion and pricing models can create confusion in the market. Additionally, local authorities’ zoning regulations and environmental policies regarding fiber-optic network installation can slow down or delay projects, further complicating the market for businesses seeking to deploy dark fiber solutions. The ever-changing regulatory environment, coupled with the complexity of compliance, represents a significant challenge for operators in the Australian market.

Market Opportunities

Expansion of 5G Networks

The ongoing rollout of 5G networks presents a significant opportunity for the Australia Multimode Dark Fiber Market. As telecommunications companies prepare for the deployment of 5G, the demand for high-capacity, low-latency infrastructure is critical. Dark fiber networks offer the scalability and speed required to support the backhaul of 5G towers, making them an ideal solution for 5G network providers. The need for robust fiber-optic networks to handle the massive increase in data traffic generated by 5G-enabled devices and applications presents a substantial growth opportunity for dark fiber providers. As Australia advances its 5G rollout, telecom operators are increasingly investing in dark fiber solutions to ensure seamless connectivity and high-speed data transmission. This growing demand for network backhaul infrastructure for 5G is expected to continue expanding, creating opportunities for increased market penetration in urban and rural areas alike.

Digital Transformation and Cloud Computing

Australia’s ongoing digital transformation and the rising adoption of cloud computing services present another significant opportunity for the multimode dark fiber market. As businesses continue to move operations to the cloud, the need for reliable, high-speed connections between data centers and end-users increases. Dark fiber offers secure, high-capacity connections that are essential for ensuring the efficient transfer of large volumes of data. The expansion of cloud-based services, including storage, computing, and real-time data processing, creates a growing demand for private, high-performance networks. Additionally, the increasing trend of hybrid cloud and multi-cloud environments drives the need for private fiber-optic solutions, as companies seek to ensure uninterrupted service and enhance their digital infrastructure. This demand for advanced, dedicated connectivity provides substantial opportunities for dark fiber operators to cater to the expanding cloud ecosystem.

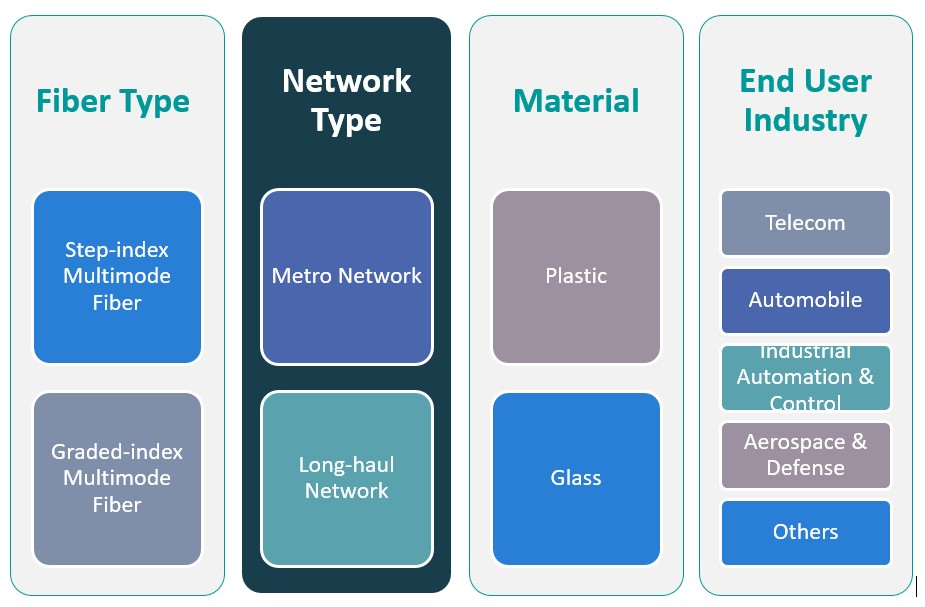

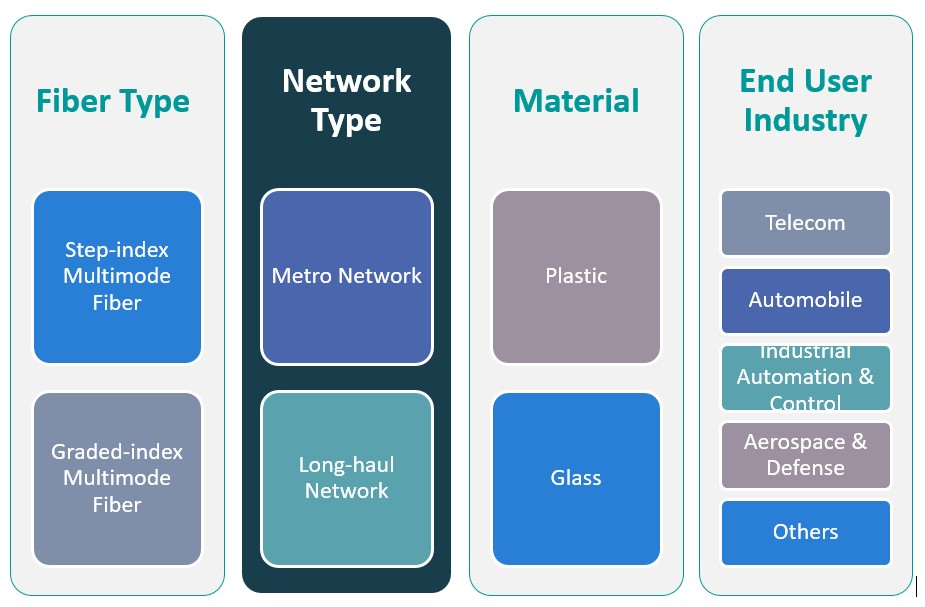

Market Segmentation Analysis

By Fiber Type:

Step-index multimode fiber is primarily used in short-distance communication networks. It is characterized by a uniform refractive index profile and is typically employed in metro networks, connecting local area networks (LANs) and facilitating high-speed data transmission. Its simplicity and cost-effectiveness make it a popular choice for businesses that require short-range communication infrastructure. Graded-index multimode fiber, with its varying refractive index profile, provides improved bandwidth and reduced signal distortion, making it ideal for medium to long-distance transmissions. This fiber type is widely used in applications that demand high-speed communication, such as large-scale enterprise networks and data centers.

By Network Type:

The metro network segment accounts for a significant share of the market, driven by the high demand for data transmission within metropolitan areas. As urbanization increases and the need for efficient data connectivity rises, metro networks relying on dark fiber offer enhanced performance and scalability for telecom and enterprise networks. The long-haul network segment addresses the demand for high-capacity, high-performance connectivity between regions. Dark fiber in long-haul applications is crucial for the backbone infrastructure of national and international telecom providers. With Australia’s growing digital infrastructure, long-haul networks are pivotal for maintaining high-speed, low-latency connectivity over vast distances.

Segments

Based on Fiber Type

- Step-index Multimode Fiber

- Graded-index Multimode Fiber

Based on Network Type

- Metro Network

- Long-haul Network

Based on Material Type

Based on End User

- Telecom

- Automobile

- Industrial Automation & Control

- Aerospace & Defense

- Others

Based on Region

- Sydney

- Melbourne

- Brisbane

Regional Analysis

Sydney (35%)

Sydney remains the largest market for multimode dark fiber in Australia, driven by its status as the country’s business and telecommunications hub. The city’s extensive infrastructure development, along with the growing demand for data centers, cloud computing services, and telecom networks, positions it as the leading region in the market. As the primary gateway for international data traffic, Sydney is home to numerous telecom providers, enterprises, and government institutions that rely heavily on dark fiber networks to support high-speed connectivity. The deployment of 5G technology in Sydney also boosts the demand for dark fiber as part of the city’s evolving telecommunications infrastructure.

Melbourne (30%)

Melbourne, Australia’s second-largest city, also plays a key role in the growth of the multimode dark fiber market. The city is a major financial and technology center, housing numerous businesses that require reliable, high-capacity data networks. Melbourne is experiencing significant investments in digital infrastructure, particularly with the expansion of data centers and cloud service providers. As businesses in the finance, healthcare, and retail sectors increasingly rely on cloud-based applications, the demand for dark fiber to connect these entities grows. Melbourne’s ongoing urbanization and the adoption of smart city initiatives further drive the need for advanced telecommunications solutions.

Key players

- Spark

- Nextgen Networks

- Optus

- TPG Telecom

- Telstra Corporation Limited

Competitive Analysis

The Australia Multimode Dark Fiber Market is highly competitive, with major players such as Spark, Nextgen Networks, Optus, TPG Telecom, and Telstra Corporation Limited driving market growth. Telstra holds a dominant position in the market due to its extensive infrastructure, nationwide reach, and continuous investments in network expansion. Optus and TPG Telecom also maintain strong market shares, capitalizing on their established customer bases and competitive offerings in fiber-optic services. Nextgen Networks is gaining traction by focusing on delivering high-performance, secure, and scalable dark fiber solutions to support enterprise and telecommunications sectors. Spark, while smaller compared to the other key players, differentiates itself by offering flexible and cost-effective solutions, targeting niche market segments. These companies compete based on factors such as network coverage, pricing models, scalability, and service quality, driving continuous innovation in the market.

Recent Developments

- In June 2024, Telstra InfraCo’s intercity fiber network project completed approximately 1,800 kilometers of fiber construction, enhancing connectivity across Australia.

- As of June 2023, TPG Group held a wholesale market share of around 22% of Australian National Broadband Network services.

- As of June 2023, Optus had a wholesale market share of approximately 13% of Australian National Broadband Network residential broadband services.

- In August 2024, Lumen Technologies entered a two-year agreement with Corning Incorporated, securing 10% of Corning’s global fiber capacity to interconnect AI-enabled data centers. This deal is Lumen’s largest cable purchase to date and will more than double its U.S. intercity fiber miles, enhancing capacity for cloud data centers and high-bandwidth applications driven by AI workloads.

- In February 2025, Deutsche Telekom praised T-Systems for its improved performance in FY24, reflecting the company’s strategic focus on enhancing its dark fiber services for enterprise customers.

- In December 2024, the GCC Sustainability Innovation Hub, which includes Etisalat, released a white paper outlining pathways for telecom operators to achieve net-zero emissions, drive renewable adoption, and foster regional collaboration.

- In 2024, Claro Argentina reported an operating profit of 706 billion pesos, a 10.1% growth compared to 2023, indicating strong performance in its telecom operations, including dark fiber services.

Market Concentration and Characteristics

The Australia Multimode Dark Fiber Market exhibits moderate to high market concentration, with a few key players dominating the landscape, such as Telstra Corporation Limited, Optus, TPG Telecom, Nextgen Networks, and Spark. These companies hold a substantial share of the market, leveraging their extensive infrastructure, established customer bases, and significant investments in network expansion. The market is characterized by intense competition in terms of service offerings, pricing strategies, and network coverage, particularly as the demand for high-speed, low-latency connectivity continues to rise. Furthermore, the market is evolving with the growing adoption of 5G networks and cloud computing, which has led to increased investments in fiber-optic infrastructure. While larger players dominate the market, smaller and regional operators are carving out niches by offering flexible and cost-effective solutions. This dynamic environment fosters continuous innovation and drives the overall market’s growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Network Type, Material Type, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- As 5G networks continue to roll out across Australia, the demand for dark fiber to support high-speed data backhaul will significantly rise. Telecom operators will increasingly rely on dark fiber to provide low-latency connectivity.

- The growing adoption of cloud computing and data storage services will drive the need for dark fiber connections between data centers. Businesses will require reliable, high-capacity networks to meet their data processing demands.

- Government initiatives like the National Broadband Network (NBN) will continue expanding dark fiber infrastructure to rural and underserved regions. This will enhance connectivity and bridge the digital divide.

- With the rise of edge computing, businesses will need dark fiber to interconnect edge data centers for faster data processing. The need for low-latency, high-bandwidth fiber networks will increase in industries such as autonomous vehicles and IoT.

- Enterprise businesses will seek dedicated dark fiber solutions for secure, high-performance, and scalable network infrastructure. This trend will be driven by digital transformation initiatives across industries.

- The Australian telecom industry may see further consolidation, with key players like Telstra and Optus expanding their dark fiber networks to offer comprehensive connectivity solutions. Mergers and acquisitions could lead to increased competition.

- Ongoing advancements in fiber optic technology, such as enhanced transmission speeds and efficiency, will improve the performance of dark fiber networks. This will drive greater adoption of multimode fibers.

- Australia’s growing smart city initiatives will rely heavily on dark fiber for their underlying infrastructure. Cities will require robust fiber-optic networks to support IoT devices, real-time monitoring, and data sharing.

- Sustainability will play a key role in the future of dark fiber networks, with businesses seeking energy-efficient solutions. Fiber optics’ lower energy consumption compared to traditional networks will be a major driver.

- Smaller, regional dark fiber providers will continue to enter the market, offering customized solutions at competitive prices. This will diversify the offerings in the market and encourage innovation.