| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Indonesia Off The Road Tire Market Size 2023 |

USD 111.40 Million |

| Indonesia Off The Road Tire Market, CAGR |

3.92% |

| Indonesia Off The Road Tire Market Size 2032 |

USD 157.70 Million |

Market Overview:

Indonesia Off The Road Tire Market size was valued at USD 111.40 million in 2023 and is anticipated to reach USD 157.70 million by 2032, at a CAGR of 3.92% during the forecast period (2023-2032).

Several factors are propelling the growth of the OTR tire market in Indonesia. The government’s robust infrastructure development initiatives, including extensive highway projects and urban development, are driving the demand for construction and mining equipment, which in turn increases the need for durable OTR tires. Additionally, the rise in mechanization within the agriculture sector is contributing to the demand for specialized tires capable of withstanding challenging terrains. Technological advancements in tire design, focusing on enhanced durability and performance, are also supporting market growth by providing solutions tailored to the specific needs of heavy-duty vehicles operating in diverse environments. Furthermore, increased mining and agricultural activities across the country are further bolstering the need for specialized OTR tires.

Regionally, the East region of Indonesia is leading in OTR tire demand, attributed to its industrial activities and manufacturing hubs. This region’s well-developed infrastructure and strategic investments in automotive manufacturing contribute significantly to the overall market growth. Other regions are also witnessing increased demand for OTR tires, driven by localized infrastructure projects and sector-specific requirements. The government’s initiatives to ease corporate tax laws and encourage foreign investment are further facilitating the establishment of commercial offices and industrial units across the country, thereby boosting the demand for commercial vehicles and, consequently, OTR tires. Additionally, major cities in Central and Western Indonesia are increasingly focusing on infrastructure upgrades, which is expected to expand the OTR tire market further in these regions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Indonesia Off-the-Road (OTR) tire market was valued at USD 111.40 million in 2023 and is projected to reach USD 157.70 million by 2032, growing at a CAGR of 3.92% during the forecast period.

- The Global OTR tire market was valued at USD 18,234 million in 2023 and is expected to grow to USD 27,097.46 million by 2032, at a CAGR of 4.5%.

- Infrastructure development initiatives, such as extensive highway projects and urban development, are driving the demand for heavy-duty machinery, increasing the need for durable OTR tires.

- The mining sector, fueled by Indonesia’s rich natural resources, significantly contributes to the OTR tire market as specialized equipment for rough terrain is required.

- The rise in agricultural mechanization, with more farms adopting advanced machinery like tractors and harvesters, is boosting demand for specialized OTR tires capable of withstanding harsh environments.

- Technological advancements in tire design, such as improved durability, fuel efficiency, and performance, are playing a key role in driving market growth across various industries.

- The increasing demand for sustainable and eco-friendly OTR tires is driven by a global shift towards environmental conservation and the desire to reduce carbon footprints.

- Regionally, Eastern Indonesia is seeing the highest OTR tire demand due to industrial activities, manufacturing hubs, and infrastructure development, with the government’s tax incentives further boosting demand across the country.

Market Drivers:

Infrastructure Development and Government Initiatives

Indonesia’s ongoing infrastructure development is a major driver of the Off-the-Road (OTR) tire market. For instance, in 2022, the Indonesian government invested significant amount in constructing a 76 km tolled highway project, reflecting the scale of public works fueling demand for heavy-duty machinery and, consequently, OTR tires. These initiatives have led to a surge in demand for heavy-duty machinery, which is essential for executing these expansive projects. As construction and mining industries are heavily reliant on robust machinery, the increasing deployment of construction and mining vehicles directly fuels the need for durable OTR tires capable of handling challenging conditions. The government’s support for such projects has also created a favorable environment for foreign investment, further enhancing the market demand for OTR tires across various sectors.

Growth of Mining and Agriculture Sectors

The mining and agriculture sectors in Indonesia are rapidly expanding, both of which significantly contribute to the growth of the OTR tire market. Indonesia is rich in mineral resources, making the mining industry a crucial part of its economy. The demand for OTR tires in mining is directly linked to the need for specialized equipment capable of navigating rough terrains and heavy workloads. Similarly, the agricultural sector is witnessing increased mechanization, with more farms adopting advanced machinery for planting, harvesting, and processing crops. These machines, including tractors and harvesters, require high-performance tires that can withstand both harsh terrain and heavy usage. As both sectors continue to grow, the demand for reliable and durable OTR tires will remain strong.

Technological Advancements in Tire Manufacturing

Technological advancements in tire manufacturing are contributing to the growth of the OTR tire market in Indonesia. Manufacturers are continuously developing tires with enhanced durability, improved traction, and better fuel efficiency, which cater to the specific needs of heavy-duty vehicles. The introduction of tires with advanced tread designs, longer lifespans, and better heat resistance has increased their appeal to industries like construction, mining, and agriculture. For example, Continental AG has introduced OTR tires engineered for enhanced fuel efficiency and reduced operational costs, targeting sectors such as logistics and construction. These technological innovations help vehicles operate more efficiently and safely in challenging environments, offering cost-saving benefits for businesses. As technology continues to evolve, it will enable further improvements in OTR tire performance, thereby driving market growth.

Rising Demand for Sustainable and Eco-Friendly Solutions

An increasing focus on sustainability and environmental impact is another key factor driving the demand for OTR tires in Indonesia. As global attention shifts towards environmental conservation, there is a growing need for eco-friendly tire solutions that contribute to reducing the carbon footprint. This shift is particularly evident in industries like agriculture and mining, where the environmental impact is under scrutiny. Manufacturers are responding to these demands by producing tires that offer better fuel efficiency, lower emissions, and are more recyclable, aligning with both governmental policies and corporate sustainability goals. As awareness of environmental issues continues to rise, the market for sustainable OTR tires is expected to expand, with businesses and industries making conscious decisions to adopt eco-friendlier solutions in their operations.

Market Trends:

Increasing Adoption of Radial Tires

One of the prominent trends in the Indonesia Off-the-Road (OTR) tire market is the growing adoption of radial tires. For instance, Sailun Group announced in March 2024 its plan to build a manufacturing facility in Demak, Central Java, with an annual capacity of 3 million semi-steel radial tires, 600,000 all-steel radial tires, and 37,000 tonnes of OTR tires, backed by an investment of USD 251.44 million. Radial tires offer superior performance compared to bias-ply tires, particularly in terms of durability, fuel efficiency, and load-bearing capacity. As industries such as mining and construction require tires that can handle harsh and demanding conditions, the demand for radial tires has increased significantly. These tires offer better traction, longer lifespan, and improved fuel efficiency, which have made them the preferred choice for many heavy-duty vehicles operating in Indonesia’s rugged environments. The shift toward radial tires is a response to the need for cost-effective solutions that also enhance operational productivity.

Focus on Tire Retreading and Reconditioning

Another key trend in the Indonesian OTR tire market is the increasing focus on tire retreading and reconditioning. The rising cost of new OTR tires has driven businesses to explore alternatives such as retreading, which offers a cost-effective way to extend the lifespan of tires. Retreading involves replacing the worn-out tread on an existing tire, allowing it to be used again without the need for a full replacement. This practice is especially prevalent in industries where the cost of maintaining heavy-duty vehicles is high. Tire retreading not only helps reduce the overall cost of vehicle maintenance but also aligns with sustainability goals by reducing the demand for new raw materials and minimizing waste. As a result, more companies in Indonesia are turning to tire retreading services, thereby boosting the market’s growth.

Shift Towards Smart Tires and IoT Integration

The integration of smart technology in OTR tires is another notable trend in Indonesia. The emergence of smart tires, which incorporate sensors and Internet of Things (IoT) technology, is transforming the way tire performance is monitored and maintained. These sensors provide real-time data on tire pressure, temperature, tread wear, and other critical metrics, enabling proactive maintenance and preventing tire-related breakdowns. For example, Continental launched the ContiConnect Live cloud-based solution, allowing fleet operators to access real-time tire data via Bluetooth dongles or telematics devices, enhancing maintenance planning and reducing downtime. By integrating IoT technology into tires, businesses can enhance fleet management, reduce downtime, and improve safety. As industries continue to prioritize efficiency and operational optimization, the demand for smart tires in Indonesia’s OTR market is expected to rise, providing businesses with valuable data that improves decision-making and reduces overall operational costs.

Rise in Demand for Premium OTR Tires

There is also a noticeable trend toward the increased demand for premium OTR tires in Indonesia. While cost-effectiveness remains a priority, many businesses are investing in high-quality, premium tires that offer superior performance and longevity. Premium OTR tires are designed to endure harsh conditions, provide enhanced safety features, and deliver greater fuel efficiency. This shift is driven by the desire to reduce the total cost of ownership by minimizing the frequency of tire replacements and improving operational efficiency. As industries such as mining, construction, and agriculture continue to expand, the demand for premium OTR tires, which offer higher performance and a longer service life, is likely to continue growing in Indonesia.

Market Challenges Analysis:

High Cost of Tires

One of the primary challenges facing the Indonesia OTR tire market is the high cost of tires, particularly premium and specialized tires. The high upfront cost of acquiring OTR tires, especially for heavy-duty vehicles in industries like mining and construction, can be a significant barrier for businesses operating in cost-sensitive environments. For instance, the Indonesian Tire Company Association (APBI) highlights that the production cost of tires in Indonesia is much higher than in neighboring countries like Vietnam and Thailand, primarily due to the high price of imported raw materials and reduced domestic rubber supply. While the benefits of enhanced durability and performance are clear, the initial expense can discourage smaller businesses or those with limited budgets from investing in high-quality tires. This cost factor could potentially slow the adoption of newer, more efficient tire technologies and limit market growth.

Fluctuations in Raw Material Prices

Another challenge is the volatility in the prices of raw materials used in tire manufacturing. The production of OTR tires relies on materials such as rubber, steel, and chemicals, which are subject to fluctuations in global commodity prices. These price swings can lead to unpredictable cost structures for manufacturers, impacting the final pricing of OTR tires. Given that tire manufacturers in Indonesia largely depend on imported raw materials, supply chain disruptions or changes in global supply dynamics can result in higher production costs, which are subsequently passed on to consumers, further hindering market growth.

Limited Availability of Skilled Workforce

The limited availability of skilled labor is another challenge for the OTR tire market in Indonesia. Manufacturing and maintaining high-performance tires require specialized expertise, which may be in short supply in certain regions of the country. In addition, the lack of skilled technicians for tire repair and maintenance services can hinder the efficiency of businesses relying on OTR tires. Without a trained workforce capable of handling advanced tire technologies and maintenance procedures, businesses may face operational inefficiencies and increased downtime, which can negatively affect overall productivity and profitability.

Regulatory and Environmental Challenges

Finally, regulatory and environmental challenges present a significant restraint to the market. While Indonesia has made strides in improving infrastructure, the country still faces challenges related to environmental regulations, particularly concerning the disposal of used tires. The lack of a well-developed recycling infrastructure for OTR tires can lead to environmental concerns and increased disposal costs for businesses. Moreover, regulatory compliance with environmental standards may necessitate additional investments in sustainable practices, further increasing the operational burden on businesses in the OTR tire market.

Market Opportunities:

The Indonesia Off-The-Road (OTR) Tire Market presents substantial opportunities driven by the country’s growing infrastructure development. As the Indonesian government continues to invest in large-scale infrastructure projects, including road construction, urbanization, and transportation networks, there is a rising demand for heavy-duty machinery. These vehicles rely heavily on OTR tires to operate efficiently in challenging environments. The ongoing expansion of mining operations, especially in Indonesia’s resource-rich regions, creates additional demand for specialized tires capable of withstanding extreme conditions. As these sectors continue to develop, businesses within the OTR tire market have significant opportunities to provide high-performance tire solutions tailored to the evolving needs of the construction, mining, and agricultural industries.

Another significant opportunity arises from the shift towards more sustainable and eco-friendly tire solutions. As global awareness around environmental issues grows, Indonesian companies are increasingly seeking tires that offer enhanced fuel efficiency, lower emissions, and are recyclable. Manufacturers that can innovate and offer eco-friendly OTR tire options stand to gain a competitive edge in the market. Additionally, the rising trend of tire retreading and the integration of smart technologies into OTR tires further contribute to market opportunities. The adoption of smart tire technologies, which provide real-time performance data, offers enhanced fleet management and reduced operational costs for businesses. These trends present fertile ground for OTR tire manufacturers to meet the evolving demands of a diverse industrial landscape in Indonesia.

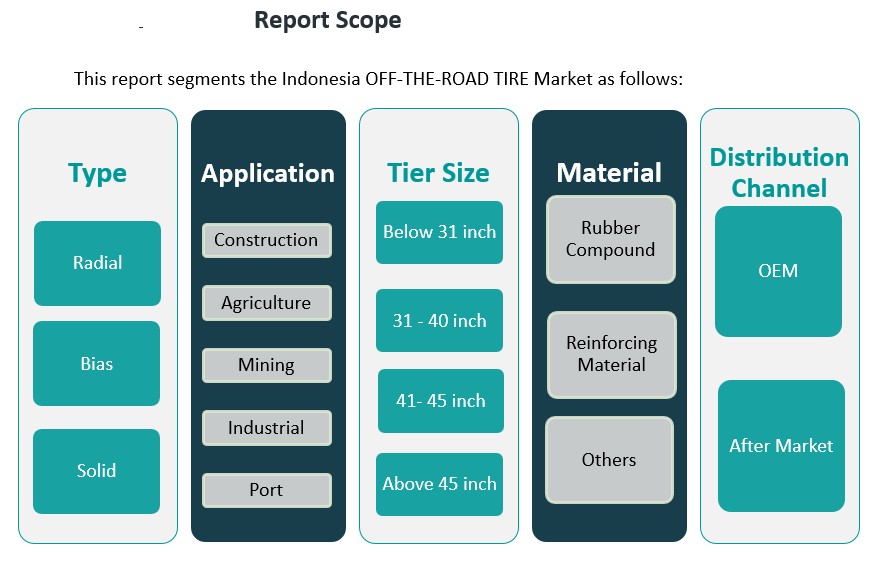

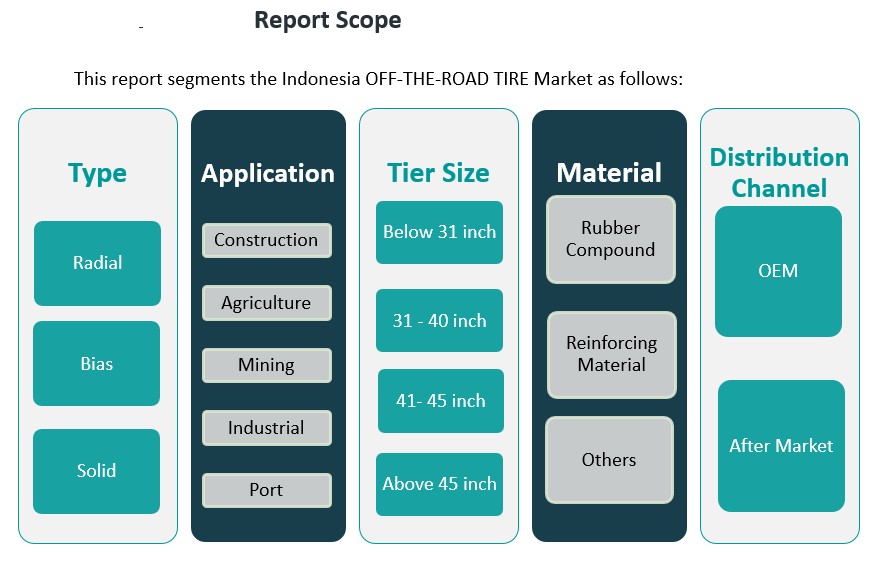

Market Segmentation Analysis:

The Indonesia Off-the-Road (OTR) tire market is segmented across various categories, each serving distinct industrial needs.

By Type Segment, OTR tires are primarily categorized into radial, bias, and solid tires. Radial tires are in high demand due to their superior durability, fuel efficiency, and better performance under heavy loads. Bias tires, while cost-effective, offer less longevity compared to radial tires but continue to serve specific applications. Solid tires are increasingly favored in sectors requiring robust performance on rough terrain, such as mining and construction.

By Application Segment, the construction, agriculture, mining, industrial, and port sectors drive significant demand for OTR tires. The construction industry relies on heavy machinery, requiring durable tires to handle tough terrains. The agricultural sector is seeing increased mechanization, thus raising the need for specialized tires. Mining operations in Indonesia, with their demanding conditions, contribute heavily to the market, as do industrial and port facilities, where OTR tires are used in various material handling and transport equipment.

By Tire Size Segment includes classifications such as below 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. Larger tire sizes are particularly prevalent in industries like mining and construction, where heavy-duty machinery is common. Smaller tire sizes are more frequently used in agriculture and industrial applications.

By Material Segment includes rubber compounds, reinforcing materials, and other components, with rubber compounds being the most widely used due to their performance and durability. Lastly, the Distribution Channel Segment comprises OEM and aftermarket sales, with OEM sales representing the primary distribution method for new vehicles, while aftermarket sales cater to replacement and maintenance needs.

Segmentation:

By Type Segment

By Application Segment

- Construction

- Agriculture

- Mining

- Industrial

- Port

By Tire Size Segment

- Below 31 inch

- 31 – 40 inch

- 41 – 45 inch

- Above 45 inch

By Material Segment

- Rubber Compound

- Reinforcing Material

- Others

By Distribution Channel Segment

Regional Analysis:

Indonesia’s Off-the-Road (OTR) tire market exhibits notable regional disparities, influenced by industrial activities, infrastructure development, and agricultural practices. While specific market share percentages by region are not readily available, qualitative insights can be drawn from the distribution of industrial and agricultural activities across the country.

Western Indonesia

Western Indonesia, particularly the islands of Sumatra and Java, plays a pivotal role in the OTR tire market. Java, being the economic and industrial hub, hosts a significant portion of the nation’s manufacturing, construction, and mining operations. The high concentration of infrastructure projects and industrial activities in this region drives substantial demand for OTR tires, especially in sectors like construction and mining. Sumatra, with its rich natural resources, also contributes to the demand for OTR tires, particularly in the mining and forestry industries.

Eastern Indonesia

Eastern Indonesia, encompassing regions such as Kalimantan, Sulawesi, and Papua, is rich in natural resources, including coal, palm oil, and minerals. The mining and agriculture sectors in these areas are significant consumers of OTR tires. Kalimantan, in particular, with its extensive coal mining operations, has a high demand for heavy-duty mining equipment and, consequently, OTR tires. Sulawesi and Papua’s agricultural activities, including palm oil plantations, also contribute to the need for specialized OTR tires for agricultural machinery.

Central and Eastern Regions

The central and eastern regions of Indonesia, while less industrialized than the western parts, are experiencing growth in agricultural mechanization. The increasing adoption of modern farming equipment in these areas is driving demand for OTR tires tailored to agricultural vehicles. As infrastructure development progresses in these regions, the need for construction and industrial vehicles—and thus OTR tires—is expected to rise.

Key Player Analysis:

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Linglong Tire

- Pirelli

- Prinx Chengshan (Shandong) Tire Co. Ltd

- Double Coin Holdings

- PT Gajah Tunggal Tbk

Competitive Analysis:

The Indonesia Off-the-Road (OTR) tire market is highly competitive, with both international and local players vying for market share. Key global tire manufacturers such as Michelin, Bridgestone, Goodyear, and Continental dominate the market, offering a wide range of high-performance tires tailored to various industrial applications, including mining, construction, and agriculture. These companies leverage their advanced technology, global supply chains, and strong brand reputation to maintain a significant presence in the Indonesian market. Local players, including PT Gajah Tunggal Tbk, also play a crucial role in the market, offering competitive pricing and localized products designed to meet the unique needs of Indonesia’s diverse industries. As the market grows, both international and local tire manufacturers are increasingly focusing on innovation, with an emphasis on sustainability, smart tire technology, and tire retreading services to capture the growing demand for cost-effective and durable tire solutions.

Recent Developments:

- In early 2025, The Goodyear Tire & Rubber Company completed the divestiture of its global off-the-road (OTR) tire business to The Yokohama Rubber Company, Limited, in an all-cash transaction valued at approximately $905 million. This move, finalized on February 3, 2025, is a significant milestone in Goodyear’s transformation strategy, allowing the company to streamline its portfolio and focus on core products and services.

- In February 2024, Titan International, Inc. announced the acquisition of Carlstar Group LLC for approximately $296 million in a cash and stock transaction. Carlstar, a global manufacturer of specialty tires and wheels, brings Titan new customer relationships and product diversification, especially in outdoor power equipment and high-speed trailers. This acquisition strengthens Titan’s position in the off-road tire market and expands its reach into new segments.

- In March 2025, Linglong Tire launched its first Asia-Pacific training center in Thailand, marking a significant step in its regional expansion strategy. The facility, developed in partnership with Sanguan Yangyont Chumphon Co., Ltd., is designed to enhance service standards, distributor capabilities, and brand experience for channel partners and end-users across the Asia-Pacific region. This initiative is part of Linglong’s broader globalization and localization strategy.

Market Concentration & Characteristics:

The Indonesia Off-the-Road (OTR) tire market exhibits a moderate level of market concentration, with a mix of large multinational corporations and local manufacturers. Global giants such as Michelin, Bridgestone, Goodyear, and Continental dominate the high-end segment, offering advanced tire solutions with cutting-edge technology and superior performance. These companies leverage their extensive distribution networks, brand recognition, and technological advancements to maintain a strong competitive position in the market. On the other hand, local players such as PT Gajah Tunggal Tbk cater to the price-sensitive segment by offering cost-effective and region-specific tire solutions. This dual market structure fosters competition between international and domestic players, allowing for product differentiation based on price, performance, and regional needs. The market is characterized by continuous innovation, with manufacturers focusing on enhancing durability, fuel efficiency, and sustainability to meet the growing demand from industries such as mining, agriculture, and construction.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, Tire Size, Material and Distribution Channel It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Indonesia’s OTR tire market is expected to grow due to increasing infrastructure and construction projects.

- The mining sector will continue to drive demand, fueled by Indonesia’s rich natural resources.

- Agricultural mechanization will increase, leading to higher demand for specialized OTR tires in rural areas.

- Technological advancements in tire durability, fuel efficiency, and smart tire solutions will play a critical role.

- Rising environmental concerns will boost the adoption of eco-friendly and sustainable tire options.

- The trend toward tire retreading will offer cost-effective solutions for businesses in construction and mining.

- Regional demand will vary, with Western Indonesia seeing the highest industrial demand and Eastern Indonesia driven by mining and agriculture.

- Market competition will intensify as both international and local players focus on performance, cost, and innovation.

- The growing push for digital solutions and IoT integration will enhance fleet management and tire performance monitoring.

- The expansion of foreign investments and the government’s focus on sustainable growth will further stimulate market opportunities.