Market Overview

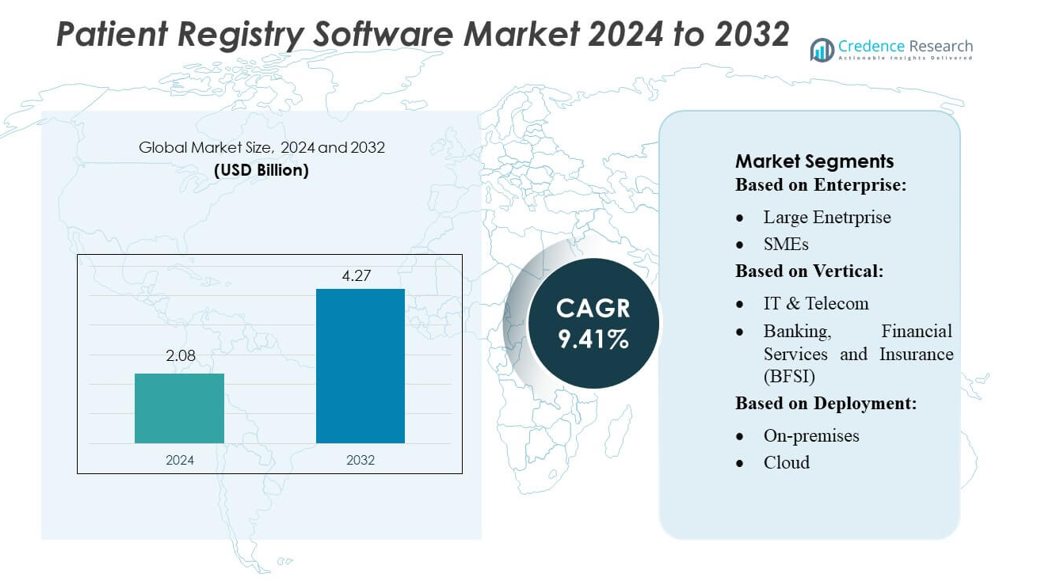

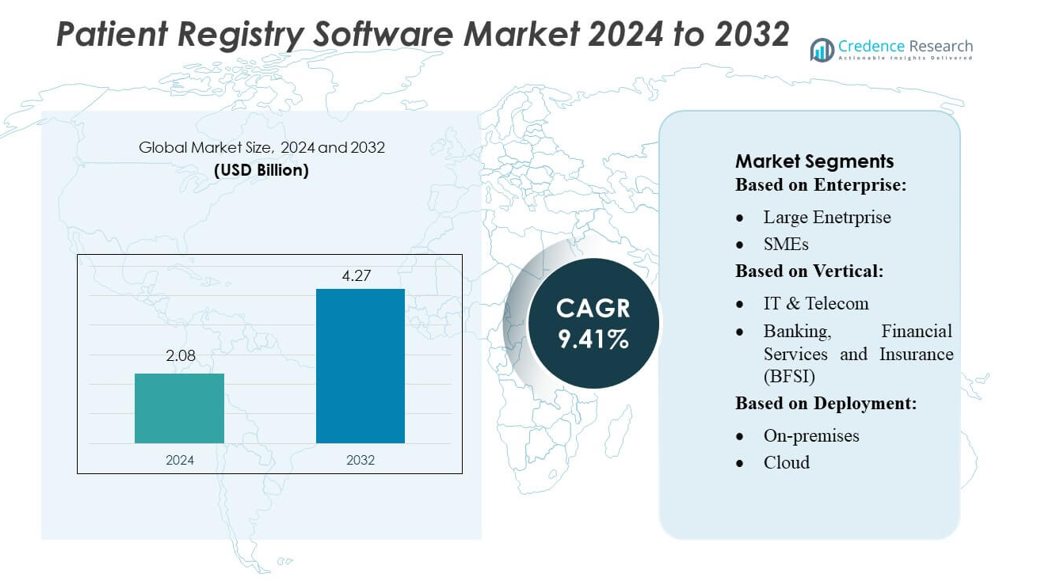

Patient Registry Software Market size was valued USD 2.08 billion in 2024 and is anticipated to reach USD 4.27 billion by 2032, at a CAGR of 9.41% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Patient Registry Software Market Size 2024 |

USD 2.08 billion |

| Patient Registry Software Market, CAGR |

9.41% |

| Patient Registry Software Market Size 2032 |

USD 4.27 billion |

The patient registry software market remains highly competitive, with leading vendors focusing on enhancing interoperability, strengthening analytics capabilities, and expanding cloud-based deployments to meet rising demand for real-world evidence and population health insights. Companies continue to refine platforms that support large, multi-center registries, automate data capture, and ensure compliance with evolving privacy regulations. North America holds the dominant position in the global market, accounting for approximately 45% of total share, supported by advanced healthcare IT infrastructure, strong integration of electronic health records, and extensive adoption of registries for clinical research, chronic disease management, and post-market surveillance.

Market Insights

- The Patient Registry Software Market was valued at USD 2.08 billion in 2024 and is projected to reach USD 4.27 billion by 2032, registering a CAGR of 9.41% during the forecast period.

- Market growth is driven by increasing demand for real-world evidence, expanding chronic disease management programs, and accelerated adoption of cloud-based and interoperable health IT solutions across hospitals and research networks.

- Key trends include rising integration of AI-enabled analytics, growing multi-center registry collaborations, and continuous modernization of data governance and compliance capabilities among vendors.

- Market restraints stem from interoperability challenges, high implementation costs for smaller facilities, and strict regulatory requirements that slow large-scale deployments.

- Regionally, North America leads with about 45% share, while Asia-Pacific shows the fastest growth; by segment, cloud deployment continues gaining share due to scalability and lower infrastructure demands, strengthening its adoption across developing and developed markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Enterprise

Large enterprises dominated the patient registry software market with an estimated over 60% share, driven by their extensive patient data volumes, established IT infrastructures, and higher adoption of advanced analytics and interoperability solutions. These organizations increasingly deploy integrated registry platforms to support population health management, clinical decision support, and regulatory reporting. SMEs accounted for the remaining share as they gradually adopt cost-effective, cloud-based registries to streamline patient tracking and improve workflow efficiency, though budget constraints and limited IT resources continue to slow their penetration compared to large enterprises.

- For instance, Qingdao Yiqing Biotechnology Co., Ltd. produces a variety of capsules company’s reported production capacity is up to 35 billion capsules annually currently, with supporting conditions to expand to 50 billion high-quality hollow capsules.

By Vertical

The IT & Telecom segment led the market with nearly 35% share, supported by strong digitalization initiatives, wider integration capabilities, and advanced data management frameworks enabling efficient registry deployment across healthcare networks. BFSI, e-commerce, and other sectors followed, leveraging patient registry solutions primarily for employee health programs, occupational risk monitoring, and wellness data administration. While BFSI uses registries to enhance health-benefit compliance, e-commerce and other verticals adopt them for workforce wellness tracking, collectively contributing to moderate but growing demand.

- For instance, Block, Inc. Square ecosystem processed 5.2 billion individual sales transactions, which demonstrates the scale and reliability of infrastructures that can support high-volume registry environments.

By Deployment

Cloud deployment remained the dominant segment, holding over 55% market share, propelled by its scalable architecture, lower upfront investment, rapid implementation, and strong demand for remote access to patient datasets across distributed care settings. Healthcare providers increasingly prefer cloud-based registries for real-time analytics, interoperability, and simplified upgrades. On-premises solutions retained a substantial share among institutions requiring stringent data control, legacy system compatibility, and greater security customization, though higher maintenance costs continue to shift preference toward cloud-based platforms over the forecast period.

Key Growth Drivers

Growing Need for Real-World Evidence (RWE) in Healthcare

The patient registry software market grows as healthcare stakeholders increasingly rely on real-world evidence to support regulatory submissions, clinical decision-making, and post-market surveillance. Governments and research institutions prioritize longitudinal patient data to track disease progression, measure treatment efficacy, and enhance population health programs. This demand accelerates adoption of advanced registry platforms capable of integrating multisource clinical data, improving outcome analytics, and enabling large-scale observational studies. Vendors benefit from rising investments in evidence-based care models, directly boosting software uptake.

- For instance, Bright-Poly brand capsules, with an annual production capacity of approximately 1.5 billion units, are certified by the USDA Organic Program and provide a superior oxygen barrier suitable for oxygen-sensitive materials like enzymes and live bacteria.

Expansion of Chronic Disease Management Programs

The rising global prevalence of chronic disorders such as diabetes, cardiovascular diseases, and cancer drives hospitals, specialty clinics, and public health agencies to adopt patient registry solutions for high-quality disease tracking. These systems enhance monitoring, adherence assessment, and care coordination, supporting providers in reducing readmissions and optimizing treatment pathways. As chronic care initiatives increasingly incorporate predictive analytics and personalized care models, registry platforms with advanced analytics capabilities gain strong traction. Long-term patient management needs also strengthen the shift toward cloud-based registry deployments.

- For instance, Roquette introduced MICROCEL® 103 SD and MICROCEL® 113 SD microcrystalline cellulose grades. These grades offer an average water activity (Aw) of no more than 0.2% and 0.1%, respectively, ensuring improved stability for moisture-sensitive formulations.

Accelerated Digital Transformation in Healthcare

Healthcare organizations continue to modernize data infrastructure, driving demand for interoperable patient registry platforms capable of integrating with EHR, laboratory, claims, and imaging systems. The transition toward unified data ecosystems encourages investment in registries that enhance data quality, automate reporting workflows, and support regulatory compliance frameworks such as HIPAA and GDPR. As digital health adoption widens, software providers expand functionality in areas like dashboard visualization, configurable templates, and real-time analytics. This digital acceleration positions patient registries as essential tools for evidence generation and operational efficiency.

Key Trends & Opportunities

Growing Adoption of AI-Driven Analytics

AI and machine learning integration into patient registries creates new opportunities for predictive risk modeling, automated data harmonization, and earlier identification of treatment patterns. AI-enhanced registries enable providers to transform unstructured clinical data into actionable insights, improving clinical research productivity and accelerating therapeutic evaluations. As health systems adopt AI for population health and personalized care, vendors offering intelligent analytics modules gain competitive advantage. This trend strengthens the strategic value of registries in precision medicine and adaptive clinical trial designs.

- For instance, Fortcaps Healthcare Ltd. utilizes an automated dipping process in its manufacturing facilities. The company has confirmed on its website and in company profiles that it produces over 6.5 billion capsules annually using 16 state-of-the-art, fully automatic capsule manufacturing machines.

Expansion of Cloud-Based and Modular Registry Solutions

Cloud-based patient registry platforms gain prominence due to lower deployment costs, faster scalability, and simplified multi-site data access. Vendors increasingly offer modular architectures that allow organizations to customize disease modules, reporting tools, and integration workflows without large upfront investments. Cloud models support real-time collaboration among research networks and enable seamless incorporation of remote patient monitoring data. This shift creates strong opportunities for subscription-based pricing models, appealing to small and mid-sized healthcare organizations.

- For instance, ACG’s ZRO 90T model offers a maximum speed of up to 90,000 capsules per hour. The ZRO 200T model offers a maximum speed of up to 200,000 capsules per hour.

Increasing Use of Registries in Value-Based Care Models

Healthcare systems transitioning toward value-based reimbursement increasingly adopt patient registries to track quality metrics, cost outcomes, and care performance benchmarks. Registries support risk stratification and enable providers to document improvements required for incentive-based payment programs. As payers and governments push for measurable, data-backed care outcomes, registry solutions that facilitate standardized reporting and automated quality measure tracking gain strategic importance. This trend drives new opportunities for vendors offering compliance-focused and outcomes-oriented platforms.

Key Challenges

Data Integration and Interoperability Limitations

Despite digital transformation, many healthcare organizations still operate fragmented data systems, creating challenges in integrating EHR, claims, pharmacy, and diagnostic data into unified registry platforms. Variability in data formats, incomplete data fields, and inconsistencies across clinical workflows hinder seamless interoperability. Vendors face the challenge of building solutions that support standardized protocols such as HL7 FHIR while minimizing implementation complexity. These integration gaps delay deployments and increase operational costs, limiting registry adoption in resource-constrained facilities.

Concerns Over Data Privacy, Security, and Compliance

Patient registries handle sensitive health data, making security and regulatory compliance major concerns for providers and research institutions. Risks associated with unauthorized access, data breaches, and non-compliance with evolving privacy regulations can slow adoption, particularly for cloud-based systems. Organizations require significant investments in governance frameworks, encryption technologies, and auditing capabilities to ensure data protection. Vendors must continually update cybersecurity features and meet stringent regulatory expectations, increasing operational burden and limiting system scalability in highly regulated regions.

Regional Analysis

North America

North America leads the patient registry software market with around 45% share, driven by advanced healthcare IT systems and strong adoption of electronic health records. The U.S. dominates due to extensive use of registries in oncology, rare diseases, and post-market drug surveillance. Supportive regulatory frameworks and high investments from hospitals, research institutions, and pharmaceutical companies further strengthen the region’s position. Growing focus on real-world evidence and outcome-based reimbursement models continues to accelerate software deployment across healthcare networks.

Europe

Europe holds approximately 28–30% of the global market, supported by government-funded disease registries, strong public health programs, and strict data governance under GDPR. Countries such as Germany, the U.K., France, and the Nordics drive adoption due to well-established digital health ecosystems. The region benefits from cross-border research collaborations and expanding rare-disease registries. Increasing emphasis on population health management, chronic disease tracking, and interoperable health-data systems continues to promote the growth of registry platforms across both public and private healthcare sectors.

Asia-Pacific

Asia-Pacific accounts for roughly 15–20% of the market and is the fastest-growing region due to rising chronic disease prevalence and expanding healthcare digitization. China, India, Japan, and South Korea drive regional demand through national digital health programs and increasing participation in global clinical research. Growing investments in hospital IT infrastructure and wider adoption of cloud-based solutions also support market expansion. As healthcare systems seek better disease monitoring and outcome measurement, patient registry software adoption continues to accelerate across both developed and emerging APAC markets.

Latin America

Latin America represents around 5–6% of the global patient registry software market, driven by gradual modernization of healthcare systems and increased focus on cancer and chronic disease registries. Brazil leads adoption through national programs that support oncology and population health reporting. Cloud-based platforms are gaining traction due to lower IT investment requirements. Although funding limitations and uneven digital infrastructure remain challenges, expanding regional collaborations and public health initiatives are gradually supporting wider deployment of patient registry tools.

Middle East & Africa

The Middle East & Africa region holds approximately 4–5% market share, with growth concentrated in GCC countries investing heavily in digital health transformation. Nations like the UAE and Saudi Arabia lead adoption through national registry programs, particularly for chronic diseases and public health monitoring. In Africa, international partnerships support disease-specific registries for HIV, maternal health, and infectious diseases. Despite limited infrastructure in several countries, rising healthcare digitalization and cloud adoption continue to create incremental opportunities for registry software deployment.

Market Segmentations:

By Enterprise:

By Vertical:

- IT & Telecom

- Banking, Financial Services and Insurance (BFSI)

By Deployment:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The patient registry software market features a competitive landscape shaped by major technology providers, including Block, Inc., Oracle, McAfee Corporation, VMware Inc., NortonLifeLock Inc., IBM Corporation, Intuit Inc., Adobe Inc., SAP, and Microsoft. The patient registry software market is defined by continuous innovation, strong digital capabilities, and a growing emphasis on interoperability and data security. Vendors increasingly invest in cloud-based platforms, AI-driven analytics, and automation tools to enhance real-time data capture and improve integration with electronic health records and other healthcare IT systems. Competition is also fueled by strategic partnerships with hospitals, research institutions, and public health agencies to develop disease-specific and population-wide registries. Companies differentiate themselves through customizable modules, compliance-focused features, and scalable architectures that support large, multi-site research networks. As demand accelerates for real-world evidence generation and outcome-based reporting, market participants prioritize advanced functionality, strong regulatory alignment, and global expansion strategies to strengthen their market position.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In October 2025, Oracle enhanced its supply chain management platform by integrating AI capabilities. This update enables the automation of various tasks for procurement professionals, such as generating standardized product descriptions and providing supplier recommendations, which can significantly streamline procurement processes.

- In January 2025, Block, a technology, announced the launch of Goose, an open-source AI agent designed to empower developers with customizable tools. Goose allows users to leverage various large language models, providing flexibility in its application across different tasks and industries.

- In November 2024, Microsoft unveiled cloud-connected software that enables customers to deploy Azure computing, networking, storage, and application services across various environments, including edge locations, on-premises data centers, and hybrid cloud setups.

- In July 2024, Adobe Inc. announced breakthrough innovations in its Adobe Illustrator and Adobe Photoshop. These industry-leading apps speed up everyday creative workflows and offer more control to creators.

Report Coverage

The research report offers an in-depth analysis based on Enterprise, Vertical, Deployment and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will increasingly integrate AI and machine learning to enhance predictive analytics and automate data processing.

- Cloud-based registry platforms will continue to gain dominance due to scalability, flexibility, and lower infrastructure requirements.

- Real-world evidence generation will drive wider adoption across pharmaceutical, biotechnology, and clinical research sectors.

- Interoperability with EHRs, wearables, and remote monitoring tools will become a core requirement for all platforms.

- Vendors will expand support for rare-disease and specialty registries as precision medicine initiatives grow.

- Cybersecurity and data governance will become stronger competitive differentiators as regulatory demands intensify.

- Patient-generated health data will play a bigger role, increasing registry depth and improving outcome tracking.

- Automated reporting tools will streamline compliance with evolving national and international health regulations.

- Partnerships between healthcare providers, tech companies, and research networks will accelerate multi-center registry projects.

- Emerging markets will adopt registry software rapidly as healthcare digitalization expands worldwide.