Market Overview

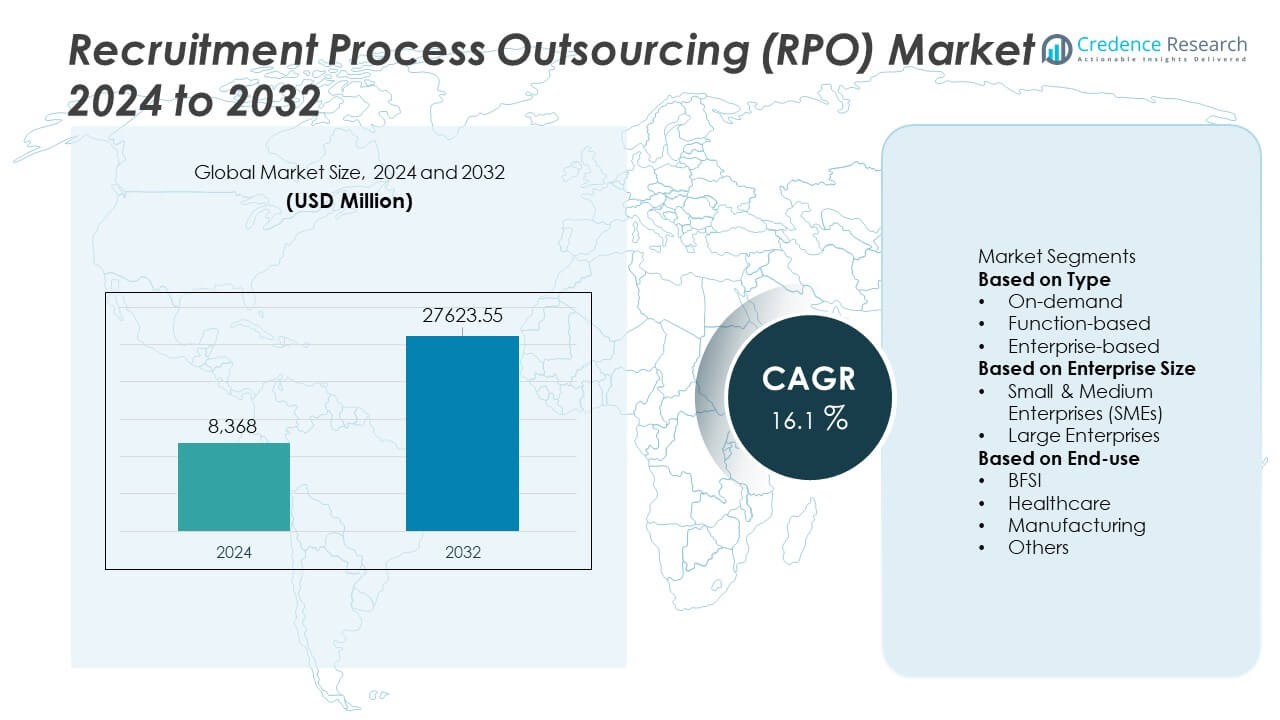

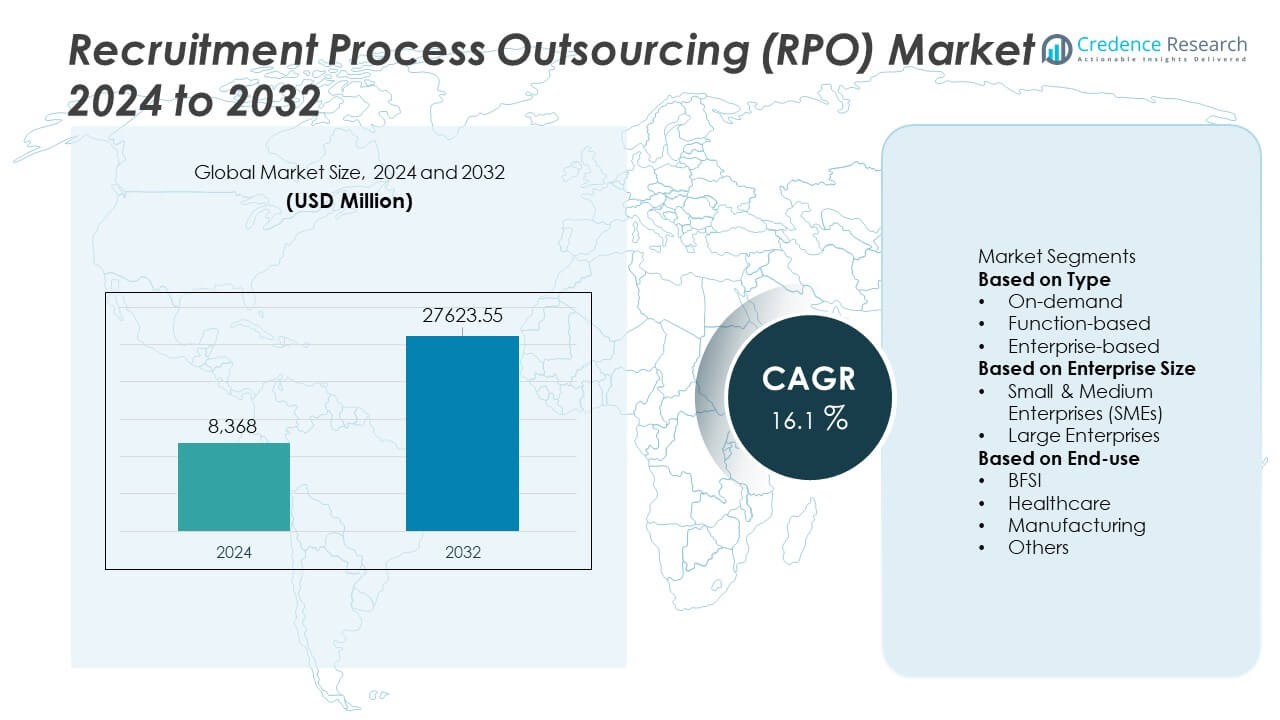

Recruitment Process Outsourcing (RPO) Market size was valued at USD 8,368 million in 2024 and is projected to reach USD 27,623.55 million by 2032, expanding at a CAGR of 16.1% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Recruitment Process Outsourcing (RPO) Market Size 2024 |

USD 8,368 Million |

| Recruitment Process Outsourcing (RPO) Market, CAGR |

16.1% |

| Recruitment Process Outsourcing (RPO) Market Size 2032 |

USD 27,623.55 Million |

The Recruitment Process Outsourcing (RPO) market is driven by leading players such as Randstad, ManpowerGroup, Adecco Group, Allegis Global Solutions, Korn Ferry, IBM Talent Acquisition, Cielo, Hudson RPO, PeopleScout, and Alexander Mann Solutions (AMS), all of which strengthen global hiring capabilities through scalable, technology-enabled recruitment services. These companies focus on AI-driven sourcing, talent analytics, and multi-country delivery models to support high-volume and specialized hiring needs across industries. North America leads the market with 38% share, supported by advanced HR technology and strong enterprise adoption. Europe follows with 31% share, driven by structured recruitment frameworks, while Asia Pacific holds 24% share due to rapid workforce expansion and rising digital hiring demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Recruitment Process Outsourcing (RPO) market was valued at USD 8,368 million in 2024 and is projected to reach USD 27,623.55 million by 2032, growing at a CAGR of 16.1% during the forecast period.

- Key drivers include rising demand for cost-efficient and scalable recruitment models, with enterprise-based RPO holding a 49% share as large organizations seek end-to-end hiring support and improved talent quality.

- Major trends include growth in AI-enabled recruitment, digital sourcing tools, and global talent intelligence platforms that enhance screening accuracy, workforce planning, and hiring efficiency.

- The competitive landscape features Randstad, ManpowerGroup, Adecco Group, Allegis Global Solutions, Korn Ferry, IBM Talent Acquisition, Cielo, Hudson RPO, PeopleScout, and AMS, all focusing on automation, analytics, and specialized sector-based hiring solutions.

- Regionally, North America leads with 38% share, Europe holds 31%, and Asia Pacific accounts for 24%, while Latin America and Middle East & Africa hold 4% and 3%, supported by growing digital recruitment adoption and rising enterprise outsourcing needs.

Market Segmentation Analysis:

By Type

Enterprise-based RPO dominated the market with a 49% share, driven by large organizations seeking end-to-end recruitment support for high-volume and multi-region hiring. These solutions help enterprises streamline talent pipelines, reduce hiring costs, and strengthen compliance across diverse labor markets. Function-based RPO also gained traction as companies outsourced targeted processes such as sourcing, screening, or assessment to improve efficiency. On-demand RPO expanded among businesses needing short-term hiring support during peak recruitment cycles. The strong performance of enterprise-based models reflects growing demand for scalable, integrated hiring solutions in competitive talent environments.

- For instance, Zenpli, a digital identity partner, leverages AI-powered automation to provide its clients with a significantly enhanced experience, including a 90% faster onboarding process for contracts and a 50% reduction in costs.

By Enterprise Size

Large enterprises accounted for the largest 58% share, supported by their continuous hiring needs, global expansion activities, and strong emphasis on standardized recruitment workflows. These organizations adopt RPO to manage complex multi-role hiring, enhance talent quality, and reduce time-to-hire. SMEs demonstrated rising adoption as they sought cost-efficient recruitment solutions to address skill shortages and limited HR capacity. Flexible, pay-as-you-go RPO models attracted smaller firms aiming to optimize hiring without heavy infrastructure investment. The dominant share of large enterprises reflects their wider dependency on structured outsourcing partnerships.

- For instance, PeopleScout delivered a high-volume enterprise RPO program that managed 95,000 annual hires for a Fortune 500 retailer, while AMS supported a global technology company by coordinating 14,000 specialized role placements across 28 countries.

By End-use

The BFSI sector held the dominant 33% share, driven by increasing demand for skilled professionals in compliance, digital banking, cybersecurity, and customer support roles. RPO providers support BFSI firms in managing stringent regulatory hiring requirements and accelerating recruitment for specialized roles. Healthcare followed with strong adoption due to growing needs for clinical, administrative, and digital health talent. Manufacturing companies used RPO to address high turnover positions and streamline volume hiring for production operations. Diversified sectors continue to adopt RPO as workforce needs evolve and competition for skilled talent intensifies.

Key Growth Drivers

Rising Demand for Scalable and Cost-Efficient Hiring Models

Organizations increasingly adopt RPO to manage fluctuating hiring volumes while maintaining cost efficiency. Scalable outsourcing models help companies respond quickly to economic shifts, market expansion, and workforce restructuring. RPO providers streamline sourcing, screening, onboarding, and compliance to reduce operational burdens on internal HR teams. Businesses benefit from optimized cost-per-hire, reduced time-to-fill, and access to larger talent pools. The growing need for flexible recruitment support drives strong adoption across both multinational enterprises and fast-growing SMEs.

- For instance, Randstad utilizes technology and automated processes for various recruitment functions, including reference and background checks. A Randstad US study found that a company’s reputation as a digital leader influences 62% of job seekers’ desire to join it.

Growing Focus on Talent Quality and Specialized Skill Acquisition

Demand for high-quality candidates in sectors such as BFSI, healthcare, IT, and manufacturing boosts the need for advanced recruitment solutions. RPO providers use AI-driven sourcing tools, assessment platforms, and global talent networks to improve candidate matching. Companies rely on structured hiring frameworks to address skill shortages, succession planning, and digital transformation needs. Enhanced analytics and talent insights help employers identify top performers faster. This shift toward competency-based hiring strengthens the long-term growth of RPO partnerships.

- For instance, Korn Ferry’s AI-enabled assessment suite evaluated more than 3.2 million candidates using validated psychometric models, while Cielo integrated a skills-analytics engine that benchmarked 9,500 technical competencies for engineering and healthcare roles.

Increasing Adoption of Digital and Analytics-Driven Recruitment

Digital recruitment technologies accelerate adoption of RPO as organizations prioritize automation and data-backed hiring decisions. AI-enabled systems streamline resume screening, candidate ranking, and interview scheduling. Predictive analytics supports better workforce planning and improves hiring accuracy. RPO providers integrate digital platforms that enhance candidate experience through personalized communication and faster response times. Growing interest in virtual assessments and remote hiring workflows further boosts market expansion across global enterprises.

Key Trends & Opportunities

Expansion of AI, Automation, and Talent Intelligence Platforms

RPO providers increasingly embed AI-driven sourcing engines, chatbots, and automated screening tools into recruitment workflows. These platforms reduce manual workload, improve candidate engagement, and enhance hiring precision. Growth in talent intelligence systems enables employers to forecast skill needs, analyze workforce gaps, and build long-term hiring strategies. Companies seek integrated tech-enabled recruitment ecosystems that support global scalability. This trend opens strong opportunities for RPO vendors delivering end-to-end digital talent solutions.

- For instance, IBM Talent Acquisition integrated its Watson-based NLP engine that analyzed 9.8 million candidate profiles to enhance skill matching, while PeopleScout deployed its Affinix automation suite that executed 1.4 million chatbot-led candidate interactions.

Rising Globalization of Workforce and Remote Hiring Needs

Remote work adoption accelerates cross-border hiring, increasing demand for RPO solutions with global reach. Companies expand talent acquisition across multiple regions to access broader skill sets and reduce hiring costs. RPO vendors offer multilingual recruitment teams, compliance expertise, and localized sourcing strategies to support global expansion. This shift creates opportunities in emerging markets where workforce mobility and digital hiring platforms continue to grow. Globalized recruitment strengthens the need for structured, technology-enabled outsourcing.

- For instance, Cielo has supported high-volume, global hiring for clients in various sectors, including life sciences companies like Sanofi and McKesson, leveraging virtual methods and technology to drive efficiency and speed.

Key Challenges

Talent Shortages and High Competition Across Critical Roles

Many industries face severe shortages in digital, healthcare, engineering, and financial roles, making talent acquisition increasingly difficult. RPO providers struggle to fill niche positions in competitive labor markets, leading to longer hiring cycles. Rising salary expectations and shifting candidate preferences add complexity. Companies must strengthen employer branding and improve engagement strategies to attract skilled applicants. These talent shortages remain a major challenge for sustaining recruitment efficiency.

Data Privacy Regulations and Compliance Complexities

Strict data protection laws such as GDPR, CCPA, and regional labor regulations increase compliance risks for RPO providers. Handling large volumes of sensitive candidate information requires robust cybersecurity and governance frameworks. Cross-border hiring adds further challenges due to variations in employment rules and documentation requirements. Failure to meet compliance standards can result in penalties and reputational damage. Ensuring secure, compliant recruitment operations remains a critical challenge for the RPO market.

Regional Analysis

North America

North America held the leading 38% share, driven by strong adoption of outsourced recruitment models across technology, healthcare, BFSI, and professional services. Companies in the region rely on RPO to manage large-scale hiring, enhance talent quality, and reduce recruitment costs. The widespread use of AI-driven sourcing, digital screening tools, and data analytics strengthens market maturity. High labor shortages in specialized roles push enterprises to partner with experienced RPO providers. Strong HR tech ecosystems and established compliance frameworks further support expansion, making North America a dominant contributor to global RPO growth.

Europe

Europe accounted for 31% share, supported by rising demand for structured hiring models and strict regulatory environments that encourage compliant recruitment practices. Enterprises across the UK, Germany, France, and the Nordics adopt RPO to streamline hiring for manufacturing, healthcare, IT, and financial sectors. Talent shortages across skilled positions increase reliance on external expertise and automated talent solutions. Growth is further supported by digital transformation initiatives and increasing cross-border recruitment needs. Europe maintains steady RPO adoption due to its mature labor markets and strong emphasis on efficient, high-quality hiring processes.

Asia Pacific

Asia Pacific captured 24% share, driven by rapid economic growth, expanding SME presence, and rising recruitment needs in IT, manufacturing, and healthcare sectors. Countries such as India, China, Japan, and Singapore increasingly rely on RPO to manage high-volume recruitment and address skill gaps. Digital hiring platforms and remote work models accelerate adoption across diverse industries. Government support for workforce development and expanding multinational operations further strengthen market growth. Asia Pacific remains one of the fastest-growing regions as companies seek scalable and cost-efficient recruitment solutions.

Latin America

Latin America held 4% share, influenced by growing digital recruitment adoption and rising demand for efficient hiring in sectors such as retail, BFSI, and manufacturing. Brazil and Mexico lead regional adoption as businesses modernize HR operations and leverage RPO to reduce hiring costs. Economic fluctuations drive organizations to adopt flexible recruitment models that support rapid workforce adjustments. Skill shortages in technical and professional roles encourage companies to rely on specialized RPO providers. Although growth is gradual, expanding digital infrastructure supports wider market penetration.

Middle East & Africa

The Middle East & Africa region accounted for 3% share, driven by increasing modernization of HR processes and rising workforce needs in construction, healthcare, oil & gas, and public sectors. Gulf countries adopt RPO to support national workforce programs and large-scale recruitment initiatives. African markets show growing adoption as organizations digitize hiring and address challenges in sourcing skilled talent. Investments in HR technology and expanding multinational presence support market growth. Despite infrastructure and skill limitations in some areas, the region continues to move toward structured and technology-enabled recruitment outsourcing.

Market Segmentations:

By Type

- On-demand

- Function-based

- Enterprise-based

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By End-use

- BFSI

- Healthcare

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights major players such as Randstad, ManpowerGroup, Adecco Group, Allegis Global Solutions, Korn Ferry, IBM Talent Acquisition, Cielo, Hudson RPO, PeopleScout, and Alexander Mann Solutions (AMS), all of whom significantly shape the Recruitment Process Outsourcing (RPO) market. These providers compete by offering end-to-end hiring solutions, advanced sourcing strategies, and technology-enabled recruitment platforms. Vendors increasingly integrate AI-driven screening tools, talent analytics, and automated workflows to enhance candidate quality and reduce time-to-hire. Strategic partnerships with HR tech firms, job portals, and assessment platforms help expand their service capabilities. Many players focus on multi-country recruitment delivery models and sector-specific expertise to support BFSI, healthcare, IT, and manufacturing industries. As enterprises prioritize global scalability, compliance, and workforce agility, competition strengthens among RPO vendors aiming to deliver customized, cost-efficient, and high-volume talent acquisition solutions.

Key Player Analysis

- Randstad

- ManpowerGroup

- Adecco Group

- Allegis Global Solutions

- Korn Ferry

- IBM Talent Acquisition

- Cielo

- Hudson RPO

- PeopleScout

- Alexander Mann Solutions (AMS)

Recent Developments

- In June 2025, ManpowerGroup Talent Solutions was named a Leader in the recruitment process outsourcing (RPO) space for the 15th consecutive year by Everest Group.

- In June 2025, Cielo was again named a Leader in the RPO Global PEAK Matrix® by Everest Group, marking its 13th consecutive year in the top quadrant.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type, Enterprise Size, End-use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AI-driven sourcing and automated candidate screening will rise across global enterprises.

- More companies will adopt full-cycle RPO models to improve scalability and reduce hiring costs.

- Data analytics will guide talent decisions, workforce planning, and skill-gap forecasting.

- Remote and cross-border hiring will expand, increasing demand for global RPO delivery centers.

- Sector-specific RPO solutions will grow as industries seek specialized talent expertise.

- Employer branding services will become a key component of RPO offerings.

- SMEs will adopt flexible, on-demand RPO models to support rapid growth cycles.

- Compliance-focused recruitment services will gain importance due to evolving labor regulations.

- Integration of digital assessments and virtual hiring tools will strengthen recruitment workflows.

- Emerging markets will experience accelerated RPO adoption as organizations modernize HR operations.