Market Overview

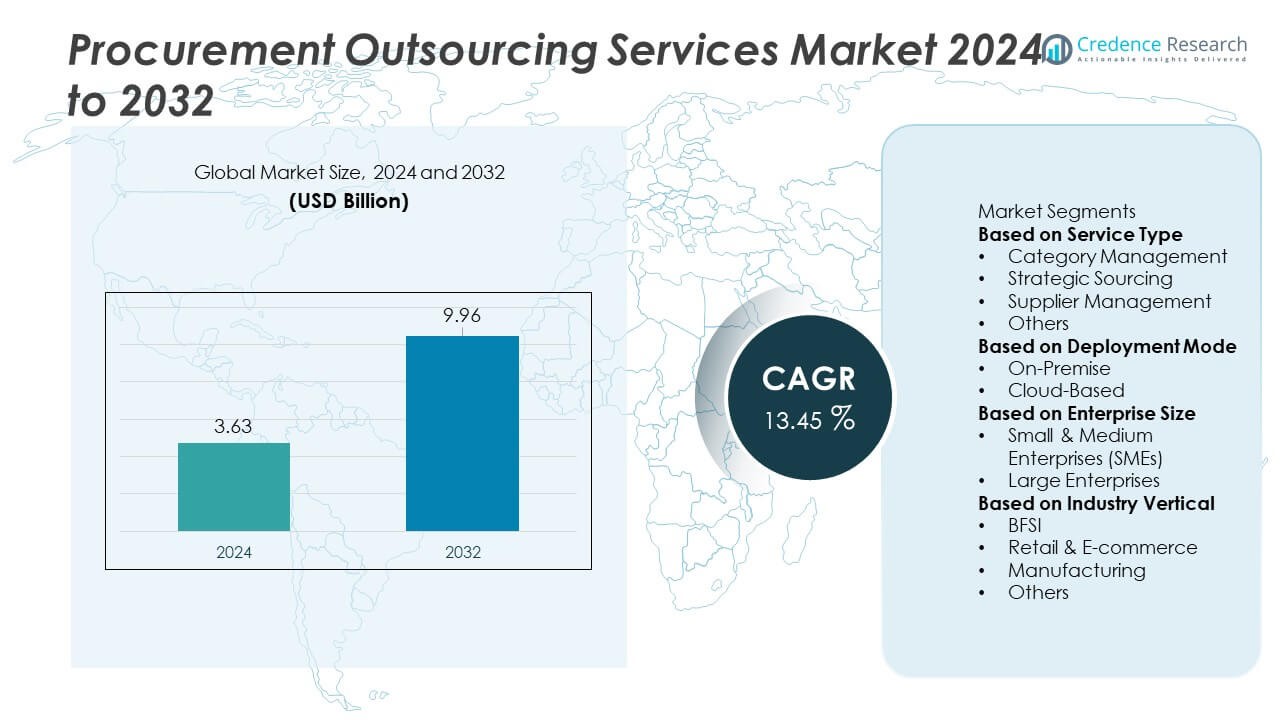

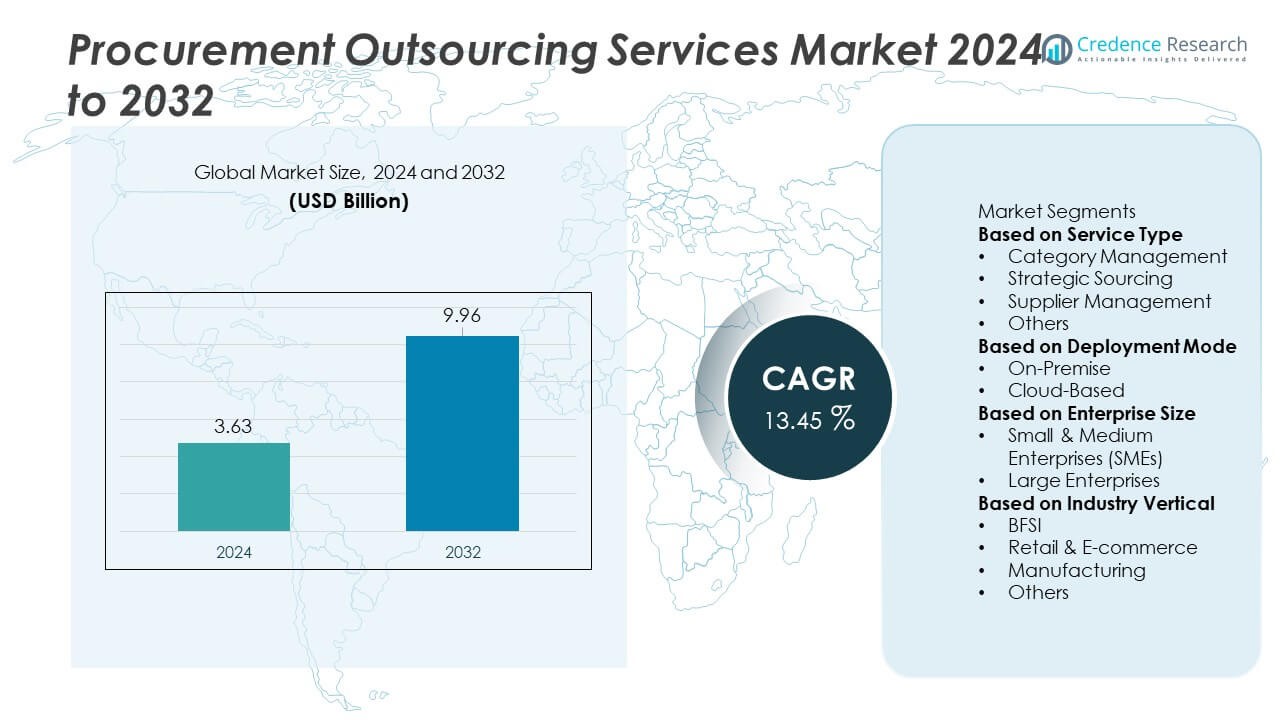

The Procurement Outsourcing Services market was valued at USD 3.63 billion in 2024 and is projected to reach USD 9.96 billion by 2032, growing at a CAGR of 13.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Procurement Outsourcing Services Market Size 2024 |

USD 3.63 Billion |

| Procurement Outsourcing Services Market, CAGR |

13.45% |

| Procurement Outsourcing Services Market Size 2032 |

USD 9.96 Billion |

Top players in the Procurement Outsourcing Services market include Accenture plc, IBM Corporation, Genpact Limited, GEP Worldwide, Infosys Limited, Wipro Limited, Capgemini SE, Tata Consultancy Services, WNS Global Services, and HCL Technologies Limited. These companies lead the industry with advanced digital procurement platforms, strong category expertise, and global delivery capabilities that support complex sourcing and supplier management needs. North America dominates the market with a 38% share, driven by high demand for cost optimization and strong adoption of cloud-based procurement tools. Europe follows with a 27% share, supported by strict compliance requirements and growing digital transformation. Asia Pacific accounts for 25%, fueled by large-scale enterprise outsourcing and rapid expansion of procurement operations across emerging markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Procurement Outsourcing Services market reached USD 3.63 billion in 2024 and is projected to reach USD 9.96 billion by 2032 at a 13.45% CAGR, reflecting strong adoption of digitally enabled sourcing and supplier management solutions.

- Growth is driven by rising demand for cost optimization and efficiency, with strategic sourcing holding a 46% segment share due to its ability to improve spend control, negotiation outcomes, and supplier performance.

- Market trends highlight increased integration of AI, analytics, and cloud-based procurement platforms that enhance real-time insights, automate workflows, and strengthen compliance across global supply chains.

- Competition intensifies as major players expand category expertise, strengthen multi-region delivery centers, and invest in automation to offer scalable, high-value procurement solutions for large enterprises and SMEs.

- Regionally, North America leads with 38%, followed by Europe at 27% and Asia Pacific at 25%, supported by strong digital transformation, supply-chain modernization, and growing outsourcing adoption across key industries.

Market Segmentation Analysis:

By Service Type

Strategic sourcing leads this segment with a 46% share, driven by rising demand for cost optimization, supplier consolidation, and structured procurement planning across global enterprises. Companies rely on strategic sourcing to gain better visibility into spending patterns and achieve long-term savings through competitive supplier negotiations. Category management also grows steadily as organizations seek improved control over indirect and direct spend. Supplier management expands as firms focus on risk mitigation and performance benchmarking. The “others” segment includes contract handling and transactional procurement, supporting back-office efficiency. The strong focus on strategic cost reduction continues to reinforce the dominance of strategic sourcing.

- For instance, GEP provides AI-powered software and managed services that help companies like Intel manage supplier performance by integrating data from disparate systems into a unified platform.

By Deployment Mode

Cloud-based procurement platforms dominate with a 68% share, supported by rapid digital transformation and strong demand for scalable, cost-efficient procurement tools. Organizations prefer cloud deployment for real-time analytics, automated workflows, and easy integration with ERP and supply-chain systems. Cloud-based models also reduce infrastructure costs, making them attractive for both large enterprises and SMEs. On-premise solutions maintain limited adoption among firms with strict data-governance requirements or legacy systems. Growing reliance on remote operations, AI-driven insights, and centralized procurement dashboards strengthens the leadership of cloud deployment across global markets.

- For instance, Coupa helped BMW digitize procurement across 31 plants by connecting more than 3,400 suppliers through a single cloud-based spend-management system.

By Enterprise Size

Large enterprises lead the market with a 63% share, driven by their high procurement volumes, complex supplier networks, and strong focus on strategic outsourcing to reduce operational overhead. These organizations rely on procurement outsourcing to streamline multi-category spending, enhance compliance, and improve supplier performance across global operations. SMEs show rising adoption as they seek external expertise to manage procurement tasks at lower cost and improve purchasing efficiency without expanding internal teams. Increasing awareness of digital procurement tools and rising pressure to control indirect expenses further support growth in both enterprise categories.

Key Growth Drivers

Growing Focus on Cost Reduction and Operational Efficiency

Organizations increasingly outsource procurement functions to reduce operational costs and streamline sourcing activities. Rising pressure to optimize spending, eliminate inefficiencies, and improve contract compliance drives firms to adopt procurement outsourcing services. These services offer structured purchasing processes, deeper supplier insights, and enhanced negotiation capabilities. Companies benefit from reduced cycle times, improved pricing, and greater transparency in purchasing decisions. As businesses expand globally, outsourcing helps manage complex procurement tasks while maintaining strong governance and financial control.

- For instance, IBM’s procurement transformation, which infused digital intelligence, cloud, and AI into its operations, enabled its procurement professionals to onboard suppliers 10 times faster and conduct pricing analysis in 10 minutes as compared to two days.

Rising Adoption of Digital and Automated Procurement Solutions

Digital transformation accelerates the demand for procurement outsourcing services that integrate analytics, cloud platforms, and automation tools. Advanced technologies improve spend visibility, supplier tracking, and workflow efficiency. Organizations increasingly adopt AI-driven sourcing, automated purchase orders, and real-time reporting systems to enhance procurement accuracy. Outsourcing partners provide scalable digital infrastructure and specialized expertise, reducing the need for in-house technology investments. This shift toward smart procurement strengthens service adoption across industries.

- For instance, Accenture automated more than 120,000 procurement transactions and digitized 2,800 supplier contracts for a global consumer goods company using its SynOps intelligence engine, improving process productivity by 22.

Increasing Supplier Complexity and Global Supply Chain Risks

Global supply chains create higher levels of risk, making supplier management and compliance more challenging for enterprises. Procurement outsourcing providers help manage multi-region supplier networks, assess risk exposure, and ensure regulatory compliance. Firms rely on specialists to strengthen supplier vetting, contract adherence, and performance monitoring. Disruptions caused by geopolitical shifts, material shortages, and transportation delays increase the need for advanced supplier oversight. This growing complexity drives long-term demand for outsourced procurement expertise.

Key Trends & Opportunities

Expansion of AI, Analytics, and Predictive Sourcing Tools

Procurement outsourcing firms increasingly invest in AI, predictive modeling, and advanced analytics to offer smarter sourcing solutions. These tools help identify cost-saving opportunities, forecast demand, and improve supplier selection accuracy. Automated data processing supports faster decision-making and enhanced compliance. The integration of predictive insights into procurement workflows creates opportunities for value-driven partnerships with enterprises seeking stronger strategic outcomes. This trend positions outsourcing firms as technology-enabled partners rather than transactional service providers.

- For instance, Capgemini leverages AI and automation in procurement and supply chain management for its clients to improve decision speed and reduce manual review time, which enhances predictive sourcing.

Growing Demand for Industry-Specific and Customized Procurement Solutions

Industries such as healthcare, manufacturing, BFSI, and retail seek tailored sourcing solutions aligned with their regulatory and operational requirements. Procurement outsourcing providers offer specialized category expertise, supplier databases, and compliance frameworks for each sector. Customization strengthens efficiency, reduces risks, and improves purchasing outcomes. As companies prioritize agility and adaptability, demand for flexible, industry-focused procurement services continues to rise. This trend creates significant opportunities for providers to differentiate offerings and expand market presence.

- For instance, Infosys BPM helped an American telecom giant resolve massive spend leakages in its procure-to-pay (P2P) process by using robust analytics and data synchronization, ultimately identifying and preventing overpayments and achieving a 90x return on investment and reducing spend leakages by over $10 million.

Key Challenges

Concerns Over Data Security and Confidentiality

Outsourcing procurement processes involves sharing sensitive financial, supplier, and contract data, raising security concerns for many organizations. Firms worry about unauthorized access, cyber threats, and potential breaches when relying on external service providers. Ensuring compliance with global data protection regulations increases complexity. Providers must invest in secure infrastructure, encryption tools, and robust data-governance frameworks to address client concerns. Data security risks can limit adoption among industries with strict confidentiality requirements.

Limited Internal Control and Change Management Issues

Companies may face reduced operational control when outsourcing procurement tasks, leading to resistance among internal teams. Misalignment between business goals and outsourced processes can impact service quality and decision-making. Organizations must adjust internal workflows, governance systems, and communication channels to support outsourced procurement functions. Poor transition planning or inadequate change management can disrupt procurement operations. These challenges highlight the need for clear governance frameworks and well-managed partnerships.

Regional Analysis

North America

North America holds a 38% share, driven by strong adoption of digital procurement platforms, mature outsourcing ecosystems, and high demand for cost optimization across large enterprises. The region benefits from advanced supply-chain infrastructure, strong vendor networks, and widespread use of AI-based sourcing and spend-analysis tools. Financial services, retail, healthcare, and manufacturing sectors rely heavily on outsourced procurement to improve compliance and reduce operational overhead. The presence of leading service providers and rapid cloud deployment further accelerate market expansion. Ongoing focus on strategic sourcing and supplier risk management continues to strengthen regional dominance.

Europe

Europe accounts for a 27% share, supported by strict regulatory frameworks, strong emphasis on governance, and rising adoption of specialized procurement outsourcing across manufacturing, automotive, and BFSI industries. Companies in the region focus on improving transparency, enhancing supplier compliance, and reducing costs through outsourced category management and strategic sourcing services. Growth is further driven by the rise of cloud-based procurement platforms and expanding cross-border supply-chain operations. Sustainability initiatives and ESG-focused procurement strategies also increase demand for expert outsourcing partners capable of handling complex supplier audits and compliance requirements.

Asia Pacific

Asia Pacific holds a 25% share, fueled by rapid industrialization, expanding enterprise digitalization, and strong cost-efficiency benefits that drive outsourcing adoption across emerging economies. Large enterprises in China, India, Japan, and Southeast Asia increasingly rely on procurement outsourcing to streamline supplier management, improve spend visibility, and optimize multi-category sourcing. The region’s growing SME sector also contributes to service demand as smaller businesses seek affordable procurement support. Strong momentum in e-commerce, telecom, and manufacturing accelerates cloud-based procurement adoption. Increasing supplier diversity and expanding global trade activities further strengthen regional growth.

Latin America

Latin America captures a 6% share, driven by growing awareness of cost reduction strategies and rising adoption of procurement outsourcing in sectors such as manufacturing, retail, and energy. Brazil and Mexico lead the market due to expanding enterprise digitalization and increasing focus on improving supplier performance and operational efficiency. Economic volatility encourages companies to seek outsourced procurement services to stabilize costs and manage supplier risks. Cloud procurement tools and regional service partnerships continue to improve accessibility. As organizations streamline indirect spend categories, outsourcing adoption is expected to expand steadily.

Middle East & Africa

The Middle East & Africa region holds a 4% share, supported by growing modernization of procurement functions across government, construction, oil & gas, and utilities sectors. Gulf countries show stronger adoption due to large-scale infrastructure projects and increased focus on structured sourcing processes. Organizations in the region seek procurement outsourcing partners to improve transparency, manage supplier risks, and optimize large contract portfolios. Africa demonstrates growing interest as enterprises look to enhance procurement maturity and reduce costs. Increasing investments in cloud infrastructure and digital transformation initiatives contribute to gradual market development.

Market Segmentations:

By Service Type

- Category Management

- Strategic Sourcing

- Supplier Management

- Others

By Deployment Mode

By Enterprise Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Industry Vertical

- BFSI

- Retail & E-commerce

- Manufacturing

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape includes major players such as Accenture plc, IBM Corporation, Genpact Limited, GEP Worldwide, Infosys Limited, Wipro Limited, Capgemini SE, Tata Consultancy Services, WNS Global Services, and HCL Technologies Limited. These companies strengthen their market presence by offering advanced sourcing solutions, AI-enabled procurement tools, and category-specific expertise across global industries. Leading providers focus on expanding cloud-based procurement platforms, enhancing spend analytics capabilities, and integrating automation to optimize end-to-end procurement workflows. Strategic partnerships with ERP vendors and supply-chain technology firms help improve service delivery and expand client reach. Companies also invest in industry-specific procurement models tailored for BFSI, manufacturing, retail, healthcare, and energy sectors. Strong global delivery centers, multi-region support teams, and scalable service models enable these players to meet diverse enterprise requirements. Continuous innovation in digital procurement, supplier risk management, and cost-reduction strategies ensures their competitive advantage in a rapidly evolving outsourcing landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Accenture plc

- IBM Corporation

- Genpact Limited

- GEP Worldwide

- Infosys Limited

- Wipro Limited

- Capgemini SE

- Tata Consultancy Services (TCS)

- WNS Global Services

- HCL Technologies Limited

Recent Developments

- In November 2025, IBM Corporation was named a Leader in Everest Group’s 2025 Procurement Outsourcing (PO) Services PEAK Matrix® Assessment, reflecting its strong capability in AI-powered source-to-pay solutions across the procurement lifecycle.

- In April 2025, Capgemini SE was recognised by Information Services Group (ISG) in its Provider Lens™ for Procurement Services 2025 as a Leader in two categories. The recognition cited Capgemini’s strong consulting-technology mixture, sustainability focus and digital procurement capabilities.

- In February 2024, Accenture plc announced the acquisition of Insight Sourcing, a strategic-sourcing and procurement-services firm, to enhance its sourcing and procurement services for private-equity, consumer-goods, retail, technology and industrial clients.

Report Coverage

The research report offers an in-depth analysis based on Service Type, Deployment Mode, Enterprise Size, Industry Vertical and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for procurement outsourcing will rise as companies prioritize cost reduction and process efficiency.

- AI-driven sourcing and predictive analytics will transform decision-making across global procurement teams.

- Cloud-based procurement platforms will gain stronger adoption due to scalability and flexibility.

- Category-specific outsourcing models will expand as industries seek specialized expertise.

- Supplier risk management services will grow in importance amid global supply-chain disruptions.

- Automation of transactional procurement will reduce manual workloads and improve cycle times.

- ESG and sustainability-focused sourcing practices will create new outsourcing opportunities.

- SMEs will increasingly adopt outsourced procurement to access advanced tools and expertise.

- Strategic partnerships between service providers and ERP vendors will strengthen service delivery.

- Multi-region delivery centers will expand to support global clients with localized procurement needs.