Market Overview

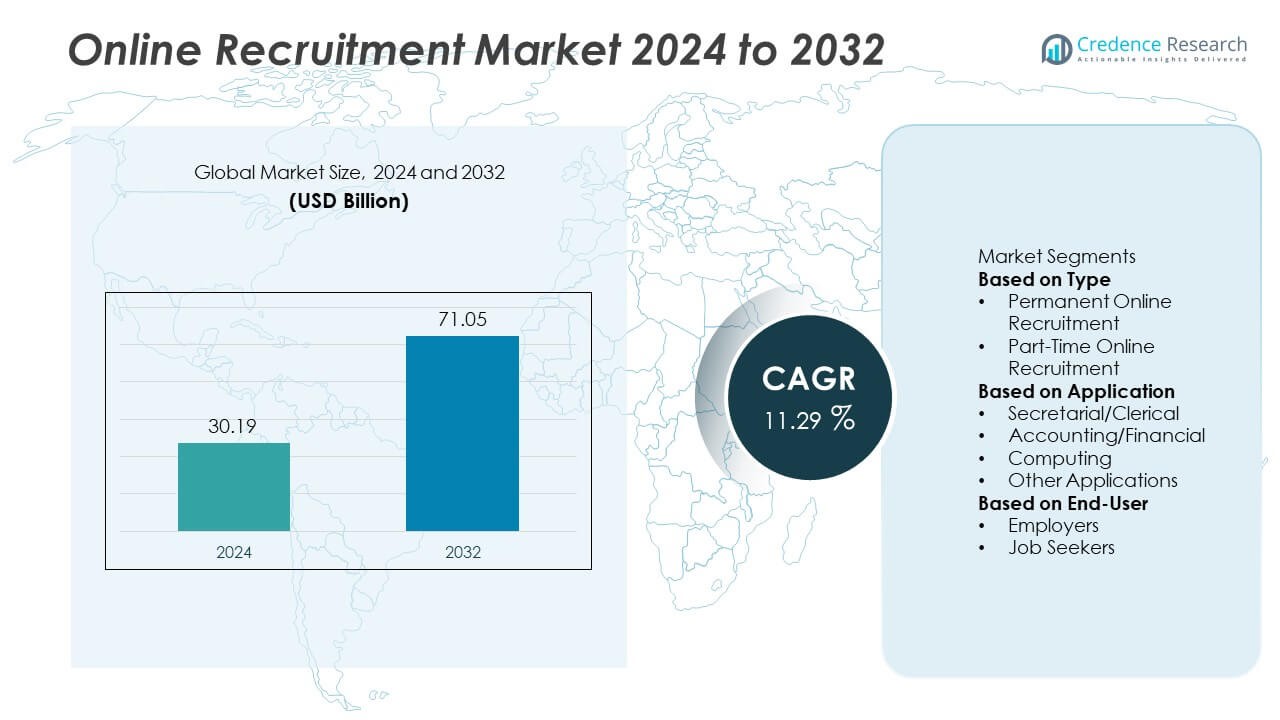

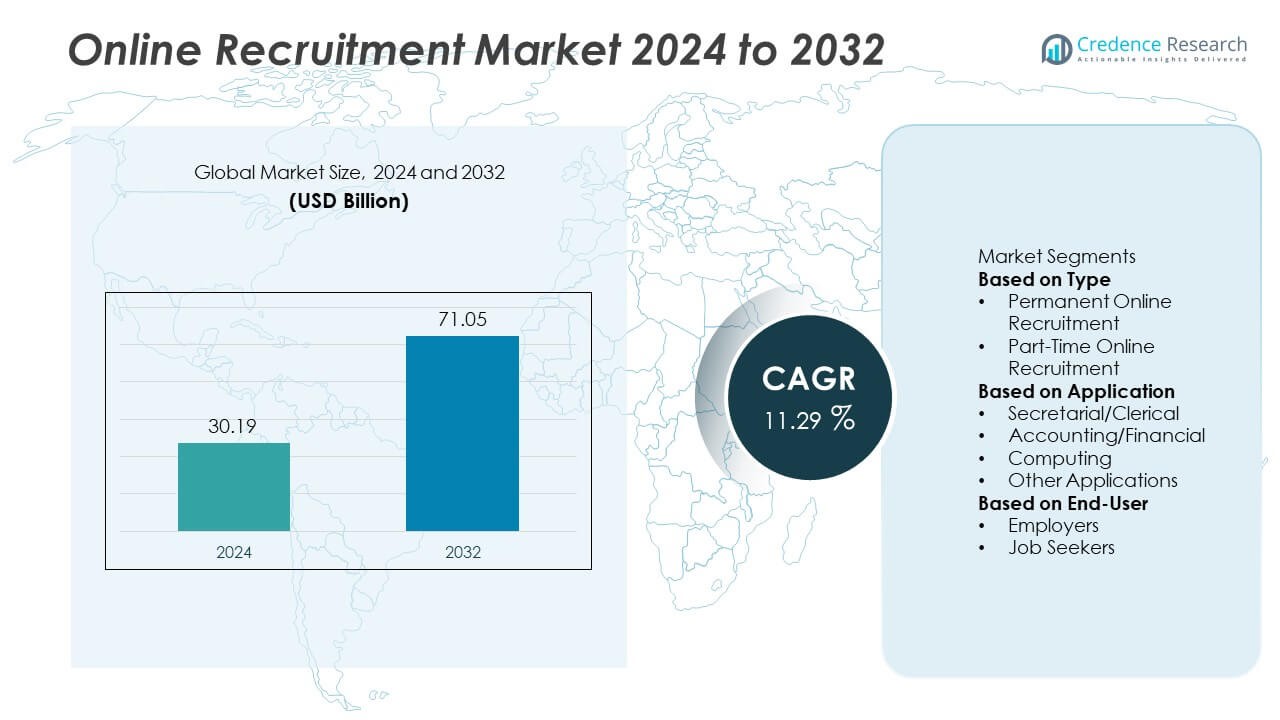

The Online Recruitment market was valued at USD 30.19 billion in 2024 and is expected to reach USD 71.05 billion by 2032, registering a CAGR of 11.29% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Online Recruitment Market Size 2024 |

USD 30.19 Billion |

| Online Recruitment Market, CAGR |

11.29% |

| Online Recruitment Market Size 2032 |

USD 71.05 Billion |

Top players in the Online Recruitment market include LinkedIn, Indeed, Monster, Glassdoor, ZipRecruiter, CareerBuilder, Randstad, Adecco, Hays, and Robert Half, each strengthening their platforms with AI-driven matching, automated screening, and large candidate databases. These companies lead through strong digital ecosystems, global reach, and advanced analytics that support faster and more accurate hiring. North America holds a 37% market share, driven by mature HR technology adoption and strong demand for skilled professionals. Europe follows with a 29% share, supported by structured labor markets and rapid digital transformation. Asia Pacific accounts for 25%, driven by high-volume hiring, mobile-first job searches, and expanding digital infrastructure across major economies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The market reached USD 30.19 billion in 2024 and will grow at a CAGR of 11.29%.

- Rising demand for digital hiring drives growth, with permanent online recruitment holding a 64% segment share.

- AI-driven screening, mobile recruitment, and social hiring shape key market trends across industries.

- Strong competition exists as LinkedIn, Indeed, Monster, and Randstad expand databases and automation capabilities.

- North America leads with a 37% share, followed by Europe at 29% and Asia Pacific at 25%, reflecting high adoption across computing roles holding a 41% segment share.

Market Segmentation Analysis:

By Type

Permanent online recruitment dominates this segment with a 64% market share, driven by rising demand for long-term workforce needs across IT, finance, healthcare, and professional services. Companies rely on digital hiring platforms to fill full-time roles due to wider candidate reach, faster screening tools, and automated matching algorithms. Part-time online recruitment grows steadily as gig work, flexible schedules, and remote opportunities expand. Platforms enhance visibility for part-time roles by offering advanced filters and AI-driven recommendations. The strong preference for permanent hiring reflects organizational focus on employee retention, structured staffing, and long-term productivity.

- For instance, LinkedIn’s AI-based recruitment system processes over 110 million job applications each week (derived from over 11,000 applications per minute) and filters candidates using skill-matching models trained on data from over 1 billion user profiles, helping employers reduce screening time significantly.

By Application

Computing roles lead the application segment with a 41% market share, supported by strong demand for software developers, data analysts, cybersecurity specialists, and cloud engineers. Digital hiring platforms help companies access specialized technical talent through targeted job postings and skill-based filtering. Accounting and financial roles follow as firms prioritize compliance, auditing, and financial planning staff. Secretarial and clerical hiring continues to grow due to administrative support needs across industries. Other applications, including marketing and HR roles, expand with the shift toward digital skill sets. The dominance of computing reflects global digital transformation and talent shortages in technology fields.

- For instance, HackerRank partners with major recruiters and delivers more than 25 million coding assessments, helping employers evaluate technical roles with verified performance data across software engineering, DevOps, and AI domains.

By End-User

Employers hold the dominant position with a 58% market share, as organizations increasingly adopt online recruitment solutions to accelerate hiring cycles, reduce HR costs, and access broader talent pools. Employers leverage AI-powered screening, automated assessments, and applicant tracking tools to streamline recruitment. Job seekers also represent a strong user group as digital platforms provide better visibility, real-time job alerts, and skills-based recommendations. Growing adoption of mobile-based job searches and remote work opportunities continues to attract job seekers online. The strong lead of employers reflects rising digital hiring budgets and the need for efficient, data-driven recruitment systems.

Key Growth Drivers

Rising Digital Transformation Across Recruitment Processes

Companies accelerate digital adoption to improve hiring speed, reduce manual workload, and enhance candidate screening accuracy. Online recruitment platforms support automated job matching, AI-driven assessments, and real-time communication features that streamline the entire hiring cycle. Organizations prefer digital tools to manage large applicant volumes, especially in competitive sectors such as IT and finance. The shift toward paperless workflows and integrated HR systems strengthens demand for online solutions. As remote hiring becomes standard practice, digital platforms gain a central role in workforce acquisition strategies.

- For instance, ZipRecruiter’s AI engine analyzes more than 5 billion job-seeker interactions each month and delivers candidate recommendations to employers within minutes, using models trained on data from over 430 million job applications.

Growing Demand for Skilled Professionals in Technology and Services

Rapid expansion of computing, data analytics, cybersecurity, and cloud-based roles drives strong reliance on online recruitment platforms. Companies use advanced search tools to identify candidates with specialized technical skills. Skill shortages in fast-growing industries push employers to adopt digital systems that widen access to global talent pools. Automated filters, skill assessments, and targeted postings improve hiring outcomes. Increased competition for high-skill professionals reinforces the need for efficient, tech-enabled recruitment channels that deliver faster and more accurate placements.

- For instance, Monster’s recruitment platform is supported by AI-based semantic search technology that helps recruiters find and evaluate candidates more efficiently than traditional keyword searches.

Expansion of Remote Work and Flexible Job Models

Remote work adoption boosts demand for digital hiring tools that enable virtual sourcing, assessment, and onboarding. Companies use online platforms to reach geographically diverse candidates and support hybrid workforce strategies. Job seekers prefer digital channels due to convenience, transparency, and personalized recommendations. The growth of flexible work models, gig roles, and contract-based jobs drives online recruitment activity across multiple sectors. This shift encourages employers to invest in scalable platforms that support virtual collaboration, video interviews, and automated scheduling.

Key Trends & Opportunities

Increased Use of AI and Automation in Talent Screening

AI-driven analytics enhance recruitment accuracy by evaluating resumes, predicting candidate fit, and supporting faster shortlist creation. Automated tools reduce human bias, improve screening consistency, and deliver personalized recommendations to employers and job seekers. Chatbots, video interview analysis, and skill-based testing offer new opportunities for platform differentiation. As companies focus on data-driven hiring, AI-enabled recruitment systems gain strong traction. This trend promotes efficiency and scalability, creating new growth avenues for developers offering advanced automation capabilities.

- For instance, HireVue’s video-assessment system has analyzed more than 70 million interviews and uses tens of thousands of data points per video to evaluate communication patterns, job-related skills, and behavioral indicators through AI-based scoring models.

Rising Adoption of Mobile Recruitment and Social Hiring

Mobile-first job searches grow as job seekers rely on smartphones for applications, alerts, and profile updates. Recruitment platforms optimize mobile interfaces to improve engagement and application completion rates. Social hiring expands as employers use platforms like LinkedIn, Facebook, and niche networks to reach passive talent. Integrated social analytics help companies evaluate candidate visibility, relevance, and networking behavior. This shift creates opportunities for platforms that blend social features, mobile tools, and AI-driven recommendations to enhance candidate sourcing and employer branding.

- For instance, Glassdoor reports approximately 63 to 64 million monthly unique visitors and manages a database of around 55 million reviews and insights, providing data that helps employers enhance their brand and culture.

Key Challenges

High Competition and Limited Differentiation Among Platforms

A large number of recruitment websites, job boards, and HR tech platforms intensify competition, making differentiation difficult. Many platforms offer similar features, such as resume matching, job alerts, and profile dashboards. Employers often switch platforms based on pricing, visibility, and integration capabilities, creating pressure on providers to innovate continuously. Smaller platforms struggle to compete with well-established global players that offer stronger databases and advanced technologies. This environment restricts long-term customer retention and increases operational costs.

Data Privacy Concerns and Cybersecurity Risks

Online recruitment platforms store sensitive candidate data, including resumes, personal information, and communication records. Weak security controls expose users to risks such as data breaches, phishing, and identity theft. Employers face compliance challenges due to varying regional data protection laws such as GDPR. Any security incident can damage platform credibility and reduce user trust. Maintaining secure infrastructure, encryption, and privacy compliance increases operational costs for providers. These risks remain a major barrier to full adoption, especially among small enterprises.

Regional Analysis

North America

North America leads the online recruitment market with a 37% share, supported by strong digital adoption and mature HR technology ecosystems across the United States and Canada. Employers rely on AI-enabled platforms, automated screening tools, and data-driven hiring workflows to manage large applicant volumes. The region’s advanced IT sector, high demand for skilled professionals, and widespread remote work practices strengthen digital hiring activity. Job seekers use mobile applications, professional networks, and online assessment tools to engage with employers. Continuous investment in HR analytics and recruitment automation reinforces North America’s leadership in the online hiring landscape.

Europe

Europe holds a 29% market share, driven by strong digital transformation initiatives and high recruitment demand across financial services, manufacturing, and technology sectors. Countries such as the UK, Germany, and France adopt online hiring platforms to streamline compliance-heavy recruitment processes and support hybrid workforce models. Growing emphasis on cross-border hiring, multilingual platforms, and data privacy compliance enhances platform usage. Job seekers rely on digital channels for transparency, skill-matching, and faster application cycles. Europe’s structured labor markets and rapid shift toward digital HR ecosystems continue to strengthen online recruitment penetration across enterprises.

Asia Pacific

Asia Pacific accounts for a 25% market share, driven by rapid economic growth, expanding digital infrastructure, and rising employment opportunities across India, China, Japan, and Southeast Asia. Employers adopt online recruitment platforms to access large talent pools and support high-volume hiring in IT, BPO, manufacturing, and e-commerce. Mobile-first job searches and social hiring expand due to strong smartphone penetration. Government-led digital workforce initiatives further support platform usage. The region’s large population, high turnover rates, and growing demand for skilled digital professionals make Asia Pacific one of the fastest-growing online recruitment markets.

Latin America

Latin America holds a 5% market share, supported by increasing digital adoption and rising demand for candidates across customer service, retail, logistics, and technology sectors. Brazil and Mexico lead the region as companies shift from traditional hiring to digital platforms that offer better reach and lower recruitment costs. Mobile-based applications gain strong traction due to high smartphone usage. Economic diversification and growing remote work opportunities encourage job seekers to rely on online portals. While adoption is growing, limited digital infrastructure in some areas still affects consistency, yet overall market momentum remains positive.

Middle East & Africa

The Middle East & Africa region captures a 4% market share, driven by rising recruitment needs in sectors such as oil and gas, construction, healthcare, and IT. Gulf countries including the UAE and Saudi Arabia invest heavily in digital hiring platforms to support skilled expatriate recruitment and nationalization policies. Online platforms support faster screening and compliance for diverse, cross-border applicants. In Africa, digital hiring grows as startups and service sectors accelerate workforce expansion. Infrastructure gaps and limited digital literacy pose challenges, yet rising internet penetration continues to strengthen long-term adoption across the region.

Market Segmentations:

By Type

- Permanent Online Recruitment

- Part-Time Online Recruitment

By Application

- Secretarial/Clerical

- Accounting/Financial

- Computing

- Other Applications

By End-User

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the Online Recruitment market features major players such as LinkedIn, Indeed, Monster, Glassdoor, ZipRecruiter, CareerBuilder, Randstad, Adecco, Hays, and Robert Half. These companies compete by offering AI-driven candidate matching, advanced analytics, automated screening tools, and mobile-optimized platforms that improve hiring efficiency. Global players strengthen their position by expanding databases, integrating skill assessments, and improving employer branding solutions. Traditional staffing firms enhance their digital capabilities through recruitment automation and hybrid service models. Platforms invest in machine learning, chatbot support, and predictive hiring insights to attract employers seeking faster and more accurate recruitment processes. Partnerships with enterprises, universities, and HR software providers further expand market reach. As job seekers shift toward mobile and social channels, leading platforms focus on user experience, personalized recommendations, and real-time engagement tools. Competition remains intense, pushing providers to innovate and differentiate through technology and industry-specific hiring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- LinkedIn Corporation

- Indeed (Recruit Holdings Co., Ltd.)

- Monster Worldwide, Inc.

- Glassdoor, Inc.

- ZipRecruiter, Inc.

- CareerBuilder, LLC

- Randstad Holding NV

- Adecco Group

- Hays plc

- Robert Half International Inc.

Recent Developments

- In July 2025, Recruit Holdings announced that Indeed and Glassdoor, Inc. will cut around 1,300 employees (about 6% of their HR-tech workforce) to accelerate AI integration and merge Glassdoor’s operations into Indeed’s platform.

- In January 2024, Indeed (under Recruit Holdings Co., Ltd.) launched “Indeed PLUS” in Japan—a job-distribution platform that automatically routes job posts to multiple job boards, improving reach and efficiency for employers and job-seekers.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Digital hiring adoption will increase as companies focus on faster recruitment cycles.

- AI-driven assessments will enhance candidate screening accuracy across industries.

- Mobile-first job searches will expand with rising smartphone usage.

- Remote and hybrid work models will deepen reliance on virtual recruitment tools.

- Social hiring will grow as employers target passive candidates on professional networks.

- Skill-based hiring platforms will gain traction as talent shortages intensify.

- Automation and chatbots will streamline communication and improve candidate engagement.

- Data analytics will strengthen recruitment decision-making for employers.

- Global talent sourcing will expand as companies hire across borders.

- Integration with HR management systems will improve workflow efficiency and platform adoption.