Market Overview

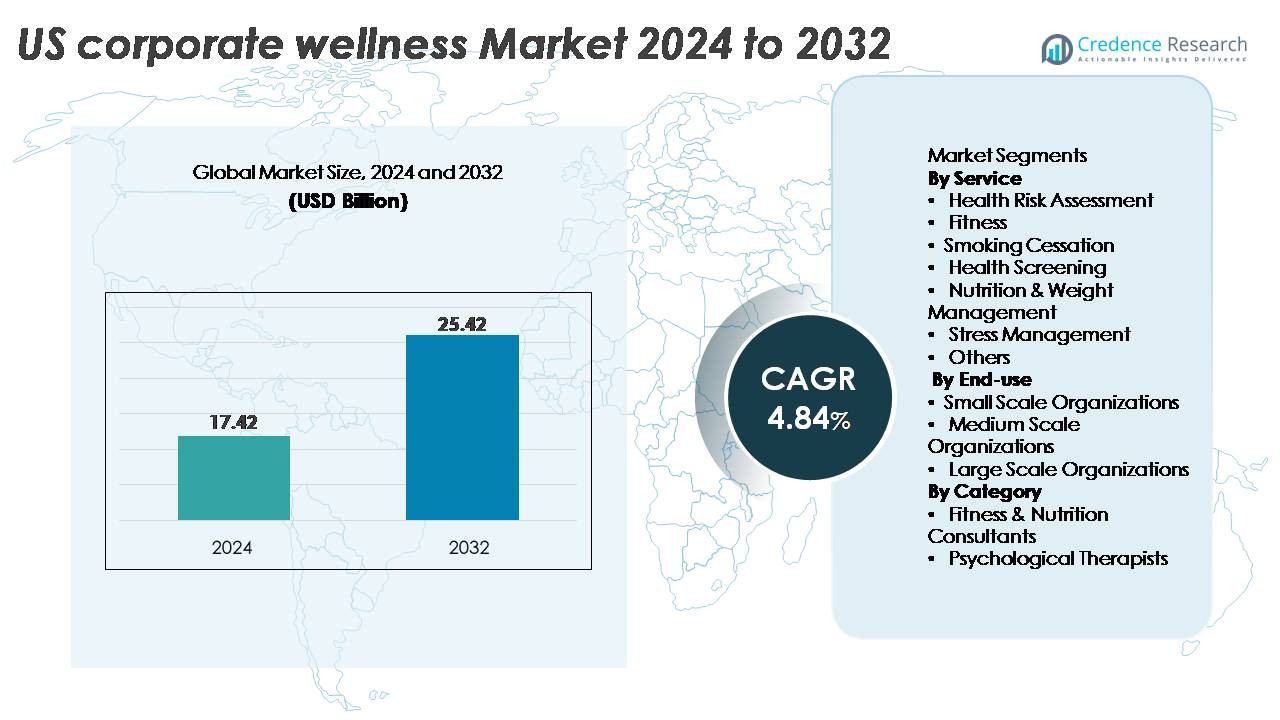

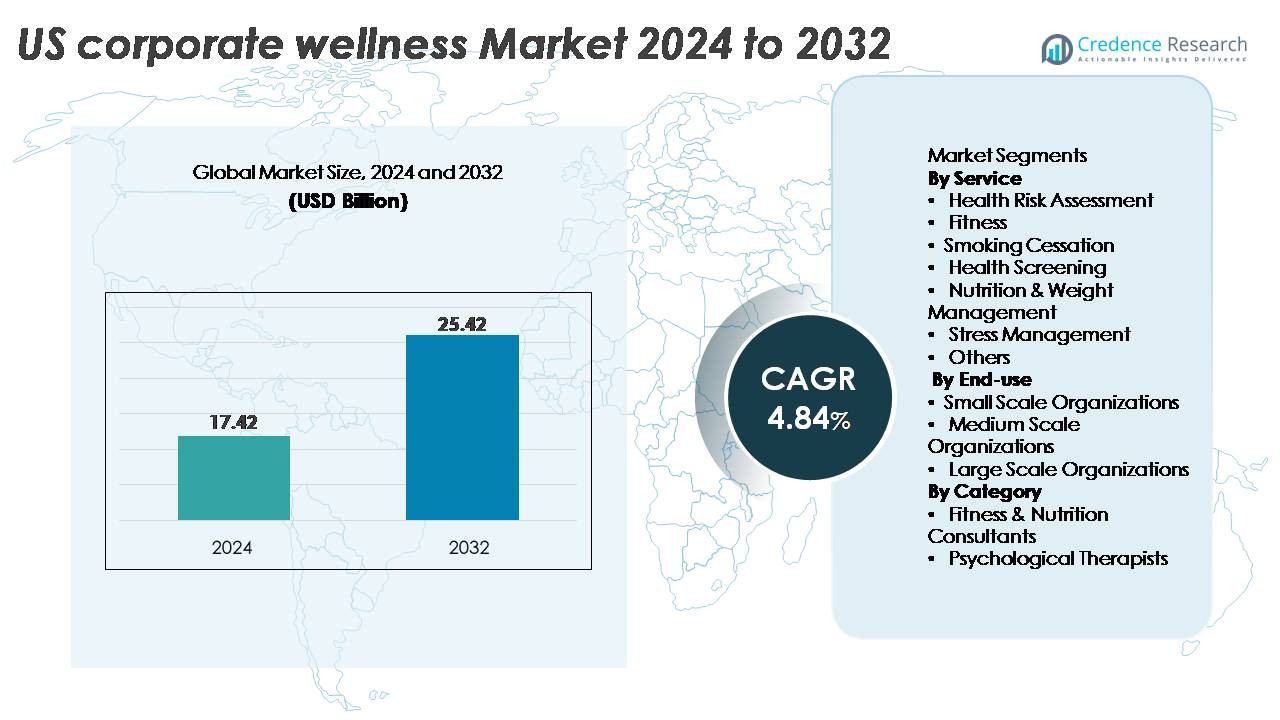

The U.S. corporate wellness market was valued at USD 17.42 billion in 2024 and is projected to reach USD 25.42 billion by 2032, expanding at a CAGR of 4.84% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ultrahigh Definition Dynamic 3D Holographic Display Market Size 2024 |

USD 17.42 Billion |

| Ultrahigh Definition Dynamic 3D Holographic Display Market, CAGR |

4.84% |

| Ultrahigh Definition Dynamic 3D Holographic Display Market Size 2032 |

USD 25.42 Billion |

The U.S. corporate wellness market is shaped by prominent players such as Vitality, Marino Wellness, Sonic Boom Wellness, Privia Health, EXOS, Wellsource, Inc., Virgin Pulse, ComPsych, and Wellness Corporate Solutions, each offering comprehensive programs spanning health screenings, mental-wellness support, lifestyle coaching, and digital engagement platforms. Virgin Pulse and ComPsych remain among the most influential due to their large employer networks and integrated wellness ecosystems, while EXOS and Sonic Boom Wellness strengthen the market through performance-driven and gamified solutions. Regionally, the South leads the market with approximately 30–35% share, followed by the West at 20–25%, the Northeast at 20–25%, and the Midwest at 15–20%, reflecting differences in workforce size, employer investment levels, and chronic disease prevalence.

Market Insights

Market Insights

- The U.S. corporate wellness market was valued at USD 17.42 billion in 2024 and is projected to reach USD 25.42 billion by 2032, expanding at a 4.84% CAGR, driven by rising employer focus on preventive health.

- Strong market drivers include the escalation of chronic diseases, increased mental-health needs, and employer demand for measurable productivity and engagement improvements across diverse workforce environments.

- Key trends reflect the shift toward holistic wellness, digital engagement platforms, gamified participation, and integration of mental-health and lifestyle coaching solutions across large and mid-sized organizations.

- Competitive dynamics are shaped by leading players such as Virgin Pulse, ComPsych, EXOS, Vitality, and Wellsource, Inc., while market restraints include low engagement rates, data-privacy concerns, and varying budget capabilities among small enterprises.

- Regionally, the South leads with 30–35%, followed by the West and Northeast at 20–25% each, and the Midwest at 15–20%; by service, Health Risk Assessment dominates due to widespread adoption of screenings and preventive evaluations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Service

Health Risk Assessment (HRA) emerges as the dominant service segment due to its central role in establishing baseline health metrics and guiding personalized wellness strategies. Organizations increasingly prioritize early detection of chronic disease risks, driving extensive adoption of biometric evaluations and digital screening tools. The fitness and nutrition & weight management segments continue to gain traction as employers integrate structured activity programs and lifestyle coaching to reduce absenteeism and improve workforce productivity. Stress management also expands as companies address rising mental-health concerns through mindfulness, resilience training, and behavioral therapy initiatives.

- For instance, Quest Diagnostics provides biometric health screenings for thousands of U.S. employers through onsite events, physician-based testing, and at-home collection kits. The company reports completing millions of individual health measurements each year across these employer programs. This large screening network helps organizations identify health risks and guide targeted wellness interventions.

By End-use

Large-scale organizations account for the largest share of the U.S. corporate wellness market, supported by their substantial budgets, established HR frameworks, and ability to implement comprehensive, multi-tiered wellness programs. These companies increasingly deploy integrated platforms that combine preventive care, mental-health support, and lifestyle coaching to enhance employee retention and productivity. Medium-scale organizations follow closely as they adopt scalable digital wellness solutions with measurable ROI. Small-scale organizations are gradually entering the market, driven by affordable virtual programs and federal incentives encouraging proactive workforce health management across diverse employment structures.

· For instance, Virgin Pulse supports over 14 million users worldwide through its enterprise wellness platform. The platform offers digital coaching, activity tracking and behavioural nudges to help employers run large-scale wellness and engagement programmes across global teams.

By Category

Organizations/Employers represent the dominant category, as most wellness initiatives are directly funded, administered, and monitored by corporate HR teams aiming to improve workforce engagement and reduce long-term healthcare expenditures. Fitness and nutrition consultants continue to support specialized program delivery through personalized coaching, data-driven meal planning, and structured activity interventions. Psychological therapists gain importance as mental-health support becomes a foundational pillar of workplace wellness, driven by rising stress levels, burnout risk, and post-pandemic workforce expectations. The growing integration of onsite counseling, digital therapy, and employee assistance programs strengthens this category’s overall adoption.

Key Growth Drivers

Rising Prevalence of Chronic Diseases and Employer Demand for Preventive Health Programs

The growing incidence of chronic lifestyle diseases such as diabetes, hypertension, cardiovascular disorders, and obesity continues to push employers toward structured wellness interventions. U.S. organizations increasingly recognize that unmanaged chronic conditions directly contribute to higher medical costs, absenteeism, and reduced productivity. As a result, employers are adopting preventive programs that combine HRAs, biometric screenings, nutrition planning, and fitness challenges to reduce long-term healthcare expenditures. Legislative encouragement for preventive healthcare and insurance incentives further accelerates adoption. Additionally, data-driven platforms empower companies to identify risk clusters across their workforce and tailor interventions accordingly. This shift toward preventive care positions corporate wellness as not only a health initiative but also a long-term cost-containment strategy that improves workforce quality and operational efficiency.

· For instance, Quest Diagnostics’ Blueprint for Wellness program processes millions of laboratory-verified biometric test results each year, supported by its national network of 2,100 patient service centers and widespread onsite screening events, enabling employers to identify chronic-disease risks with clinical accuracy.

Expansion of Mental-Health and Stress-Management Solutions in the Workplace

The U.S. workforce faces rising rates of stress, anxiety, and burnout, driven by demanding work cultures, hybrid schedules, economic uncertainty, and digital overload. Employers are increasingly prioritizing mental wellness programs as a strategic necessity to maintain productivity and employee retention. Corporate initiatives now include Employee Assistance Programs (EAPs), cognitive-behavioral therapy access, mindfulness training, and resilience-building workshops. The rapid destigmatization of mental-health support combined with insurance reimbursement improvements encourages enterprises to integrate psychological well-being as a core wellness pillar. Digital mental-health platforms and teletherapy services have expanded accessibility and confidentiality, enabling employees to receive real-time support regardless of location. Organizations adopting proactive mental-health strategies report measurable declines in turnover rates and presenteeism, making this segment a major growth driver.

- For instance, ComPsych’s GuidanceResources® platform supports more than 60,000 organizations worldwide and delivers millions of counseling and behavioral-health interactions each year through its nationwide network of licensed clinicians. The platform provides 24/7 access to mental-health support, crisis counseling and structured care pathways for employees across the U.S. and global markets.

Increasing Adoption of Digital Wellness Platforms and Data-Analytics-Based Program Personalization

Advanced digital wellness platforms are reshaping the U.S. corporate wellness landscape by enabling scalable, personalized, and outcome-oriented interventions. Employers increasingly utilize wearable devices, mobile apps, AI-driven coaching, and remote monitoring tools to track physical activity, sleep patterns, nutritional behavior, and stress indicators. These technologies support continuous engagement through gamified challenges, reward systems, and personalized health nudges. Data analytics allow companies to assess program effectiveness, optimize participation, and identify health risk areas across employee segments. Hybrid and remote work environments make digital platforms indispensable, ensuring inclusive participation regardless of employee location. The ability to quantify ROI such as reduced sick days or improvements in health scores further drives rapid adoption. As digital ecosystems expand, organizations benefit from continuous monitoring, enhanced employee engagement, and improved long-term well-being outcomes.

Key Trends and Opportunities

Integration of Holistic Wellness Models Combining Physical, Emotional, Financial, and Social Health

Corporate wellness is shifting from traditional physical-health programs to comprehensive models that address emotional, financial, and social well-being. Employees increasingly expect employers to support multiple aspects of their life challenges, including debt management, retirement planning, social connectedness, childcare support, and work-life balance. Companies adopting holistic programs report stronger engagement, as employees value solutions that extend beyond medical risk reduction. Financial wellness tools, stress-relief sessions, peer-support communities, and purpose-driven engagement activities are becoming mainstream. This evolution creates opportunities for vendors offering multi-dimensional solutions that unify multiple wellness modalities under a single digital platform. Employers that embrace holistic wellness strengthen organizational culture, improve loyalty, and enhance long-term workforce stability.

· For instance, Personify Health now supports about 25 million people through its unified health and wellbeing platform, combining care navigation, benefits management, and daily wellness engagement. The platform uses analytics and AI to personalize recommendations across physical, emotional, and financial health needs. It also reports sustained user-engagement rates above 70% among participating populations.

Growth of Hybrid and Remote Workforce Wellness Solutions

The rise of remote and hybrid work models has reshaped wellness delivery, accelerating demand for virtual programs and digital engagement tools. Organizations increasingly deploy remote fitness sessions, virtual health coaching, telemedicine consultations, and remote stress-relief workshops to maintain employee well-being regardless of location. Wearables and wellness apps help employers track participation and outcomes across geographically dispersed teams. This shift presents major opportunities for vendors offering flexible, scalable solutions tailored to hybrid workforces, including asynchronous learning, on-demand therapy, and adaptive wellness challenges. As employees prioritize flexibility and autonomy, remote wellness platforms strengthen participation rates and help employers maintain cohesive health strategies across distributed teams.

· For instance, Peloton reported that members completed over 385 million workouts in 2023, highlighting strong engagement across its connected-fitness platform. The Peloton Corporate Wellness program gives employers access to this same library of live and on-demand classes spanning strength, cycling, running, and mindfulness. This setup supports hybrid teams with flexible, guided wellness options.

Employer Incentive Programs and Gamified Engagement Models

Gamification is emerging as a powerful tool for enhancing employee motivation and sustained participation in wellness initiatives. Employers increasingly incorporate reward-based systems, milestone achievements, team competitions, and point-based challenges to cultivate consistent engagement. Incentive structures such as insurance premium reductions, wellness credits, wearable device subsidies, or gift-card rewards further motivate participation. These programs create opportunities for wellness vendors to integrate behavioral science principles and micro-engagement strategies into platform design. As organizations seek quantifiable improvements in employee health metrics, gamified models offer a scalable and measurable approach to maintaining participation and encouraging long-term healthy behavior changes.

Key Challenges

Variable Employee Engagement and Participation Rates Across Corporate Wellness Programs

Despite growing investment in wellness offerings, employee engagement remains uneven across organizations. Many employees fail to consistently participate due to time constraints, lack of personalized relevance, unclear incentives, or skepticism regarding program benefits. Low engagement undermines ROI and limits measurable improvement in workforce health outcomes. Employers must balance program design with personalized approaches to drive participation, making segmentation by risk level and demographics essential. Communication gaps and limited cultural alignment further hinder adoption, particularly in diverse and hybrid workforces. Addressing these barriers requires stronger personalization, clear value communication, gamified engagement strategies, and leadership-driven wellness cultures.

Data Privacy Concerns and Regulatory Compliance Barriers in Health Information Management

Corporate wellness programs increasingly rely on sensitive employee health data, raising concerns around privacy, confidentiality, and regulatory compliance. Employers must navigate complex frameworks such as HIPAA, ADA, GINA, and state-specific privacy laws, which restrict the handling and sharing of biometric, psychological, and digitally collected health information. Mismanagement or perceived misuse of data can significantly erode employee trust and deter participation. Vendors and employers must implement robust data-protection measures, transparent communication practices, and secure data-sharing protocols. Ensuring compliance while delivering personalized, analytics-driven wellness insights presents an ongoing challenge that requires significant investment in cybersecurity and governance.

Regional Analysis

Northeast

The Northeast region holds a substantial portion of the U.S. corporate wellness market, driven by the high concentration of corporate headquarters, large metropolitan labor forces, and robust employer spending on wellness programs. While exact public data is limited, the region’s uptake is above the national average due to prevalence of financial-services, tech, and professional firms that prioritize employee health benefits. The region’s share is estimated at roughly 20–25% of the national U.S. wellness revenue. High awareness of health screening, preventive care and mental-health support among employers supports steady adoption, making the Northeast a mature, stable market for wellness services.

Midwest

The Midwest accounts for a significant portion of corporate wellness market share in the U.S., reflecting its sizable manufacturing, industrial, and service-sector employer base. With moderate wage levels and relatively stable workforce demographics, many Midwestern firms invest in cost-effective wellness solutions, focusing on preventive health screening, fitness, and weight management to reduce long-term healthcare expenditures. The region likely contributes around 15–20% of the U.S. corporate wellness revenue. Steady program adoption, especially among medium and large enterprises, underpins the region’s growth potential as companies increasingly recognize the productivity and cost-saving benefits of employee well-being initiatives.

South

The Southern United States leads in growth momentum and likely contributes the largest regional share estimated around 30–35% of U.S. corporate wellness revenue. The region’s elevated rates of chronic health conditions, including obesity and diabetes, drive employer demand for wellness programs such as health risk assessments, fitness, nutrition management, and smoking-cessation services. A competitive labor market in Southern states prompts employers to differentiate through wellness benefits to attract and retain talent. Additionally, favorable weather and cultural acceptance of wellness and outdoor activity facilitate program participation, making the South a core growth engine for corporate wellness.

West

The Western region including major employment hubs in technology, entertainment, and service sectors represents a growing share of the U.S. corporate wellness market, estimated at about 20–25%. High awareness around holistic health, emphasis on mental wellness, lifestyle coaching, and flexible wellness offerings (onsite gyms, telehealth, digital fitness) support robust uptake. Employers in the West tend to adopt comprehensive, integrated wellness programs, often combining physical health, stress management and mental-health interventions. As remote work and flexible employment models rise, Western firms increasingly leverage digital wellness platforms, strengthening the region’s role in market growth.

Market Segmentations:

By Service

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

By End-use

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

By Category

- Fitness & Nutrition Consultants

- Psychological Therapists

- Organizations / Employers

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. corporate wellness market features a fragmented yet increasingly consolidating competitive landscape, led by established vendors such as ComPsych, Labcorp/Wellness Corporate Solutions, Virgin Pulse, Quest Diagnostics, and Optum, which collectively command a significant share through comprehensive, nationwide program portfolios. These players compete on integrated platforms that bundle health risk assessments, screenings, mental-health support, lifestyle coaching, and analytics-driven reporting for large employers. Below this tier, a broad field of specialists including EXOS, Vitality Group, Limeade, MediKeeper, Marino Wellness, Wellsource, and Truworth Wellness focus on niche strengths such as performance coaching, digital engagement, or data platforms, often targeting mid-sized enterprises or sector-specific needs. Competition is intensifying as technology firms and benefits platforms enter the space, pushing incumbents to invest in AI-enabled personalization, mobile-first delivery, and strategic partnerships with insurers, health systems, and fitness networks. This dynamic environment encourages continuous innovation around engagement models, outcome measurement, and holistic wellness offerings.

Key Player Analysis

- Vitality

- Marino Wellness

- Sonic Boom Wellness

- EXOS

- Wellsource, Inc.

- Virgin Pulse

- ComPsych

- Wellness Corporate Solutions

Recent Developments

- In September 2025, EXOS formed a strategic partnership with Power Plate to enhance human performance and recovery offerings for corporate clients.

- In February 2024 (following its November 2023 merger with HealthComp), Virgin Pulse launched a new unified brand, Personify Health, creating a combined platform offering health-plan administration and holistic wellness services

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Service, End-Use, Category and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Employers will increasingly integrate holistic wellness models combining physical, mental, financial, and social well-being into unified platforms.

- Digital wellness ecosystems using AI, wearables, and personalized coaching will become central to program delivery and continuous engagement.

- Mental-health support, including virtual therapy and resilience training, will expand as a core pillar of corporate wellness strategies.

- Gamified engagement models will grow as companies seek higher participation and measurable behavior change across dispersed workforces.

- Hybrid and remote employee wellness programs will strengthen as flexible work environments remain widespread.

- Data analytics will drive more precise health-risk segmentation and ROI evaluation for employers.

- Partnerships between wellness vendors, insurers, and healthcare providers will deepen to create integrated care pathways.

- Preventive health initiatives will gain prominence as employers aim to reduce long-term medical costs and absenteeism.

- Personalized nutrition, sleep health, and stress-management solutions will increase adoption across employee groups.

- Corporate wellness programs will expand in small and mid-sized organizations as digital solutions make offerings more affordable and scalable.

Market Insights

Market Insights