| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Retail Pharmacy Market Size 2024 |

USD 52,569.90 Million |

| Japan Retail Pharmacy Market, CAGR |

4.24% |

| Japan Retail Pharmacy Market Size 2032 |

USD 73,311.06 Million |

Market Overview

The Japan Retail Pharmacy Market is projected to grow from USD 52,569.90 million in 2024 to an estimated USD 73,311.06 million by 2032, with a compound annual growth rate (CAGR) of 4.24% from 2025 to 2032. This growth is driven by the increasing demand for healthcare services, particularly among the aging population, and the expansion of retail pharmacy networks across the country.

Key drivers of market growth include the aging demographic, which leads to a higher prevalence of chronic diseases and a greater need for pharmaceutical care. Additionally, the expansion of retail pharmacy chains and the increasing availability of OTC products contribute to market growth. Technological advancements, such as pharmacy automation and digital health services, are also enhancing operational efficiency and customer experience.

Geographically, the Kanto region, encompassing Tokyo, is the largest market for retail pharmacies, driven by its dense population and high healthcare demand. Other regions, including Kansai and Chubu, are also experiencing growth due to expanding pharmacy networks and increasing consumer awareness. Major players in the market include Tsuruha Holdings, Welcia Holdings, and Matsumoto Kiyoshi Holdings, which dominate the retail pharmacy landscape with extensive store networks and a wide range of pharmaceutical products.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Retail Pharmacy Market is projected to grow from USD 52,569.90 million in 2024 to USD 73,311.06 million by 2032, with a CAGR of 4.24% from 2025 to 2032.

- The Global Retail Pharmacy Market is expected to grow from USD 14,45,920.00 million in 2024 to USD 19,65,958.05 million by 2032, at a CAGR of 3.92% from 2025 to 2032.

- Key growth drivers include the aging population, increasing chronic disease prevalence, and the expansion of retail pharmacy networks across Japan.

- The adoption of pharmacy automation, digital health services, and e-prescriptions are enhancing operational efficiency and customer experience in retail pharmacies.

- The market faces challenges from regulatory hurdles and price pressure on pharmaceutical products, which may limit profit margins for pharmacy operators.

- The Kanto region, including Tokyo, holds the largest market share due to its dense population and significant healthcare demand.

- Kansai and Chubu regions are also witnessing growth, driven by expanding pharmacy networks and rising consumer awareness of healthcare options.

- Major players such as Tsuruha Holdings, Welcia Holdings, and Matsumoto Kiyoshi Holdings dominate the market with extensive store networks and diverse product portfolios.

Report Scope

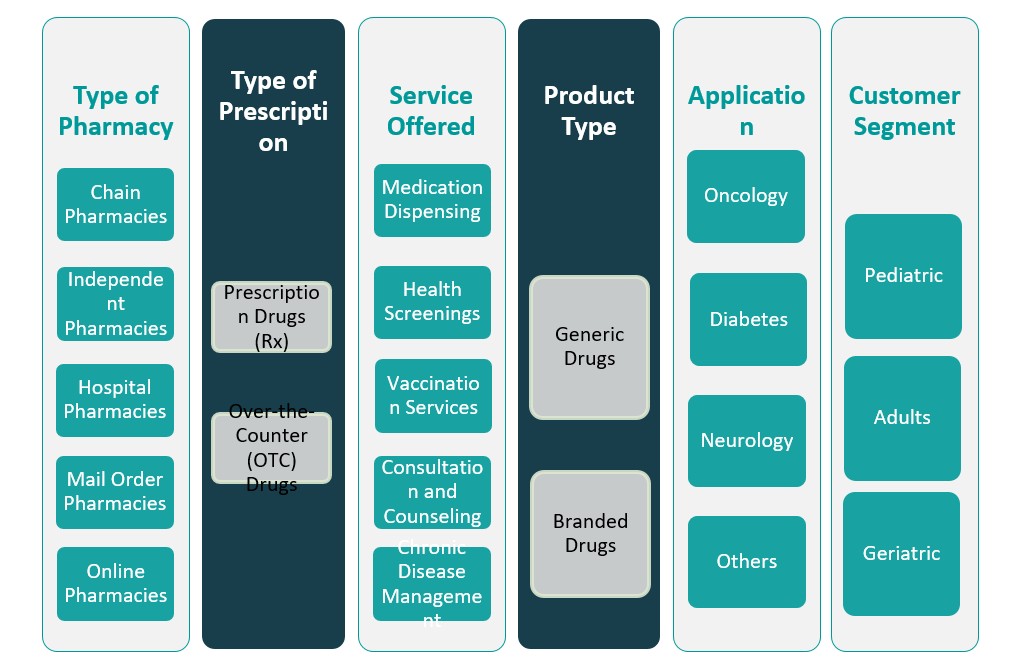

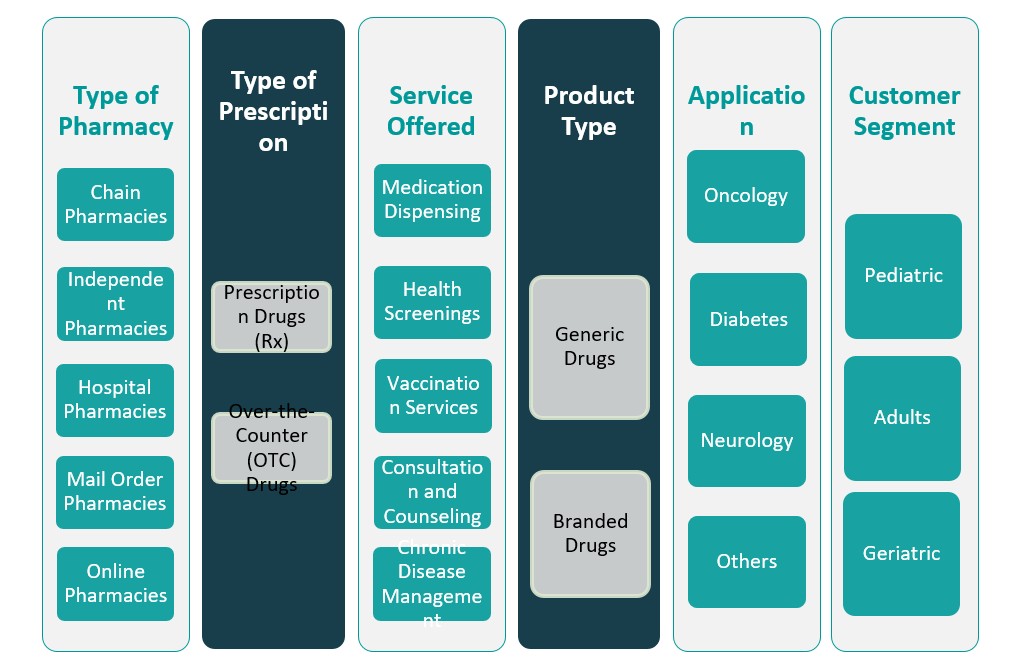

This report segments the Japan Retail Pharmacy Market as follows:

Market Drivers

Aging Population and Rising Prevalence of Chronic Diseases

Japan’s rapidly aging population significantly influences the growth trajectory of its retail pharmacy market. As of recent demographic estimates, over 29% of Japan’s total population is aged 65 years and older—a trend that is projected to intensify over the coming decades. This demographic shift has resulted in an increased prevalence of chronic diseases, including hypertension, diabetes, cardiovascular conditions, arthritis, and neurological disorders such as Alzheimer’s disease. Consequently, there is a rising demand for long-term prescription medications, continuous health monitoring, and preventive healthcare measures, all of which drive traffic to retail pharmacies. For instance, many pharmacies have introduced home visit pharmaceutical services, a government-supported initiative that aims to provide pharmaceutical support for elderly patients who have difficulty visiting healthcare institutions. This demographic-driven expansion of services strengthens the retail pharmacy ecosystem and enhances customer engagement while promoting medication adherence.

Expansion of OTC Drug Use and Consumer Health Awareness

The growing consumer inclination towards self-medication and preventive healthcare has accelerated the demand for over-the-counter (OTC) pharmaceuticals in Japan. Japanese consumers have increasingly taken a proactive approach to health management, seeking solutions for minor ailments such as allergies, digestive issues, cold and flu symptoms, and skin conditions without visiting a doctor. This behavioral shift has boosted OTC drug sales and expanded the product portfolio of retail pharmacies, making them integral points of primary healthcare access. For instance, the Japanese government has approved more “switch OTC” products—prescription drugs reclassified as OTC—which further expands the range of self-medication options available in retail outlets. Retail pharmacies in Japan are capitalizing on this trend by diversifying their offerings and enhancing in-store experiences through product consultations and tailored health solutions.

Digital Transformation and Integration of Pharmacy Automation

Digitalization and technological innovation represent crucial growth drivers for Japan’s retail pharmacy sector. Pharmacies are increasingly adopting pharmacy automation systems, such as automated dispensing machines, electronic prescription systems (e-prescriptions), and inventory management platforms. These technologies enhance operational efficiency, reduce medication errors, and improve prescription filling speed, thereby boosting customer satisfaction and workflow efficiency. Furthermore, the integration of electronic health records (EHRs) with pharmacy systems enables pharmacists to deliver more personalized and data-driven healthcare. Through EHR access, pharmacists can assess a patient’s medication history, identify drug interactions, and collaborate more effectively with physicians. In response to the COVID-19 pandemic and the broader push toward contactless services, many pharmacies also began offering telepharmacy services and digital consultations. These advancements not only align with Japan’s broader healthcare digitization efforts but also appeal to younger, tech-savvy consumers seeking convenience and rapid service delivery. In parallel, mobile applications and loyalty programs linked with pharmacy chains are being leveraged to drive engagement, allow for e-commerce purchases, and facilitate prescription refills or reminders. These innovations are transforming the traditional retail pharmacy model into a more responsive, omnichannel healthcare experience that addresses the evolving needs of modern consumers.

Policy Reforms and Government Support for Community Pharmacy Development

Japan’s government has implemented a range of policy reforms aimed at reinforcing the role of pharmacies within the national healthcare system. One of the cornerstone strategies is the promotion of “Health Support Pharmacies” (HSPs), which are accredited retail pharmacies that provide community-based services beyond conventional drug dispensing. HSPs offer services such as health promotion education, nutritional guidance, disease prevention consultations, and coordination with local healthcare providers to support patient-centered care. Additionally, the Ministry of Health, Labour and Welfare (MHLW) is actively encouraging the development of “family pharmacies” or “pharmacies of choice” that maintain long-term relationships with patients. These pharmacies are incentivized to keep comprehensive medication records and offer follow-up services, which not only contribute to improved therapeutic outcomes but also help reduce national healthcare expenditures by preventing duplicate prescriptions and adverse drug events. Pharmacy reimbursement models are also being revised to reward pharmaceutical care services rather than mere product sales. This shift recognizes the evolving role of pharmacists as healthcare providers who contribute to primary care and chronic disease management. By aligning financial incentives with healthcare goals, the Japanese government fosters a sustainable and community-integrated retail pharmacy model. Together, these regulatory measures and initiatives underscore the government’s commitment to fortifying Japan’s retail pharmacy infrastructure and enhancing its capacity to meet public health needs. They also create a favorable environment for private sector investment and innovation in pharmacy operations and services.

Market Trends

Rise of Omnichannel Retail and E-Pharmacy Integration

Japan’s retail pharmacy market is undergoing a significant transformation with the rapid integration of omnichannel strategies. Consumers are increasingly turning to digital platforms for health consultations, prescription refills, and product purchases. For instance, during the COVID-19 pandemic, Japan experienced a 40% increase in the use of e-prescriptions, reflecting the growing reliance on digital healthcare solutions. Pharmacies are now offering mobile apps, online ordering, home delivery, and digital payment options to meet consumer expectations for convenience and accessibility. E-prescriptions and cloud-based patient data systems enable streamlined order processing and medication tracking, further enhancing operational efficiency. Many pharmacies introduced remote consultations and digital health advice via AI chatbots and licensed professionals, which saw a 25% rise in adoption among urban populations. This trend is particularly appealing to the tech-savvy younger population and busy working professionals who prefer managing their healthcare online. Omnichannel retail also supports data-driven personalization, allowing pharmacies to offer targeted promotions, loyalty programs, and medication reminders. As regulatory frameworks adapt to support digital pharmacy services, Japan’s retail pharmacies are set to become more connected, responsive, and consumer-centric. This ongoing digitization is not only reshaping customer engagement but also reinforcing pharmacies’ roles as critical access points for holistic health management.

Expansion of Health Support and Community-Based Pharmacy Services

A notable trend shaping the Japan retail pharmacy market is the expansion of health support pharmacies and community-based services. For instance, as of 2024, over 12,000 pharmacies in Japan have been certified as “Health Support Pharmacies” (HSPs), offering proactive health consultations, disease prevention education, and nutritional guidance. These pharmacies are positioned as community health hubs that collaborate closely with local clinics and hospitals to deliver continuous patient care. In addition, the focus on “family pharmacies” or “pharmacies of choice” has gained momentum, with surveys indicating that 65% of elderly patients prefer these pharmacies for their personalized support and comprehensive medication management. Pharmacists are receiving expanded training to deliver services like smoking cessation programs, medication therapy management, and vaccinations, with over 80% of pharmacists now certified to administer vaccines. This trend reflects a broader redefinition of the pharmacist’s role from a dispenser to a healthcare provider. It also aligns with Japan’s demographic profile, where a significant portion of the population requires regular health guidance, particularly the elderly. With supportive policy frameworks and growing public trust, community-oriented pharmacy services are strengthening the sector’s relevance in Japan’s evolving healthcare landscape.

Increased Demand for Personalized and Preventive Healthcare Solutions

Japan’s retail pharmacy sector is witnessing a growing demand for personalized and preventive healthcare offerings. As consumers become more health-conscious and proactive in managing their well-being, pharmacies are diversifying their product ranges and services to meet individualized needs. Pharmacies now stock a broader selection of functional foods, nutraceuticals, and supplements tailored to support specific health goals such as immune support, cardiovascular health, and stress reduction. Pharmacogenetic testing and personalized health screening kits are also gaining popularity, allowing individuals to make informed decisions based on their genetic predispositions or biometric markers. Retail pharmacies are increasingly adopting data analytics tools to recommend products or interventions based on customer purchase history, lifestyle, or health conditions. Moreover, wearable technology integration—such as smart thermometers or blood pressure monitors—is enabling consumers to track health metrics and consult pharmacists for actionable insights. This trend aligns with Japan’s cultural emphasis on preventive care and longevity. Pharmacies are actively positioning themselves as trusted wellness partners by offering coaching, diet advice, and long-term health planning. As the healthcare industry continues to shift toward value-based models, personalized services in retail pharmacy settings are emerging as a competitive differentiator and a strategic focus for growth and consumer engagement.

Pharmacy Automation and AI-Driven Efficiency Enhancements

Technological advancements, particularly in automation and artificial intelligence (AI), are significantly influencing the operational models of retail pharmacies in Japan. Automation has become instrumental in reducing dispensing errors, streamlining inventory management, and improving overall workflow. Pharmacies are implementing robotic dispensers, automated pill packaging machines, and smart storage systems to increase throughput and reduce waiting times. These innovations not only improve accuracy but also free up pharmacists to focus on more value-added services such as consultations and health screenings. Simultaneously, AI-powered platforms are being used to forecast demand, personalize promotions, and support decision-making in medication management. Chatbots and virtual assistants are being deployed to handle routine queries, book appointments, and remind patients about prescription refills. With the rise of big data analytics, retail chains are leveraging customer insights to optimize product assortments and operational strategies. Furthermore, pharmacy chains are integrating these technologies with electronic health records (EHRs) to support a more coordinated and intelligent approach to patient care. This digital transformation is driven by Japan’s emphasis on innovation, efficiency, and patient safety. As automation and AI adoption expand, pharmacies are evolving from transactional retail points into highly efficient, tech-enabled healthcare access hubs, ensuring scalability and improved service quality in a competitive market landscape.

Market Challenges

Workforce Shortages and Strain on Pharmacist Resources

One of the major challenges confronting the Japan retail pharmacy market is the shortage of qualified pharmacists and healthcare personnel. Despite increasing demand for pharmaceutical services due to an aging population and the rising incidence of chronic diseases, the supply of pharmacists has not kept pace. This shortage creates a significant burden on existing pharmacy staff, leading to increased workloads, longer waiting times for customers, and reduced opportunities for pharmacists to offer value-added services such as patient counseling and medication therapy management. Smaller, independent pharmacies, in particular, face difficulties in attracting and retaining qualified pharmacists. For instance, nearly 40% of independent pharmacies in Japan report challenges in hiring pharmacists, resulting in operational inefficiencies and reduced competitiveness compared to large pharmacy chains. Furthermore, the growing complexity of pharmaceutical care—such as the need for medication reconciliation, adverse drug reaction monitoring, and chronic disease management—places additional pressure on pharmacists to expand their roles. Without sufficient staffing levels, pharmacies struggle to maintain high standards of service quality, customer satisfaction, and compliance with regulatory expectations. Addressing this workforce challenge requires strategic efforts, including promoting pharmacy education, improving working conditions, leveraging pharmacy automation technologies, and fostering professional development programs to equip pharmacists for evolving healthcare roles.

Regulatory Constraints and Intensifying Price Pressures

Japan’s retail pharmacy market also grapples with stringent regulatory frameworks and increasing price pressures that challenge profitability and business sustainability. Government-mandated drug price revisions, which occur regularly to control healthcare spending, result in declining reimbursement rates for prescription medications. These revisions negatively impact pharmacy revenues, particularly for pharmacies heavily reliant on prescription sales. In addition, regulatory requirements for accreditation as Health Support Pharmacies impose operational burdens, as they demand additional investments in staff training, facility upgrades, and service expansion. Compliance with these regulations can be financially taxing, especially for small and mid-sized pharmacy operators. Simultaneously, intense market competition among pharmacy chains, drugstores, and online pharmacies has triggered aggressive price wars, further squeezing profit margins. Consumers’ growing price sensitivity, driven by widespread availability of generic drugs and discounted OTC products, exacerbates this issue. To navigate these challenges, retail pharmacies must diversify revenue streams by offering healthcare services, digital solutions, and wellness products. Strategic adaptation, operational efficiency improvements, and collaboration with broader healthcare networks are critical to sustaining profitability and maintaining relevance in Japan’s evolving pharmaceutical landscape.

Market Opportunities

Expansion of Integrated Healthcare Services through Pharmacies

The Japan retail pharmacy market holds strong opportunities for growth through the expansion of integrated healthcare services. As the healthcare system increasingly shifts toward preventive care and community-based models, pharmacies are well-positioned to offer broader services beyond traditional medication dispensing. Health support pharmacies (HSPs) present a significant opportunity for retailers to become essential healthcare hubs by providing nutritional counseling, chronic disease management, health screenings, vaccination services, and medication adherence programs. Collaborations between pharmacies, local clinics, and public health agencies can create comprehensive care networks that address the needs of an aging population while reducing strain on hospitals. Pharmacies that proactively integrate primary care services and leverage patient education initiatives can differentiate themselves competitively, build customer loyalty, and secure new revenue streams supported by evolving government policies promoting decentralized healthcare access.

Leveraging Digital Health and E-Commerce Expansion

Another major market opportunity lies in the strategic adoption of digital health technologies and e-commerce platforms. The rapid consumer shift toward online health management and telepharmacy services creates a favorable environment for pharmacies to expand their reach digitally. Offering services such as e-prescriptions, online medication ordering, virtual consultations, and home delivery can significantly enhance customer engagement and convenience. Additionally, data-driven insights from digital interactions enable pharmacies to personalize services, recommend targeted health solutions, and optimize inventory management. Pharmacies that invest in robust digital infrastructure and omnichannel strategies will be better positioned to meet the needs of tech-savvy consumers, strengthen brand loyalty, and capture a larger share of the evolving healthcare retail market in Japan.

Market Segmentation Analysis

By Type of Pharmacy

The Japan retail pharmacy market is segmented into chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Chain pharmacies dominate the market due to their extensive geographic reach, brand recognition, and diversified service offerings. These pharmacies benefit from economies of scale and strong partnerships with pharmaceutical manufacturers. Independent pharmacies, although smaller in scale, retain significance in rural and suburban areas by offering personalized services. Hospital pharmacies primarily serve in-house patients but are expanding their outpatient operations to provide more accessible pharmaceutical care. Mail order pharmacies are gaining traction among patients with chronic conditions requiring regular medication refills, supported by home delivery services. Meanwhile, online pharmacies are experiencing rapid growth, fueled by the increasing demand for digital convenience and regulatory support for e-prescriptions.

By Type of Prescription

The market is bifurcated into prescription drugs (Rx) and over-the-counter (OTC) drugs. Prescription drugs contribute the majority of revenue, driven by the high prevalence of chronic diseases and the aging population’s medication needs. However, the OTC segment is expanding as consumers increasingly seek self-care solutions for minor health issues, boosting the sales of non-prescription medications, supplements, and preventive products.

Segments

Based on Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Based on Type of prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Based on Service offered

- Medication Dispensing

- Health Screenings

- Vaccination Services

- Consultation and Counseling

- Chronic Disease Management

Based on Product Type

- Generic Drugs

- Branded Drugs

Based on Application

- Oncology

- Diabetes

- Neurology

- Others

Based on Customer

- Paediatric

- Adults

- Geriatric

Based on Region

Regional Analysis

Kanto region (45-50%)

The Kanto region, encompassing the Greater Tokyo Area, commands the largest market share at approximately 45–50%. This dominance is attributed to its high population density, advanced healthcare facilities, and the presence of numerous hospitals and pharmacies. The region’s adoption of cutting-edge technologies and pharmacy automation further bolsters its market position.

Kansai region (20-25%)

The Kansai region, including major cities like Osaka and Kyoto, holds a substantial market share of around 20–25%. Known for its well-developed healthcare sector, Kansai benefits from a high concentration of medical institutions and a focus on improving healthcare efficiency and patient safety. The region’s commitment to enhancing healthcare services has driven the adoption of pharmacy automation solutions.

Chubu region (10-15%)

The Chubu region, with cities such as Nagoya, accounts for approximately 10–15% of the market. Its strategic location and robust industrial base contribute to a growing demand for healthcare services, including retail pharmacies. The region’s emphasis on integrating technology into healthcare practices supports the expansion of pharmacy services.

Key players

- Matsumoto Kiyoshi Holdings Co., Ltd

- Aeon Co., Ltd

- Lawson, Inc

- Tsuruha Holdings Inc

- FamilyMart Co., Ltd

Competitive Analysis

The Japan retail pharmacy market is highly competitive, characterized by the strong presence of both established pharmacy chains and diversified retail groups. Leading players such as Matsumoto Kiyoshi Holdings Co., Ltd and Tsuruha Holdings Inc dominate the landscape with extensive store networks, strong brand recognition, and broad product portfolios, spanning prescription drugs, OTC products, and wellness goods. Aeon Co., Ltd and FamilyMart Co., Ltd leverage their diversified retail operations to integrate pharmacy services into their broader consumer offerings, enhancing customer convenience. Lawson, Inc has also strategically expanded its healthcare segment through partnerships and in-store pharmacies. Competition is intensifying as players invest in digitalization, expand health-related services, and adopt customer-centric business models to strengthen market share. The focus on preventive healthcare, personalized services, and omnichannel engagement is reshaping competitive dynamics, compelling companies to innovate continuously to maintain their leadership in Japan’s evolving retail pharmacy market.

Recent Developments

- As of March 31, 2024, Apollo Pharmacy operated 6,030 stores across approximately 1,200 cities and towns in 22 states and 5 union territories. The company continues to expand its digital healthcare platform, offering services like online medicine delivery and virtual doctor consultations.

- In October 2024, Caring Pharmacy Retail Management Sdn Bhd, a 75%-owned unit of 7-Eleven Malaysia Holdings Bhd, announced acquisitions of equity interest and business assets in several pharmaceutical outlets for a combined cash consideration of RM48.86 million.

- In June 2024, the Australian Competition and Consumer Commission (ACCC) expressed concerns that the proposed acquisition of Chemist Warehouse by Sigma Healthcare could substantially lessen competition in pharmacy retailing, potentially leading to higher prices and reduced service quality.

- In January 2025, Watsons Philippines ended 2024 with 1,166 stores, expanding its community pharmacy format. The company opened more than 50 stores outside of Metro Manila.

Market Concentration and Characteristics

The Japan retail pharmacy market exhibits a moderately concentrated structure, with a few dominant players such as Matsumoto Kiyoshi Holdings Co., Ltd, Tsuruha Holdings Inc, Aeon Co., Ltd, and FamilyMart Co., Ltd commanding significant market shares. These companies benefit from extensive retail networks, strong brand equity, and diversified service offerings that include prescription dispensing, OTC sales, and preventive healthcare services. The market is characterized by a blend of traditional brick-and-mortar outlets and rapidly growing online pharmacy platforms, driven by the increasing consumer preference for convenience and digital health solutions. Regulatory initiatives supporting Health Support Pharmacies and the promotion of generic drugs are shaping operational strategies across the sector. Moreover, the market reflects a strong emphasis on personalized healthcare, community-based services, and the integration of pharmacy automation technologies to enhance service efficiency. Competitive intensity remains high, encouraging continuous innovation, strategic partnerships, and regional expansion to cater to Japan’s aging and health-conscious population.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Type of Pharmacy, Type of prescription, Service offered, Product Type, Application, Customer and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Japan retail pharmacy market will continue to grow steadily, driven by the expanding elderly population and increasing chronic disease burden across the country.

- Pharmacies will strengthen their roles as primary healthcare hubs by offering expanded services such as health screenings, chronic disease management, and vaccination programs.

- The adoption of digital health platforms, including e-prescriptions, telepharmacy services, and mobile health applications, will enhance consumer convenience and loyalty.

- Online pharmacies and mail-order services will experience strong growth, supported by regulatory advancements and the increasing demand for contactless healthcare options.

- Health Support Pharmacies will become more widespread, as government initiatives encourage pharmacies to offer community-based health promotion and preventive care services.

- Pharmacy chains will invest heavily in automation technologies, such as robotic dispensing and AI-driven inventory management, to improve operational efficiency and reduce errors.

- The growing popularity of self-medication and preventive healthcare will boost the sales of OTC drugs, health supplements, and functional foods in retail pharmacies.

- Strategic collaborations between pharmacies, hospitals, and technology companies will emerge to deliver integrated, patient-centric healthcare solutions across Japan.

- The market will witness increased competition, prompting players to focus on personalized service offerings, loyalty programs, and regional expansions to secure market share.

- Sustainability initiatives, including eco-friendly packaging and carbon footprint reduction efforts, will gain prominence as pharmacies align with broader environmental and social governance trends.