| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Memory Foam Mattress Market Size 2024 |

USD 8,564.4 Million |

| Memory Foam Mattress Market, CAGR |

5.80% |

| Memory Foam Mattress Market Size 2032 |

USD 13,445.7 Million |

Market Overview

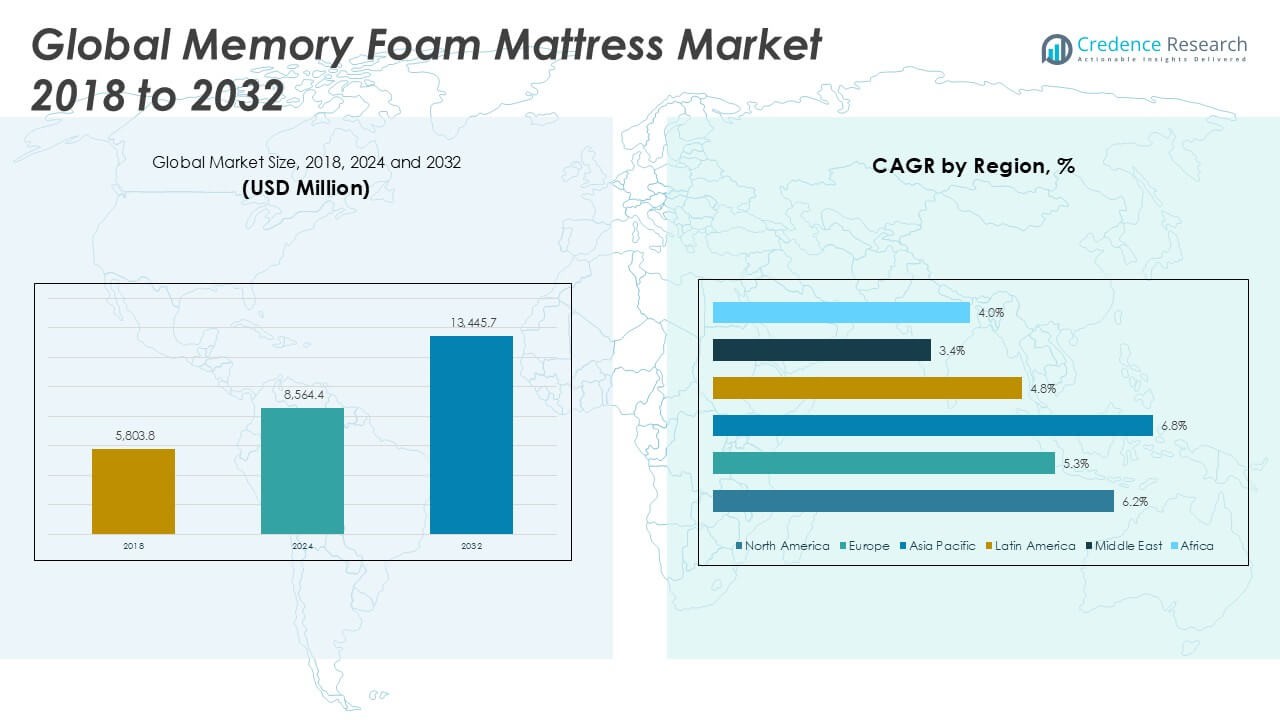

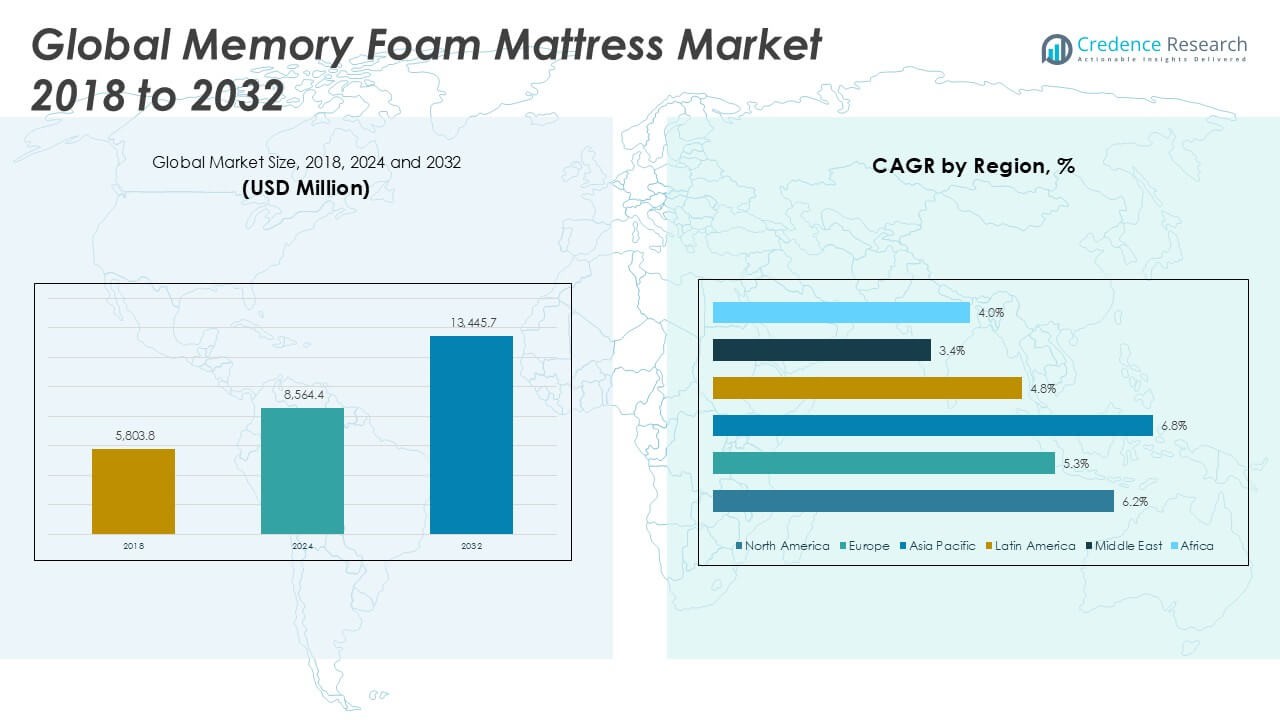

The Global Memory Foam Mattress Market is projected to grow from USD 8,564.4 million in 2024 to an estimated USD 13,445.7 million Based on 2032, with a compound annual growth rate (CAGR) 5.80% from 2025 to 2032.

Manufacturers capitalize on growing health awareness and the importance of quality rest. Memory foam’s pressure-relieving properties and durability attract consumers seeking pain-management and spinal alignment benefits. Brands intensify R\&D efforts to address heat retention issues through advanced ventilation technologies and phase-change materials. Customized firmness options and smart-bed integrations—featuring sleep tracking and adjustable support—spur demand among tech-savvy demographics.

North America commands a significant share, underpinned by high disposable incomes and well-established retail networks. Europe exhibits steady growth driven by sustainability regulations and rising adoption of eco-friendly foam alternatives. The Asia Pacific region offers the highest CAGR, fueled by rapid urbanization, expanding middle-class populations, and increasing awareness of sleep health. Key players shaping the competitive landscape include Tempur-Sealy International, Serta Simmons Bedding, Sleep Number Corporation, and Casper Sleep Inc. These companies focus on strategic partnerships, product diversification, and regional expansion to consolidate market positions.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Memory Foam Mattress Market will expand from USD 8,564.4 million in 2024 to USD 13,445.7 million by 2032 at a 5.80% CAGR.

- Growing consumer emphasis on ergonomic bedding and pain relief fuels demand for pressure-relieving memory foam products.

- Direct-to-consumer online channels reduce distribution costs and enable trial programs, boosting market reach.

- Fluctuating prices for polyurethane and specialty additives pressure manufacturers’ margins and pricing strategies.

- Proliferation of value-oriented brands and private labels forces incumbents to differentiate through innovation and branding.

- With a 35.6% share, high disposable incomes and established retail networks sustain leadership in gel-infused and smart-bed segments.

- At a 6.8% CAGR, rapid urbanization, rising middle-class incomes, and e-commerce adoption drive robust growth in key markets.

Market Drivers

Growing Consumer Focus on Health and Comfort

Rising incidence of sleep disorders drives people to invest in supportive bedding solutions. The Global Memory Foam Mattress Market benefits from heightened demand for ergonomic designs that promote spinal alignment and pain relief. It offers pressure distribution and contouring features that reduce discomfort. Manufacturers highlight therapeutic advantages in marketing campaigns. It supports recovery after physical activity by enhancing rest quality. Health professionals recommend memory foam for chronic back conditions. It appeals to aging populations seeking sustained comfort.

- For instance, a 2024 survey by the National Sleep Foundation found that over 18 million consumers in the United States purchased memory foam mattresses specifically for health-related reasons, such as back pain relief and improved sleep quality.

Technological Innovations Enhancing Product Appeal

Manufacturers invest in gel infusion and open-cell structures to improve heat dissipation and airflow. The Global Memory Foam Mattress Market sees growth through integration of phase-change materials that adjust temperatures. It enhances comfort and regulates microclimate throughout the night. Brands introduce adjustable firmness layers to address individual preferences. It incorporates smart sensors for sleep tracking in connected beds. Consumers value data-driven insights to optimize rest routines. It drives premium segment expansion.

- For instance, according to company reports and industry analysis in 2024, more than 6 million memory foam mattresses with integrated cooling gel or phase-change technology were sold globally, reflecting strong consumer interest in advanced comfort features.

Expansion of E-Commerce and Direct Sales Channels

Online platforms enable direct engagement with consumers and lower distribution costs. The Global Memory Foam Mattress Market experiences higher penetration through digital sales strategies. It offers virtual showrooms and trial periods that reduce purchase hesitation. Retailers provide free shipping and convenient return policies to build confidence. It leverages targeted digital advertising to reach niche demographics. Subscription-based models allow gradual payments for premium products. It strengthens brand loyalty through personalized experiences.

Sustainability and Eco-Friendly Material Adoption

Consumers demand eco-safe materials and transparent supply chains. The Global Memory Foam Mattress Market shifts toward plant-based and bio-polymer foams to meet green criteria. It reduces reliance on petroleum-derived components and lowers carbon footprints. Companies obtain certifications from recognized environmental bodies to validate claims. It supports circular economy initiatives through recyclable packaging. Certifications earn trust among environmentally conscious buyers. It positions brands competitively in the sustainable segment.

Market Trends

Rising Personalization through Customizable Firmness Options

The Global Memory Foam Mattress Market shows strong demand for adjustable support levels. It allows users to select comfort settings that suit body type and sleep position. Manufacturers offer multiple foam layers that homeowners can rearrange. It drives preference for split firmness designs in couples’ mattresses. Retailers highlight modular constructions that adapt to changing comfort needs. It supports premium pricing strategies and enhances consumer satisfaction.

- For instance, Sleep Number reported that more than 2,000,000 customers have purchased mattresses with adjustable firmness settings, reflecting the growing popularity of personalized sleep solutions.

Integration of Smart Technologies in Sleep Solutions

The Global Memory Foam Mattress Market embraces embedded sensors for sleep pattern analysis. It tracks heart rate and movement to deliver personalized rest recommendations. Brands integrate Bluetooth modules that communicate with smartphone apps. It boosts interest in connected sleep ecosystems. Manufacturers collaborate with health startups to refine data algorithms. It increases perceived value among tech-focused consumers.

- For instance, according to a survey by the Consumer Technology Association, over 4,500,000 smart mattresses and sleep tracking devices with integrated sensors were sold in the United States in 2024, highlighting rapid adoption of technology-driven sleep solutions.

Growth of Direct-to-Consumer Online Sales Channels

The Global Memory Foam Mattress Market expands through digital storefronts and trial programs. It eliminates retail markups and offers competitive pricing. Companies provide free doorstep delivery and hassle-free returns. It encourages first-time buyers to test premium products. Online reviews and influencer marketing shape purchase decisions. It reduces dependency on brick-and-mortar showrooms.

Shift toward Sustainable and Natural Materials

The Global Memory Foam Mattress Market shifts focus to plant-based foam formulations. It uses soy and castor oil blends that lower environmental impact. Manufacturers source certified organic textiles for mattress covers. It achieves third-party eco-label certifications. Consumers reward brands that demonstrate transparent supply chains. It fosters long-term loyalty among eco-aware buyers.

Market Challenges

Escalating Production Costs and Material Price Volatility

The Global Memory Foam Mattress Market faces pressure from rising raw material prices for polyurethane and specialty additives. It must absorb higher input costs without undermining profit margins. Manufacturers invest in cost-control measures to maintain competitive pricing. It requires efficient supply chain management to secure stable material supplies. Regulatory changes in chemical handling impose additional compliance expenses. It compels producers to balance quality standards with budget constraints. Fluctuating energy costs further complicate manufacturing budgets.

- For instance, a medium-sized mattress manufacturing facility typically pays between $50,000 and $100,000 per year in electricity bills, $10,000 to $25,000 annually for water and sewage, and $15,000 to $30,000 in annual natural gas expenses, illustrating the significant operational costs that must be managed alongside raw material price fluctuations

Intense Competition and Quality Assurance Concerns

The Global Memory Foam Mattress Market encounters fierce rivalry from value-oriented brands and private labels. It struggles to differentiate products amid similar feature sets. Counterfeit and low-quality imports undermine consumer confidence in genuine offerings. It relies on rigorous testing protocols to validate durability and safety claims. Warranty costs rise when products fail to meet performance expectations. It prompts investment in third-party certifications to reassure buyers. Tightening margin pressures challenge ongoing innovation efforts.

Market Opportunities

Emerging Demand in Residential and Hospitality Sectors

Urbanization and rising disposable incomes drive greater investment in premium sleep solutions. The Global Memory Foam Mattress Market benefits from growing demand in residential and hospitality segments. Aging demographics and wellness tourism create need for specialized comfort products. It offers potential for partnerships with healthcare providers to supply therapeutic bedding. Short-term rental platforms seek durable mattresses that deliver guest satisfaction. It supports volume growth through bulk contracts with serviced apartments and homestays. Stakeholders can target emerging markets where organized retail expands mattress penetration.

Expansion Potential through Technological Partnerships and Custom Services

Collaborations with smart technology firms enable integration of sleep tracking features. The Global Memory Foam Mattress Market can leverage direct-to-consumer subscription models. It fosters customer retention through periodic upgrades and personalized maintenance plans. Customizable firmness and modular layering attract niche segments seeking tailored solutions. It opens B2B opportunities with fitness centers and corporate wellness programs. Licensing foam technologies to local manufacturers accelerates geographic reach. Strategic alliances with eco-friendly material suppliers strengthen green credentials.

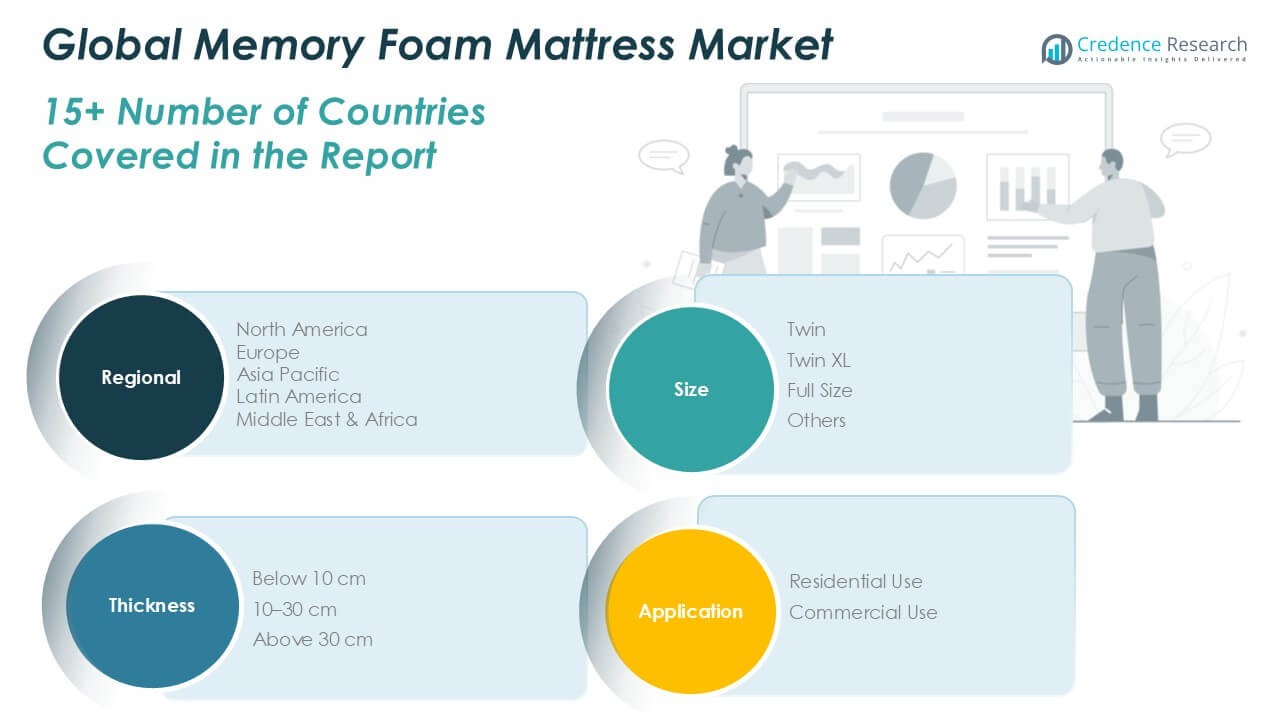

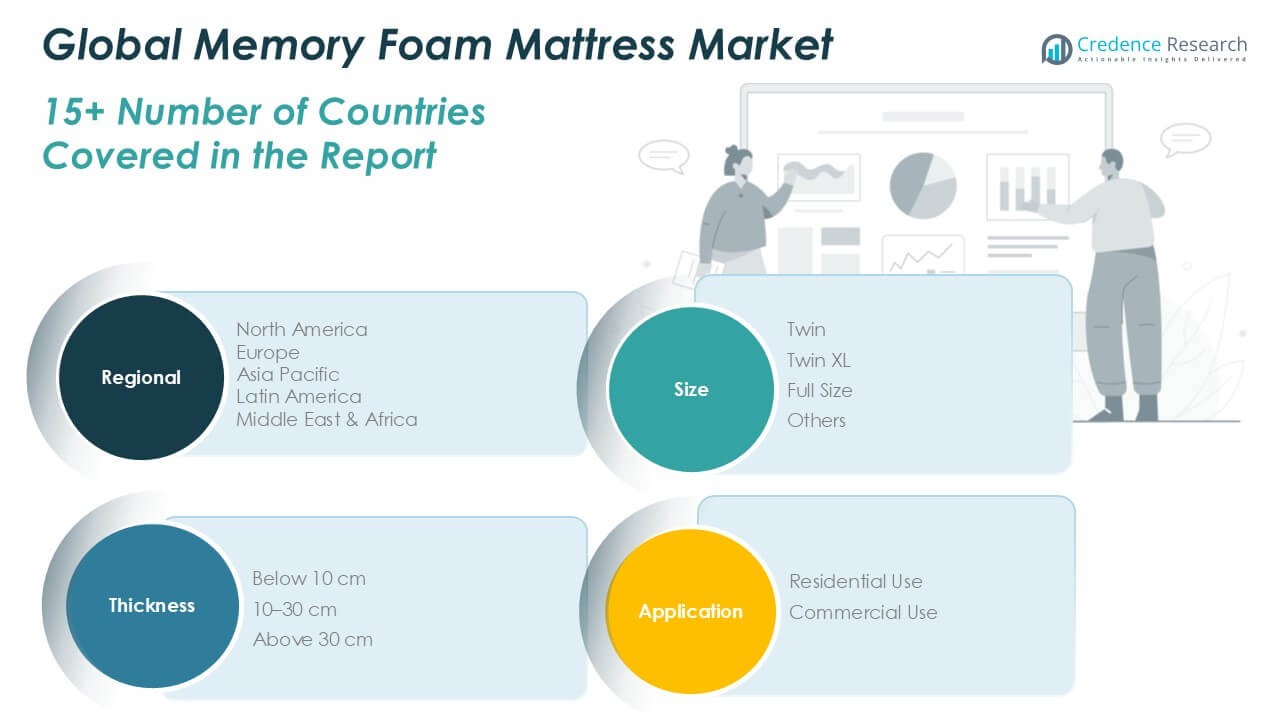

Market Segmentation Analysis

By Size

The Global Memory Foam Mattress Market divides volume and revenue shares among Twin, Twin XL, Full Size, and Others categories. It attributes higher volume share to the Twin segment, driven by youth and guest room demand. Twin XL captures a niche in college housing and hospitality sectors. Full Size secures significant revenue share through family and master bedroom sales. Other sizes, including Queen and King variants, sustain premium pricing strategies. Manufacturers adjust production allocations to match shifting consumer preferences.

- For instance, according to a 2024 industry survey by the International Sleep Products Association, over 12 million Twin size memory foam mattresses were sold globally, compared to 5 million Twin XL, 8 million Full Size, and 15 million in the Others category (including Queen and King sizes).

By Thickness

The Global Memory Foam Mattress Market categorizes offerings into Below 10 cm, 10–30 cm, and Above 30 cm thickness segments. It records strong volume share in the 10–30 cm tier, balancing comfort and cost. Below 10 cm products target portable and mattress-topper applications. Above 30 cm variants achieve higher revenue per unit, catering to luxury and therapeutic niches. Suppliers refine foam densities across these thicknesses to optimize support and durability.

- For instance, company shipment data from 2024 show that approximately 22 million memory foam mattresses in the 10–30 cm thickness range were sold worldwide, compared to 4 million units below 10 cm and 2 million units above 30 cm.

By Application

The Global Memory Foam Mattress Market separates applications into Residential and Commercial uses. It claims dominant volume in residential channels, supported by online and retail distribution. Commercial applications—spanning hotels, healthcare facilities, and short-stay rentals—generate higher revenue per mattress. Brands tailor product features, such as hypoallergenic covers and antimicrobial treatments, to meet specific sector requirements. Strategic partnerships with hospitality chains drive bulk contract growth.

Segments

Based on Size

- Twin

- Twin XL

- Full Size

- Others

Based on Thickness

- Below 10 cm

- 10-30 cm

- Above 30 cm

Based on Application

- Residential Use

- Commercial Use

Based on Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Memory Foam Mattress Market

North America holds a 35.6% regional market share, with sales rising from USD 2,234.5 million in 2018 to USD 3,048.9 million in 2024 and a projected USD 4,410.2 million by 2032. It sustains growth through innovation in gel-infused foams and temperature-regulating covers. High disposable incomes and strong retail networks underpin demand. It benefits from partnerships between mattress makers and sleep clinics. Consumers value warranties and trial periods offered by leading brands. It faces competitive pressure to introduce eco-friendly materials. It maintains a 6.2% CAGR through 2032.

Europe Memory Foam Mattress Market

Europe accounts for 26.2% share, expanding from USD 1,596.0 million in 2018 to USD 2,243.9 million in 2024 and reaching USD 3,307.6 million by 2032. It emphasizes sustainable foams derived from plant-based sources. Stringent chemical regulations drive adoption of certified products. It leverages online and specialty retail channels for premium lines. Consumers seek hypoallergenic and antimicrobial features. It competes on design and thermal performance. It achieves a 5.3% CAGR over the forecast period.

Asia Pacific Memory Foam Mattress Market

Asia Pacific captures 24.8% of the market, growing from USD 1,172.4 million in 2018 to USD 2,124.0 million in 2024 and projected USD 3,805.1 million by 2032. It leads in CAGR at 6.8%, driven by urbanization and rising middle-class incomes. It profits from direct-to-consumer brands that offer trial periods. Manufacturers localize production to reduce costs. It integrates smart sensors in premium models. It addresses tropical climates with enhanced ventilation. It secures bulk contracts with hospitality chains.

Latin America Memory Foam Mattress Market

Latin America holds a 6.1% share, rising from USD 313.4 million in 2018 to USD 522.4 million in 2024 and forecast USD 927.8 million by 2032. It attracts investment from global mattress players entering Brazil and Mexico. It adapts products to local firmness preferences. It relies on e-commerce and regional distributors. It faces logistical challenges in remote areas. It promotes financing options to boost sales. It sustains a 4.8% CAGR through 2032.

Middle East Memory Foam Mattress Market

The Middle East accounts for 4.2% market share, with values climbing from USD 238.0 million in 2018 to USD 359.7 million in 2024 and projected USD 605.1 million by 2032. It leverages luxury hotel partnerships and residential projects. It requires heat-dissipating foam technologies for warm climates. It invests in Arabic-language marketing and localized service centers. It tests antimicrobial treatments for shared accommodations. It balances import reliance with emerging local production. It posts a 3.4% CAGR to 2032.

Africa Memory Foam Mattress Market

Africa commands a 3.1% share, growing from USD 249.6 million in 2018 to USD 265.5 million in 2024 and expected USD 389.9 million by 2032. It targets South Africa and Nigeria through specialty retailers. It adopts portable, lower-thickness models for cost-sensitive segments. It experiments with plant-oil blends to reduce import costs. It engages in trade partnerships to expand distribution networks. It emphasizes warranty offerings to build consumer trust. It achieves a 4.0% CAGR over the forecast period.

Key players

- Tempur Sealy International

- Serta Simmons Bedding

- Sleep Number

- Casper Sleep

- Purple Innovation

- Emma – The Sleep Company

- 3D Biomatrix, Inc.

- King Koil

- Mlily

- Nectar Sleep

- Zinus

- Tuft & Needle

- Ashley Sleep

- Dunlopillo

Competitive Analysis

Competition in the Memory Foam Mattress Market intensifies each manufacturer differentiates through technology, distribution and branding. Tempur Sealy International leverages research capabilities to deliver high-margin premium products. Serta Simmons Bedding expands direct-sales network to reach younger consumers. Sleep Number secures leadership in adjustable support systems with proprietary sleep tracking sensors. Casper Sleep relies on digital marketing and urban pop-up stores to foster brand loyalty. Purple Innovation highlights grid-based foam innovation to solve heat retention. Established players face pressure from value-oriented brands such as Zinus and Tuft & Needle that offer lower-cost alternatives. It demands continuous product upgrades and cost optimization to preserve market position. Strategic partnerships with hospitality and healthcare segments enable volume stability. Environmental certifications and supply chain transparency emerge competitive levers. Consolidation through mergers and acquisitions accelerates scale benefits and operational synergies. New entrants must invest heavily in e-commerce infrastructure and customer service to gain foothold.

Recent Developments

- In July 2024, the FTC moved to block Tempur Sealy International’s $4 billion acquisition of Mattress Firm due to concerns about potential suppression of competition and price increases for consumers. The FTC alleged that the merger would give Tempur Sealy, the world’s largest mattress supplier, the ability and incentive to limit competition and raise prices after acquiring Mattress Firm. The agency filed a complaint in federal court to halt the transaction.

Market Concentration and Characteristics

Market concentration in the Memory Foam Mattress Market remains moderate, with the top five global players capturing over 60% of total revenues. It features an oligopolistic structure, where established brands leverage scale advantages and extensive distribution networks. Niche and direct-to-consumer entrants hold the remaining share, challenging incumbents through competitive pricing and digital engagement. High entry barriers stem from investment needs in R&D, manufacturing infrastructure, and marketing. It relies on product differentiation—such as proprietary foam formulations and smart-bed integrations—to maintain brand loyalty. Channel diversity spans traditional retail, e-commerce, and hospitality partnerships, driving varied competitive dynamics. It underscores the importance of strategic alliances and mergers to achieve operational efficiencies and broaden geographic reach within this evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Size, Thickness, Application and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- It will optimize personalized comfort, pressure relief and performance metrics through data insights. They will analyze biometric sleep data via embedded sensors and adjust firmness and temperature in real time.

- Leading brands will source plant-derived ingredients and implement recycled materials at scale. They will secure third-party eco-certifications to attract environmentally conscious customers.

- Companies will open regional websites and virtual showrooms to reach new markets. They will establish local fulfillment centers to offer free expedited shipping and hassle-free returns.

- Consumers will control mattress settings, bedtime routines, and sleep analytics through mobile apps. Manufacturers will ensure seamless synchronization with existing home automation systems.

- Users will adjust foam densities, support zones, and firmness levels at home. Retailers will preview personalized mattress builds and guarantee tailored comfort before purchase.

- Medical professionals and rehabilitation centers will endorse certified products. Sleep clinics will integrate these mattresses into treatment protocols for chronic pain and mobility improvement.

- Brands will feature high-thread-count fabrics and artisanal mattress covers. They will target affluent consumers seeking exclusive sleep solutions and elevated bedroom aesthetics.

- Hotels and resorts will demand rapid-rebound mattresses with antimicrobial treatments. Manufacturers will offer robust warranties and high-performance specifications for intensive guest turnover.

- Consumers will experience product features via interactive 3D simulations at home. These digital experiences will reduce return rates and strengthen brand engagement.

- Companies will achieve economies of scale and broaden product portfolios through M\&A. They will secure new technologies and expand geographic reach to reinforce competitive positioning.