Market Overview

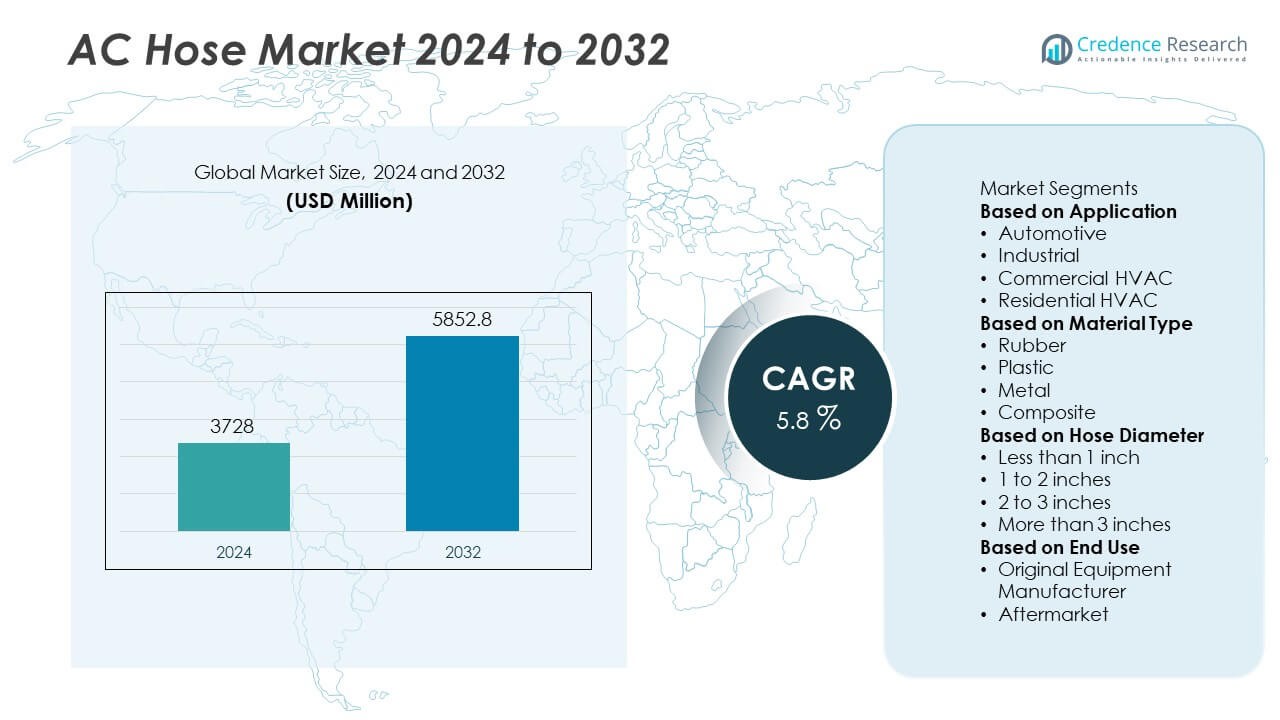

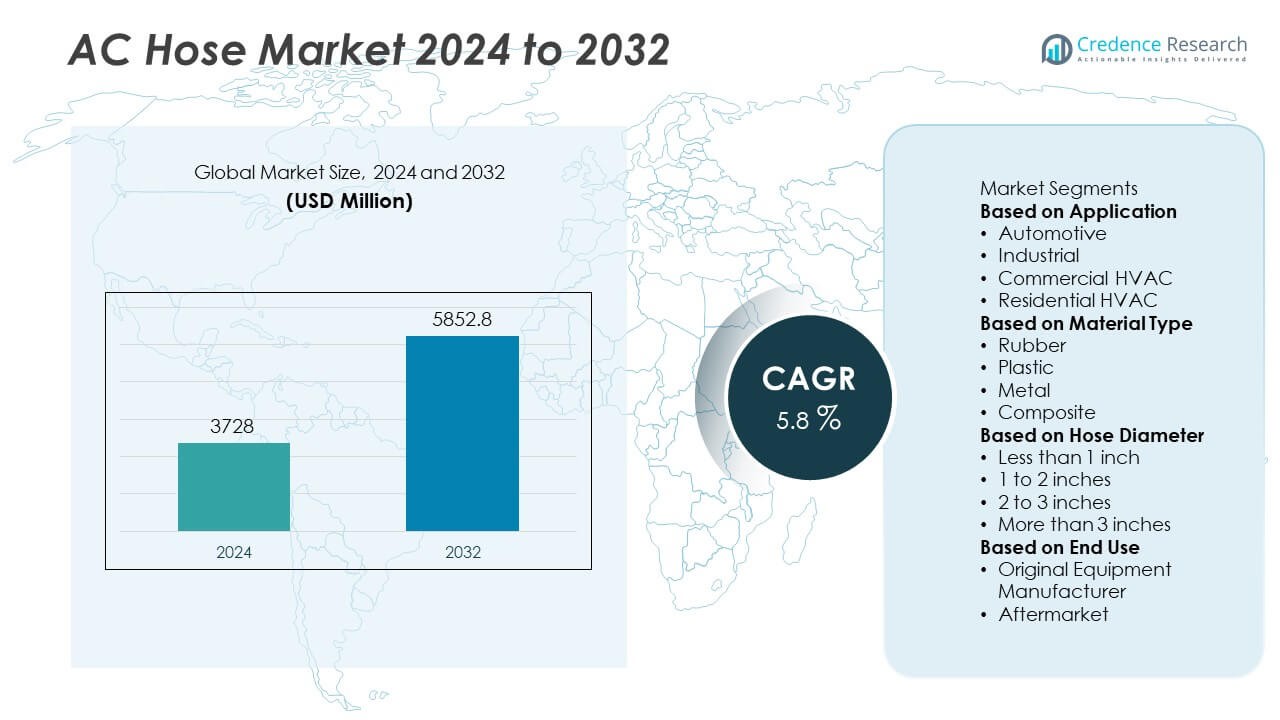

The AC Hose Market was valued at USD 3,728 million in 2024 and is projected to reach USD 5,852.8 million by 2032, growing at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| AC Hose Market Size 2024 |

USD 3,728 Million |

| AC Hose Market, CAGR |

5.8% |

| AC Hose Market Size 2032 |

USD 5,852.8 Million |

AC Hose Market grows with rising vehicle production and increasing demand for air conditioning systems in passenger and commercial vehicles. Automakers integrate advanced HVAC systems to improve comfort and energy efficiency, boosting hose adoption. It benefits from stricter emission regulations that drive development of low-permeation, eco-friendly hose materials.

AC Hose Market shows strong presence across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with Asia-Pacific leading growth due to high vehicle production, urbanization, and rising adoption of air conditioning systems in mass-market vehicles. North America follows with robust demand supported by a large vehicle fleet, extreme weather conditions, and growing adoption of electric and hybrid vehicles requiring advanced thermal management solutions. Europe maintains steady growth, driven by strict emission regulations and a focus on lightweight, eco-friendly hoses compatible with new refrigerants. Latin America and Middle East & Africa present rising opportunities with increasing consumer preference for comfort features and expansion of automotive assembly plants. Key players such as Continental AG, Goodyear Tire and Rubber Company, Sumitomo Riko, and Hosepower LLC focus on developing durable, leak-resistant hoses, investing in R&D for advanced materials, and expanding regional production capabilities to meet global demand efficiently.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- AC Hose Market was valued at USD 3,728 million in 2024 and is projected to reach USD 5,852.8 million by 2032, growing at a CAGR of 5.8%.

- Rising vehicle production and consumer demand for air conditioning systems drive strong adoption across passenger cars, SUVs, and commercial vehicles.

- Trends highlight the use of lightweight, low-permeation, and eco-friendly materials to meet emission norms and improve system efficiency.

- Key players such as Continental AG, Goodyear Tire and Rubber Company, Sumitomo Riko, Hosepower LLC, and Hoses Direct focus on advanced material development, precision manufacturing, and global supply chain expansion.

- Market faces challenges from raw material price volatility, refrigerant transition requirements, and the need for continuous compliance with global emission regulations.

- Asia-Pacific leads growth supported by rising automotive production and electrification, while North America and Europe show steady demand driven by extreme climate conditions and regulatory pressure.

- Opportunities emerge from growing EV production, government incentives for energy-efficient systems, and rising aftermarket demand for durable and maintenance-free AC hoses worldwide.

Market Drivers

Rising Demand for Automotive Air Conditioning Systems

AC Hose Market grows with increasing installation of air conditioning systems in passenger and commercial vehicles. Rising consumer preference for comfort and climate control drives higher demand for reliable hose assemblies. It ensures proper flow of refrigerant, contributing to vehicle performance and cooling efficiency. Automakers integrate advanced AC systems even in entry-level models to meet customer expectations. Growth in the automotive sector, especially in emerging economies, fuels adoption of AC hoses. This demand supports steady revenue for suppliers and manufacturers globally.

- For instance, Continental’s ContiTech division now manufactures the Galaxy OEM #6 AC barrier hose, following its acquisition of Goodyear’s Engineered Products business, Veyance Technologies, in 2015. This hose is recommended for R-134a systems and is available with a 5/16-inch (7.94 mm) inner diameter.

Stringent Emission and Efficiency Standards

AC Hose Market benefits from regulatory pressure to improve energy efficiency and reduce refrigerant leakage. Governments enforce strict emission norms, pushing manufacturers to develop durable and leak-resistant hose materials. It encourages innovation in lightweight and eco-friendly hose designs compatible with low-GWP refrigerants. Automotive OEMs prefer high-performance hoses that meet global standards and support sustainability goals. This compliance-driven demand strengthens the position of premium hose manufacturers. The shift aligns with the industry’s focus on environmental responsibility.

- For instance, Sumitomo Riko has developed automotive AC refrigerant circulation hoses that utilize polymer materials for superior heat resistance and combine rubber and resin technology. Their portfolio of automotive hoses, including AC hoses, features lightweight properties and strong sealing technology to prevent leaks and better withstand harsh engine bay conditions.

Growth in Electric and Hybrid Vehicle Production

AC Hose Market expands with rising production of electric and hybrid vehicles requiring efficient thermal management. EVs depend on optimized AC systems for cabin cooling and battery temperature control. It increases demand for hoses that can handle higher pressures and new refrigerants. Suppliers design specialized hose solutions to improve thermal efficiency and extend vehicle range. Government incentives for EV adoption further support this trend. The transition to electric mobility creates significant growth opportunities for hose manufacturers.

Advancements in Material and Manufacturing Technologies

AC Hose Market is driven by innovations in rubber compounds, thermoplastics, and reinforcement technologies. Advanced materials offer better flexibility, durability, and resistance to extreme temperatures. It enables production of lightweight hoses that improve fuel efficiency and reduce vehicle weight. Automation and precision manufacturing ensure consistent quality and reduced defect rates. Manufacturers invest in R&D to develop hoses compatible with next-generation refrigerants. These technological improvements help suppliers stay competitive and meet evolving automotive requirements.

Market Trends

Shift Toward Lightweight and Eco-Friendly Materials

AC Hose Market is witnessing a transition toward lightweight, recyclable, and low-permeation materials. Automakers focus on reducing vehicle weight to improve fuel efficiency and lower emissions. It drives demand for thermoplastic and advanced rubber hoses with superior strength and flexibility. These materials also enhance resistance to leakage and ensure compatibility with new refrigerants. Manufacturers invest in sustainable production processes to meet environmental regulations. This trend supports the industry’s move toward greener and more efficient automotive components.

- For instance, Gates developed its PolarSeal™ II Hose where a specific version has an inside diameter of 10.3 mm, a maximum working pressure of 350 psi, and meets SAE J3062 Type C, Class I standards.

Integration of Hoses in Advanced HVAC Systems

AC Hose Market benefits from rising adoption of integrated HVAC systems in modern vehicles. Automakers design compact and efficient systems that require precise and reliable hose assemblies. It ensures smooth refrigerant flow for consistent cooling performance in diverse driving conditions. Growing popularity of multi-zone climate control increases demand for specialized hoses. Tier-1 suppliers collaborate with OEMs to develop customized solutions that optimize space and reduce energy consumption. This trend enhances the overall passenger comfort and vehicle performance.

- For instance, Gates offers a PolarSeal II hose, part number 71091, with a continuous operating temperature range of -22°F to +257°F and a minimum bend radius of 50.8 mm for the Dash 8 size, enabling tight routing in complex HVAC module assemblies.

Rising Adoption in Electric and Hybrid Vehicles

AC Hose Market experiences growth from expanding EV and hybrid production worldwide. Thermal management plays a critical role in maintaining battery performance and cabin comfort. It leads to demand for hoses capable of handling high pressures and advanced refrigerants. Manufacturers focus on developing low-conductivity and high-strength hose designs to improve efficiency. EV makers adopt innovative AC systems that require tailored hose configurations. This trend is expected to remain a key growth driver over the coming years.

Focus on Durability and Extended Lifespan

AC Hose Market sees growing emphasis on durability and maintenance-free performance. Customers expect longer-lasting components that reduce service costs and downtime. It drives R&D efforts to create hoses with improved abrasion, ozone, and chemical resistance. High-performance reinforcement layers and precision fittings improve reliability under extreme conditions. OEMs prefer hoses that maintain performance across a wide temperature range. This trend aligns with industry goals of improving overall vehicle quality and customer satisfaction.

Market Challenges Analysis

Volatility in Raw Material Prices and Supply Chain Issues

AC Hose Market faces challenges due to fluctuations in prices of rubber, plastics, and reinforcement materials. Rising costs increase production expenses and impact profit margins for manufacturers. It puts pressure on suppliers to maintain competitive pricing while meeting quality standards. Global supply chain disruptions and logistics delays further affect timely delivery of hoses. Automakers face risks of production slowdowns when component availability becomes uncertain. Companies must invest in supplier diversification and inventory planning to minimize these risks. Ensuring consistent raw material supply remains a major operational challenge.

Stringent Regulatory Compliance and Compatibility Requirements

AC Hose Market is affected by strict environmental regulations and refrigerant transition standards. Manufacturers must design hoses that are compatible with new low-GWP refrigerants while preventing leakage. It requires significant R&D investment and continuous product testing to meet global compliance. Failure to meet standards can lead to recalls and reputational damage. Smaller players struggle to keep up with evolving norms due to high development costs. OEMs demand validated and certified components, raising entry barriers for new suppliers. Maintaining compliance while managing costs remains a key challenge for industry participants.

Market Opportunities

Rising Demand from Emerging Automotive Markets

AC Hose Market holds strong opportunities due to growing vehicle production in Asia-Pacific, Latin America, and Africa. Rising disposable incomes and urbanization drive demand for passenger vehicles equipped with air conditioning systems. It encourages OEMs to expand manufacturing facilities and increase local sourcing of components. Governments support automotive sector growth through incentives and infrastructure development. Suppliers can capture significant market share by offering cost-effective and reliable hose solutions tailored to regional needs. This expansion opens new revenue streams for global and regional players.

Innovation in Thermal Management for Electric Vehicles

AC Hose Market gains growth potential from increasing adoption of electric and hybrid vehicles requiring advanced cooling systems. EVs depend on efficient AC hoses to manage battery temperature and maintain cabin comfort. It creates demand for specialized hoses capable of handling higher pressures and next-generation refrigerants. Manufacturers investing in lightweight, high-performance materials can gain competitive advantage. Collaborations with EV makers help suppliers design custom solutions for optimized thermal efficiency. This trend positions hose manufacturers to benefit from the accelerating transition to electric mobility.

Market Segmentation Analysis:

By Application

AC Hose Market is segmented by application into passenger cars, commercial vehicles, and off-highway vehicles. Passenger cars hold the largest share due to high demand for air conditioning systems across compact, mid-size, and luxury models. It supports vehicle comfort and contributes to energy-efficient climate control. Commercial vehicles, including trucks and buses, show steady demand for durable hoses to maintain cooling in heavy-duty conditions. Off-highway vehicles such as construction and agricultural equipment also integrate AC hoses to improve operator comfort. Growth in each segment is driven by rising production volumes and consumer expectations for thermal comfort.

- For instance, Continental’s Galaxy SLE G4890 AC suction-hose series offers an inside diameter of 12.7 mm (½ inch), an outside diameter of 19.40 mm, and a minimum burst pressure of 2 000 psi for the -10 size.

By Material Type

AC Hose Market by material type includes rubber hoses, thermoplastic hoses, and metal-reinforced hoses. Rubber hoses remain widely used due to flexibility, cost efficiency, and reliable performance. It performs well under varying pressure and temperature ranges. Thermoplastic hoses gain popularity for their lightweight construction and improved resistance to chemical degradation. Metal-reinforced hoses are preferred for high-pressure applications and extreme operating conditions. Continuous R&D focuses on developing low-permeation and eco-friendly materials to meet regulatory requirements and improve system efficiency.

- For instance, Sumitomo Riko’s ADVANSTAR DHD-4SP hose in size -25 (25.4 mm inner diameter) has a maximum working pressure of 4,061 psi (280 bar), a minimum burst pressure of 16,244 psi (1120 bar), and a minimum bend radius of 340 mm.

By Hose Diameter

AC Hose Market by hose diameter is categorized into small, medium, and large bore hoses. Small diameter hoses are commonly used in passenger cars where space is limited and weight reduction is critical. It offers compact routing options while maintaining refrigerant flow efficiency. Medium diameter hoses are widely adopted in SUVs, light trucks, and commercial vehicles for balanced performance and durability. Large bore hoses are designed for heavy-duty and off-road applications where higher refrigerant flow rates are required. This segmentation allows manufacturers to offer tailored solutions for different vehicle categories and performance needs.

Segments:

Based on Application

- Automotive

- Industrial

- Commercial HVAC

- Residential HVAC

Based on Material Type

- Rubber

- Plastic

- Metal

- Composite

Based on Hose Diameter

- Less than 1 inch

- 1 to 2 inches

- 2 to 3 inches

- More than 3 inches

Based on End Use

- Original Equipment Manufacturer

- Aftermarket

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 26% market share in the AC Hose Market, supported by strong demand for passenger vehicles and SUVs equipped with advanced air conditioning systems. The U.S. leads production, with automakers integrating efficient HVAC systems across all vehicle segments to meet rising consumer expectations for comfort. It benefits from steady replacement demand driven by the large on-road vehicle fleet and harsh weather conditions that require reliable cooling. Growth in electric and hybrid vehicle adoption also fuels demand for specialized AC hoses designed for thermal management systems. Canada and Mexico contribute significantly through manufacturing facilities and supply chain networks, strengthening regional production capacity. The focus on energy efficiency and compliance with environmental standards further boosts innovation in hose design and materials.

Europe

Europe accounts for 29% market share, making it one of the leading regions for the AC Hose Market. Strong automotive manufacturing bases in Germany, France, and Italy drive consistent demand for advanced HVAC components. It benefits from strict EU regulations on emissions and refrigerant leakage, encouraging adoption of low-permeation and eco-friendly hoses. European OEMs invest in lightweight materials and compact system designs to enhance fuel efficiency. The region is also experiencing growth in electric and plug-in hybrid vehicles, which require specialized hoses for battery cooling and cabin climate control. Expansion of premium vehicle production supports the use of high-performance and durable hoses. Collaboration between Tier-1 suppliers and automakers accelerates innovation and product customization to meet regional requirements.

Asia-Pacific

Asia-Pacific captures 33% market share and represents the fastest-growing region in the AC Hose Market. China, India, Japan, and South Korea are major contributors, driven by rapid urbanization, rising disposable incomes, and strong vehicle production rates. It benefits from growing demand for air-conditioned vehicles even in entry-level segments, making AC systems a standard feature. Government initiatives promoting electric vehicle manufacturing and adoption support development of hoses designed for next-generation refrigerants and high-pressure systems. Local suppliers expand capacity to meet the needs of global OEMs operating in the region. Rising exports of vehicles from Asia-Pacific further boost production of AC hoses for international markets. Continuous investment in R&D and manufacturing technology enhances competitiveness of regional players.

Latin America

Latin America holds 7% market share, driven by increasing demand for passenger vehicles and light commercial vehicles with integrated AC systems. Brazil and Mexico dominate production, supported by automotive assembly plants catering to both domestic and export markets. It faces challenges from economic fluctuations but continues to show steady growth due to improving living standards and consumer expectations for in-vehicle comfort. Adoption of replacement hoses also supports aftermarket demand. Regional suppliers focus on providing cost-effective and durable hoses suitable for diverse climate conditions.

Middle East & Africa

Middle East & Africa represent 5% market share, supported by the high need for efficient cooling systems due to extreme weather conditions. Gulf countries such as UAE and Saudi Arabia lead adoption with high vehicle ownership and demand for reliable HVAC components. It benefits from strong aftermarket sales as harsh operating conditions increase replacement frequency. South Africa and Nigeria contribute to demand with growing passenger and commercial vehicle markets. Investment in automotive distribution networks and assembly plants further supports regional growth. Rising interest in electric mobility is expected to create future demand for specialized AC hoses designed for EV thermal management.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Sae International

- Hoses Direct

- Continental AG

- Goodyear Tire and Rubber Company

- Sumitomo Riko

- Dexter Magnetic Technologies

- Hosepower LLC

- Rubber and Plastics Company

- Air Systems Components

- Hydraulic Hose Manufacturer

Competitive Analysis

Competitive landscape of the AC Hose Market is shaped by leading players such as Continental AG, Goodyear Tire and Rubber Company, Sumitomo Riko, Hosepower LLC, Hoses Direct, Rubber and Plastics Company, Dexter Magnetic Technologies, Air Systems Components, and Sae International. These companies focus on developing advanced hose designs with improved flexibility, durability, and resistance to refrigerant leakage. They invest in R&D to produce low-permeation hoses compatible with next-generation refrigerants and meet stringent global emission standards. Strategic partnerships with automakers and HVAC system manufacturers enable them to deliver customized solutions for passenger cars, commercial vehicles, and electric vehicle applications. Players expand production capacity and adopt automation technologies to enhance quality and reduce manufacturing costs. Global presence and robust distribution networks help ensure timely delivery and support aftermarket demand. Continuous innovation in lightweight materials and thermal management solutions allows these companies to maintain competitiveness and capture new opportunities in growing automotive markets.

Recent Developments

- In June 2025, Continental AG, Introduced a multi-purpose marine hose to simplify vessel maintenance.

- In February 2025, Sumitomo Riko exhibited mobility components at H2 & FC EXPO.

- In December 2024, Continental AG, Unveiled the X-Life XCP5 hose: a high-pressure braided hose (5000 PSI), ISO 18752 compliant, with extra abrasion resistance.

- In January 2024, Continental revealed a new hydraulic hose plant plan in Aguascalientes, Mexico.

Report Coverage

The research report offers an in-depth analysis based on Application, Material Type, Hose Diameter, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for AC hoses will rise with increasing global vehicle production and HVAC system installation.

- Adoption of lightweight and low-permeation materials will become a key manufacturing priority.

- Electric and hybrid vehicle growth will create demand for specialized thermal management hoses.

- Development of hoses compatible with next-generation refrigerants will gain momentum.

- Automation in manufacturing will improve quality control and reduce production costs.

- Aftermarket demand will grow due to aging vehicle fleets and replacement needs.

- Asia-Pacific will remain the fastest-growing region with expanding automotive production.

- Strategic partnerships with OEMs will drive innovation and customized product development.

- Regulatory compliance will continue to shape product design and material selection.

- Focus on durability and extended lifespan will enhance customer satisfaction and reduce maintenance costs.