| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Party Supplies Market Size 2024 |

USD 12,935.90 million |

| Party Supplies Market, CAGR |

7.34% |

| Party Supplies Market Size 2032 |

USD 22,799.25 million |

Market Overview

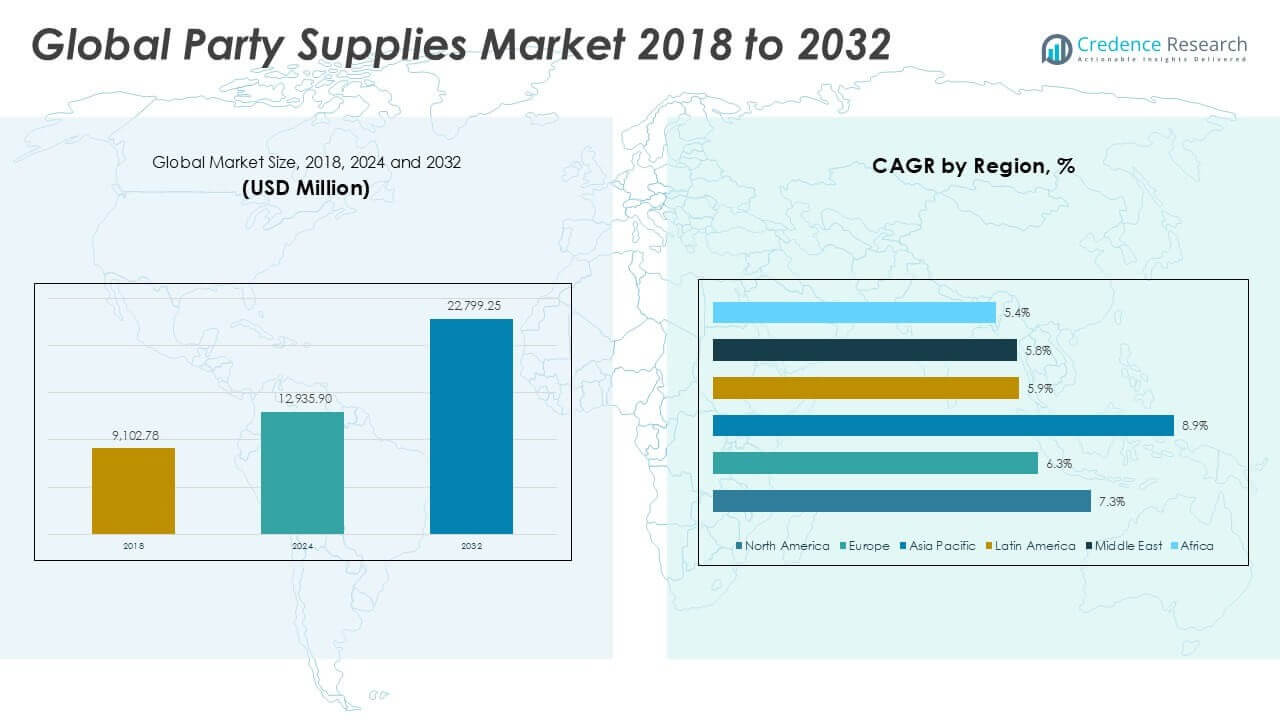

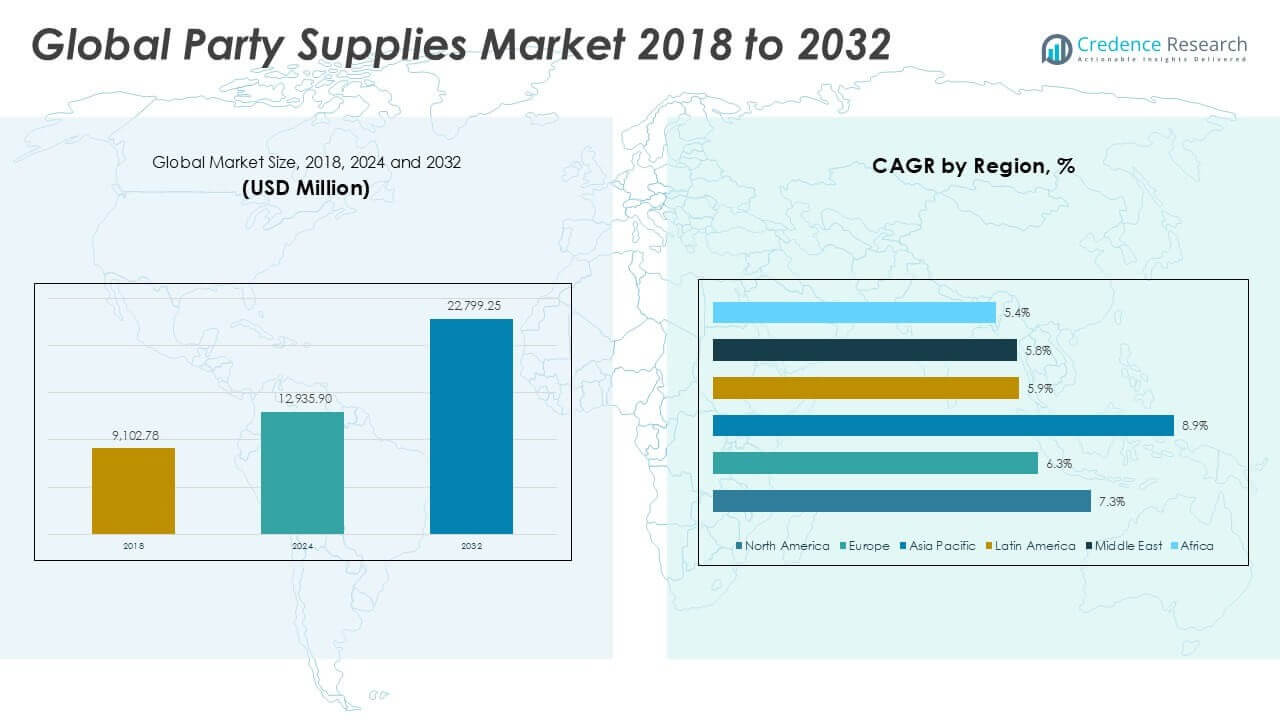

Party Supplies Market size was valued at USD 9,102.78 million in 2018 to USD 12,935.90 million in 2024 and is anticipated to reach USD 22,799.25 million by 2032, at a CAGR of 7.34% during the forecast period.

Party Supplies Market continues to gain momentum, driven by rising disposable incomes, increased socialization, and the growing trend of themed celebrations across both developed and emerging economies. Urbanization and a strong culture of event hosting—such as birthdays, weddings, corporate gatherings, and seasonal festivities—fuel demand for a wide range of party supplies, including decorations, tableware, and balloons. E-commerce platforms significantly enhance market accessibility and product variety, allowing consumers to customize purchases and stay updated on new trends. Sustainability is shaping purchasing decisions, as eco-friendly and reusable party products gain popularity in response to environmental concerns. Additionally, the influence of social media and digital marketing accelerates consumer engagement, with influencers and brands promoting creative party themes and innovative decor ideas. Collectively, these factors are expected to support steady growth and diversification within Party Supplies Market over the coming years.

The Party Supplies Market demonstrates robust growth across diverse geographies, with North America, Europe, and Asia Pacific emerging as major regions of demand. North America leads the market due to high consumer spending and a strong culture of event hosting in the United States and Canada. Europe follows closely, supported by rich cultural traditions and a rising preference for eco-friendly products in countries such as the United Kingdom, Germany, and France. Asia Pacific is witnessing rapid expansion, fueled by urbanization and increasing disposable incomes in China, India, and Japan. Key players shaping the competitive landscape include Party City Holdco Inc., Unique Industries, Inc., and American Greetings Corporation, each offering extensive product portfolios and leveraging strong distribution networks. Pioneer Worldwide also plays a significant role with a focus on innovative and customized party products. Collectively, these companies drive product development and market reach, adapting to evolving consumer preferences across regions.

Market Insights

- The Party Supplies Market was valued at USD 12,935.90 million in 2024 and is projected to reach USD 22,799.25 million by 2032, growing at a CAGR of 7.34% during the forecast period.

- Increasing disposable incomes, urbanization, and a rising culture of celebrations and themed events are driving robust market demand worldwide.

- E-commerce expansion and digital marketing enable greater accessibility and variety, making it easier for consumers to discover and purchase party supplies online.

- Key trends include the growing popularity of themed and personalized party products, as well as a noticeable shift toward eco-friendly and sustainable materials.

- Leading companies such as Party City Holdco Inc., Unique Industries, Inc., and American Greetings Corporation focus on product innovation and strategic partnerships to maintain competitive advantage.

- Market restraints include regulatory pressures related to single-use plastics, economic uncertainties impacting consumer spending, and supply chain challenges in sourcing raw materials.

- North America dominates the market with strong event culture and consumer spending, while Asia Pacific is the fastest-growing region, driven by urbanization and expanding middle-class populations.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Disposable Income and Urbanization Stimulate Market Demand

Increasing disposable incomes and rapid urbanization fuel the demand for party supplies worldwide. With more consumers able to spend on discretionary products, event-hosting activities such as birthdays, anniversaries, and social gatherings have become more frequent. The Party Supplies Market benefits from this shift in consumer behavior, supporting a growing preference for elaborate celebrations and visually appealing decorations. Urban centers, in particular, drive market expansion with higher event frequency and demand for premium, customized party products. Changing lifestyles and the pursuit of unique experiences further influence spending patterns in this segment. The combination of economic growth and evolving social trends continues to support robust market performance.

- For instance, the event planning industry, which significantly contributes to the party supplies sector, generated revenues of approximately $5 billion in 2022.

Sustainability and Eco-Friendly Product Innovations

Environmental concerns are shaping the future of party supplies, driving demand for sustainable and reusable products. Consumers show a preference for biodegradable decorations, recyclable tableware, and minimal packaging to reduce environmental impact. The Party Supplies Market embraces these trends, encouraging manufacturers to innovate with eco-friendly materials and responsible sourcing practices. Regulatory pressures and increased awareness about waste generation push brands to develop greener alternatives. Sustainability initiatives create opportunities for differentiation and long-term brand loyalty. The shift toward environmentally conscious choices is expected to strengthen the market’s resilience and relevance in the years ahead.

- For instance, single-use plastic party supplies are being substituted with biodegradable, compostable, and recyclable options like paper decorations, bamboo tableware, and reusable fabric banners.

E-commerce Expansion Enhances Accessibility and Product Variety

The rapid growth of e-commerce platforms transforms the purchasing landscape for party supplies. Online channels offer consumers access to a vast selection of products, competitive pricing, and the convenience of home delivery. The Party Supplies Market leverages digital platforms to introduce innovative designs and themed collections, capturing a broad audience. E-commerce facilitates greater product customization and personalization, aligning with consumer demand for tailored event experiences. Social media marketing and influencer collaborations drive awareness and inspiration, prompting quick purchasing decisions. Digital transformation within the industry contributes significantly to the market’s sustained growth trajectory.

Growing Popularity of Themed and Seasonal Events

The rising trend of themed parties and seasonal celebrations propels demand for diverse and creative party supplies. Consumers increasingly seek coordinated decorations, tableware, and party favors that reflect specific themes or holidays. The Party Supplies Market responds with a wide assortment of products that cater to both traditional and contemporary tastes. Seasonal events such as Halloween, Christmas, and New Year’s Eve generate recurring spikes in demand, supporting year-round business opportunities for suppliers. The market also witnesses the influence of pop culture and media on product offerings, expanding the appeal to different age groups and demographics. This emphasis on creativity and personalization solidifies the market’s dynamic growth.

Market Trends

E-commerce and Digitalization Transform Consumer Access

The proliferation of online retail channels has revolutionized the way consumers access and purchase party supplies. The Party Supplies Market benefits from the seamless experience offered by e-commerce platforms, which provide a broad selection of products, flexible payment options, and doorstep delivery. It enables consumers to compare prices, discover new trends, and source unique items beyond local availability. Brands and manufacturers leverage digital marketing and influencer partnerships to increase visibility and boost product awareness. Virtual event planning tools and interactive online catalogs help consumers visualize their celebrations, enhancing confidence in their purchasing decisions. This digital shift supports a dynamic marketplace, offering greater accessibility and convenience.

- For instance, digital marketing campaigns and influencer partnerships have boosted online sales of party supplies, increasing consumer engagement.

Growing Popularity of Customization and Themed Parties

A strong preference for personalization drives demand for unique and themed party supplies. The Party Supplies Market sees increased interest in customized decorations, coordinated tableware, and exclusive party favors tailored to specific occasions and individual tastes. It responds to consumer expectations by introducing product lines that cater to diverse themes, from classic milestones to pop culture-inspired events. Social media plays a vital role in amplifying the popularity of personalized celebrations, with visually striking content encouraging trend adoption. Custom printing, on-demand design, and interactive planning services allow for a high level of individual expression. The focus on themed experiences boosts market growth and sets a competitive standard for innovation.

Sustainability and Eco-Friendly Product Adoption Accelerate

Growing environmental consciousness prompts significant changes in product development and purchasing behavior within the party supplies sector. The Party Supplies Market is witnessing increased demand for biodegradable, recyclable, and reusable materials, reflecting a shift toward sustainability. It encourages manufacturers to reduce single-use plastics, introduce eco-friendly packaging, and promote responsible sourcing. Regulatory frameworks and consumer advocacy for green alternatives further accelerate the adoption of sustainable practices. Brands that prioritize eco-friendly solutions enjoy stronger customer loyalty and differentiation in a crowded market. The emphasis on sustainability reshapes the industry and guides future product innovations.

Seasonal and Cultural Events Fuel Year-Round Demand

Recurring seasonal celebrations and cultural events underpin consistent demand for party supplies throughout the year. The Party Supplies Market captures significant sales spikes during holidays such as Christmas, Halloween, and New Year’s Eve, as well as cultural festivals and major life milestones. It benefits from the spread of holiday traditions and the increasing popularity of themed gatherings among all age groups. Regional variations in festivities allow for diversified product offerings and marketing campaigns. Continuous product refreshes aligned with event calendars sustain consumer interest and drive repeat purchases. This year-round demand creates stability and opportunities for sustained market expansion.

- For instance, festive and cultural celebrations, such as New Year, Christmas, and Halloween, fuel market growth.

Market Challenges Analysis

Sustainability Pressures and Regulatory Compliance Intensify

Rising environmental concerns and stricter regulations challenge the Party Supplies Market, pushing it to rethink traditional manufacturing and packaging practices. Growing public scrutiny of single-use plastics and non-biodegradable materials places pressure on companies to adopt eco-friendly alternatives. It must invest in research and development to create sustainable products that align with evolving consumer preferences and comply with new government mandates. The transition to green materials can increase production costs and affect supply chain dynamics, requiring close collaboration with suppliers and ongoing process adjustments. Brands that fail to address these sustainability issues risk losing market share and facing reputational damage. The market’s long-term viability hinges on its ability to innovate and adapt quickly to these changing requirements.

Economic Uncertainty and Fluctuating Consumer Spending

Economic volatility and shifts in consumer spending patterns present persistent challenges for the Party Supplies Market. Unpredictable factors such as inflation, currency fluctuations, and crises impact discretionary purchases, leading to fluctuating demand for party supplies. It faces heightened competition from low-cost and unbranded alternatives, putting pressure on margins and profitability. Supply chain disruptions, logistical delays, and rising raw material costs further complicate operations and pricing strategies. Market participants must remain agile, diversifying product lines and optimizing operational efficiency to withstand economic headwinds. Sustained growth depends on the market’s capacity to manage these risks while maintaining product appeal and customer loyalty.

- For instance, the increasing prevalence of e-commerce platforms has significantly boosted the party supplies market, offering consumers a wide variety of products at competitive prices.

Market Opportunities

Expansion into Emerging Markets and New Demographics

Rapid urbanization and rising disposable incomes in emerging markets present significant growth opportunities for the Party Supplies Market. It can tap into new customer segments by expanding distribution networks and tailoring products to regional tastes and cultural celebrations. Brands that invest in localized marketing and adapt their offerings to reflect local traditions stand to gain market share. Partnerships with local retailers and e-commerce platforms facilitate deeper market penetration and enhance brand visibility. Understanding the preferences of younger consumers and families can drive product innovation and sustain long-term growth. The ability to effectively reach these untapped demographics will shape future market dynamics.

Innovation in Product Design and Sustainable Solutions

Ongoing demand for personalization and sustainable products creates avenues for innovation within the Party Supplies Market. It can leverage advances in materials science and digital printing to offer customized, eco-friendly party supplies that appeal to environmentally conscious consumers. Introducing reusable and biodegradable products strengthens competitive positioning and aligns with sustainability trends. Brands that embrace digital technologies for interactive design, virtual party planning, and personalized customer experiences can further differentiate themselves in a crowded market. Enhanced product functionality, creative packaging, and trend-responsive collections attract new consumers and foster brand loyalty. Innovation in both design and sustainability remains central to capturing emerging opportunities.

Market Segmentation Analysis:

By Product Type:

By product type, balloons, banners, pinatas, games, home decor, tableware/disposables, and take away gifts represent the primary categories, with balloons and tableware/disposables driving substantial revenue due to their essential role in both small and large-scale events. The market sees continuous innovation in design and functionality across all product types, with eco-friendly and themed products gaining traction.

By Application:

By application, it serves both commercial and domestic users, with domestic use accounting for a larger share owing to frequent household celebrations, while commercial use includes events, corporate gatherings, and institutional parties.

By Distribution Channel:

In terms of distribution channel, supermarket/hypermarket and specialized stores remain vital for immediate purchases and product variety. E-commerce experiences rapid growth, offering extensive selection, customization, and convenience for both end-users and event planners. The Party Supplies Market leverages these segmented approaches to maximize reach and adaptability in a dynamic consumer landscape.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product Type:

- Balloons

- Banners

- Pinatas

- Games

- Home Decor

- Tableware/Disposables

- Take Away Gifts

- Others

Based on Application:

- Commercial Use

- Domestic Use

Based on Distribution Channel:

- Supermarket/Hypermarket

- Convenience Stores

- Specialized Stores

- E-commerce

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America Party Supplies Market

North America Party Supplies Market grew from USD 3,991.11 million in 2018 to USD 5,613.08 million in 2024 and is projected to reach USD 9,920.30 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.3%. North America holds the largest market share at 44%, driven by strong consumer spending in the United States and Canada. It benefits from established event culture, high disposable incomes, and robust distribution channels, including specialized party stores and large retail chains. The U.S. remains the dominant country, with a thriving e-commerce sector and widespread adoption of themed parties and seasonal celebrations. Canada contributes steady growth, particularly in urban centers. Market participants focus on product innovation and sustainable solutions to maintain competitive advantage in this region.

Europe Party Supplies Market

Europe Party Supplies Market increased from USD 2,171.56 million in 2018 to USD 2,953.69 million in 2024 and is forecast to reach USD 4,841.03 million by 2032, at a CAGR of 6.3%. Europe accounts for a 21% market share, led by the United Kingdom, Germany, and France. The region features a diverse range of cultural festivities, driving demand for both traditional and contemporary party supplies. It benefits from mature retail infrastructure and rising interest in eco-friendly products, with several countries implementing strict regulations on single-use plastics. E-commerce growth continues, supporting accessibility and variety. European consumers place emphasis on quality and sustainability, shaping supplier strategies.

Asia Pacific Party Supplies Market

Asia Pacific Party Supplies Market expanded from USD 1,787.24 million in 2018 to USD 2,748.55 million in 2024 and is expected to reach USD 5,474.44 million by 2032, posting the highest CAGR of 8.9%. Asia Pacific holds a 24% market share, with China, Japan, and India as key contributors. Rapid urbanization, rising disposable incomes, and increasing popularity of western-style celebrations fuel demand. The region experiences strong growth in online sales, with local and international brands enhancing their digital presence. Customized and themed products are in high demand for weddings, birthdays, and festivals. Expanding middle-class populations further drive market expansion.

Latin America Party Supplies Market

Latin America Party Supplies Market grew from USD 518.86 million in 2018 to USD 729.75 million in 2024 and is anticipated to reach USD 1,163.97 million by 2032, with a CAGR of 5.9%. Latin America represents a 5% market share, with Brazil and Mexico as leading countries. Festive culture and frequent community gatherings support steady demand for party supplies. The market faces challenges from economic volatility but benefits from the popularity of traditional events such as Carnival and Día de los Muertos. Supermarkets and local party stores dominate distribution, though e-commerce adoption is rising. Suppliers adapt offerings to reflect regional tastes and customs.

Middle East Party Supplies Market

Middle East Party Supplies Market expanded from USD 395.06 million in 2018 to USD 530.29 million in 2024 and is projected to reach USD 843.42 million by 2032, registering a CAGR of 5.8%. The region accounts for a 4% market share, with the United Arab Emirates and Saudi Arabia leading sales. Cultural and religious celebrations such as Eid and weddings create sustained demand for party supplies. It benefits from growth in retail development and increasing adoption of western-style parties among younger populations. Market growth is supported by luxury and premium product segments. Online channels continue to gain traction in urban markets.

Africa Party Supplies Market

Africa Party Supplies Market grew from USD 238.95 million in 2018 to USD 360.54 million in 2024 and is set to reach USD 556.10 million by 2032, achieving a CAGR of 5.4%. Africa represents a 2% market share, with South Africa and Nigeria as prominent countries. Growing urbanization, youthful demographics, and rising middle-class incomes stimulate demand. The market remains highly price-sensitive, with informal retail channels playing a significant role. It faces challenges from limited distribution infrastructure but sees gradual growth in organized retail and e-commerce. Cultural festivals and family celebrations drive seasonal spikes in product sales.

Key Player Analysis

- Party City Holdco Inc.

- Unique Industries, Inc.

- American Greetings Corporation

- Pioneer Worldwide

- Shutterfly, Inc.

- Hallmark Licensing, LLC

- Artisano Designs

- Huhtamaki

- Omni Media Inc

- Martha Stewart Living

- Chinet

- Artisano Designs

Competitive Analysis

The competitive landscape of the Global Party Supplies Market features a mix of established brands and innovative entrants, with leading players including Party City Holdco Inc., Unique Industries, Inc., American Greetings Corporation, Pioneer Worldwide, Shutterfly, Inc., Hallmark Licensing, LLC, Artisano Designs, Huhtamaki, Omni Media Inc, Martha Stewart Living, and Chinet. These companies maintain market leadership through comprehensive product portfolios that address diverse consumer needs, from classic decorations to themed, personalized, and eco-friendly offerings. Strategic distribution is central to their success, leveraging both traditional retail channels and expanding e-commerce platforms to maximize reach and convenience. Innovation remains a key differentiator, with top players investing in product design, digital integration, and sustainable materials to capture evolving consumer trends. Partnerships, licensing agreements with entertainment brands, and influencer collaborations further enhance brand visibility and customer engagement. Financial strength and global supply chain networks support operational resilience, while local customization and targeted marketing drive relevance in key regions. The market’s competitive intensity encourages continuous improvement and rapid adaptation, enabling leading players to set industry standards and respond proactively to regulatory, technological, and demographic shifts.

Recent Developments

- In May 2025, Huhtamaki Egypt secured the Golden License to build a sustainable molded fiber packaging plant in Sadat City, Egypt, with operations expected to begin in August 2026. The facility will use recycled wastepaper and advanced technology to produce eco-friendly packaging.

- In February 2025, Party City locations were restocked with new merchandise as store closing sales entered final weeks, indicating a major transition in retail operations.

- In February 2025, Elliott Investment Management completed its acquisition of a majority stake in American Greetings, with CD&R and the Weiss family retaining significant minority interests. The move is expected to accelerate growth and innovation.

- In January 2025,Pioneer Corporation launched an R&D center in Germany to bolster its B2B business with European automakers, focusing on sound solutions for vehicles.

Market Concentration & Characteristics

The Party Supplies Market exhibits moderate market concentration, with a handful of large multinational companies dominating significant share alongside numerous regional and niche players. It features a highly dynamic and seasonal demand pattern, driven by holidays, festivals, and milestone celebrations across diverse demographics. The market is characterized by rapid product innovation, short product life cycles, and a strong focus on customization and themed offerings. E-commerce plays a pivotal role in broadening market access and facilitating consumer engagement, while sustainability and regulatory compliance shape product development strategies. Companies emphasize agility, trend responsiveness, and customer-centric design to maintain competitive positioning. The Party Supplies Market thrives on its ability to quickly adapt to changing consumer preferences, event trends, and emerging technologies.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Companies will continue to develop more customizable and themed products to cater to niche markets and individual preferences.

- Sustainability will remain a central focus, with increased investment in biodegradable, recyclable, and reusable party supplies.

- The rise of influencer marketing and user-generated content will drive brand awareness and shape consumer choices in party supply categories.

- Suppliers will enhance logistics and delivery capabilities to meet growing consumer expectations for speed and reliability, especially in urban markets.

- Cross-border e-commerce will open new growth avenues, allowing brands to reach international customers and expand beyond traditional boundaries.

- The integration of digital tools, such as party planning apps and online visualization software, will simplify the consumer planning process.

- Seasonal and cultural celebrations will continue to generate strong, recurring demand, encouraging product refreshes and limited-edition collections.

- Corporate and institutional event segments will provide growth opportunities through bulk orders and premium party supply solutions.

- Companies will explore collaborations with entertainment and media brands to launch exclusive, licensed collections that capture fan interest.

- The market will see increased competition from emerging players, encouraging continuous innovation, quality improvements, and competitive pricing strategies.