Market Overview

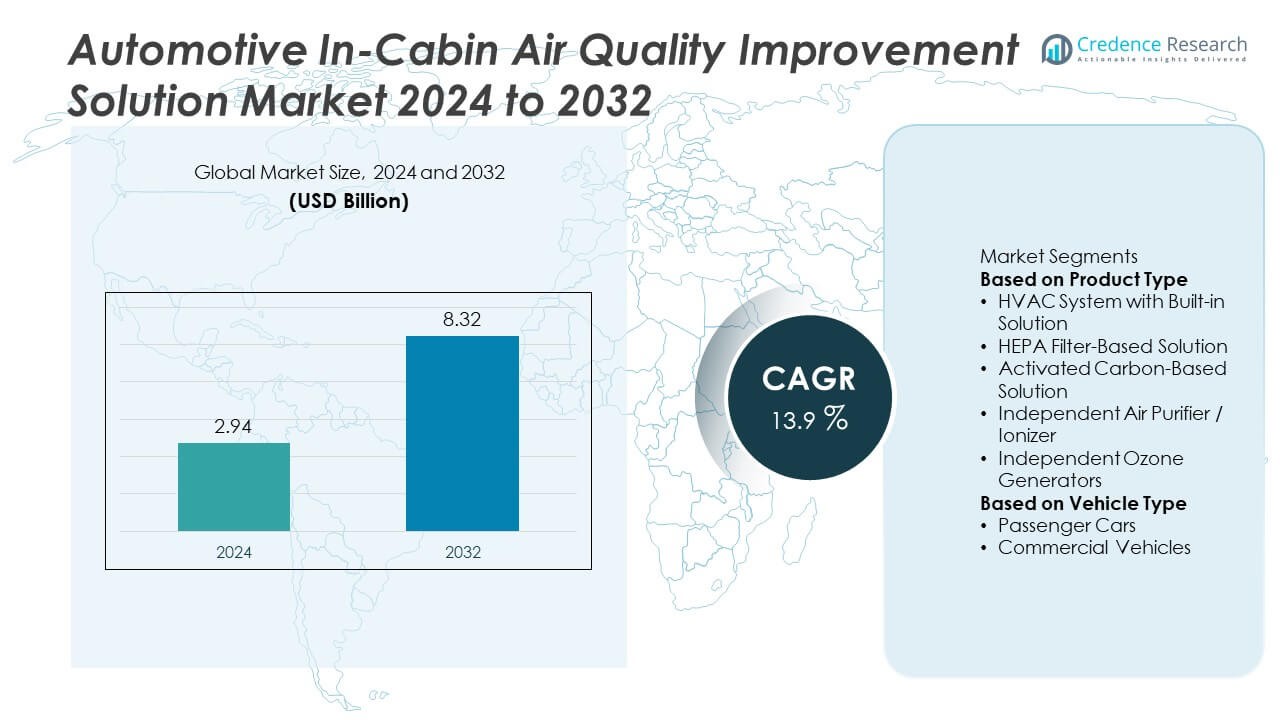

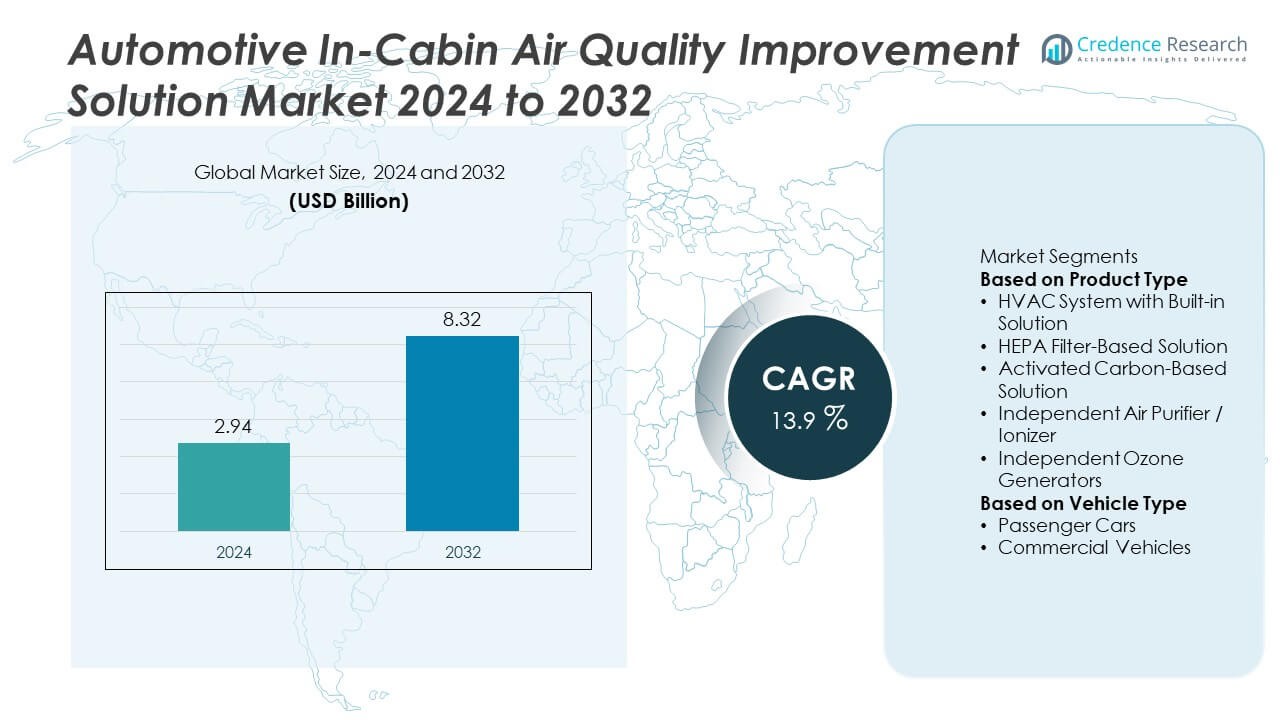

Automotive In-Cabin Air Quality Improvement Solution market size was valued at USD 2.94 billion in 2024 and is projected to reach USD 8.32 billion by 2032, growing at a CAGR of 13.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive In-Cabin Air Quality Improvement Solution Market Size 2024 |

USD 2.94 Billion |

| Automotive In-Cabin Air Quality Improvement Solution Market, CAGR |

13.9% |

| Automotive In-Cabin Air Quality Improvement Solution Market Size 2032 |

USD 8.32 Billion |

Top players in the Automotive In-Cabin Air Quality Improvement Solution market include MANN+HUMMEL, Toyota, Valeo, Marelli, DENSO Corporation, Bosch, MAHLE GmbH, Ford Motor Company, Air International Thermal Systems, and Hyundai Mobis. These companies focus on integrating advanced HVAC systems, HEPA filters, and ionization technologies to enhance cabin air quality and meet regulatory standards. Asia-Pacific leads the market with 34% share, driven by high urban air pollution levels and growing adoption of built-in air purification systems in passenger cars. Europe follows with 28% share, supported by stringent air quality regulations, while North America accounts for 27% share, driven by rising consumer awareness and growth in electric and premium vehicle segments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive In-Cabin Air Quality Improvement Solution market was valued at USD 2.94 billion in 2024 and is projected to reach USD 8.32 billion by 2032, growing at a CAGR of 13.9% during the forecast period.

- Rising concerns about air pollution and passenger health drive demand, with HVAC systems with built-in solutions holding the largest share and passenger cars accounting for the majority of installations.

- Key trends include integration of smart air quality sensors, real-time monitoring systems, and development of HEPA and activated carbon filters for advanced purification.

- The market is competitive with players such as MANN+HUMMEL, Valeo, Bosch, and DENSO focusing on R&D, OEM partnerships, and scalable solutions for mass-market vehicles.

- Asia-Pacific leads with 34% share, followed by Europe at 28% and North America at 27%, supported by rising EV sales, stricter air quality regulations, and growing consumer demand for enhanced cabin comfort.

Market Segmentation Analysis:

By Product Type

HVAC systems with built-in solutions dominate the market with the largest share of 45%, driven by their integration into modern vehicle designs and ability to provide real-time air quality monitoring and filtration. Automakers are increasingly equipping vehicles with advanced HVAC systems that include PM2.5 filtration, ionization, and air purification features to meet consumer demand for cleaner cabin environments. HEPA filter-based solutions are also gaining traction, particularly in premium vehicles, due to their ability to capture fine particles and allergens. Activated carbon filters remain popular for eliminating odors and harmful gases, complementing primary filtration systems.

- For instance, Tesla’s Model X uses a medical-grade HEPA filter certified to remove 99.97% of particles sized 0.3 micrometers, plus acid-gas and alkaline-gas neutralization layers within its Bioweapon Defense Mode.

By Vehicle Type

Passenger cars account for the majority of the market with 65% share, as consumers prioritize clean and healthy cabin environments for daily commutes and long-distance travel. Demand is particularly strong in urban areas where air pollution levels are high. Premium and electric vehicles often integrate advanced multi-layer filtration and real-time air quality sensors, enhancing adoption rates. Commercial vehicles represent a smaller but rapidly growing segment, driven by fleet operators focusing on driver health and regulatory compliance in logistics and public transport. Expansion of shared mobility and ride-hailing services is further increasing demand for in-cabin air quality solutions.

- For instance, Mercedes-Benz equips its EQS with the Energizing Air Control Plus system, where the HEPA filter and activated carbon layers filter both interior and exterior air, switching to recirculation upon detecting elevated NO₂ or particulate levels.

Key Growth Drivers

Rising Air Pollution and Health Concerns

Growing urbanization and deteriorating air quality are major drivers for the automotive in-cabin air quality improvement solution market. Consumers are increasingly aware of the health impacts of pollutants such as PM2.5, allergens, and VOCs, which has boosted demand for advanced filtration systems. Automakers are integrating cabin air quality monitoring and purification technologies as a standard or premium feature. Regulatory pressure in regions like Asia-Pacific and Europe is further encouraging adoption. This rising focus on passenger well-being is pushing OEMs and aftermarket suppliers to invest in innovative air purification solutions.

- For instance, the MANN-FILTER FreciousPlus cabin air filter is designed to block up to 95% of harmful PM2.5 particulates in urban traffic. It uses a multi-layered, biofunctional technology to also trap allergens, mold, and unpleasant odors.

Increased Adoption in Electric and Premium Vehicles

Electric and premium vehicle manufacturers are leading adopters of advanced in-cabin air quality solutions. EV makers differentiate their offerings by including multi-stage filtration systems, ionizers, and real-time air quality sensors to enhance cabin comfort. Premium brands leverage these solutions to improve passenger experience and meet luxury market expectations. Growing sales of electric vehicles globally, driven by environmental regulations and incentives, are expanding the installed base of advanced HVAC and HEPA filter solutions, thereby fueling market growth across key automotive segments.

- For instance, Audi offers an optional air quality package for the e-tron Quattro and other models, which uses a combination filter featuring activated carbon to trap harmful gases and particulates, including some allergens, in the cabin.

Regulatory Push for Cabin Air Quality Standards

Governments and regulatory bodies are introducing guidelines and standards for in-cabin air quality to protect drivers and passengers from harmful pollutants. Initiatives in China, Europe, and North America are mandating the use of efficient filtration systems in new vehicles. This compliance-driven demand is motivating OEMs to integrate higher-grade HEPA and activated carbon filters, even in mid-range vehicle segments. Regulatory frameworks also encourage R&D investments to improve filter efficiency, durability, and maintenance intervals, strengthening the market for in-cabin air quality improvement solutions globally.

Key Trends & Opportunities

Integration of Smart Sensors and Connected Systems

The integration of IoT-enabled sensors and connected systems is transforming in-cabin air quality solutions. Real-time monitoring of particulate matter, CO₂, and VOC levels allows automatic adjustment of HVAC systems for optimal air quality. Automakers are offering smartphone connectivity, enabling users to track cabin air quality remotely. This trend supports the development of data-driven maintenance schedules and predictive analytics for filter replacement. The adoption of connected solutions is expected to rise significantly, creating opportunities for technology providers and enabling differentiation for OEMs.

- For instance, the BYD Seal includes a PM2.5 detector that updates outside versus inside air particle counts on its infotainment screen, showing exact numerical values. The system provides near real-time air quality monitoring. An effective air purification system is also featured to maintain good cabin air quality.

Growing Demand for Aftermarket and Retrofit Solutions

The aftermarket segment is witnessing strong growth as consumers retrofit their vehicles with portable air purifiers, ionizers, and advanced filters. This trend is particularly visible in regions with severe pollution, where consumers seek immediate solutions without waiting for OEM-installed systems. E-commerce platforms have made these products more accessible, while falling prices are encouraging wider adoption. Manufacturers are introducing compact, easy-to-install products tailored for mass-market vehicles, opening opportunities for new entrants and established brands to expand their reach in emerging economies.

- For instance, Panasonic launched its nanoe X portable air purifier for vehicles, which cleans the car cabin in about 2 hours at a noise level of approximately 36 decibels, powered via USB and fitting into most cup holders.

Key Challenges

High Cost of Advanced Filtration Systems

The cost of integrating HEPA-grade filters, ionizers, and smart sensors remains a barrier, particularly in price-sensitive markets. These technologies increase vehicle manufacturing costs and are often limited to premium segments. Aftermarket products face similar price challenges, which may deter budget-conscious buyers. Manufacturers are working on cost optimization through mass production and material innovation, but affordability remains a critical factor that could slow adoption in entry-level vehicles.

Maintenance and Filter Replacement Concerns

Frequent filter replacement and maintenance requirements pose a challenge for users and fleet operators. Poorly maintained filters can reduce system efficiency and compromise cabin air quality. Lack of awareness about replacement intervals leads to inconsistent performance. Manufacturers are focusing on longer-lasting filters and integrating maintenance alerts to address this issue, but consumer education and service network development remain essential for ensuring consistent adoption and user satisfaction.

Regional Analysis

North America

North America holds 27% market share, driven by strong consumer awareness about air pollution and its health effects. Automakers in the region integrate advanced HVAC systems, HEPA filters, and ionizers in mid-range and premium vehicles to meet growing demand for cabin comfort. The U.S. leads adoption, supported by rising electric vehicle sales and regulatory focus on in-cabin air quality standards. Commercial vehicle fleets are increasingly deploying purification systems to ensure driver health and meet workplace safety requirements. Technological innovation and aftermarket availability further strengthen the market’s expansion across both passenger and commercial vehicle segments.

Europe

Europe accounts for 28% market share, supported by stringent EU regulations on vehicle emissions and cabin air quality. Germany, France, and the U.K. lead demand, with premium automakers offering advanced multi-layer filtration and real-time monitoring systems. Growth is further fueled by the adoption of electric and hybrid vehicles, which often feature sophisticated HVAC systems. Rising concerns about allergens, VOCs, and fine particulate matter drive demand across urban regions. Fleet operators and shared mobility providers are also adopting air purification solutions to enhance passenger safety and satisfaction, strengthening the market presence in this region.

Asia-Pacific

Asia-Pacific leads with 34% market share, making it the largest and fastest-growing region. China and India drive demand due to severe urban air pollution levels and government regulations promoting better cabin air quality. Automakers in the region offer built-in HVAC filtration and air purification systems, even in mass-market vehicle segments, to meet consumer health expectations. Japan and South Korea emphasize high-efficiency filtration systems in premium and electric vehicles. The growing popularity of aftermarket portable purifiers and retrofit solutions also contributes to rapid expansion, making Asia-Pacific a major hub for production and innovation in this market.

Latin America

Latin America holds 6% market share, with Brazil and Mexico as key markets adopting in-cabin air quality improvement solutions. Growing vehicle sales and rising consumer awareness about air pollution are driving demand for HEPA filters and activated carbon-based solutions. Aftermarket installations are common, as many vehicles are retrofitted with air purifiers to enhance passenger comfort. Expansion of shared mobility and taxi fleets in major cities is also creating opportunities for adoption. Economic development, coupled with growing middle-class spending, is expected to further boost demand for affordable, easy-to-install in-cabin purification systems across the region.

Middle East & Africa

Middle East & Africa represent 5% market share, supported by rising demand for air purification in regions affected by dust, sandstorms, and high pollution levels. GCC countries, including the UAE and Saudi Arabia, lead adoption in luxury vehicles and public transport fleets. South Africa shows steady demand, driven by growing urbanization and consumer focus on health. Automakers and aftermarket providers offer HVAC upgrades and ionizers tailored for harsh climatic conditions. Investment in smart city mobility projects and increasing sales of premium vehicles are likely to further drive the demand for in-cabin air quality solutions in this region.

Market Segmentations:

By Product Type

- HVAC System with Built-in Solution

- HEPA Filter-Based Solution

- Activated Carbon-Based Solution

- Independent Air Purifier / Ionizer

- Independent Ozone Generators

By Vehicle Type

- Passenger Cars

- Commercial Vehicles

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Automotive In-Cabin Air Quality Improvement Solution market features key players such as MANN+HUMMEL, Toyota, Valeo, Marelli, DENSO Corporation, Bosch, MAHLE GmbH, Ford Motor Company, Air International Thermal Systems, and Hyundai Mobis. These companies focus on developing advanced HVAC systems, HEPA filter technologies, and integrated air purification modules to meet rising consumer demand for clean and safe cabin environments. Strategic initiatives include partnerships with OEMs, investment in R&D for smart sensor integration, and product innovation to improve filter efficiency and longevity. Manufacturers are also targeting mass-market vehicles by offering cost-effective solutions, enabling wider adoption beyond luxury segments. Additionally, aftermarket solutions and retrofit kits are expanding the customer base. Competitive differentiation is driven by innovation, compliance with global air quality regulations, and the ability to offer customizable solutions for electric vehicles, passenger cars, and commercial fleets, strengthening the global presence of leading players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2025, Bosch announced new software-driven mobility solutions at IAA Mobility; though not exclusively about cabin air, it includes connected systems that enable dynamic control of vehicle environment (ventilation, sensor integration) in new vehicle models.

- In July 2025, DENSO Corporation launched a joint demonstration project (with Dream Incubator) in India for a digital platform (“Solwer”) that covers aftermarket value chain data including vehicle and inventory air-quality component tracking.

- In 2025, MAHLE GmbH introduced a new thermal management module with integrated heat pump for electric vehicles to improve HVAC efficiency and thus cabin climate management.

- In October 2024, MANN+HUMMEL launched a cabin air filter featuring nanofibers that improves filtration of ultra-fine particles and pollutants from both outside and inside of vehicles.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Vehicle Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for in-cabin air quality systems will grow as urban pollution levels continue to rise.

- Automakers will integrate advanced HVAC systems and multi-stage filters even in mid-range vehicles.

- HEPA and activated carbon filter adoption will expand with rising awareness of health benefits.

- Connected air quality monitoring and app-based control will become a standard feature in new vehicles.

- Electric and premium vehicles will lead innovation with built-in purifiers and ionization technology.

- Aftermarket and retrofit solutions will see strong growth in developing markets.

- Manufacturers will focus on longer-lasting filters and lower maintenance requirements.

- Regulatory standards for cabin air quality will tighten, driving OEM adoption globally.

- Asia-Pacific will remain the largest market due to urbanization and rapid vehicle sales growth.

- Strategic collaborations between automakers and filtration technology providers will boost product development and market reach.