11 August 2025, India

President Donald Trump announced in early August 2025 that India would be subject to an additional 25% penalty tariff on imports, introducing the total to 50%, in response to India’s continued purchase of discounted Russian crude. The administration’s “secondary sanctions” strategy, which involves penalizing third-party nations that trade with Russia in order to apply indirect pressure, includes this action.

The oil market hardly responded to the policy, despite it making headlines. Even the price of Brent crude fell, indicating that traders do not think these threats will result in a major disruption of supply.

The “TACO” Effect of Market Skepticism

Many of Trump’s tariff threats are now viewed by traders as temporary political theatre, according to commodity analysts, including Clyde Russell, a columnist for Reuters. Previous episodes have taught investors that aggressive rhetoric often gives way to delayed or watered-down measures, particularly when global economic impacts could negatively impact U.S. consumers.

India’s Strategic Energy Position

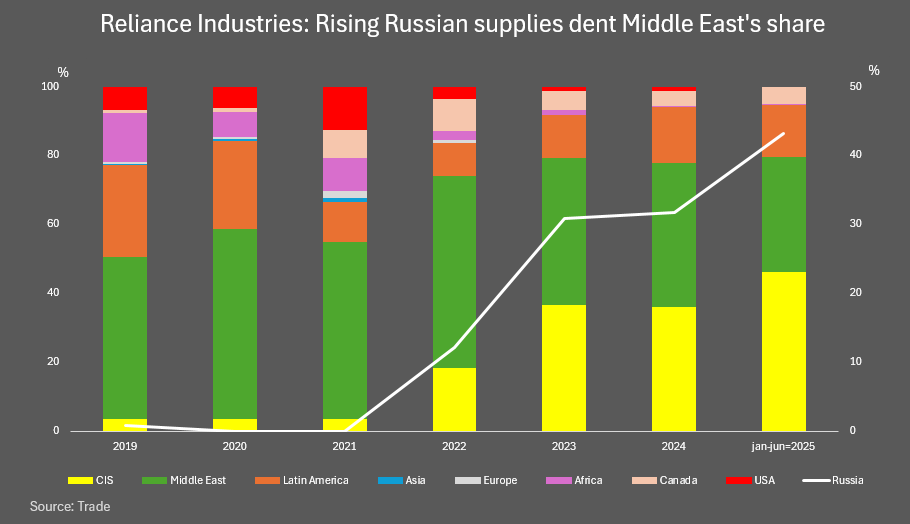

The second-largest importer of oil in the world, India imports more than 85% of its crude needs. It has resorted to using Russia’s Urals crude at steep discounts, frequently $6–$8 less than Brent, in recent years in order to protect its economy from rising energy costs.

New Delhi maintains that cost competitiveness and energy security outweigh any immediate diplomatic strain, despite pressure from the United States. Cheap Russian oil, according to officials, helps control domestic inflation, boost industrial output, and make fuel more affordable in rural areas.

India’s Oil Trade Position

| Source Region | Volume (mbpd) | Share of Imports | Key Grades |

| Russia | 1.8 | 37% | Urals (Medium Sour) |

| Middle East | 2.0 | 41% | Arab Light, Basrah Light |

| Africa | 0.5 | 10% | Bonny Light, Escravos |

| U.S. & Others | 0.6 | 12% | WTI, Light Sweet |

Global oil prices are also cushioned by other developments:

- Production increases from OPEC+ are anticipated to reach ~500,000 barrels per day in the upcoming months.

- Trade flows that are more diverse: If Russian imports were disrupted, India could buy more goods from Middle Eastern producers.

- Demand patterns by season: A slowdown in demand after the summer lowers price sensitivity.

- One of the main reasons why prices stay stable is because traders perceive little risk of a supply shock due to these buffers.

Refinery Challenges with Replacement Crudes

- India’s advanced refining infrastructure is designed to process a variety of sweet and sour crudes. If imports from the Urals must be cut:

- Middle Eastern Options: Prices in those markets may rise as a result of increased purchases from Saudi Arabia and Iraq.

- S. Light Crudes: The product output mix may be disrupted by increased imports from the United States because U.S. shale oil produces more gasoline and less diesel, which is out of step with India’s export-driven diesel market.

- Logistical Costs: Compared to spot Middle Eastern or American cargoes, Russian Urals frequently arrive through discounted long-term contracts, which lowers freight costs per barrel.

India’s Russian Crude Exposure

| Metric | Current Value | Impact of Tariffs | Likely Adjustment |

| Russian Crude Imports | 1.8 million bpd | Could fall by 30–50% if fully enforced | Replace with Saudi/Iraq grades |

| Share of Total Imports | 37% | Drop to ~20% | More Middle Eastern & some U.S. crude |

| Urals Grade Share | 90% | Significant loss of medium sour supply | Shift to Arab Light / Basrah Light |

| Freight Costs | Low (bulk shipments from Russia) | Higher with diversified sourcing | Increase in landed cost |

| Diesel Output | Stable with Urals | Likely to fall with lighter crude | Export revenue impact |

| Global Price Effect | Neutral now | +$5–10/bbl if medium sour tightens | Traders to monitor OPEC spare capacity |

Conclusion

While the crude market appears calm for now, the structural reality is that India cannot easily replace Russian medium sour barrels without cost and configuration adjustments. Brent prices are steady, and India still imports Russian oil through unofficial channels. Not only is replacing Urals a change in procurement, but it also carries the risk of increased expenses, decreased refining margins, and geopolitical recalibration.

India’s strategic decision centers on striking a balance between diplomatic sovereignty and energy affordability. Despite tension from Washington, reduced Russian oil is expected to continue to play a significant role in India’s energy mix as long as it is still economically attractive and logistically feasible.