Market Overview

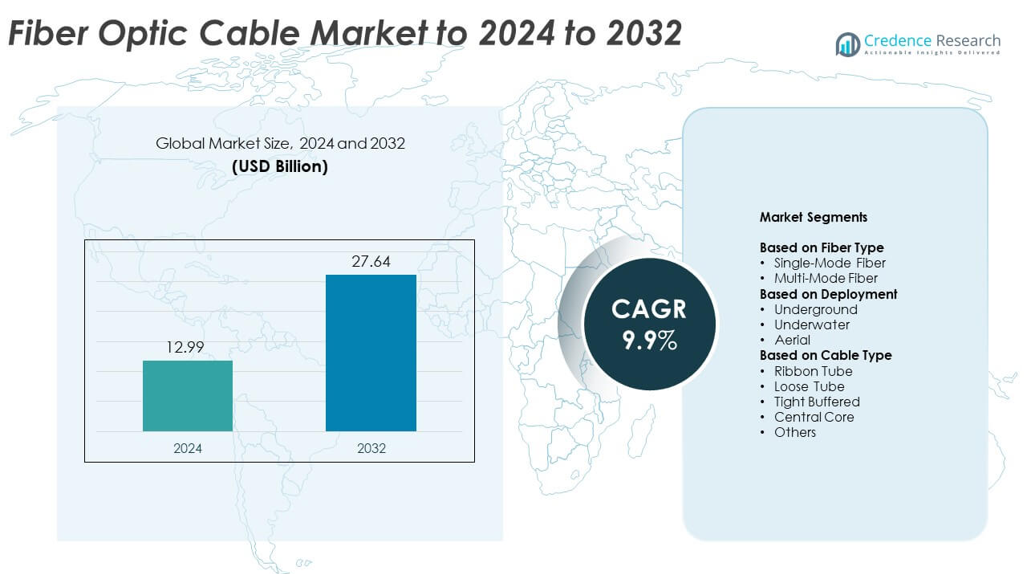

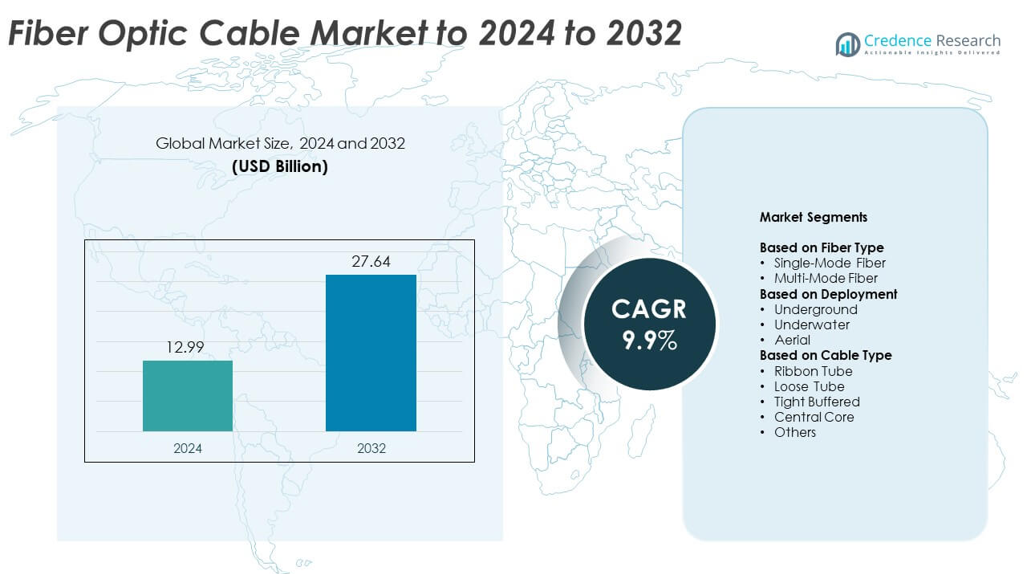

The Fiber Optic Cable market size was valued at USD 12.99 billion in 2024 and is anticipated to reach USD 27.64 billion by 2032, at a CAGR of 9.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Fiber Optic Cable market Size 2024 |

USD 12.99 billion |

| Fiber Optic Cable market, CAGR |

9.9% |

| Fiber Optic Cable market Size 2032 |

USD 27.64 billion |

The Fiber Optic Cable market is led by key players such as Prysmian Group, Corning Incorporated, CommScope Holding Company Inc., Fujikura Ltd., Sumitomo Electric Industries Ltd., Sterlite Technologies Ltd., Lumen Tech, Yangtze Optical Fiber and Cable Joint Stock Ltd Co., Furukawa Electric, and SNL Tech. These companies focus on expanding fiber production capacity, developing advanced cable designs, and forming strategic partnerships with telecom and cloud service providers. Asia Pacific dominated the global market with a 32% share in 2024, driven by large-scale 5G rollouts, strong broadband initiatives, and rapid infrastructure modernization. North America followed with 34%, supported by extensive data center growth and digital transformation efforts.

Market Insights

- The Fiber Optic Cable market was valued at USD 12.99 billion in 2024 and is projected to reach USD 27.64 billion by 2032, growing at a CAGR of 9.9%.

- Growing demand for high-speed connectivity, 5G expansion, and data center development are major drivers fueling market growth.

- The market is witnessing strong trends in FTTH adoption, smart city infrastructure, and underwater cable network expansion across key economies.

- Competition remains intense with leading players investing in product innovation, sustainability, and large-scale global partnerships to strengthen their market presence.

- Asia Pacific led with a 32% share, followed by North America at 34%, while the single-mode fiber segment dominated with over 67% share in 2024, driven by superior long-distance transmission and low latency capabilities.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type

Single-mode fiber dominated the market with over 67% share in 2024. Its dominance is driven by higher bandwidth capacity and long-distance transmission efficiency, making it ideal for 5G networks and data center interconnections. Multi-mode fiber held a smaller share due to limited range but remained relevant for short-distance communication in enterprises and campuses. Growing internet penetration, expansion of high-speed broadband infrastructure, and increased demand for cloud connectivity are major drivers supporting single-mode fiber adoption worldwide.

- For instance, Corning manufactured its 1 billionth kilometer of optical fiber in 2017 and has produced a significantly greater amount since then.

By Deployment

The underground segment accounted for around 58% share in 2024, emerging as the leading deployment method. Its dominance is supported by better protection against environmental damage and consistent signal performance. Governments and telecom operators are investing heavily in underground fiber networks to enhance reliability and reduce maintenance costs. The underwater segment is expanding rapidly due to growing intercontinental data traffic, while aerial deployment is preferred for rural or temporary installations due to cost benefits and easy setup.

- For instance, Openreach has rolled out full fibre to 20 million UK premises.

By Cable Type

Loose tube cables led the market with nearly 42% share in 2024. Their high flexibility, moisture resistance, and suitability for outdoor installations make them ideal for long-distance telecommunication networks. Ribbon tube cables are gaining momentum in data centers and FTTH applications for their high fiber density and faster splicing. Tight buffered and central core types serve specialized indoor and industrial uses. Growing demand for durable, high-performance fiber cables and rising smart city projects are fueling adoption across telecommunication and infrastructure sectors.

Key Growth Drivers

Rising 5G Network Expansion

The rollout of 5G networks is a major growth driver for the fiber optic cable market. Telecom operators are heavily investing in fiber infrastructure to support high-speed data transfer and low latency. Single-mode fiber cables are widely used for backhaul connectivity in 5G base stations. Expanding digital infrastructure in developing economies and the rising adoption of smart devices are further accelerating demand. The integration of IoT-based communication networks also strengthens fiber optic deployments for faster and more reliable data transmission.

- For instance, China Mobile announced in March 2025 that it plans to reach nearly 2.8 million 5G base stations by the end of 2025.

Growing Data Center Construction

The rising number of data centers worldwide significantly drives market growth. Cloud computing, artificial intelligence, and enterprise digitization are boosting the need for high-speed connectivity. Fiber optic cables are preferred in hyperscale and edge data centers for their bandwidth capacity and energy efficiency. Major tech companies are expanding fiber-based networks to handle massive data traffic efficiently. This trend aligns with increasing investments in submarine fiber links and colocation facilities to enhance global data exchange capabilities.

- For instance, Broadcom’s Bailly CPO switch delivers 51.2 Tbps per device.

Government-led Broadband Initiatives

Government programs promoting high-speed broadband networks are fueling fiber optic cable demand. Several nations are investing in national fiber rollouts to enhance internet access and bridge digital gaps. Public-private partnerships are increasing to deploy fiber in rural and semi-urban regions. Policies promoting smart city development and digital education further strengthen the market. These initiatives not only boost fiber cable production but also encourage innovations in cost-effective installation and maintenance technologies.

Key Trends and Opportunities

Shift Toward Fiber-to-the-Home (FTTH)

The global shift toward FTTH connections is creating major opportunities for fiber optic cable suppliers. Rising demand for high-speed home internet, driven by streaming, gaming, and remote work, is accelerating FTTH installations. Urbanization and digital transformation in residential areas are leading telecom operators to replace legacy copper networks with optical fiber. The trend also supports future-ready smart home ecosystems, improving energy management and connectivity performance.

- For instance, Verizon announced in September 2024 its plan to acquire Frontier, which, combined with its own network, is projected to enable it to pass over 25 million premises with fiber by the time the deal closes in early 2026.

Emergence of Smart Infrastructure Projects

Smart city and digital infrastructure projects are boosting the adoption of fiber networks. Governments and enterprises are deploying fiber-based connectivity to support real-time monitoring, surveillance, and automation. These projects require low-latency, high-capacity networks that only fiber can provide. Expanding investments in industrial automation, intelligent transportation, and cloud integration present strong growth potential for fiber optic cable manufacturers and installers across both developed and emerging markets.

- For instance, Google’s Dunant subsea cable provides 250 Tbps trans-Atlantic capacity.

Key Challenges

High Installation and Maintenance Costs

The high initial cost of fiber installation remains a key challenge in many regions. Laying fiber cables underground or underwater involves significant labor, equipment, and regulatory expenses. Maintenance in difficult terrains or densely populated areas further adds to operational costs. These factors often restrict adoption in low-income or rural zones where wireless alternatives seem more economical. Reducing installation costs through modular and pre-terminated cable solutions is becoming critical for broader market penetration.

Competition from Wireless Communication Technologies

Rising advancements in wireless communication, including satellite internet and fixed wireless access, pose a challenge to fiber optic cable adoption. Wireless solutions offer faster deployment and lower infrastructure requirements, appealing to remote and underdeveloped regions. Although fiber delivers superior bandwidth and reliability, competition from evolving wireless systems can slow its market penetration. The industry must focus on hybrid connectivity solutions that integrate fiber and wireless technologies to maintain long-term competitiveness.

Regional Analysis

North America

North America held a 34% share of the global fiber optic cable market in 2024. The region benefits from rapid 5G network expansion, strong data center construction, and increasing broadband adoption. The United States leads with major investments from telecom giants and cloud providers focusing on high-speed connectivity. Government programs supporting rural broadband deployment further boost fiber installations. Rising adoption of smart city projects and connected devices continues to drive demand. Canada and Mexico also contribute to market growth through ongoing infrastructure modernization and enterprise digital transformation initiatives.

Europe

Europe accounted for 28% of the fiber optic cable market in 2024. The region’s growth is driven by the expansion of FTTH networks and stringent EU policies promoting digital infrastructure. Countries such as Germany, France, and the UK are investing heavily in fiber deployment to replace copper networks. Increased demand for cloud-based services and high-speed internet across urban areas strengthens the market. Public and private partnerships are enhancing connectivity in rural regions, while advancements in data transmission technologies continue to accelerate fiber adoption across the continent.

Asia Pacific

Asia Pacific dominated the market with a 32% share in 2024, emerging as the fastest-growing region. Rapid urbanization, strong government digitalization programs, and large-scale 5G rollouts are key growth drivers. China leads with extensive national fiber networks supporting both commercial and residential connectivity. India, Japan, and South Korea are also witnessing major expansions in data centers and broadband access. Growing e-commerce, industrial automation, and IoT integration further contribute to strong regional demand for fiber optic infrastructure across telecom and enterprise applications.

Latin America

Latin America captured an 8% share of the fiber optic cable market in 2024. The region’s growth is supported by increasing broadband penetration and modernization of telecommunications networks. Brazil and Mexico are the leading contributors with heavy investments in FTTH and 5G infrastructure. Growing government support for digital inclusion programs is driving fiber installations in underserved areas. The rising demand for streaming services and cloud applications further supports expansion, while international partnerships are enhancing regional connectivity and boosting fiber manufacturing capacity.

Middle East and Africa

The Middle East and Africa region accounted for a 6% market share in 2024. Increasing investments in smart city development, 5G deployment, and cross-border data cables are fueling market growth. The UAE, Saudi Arabia, and South Africa lead the region with ongoing national broadband projects. Rapid digital transformation across industries, coupled with growing internet user bases, supports fiber optic expansion. However, high installation costs and limited rural coverage remain challenges. Efforts to enhance regional data hubs and strengthen submarine cable networks are expected to drive future growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Fiber Type

- Single-Mode Fiber

- Multi-Mode Fiber

By Deployment

- Underground

- Underwater

- Aerial

By Cable Type

- Ribbon Tube

- Loose Tube

- Tight Buffered

- Central Core

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Fiber Optic Cable market is highly competitive, featuring major players such as Prysmian Group, Corning Incorporated, CommScope Holding Company Inc., Fujikura Ltd., Sumitomo Electric Industries Ltd., Sterlite Technologies Ltd., Lumen Tech, Yangtze Optical Fiber and Cable Joint Stock Ltd Co., Furukawa Electric, and SNL Tech. These companies compete through technological innovation, large-scale production capacity, and global distribution networks. Market participants focus on expanding fiber manufacturing facilities and enhancing product efficiency to meet growing 5G and broadband demands. Strategic partnerships with telecom operators, governments, and cloud providers support large infrastructure projects. Continuous R&D efforts target improved fiber durability, higher bandwidth capacity, and cost-effective installation solutions. Companies are also investing in eco-friendly manufacturing and recyclable fiber materials to align with sustainability goals. Intense competition drives pricing strategies and regional expansion, ensuring strong presence across key markets in North America, Europe, and the Asia Pacific region.

Key Player Analysis

Recent Developments

- In 2024, Sterlite technologies ltd announced the production of fibre optic cables in US.

- In 2023, Corning opened a new optical cable manufacturing campus in North Carolina

- In 2023, Prysmian Group launched a 16-fiber FlexRibbon™ cable designed for high-speed data center applications.

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Deployment, Cable Type and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow rapidly due to rising global broadband and 5G network expansion.

- Increased demand for FTTH connections will drive large-scale residential fiber installations.

- Government digitalization projects and public–private partnerships will enhance fiber adoption.

- The surge in data center construction will boost long-distance and high-bandwidth fiber demand.

- Emerging smart city projects will accelerate fiber deployments across public infrastructure.

- Advancements in submarine and intercontinental fiber networks will improve global connectivity.

- The integration of IoT and AI applications will increase data traffic, strengthening fiber demand.

- Continuous innovation in lightweight and high-capacity fiber designs will improve network performance.

- Partnerships between telecom operators and technology providers will expand deployment capabilities.

- The shift toward sustainable, energy-efficient networks will encourage eco-friendly fiber manufacturing.