Market Overview

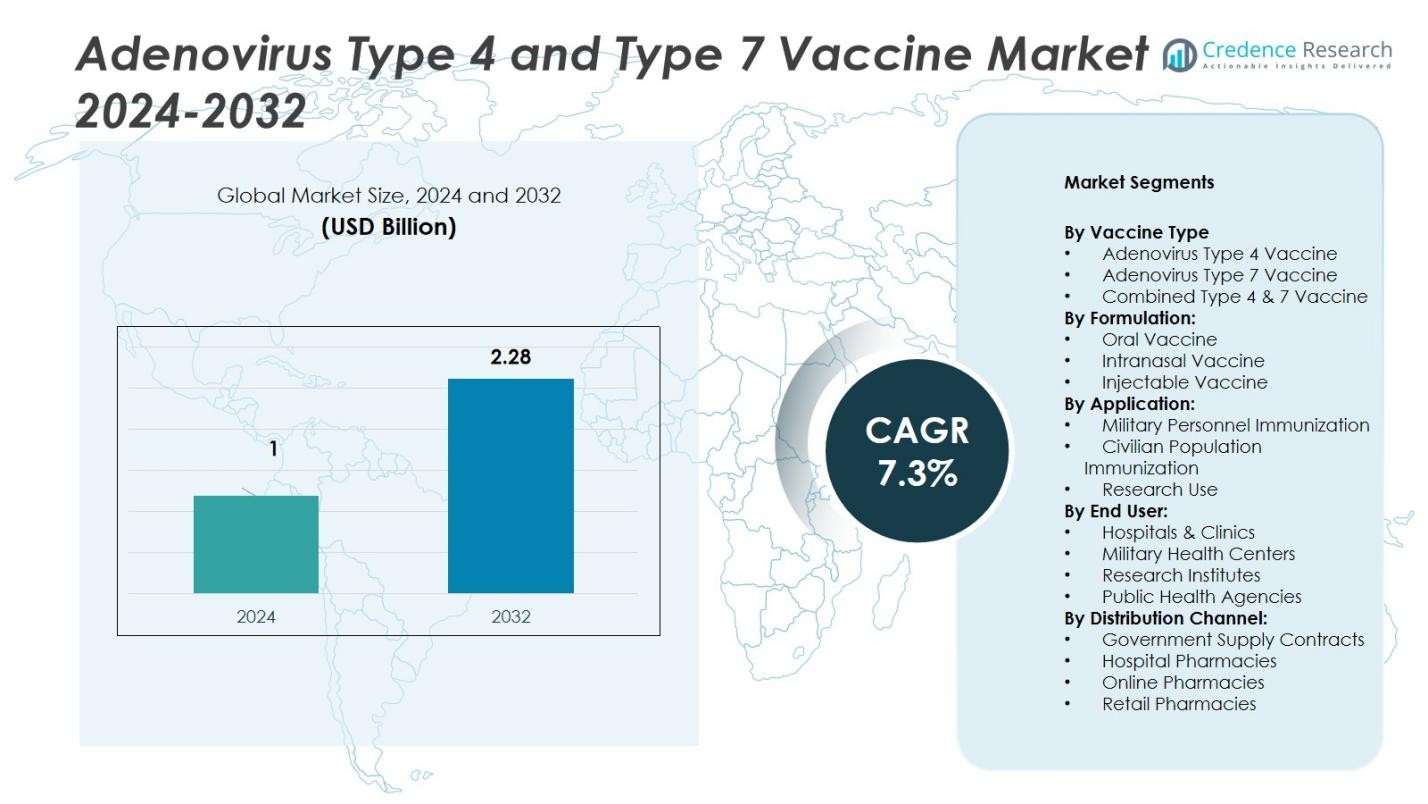

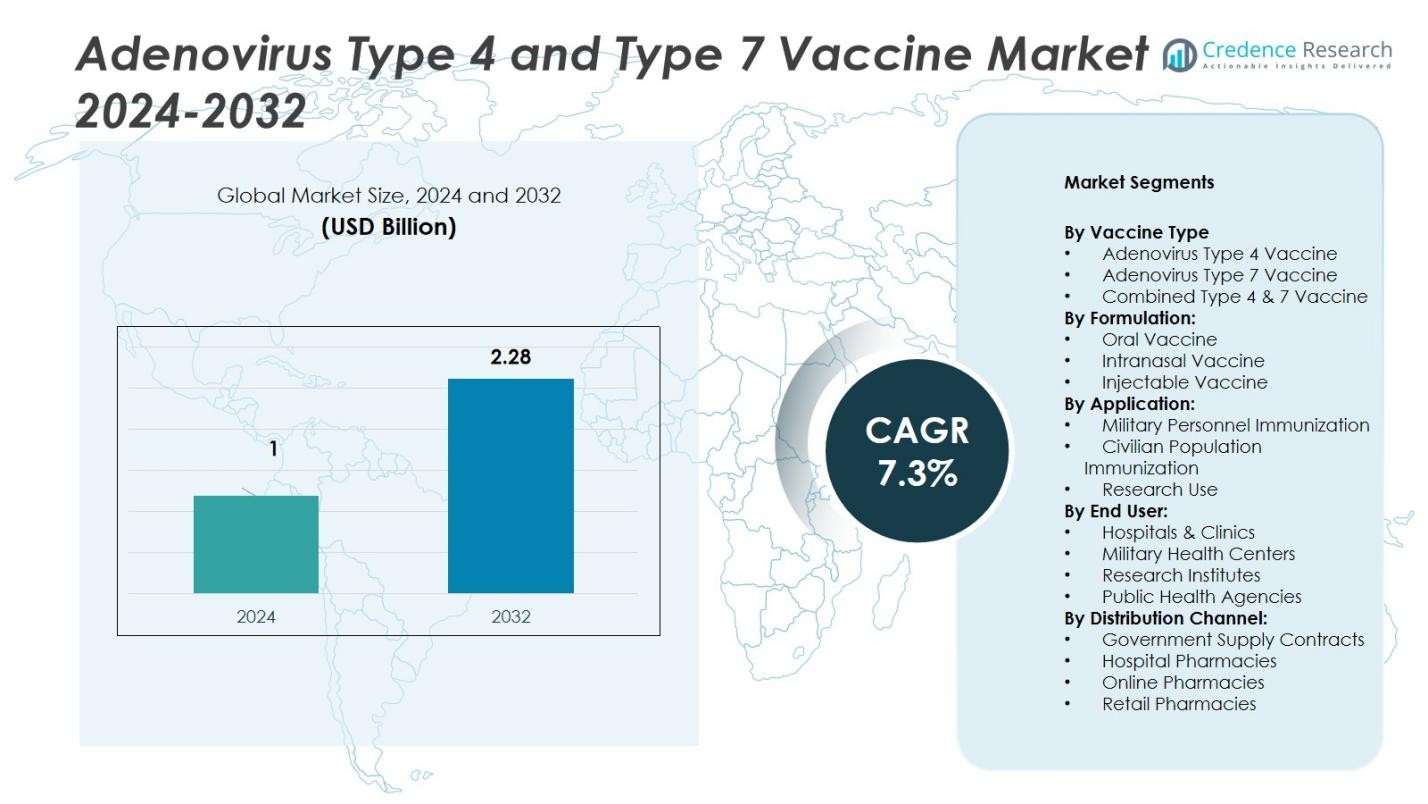

Adenovirus Type 4 and Type 7 Vaccine Market size was valued at USD 1 billion in 2024 and is projected to reach USD 2.28 billion by 2032, growing at a CAGR of 7.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adenovirus Type 4 and Type 7 Vaccine Market Size 2024 |

USD 1 Billion |

| Adenovirus Type 4 and Type 7 Vaccine Market, CAGR |

7.3% |

| Adenovirus Type 4 and Type 7 Vaccine Market Size 2032 |

USD 2.28 Billion |

The Adenovirus Type 4 and Type 7 Vaccine Market is led by prominent companies such as Batavia Biosciences B.V., AlphaVax, Inc., Teva Pharmaceuticals, BAVARIAN NORDIC, Wyeth Laboratories, and Barr Labs. These firms focus on producing high-efficacy combined vaccines with improved storage stability and scalable manufacturing platforms. North America dominates the global market with a 46% share, driven by strong defense immunization programs and consistent procurement by the U.S. Department of Defense. Europe follows with 24% share, supported by advanced biotech capabilities and R&D collaborations, while Asia-Pacific rapidly expands production infrastructure to meet growing vaccine demand.

Market Insights

Market Insights

- The Adenovirus Type 4 and Type 7 Vaccine Market was valued at USD 1 billion in 2024 and is projected to reach USD 2.28 billion by 2032, growing at a CAGR of 7.3%.

- Strong defense immunization programs drive market growth, with the Combined Type 4 & 7 Vaccine segment leading at 54% share due to dual protection and operational efficiency.

- Oral vaccine formulations dominate with a 62% share, supported by easy administration and large-scale deployment capability across military health systems.

- The market remains moderately consolidated, with key players like Batavia Biosciences B.V., AlphaVax, and BAVARIAN NORDIC focusing on advanced formulations and government contracts.

- Regionally, North America leads with 46% share driven by defense healthcare procurement, followed by Europe with 24% and Asia-Pacific with 19%, supported by expanding vaccine manufacturing and public health preparedness programs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Vaccine Type:

The Combined Type 4 & 7 Vaccine segment holds the largest market share of 54% in 2024. Its dominance is driven by its dual immunization capability, offering protection against both adenovirus strains with a single dose regimen. This combination significantly reduces logistic complexity for military and civilian vaccination programs. The U.S. Department of Defense primarily utilizes this vaccine for active-duty personnel, ensuring high immunization coverage and readiness. Continuous advancements in stability and safety profiles further strengthen its demand across government and institutional health programs.

- For instance, the U.S. Department of Defense administers the live oral Adenovirus Type 4 and Type 7 Vaccine (Barr Labs, Inc.) to all active-duty military recruits during basic training, resulting in a dramatic decline in adenovirus-related respiratory illness among trainees since its reintroduction in 2011.

By Formulation:

The Oral Vaccine segment leads the market with a 62% share due to its ease of administration, high compliance, and suitability for mass immunization programs. Oral formulations eliminate the need for trained medical staff, enabling large-scale deployment in military bases and outbreak zones. The stability of enteric-coated tablets at varied temperatures enhances field usability. Government contracts and defense procurement policies favor oral delivery because it minimizes storage and transport costs, thereby supporting wider adoption in both developed and emerging defense health systems.

- For instance, the live oral Ty21a capsules (injectable alternative) for typhoid were used in outbreak‑zone campaigns because volunteers could take them without trained injectable‑staff supervision.

By Application:

The Military Personnel Immunization segment dominates the market with a 68% share, as adenovirus infections pose significant risks in close-quarter military environments. The vaccine’s inclusion in mandatory immunization schedules across armed forces in the U.S. and allied nations sustains this lead. Defense health agencies emphasize continuous vaccination cycles for recruits and active-duty personnel to maintain operational readiness. Rising defense healthcare budgets and frequent troop deployments further amplify the demand for adenovirus vaccines, reinforcing this segment’s long-term market leadership.

Key Growth Drivers

Rising Military Immunization Programs

The growing prevalence of adenovirus infections among military personnel drives vaccine adoption. Governments continue to prioritize mandatory immunization schedules to maintain troop readiness and reduce infection outbreaks in training camps. For instance, the U.S. Department of Defense mandates adenovirus vaccination for recruits, ensuring consistent demand for combined Type 4 and 7 formulations. Expanding defense healthcare budgets and modernization programs across NATO and allied forces further accelerate the deployment of these vaccines in large-scale immunization campaigns.

- For instance, the U.S. Department of Defense administers the Barr Labs adenovirus vaccine (Types 4 and 7) to new recruits at military training facilities, reporting over 99% immunization coverage annually.

Increased Focus on Biodefense and Pandemic Preparedness

Heightened awareness of viral outbreak prevention strengthens investments in adenovirus vaccine development. Health agencies and biotechnology firms are expanding manufacturing capabilities to prepare for potential respiratory virus emergencies. The inclusion of adenovirus vaccines in national biodefense stockpiles ensures supply stability during health crises. Governments are also funding research for enhanced thermostability and broader serotype coverage. This preparedness-oriented approach supports a steady growth trajectory for adenovirus vaccine producers.

- For instance, Oxford Biomedica optimized the adenovirus vector production process for their ChAdOx1 nCoV-19 vaccine, enhancing upstream volumetric productivity by approximately fourfold, enabling production of 10,000 doses per liter of bioreactor capacity within 100 days of pathogen sequencing.

Advancements in Vaccine Formulation Technology

Innovations in oral and intranasal delivery platforms improve vaccine efficiency and user compliance. These non-invasive methods eliminate cold-chain dependency and reduce medical supervision requirements. Companies such as Batavia Biosciences and AlphaVax are developing next-generation adenovirus formulations with optimized immune response and prolonged protection. The transition from injectable to oral forms simplifies logistics, especially for field operations. Continuous improvements in stability, dosage precision, and multi-serotype protection drive strong adoption among military and public health sectors.

Key Trends and Opportunities

Expansion into Civilian Immunization Programs

Although primarily used in military settings, adenovirus vaccines are gradually entering civilian markets. Rising awareness of respiratory infections and their cross-transmission potential creates new demand. Governments and healthcare organizations are exploring mass immunization programs for healthcare workers, travelers, and high-risk populations. Partnerships between vaccine developers and public health authorities enable broader accessibility and funding. This civilian adoption trend opens long-term opportunities for manufacturers to expand beyond defense contracts.

- For instance, the Russian adenovirus-based COVID-19 vaccine developed by the Gamaleya Institute entered Phase III clinical trials in the UAE, supported by the UAE Ministry of Health, reflecting a civilian application beyond initial emergency use.

Collaborative Research and Global Partnerships

Strategic collaborations between biotech firms and defense agencies are shaping future innovation. Companies like BAVARIAN NORDIC and Teva Pharmaceuticals engage in research partnerships to enhance vaccine stability and scalability. International alliances promote technology transfer and joint production, ensuring reliable global supply. These partnerships foster accelerated regulatory approvals and strengthen resilience against infectious disease outbreaks. The cooperative model also supports diversification of production hubs across North America, Europe, and Asia-Pacific.

- For instance, Bavarian Nordic entered a manufacturing and licensing agreement with the Serum Institute of India for its MVA-BN mpox vaccine, enabling technology transfer and expanding production capacity to support global access during outbreaks.

Key Challenges

Limited Commercial Availability Outside Military Use

The adenovirus Type 4 and Type 7 vaccines remain largely restricted to military immunization, limiting revenue potential from civilian sectors. Regulatory hurdles and limited awareness among the general population constrain wider adoption. Moreover, the absence of large-scale commercial marketing strategies hampers visibility. Manufacturers face challenges in justifying expansion costs without clear civilian demand. Addressing these barriers will be critical to unlocking full market potential and achieving broader public health impact.

Stringent Manufacturing and Regulatory Standards

Producing adenovirus vaccines involves complex bioprocessing and strict biosafety requirements. Compliance with Good Manufacturing Practices (GMP) and multi-layer regulatory reviews prolongs product approval timelines. Smaller biotech companies often face high costs related to biosafety level production facilities and clinical trials. Differences in regional regulatory frameworks further delay international distribution. To remain competitive, manufacturers must invest heavily in advanced production systems and regulatory expertise, which increases operational expenditure and market entry barriers.

Regional Analysis

North America

North America dominates the Adenovirus Type 4 and Type 7 Vaccine Market with a 46% share in 2024. The region’s leadership stems from strong defense healthcare programs and consistent procurement by the U.S. Department of Defense. The vaccine’s mandatory inclusion in military immunization schedules ensures continuous demand. Advanced biotechnology infrastructure, favorable government contracts, and robust R&D initiatives by key players such as Barr Labs and Wyeth Laboratories sustain growth. Canada’s increasing investments in infectious disease preparedness also enhance regional demand for advanced adenovirus vaccines.

Europe

Europe holds a 24% market share, supported by growing defense collaborations and medical research initiatives. Nations such as the U.K., Germany, and France emphasize improving soldier health safety and pandemic readiness. European biotech firms like BAVARIAN NORDIC are investing in improved viral vector technologies to enhance vaccine stability and scalability. Rising government funding for vaccine manufacturing and research partnerships with academic institutions further boost the market. The presence of well-regulated healthcare systems ensures consistent quality control, making Europe a key region for adenovirus vaccine development.

Asia-Pacific

Asia-Pacific accounts for a 19% share of the global market, driven by increasing defense healthcare budgets and expanding vaccine manufacturing capabilities in China, Japan, and India. Governments in the region are adopting preventive immunization programs for military recruits to reduce adenovirus-related respiratory outbreaks. Collaborations between local biotech companies and global vaccine developers enhance technology transfer and product accessibility. Ongoing investments in infrastructure modernization and public health preparedness are expected to strengthen the region’s position as a vital production and supply hub over the forecast period.

Latin America

Latin America represents a 6% market share, supported by gradual adoption of adenovirus vaccines within public health and defense systems. Brazil and Mexico are leading regional markets, focusing on strengthening immunization infrastructure and participating in global biodefense initiatives. Collaborative programs between regional research institutes and international vaccine manufacturers help address production gaps. While the scale of adoption remains moderate, government interest in respiratory disease control and increased healthcare funding indicate potential for higher uptake in future years.

Middle East & Africa

The Middle East & Africa region holds a 5% share, mainly driven by defense sector immunization and international health assistance programs. Countries such as Saudi Arabia, the UAE, and South Africa are investing in vaccine procurement to improve soldier and healthcare worker protection. Limited domestic production capacity leads to reliance on imports from North America and Europe. However, regional collaborations and WHO-backed immunization initiatives are encouraging localized manufacturing and technology partnerships, expected to gradually expand vaccine access and market presence.

Market Segmentations:

By Vaccine Type

- Adenovirus Type 4 Vaccine

- Adenovirus Type 7 Vaccine

- Combined Type 4 & 7 Vaccine

By Formulation:

- Oral Vaccine

- Intranasal Vaccine

- Injectable Vaccine

By Application:

- Military Personnel Immunization

- Civilian Population Immunization

- Research Use

By End User:

- Hospitals & Clinics

- Military Health Centers

- Research Institutes

- Public Health Agencies

By Distribution Channel:

- Government Supply Contracts

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Adenovirus Type 4 and Type 7 Vaccine Market features major players such as Batavia Biosciences B.V., AlphaVax, Inc., Teva Pharmaceuticals, BAVARIAN NORDIC, Wyeth Laboratories, and Barr Labs. The market remains highly specialized, with a limited number of authorized manufacturers serving both defense and public health sectors. These companies focus on producing combined Type 4 and 7 vaccines with improved stability, scalability, and shelf life. Strategic partnerships with defense organizations and government agencies strengthen long-term supply contracts. Firms are also investing in oral and intranasal delivery systems to enhance mass immunization efficiency. Collaborations between biotechnology firms and military health agencies drive continuous R&D for next-generation adenovirus vaccines. While North America dominates production, European firms are expanding biomanufacturing capacities to meet global demand, ensuring supply resilience and compliance with evolving safety standards.

Key Player Analysis

Recent Developments

- In April 2025, Frontiers Media published research on the development of a novel Adenovirus Type 4 vector, which is emerging as a promising platform for respiratory vaccines.

- In 2023, research introduced a recombinant subunit vaccine candidate, rBV-hexon, which expresses the adenovirus type 7 hexon protein. This candidate demonstrated promising immunogenicity and safety in preclinical studies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Vaccine Type, Formulation, Application, End User, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with stronger government and defense procurement programs focused on infectious disease prevention.

- Technological innovations will improve oral and intranasal formulations, enhancing storage stability and ease of administration.

- Global defense collaborations will strengthen vaccine production and distribution across military networks.

- Growing awareness of respiratory infection control will open civilian immunization opportunities.

- Strategic partnerships between biotech firms and public health agencies will boost R&D funding and scale-up efforts.

- Europe and Asia-Pacific will emerge as key production hubs for adenovirus vaccines.

- Continuous advancements in biomanufacturing and viral vector technology will increase production efficiency.

- Regulatory harmonization will accelerate vaccine approvals and global distribution timelines.

- Expansion into developing nations will create new growth avenues supported by WHO-led immunization programs.

- Rising investment in biodefense preparedness will secure long-term demand for adenovirus Type 4 and Type 7 vaccines.

Market Insights

Market Insights