Market Overview

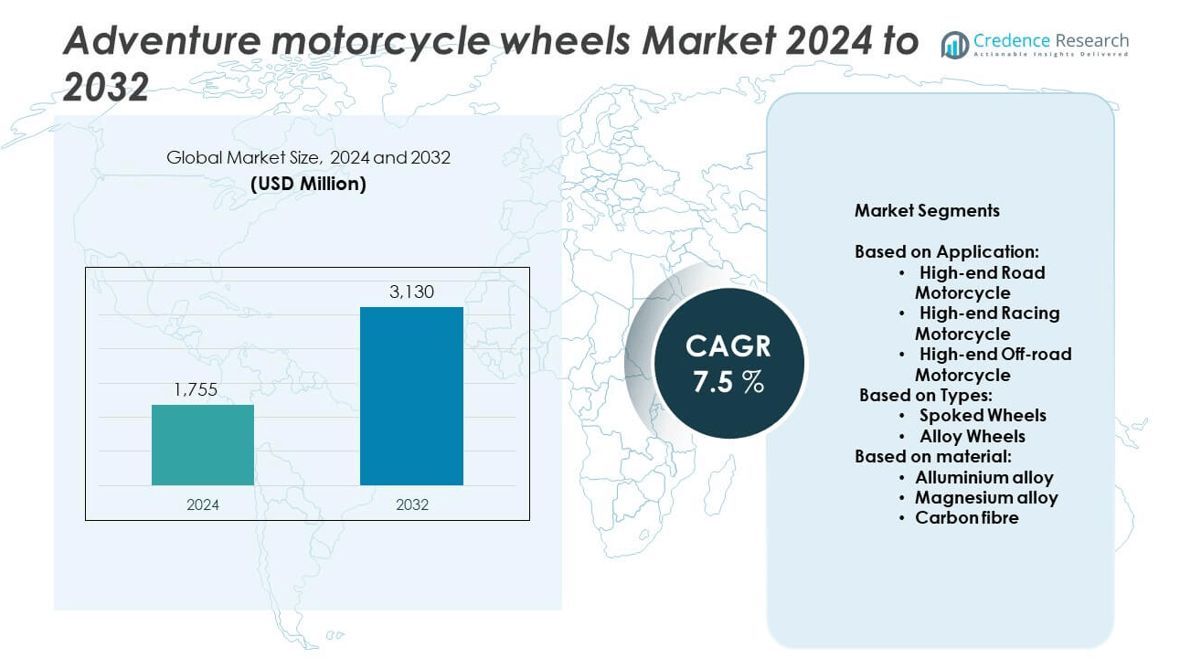

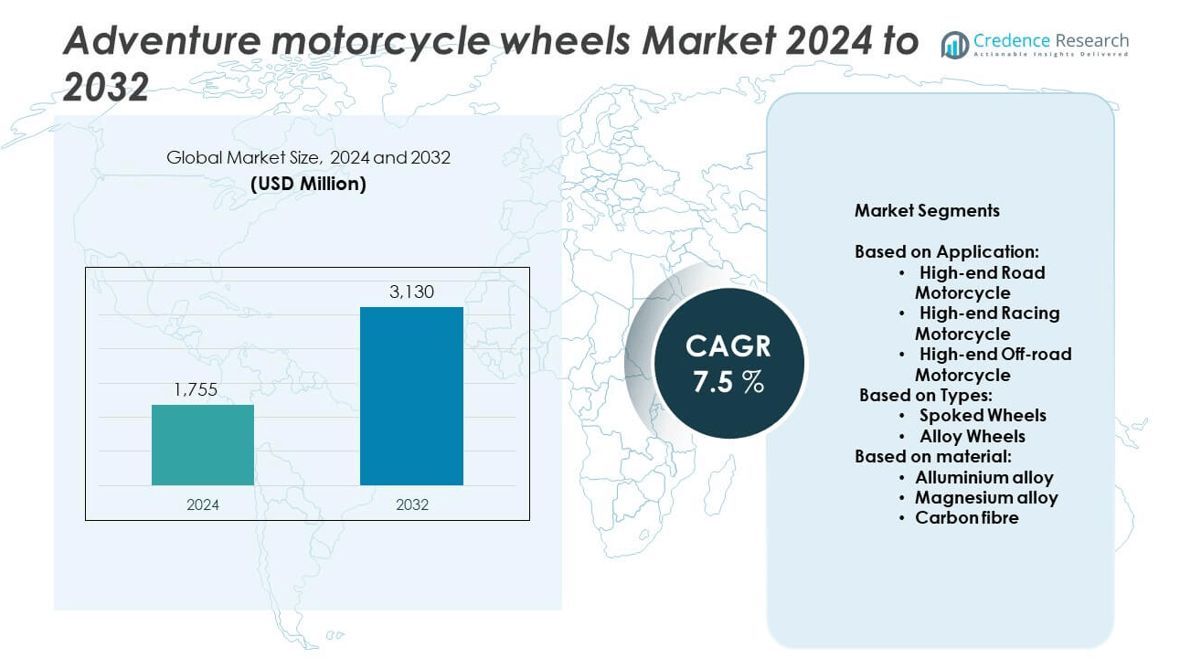

The global adventure motorcycle wheels market was valued at USD 1,755 million in 2024 and is projected to reach approximately USD 3,130 million by 2032, growing at a compound annual growth rate (CAGR) of 7.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Adventure Motorcycle Wheels Market Size 2024 |

USD 1,755 million |

| Adventure Motorcycle Wheels Market, CAGR |

7.5% |

| Adventure Motorcycle Wheels Market Size 2032 |

USD 3,130 million |

The adventure motorcycle wheels market is driven by rising demand for long-distance touring, off-road capabilities, and the growing popularity of mid to heavy adventure motorcycles. Manufacturers focus on durability, performance, and material innovation to meet rider expectations. Trends such as the adoption of tubeless spoke wheels, use of lightweight alloys, and increased consumer interest in wheel customization are shaping product development.

The geographical landscape of the adventure motorcycle wheels market is shaped by strong demand across North America, Europe, and Asia Pacific, with growing interest in Latin America and Oceania. North America, particularly the U.S., hosts key players like Woody’s Wheel Works, Dubya USA. In Europe, brands such as Heidenau, Marvic S.A., and Rally-Raid Products drive innovation through advanced materials and specialized off-road wheel systems. Australia and New Zealand support regional growth with rising adventure tourism and demand for high-performance wheels, benefiting brands like MOTOZ.

Market Insights

- The adventure motorcycle wheels market was valued at USD 1,755 million in 2024 and is expected to reach USD 3,130 million by 2032, growing at a CAGR of 7.5%.

- Increasing popularity of long-distance touring and off-road riding is driving demand for durable and performance-focused wheels.

- Tubeless spoke wheels and lightweight alloy options are gaining traction due to their balance of strength, convenience, and ride comfort.

- Competitive landscape includes key players like Woody’s Wheel Works, Dubya USA, MOTOZ, and Rally-Raid Products, focusing on customization, material innovation, and aftermarket expansion.

- High production costs and supply chain disruptions act as key restraints, limiting product accessibility in some regions.

- North America, Europe, and Asia Pacific remain leading regions with strong consumer demand and established motorcycle cultures.

- Customization trends, digital retail growth, and expanding adventure tourism continue to create new opportunities for market players.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Popularity of Long-Distance Touring and Off-Road Riding is Boosting Demand

The increasing interest in long-distance touring and off-road adventure riding is a major driver of the adventure motorcycle wheels market. Riders now seek durable and performance-oriented wheels that can handle rough terrains and extended journeys. This shift in consumer preference supports higher demand for spoke and alloy wheels built for both strength and flexibility. Manufacturers respond by offering wheels with improved load-carrying capacities and impact resistance. It strengthens product development strategies across the industry. The adventure motorcycle wheels market benefits directly from this rise in adventure touring culture, especially in North America, Europe, and parts of Asia.

- For instance, spoked wheel rims made from aluminum alloy withstand compressive loads of up to 20,000 N with rim tension levels near 66 MPa.

Rising Sales of Mid-Weight and Heavy Adventure Motorcycles Fuel Wheel Upgrades

The increasing production and sales of mid-weight and heavy-duty adventure motorcycles are encouraging the use of specialized wheels. Manufacturers focus on fitting motorcycles with wheels that can accommodate high engine power and weight, while ensuring stability on varied terrains. It has led to the development of multi-material wheel systems designed for performance and safety. Consumers increasingly replace standard wheels with aftermarket options that offer better strength and reduced weight. The adventure motorcycle wheels market sees strong traction from enthusiasts seeking improved ride quality and custom design. It has become a key focus for OEMs and aftermarket suppliers alike.

- For instance, Carbon Revolutionis a global technology company and Tier 1 OEM supplier, which has successfully innovated, commercialised and industrialised the supply of lightweight carbon fibre wheels to the global automotive industry.

Technological Advancements in Materials and Manufacturing Processes Accelerate Adoption

Innovations in material science and production techniques continue to improve the performance and longevity of motorcycle wheels. Lightweight alloys, corrosion-resistant coatings, and CNC-machined components allow for wheels that perform well in diverse environments. It supports growing consumer expectations for both functionality and aesthetics. Manufacturers now offer products with enhanced shock absorption and reduced rolling resistance. These advances help riders tackle demanding trails with greater confidence. The adventure motorcycle wheels market gains from the rising preference for technologically enhanced wheel designs.

Expanding Aftermarket Ecosystem and Customization Preferences Drive Product Demand

The aftermarket segment plays a crucial role in shaping the adventure motorcycle wheels market. Riders increasingly invest in customized wheels to suit personal style and performance needs. It includes demand for different rim sizes, finishes, spoke patterns, and color options. Aftermarket brands continue to expand their product lines to meet these varied consumer requirements. E-commerce platforms further simplify access to specialized wheels, boosting sales across regions. This trend continues to accelerate wheel replacements and upgrades beyond standard offerings.

Market Trends

Increased Consumer Shift Toward Tubeless and Spoke Wheel Combinations Gains Momentum

Riders now prefer tubeless spoke wheels for better puncture resistance and ease of repair during off-road travel. This trend is reshaping product offerings across brands, blending the durability of spoke wheels with the convenience of tubeless designs. It improves safety while reducing downtime during long-distance rides. Manufacturers are integrating this combination into stock and aftermarket options to meet evolving rider demands. The adventure motorcycle wheels market reflects this shift, with rising adoption among both premium and mid-range motorcycle categories. It continues to influence wheel innovation and design strategies globally.

- For instance, In September 2024, Royal Enfield officially announced the tubeless wire-spoked wheels (also called cross‑spoke wheels) for the Himalayan 450 via its “Make It Yours” (MiY) and Genuine Motorcycle Accessories (GMA) programs

OEMs Emphasize Lightweight Materials to Improve Performance and Fuel Efficiency

Motorcycle manufacturers focus on reducing overall vehicle weight without compromising durability or strength. This push has led to increased use of aluminum alloys and carbon-reinforced materials in wheel construction. It helps improve fuel efficiency and handling, especially on challenging terrains. OEMs now incorporate these advanced materials into original equipment specifications for adventure motorcycles. The adventure motorcycle wheels market responds with lightweight, high-performance solutions designed for both touring and technical off-road use. It supports growing consumer expectations for high-end performance at competitive prices.

- For instance, One of the most noticeable upgrades on the 2025 KTM 390 Adventure is the new 21-inch front and 17-inch rear tubeless spoke wheel setup.

Growing Interest in Aesthetic Customization Encourages Visual and Functional Modifications

Riders increasingly personalize their motorcycles, placing equal importance on performance and appearance. Wheel customization has emerged as a key element, with trends favoring anodized finishes, bold spoke designs, and varied rim sizes. It drives aftermarket brands to expand their offerings and create visually distinct, terrain-specific models. Customization supports rider identity and enhances perceived value of the motorcycle. The adventure motorcycle wheels market incorporates this trend into both design and marketing efforts. It influences how brands position new product lines to attract lifestyle-oriented consumers.

Online Retail and Digital Platforms Streamline Access to Specialized Wheel Products

E-commerce continues to transform how riders shop for replacement and upgrade parts. Online platforms provide easy access to a broad range of wheels, specifications, and customization options. It reduces the reliance on physical dealerships and widens the customer base across geographies. Buyers now compare products, read reviews, and explore compatibility features before making informed decisions. The adventure motorcycle wheels market benefits from this digital convenience, with brands strengthening their direct-to-consumer strategies. It creates more responsive supply chains and competitive pricing models.

Market Challenges Analysis

High Cost of Advanced Materials and Custom Wheels Limits Mass Adoption

The use of advanced alloys, reinforced spokes, and premium finishes significantly increases the production cost of adventure motorcycle wheels. These high-end components often price out entry-level or casual riders who prefer budget-friendly alternatives. It restricts adoption in emerging markets where cost sensitivity remains high. Manufacturers struggle to balance innovation with affordability while maintaining performance standards. The adventure motorcycle wheels market faces this barrier as a key challenge in scaling demand across all customer segments. It slows overall penetration, especially in regions with limited access to financing or aftermarket support.

Supply Chain Disruptions and Limited Availability of Specialized Components Create Delays

Complex manufacturing processes and reliance on specialized raw materials often lead to extended production cycles and supply shortages. It affects both OEMs and aftermarket suppliers who depend on timely component delivery. Global logistics issues, trade restrictions, and raw material price fluctuations increase uncertainty in the supply chain. These disruptions can delay product launches and reduce inventory availability for consumers. The adventure motorcycle wheels market experiences constraints in meeting growing demand due to these limitations. It pressures manufacturers to build more resilient and localized sourcing strategies.

Market Opportunities

Expanding Adventure Tourism Industry Unlocks New Consumer Segments and Regional Markets

The rising popularity of adventure tourism presents a strong growth opportunity for wheel manufacturers. More travelers seek guided motorcycle expeditions and off-road experiences across remote locations. It drives demand for robust and adaptable wheels that can perform under extreme conditions. Manufacturers can capitalize on this trend by targeting rental fleets, tour operators, and travel-focused motorcycle brands. The adventure motorcycle wheels market stands to benefit from expanding tourism infrastructure in regions such as Southeast Asia, Africa, and South America. It creates long-term potential for both OEM and aftermarket segments.

Product Innovation in Modular and Customizable Wheels Supports Market Differentiation

Innovation in modular wheel designs offers opportunities to meet the diverse needs of off-road and dual-sport riders. Riders value the ability to customize wheel setups based on terrain or personal preference. It encourages manufacturers to invest in detachable rims, interchangeable spoke patterns, and terrain-specific finishes. These product features improve functionality and appeal to performance-focused consumers. The adventure motorcycle wheels market can use this trend to offer value-added options that go beyond standard configurations. It helps brands create differentiation and attract a loyal customer base.

Market Segmentation Analysis:

By Application:

The adventure motorcycle wheels market is segmented into high-end road motorcycles, high-end racing motorcycles, and high-end off-road motorcycles. High-end off-road motorcycles hold a significant share due to the growing demand for rugged and terrain-capable bikes. It reflects a rising interest in adventure touring and trail exploration. High-end road motorcycles follow closely, driven by consumers seeking durability and style for long-distance rides. High-end racing motorcycles contribute through performance-focused buyers who demand lightweight, high-speed components. Each application segment supports product differentiation and innovation within the market.

- For instance, Royal Enfield bike price starts from Rs. 1,49,900. Royal Enfield offers 14 new models in India with most popular bikes being Hunter 350, Classic 350 and Continental GT 650.

By Type:

The market is divided into spoked wheels and alloy wheels. Spoked wheels dominate due to their superior shock absorption, flexibility, and suitability for uneven terrain. It makes them a preferred choice among off-road and dual-sport riders. Alloy wheels maintain a strong presence in road and racing segments where aesthetics, low maintenance, and precision matter. Manufacturers continue to improve both types through design enhancements and hybrid solutions, catering to a broader customer base. The adventure motorcycle wheels market gains from this balance of utility and performance across rider preferences.

- For instance, KTM 890 Adventure R is powered by 889 cc engine.This 890 Adventure R engine generates a power of 104.69 PS @ 8000 rpm and a torque of 100 Nm @ 6500 rpm. The claimed mileage of 890 Adventure R is 22.22 kmpl.

By Material:

The market includes aluminum alloy, magnesium alloy, and carbon fiber. Aluminum alloy leads due to its durability, corrosion resistance, and cost-effectiveness. It supports wide adoption across OEM and aftermarket offerings. Magnesium alloy, while more expensive, attracts performance-oriented riders seeking lightweight construction and high strength. Carbon fiber wheels occupy a niche segment, favored in racing applications for their unmatched strength-to-weight ratio. It helps premium brands introduce advanced products to differentiate themselves in a competitive market. The use of innovative materials continues to shape buyer expectations and elevate product standards.

Segments:

Based on Application:

- High-end Road Motorcycle

- High-end Racing Motorcycle

- High-end Off-road Motorcycle

Based on Types:

- Spoked Wheels

- Alloy Wheels

Based on Material:

- Alluminium alloy

- Magnesium alloy

- Carbon fibre

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America accounted for approximately 28% of the global adventure motorcycle wheels market share in 2024. The region’s strong demand is driven by a well-established motorcycling culture, expanding interest in off-road touring, and a high concentration of premium adventure motorcycle owners. The United States remains the largest contributor, supported by a robust aftermarket ecosystem and a preference for long-distance travel motorcycles. Brands like Harley-Davidson, BMW, and KTM continue to dominate the adventure segment in this region, boosting the demand for advanced wheel components. Riders in North America often upgrade their motorcycles with customized and performance-focused wheels, which further supports aftermarket sales. It encourages suppliers to develop specialized products suited for both paved and unpaved terrain. Canada also shows steady growth, supported by expanding adventure tourism and a growing community of dual-sport riders.

Europe

Europe holds a significant 33% share of the global market, making it the leading region in the adventure motorcycle wheels segment. Countries such as Germany, Italy, France, and the UK lead in both production and consumption of adventure motorcycles and related components. The presence of leading motorcycle brands like BMW Motorrad, Ducati, and Triumph increases the penetration of high-performance wheels in the region. Consumers in Europe prioritize durability, handling, and advanced material construction in their wheel choices. Strict regulations around vehicle safety and emissions also influence product design and quality. It drives innovation and accelerates the adoption of lightweight and corrosion-resistant materials such as aluminum and magnesium alloys. European riders frequently participate in cross-border adventure tours, which demands strong, versatile wheel systems.

Asia Pacific

Asia Pacific contributes around 24% of the global adventure motorcycle wheels market. The region is witnessing rising motorcycle ownership, especially in countries like India, China, Thailand, and Indonesia. Growth in disposable income and interest in leisure riding support the expanding demand for mid-range and premium adventure motorcycles. It fuels the need for affordable yet durable wheel options. Japan plays a key role in manufacturing, with brands such as Honda, Yamaha, and Suzuki focusing on both domestic and global markets. India is emerging as a fast-growing market, driven by companies like Royal Enfield and Hero MotoCorp investing in adventure segment offerings. The availability of rugged terrains and increasing awareness of motorcycle touring continues to boost demand for off-road-capable wheels. Local manufacturing also helps lower product costs and improve accessibility in this region.

Latin America

Latin America holds about 8% of the global market share. Brazil, Argentina, and Mexico are the major contributors, where motorcycle use extends beyond commuting to include recreational riding. The region’s diverse geography, from mountains to forests, increases interest in dual-sport and adventure motorcycles. It supports steady demand for spoked and alloy wheels that can handle rough road conditions. Limited access to premium wheel components and high import duties pose challenges, but growing local production and aftermarket development help improve availability. It opens opportunities for affordable, terrain-specific wheel solutions tailored to regional needs.

The Middle East and Africa

The Middle East and Africa represent approximately 7% of the adventure motorcycle wheels market. Though relatively small, this region is seeing rising interest in motorcycle adventure tourism and off-road events. Countries like South Africa, the UAE, and Morocco are investing in tourism infrastructure that supports off-road exploration. It has led to gradual growth in premium motorcycle sales and related wheel components. However, limited dealer networks and high import costs restrict faster adoption. Market players can benefit by establishing partnerships with regional distributors and promoting locally relevant product lines designed for desert and mountain terrains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Woody’s Wheel Works

- Heidenau

- Marvic S.A.

- MOTOZ

- Dubya USA

- Shinko Tire USA

- Haan Wheels

- Rally-Raid Products

- Rocky Mountain ATV/MC

- Mitas

Competitive Analysis

The adventure motorcycle wheels market is highly competitive, with key players including Woody’s Wheel Works, Heidenau, Marvic S.A., MOTOZ, Dubya USA, Shinko Tire USA, Haan Wheels, Rally-Raid Products, and Rocky Mountain ATV/MC. Companies in this space focus on lightweight construction, spoke reinforcement, and compatibility with high-end adventure motorcycles to meet evolving rider needs. Premium aftermarket segments emphasize custom-built and performance-enhanced wheelsets designed for off-road durability. Tire-wheel integration supports riders navigating extreme trail conditions, while advanced materials such as magnesium and forged aluminum improve strength-to-weight ratios for racing and rugged applications. Terrain-specific wheel kits and accessories are tailored to dual-sport and touring demands. Competitive strategies center on technology, customization, and consumer trust. Market expansion relies on strategic partnerships, OEM collaborations, and online distribution networks that enhance accessibility and brand reach.

Recent Developments

- In June 4 2025, The Tractionator Outback Race, developed by Motoz over four years, is designed for the toughest rally raid conditions.After extensive testing on the challenging Finke Desert Race track and covering thousands of kilometers across Australia’s rugged red heart. The MOTOZ Tractionator Outback Race is finally here– a brand-new rear tire purpose-built for high-speed off-road.

- In November 2024, Heidenau unveiled the K34 Arrow cruiser tyre at the 2024 EICMA, blending classic styling with aramid-enhanced construction for better stability.

- In May 2024, Mitas launched the Enduro Trail‑XT adventure tire, designed as a rear fitment to pair with the ENDURO TRAIL‑XT+ front tire for improved handling across varied terrain.

Market Concentration & Characteristics

The adventure motorcycle wheels market remains moderately concentrated, with a mix of established manufacturers and niche aftermarket players operating across global and regional levels. Key participants focus on product durability, terrain-specific performance, and material innovation to maintain competitive advantage. It features a high level of customization, with riders demanding wheel systems that match both off-road endurance and on-road stability. The market supports a balance between OEM supply and aftermarket upgrades, allowing consumers to modify their wheels based on riding preferences and environmental conditions. It reflects strong brand loyalty, particularly in premium segments, where riders rely on trusted manufacturers for safety and performance. While large players dominate in North America and Europe, emerging brands are expanding in Asia Pacific and Latin America, catering to cost-sensitive buyers. The adventure motorcycle wheels market benefits from a stable demand cycle tied to motorcycle sales, touring trends, and the rise of motorsport and off-road expeditions. It continues to evolve through digital retail, material advancements, and rider-centric engineering.

Report Coverage

The research report offers an in-depth analysis based on Application, Types, Material and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. It discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth.

Future Outlook

- The market will see rising demand due to increased interest in off-road and long-distance motorcycle touring.

- Manufacturers will focus more on lightweight and impact-resistant materials to enhance wheel durability.

- Spoked tubeless wheels will continue gaining popularity among dual-sport and adventure riders.

- Customization options will expand, offering more colors, spoke patterns, and rim sizes to match rider preferences.

- Online platforms will play a larger role in product discovery, sales, and customer support.

- Aftermarket players will introduce modular and terrain-specific wheels for niche rider segments.

- Partnerships between OEMs and premium wheel brands will increase to meet performance and design standards.

- More brands will localize production to reduce lead times and improve regional availability.

- Integration of smart features such as pressure sensors and heat resistance will emerge in premium models.

- Sustainability in sourcing and recycling of materials will become a greater focus in product development.