Market Overview

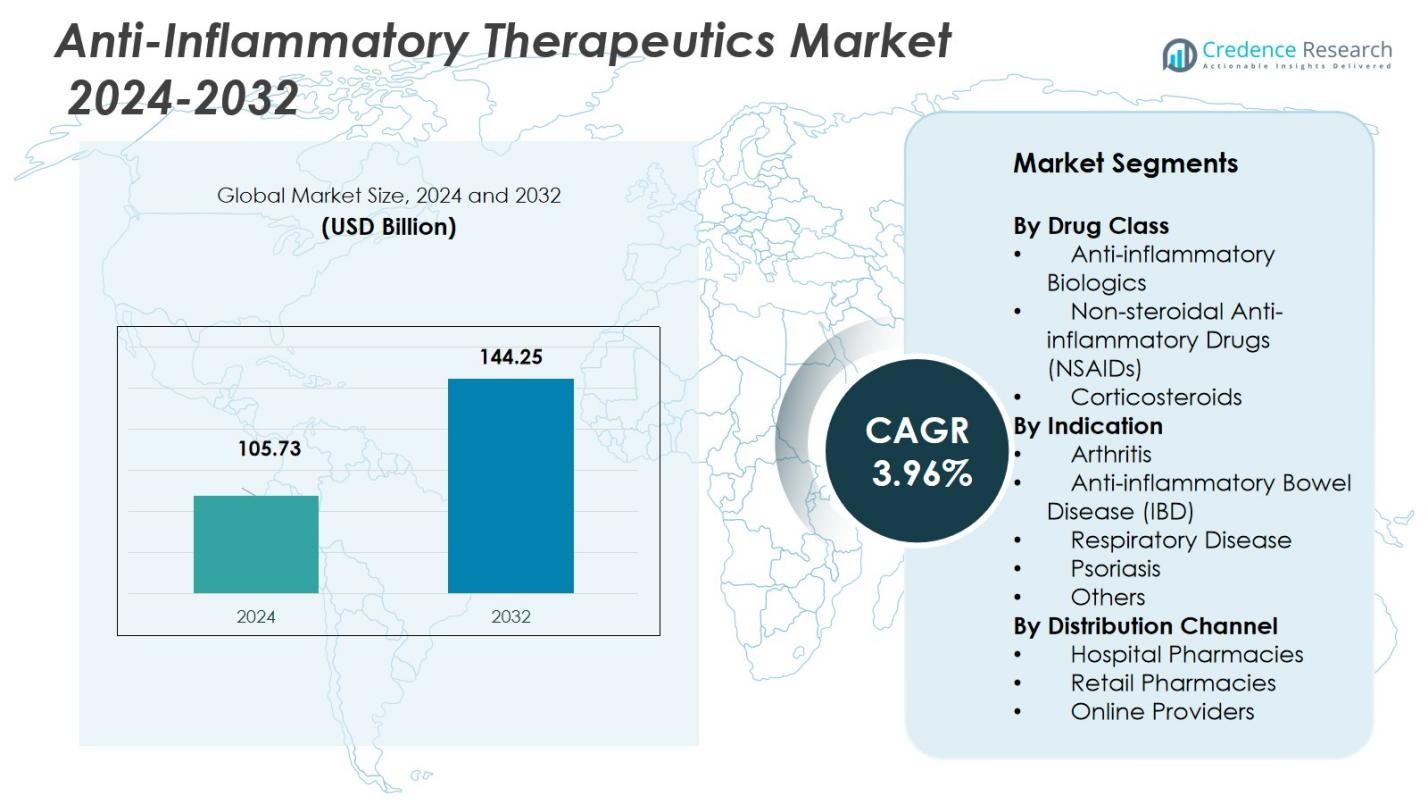

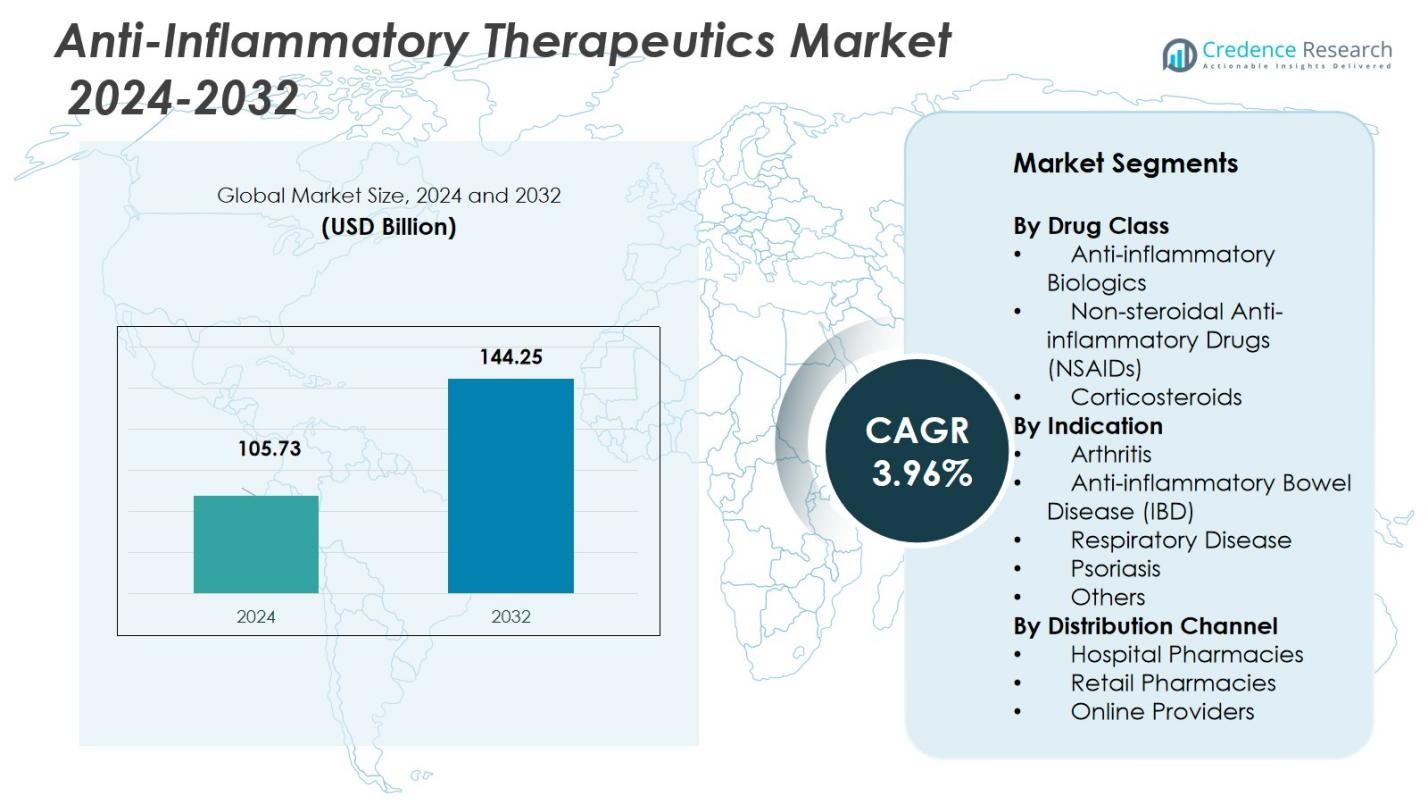

The Anti-Inflammatory Therapeutics Market size was valued at USD 105.73 Billion in 2024 and is anticipated to reach USD 144.25 Billion by 2032, at a CAGR of 3.96% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti-Inflammatory Therapeutics Market Size 2024 |

USD 105.73 Billion |

| Anti-Inflammatory Therapeutics Market, CAGR |

3.96% |

| Anti-Inflammatory Therapeutics Market Size 2032 |

USD 144.25 Billion |

The Anti-Inflammatory Therapeutics Market is led by key players such as Eli Lilly and Company, F. Hoffmann-La Roche AG, Pfizer Inc., GSK, Johnson & Johnson Services, Inc., Novartis AG, AstraZeneca PLC, Amgen Inc., and Merck & Co., Inc. These companies dominate the market with diversified portfolios of NSAIDs, corticosteroids, and biologics, addressing a wide range of inflammatory conditions such as arthritis, psoriasis, and respiratory diseases. North America holds the largest regional share, accounting for 45.0% of the market in 2024, driven by advanced healthcare infrastructure and high adoption rates of biologic therapies. Europe follows with a 30.0% share, supported by its aging population and strong public healthcare systems. The Asia-Pacific region, representing 20.0% of the market, is witnessing rapid growth due to increasing healthcare access and rising awareness in emerging economies like China and India.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Anti-Inflammatory Therapeutics Market size was valued at USD 105.73 Billion in 2024 and is anticipated to reach USD 144.25 Billion by 2032, growing at a CAGR of 3.96% during the forecast period.

- The rising prevalence of chronic inflammatory diseases, particularly arthritis and respiratory conditions, is driving the demand for effective anti-inflammatory therapies across the globe.

- Key trends include increasing adoption of biologic therapies and biosimilars, with a growing focus on personalized medicine tailored to individual patient profiles.

- Market restraints include regulatory hurdles, pricing pressures, and safety concerns associated with long-term use of certain anti-inflammatory drugs, such as NSAIDs and corticosteroids.

- North America leads the market with a 45.0% share in 2024, followed by Europe at 30.0%. The Asia-Pacific region, growing at a rapid pace, holds 20.0% of the market share in 2024, driven by increased healthcare access and awareness.

Market Segmentation Analysis:

Market Segmentation Analysis:

By Drug Class

The Anti-Inflammatory Therapeutics Market is primarily divided into three major drug classes: Anti-inflammatory Biologics, Non-steroidal Anti-inflammatory Drugs (NSAIDs), and Corticosteroids. Among these, NSAIDs dominate the market with the largest share, accounting for 55.2% in 2024. This dominance is driven by their widespread use in treating pain and inflammation across various conditions such as arthritis and muscle injuries. NSAIDs’ availability over-the-counter further boosts their market share. Anti-inflammatory Biologics are expected to grow at a significant rate, driven by advancements in biologic therapies for autoimmune diseases like rheumatoid arthritis.

- For instance, ibuprofen from Advil provides rapid relief for arthritis pain and fever through COX enzyme inhibition, available OTC for everyday use. Naproxen in Aleve offers longer-lasting effects for muscle injuries, taken every 8-12 hours as needed.

By Indication

The market is segmented based on indication, with the key segments being Arthritis, Anti-inflammatory Bowel Disease (IBD), Respiratory Disease, Psoriasis, and Others. Arthritis holds the largest share of the market, representing 43.8% in 2024. The increasing prevalence of osteoarthritis and rheumatoid arthritis, coupled with the effectiveness of anti-inflammatory therapeutics, drives this dominance. Respiratory diseases are expected to see robust growth, particularly due to the rising cases of asthma and chronic obstructive pulmonary disease (COPD), further increasing the demand for anti-inflammatory treatments.

- For instance, Pfizer’s Xeljanz (tofacitinib) has demonstrated significant efficacy in treating moderate to severe rheumatoid arthritis, contributing to its strong uptake.

By Distribution Channel

The distribution channels for Anti-Inflammatory Therapeutics include Hospital Pharmacies, Retail Pharmacies, and Online Providers. Retail Pharmacies hold the dominant share, contributing 47.5% in 2024. This is attributed to the wide accessibility and convenience of purchasing anti-inflammatory drugs at retail outlets. Online Providers are the fastest-growing sub-segment, driven by the increasing trend of e-commerce and telemedicine. The convenience of online purchasing, along with home delivery options, is a key driver of growth in this segment, particularly during the COVID-19 pandemic and beyond.

Key Growth Drivers

Rising Prevalence of Chronic Diseases

The increasing prevalence of chronic diseases, particularly arthritis, respiratory diseases, and inflammatory bowel diseases, is a significant driver of growth in the Anti-Inflammatory Therapeutics Market. As the global population ages, the incidence of these conditions rises, boosting the demand for effective anti-inflammatory treatments. Arthritis, particularly osteoarthritis and rheumatoid arthritis, represents a major portion of this demand. These diseases often require long-term management, which further fuels the market for both biologic and non-biologic anti-inflammatory therapies, contributing to market expansion.

- For instance, tumor necrosis factor inhibitors such as etanercept (Enbrel), adalimumab (Humira), and infliximab (Remicade) serve as key biologic options for rheumatoid arthritis management. These therapies target inflammation to reduce joint damage in long-term care.

Advancements in Biologic Therapies

Technological advancements in biologic therapies have significantly impacted the Anti-Inflammatory Therapeutics Market, providing more effective and targeted treatments for inflammatory diseases. Biologics, such as TNF inhibitors and interleukin inhibitors, offer more specific treatment options for autoimmune diseases, resulting in improved patient outcomes. These therapies are particularly useful for treating conditions like rheumatoid arthritis and psoriasis. As research progresses and new biologics are introduced, the market is expected to experience a substantial growth trajectory, driven by increasing adoption of these advanced therapies.

- For instance, TNF inhibitors such as adalimumab (Humira), etanercept (Enbrel), and infliximab (Remicade) are widely used to treat rheumatoid arthritis and psoriasis, showing significant improvement in patient outcomes.

Increased Consumer Awareness and Healthcare Accessibility

Growing consumer awareness about inflammatory diseases and the availability of treatment options are key factors propelling the Anti-Inflammatory Therapeutics Market. Patients are now more knowledgeable about the benefits of early diagnosis and treatment, leading to higher demand for anti-inflammatory drugs. In addition, improving healthcare access in both developed and emerging markets is expanding the reach of these therapies, driving growth. As patients seek more effective treatments for inflammatory conditions, the market for both over-the-counter NSAIDs and prescription biologics continues to grow.

Key Trends & Opportunities

Shift Towards Personalized Medicine

Personalized medicine is gaining traction in the Anti-Inflammatory Therapeutics Market, with treatments being tailored to the genetic and molecular profiles of patients. This shift allows for more targeted therapies that can enhance the effectiveness of treatment while reducing potential side effects. The increasing adoption of precision medicine, coupled with advancements in genomic testing, opens new opportunities for developing custom therapies for inflammatory diseases. This trend is particularly important for biologics, which can be fine-tuned to specific biomarkers for improved outcomes, presenting a significant opportunity in the market.

- For instance, Sanofi/Regeneron’s sarilumab (Kevzara) is an IL-6 receptor inhibitor approved in 2017 for treating adults with moderately to severely active rheumatoid arthritis who have had an inadequate response to or intolerance of one or more disease-modifying antirheumatic drugs (DMARDs).

Growth of Online Pharmacies and E-Commerce

The rise of online pharmacies and e-commerce platforms is reshaping the distribution of anti-inflammatory therapeutics. Online providers are growing rapidly, driven by the convenience and accessibility they offer consumers. This trend has been accelerated by the COVID-19 pandemic, which led to an increase in remote healthcare consultations and home delivery of medications. Online pharmacies are not only expanding access but also offering a wider range of over-the-counter and prescription anti-inflammatory drugs. This trend presents opportunities for market players to tap into the digital distribution landscape and enhance consumer engagement.

- For instance, Amazon Pharmacy launched its services in the U.S., allowing customers to access prescription medications, including anti-inflammatory drugs, directly from their homes.

Key Challenges

Regulatory and Pricing Pressure

Regulatory hurdles and pricing pressures are significant challenges for the Anti-Inflammatory Therapeutics Market. In many regions, regulatory approval processes for new biologics and drugs can be time-consuming and expensive, delaying the introduction of innovative therapies. Moreover, increasing scrutiny on drug pricing and the demand for affordable healthcare options place pressure on companies to reduce costs while maintaining product efficacy. This regulatory landscape can impact the market’s ability to rapidly innovate and launch new treatments, affecting the overall growth potential.

Side Effects and Safety Concerns

Safety concerns, particularly related to long-term use of non-steroidal anti-inflammatory drugs (NSAIDs) and corticosteroids, pose a significant challenge in the Anti-Inflammatory Therapeutics Market. While these drugs are effective, they can lead to severe side effects such as gastrointestinal bleeding, cardiovascular issues, and kidney damage when used over extended periods. This has led to concerns among healthcare providers and patients, limiting the widespread adoption of certain treatments. The need for safer alternatives and better risk management strategies presents a challenge for market players.

Regional Analysis

North America

North America leads the global Anti‑Inflammatory Therapeutics Market, holding a 45.0% share in 2024. Strong healthcare infrastructure, high per‑capita healthcare expenditure, and robust research and development activities support this dominance. The region benefits from early adoption of innovative biologics and specialty anti‑inflammatory therapies, supported by regulatory frameworks and high chronic disease prevalence. Key markets such as the United States and Canada drive demand through widespread access to advanced therapies and continuing demand for management of inflammatory and autoimmune conditions.

Europe

Europe commands the second‑largest regional share in the anti‑inflammatory therapeutics market, at 30.0% in 2024. The region’s aging population, increasing prevalence of chronic inflammatory disorders, and strong public healthcare systems underpin this performance. Regulatory oversight from agencies such as the European Medicines Agency supports introduction of newer biologics and biosimilars, while widespread national reimbursement frameworks encourage patient access. Countries including Germany, France, and the United Kingdom lead demand for both traditional NSAIDs and advanced biologic treatments.

Asia‑Pacific

The Asia‑Pacific region holds 20.0% of the global anti‑inflammatory therapeutics market in 2024 and is emerging as the fastest-growing region during the forecast period. Growth in this region is driven by rising healthcare access, increasing disposable incomes, and expanding awareness of inflammatory diseases in populous countries such as China and India. Government efforts to improve healthcare infrastructure and greater penetration of both generic NSAIDs and novel biologics support expansion. Rapid urbanization and growing chronic disease burden further contribute to demand escalation in the region.

Latin America

Latin America accounts for 3.0% of the global anti‑inflammatory therapeutics market in 2024. Growth in this region is supported by improving healthcare infrastructure, increasing access to medicines, and rising awareness of inflammatory diseases among patients. Expansion of distribution networks, increasing penetration of retail and hospital pharmacies, and gradual uptake of prescription anti‑inflammatory drugs are driving market growth. However, constrained healthcare spending and slower adoption rates of high‑cost biologics moderate market share in the near term.

Middle East & Africa

The Middle East & Africa region represents 2.0% of the market in 2024. The region’s growth is supported by gradual improvements in healthcare delivery systems, rising prevalence of chronic inflammatory diseases, and increasing demand for both conventional anti‑inflammatory drugs and emerging biologics. Regulatory reforms and growing public‑private investment in healthcare access are gradually expanding market penetration. Nevertheless, limited healthcare budgets, lower per‑capita drug spend, and slower regulatory approval timelines for new therapies restrain rapid growth.

Market Segmentations:

By Drug Class

- Anti-inflammatory Biologics

- Non-steroidal Anti-inflammatory Drugs (NSAIDs)

- Corticosteroids

By Indication

- Arthritis

- Anti-inflammatory Bowel Disease (IBD)

- Respiratory Disease

- Psoriasis

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Providers

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape of the Anti‑Inflammatory Therapeutics Market features key players such as Eli Lilly and Company, F. Hoffmann‑La Roche AG, Pfizer Inc., GSK, Johnson & Johnson Services, Inc., Novartis AG, AstraZeneca PLC, Amgen Inc., and Merck & Co., Inc. These firms maintain a stronghold through diversified portfolios of biologics, NSAIDs, and corticosteroids, balanced across therapeutic areas like arthritis, IBD, respiratory disease and psoriasis. Market competition intensifies as companies seek to expand via novel biologics, biosimilars, and generics, while optimizing cost‑effectiveness and distribution outreach. Leading firms leverage their R&D capabilities, global regulatory experience, and broad distribution networks to defend and grow their market share. Meanwhile, mid‑sized and generic drug manufacturers challenge incumbents by offering lower-cost alternatives, particularly in price‑sensitive regions. As a result, the market remains moderately consolidated, but dynamic — marked by continuous product launches, patent expirations, and strategic repositioning to address evolving demand and regulatory pressures.

Key Player Analysis

- Ferring Pharmaceuticals

- Pfizer Inc.

- Johnson & Johnson Services, Inc.

- Amgen Inc.

- Merck & Co., Inc.

- GSK

- AstraZeneca PLC

- Novartis AG

- Eli Lilly and Company

- F. Hoffmann-La Roche AG

Recent Developments

- In October 2025 the company Novartis announced that it will present late‑breaking Phase III data on its investigational anti‑inflammatory biologic for Sjögren’s disease and biomarker data for a cell‑based therapy in Systemic lupus erythematosus at the American College of Rheumatology Convergence 2025.

- In June 2025, Xifyrm™ (meloxicam injection), an IV non‑steroidal anti‑inflammatory drug (NSAID), received approval from the U.S. Food and Drug Administration for management of moderate‑to‑severe pain, expanding NSAID treatment options available to clinicians.

- In October 2025 the U.S. Food and Drug Administration (FDA) approved an updated indication for RINVOQ (upadacitinib), expanding its use to adults with moderately to severely active ulcerative colitis (UC) and Crohn’s disease (CD) under broader conditions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Report Coverage

The research report offers an in-depth analysis based on Drug Class, Indication, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Continued rise in global prevalence of chronic inflammatory and autoimmune diseases will steadily expand demand for anti‑inflammatory therapies.

- Ongoing innovation in biologics, small molecules, and targeted therapies will yield more effective and safer treatment options increasing uptake across patient segments.

- Growing adoption of biosimilars will widen access to biologic‑level anti‑inflammatory treatments at lower cost, especially in price‑sensitive and emerging markets.

- Expansion of healthcare infrastructure and improved access in emerging regions (e.g., Asia‑Pacific, Latin America) will drive market penetration and growth beyond traditional markets.

- Increased patient awareness of inflammatory diseases and early intervention benefits will prompt higher demand for both prescription and over‑the‑counter anti‑inflammatory drugs.

- Growth in indications beyond traditional arthritis such as inflammatory bowel disease, respiratory disorders, and dermatological inflammation will broaden the therapeutic need and expand market scope.

- Rise in personalized medicine and precision‑targeted anti‑inflammatory treatments tailored to genetic or biomarker profiles will open pathways for niche drug adoption.

- Increasing use of digital health solutions, telemedicine, and e‑commerce will facilitate easier drug access and adherence supporting growth in online and remote distribution channels.

- Expansion of regulatory approvals and faster market entry for novel therapies (including biologics and small molecules) will shorten time‑to‑market and bring forward innovation-led growth.

- Growing pressure on cost-effective care will push pharmaceutical companies to optimize manufacturing, introduce generics and biosimilars, and adapt pricing strategies enabling sustained growth while improving affordability.

Market Segmentation Analysis:

Market Segmentation Analysis: