Market Overview:

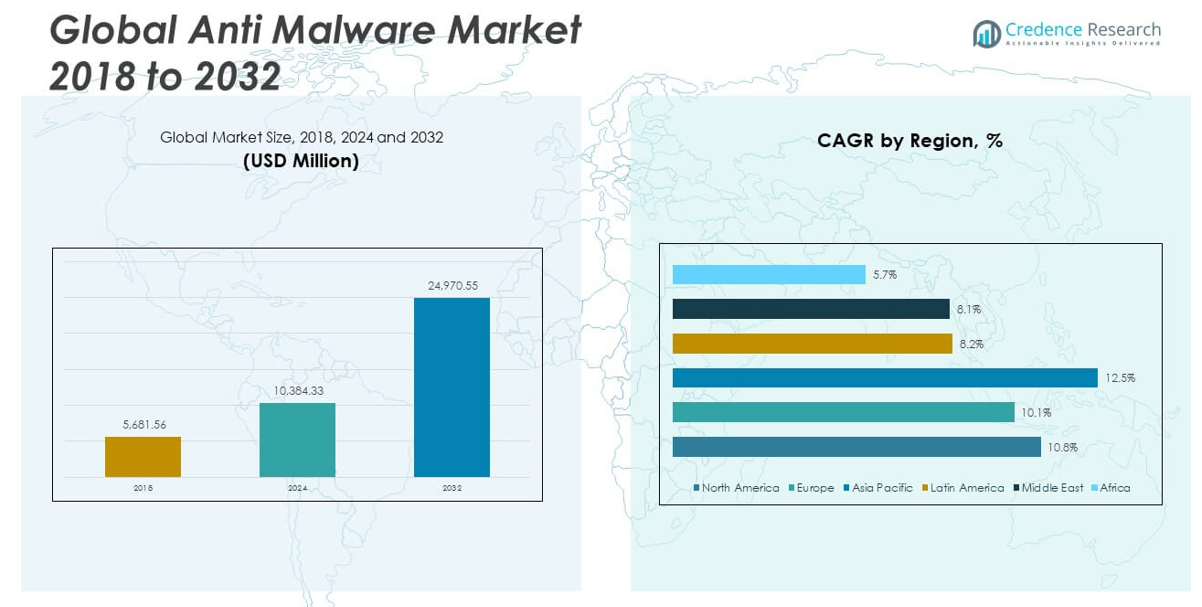

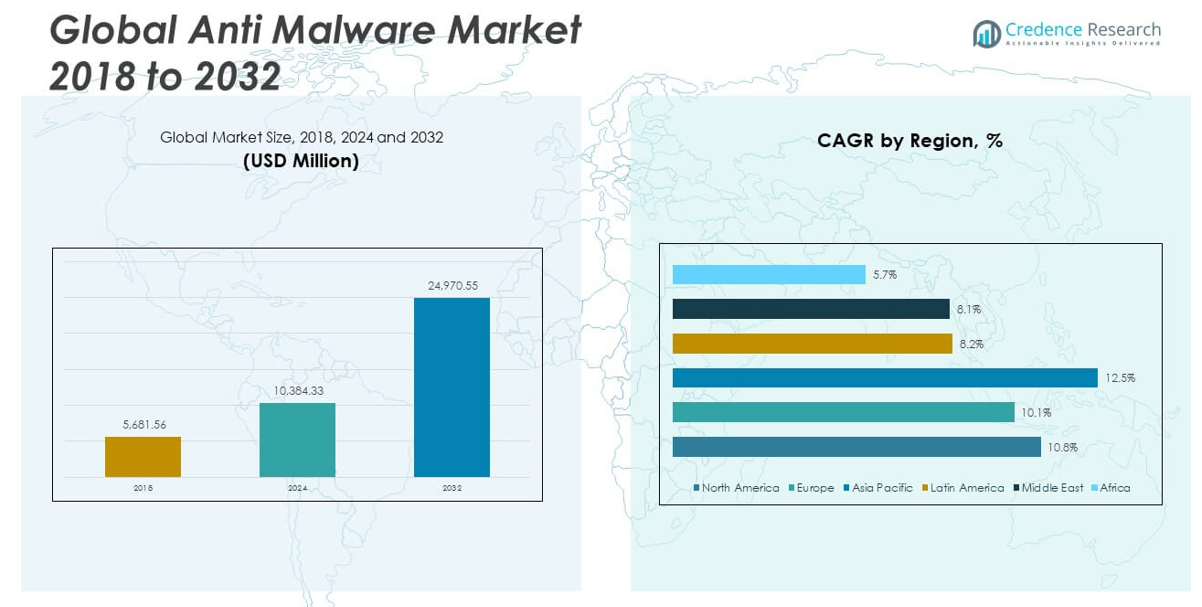

The Global Anti Malware Market size was valued at USD 5,681.56 million in 2018 to USD 10,384.33 million in 2024 and is anticipated to reach USD 24,970.55 million by 2032, at a CAGR of 10.80% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Anti Malware Market Size 2024 |

USD 10,384.33 million |

| Anti Malware Market, CAGR |

10.80% |

| Anti Malware Market Size 2032 |

USD 24,970.55 million |

One of the primary drivers fueling the growth of the anti-malware market is the escalating number of sophisticated cyber threats targeting both individuals and enterprises. The proliferation of malware-as-a-service (MaaS) platforms has lowered the entry barrier for cybercriminals, resulting in a substantial rise in malware attacks globally. Organizations are increasingly turning to advanced anti-malware solutions that incorporate machine learning and behavior-based detection to identify anomalies in real-time. Moreover, the widespread digitalization of sectors such as healthcare, banking, education, and e-commerce has led to an exponential increase in vulnerable endpoints and entry points, requiring comprehensive threat protection strategies. The growing adoption of Internet of Things (IoT) devices and mobile computing also presents new vulnerabilities that demand constant monitoring and rapid response. Additionally, regulatory compliance requirements such as GDPR, HIPAA, and CCPA are pushing enterprises to implement strong cybersecurity measures, including malware protection tools, to safeguard customer data and avoid heavy penalties.

Regionally, North America dominates the global anti-malware market, accounting for the largest revenue share due to its advanced IT infrastructure, high cybersecurity awareness, and presence of major security vendors. The United States leads in adoption, driven by strong regulatory mandates and high-profile cyber incidents across government and corporate sectors. Europe follows closely, with strict data privacy laws such as the General Data Protection Regulation (GDPR) compelling enterprises to invest in comprehensive anti-malware solutions. Countries like Germany, the UK, and France are at the forefront of implementing advanced cybersecurity frameworks. Meanwhile, the Asia-Pacific region is witnessing the fastest growth, fueled by rapid digital transformation, increasing internet penetration, and a rise in cyberattacks targeting. Latin America and the Middle East & Africa are also experiencing steady growth, supported by expanding IT infrastructure and rising awareness about cyber threats, though these regions currently hold a smaller share of the global market.

Market Insights:

- The Global Anti-Malware Market grew from USD 5,681.56 million in 2018 to USD 10,384.33 million in 2024 and is projected to reach USD 24,970.55 million by 2032, registering a CAGR of 10.80% during the forecast period.

- The surge in sophisticated cyberattacks such as zero-day exploits, ransomware, and malware-as-a-service is fueling demand for AI-driven anti-malware tools with real-time behavioral analysis.

- The rise of cloud computing, remote work, and Internet of Things (IoT) devices is expanding the attack surface, prompting adoption of scalable cloud-native anti-malware solutions.

- Stringent data protection regulations like GDPR, HIPAA, and CCPA are pushing enterprises to implement robust malware protection tools to avoid penalties and safeguard customer data.

- North America accounts for over 35% of the global market, driven by advanced IT infrastructure, high cybersecurity awareness, and strong regulatory frameworks.

- Asia Pacific is witnessing the fastest growth in the market, supported by rapid digital transformation, growing cyber threats, and increased cybersecurity investments in countries like India, China, and Japan.

- Technical limitations such as high false positive rates and sophisticated evasion techniques are challenging anti-malware effectiveness, necessitating continuous innovation and multi-layered threat detection systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Rising Cybercrime and Sophisticated Threat Vectors Continue to Elevate Enterprise Risk Exposure

The increasing frequency and complexity of cyberattacks remain a primary driver for the Global Anti-Malware Market. Threat actors continue to develop advanced persistent threats, zero-day exploits, and polymorphic malware that evade traditional security layers. This surge in malicious activity targets critical infrastructure, financial institutions, healthcare systems, and government networks. Organizations are under pressure to deploy advanced security platforms capable of real-time detection, incident response, and threat remediation. The rise of cybercrime-as-a-service models further expands the pool of attackers, amplifying the demand for robust endpoint and network protection tools. It has become imperative for enterprises to invest in anti-malware technologies that leverage behavioral analytics, machine learning, and threat intelligence to address evolving risks.

- For instance, Cisco’s Universal Zero Trust Network Access (ZTNA) solution enables consistent, identity-driven security for every user and device—including IoT/OT assets—across all applications and locations.

Cloud Adoption and Remote Work Expansion Are Creating New Attack Surfaces

The shift to cloud environments and remote work arrangements is contributing to the vulnerability of enterprise networks. The adoption of SaaS platforms, multi-cloud infrastructure, and virtual collaboration tools increases the complexity of IT ecosystems. This transformation introduces new endpoints and weakens traditional security perimeters, exposing networks to malware, phishing, and ransomware attacks. The Global Anti-Malware Market benefits from this trend as enterprises prioritize scalable, cloud-based security platforms to safeguard users and data across hybrid work environments. It supports security operations by enabling centralized monitoring, policy enforcement, and rapid updates. Businesses now require dynamic and adaptive malware protection tools that match the scale and pace of digital operations.

Growing Regulatory Requirements and Compliance Mandates Are Driving Security Investment

Governments and regulatory bodies are tightening cybersecurity standards across sectors to protect sensitive data and ensure operational resilience. Regulations such as GDPR, HIPAA, PCI DSS, and the Cybersecurity Maturity Model Certification (CMMC) mandate strong malware protection and breach response protocols. Failure to comply can result in financial penalties, reputational damage, and legal consequences. This compliance-driven environment compels organizations to deploy anti-malware solutions as part of a broader risk management strategy. The Global Anti-Malware Market gains traction from enterprises seeking to meet these obligations through proactive threat detection and remediation capabilities. It allows businesses to maintain regulatory alignment while improving overall cybersecurity posture.

Increased Mobile Device Penetration and IoT Proliferation Are Expanding the Threat Landscape

The widespread use of mobile devices and the rapid growth of Internet of Things (IoT) ecosystems are enlarging the attack surface for cybercriminals. Smartphones, tablets, wearables, and connected sensors are often poorly secured, making them attractive targets for malware distribution. It creates opportunities for attackers to infiltrate networks and exfiltrate data through unconventional vectors. The Global Anti-Malware Market addresses this challenge by introducing mobile security platforms and IoT-specific protection frameworks that offer real-time visibility and control. Vendors are enhancing product portfolios to support diverse device types, operating systems, and connectivity protocols. Organizations are now integrating anti-malware capabilities into endpoint management and network monitoring systems to contain threats across all digital assets.

- For instance, Phosphorus Cybersecurity’s Unified xIoT Security Management Platform delivers agentless, automated discovery and remediation for IoT, OT, IIoT, and IoMT devices, supporting over 950 manufacturers and more than a million device models.

Market Trends:

Integration of Artificial Intelligence and Automation Is Enhancing Threat Detection Accuracy

Vendors are increasingly embedding artificial intelligence (AI) and automation into anti-malware platforms to strengthen threat detection and incident response. These technologies improve the accuracy of identifying unknown threats by analyzing large datasets and learning from behavior patterns. AI enables systems to detect anomalies that traditional signature-based tools often miss. Automation accelerates response times and reduces the burden on security teams by executing predefined actions when malware is detected. The Global Anti-Malware Market is shifting toward autonomous security models that require minimal manual intervention. It supports faster containment of threats and improves resilience against evolving malware tactics.

- For example, IBM’s Security Cost of Data Breach Report 2023 found that organizations with extensive use of AI and automation reduced the average data breach lifecycle by 108 days (214 days vs. 322 days) and cut average breach costs by $1.76 million

Demand for Unified Threat Management Solutions Is Streamlining Cybersecurity Operations

Organizations are adopting unified threat management (UTM) systems that combine anti-malware, firewall, intrusion prevention, and content filtering into a single platform. This consolidation simplifies cybersecurity infrastructure and reduces the complexity of managing multiple tools. UTM solutions offer centralized visibility, improved coordination of defense mechanisms, and lower operational costs. Enterprises prefer integrated platforms that can scale across hybrid networks while maintaining consistent protection. The Global Anti-Malware Market is seeing greater investment in bundled solutions that reduce vendor sprawl and improve operational efficiency. It reflects a growing preference for holistic security frameworks over fragmented, point-based products.

- For example, Fortinet’s FortiGate integrates UTM capabilities, using heuristic analysis and sandboxing to detect both known and novel malware, with intrusion prevention systems (IPS) analyzing data packets for threat patterns.

Rising Focus on Endpoint Detection and Response Tools Is Reshaping Security Strategies

Endpoint Detection and Response (EDR) tools are gaining traction as enterprises seek greater visibility into endpoint activities and advanced threat hunting capabilities. These tools go beyond basic anti-malware by continuously monitoring endpoints, logging behaviors, and supporting forensic investigations. EDR platforms can isolate infected devices, analyze the root cause of attacks, and facilitate rapid remediation. The Global Anti-Malware Market is aligning with this trend by incorporating EDR features into traditional malware protection products. It enables security teams to proactively manage threats and mitigate breaches before they escalate. Demand for endpoint-centric solutions is increasing across sectors with distributed workforces and high mobility.

Growing Adoption of Zero Trust Architecture Is Shaping Malware Defense Models

The Zero Trust security model, which operates on the principle of “never trust, always verify,” is influencing how anti-malware solutions are designed and deployed. This approach requires continuous verification of users, devices, and applications, regardless of their location within or outside the network. Anti-malware systems are now expected to integrate with identity management, micro-segmentation, and access control frameworks. The Global Anti-Malware Market is evolving to support this architecture by offering solutions that function seamlessly across distributed and dynamic environments. It promotes more granular control over threats and minimizes the lateral movement of malware within networks. Enterprises are reconfiguring their security stacks to align with Zero Trust principles.

Market Challenges Analysis:

High False Positive Rates and Detection Limitations Are Undermining Trust in Security Tools

Despite advancements in malware detection technologies, high false positive rates continue to hinder operational efficiency and user trust. Security teams often face alert fatigue from redundant or inaccurate notifications, which diverts attention from real threats. Anti-malware systems sometimes misclassify legitimate files and applications, causing unnecessary disruptions in business operations. This issue becomes critical in sectors with strict uptime requirements such as healthcare and finance. The Global Anti-Malware Market is under pressure to balance sensitivity with precision while maintaining rapid response capabilities. It requires continuous refinement of algorithms and better integration with threat intelligence platforms to reduce errors and improve threat identification.

Evolving Malware Techniques and Encryption Are Outpacing Traditional Defenses

Cybercriminals are adopting highly evasive techniques such as polymorphism, living-off-the-land tactics, and encrypted payloads to bypass conventional defenses. Traditional signature-based detection methods struggle to keep pace with these dynamic threats, making them insufficient in isolation. Malware that hides within legitimate applications or uses fileless execution makes detection more complex and response slower. The Global Anti-Malware Market faces the challenge of staying ahead of attackers who constantly adjust their methods to exploit new vulnerabilities. It must evolve to offer multi-layered protection, real-time analytics, and behavioral analysis to counter these sophisticated threats. Vendors must invest in continuous innovation to maintain product relevance and ensure comprehensive security coverage.

Market Opportunities:

Expansion of Cybersecurity Needs in Small and Medium Enterprises Presents Untapped Demand

Small and medium enterprises (SMEs) are becoming prime targets for malware attacks due to limited IT resources and less mature security infrastructure. Many SMEs lack dedicated cybersecurity teams, creating a strong need for affordable, automated anti-malware solutions. The Global Anti-Malware Market can tap into this segment by offering scalable, easy-to-deploy platforms tailored to SME environments. It allows vendors to deliver value-driven protection without compromising on core detection capabilities. Cloud-based delivery models and managed security services are particularly well-suited for this segment. Demand from SMEs is expected to grow rapidly as they digitize operations and handle more sensitive data.

Emerging Markets and Government Cybersecurity Initiatives Are Driving New Investments

Rapid digital transformation across emerging economies in Asia-Pacific, Latin America, and Africa is opening up new revenue streams for anti-malware providers. Governments are launching national cybersecurity programs and regulatory frameworks that require stronger endpoint protection across public and private sectors. The Global Anti-Malware Market stands to benefit from these policy shifts and infrastructure upgrades. It provides vendors with the opportunity to partner with local agencies and build region-specific threat intelligence networks. Public-private collaborations and training initiatives also support long-term market penetration. These regions offer high-growth potential for both consumer and enterprise-grade malware protection solutions.

Market Segmentation Analysis:

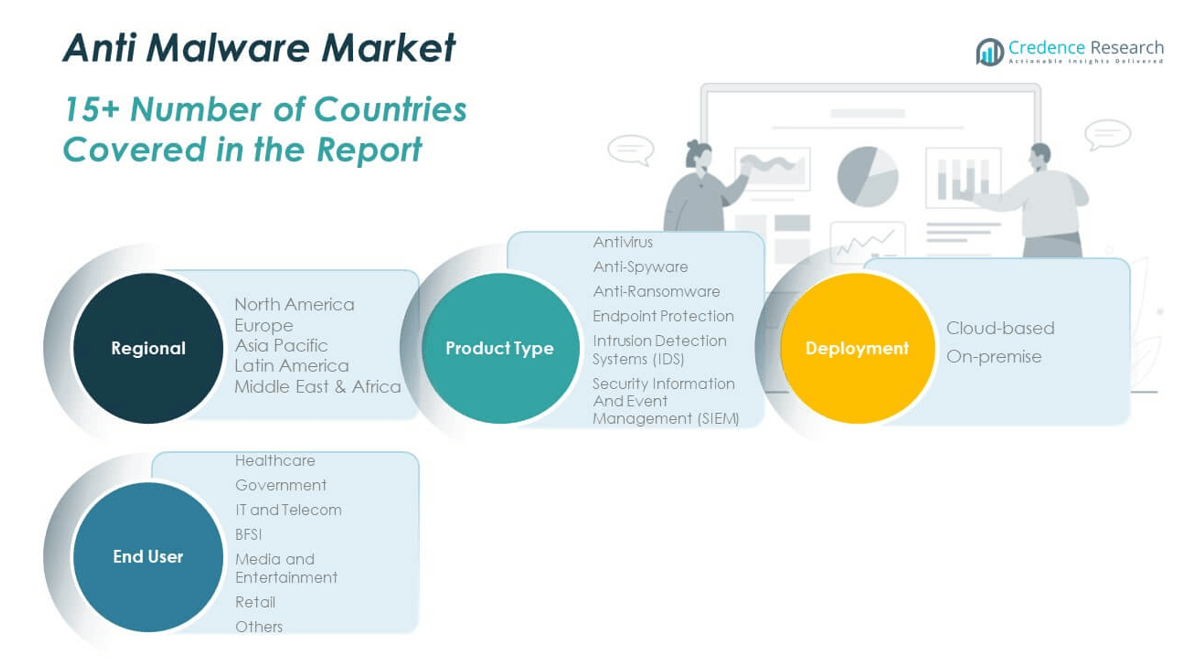

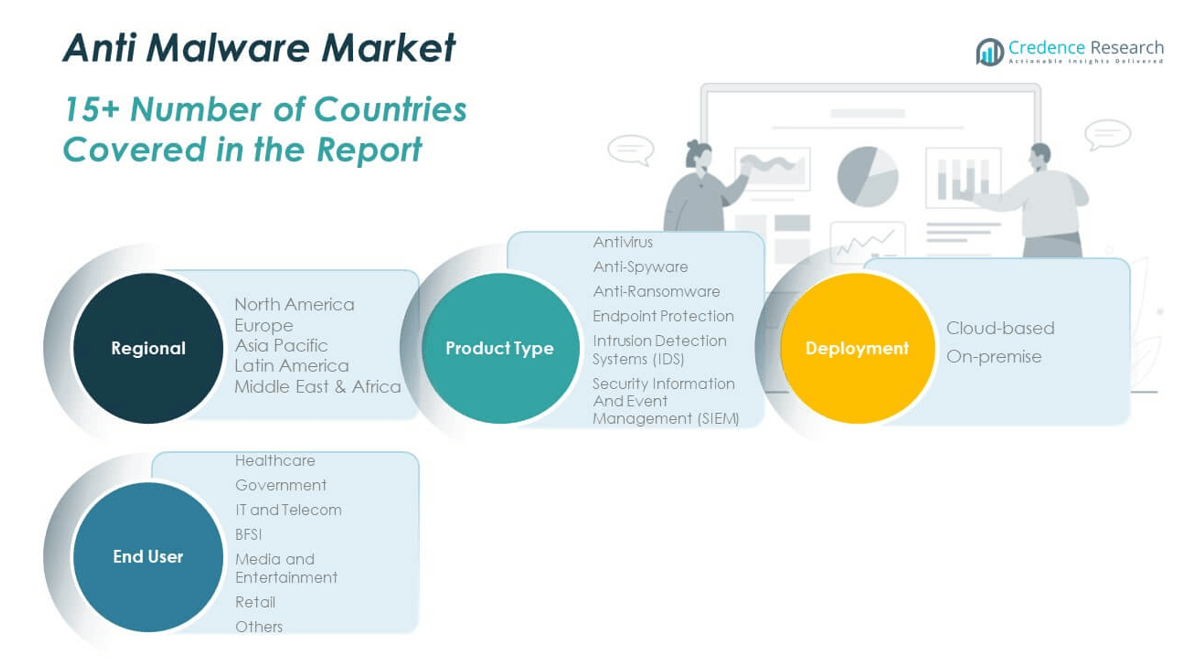

The Global Anti Malware Market is segmented by product type, deployment, and end user, each playing a crucial role in defining its growth path.

By product types, antivirus and endpoint protection dominate due to their widespread adoption across enterprise and personal systems. Anti-ransomware solutions are gaining traction with the rising sophistication of cyber threats. Intrusion Detection Systems (IDS) and Security Information and Event Management (SIEM) are being increasingly used in high-security environments, especially in large enterprises.

- For instance, CrowdStrike’s Falcon platform, a leader in endpoint protection, reported in its 2025 Threat Hunting Report that it blocked over 250,000 unique ransomware attacks in the first half of 2025 alone, leveraging its cloud-native AI analytics.

By deployment, cloud-based solutions are witnessing rapid growth owing to scalability, cost efficiency, and ease of updates. On-premise models continue to hold value among organizations with stringent data control requirements and regulatory compliance needs. This dual approach allows the market to cater to a wide range of operational preferences.

- For instance, Palo Alto Networks’ Cortex XSOAR offers a hybrid deployment model, with on-premises installations supporting over 2,000 organizations in highly regulated sectors, enabling full data residency and custom workflow automation to meet compliance mandates.

By end user, the Global Anti Malware Market sees significant demand from the IT and telecom and BFSI sectors, driven by the need to protect sensitive data and critical infrastructure. The healthcare sector is also adopting advanced anti-malware tools to safeguard patient information and comply with regulatory standards. Government bodies rely on these solutions to counteract growing cyber threats to national data systems. Retail and media sectors are adopting them to protect consumer data and digital assets, while the “Others” category includes education and manufacturing industries with rising cybersecurity priorities.

Segmentation:

By Product Type

- Antivirus

- Anti-Spyware

- Anti-Ransomware

- Endpoint Protection

- Intrusion Detection Systems (IDS)

- Security Information and Event Management (SIEM)

By Deployment

By End User

- Healthcare

- Government

- IT and Telecom

- BFSI (Banking, Financial Services, and Insurance)

- Media and Entertainment

- Retail

- Others

By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

The North America Anti-Malware Market size was valued at USD 2,415.99 million in 2018 to USD 4,368.68 million in 2024 and is anticipated to reach USD 10,535.05 million by 2032, at a CAGR of 10.8% during the forecast period. North America holds the largest share of the Global Anti-Malware Market, accounting for over 35% of the global revenue. The region benefits from early technology adoption, a strong cybersecurity regulatory framework, and the presence of major cybersecurity vendors. Enterprises in the United States and Canada invest heavily in endpoint protection, threat intelligence, and incident response systems. It reflects high awareness across industries such as BFSI, healthcare, and government. The growth in remote work, cloud migration, and ransomware threats continues to drive demand for advanced anti-malware platforms. North America remains a mature but dynamic market with sustained investment in next-generation cybersecurity tools.

The Europe Anti-Malware Market size was valued at USD 1,785.94 million in 2018 to USD 3,158.01 million in 2024 and is anticipated to reach USD 7,194.33 million by 2032, at a CAGR of 10.1% during the forecast period. Europe contributes approximately 25% of the Global Anti-Malware Market, supported by strict data protection laws and growing investment in digital transformation. Countries such as Germany, the UK, and France lead the region in adopting enterprise security platforms. The General Data Protection Regulation (GDPR) has heightened focus on threat prevention and breach notification protocols. It is encouraging both private companies and public institutions to prioritize malware defense. The demand for integrated security solutions and endpoint detection tools continues to rise across sectors. Europe maintains a strong growth trajectory, driven by regulatory compliance and cyber resilience initiatives.

The Asia Pacific Anti-Malware Market size was valued at USD 1,097.87 million in 2018 to USD 2,174.16 million in 2024 and is anticipated to reach USD 5,918.24 million by 2032, at a CAGR of 12.5% during the forecast period. Asia Pacific is the fastest-growing region in the Global Anti-Malware Market, accounting for nearly 20% of global share with strong expansion prospects. The region is experiencing a surge in cyberattacks targeting critical infrastructure, e-commerce, and cloud platforms. Rapid digitization in countries such as China, India, Japan, and South Korea is creating new vulnerabilities across consumer and enterprise networks. It has prompted both governments and corporations to boost cybersecurity spending and adopt scalable anti-malware solutions. Rising awareness, regulatory developments, and growing internet penetration are accelerating market demand. Asia Pacific presents high growth potential driven by both economic development and security modernization.

The Latin America Anti-Malware Market size was valued at USD 183.14 million in 2018 to USD 328.63 million in 2024 and is anticipated to reach USD 656.40 million by 2032, at a CAGR of 8.2% during the forecast period. Latin America holds a modest share in the Global Anti-Malware Market, contributing under 5% of total revenue, yet demonstrates steady growth. Countries such as Brazil, Mexico, and Argentina are witnessing a rise in ransomware and phishing incidents. Enterprises are beginning to implement more structured cybersecurity frameworks to manage rising threats. It is encouraging the deployment of endpoint protection tools, mobile security applications, and cloud-based threat intelligence. Government-led digital transformation programs are further driving market adoption. Latin America’s market is evolving with increasing emphasis on securing critical digital infrastructure.

The Middle East Anti-Malware Market size was valued at USD 143.97 million in 2018 to USD 238.15 million in 2024 and is anticipated to reach USD 472.78 million by 2032, at a CAGR of 8.1% during the forecast period. The Middle East accounts for a small but growing portion of the Global Anti-Malware Market, led by the UAE, Saudi Arabia, and Israel. These countries are prioritizing national cybersecurity strategies and investing in next-generation defense technologies. Critical sectors such as oil and gas, finance, and telecom are frequent targets of malware attacks. It is accelerating the adoption of endpoint and network protection solutions. Ongoing digital infrastructure upgrades and smart city initiatives are further contributing to market expansion. The region is steadily advancing toward stronger cyber resilience across both public and private domains.

The Africa Anti-Malware Market size was valued at USD 54.65 million in 2018 to USD 116.71 million in 2024 and is anticipated to reach USD 193.75 million by 2032, at a CAGR of 5.7% during the forecast period. Africa represents the smallest regional share in the Global Anti-Malware Market, contributing less than 2%, but shows gradual progress in cybersecurity readiness. Growing internet usage and mobile adoption have made the continent more vulnerable to malware attacks. Governments and businesses are beginning to recognize the importance of digital protection and data privacy. It is fueling demand for affordable, cloud-based anti-malware platforms, particularly in urban centers. Cybersecurity initiatives by regional organizations and international partnerships are helping raise awareness. Africa’s market is expected to grow steadily as digital ecosystems expand and cyber threats become more pronounced.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- McAfee

- Symantec (NortonLifeLock)

- Kaspersky Lab

- Bitdefender

- Trend Micro

- Microsoft

- Cisco

- Check Point Software Technologies

- Sophos

- Palo Alto Networks

Competitive Analysis:

The Global Anti-Malware Market features intense competition with a mix of established cybersecurity firms and emerging technology providers. Key players include McAfee, NortonLifeLock, Kaspersky, Bitdefender, Trend Micro, and Sophos, each offering a broad portfolio of consumer and enterprise-focused solutions. It remains highly dynamic, with vendors investing in AI-driven detection, cloud-based platforms, and endpoint security innovations to differentiate their offerings. Partnerships with cloud service providers and managed security service providers are expanding market reach. Startups and niche players are gaining traction through specialized tools addressing mobile and IoT threats. Vendors compete on performance, real-time analytics, pricing flexibility, and integration with broader security ecosystems. The market continues to evolve rapidly, with acquisitions and product innovations shaping vendor positioning. Players that prioritize threat intelligence, automation, and scalable deployment models maintain a strong competitive edge in both mature and developing regions.

Recent Developments:

- In April 2025, Malwarebytes launched a Global Strategic Partner Program, officially announced April 28, 2025. This new initiative gives financial institutions, HR benefits providers, and ISPs access to bundled security, privacy, and identity protection solutions helping them integrate Malwarebytes’ technologies into their own platforms and better protect customers from rising cybercrime.

- In January 2025, WatchGuard Technologies completed the acquisition of ActZero a managed detection and response provider that uses AI-driven threat analysis. The deal, announced January 8, 2025, aims to bolster WatchGuard’s 24/7 MDR capabilities with more rapid and automated threat response powered by AI.

Market Concentration & Characteristics:

The Global Anti-Malware Market is moderately concentrated, with a few dominant players holding significant market share and numerous regional and niche vendors competing for specialized segments. It features rapid innovation cycles driven by evolving threat landscapes and continuous advancements in artificial intelligence and cloud security. The market favors vendors that offer integrated, scalable, and real-time protection across multiple endpoints and operating systems. Product differentiation relies on threat detection accuracy, response speed, system compatibility, and ease of deployment. It also reflects strong demand for cloud-native platforms and subscription-based pricing models, which appeal to enterprises and small businesses alike. The market’s characteristics include high customer churn, fast-paced product development, and a growing emphasis on managed security services.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Deployment and End User.It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- AI and machine learning will play a central role in enhancing threat detection and response capabilities.

- Cloud-based anti-malware solutions will see increased adoption due to scalability and ease of deployment.

- Demand for mobile and IoT malware protection will grow as device usage expands globally.

- Small and medium enterprises will become a key growth segment, driving demand for affordable, lightweight solutions.

- Integration with broader cybersecurity ecosystems will be crucial for product competitiveness.

- Emerging markets in Asia Pacific, Latin America, and Africa will offer new revenue opportunities for vendors.

- Zero Trust architecture adoption will influence future product development and deployment models.

- Regulatory mandates and data privacy laws will continue to push enterprises toward advanced malware protection.

- Threat intelligence sharing and collaboration will become standard across industries and governments.

- Vendors that invest in automation and behavioral analysis will lead in market share and customer retention.