Market Overview

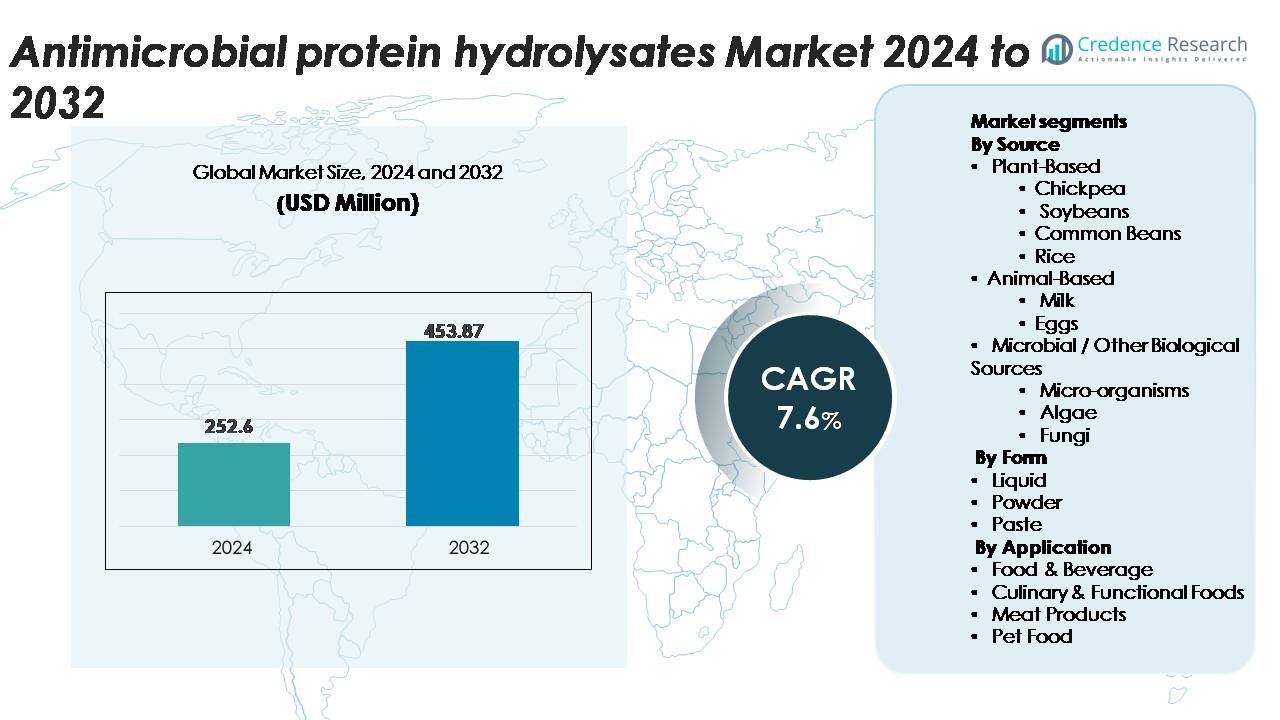

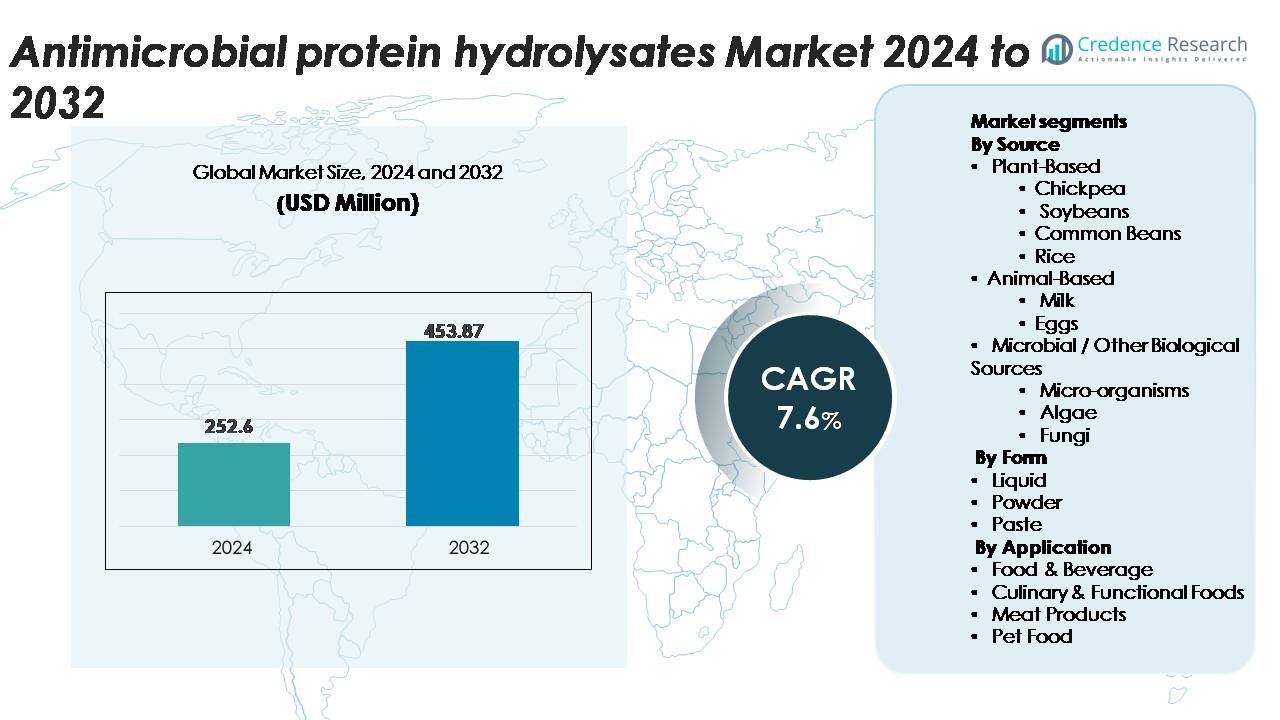

The global antimicrobial protein hydrolysates market was valued at USD 252.6 million in 2024 and is projected to reach USD 453.87 million by 2032, reflecting a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Antimicrobial Protein Hydrolysates Market Size 2024 |

USD 252.6 Million |

| Antimicrobial Protein Hydrolysates Market, CAGR |

7.6% |

| Antimicrobial Protein Hydrolysates Market Size 2032 |

USD 453.87 Million |

The antimicrobial protein hydrolysates market is shaped by a diverse group of global and regional players, including Kerry Group, Cargill Incorporated, Kemin Industries, AMCO Proteins, Aker Biomarine, Sonac, BRF Ingredients, Titan Biotech Limited, Crescent Biotech, Proliver, Biomega Group, Loryma GmbH, IQI Petfood, Vetpharm Laboratories, IsoNova Technologies LLC, A Constantino & C Spa, New Alliance Dye Chem Pvt Ltd, and Pestell Nutrition Inc. These companies compete through advancements in enzymatic hydrolysis, peptide purification, and sustainable sourcing. North America leads the market with approximately 33% share, supported by strong R&D capabilities, clean-label adoption, and robust demand for natural antimicrobial ingredients across food, functional nutrition, and pet food sectors.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The global antimicrobial protein hydrolysates market was valued at USD 252.6 million in 2024 and is projected to reach USD 453.87 million by 2032, registering a CAGR of 7.6% during the forecast period.

- Market growth is driven by rising adoption of natural antimicrobials in food preservation, functional nutrition, meat processing, and premium pet food, supported by clean-label reformulation and increasing consumer preference for minimally processed products.

- Key trends include expanding use of plant- and microbial-derived hydrolysates, precision enzymatic processing, and growing integration of bioactive peptides into fortified foods and high-protein formulations, enhancing functional and antimicrobial performance.

- Competitive dynamics involve active innovation from major players such as Kerry Group, Cargill, Kemin Industries, Sonac, Aker Biomarine, AMCO Proteins, BRF Ingredients, and Titan Biotech, focusing on advanced hydrolysis technologies and sustainable sourcing.

- Regionally, North America leads with ~33% share, followed by Europe at ~28% and Asia-Pacific at ~32%; by form, powder hydrolysates dominate with the largest segment share, supported by superior stability and formulation flexibility.

Market Segmentation Analysis:

By Source

Plant-based antimicrobial protein hydrolysates dominate the market, accounting for the largest share due to strong demand for clean-label, allergen-controlled, and sustainable bioactive ingredients. Among plant sources, soybean hydrolysates hold the leading position, supported by their high peptide yield, broad antimicrobial spectrum, and established processing infrastructure. Chickpea and common bean hydrolysates are gaining traction for their balanced amino-acid profiles, while rice-based variants benefit from hypoallergenic positioning. Animal-derived hydrolysates from milk and eggs serve niche high-potency segments, whereas microbial and algal sources grow steadily due to their consistency, scalability, and functional peptide diversity.

- For instance, commercial soy protein hydrolysates typically contain 85–90 g protein per 100 g with more than 70% of peptides below 5,000 Da, enabling strong antimicrobial and functional performance.

By Form

Powder-based antimicrobial protein hydrolysates represent the dominant form, capturing the highest market share thanks to their extended shelf stability, ease of incorporation into dry blends, and superior transport efficiency. Manufacturers favor powders for applications in functional foods, nutraceuticals, and meat preservation where controlled dosage and formulation flexibility are critical. Liquid hydrolysates retain relevance in beverage fortification and rapid-dissolution applications, while paste formats serve specialized processed-food categories requiring concentrated functionality. Rising demand for powdered antimicrobial peptides in high-volume manufacturing continues to reinforce its leadership across global ingredient supply chains.

- For instance, AMCO Proteins’ HydroDough 8000 wheat-gluten hydrolysate offers a documented degree of hydrolysis of 5.5–7.5 DH, enabling predictable functionality and stable peptide activity in dry blends.

By Application

The food & beverage segment leads the application landscape, holding the largest market share due to expanding use of antimicrobial hydrolysates in preservation, shelf-life extension, and clean-label reformulation. Functional foods utilize these peptides for natural protection against spoilage organisms, while culinary preparations adopt them to enhance microbial stability without synthetic additives. Meat processors increasingly incorporate hydrolysates into marinades and coatings to reduce pathogenic risks. Pet food manufacturers employ protein hydrolysates to address palatability and microbial safety. Regulatory shifts toward natural antimicrobials and consumer preference for minimally processed foods continue to strengthen the segment’s dominance.

Key Growth Drivers

Rising Demand for Clean-Label Antimicrobials in Food Systems

The market benefits strongly from the global transition toward clean-label preservatives, as food manufacturers seek natural, functional alternatives to synthetic antimicrobials. Antimicrobial protein hydrolysates deliver broad efficacy against pathogens such as Listeria monocytogenes, Salmonella, and spoilage bacteria through bioactive peptides generated via enzymatic hydrolysis. These peptides offer superior compatibility with minimally processed foods, aligning with regulatory pressures to reduce artificial additives. Their integration into meat products, ready-to-eat meals, functional beverages, and bakery formulations is expanding rapidly. Growing consumer preference for natural preservation technologies combined with rising investments by ingredient suppliers in peptide optimization, membrane filtration, and advanced hydrolysis techniques continues to reinforce adoption across mainstream and premium food categories.

· For instance, Kemin Industries’ natural antimicrobial formulation BactoCEASE® NV used in meat and ready-to-eat products contains a documented clean-label buffered vinegar system which, when applied at recommended dosage rates, results in a final acetic acid concentration of less than 1 g per 100 g of product (typically around 0.2% to 0.6%). This achieves proven reductions in spoilage bacteria and pathogens such as Listeria monocytogenes, demonstrating industry capability for natural pathogen control.

Advancements in Enzymatic Hydrolysis and Peptide Profiling Technologies

Continuous improvements in enzymatic processing, chromatographic separation, and peptide fingerprinting significantly accelerate market growth by enabling highly targeted antimicrobial activity. Innovations in protease engineering, precision hydrolysis control, and bioinformatics-driven peptide mapping enhance stability, potency, and consistency across batches. These advancements support the development of application-specific hydrolysates tailored for pH-sensitive foods, high-protein formulations, or pathogen-prone products. Industrial-scale membrane bioreactors and ultrafiltration systems reduce production variability, enabling cost-efficient scaling. As more manufacturers adopt high-throughput peptide characterization tools and optimize hydrolysis parameters for maximal antimicrobial yield, the commercial viability of protein hydrolysates strengthens, especially within food safety, nutraceutical, and pet nutrition industries.

- For instance, AMCO Proteins’ enzymatically produced wheat-gluten hydrolysate (HydroDough 8000) is manufactured to a documented degree of hydrolysis of 5.5–7.5 DH, ensuring consistent peptide release and predictable functional performance across batches.

Expanding Applications in Pet Nutrition, Functional Foods, and Meat Preservation

The market grows in response to broader use of antimicrobial hydrolysates across diverse applications that require both safety and functional performance. In pet nutrition, hydrolysates improve microbial stability while enhancing aroma, palatability, and digestibility supporting premium and therapeutic diets. In functional foods, peptide-rich hydrolysates address the demand for natural preservation in protein beverages, sports nutrition, and fortified products. Meat processors increasingly integrate hydrolysates into marinades, coatings, and brines to reduce spoilage and pathogenic contamination, allowing longer distribution cycles. The multi-functional benefits antimicrobial activity, improved solubility, enhanced sensory characteristics, and nutritional value drive strong formulation interest from manufacturers seeking high-performing, label-friendly ingredients.

Key Trends & Opportunities:

Growth of Sustainable, Plant-Based, and Microbial Protein Inputs

Companies are expanding their portfolios toward plant-based and microbial protein hydrolysates to meet sustainability targets and reduce dependence on animal-derived ingredients. Growing interest in chickpea, soybean, rice, algae, and microbial sources reflects their lower environmental footprint, scalable cultivation, and stable supply chains. Algal and fungal hydrolysates present notable opportunities due to their high peptide density and unique antimicrobial profiles. As plant-based product developers shift toward naturally preserved systems, demand for compatible hydrolysates rises. This trend aligns with regulatory support for eco-friendly bioactives and strong consumer acceptance of plant-origin ingredients in both food and nutraceutical applications, driving innovation across the value chain.

- For instance, Cargill’s RadiPure™ pea-protein isolate provides 85 g of protein per 100 g, supplying a high-purity substrate ideal for controlled enzymatic hydrolysis. In chickpea proteins, InnovoPro’s CP-Pro 70 concentrate offers 70 g protein per 100 g, enabling strong peptide yield after hydrolysis.

Integration of Bioactive Peptides in High-Performance Formulations

A significant opportunity emerges from the incorporation of antimicrobial peptides into advanced formulations such as fortified beverages, shelf-stable protein bars, specialized infant foods, and medical nutrition. The compatibility of hydrolysates with diverse matrices enables targeted control of microbial growth without altering sensory attributes. Companies are also exploring synergistic combinations with probiotics, natural antioxidants, and fermentates to enhance multi-functional performance. Precision formulation enables hydrolysates to serve both as preservation agents and as contributors to nutritional and functional value. This expands their commercial relevance in rapidly growing categories emphasizing health, longevity, and natural protection.

- For instance, Arla Foods Ingredients’ Lacprodan® HYDRO.365 is an extensively hydrolyzed whey protein with 90 g protein per 100 g and a documented degree of hydrolysis of 27–32 DH, enabling rapid absorption and stable peptide activity in clinical and sports formulations.

Rising Investments in Biotechnology-Driven Ingredient Manufacturing

The market experiences strong opportunity from advancements in bioprocess engineering, including continuous hydrolysis systems, immobilized enzyme reactors, and AI-assisted peptide prediction platforms. Biotechnology firms increasingly partner with food ingredient suppliers to develop hydrolysates optimized for specific pathogens, food matrices, and processing conditions. Improvements in scaling efficiency reduce cost barriers, making high-purity antimicrobial hydrolysates more accessible for mass-market applications. The integration of fermentation-derived peptides and designer antimicrobial sequences further expands product possibilities. These technology-driven improvements position the market for long-term innovation and deeper penetration into regulated food safety applications.

Key Challenges:

High Production Costs and Complex Processing Requirements

Antimicrobial protein hydrolysates require specialized enzymatic systems, controlled hydrolysis environments, and advanced separation technologies, which elevate production costs compared to traditional preservatives. Maintaining batch-to-batch consistency in peptide composition demands sophisticated equipment and significant operational expertise. Filtration via ultrafiltration or nanofiltration adds additional cost layers, especially for high-purity formats. These challenges limit adoption in cost-sensitive segments such as commodity packaged foods and mass-market meat products. Furthermore, variability in raw material quality—especially in plant and microbial sources—creates formulation challenges and necessitates more stringent quality assurance across the supply chain.

Regulatory Complexity and Standardization Limitations

Regulatory frameworks for antimicrobial peptides differ widely across regions, creating hurdles for global commercialization. Lack of standardized definitions, purity benchmarks, and safety assessment protocols complicates product registration, particularly in the food and nutraceutical sectors. Some jurisdictions require extensive toxicological, allergenicity, and stability data, prolonging approval timelines. Ensuring clear labeling for allergen-derived hydrolysates (e.g., milk, egg, soy) adds compliance complexity. Variability in accepted antimicrobial claims also restricts marketing flexibility. These regulatory inconsistencies challenge manufacturers seeking rapid global expansion and increase the cost and duration of market entry strategies.

Regional Analysis:

North America

North America holds the leading share of the global market, accounting for approximately 33%, driven by strong demand for natural antimicrobials in processed foods, functional nutrition, meat preservation, and premium pet food formulations. The region benefits from advanced enzymatic hydrolysis technologies, strong R&D capabilities, and early adoption of bioactive peptide ingredients. Regulatory support for clean-label and minimally processed foods accelerates manufacturer investments in plant, dairy, egg, and microbial hydrolysates. Rising consumer preference for natural preservatives and the expansion of peptide-based ingredient portfolios by U.S. and Canadian suppliers continue to reinforce the region’s leadership.

Europe

Europe represents the second-largest market, holding around 28%, supported by stringent food safety regulations and strong industry transition toward natural antimicrobials. The region’s established functional food, meat processing, and nutraceutical sectors drive consistent adoption of protein hydrolysates. Manufacturers increasingly integrate plant-based and microbial peptide solutions to meet sustainability and clean-label standards. Strong government oversight on synthetic preservatives further encourages reformulation using bioactive peptides. Growing consumer interest in high-protein, fortified, and minimally processed foods—combined with active innovation hubs in Germany, France, the Netherlands, and Scandinavia—continues to elevate Europe’s demand profile.

Asia-Pacific

Asia-Pacific is the fastest-growing market, holding approximately 32%, driven by expanding food processing industries, rising protein consumption, and increased investment in natural preservation technologies. Countries such as China, Japan, South Korea, and India accelerate adoption in meat processing, functional beverages, fortified foods, and pet nutrition. Rapid urbanization heightens demand for safe, shelf-stable packaged foods, boosting the need for antimicrobial hydrolysates. The region’s strong presence in plant protein cultivation—especially soy, chickpea, and rice—supports scalable hydrolysate production. Growing biotechnology investments and rising preference for clean-label ingredients position Asia-Pacific as a high-potential growth hub.

Latin America

Latin America accounts for approximately 8% of the market, driven by increasing modernization of food manufacturing and growing demand for natural preservation in meat, dairy, and ready-to-eat products. Brazil, Mexico, and Argentina lead adoption due to expanding protein processing industries and rising export-oriented food production. Producers explore antimicrobial hydrolysates to improve product stability during long distribution cycles. Although technology adoption remains uneven, growing interest in pet food and functional foods creates new opportunities. Strengthening regulatory alignment with global food safety frameworks supports broader use of protein hydrolysates across the region.

Middle East & Africa

The Middle East & Africa region holds around 5% of the market, supported by rising demand for shelf-stable foods, dairy products, and premium pet nutrition. Gulf countries increasingly adopt natural antimicrobial solutions to meet quality and import standards for processed foods. Growing investments in food manufacturing hubs, particularly in the UAE and Saudi Arabia, generate interest in protein hydrolysates that enhance microbial safety. In Africa, adoption remains gradual but benefits from expanding urban food markets and rising investment in cold-chain and meat processing infrastructure. Limited local production capacity creates reliance on imported hydrolysates.

Market Segmentations:

By Source

- Plant-Based

- Chickpea

- Soybeans

- Common Beans

- Rice

- Animal-Based

- Microbial / Other Biological Sources

- Micro-organisms

- Algae

- Fungi

By Form

By Application

- Food & Beverage

- Culinary & Functional Foods

- Meat Products

- Pet Food

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape:

The competitive landscape of the antimicrobial protein hydrolysates market is characterized by a mix of established ingredient manufacturers, biotechnology firms, and specialized peptide-processing companies focused on natural preservation solutions. Leading players prioritize advancements in enzymatic hydrolysis, membrane filtration, and peptide profiling to produce high-purity hydrolysates with targeted antimicrobial activity. Companies expand portfolios to include plant, dairy, egg, algal, and microbial-derived peptides, enhancing applicability across food, functional nutrition, and pet food sectors. Strategic partnerships with food processors and biotech innovators strengthen product development pipelines, while investments in scalable bioprocessing systems improve production efficiency. Competitors increasingly emphasize clean-label, non-allergenic, and sustainably sourced formulations to align with regulatory and consumer expectations. Continuous R&D in bioactive peptide optimization, combined with regional expansion initiatives, positions market leaders to capture the growing demand for natural antimicrobial solutions across global food value chains.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- AMCO Proteins

- Pestell Nutrition Inc

- Aker Biomarine

- Proliver

- Cargill Incorporated

- Crescent Biotech

- Loryma GmbH (Crespel & Deiters Group)

- Kemin Industries

- Titan Biotech Limited

- BRF Ingredients

Recent Developments:

- In March 2025, BRF Ingredients (under the name “MBRFi”) announced that its product BioActio Health & Performance, a chicken-derived hydrolyzed protein, won the “F3 Krill Replacement Challenge,” positioning itself as a sustainable, peptide-rich alternative to marine protein sources in aquaculture feed.

- In November 2022, Aker BioMarine The company introduced the PL+ delivery platform, a phospholipid-based system from krill oil designed to improve bioavailability of bioactives.

Report Coverage:

The research report offers an in-depth analysis based on Source, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for natural antimicrobial ingredients will rise as food manufacturers accelerate clean-label reformulation efforts.

- Advancements in enzymatic hydrolysis and peptide profiling will enable more targeted, higher-potency antimicrobial hydrolysates.

- Plant-based and microbial protein sources will gain traction due to sustainability priorities and expanding supply chains.

- Integration of antimicrobial peptides into fortified foods and functional beverages will broaden market penetration.

- Meat processors will increasingly adopt hydrolysates to enhance safety, reduce spoilage, and extend product shelf life.

- Premium pet food formulations will continue to use hydrolysates for both microbial protection and improved palatability.

- Biotechnology partnerships will expand, enabling development of customized peptide solutions for specific food matrices.

- Powder formulations will strengthen their lead due to stability advantages and compatibility with large-scale manufacturing.

- Regulatory alignment toward natural preservatives will support faster adoption across global food sectors.

- Asia-Pacific will emerge as a major growth hub, driven by rising urban consumption and investments in food safety technologies.